Key Insights

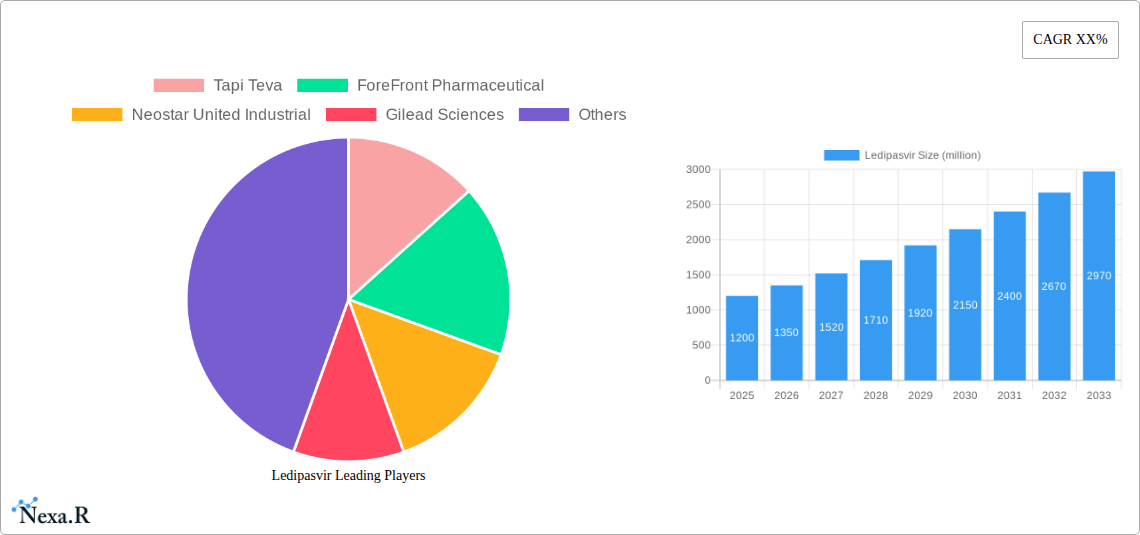

The global Ledipasvir market is poised for significant growth, projected to reach a substantial valuation by 2033. Driven by the persistent burden of Hepatitis C infections and the increasing efficacy of Ledipasvir-based therapies, the market's expansion is anticipated to be robust. Key market drivers include the rising prevalence of Hepatitis C, particularly in emerging economies, coupled with government initiatives and healthcare infrastructure development aimed at combating the disease. The growing demand for high-purity Ledipasvir (above 99%) for pharmaceutical formulations underscores the industry's commitment to safety and efficacy. Companies like Gilead Sciences, a pioneer in direct-acting antivirals, are expected to continue playing a pivotal role, alongside other established and emerging pharmaceutical players focused on antiviral drug development. The market's trajectory is also influenced by advancements in drug discovery and a focus on combination therapies that enhance treatment outcomes.

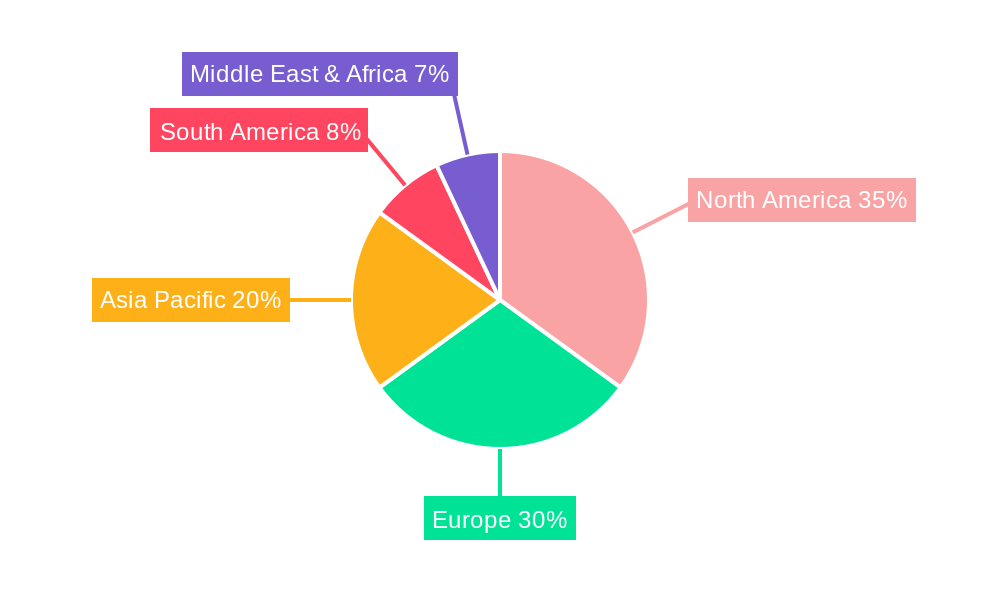

The market's growth is further supported by evolving treatment paradigms and increasing patient access to advanced therapies. While the market benefits from strong demand, potential restraints may include the development of alternative treatments or drug resistance, although Ledipasvir has demonstrated a high barrier to resistance. The competitive landscape is characterized by a focus on research and development, strategic partnerships, and expanding manufacturing capabilities. Geographically, North America and Europe are anticipated to maintain significant market shares due to established healthcare systems and high adoption rates of advanced treatments. However, the Asia Pacific region, particularly China and India, is expected to witness accelerated growth owing to a large patient pool and increasing healthcare expenditure. This dynamic market presents opportunities for stakeholders focused on delivering effective and accessible Ledipasvir-based solutions to a global patient population battling Hepatitis C.

Here is a comprehensive, SEO-optimized report description for Ledipasvir, designed to maximize visibility and engagement:

Ledipasvir Market Analysis Report: Global Hepatitis C Treatment Dominance & Future Outlook (2019-2033)

This in-depth market research report provides a definitive analysis of the global Ledipasvir market, a critical antiviral medication primarily used for treating Hepatitis C. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. We meticulously analyze the parent and child markets, offering a holistic view for industry professionals, researchers, and investors seeking to understand the intricate landscape of Hepatitis C therapeutics and advanced pharmaceutical ingredients.

Ledipasvir Market Dynamics & Structure

The Ledipasvir market exhibits a moderately concentrated structure, primarily driven by advancements in Hepatitis C treatment protocols and the ongoing demand for highly effective antiviral therapies. Technological innovation in drug formulation and synthesis processes remains a key driver, with companies continuously striving for enhanced purity and efficacy of Ledipasvir. Stringent regulatory frameworks governing pharmaceutical production and approval play a significant role in shaping market entry and competitive dynamics. While Hepatitis C remains the primary application, exploring "Other" therapeutic applications presents future growth potential. Competitive product substitutes, though limited in the direct Hepatitis C space, include alternative antiviral regimens and novel treatment modalities, influencing market strategies. End-user demographics are largely defined by patient populations diagnosed with Hepatitis C, with a focus on both developed and emerging economies. Merger and acquisition (M&A) trends are expected to be moderate, focusing on strategic consolidations to enhance R&D capabilities or expand market reach.

- Market Concentration: Moderate, influenced by a few key players and evolving generic competition.

- Technological Innovation Drivers: Advancements in antiviral drug discovery, improved synthesis routes for high-purity Ledipasvir, and formulation technologies.

- Regulatory Frameworks: FDA, EMA, and other national health authority approvals are critical.

- Competitive Product Substitutes: Other direct-acting antiviral (DAA) combinations, interferon-based therapies (in declining use), and emerging pan-genotypic treatments.

- End-User Demographics: Patients diagnosed with Hepatitis C genotypes 1, 3, 4, 5, and 6.

- M&A Trends: Focus on acquiring specialized manufacturing capabilities or expanding geographic footprints for Hepatitis C treatments.

Ledipasvir Growth Trends & Insights

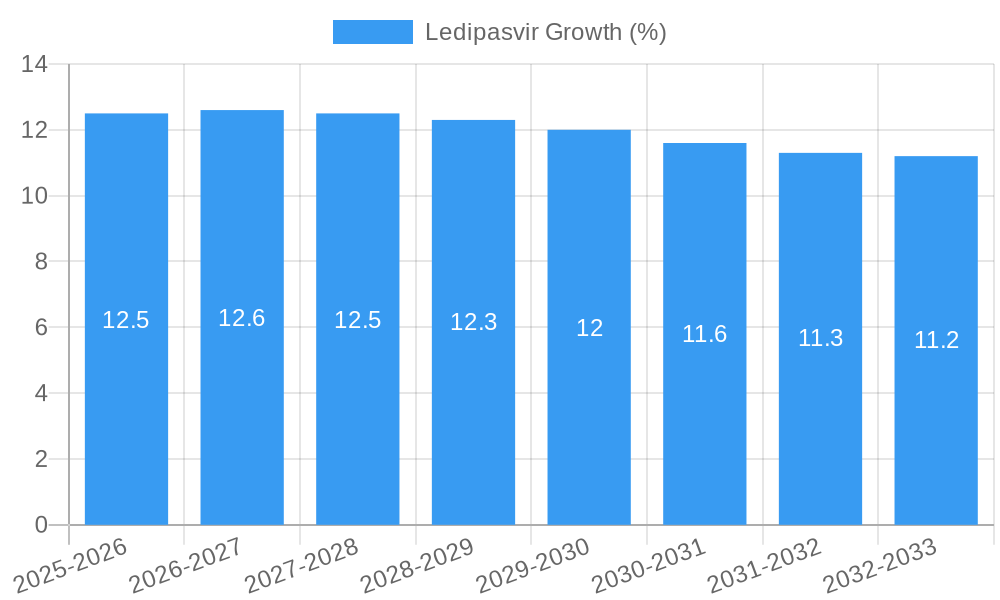

The global Ledipasvir market is poised for significant evolution, driven by increasing Hepatitis C prevalence, advancements in treatment efficacy, and expanded access to care. The market size is projected to witness a steady Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Adoption rates of Ledipasvir-based therapies, particularly in combination with other antivirals, have seen substantial growth, further bolstered by public health initiatives aimed at Hepatitis C eradication. Technological disruptions, while less pronounced in established antiviral classes, are focused on optimizing manufacturing processes for cost-effectiveness and ensuring the availability of high-purity Ledipasvir (Purity Above 99%). Consumer behavior shifts, influenced by growing awareness of Hepatitis C's treatability and the desire for effective, well-tolerated treatments, are also contributing positively to market penetration. The base year of 2025 marks a crucial point for understanding current market penetration, which is estimated to be xx% of the eligible Hepatitis C patient population. Future growth will be significantly impacted by the sustained effectiveness of Ledipasvir-containing regimens and their accessibility in diverse economic settings. The forecast period (2025-2033) anticipates sustained demand, with potential for market expansion into previously underserved regions. The historical period (2019-2024) laid the groundwork for current market dynamics, marked by the emergence and widespread adoption of direct-acting antivirals.

Dominant Regions, Countries, or Segments in Ledipasvir

The Hepatitis C application segment is unequivocally the dominant force driving the Ledipasvir market. Within this application, the "Purity Above 99%" type segment commands significant market share due to stringent pharmaceutical quality standards and the necessity for highly pure active pharmaceutical ingredients (APIs) in advanced therapies. Regionally, North America and Europe have historically led in Ledipasvir adoption, fueled by robust healthcare infrastructure, higher disposable incomes, and comprehensive insurance coverage for Hepatitis C treatments. However, the Asia-Pacific region is emerging as a critical growth engine, driven by a burgeoning patient population, increasing healthcare expenditure, and government-led Hepatitis C elimination programs. Economic policies that prioritize public health and facilitate access to affordable medicines are key drivers in these emerging markets. The infrastructure for pharmaceutical manufacturing and distribution is rapidly developing across Asia, further supporting Ledipascar market expansion. The market share within the Hepatitis C segment for Ledipasvir-based treatments is estimated to be around xx million units in 2025, with substantial growth potential projected in regions like India and China. The market dominance is further reinforced by the proven efficacy and favorable safety profiles of Ledipasvir in treating specific genotypes of Hepatitis C.

- Dominant Segment: Application: Hepatitis C

- Leading Product Type: Purity Above 99%

- Key Regional Drivers:

- North America & Europe: Advanced healthcare systems, high prevalence, and strong reimbursement policies.

- Asia-Pacific: Rapidly growing patient pool, government initiatives, and increasing affordability.

- Market Share (Hepatitis C Application, 2025): xx million units.

- Growth Potential in Asia-Pacific: Significant due to increasing awareness and access.

Ledipasvir Product Landscape

The Ledipasvir product landscape is characterized by its role as a potent NS5A inhibitor, crucial in the treatment of chronic Hepatitis C virus (HCV) infection. Innovations primarily revolve around its highly effective synergy when co-formulated with other antiviral agents, leading to pan-genotypic regimens with high cure rates and short treatment durations. The unique selling proposition of Ledipasvir lies in its ability to achieve sustained virologic response (SVR) in a broad spectrum of HCV genotypes, minimizing the need for individualized treatment strategies. Technological advancements focus on optimizing the pharmacokinetic profile of Ledipasvir-based combinations, enhancing patient adherence, and reducing potential drug-drug interactions. The market primarily features pharmaceutical-grade Ledipasvir with purity levels exceeding 99%, ensuring safety and efficacy.

Key Drivers, Barriers & Challenges in Ledipasvir

Key Drivers: The Ledipasvir market is propelled by the persistent global burden of Hepatitis C, the proven efficacy of Ledipasvir-based direct-acting antiviral (DAA) regimens in achieving high cure rates, and increasing government-led initiatives aimed at Hepatitis C elimination. Technological advancements in API synthesis ensuring high purity and cost-effectiveness also act as strong drivers.

Barriers & Challenges: Despite its efficacy, challenges include the high cost of advanced DAA therapies, particularly in low- and middle-income countries, limiting access. Regulatory hurdles for new combination therapies and the emergence of drug-resistant strains of HCV, though rare with Ledipasvir, pose potential long-term challenges. Supply chain complexities and ensuring consistent availability of high-purity Ledipasvir across diverse geographies also present significant operational challenges.

Emerging Opportunities in Ledipasvir

Emerging opportunities in the Ledipasvir market lie in expanding its application beyond current Hepatitis C treatment paradigms, exploring potential synergistic effects in treating other viral infections, or in novel drug delivery systems that further enhance patient convenience and adherence. Untapped markets in regions with a high, undiagnosed Hepatitis C population represent a significant growth avenue. Evolving consumer preferences for simplified treatment regimens and the development of more affordable generic formulations of Ledipasvir-based therapies will also unlock new market segments and opportunities for increased market penetration.

Growth Accelerators in the Ledipasvir Industry

Long-term growth in the Ledipasvir industry will be significantly accelerated by ongoing research into broader applications of NS5A inhibitors, strategic partnerships between pharmaceutical manufacturers and public health organizations to enhance access in developing nations, and aggressive market expansion strategies targeting underserved patient populations. Breakthroughs in manufacturing technologies that reduce production costs without compromising purity will further fuel growth. Furthermore, the development of novel combination therapies that offer even shorter treatment durations or overcome potential resistance mechanisms will act as crucial catalysts for sustained market expansion and adoption.

Key Players Shaping the Ledipasvir Market

- Gilead Sciences

- Tapi Teva

- ForeFront Pharmaceutical

- Neostar United Industrial

Notable Milestones in Ledipasvir Sector

- 2014: FDA approval of Harvoni (ledipasvir/sofosbuvir), a landmark combination therapy for Hepatitis C.

- 2015: EMA approval of Harvoni, expanding market access in Europe.

- 2016-2018: Increased market penetration and uptake of Ledipasvir-based treatments globally.

- 2019-2020: Emergence of generic versions and increased competition, driving down costs.

- 2021-2023: Ongoing research into improved formulations and expanded treatment guidelines for Hepatitis C.

In-Depth Ledipasvir Market Outlook

The future outlook for the Ledipasvir market remains robust, primarily driven by its established efficacy in Hepatitis C treatment and the ongoing global efforts to eliminate the disease. Growth accelerators such as the development of more affordable generic options and the potential for expanded therapeutic applications will continue to propel market expansion. Strategic opportunities lie in solidifying market presence in emerging economies through partnerships and tailored access programs, ensuring that the benefits of effective Hepatitis C treatment reach a wider patient base. The sustained demand for high-purity Ledipasvir (Purity Above 99%) will remain a cornerstone of its market value.

Ledipasvir Segmentation

-

1. Application

- 1.1. Hepatitis C

- 1.2. Other

-

2. Types

- 2.1. Purity Above 99%

- 2.2. Purity Below 99%

Ledipasvir Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ledipasvir REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hepatitis C

- 5.1.2. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Purity Above 99%

- 5.2.2. Purity Below 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hepatitis C

- 6.1.2. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Purity Above 99%

- 6.2.2. Purity Below 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hepatitis C

- 7.1.2. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Purity Above 99%

- 7.2.2. Purity Below 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hepatitis C

- 8.1.2. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Purity Above 99%

- 8.2.2. Purity Below 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hepatitis C

- 9.1.2. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Purity Above 99%

- 9.2.2. Purity Below 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ledipasvir Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hepatitis C

- 10.1.2. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Purity Above 99%

- 10.2.2. Purity Below 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tapi Teva

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ForeFront Pharmaceutical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neostar United Industrial

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gilead Sciences

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Tapi Teva

List of Figures

- Figure 1: Global Ledipasvir Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Ledipasvir Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Ledipasvir Revenue (million), by Application 2024 & 2032

- Figure 4: North America Ledipasvir Volume (K), by Application 2024 & 2032

- Figure 5: North America Ledipasvir Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Ledipasvir Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Ledipasvir Revenue (million), by Types 2024 & 2032

- Figure 8: North America Ledipasvir Volume (K), by Types 2024 & 2032

- Figure 9: North America Ledipasvir Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Ledipasvir Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Ledipasvir Revenue (million), by Country 2024 & 2032

- Figure 12: North America Ledipasvir Volume (K), by Country 2024 & 2032

- Figure 13: North America Ledipasvir Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Ledipasvir Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Ledipasvir Revenue (million), by Application 2024 & 2032

- Figure 16: South America Ledipasvir Volume (K), by Application 2024 & 2032

- Figure 17: South America Ledipasvir Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Ledipasvir Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Ledipasvir Revenue (million), by Types 2024 & 2032

- Figure 20: South America Ledipasvir Volume (K), by Types 2024 & 2032

- Figure 21: South America Ledipasvir Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Ledipasvir Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Ledipasvir Revenue (million), by Country 2024 & 2032

- Figure 24: South America Ledipasvir Volume (K), by Country 2024 & 2032

- Figure 25: South America Ledipasvir Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Ledipasvir Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Ledipasvir Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Ledipasvir Volume (K), by Application 2024 & 2032

- Figure 29: Europe Ledipasvir Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Ledipasvir Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Ledipasvir Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Ledipasvir Volume (K), by Types 2024 & 2032

- Figure 33: Europe Ledipasvir Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Ledipasvir Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Ledipasvir Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Ledipasvir Volume (K), by Country 2024 & 2032

- Figure 37: Europe Ledipasvir Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Ledipasvir Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Ledipasvir Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Ledipasvir Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Ledipasvir Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Ledipasvir Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Ledipasvir Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Ledipasvir Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Ledipasvir Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Ledipasvir Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Ledipasvir Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Ledipasvir Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Ledipasvir Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Ledipasvir Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Ledipasvir Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Ledipasvir Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Ledipasvir Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Ledipasvir Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Ledipasvir Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Ledipasvir Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Ledipasvir Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Ledipasvir Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Ledipasvir Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Ledipasvir Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Ledipasvir Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Ledipasvir Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ledipasvir Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ledipasvir Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Ledipasvir Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Ledipasvir Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Ledipasvir Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Ledipasvir Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Ledipasvir Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Ledipasvir Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Ledipasvir Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Ledipasvir Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Ledipasvir Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Ledipasvir Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Ledipasvir Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Ledipasvir Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Ledipasvir Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Ledipasvir Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Ledipasvir Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Ledipasvir Volume K Forecast, by Country 2019 & 2032

- Table 81: China Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Ledipasvir Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Ledipasvir Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ledipasvir?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Ledipasvir?

Key companies in the market include Tapi Teva, ForeFront Pharmaceutical, Neostar United Industrial, Gilead Sciences.

3. What are the main segments of the Ledipasvir?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ledipasvir," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ledipasvir report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ledipasvir?

To stay informed about further developments, trends, and reports in the Ledipasvir, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence