Key Insights

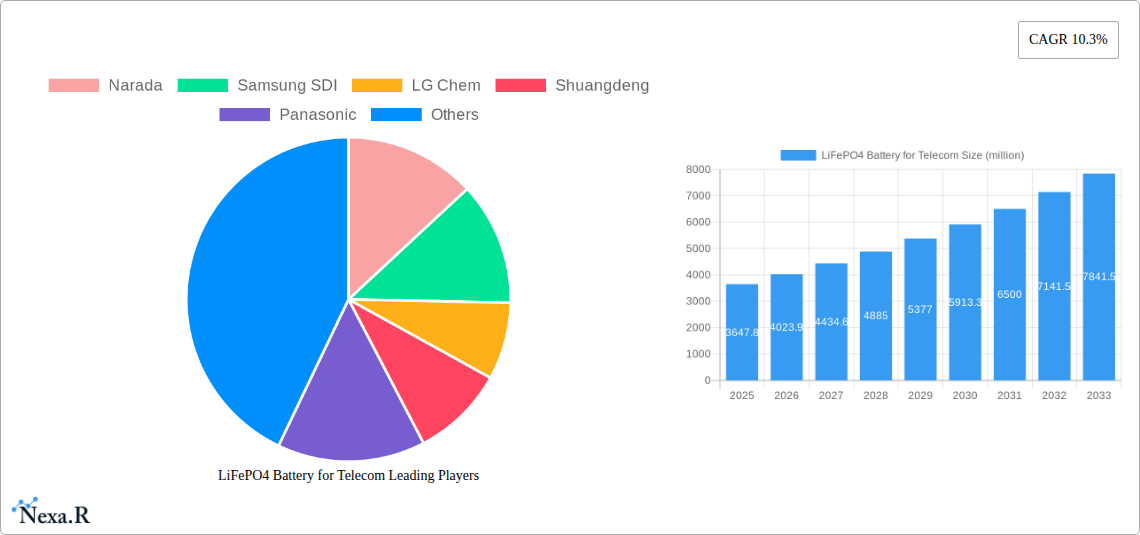

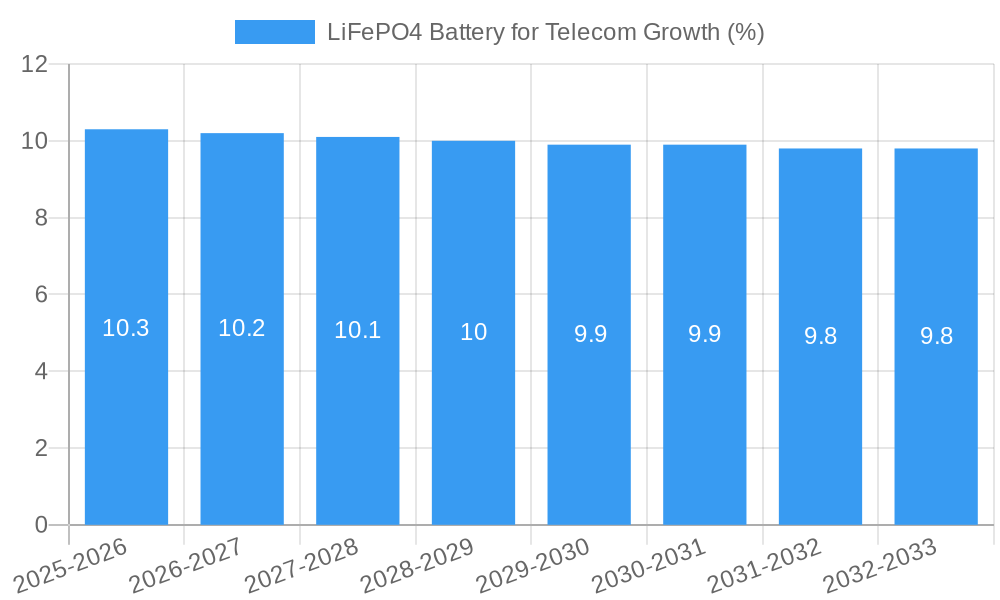

The global LiFePO4 battery market for telecom applications is poised for significant expansion, projected to reach USD 3647.8 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.3%. This impressive growth is fueled by the escalating demand for reliable and long-lasting power solutions in the telecommunications sector. The proliferation of 5G networks, the increasing density of cell sites, and the critical need for uninterrupted power supply in base stations are primary drivers. LiFePO4 batteries, known for their superior safety, extended cycle life, and excellent thermal stability compared to traditional battery chemistries, are becoming the preferred choice for telecom infrastructure. The market is segmented by application, with Mobile Switching Centers (MSCs) and Macro Cell Sites representing the largest segments due to their extensive power requirements. However, the growing deployment of smaller cell sites (Micro, Pico, and Femto) to enhance network coverage and capacity is also contributing to market diversification. In terms of capacity, segments ranging from less than 50 Ah to over 200 Ah cater to the diverse needs of telecom deployments, from small cell back-up to large data center power management.

The market's trajectory is further supported by ongoing technological advancements and increasing adoption of energy-efficient solutions within the telecom industry. Key trends include the integration of smart battery management systems for enhanced performance and predictive maintenance, as well as the growing focus on sustainable and environmentally friendly energy storage. Despite the positive outlook, the market faces certain restraints, such as the initial high capital expenditure for LiFePO4 battery installations and potential raw material price volatility. Nevertheless, the long-term benefits in terms of operational cost savings and reliability are expected to outweigh these challenges. Major players like Narada, Samsung SDI, LG Chem, and EVE Energy are actively investing in research and development and expanding their production capacities to meet the surging demand across various regions, with Asia Pacific, particularly China and India, expected to lead in market growth due to rapid infrastructure development.

This in-depth report provides a definitive analysis of the global LiFePO4 battery market for telecommunications applications. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research offers critical insights into market dynamics, growth trajectories, key players, and emerging opportunities. The report leverages sophisticated analytical tools and extensive primary and secondary research to deliver actionable intelligence for stakeholders.

LiFePO4 Battery for Telecom Market Dynamics & Structure

The global LiFePO4 battery market for telecom applications is characterized by a moderate concentration, with key players continuously vying for market share through technological advancements and strategic expansions. The increasing demand for reliable and long-lasting backup power solutions in the rapidly expanding telecom infrastructure is a primary driver. Technological innovation, particularly in improving energy density, charging speeds, and overall lifespan, remains crucial for competitive differentiation. Regulatory frameworks, though evolving, are generally supportive of greener and more efficient energy storage solutions, impacting battery safety standards and deployment guidelines. Competitive product substitutes, such as lead-acid batteries, are gradually being phased out due to their inferior performance and environmental concerns, further solidifying LiFePO4’s dominance. End-user demographics in the telecom sector are increasingly sophisticated, demanding high-performance, low-maintenance, and cost-effective battery solutions. Mergers and acquisition (M&A) trends indicate a consolidation phase, with larger companies acquiring innovative startups to enhance their product portfolios and market reach. For instance, the M&A volume in this sector has seen a steady increase, with an estimated XX million units in strategic deals over the historical period.

- Market Concentration: Moderate, with significant influence from established manufacturers.

- Technological Innovation Drivers: Enhanced energy density, faster charging, extended cycle life, improved safety features.

- Regulatory Frameworks: Focus on safety standards (e.g., UL certification), environmental compliance, and grid integration policies.

- Competitive Product Substitutes: Gradual displacement of lead-acid batteries due to performance and environmental advantages.

- End-User Demographics: Telecom operators, tower companies, data centers prioritizing reliability, cost-efficiency, and operational longevity.

- M&A Trends: Strategic acquisitions to strengthen product offerings and expand market presence.

LiFePO4 Battery for Telecom Growth Trends & Insights

The LiFePO4 battery for telecom market is poised for substantial growth, driven by the ubiquitous expansion of 5G networks and the increasing need for robust and sustainable energy storage solutions. The market size is projected to escalate significantly, from an estimated $XX billion in the base year of 2025 to an anticipated $XXX billion by the end of the forecast period in 2033. This impressive growth is underpinned by a Compound Annual Growth Rate (CAGR) of approximately XX%, reflecting the accelerating adoption of LiFePO4 technology across various telecom infrastructure segments. Technological disruptions, such as advancements in battery management systems (BMS) and the integration of artificial intelligence for predictive maintenance, are further enhancing the performance and reliability of these batteries, thereby boosting adoption rates.

Consumer behavior shifts, primarily from telecom operators and infrastructure providers, are moving towards prioritizing long-term total cost of ownership (TCO) over initial purchase price. This trend favors LiFePO4 batteries due to their extended lifespan, reduced maintenance requirements, and superior energy efficiency compared to traditional alternatives. The penetration of LiFePO4 batteries in the telecom sector is expected to climb from an estimated XX% in 2025 to over XX% by 2033. This surge is fueled by the critical need for uninterrupted power supply at cell sites, especially in remote or challenging environments, where LiFePO4's resilience and safety features are paramount. The transition from older, less efficient battery technologies to advanced LiFePO4 solutions is not just a performance upgrade but a strategic move towards operational sustainability and reduced carbon footprint for telecom giants.

The continuous build-out of mobile switching centers (MSCs) and the increasing density of macro, micro, pico, and femto cell sites globally necessitate a reliable and scalable power backup. LiFePO4 batteries, with their inherent safety, thermal stability, and long cycle life, are becoming the de facto standard for these critical applications. The development of higher capacity LiFePO4 cells, exceeding 200 Ah, is particularly crucial for supporting the growing power demands of advanced base stations and data centers. Furthermore, the evolving landscape of renewable energy integration within telecom infrastructure, where LiFePO4 batteries excel as efficient energy storage partners, is another significant growth catalyst.

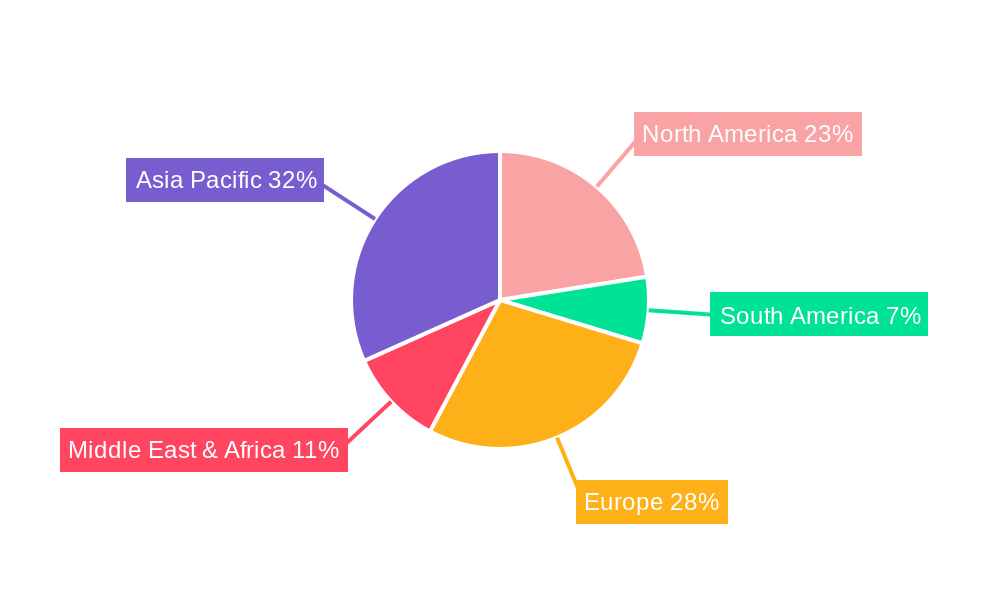

Dominant Regions, Countries, or Segments in LiFePO4 Battery for Telecom

The LiFePO4 battery for telecom market's dominance is currently most pronounced in the Asia-Pacific region, driven by its rapid 5G network deployment, massive manufacturing capabilities, and supportive government policies for renewable energy and digital infrastructure. Countries like China are leading the charge, not only as major consumers but also as powerhouse manufacturers of LiFePO4 batteries, accounting for an estimated XX% of the global market share in 2025. This dominance is further amplified by the sheer scale of telecom infrastructure development within the region.

Within the Application segment, the Macro Cell Site application is exhibiting the strongest growth and market penetration. This is directly attributable to the extensive deployment of 4G and 5G base stations, which require substantial and reliable backup power. Macro cell sites, being the backbone of mobile networks, demand high-capacity batteries with extended backup times, a niche where LiFePO4 batteries, particularly those exceeding 100 Ah, excel.

In terms of Types, the Capacity (Ah) 100-200 segment is currently the most significant contributor to market revenue and volume. These batteries offer an optimal balance of energy density, cost-effectiveness, and backup duration for a wide array of telecom infrastructure. However, the Capacity (Ah) More than 200 segment is witnessing the fastest growth rate, driven by the increasing power demands of advanced 5G equipment and edge computing deployments.

Key drivers behind this regional and segmental dominance include:

- Economic Policies: Government incentives for 5G rollout and renewable energy adoption in Asia-Pacific, particularly China, have spurred significant investment in telecom infrastructure and associated battery solutions.

- Infrastructure Development: The aggressive expansion of mobile networks, data centers, and telecommunication towers necessitates robust and scalable power backup systems, making LiFePO4 batteries indispensable.

- Technological Advancement & Local Manufacturing: Asia-Pacific's leadership in battery manufacturing technology, coupled with competitive pricing, gives it a substantial advantage.

- Growing Demand for Reliability: The increasing reliance on mobile connectivity for critical services fuels the demand for high-reliability power solutions at all cell site levels.

The market share for LiFePO4 batteries in macro cell sites is estimated to be around XX% in 2025, with a projected growth to XX% by 2033. The 100-200 Ah capacity segment holds an estimated XX% market share, while the >200 Ah segment, though smaller, is expected to grow at a CAGR of XX%.

LiFePO4 Battery for Telecom Product Landscape

The LiFePO4 battery product landscape for telecom is characterized by continuous innovation focused on enhancing performance, safety, and cost-effectiveness. Manufacturers are increasingly developing high-energy-density cells and modules specifically tailored for the demanding operational environments of telecom infrastructure. Key advancements include improved thermal management systems to ensure stable operation in extreme temperatures and sophisticated battery management systems (BMS) that optimize charging, discharging, and overall battery health, prolonging lifespan and preventing failures. Applications range from primary backup power for macro cell towers to smaller, more distributed power solutions for micro, pico, and femto cells. Unique selling propositions often revolve around extended cycle life (thousands of cycles), superior safety profiles compared to other lithium-ion chemistries, and faster recharge times. The integration of smart features for remote monitoring and diagnostics is also becoming a standard offering, enabling proactive maintenance and reducing operational downtime.

Key Drivers, Barriers & Challenges in LiFePO4 Battery for Telecom

The LiFePO4 battery market for telecom is propelled by several key drivers. The relentless global expansion of 5G networks is a primary catalyst, demanding highly reliable and energy-dense backup power solutions. The increasing need for uninterrupted services, even in remote or power-deficient areas, makes these batteries essential. Furthermore, governmental initiatives promoting renewable energy integration and sustainability in infrastructure development favor LiFePO4 due to its longer lifespan and environmental benefits. Technological advancements in battery management systems (BMS) and cell chemistry are enhancing performance and safety, making them more attractive for telecom operators.

However, several barriers and challenges exist. The initial capital cost of LiFePO4 batteries, while decreasing, can still be higher than traditional lead-acid alternatives, posing a challenge for budget-conscious deployments. Supply chain disruptions and the fluctuating prices of raw materials, such as lithium and cobalt, can impact production costs and availability, creating uncertainty. Stringent safety regulations and certification processes in some regions can also slow down product adoption. Moreover, competition from other emerging battery technologies and the need for specialized recycling infrastructure present ongoing challenges.

- Key Drivers:

- 5G network expansion and increased data traffic.

- Demand for grid modernization and telecom infrastructure resilience.

- Government support for green energy solutions.

- Technological advancements in battery performance and safety.

- Key Barriers & Challenges:

- Higher upfront capital expenditure.

- Raw material price volatility and supply chain risks.

- Evolving safety standards and regulatory compliance.

- Competition from alternative energy storage technologies.

- Development of specialized recycling infrastructure.

Emerging Opportunities in LiFePO4 Battery for Telecom

Emerging opportunities in the LiFePO4 battery for telecom market are abundant, particularly in areas of intelligent energy management and distributed power solutions. The growing trend of edge computing within telecom infrastructure presents a significant avenue for customized LiFePO4 battery solutions, offering reliable power for localized processing units. Furthermore, the integration of LiFePO4 batteries with renewable energy sources, such as solar and wind power, at telecom sites is a burgeoning opportunity, enabling greater energy independence and reduced operational costs. The development of modular and scalable battery systems that can be easily deployed and expanded to meet evolving network demands will also unlock new market segments. Untapped rural and remote areas, where grid stability is a concern, represent a substantial growth area for reliable LiFePO4 backup power solutions.

Growth Accelerators in the LiFePO4 Battery for Telecom Industry

Long-term growth in the LiFePO4 battery for telecom industry will be significantly accelerated by ongoing technological breakthroughs in cell chemistry, leading to higher energy densities and even longer cycle lives. Strategic partnerships between battery manufacturers and telecom equipment providers are crucial for co-developing integrated power solutions that are optimized for specific network architectures and operational requirements. Furthermore, market expansion strategies focusing on emerging economies with rapidly developing telecom infrastructures will be a key growth accelerator. The increasing focus on sustainability and circular economy principles, including efficient battery recycling programs, will also foster greater adoption and market confidence. The continuous innovation in Battery Management Systems (BMS) to enhance predictive analytics and remote diagnostics will further boost operational efficiency and reduce TCO.

Key Players Shaping the LiFePO4 Battery for Telecom Market

- Narada

- Samsung SDI

- LG Chem

- Shuangdeng

- Panasonic

- Coslight

- GS Yuasa Corporation

- Sacred Sun

- ZTT

- EVE Energy

- EEMB

- Vision Group

- Topband

- Zhejiang GBS

- UFO battery

Notable Milestones in LiFePO4 Battery for Telecom Sector

- 2019: Increased adoption of LiFePO4 for telecom backup power solutions due to enhanced safety and longevity compared to lead-acid batteries.

- 2020: Major telecom operators begin piloting LiFePO4 batteries for 5G base station deployments, recognizing their potential for improved performance and reduced maintenance.

- 2021: Significant advancements in energy density and cost reduction for LiFePO4 cells, making them more competitive for large-scale telecom infrastructure.

- 2022: Growing emphasis on integrated Battery Management Systems (BMS) with remote monitoring capabilities for LiFePO4 telecom batteries.

- 2023: Increased M&A activity as established battery manufacturers acquire smaller, innovative companies to expand their LiFePO4 portfolio for telecom.

- 2024: Greater focus on sustainable sourcing of raw materials and development of advanced recycling processes for LiFePO4 batteries used in telecom.

In-Depth LiFePO4 Battery for Telecom Market Outlook

- 2019: Increased adoption of LiFePO4 for telecom backup power solutions due to enhanced safety and longevity compared to lead-acid batteries.

- 2020: Major telecom operators begin piloting LiFePO4 batteries for 5G base station deployments, recognizing their potential for improved performance and reduced maintenance.

- 2021: Significant advancements in energy density and cost reduction for LiFePO4 cells, making them more competitive for large-scale telecom infrastructure.

- 2022: Growing emphasis on integrated Battery Management Systems (BMS) with remote monitoring capabilities for LiFePO4 telecom batteries.

- 2023: Increased M&A activity as established battery manufacturers acquire smaller, innovative companies to expand their LiFePO4 portfolio for telecom.

- 2024: Greater focus on sustainable sourcing of raw materials and development of advanced recycling processes for LiFePO4 batteries used in telecom.

In-Depth LiFePO4 Battery for Telecom Market Outlook

The future market outlook for LiFePO4 batteries in the telecom sector is exceptionally robust, driven by the ongoing global digital transformation and the insatiable demand for connectivity. Growth accelerators such as the continued expansion of 5G networks, the integration of renewable energy sources at telecom sites, and the development of intelligent edge computing infrastructure will significantly bolster market expansion. Strategic collaborations between battery manufacturers and telecom giants will foster the creation of tailored, high-performance power solutions. The increasing awareness and adoption of sustainable energy storage practices will further solidify LiFePO4's position as the preferred technology for its environmental benefits and long operational lifespan. Emerging market opportunities in rural electrification and critical infrastructure resilience will continue to fuel demand, ensuring a promising trajectory for the LiFePO4 battery for telecom market.

LiFePO4 Battery for Telecom Segmentation

-

1. Application

- 1.1. Mobile Switching Center(MSC)

- 1.2. Macro Cell Site

- 1.3. Micro Cell Site

- 1.4. Pico Cell Site

- 1.5. Femto Cell Site

-

2. Types

- 2.1. Capacity (Ah) Less than 50

- 2.2. Capacity (Ah) 50-100

- 2.3. Capacity (Ah) 100-200

- 2.4. Capacity (Ah) More than 200

LiFePO4 Battery for Telecom Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LiFePO4 Battery for Telecom REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Mobile Switching Center(MSC)

- 5.1.2. Macro Cell Site

- 5.1.3. Micro Cell Site

- 5.1.4. Pico Cell Site

- 5.1.5. Femto Cell Site

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Capacity (Ah) Less than 50

- 5.2.2. Capacity (Ah) 50-100

- 5.2.3. Capacity (Ah) 100-200

- 5.2.4. Capacity (Ah) More than 200

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Mobile Switching Center(MSC)

- 6.1.2. Macro Cell Site

- 6.1.3. Micro Cell Site

- 6.1.4. Pico Cell Site

- 6.1.5. Femto Cell Site

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Capacity (Ah) Less than 50

- 6.2.2. Capacity (Ah) 50-100

- 6.2.3. Capacity (Ah) 100-200

- 6.2.4. Capacity (Ah) More than 200

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Mobile Switching Center(MSC)

- 7.1.2. Macro Cell Site

- 7.1.3. Micro Cell Site

- 7.1.4. Pico Cell Site

- 7.1.5. Femto Cell Site

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Capacity (Ah) Less than 50

- 7.2.2. Capacity (Ah) 50-100

- 7.2.3. Capacity (Ah) 100-200

- 7.2.4. Capacity (Ah) More than 200

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Mobile Switching Center(MSC)

- 8.1.2. Macro Cell Site

- 8.1.3. Micro Cell Site

- 8.1.4. Pico Cell Site

- 8.1.5. Femto Cell Site

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Capacity (Ah) Less than 50

- 8.2.2. Capacity (Ah) 50-100

- 8.2.3. Capacity (Ah) 100-200

- 8.2.4. Capacity (Ah) More than 200

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Mobile Switching Center(MSC)

- 9.1.2. Macro Cell Site

- 9.1.3. Micro Cell Site

- 9.1.4. Pico Cell Site

- 9.1.5. Femto Cell Site

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Capacity (Ah) Less than 50

- 9.2.2. Capacity (Ah) 50-100

- 9.2.3. Capacity (Ah) 100-200

- 9.2.4. Capacity (Ah) More than 200

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LiFePO4 Battery for Telecom Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Mobile Switching Center(MSC)

- 10.1.2. Macro Cell Site

- 10.1.3. Micro Cell Site

- 10.1.4. Pico Cell Site

- 10.1.5. Femto Cell Site

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Capacity (Ah) Less than 50

- 10.2.2. Capacity (Ah) 50-100

- 10.2.3. Capacity (Ah) 100-200

- 10.2.4. Capacity (Ah) More than 200

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Narada

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung SDI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Chem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shuangdeng

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panasonic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coslight

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GS Yuasa Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sacred Sun

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZTT

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EVE Energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EEMB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vision Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Topband

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhejiang GBS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 UFO battery

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Narada

List of Figures

- Figure 1: Global LiFePO4 Battery for Telecom Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America LiFePO4 Battery for Telecom Revenue (million), by Application 2024 & 2032

- Figure 3: North America LiFePO4 Battery for Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America LiFePO4 Battery for Telecom Revenue (million), by Types 2024 & 2032

- Figure 5: North America LiFePO4 Battery for Telecom Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America LiFePO4 Battery for Telecom Revenue (million), by Country 2024 & 2032

- Figure 7: North America LiFePO4 Battery for Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America LiFePO4 Battery for Telecom Revenue (million), by Application 2024 & 2032

- Figure 9: South America LiFePO4 Battery for Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America LiFePO4 Battery for Telecom Revenue (million), by Types 2024 & 2032

- Figure 11: South America LiFePO4 Battery for Telecom Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America LiFePO4 Battery for Telecom Revenue (million), by Country 2024 & 2032

- Figure 13: South America LiFePO4 Battery for Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe LiFePO4 Battery for Telecom Revenue (million), by Application 2024 & 2032

- Figure 15: Europe LiFePO4 Battery for Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe LiFePO4 Battery for Telecom Revenue (million), by Types 2024 & 2032

- Figure 17: Europe LiFePO4 Battery for Telecom Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe LiFePO4 Battery for Telecom Revenue (million), by Country 2024 & 2032

- Figure 19: Europe LiFePO4 Battery for Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa LiFePO4 Battery for Telecom Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa LiFePO4 Battery for Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa LiFePO4 Battery for Telecom Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa LiFePO4 Battery for Telecom Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa LiFePO4 Battery for Telecom Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa LiFePO4 Battery for Telecom Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LiFePO4 Battery for Telecom Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific LiFePO4 Battery for Telecom Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific LiFePO4 Battery for Telecom Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific LiFePO4 Battery for Telecom Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific LiFePO4 Battery for Telecom Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific LiFePO4 Battery for Telecom Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global LiFePO4 Battery for Telecom Revenue million Forecast, by Country 2019 & 2032

- Table 41: China LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific LiFePO4 Battery for Telecom Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LiFePO4 Battery for Telecom?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the LiFePO4 Battery for Telecom?

Key companies in the market include Narada, Samsung SDI, LG Chem, Shuangdeng, Panasonic, Coslight, GS Yuasa Corporation, Sacred Sun, ZTT, EVE Energy, EEMB, Vision Group, Topband, Zhejiang GBS, UFO battery.

3. What are the main segments of the LiFePO4 Battery for Telecom?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 3647.8 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LiFePO4 Battery for Telecom," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LiFePO4 Battery for Telecom report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LiFePO4 Battery for Telecom?

To stay informed about further developments, trends, and reports in the LiFePO4 Battery for Telecom, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence