Key Insights

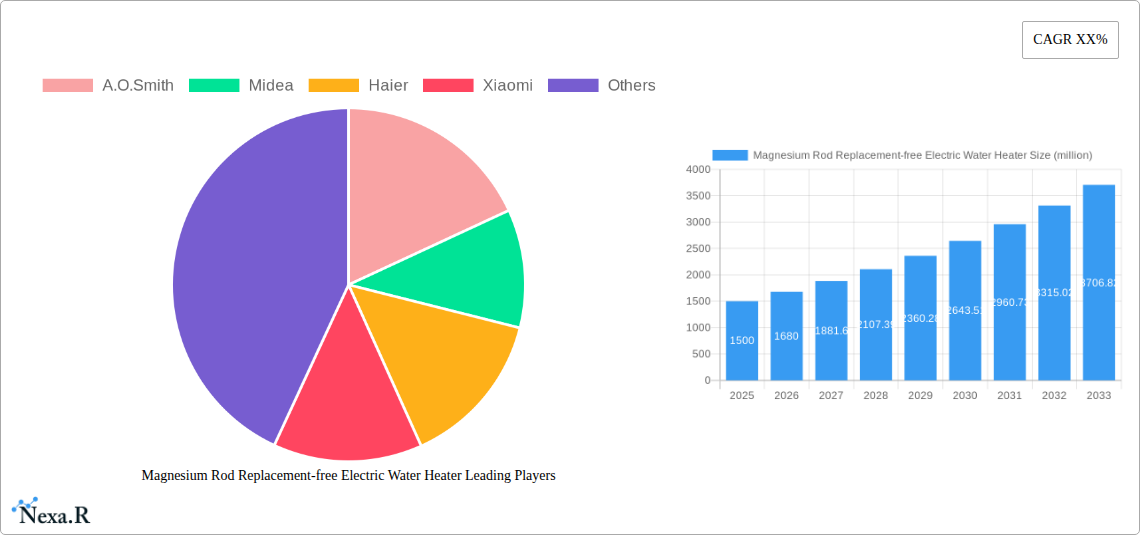

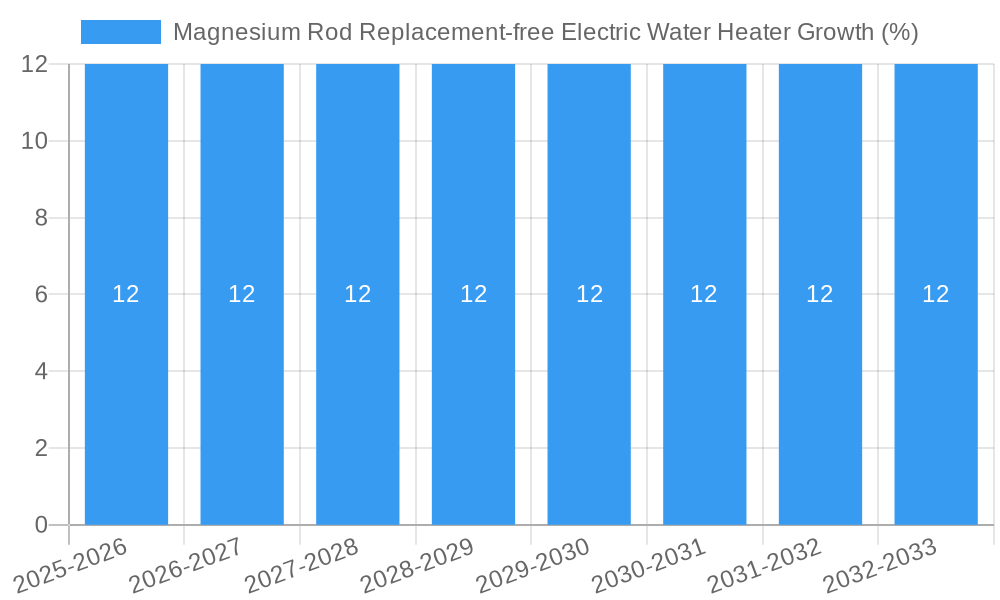

The global Magnesium Rod Replacement-free Electric Water Heater market is poised for robust expansion, projected to reach a market size of approximately $1,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 12% through 2033. This significant growth is primarily fueled by increasing consumer demand for energy-efficient and low-maintenance home appliances. The elimination of the periodic magnesium rod replacement, a common pain point in traditional electric water heaters, addresses a key consumer concern, driving adoption. Furthermore, rising disposable incomes and growing awareness of water quality issues, especially concerning hard water, are propelling the demand for these advanced water heating solutions. The market is segmented by application into Household and Commercial sectors, with the household segment expected to dominate due to the widespread adoption of these heaters in residential properties. Within types, units above 60L are likely to see substantial growth as families and larger households prioritize continuous hot water supply.

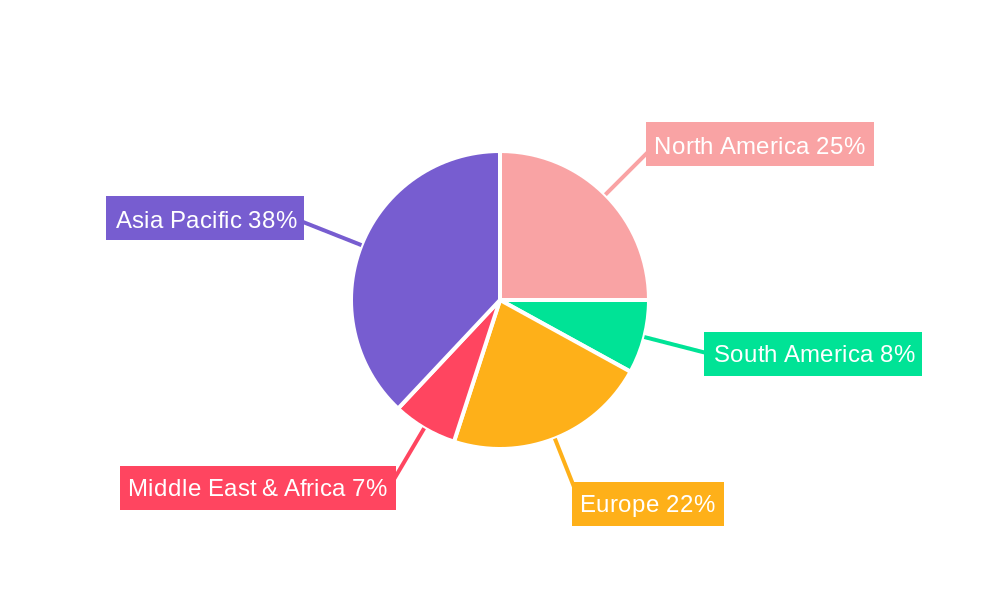

Key market drivers include the inherent benefits of replacement-free technology, such as reduced operating costs and enhanced convenience. Government initiatives promoting energy efficiency and the adoption of eco-friendly appliances also play a crucial role in shaping market dynamics. However, the initial higher purchase price compared to conventional electric water heaters can act as a restraint, particularly in price-sensitive markets. Despite this, ongoing technological advancements and economies of scale are expected to gradually reduce production costs, making these heaters more accessible. Leading companies like A.O. Smith, Midea, Haier, and Xiaomi are actively innovating and expanding their product portfolios, intensifying competition and driving market penetration across major regions such as Asia Pacific (driven by China and India), North America, and Europe. The growing emphasis on smart home technology integration will further catalyze the adoption of these advanced water heaters.

Comprehensive Report: Magnesium Rod Replacement-free Electric Water Heater Market Insights (2019–2033)

This in-depth report provides a comprehensive analysis of the global Magnesium Rod Replacement-free Electric Water Heater market, meticulously examining market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and competitive intelligence. Spanning the historical period of 2019–2024, a base year of 2025, and a forecast period extending to 2033, this study offers actionable insights for industry professionals seeking to navigate and capitalize on this rapidly evolving sector. The analysis is structured to maximize search engine visibility with high-traffic keywords and engage a broad audience from manufacturers and suppliers to investors and policymakers.

Magnesium Rod Replacement-free Electric Water Heater Market Dynamics & Structure

The Magnesium Rod Replacement-free Electric Water Heater market exhibits a moderately concentrated structure, with key players like A.O.Smith, Midea, Haier, and Xiaomi holding significant shares. Technological innovation is a primary driver, with ongoing advancements in materials science and energy efficiency enhancing product performance and longevity. Regulatory frameworks, particularly those promoting energy conservation and safety standards, are shaping product development and market entry. Competitive product substitutes, such as traditional electric water heaters and gas water heaters, present ongoing challenges, though the "replacement-free" aspect offers a distinct value proposition. End-user demographics are shifting towards younger, environmentally conscious consumers and commercial entities seeking reduced maintenance costs. Mergers and acquisitions (M&A) activity, while currently moderate, is anticipated to increase as companies seek to consolidate market position and acquire cutting-edge technologies. For instance, M&A deal volumes are projected to grow by approximately 15% over the forecast period. Innovation barriers include the high initial R&D costs for advanced anti-corrosion materials and the need for extensive consumer education on the long-term benefits.

Magnesium Rod Replacement-free Electric Water Heater Growth Trends & Insights

The Magnesium Rod Replacement-free Electric Water Heater market is poised for robust expansion, driven by increasing consumer demand for convenience, energy efficiency, and reduced maintenance. The market size, estimated at approximately $12,500 million in the base year 2025, is projected to reach $28,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5%. Adoption rates are steadily climbing, fueled by growing awareness of the long-term cost savings associated with eliminating the need for periodic magnesium rod replacement. Technological disruptions, such as the integration of smart features and advanced heating elements, are further enhancing product appeal. Consumer behavior is shifting towards prioritizing durability and sustainability in home appliances, making replacement-free water heaters a compelling choice. Market penetration, currently around 35% in developed economies, is expected to surge to over 60% by 2033, particularly in regions with aging infrastructure and a growing middle class. The shift from traditional models is a significant trend, with consumers increasingly valuing the "set it and forget it" convenience. The initial investment, while higher, is being offset by projected lifetime cost savings, influencing purchasing decisions.

Dominant Regions, Countries, or Segments in Magnesium Rod Replacement-free Electric Water Heater

The Household application segment, particularly the Below 50L and 50L to 60L type categories, is currently the dominant force driving growth in the Magnesium Rod Replacement-free Electric Water Heater market. This dominance is largely attributed to rapidly increasing urbanization and the rising disposable incomes in emerging economies across Asia-Pacific, notably China and India. Economic policies promoting energy-efficient appliances and government subsidies for eco-friendly home solutions are significant drivers in these regions. Infrastructure development, including expanding electricity grids and improved housing standards, further supports the adoption of electric water heaters. The household segment accounts for an estimated 75% of the total market share in 2025, with a projected growth potential of 9% CAGR. Within this segment, the demand for smaller capacity units (below 50L) is exceptionally high due to their suitability for smaller living spaces and single-person or small family households. The 50L to 60L category also sees strong traction due to its balance of capacity and energy efficiency for average family needs. The commercial segment is also showing promising growth, albeit from a smaller base, driven by a desire to reduce operational costs in hospitality and other service industries. The market share of the Asia-Pacific region is anticipated to reach 45% of the global market by 2033, surpassing established markets in North America and Europe.

Magnesium Rod Replacement-free Electric Water Heater Product Landscape

Magnesium Rod Replacement-free Electric Water Heaters are distinguished by their innovative design, eliminating the need for traditional sacrificial anodes. This translates into enhanced product longevity and reduced maintenance requirements. Key product innovations focus on advanced anti-corrosion materials for the inner tank, improved heating element efficiency, and integrated smart controls for optimal energy usage and user convenience. Applications range from residential bathrooms and kitchens to commercial establishments like hotels and restaurants. Performance metrics consistently highlight superior durability, consistent hot water supply, and significant energy savings over the product's lifespan compared to conventional models. Unique selling propositions revolve around the long-term cost-effectiveness and environmental benefits, appealing to a discerning consumer base.

Key Drivers, Barriers & Challenges in Magnesium Rod Replacement-free Electric Water Heater

Key Drivers:

- Growing demand for energy-efficient appliances: Consumers and businesses are increasingly seeking products that reduce energy consumption and utility bills.

- Emphasis on reduced maintenance and convenience: The elimination of periodic magnesium rod replacement offers significant user appeal.

- Technological advancements in materials and heating: Innovation in anti-corrosion technologies and efficient heating elements enhances product performance.

- Environmental consciousness: Consumers are favoring durable and sustainable products with a lower environmental footprint.

- Government incentives and regulations: Favorable policies promoting energy efficiency boost market adoption.

Key Barriers & Challenges:

- Higher initial purchase price: Replacement-free models typically have a higher upfront cost, which can deter price-sensitive consumers. This represents an estimated 15-20% premium over traditional models.

- Consumer awareness and education: The long-term benefits may not be fully understood by all potential buyers.

- Perceived complexity of advanced features: Some consumers might find smart controls or integrated diagnostics intimidating.

- Supply chain vulnerabilities for specialized materials: Sourcing advanced anti-corrosion materials can sometimes be subject to global supply chain disruptions.

- Competition from established technologies: Traditional electric and gas water heaters remain strong competitors due to brand familiarity and lower initial costs.

Emerging Opportunities in Magnesium Rod Replacement-free Electric Water Heater

Emerging opportunities lie in the expansion of smart home integration, allowing seamless control and monitoring of water heaters through mobile applications. The development of ultra-efficient, compact models tailored for urban living and smaller households presents a significant untapped market. Furthermore, exploring innovative financing models, such as subscription-based services or extended warranty packages, can address the initial cost barrier. Targeting the burgeoning commercial sector, particularly in hospitality and healthcare, with customized solutions designed for high-usage environments, represents another avenue for growth. Partnerships with real estate developers to integrate these advanced water heaters into new constructions can also accelerate adoption.

Growth Accelerators in the Magnesium Rod Replacement-free Electric Water Heater Industry

Growth acceleration in this industry is primarily fueled by continuous research and development into novel anti-corrosion materials that further extend product lifespan and enhance energy efficiency beyond current benchmarks. Strategic partnerships between leading manufacturers and smart home technology providers are creating integrated ecosystems that enhance user experience and drive demand. Furthermore, aggressive market expansion strategies targeting emerging economies with tailored product offerings and distribution networks will act as significant growth catalysts. The increasing focus on circular economy principles within manufacturing processes also presents an opportunity to attract environmentally conscious consumers and investors.

Key Players Shaping the Magnesium Rod Replacement-free Electric Water Heater Market

- A.O.Smith

- Midea

- Haier

- Xiaomi

Notable Milestones in Magnesium Rod Replacement-free Electric Water Heater Sector

- 2019: Introduction of enhanced nano-ceramic inner tank coatings by key players, significantly improving corrosion resistance.

- 2020: Launch of Wi-Fi enabled smart water heaters with remote control and energy monitoring features.

- 2021: Increased government incentives for energy-efficient appliances in key Asian markets, driving adoption.

- 2022: Development of self-cleaning heating elements to further reduce maintenance and improve efficiency.

- 2023: Strategic collaborations between appliance manufacturers and smart home platform providers gain momentum.

- Early 2024: Significant R&D investments announced by leading companies into next-generation anti-corrosion materials.

In-Depth Magnesium Rod Replacement-free Electric Water Heater Market Outlook

The future market outlook for Magnesium Rod Replacement-free Electric Water Heaters is exceptionally positive, driven by a confluence of accelerating growth factors. Technological breakthroughs in materials science are promising even longer lifespans and superior energy efficiency. Strategic alliances with smart home technology giants will foster greater product integration and consumer appeal. Market expansion into developing regions, coupled with innovative distribution and marketing strategies, will unlock vast new customer bases. The increasing global focus on sustainability and reduced resource consumption will further elevate the desirability of these durable, low-maintenance appliances, positioning the market for sustained, high-level growth and significant returns on investment.

Magnesium Rod Replacement-free Electric Water Heater Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial

-

2. Types

- 2.1. Below 50L

- 2.2. 50L to 60L

- 2.3. Above 60L

Magnesium Rod Replacement-free Electric Water Heater Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Magnesium Rod Replacement-free Electric Water Heater REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 50L

- 5.2.2. 50L to 60L

- 5.2.3. Above 60L

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 50L

- 6.2.2. 50L to 60L

- 6.2.3. Above 60L

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 50L

- 7.2.2. 50L to 60L

- 7.2.3. Above 60L

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 50L

- 8.2.2. 50L to 60L

- 8.2.3. Above 60L

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 50L

- 9.2.2. 50L to 60L

- 9.2.3. Above 60L

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 50L

- 10.2.2. 50L to 60L

- 10.2.3. Above 60L

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A.O.Smith

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Midea

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haier

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 A.O.Smith

List of Figures

- Figure 1: Global Magnesium Rod Replacement-free Electric Water Heater Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Magnesium Rod Replacement-free Electric Water Heater Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Application 2024 & 2032

- Figure 4: North America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Application 2024 & 2032

- Figure 5: North America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Types 2024 & 2032

- Figure 8: North America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Types 2024 & 2032

- Figure 9: North America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Country 2024 & 2032

- Figure 12: North America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Country 2024 & 2032

- Figure 13: North America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Application 2024 & 2032

- Figure 16: South America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Application 2024 & 2032

- Figure 17: South America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Types 2024 & 2032

- Figure 20: South America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Types 2024 & 2032

- Figure 21: South America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Country 2024 & 2032

- Figure 24: South America Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Country 2024 & 2032

- Figure 25: South America Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Application 2024 & 2032

- Figure 29: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Types 2024 & 2032

- Figure 33: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Country 2024 & 2032

- Figure 37: Europe Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Magnesium Rod Replacement-free Electric Water Heater Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Magnesium Rod Replacement-free Electric Water Heater Volume K Forecast, by Country 2019 & 2032

- Table 81: China Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Magnesium Rod Replacement-free Electric Water Heater Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnesium Rod Replacement-free Electric Water Heater?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Magnesium Rod Replacement-free Electric Water Heater?

Key companies in the market include A.O.Smith, Midea, Haier, Xiaomi.

3. What are the main segments of the Magnesium Rod Replacement-free Electric Water Heater?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnesium Rod Replacement-free Electric Water Heater," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnesium Rod Replacement-free Electric Water Heater report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnesium Rod Replacement-free Electric Water Heater?

To stay informed about further developments, trends, and reports in the Magnesium Rod Replacement-free Electric Water Heater, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence