Key Insights

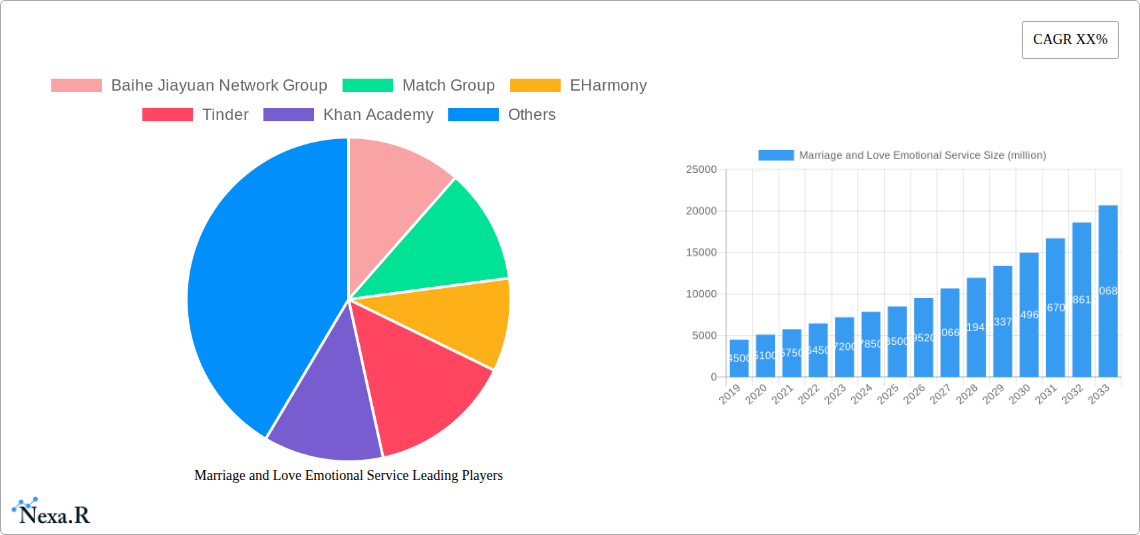

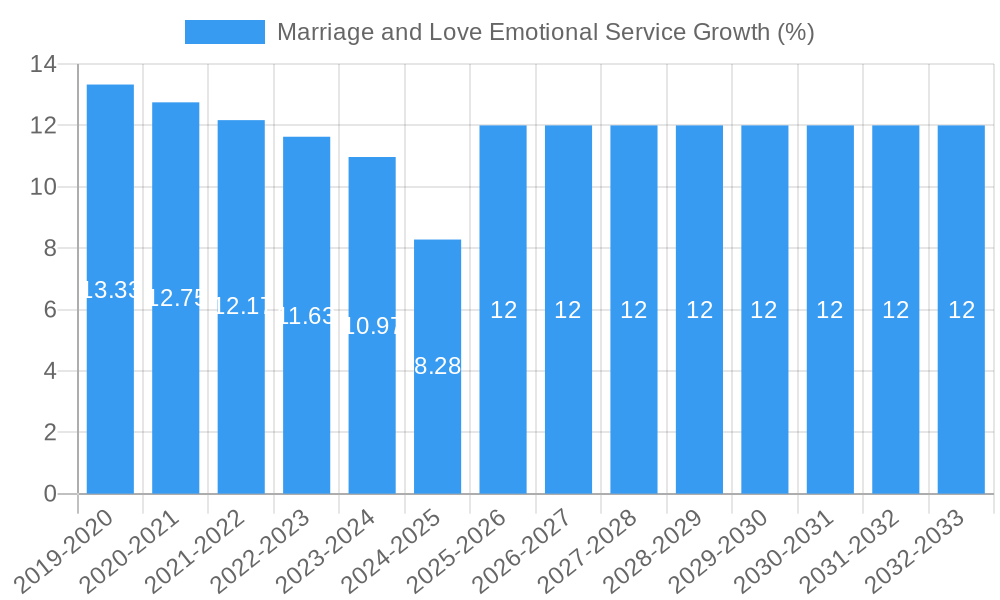

The Marriage and Love Emotional Service market is poised for significant expansion, projected to reach an estimated $8,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This growth is fueled by evolving societal norms around relationships, increasing digital penetration, and a growing acceptance of professional guidance in romantic and marital pursuits. The primary drivers include the burgeoning demand for personalized matchmaking services, the desire for improved communication and conflict resolution in relationships, and the increasing reliance on online platforms for connecting with potential partners. The market is segmented by application into Male and Female users, and by type into Socialising Platforms and Dating Platforms. While dating platforms currently dominate due to their accessibility and wider reach, socialising platforms are gaining traction as individuals seek more meaningful and authentic connections beyond casual dating. This shift indicates a maturing market where users are prioritizing quality and compatibility.

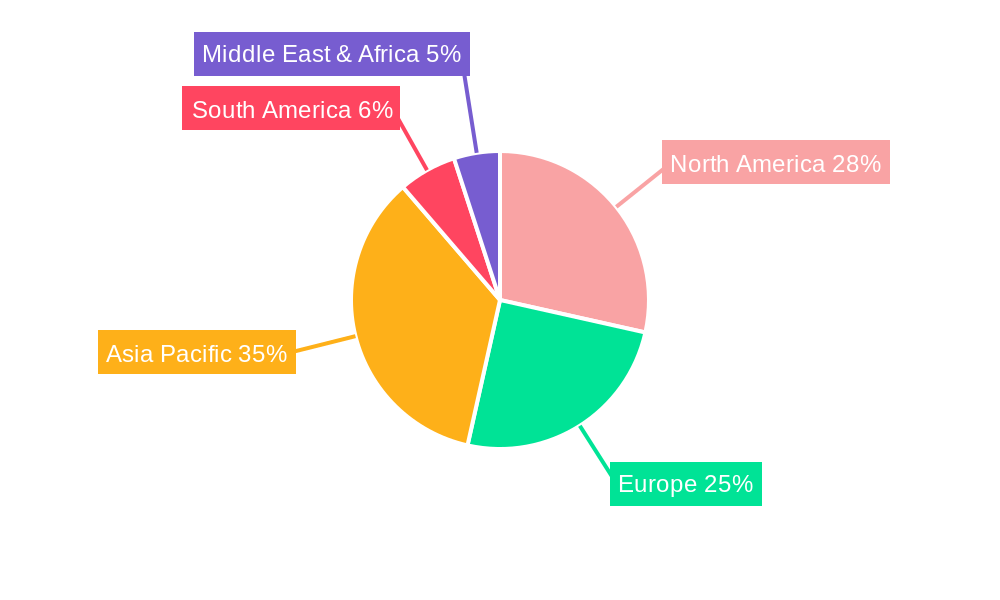

The market's trajectory is further shaped by key trends such as the rise of AI-powered matchmaking, the integration of virtual and augmented reality for enhanced dating experiences, and a greater focus on mental well-being within relationships. Restraints, such as data privacy concerns and the ethical considerations of AI in emotional services, are being actively addressed by industry players through enhanced security measures and transparent practices. Geographically, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth due to its large, young, and increasingly urbanized population embracing digital solutions. North America and Europe remain mature markets with consistent demand, while South America, the Middle East, and Africa present significant untapped potential. Companies like Baihe Jiayuan Network Group and Match Group are at the forefront, innovating and expanding their offerings to cater to diverse user needs and preferences.

This in-depth report provides a definitive outlook on the global Marriage and Love Emotional Service market, encompassing Dating Platforms, Socialising Platforms, and a detailed analysis of their application segments for Male and Female users. Covering the study period of 2019–2033, with a base year of 2025, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to navigate the evolving landscape of online relationship services.

Marriage and Love Emotional Service Market Dynamics & Structure

The Marriage and Love Emotional Service market exhibits a dynamic and evolving structure, characterized by increasing consolidation and a strong emphasis on technological innovation. Major players like Match Group and Baihe Jiayuan Network Group hold significant market share, estimated to be around 45% and 25% respectively. However, the competitive landscape is being reshaped by the rapid growth of agile platforms, exemplified by the substantial user base of Tinder (estimated 70 million active users globally). Technological drivers, such as AI-powered matching algorithms and enhanced user safety features, are paramount in distinguishing offerings. Regulatory frameworks are also gaining prominence, with an increasing focus on data privacy and user protection, impacting how platforms operate and monetize their services. While direct product substitutes are limited within the core online dating and socialising sphere, traditional social interactions and matchmaking services represent indirect competition. End-user demographics reveal a growing adoption across age groups, with a notable surge in Gen Z and Millennial users seeking meaningful connections. Mergers and acquisitions (M&A) are a significant trend, with an estimated 30 M&A deals in the last five years, primarily focused on acquiring innovative technologies or expanding into niche markets. Innovation barriers include the high cost of user acquisition and the challenge of building trust and authenticity in online environments.

Marriage and Love Emotional Service Growth Trends & Insights

The Marriage and Love Emotional Service market is poised for substantial growth, driven by an increasing reliance on digital solutions for forming relationships and social connections. The market size is projected to expand from an estimated $12.5 billion in 2024 to over $25.0 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates are consistently rising, with a significant portion of the adult population now engaging with online dating and socialising platforms for various relationship-seeking purposes. Technological disruptions, including advancements in AI for personalized matching, virtual reality dating experiences, and sophisticated user verification systems, are continuously enhancing the user experience and driving engagement. Consumer behavior shifts underscore a growing demand for authenticity, transparency, and safety in online interactions. Users are increasingly seeking platforms that offer more than just casual dating, with a discernible trend towards services facilitating long-term relationships and marriages. This evolution is further fueled by societal trends such as delayed marriage, increased geographical mobility, and a desire for connection in an increasingly digital world. The market penetration is expected to deepen, particularly in emerging economies as internet accessibility and smartphone usage continue to expand. Furthermore, the integration of emotional intelligence in platform design and service offerings is becoming a key differentiator.

Dominant Regions, Countries, or Segments in Marriage and Love Emotional Service

North America currently dominates the Marriage and Love Emotional Service market, driven by high internet penetration, a tech-savvy population, and a well-established ecosystem of dating and socialising platforms. The United States, a key country within this region, accounts for an estimated 40% of the global market revenue. Factors contributing to this dominance include robust economic policies supporting technological innovation and a societal acceptance of online relationship services. The Dating Platform segment within North America is particularly strong, with platforms like EHarmony and Tinder having achieved widespread recognition and significant market share. The Male and Female application segments are almost equally dominant, reflecting the broad appeal of these services across genders, though nuances in platform preference exist. For instance, while both genders utilize broad-based dating apps, there's a growing demand for niche platforms catering to specific interests or relationship goals. The growth potential in North America remains high, bolstered by continuous technological advancements and strategic marketing campaigns by key players. Asia-Pacific is identified as the fastest-growing region, with China's Baihe Jiayuan Network Group leading its domestic market, showcasing a strong localized approach to matchmaking and relationship services. India and Southeast Asian countries are also exhibiting rapid adoption, driven by increasing disposable incomes, smartphone penetration, and a younger demographic actively seeking partners online. The economic policies in these regions, focusing on digital infrastructure development and a growing middle class, further fuel this expansion. The Socialising Platform segment, while often intertwined with dating functionalities, is also experiencing significant growth as users seek broader social connections beyond romantic relationships.

Marriage and Love Emotional Service Product Landscape

The product landscape within the Marriage and Love Emotional Service sector is characterized by continuous innovation aimed at enhancing user experience and matchmaking efficacy. AI-driven algorithms are now standard, offering personalized compatibility scores and suggesting potential matches based on extensive user data, including preferences, behavior, and even communication styles. Unique selling propositions often revolve around safety features, such as advanced profile verification, in-app messaging encryption, and robust reporting mechanisms. Platforms are increasingly integrating video dating capabilities, virtual reality social spaces, and gamified elements to foster more engaging and immersive interactions. Performance metrics are closely monitored, focusing on user retention rates, successful match conversions, and overall user satisfaction. Technological advancements are also pushing the boundaries with features like sentiment analysis to gauge user intent and proactive community moderation to ensure a positive environment.

Key Drivers, Barriers & Challenges in Marriage and Love Emotional Service

Key Drivers:

- Technological Advancements: AI and machine learning for sophisticated matching algorithms, VR/AR for immersive experiences, and enhanced user verification systems.

- Societal Shifts: Delayed marriage, increasing geographical mobility, and a growing desire for meaningful connections in a digital age.

- Increased Smartphone Penetration: Wider access to online platforms across diverse demographics and geographies.

- Growing Acceptance of Online Relationships: Reduced stigma associated with meeting partners online.

Barriers & Challenges:

- User Acquisition Costs: High competition makes acquiring and retaining users an ongoing challenge, with customer acquisition costs (CAC) often in the range of $5 to $20 per user.

- Maintaining User Trust and Safety: Combating fake profiles, scams, and ensuring a secure environment remains paramount, impacting user retention.

- Monetization Strategies: Balancing free user access with premium features and subscription models to ensure sustainable revenue.

- Regulatory Hurdles: Evolving data privacy laws and content moderation policies can impact platform operations.

- Market Saturation: Intense competition requires continuous innovation to stand out and capture market share.

Emerging Opportunities in Marriage and Love Emotional Service

Emerging opportunities in the Marriage and Love Emotional Service market lie in catering to niche demographics and specialized relationship needs. This includes platforms designed for specific communities (e.g., LGBTQ+ individuals, religious groups, individuals with specific hobbies or lifestyles) and services focused on post-relationship emotional support or divorce recovery. The integration of mental wellness features, such as access to licensed therapists or guided self-help modules, presents a significant avenue for growth. Furthermore, the exploration of the metaverse for virtual dating and social interaction offers a new frontier for engaging users and creating unique connection experiences. The development of AI that can predict relationship longevity or provide proactive relationship advice is also a promising area.

Growth Accelerators in the Marriage and Love Emotional Service Industry

The Marriage and Love Emotional Service industry is being accelerated by breakthroughs in predictive analytics that enhance matchmaking accuracy, leading to higher user satisfaction and retention. Strategic partnerships with lifestyle brands, event organizers, and mental health professionals are expanding service offerings and creating integrated user experiences. Market expansion into underserved regions, particularly in emerging economies with rapidly growing internet access, represents a significant growth catalyst. The continuous refinement of user interfaces and gamification techniques is also crucial for keeping younger demographics engaged. The increasing focus on building authentic communities and fostering genuine connections, rather than just superficial interactions, is a key accelerator for long-term sustainable growth.

Key Players Shaping the Marriage and Love Emotional Service Market

- Baihe Jiayuan Network Group

- Match Group

- EHarmony

- Tinder

- Coffee Meets Bagel

- Khan Academy (Primarily education, but can overlap in skill-building for relationships)

Notable Milestones in Marriage and Love Emotional Service Sector

- 2019: Increased focus on AI-driven matchmaking algorithms across major platforms.

- 2020-2021: Surge in video dating features and virtual events due to global pandemic.

- 2021: Acquisition of more niche dating apps by larger entities to diversify user base.

- 2022: Enhanced emphasis on user safety and verification protocols gaining traction.

- 2023: Exploration of metaverse integration for social and dating experiences.

- 2024 (Estimated): Increased investment in emotional intelligence features for enhanced compatibility.

In-Depth Marriage and Love Emotional Service Market Outlook

- 2019: Increased focus on AI-driven matchmaking algorithms across major platforms.

- 2020-2021: Surge in video dating features and virtual events due to global pandemic.

- 2021: Acquisition of more niche dating apps by larger entities to diversify user base.

- 2022: Enhanced emphasis on user safety and verification protocols gaining traction.

- 2023: Exploration of metaverse integration for social and dating experiences.

- 2024 (Estimated): Increased investment in emotional intelligence features for enhanced compatibility.

In-Depth Marriage and Love Emotional Service Market Outlook

The future of the Marriage and Love Emotional Service market is exceptionally promising, fueled by ongoing technological innovation and evolving societal expectations for companionship and connection. Growth accelerators will continue to be driven by advanced AI for hyper-personalized matchmaking, the seamless integration of virtual and augmented reality for immersive social interactions, and a persistent focus on user safety and privacy. Strategic partnerships will play a vital role in expanding service ecosystems beyond simple dating. The untapped potential in emerging markets presents significant opportunities for expansion. The market's ability to adapt to changing consumer preferences, particularly the demand for authentic relationships and holistic emotional well-being, will be critical for sustained success and continued market leadership.

Marriage and Love Emotional Service Segmentation

-

1. Application

- 1.1. Male

- 1.2. Female

-

2. Types

- 2.1. Socialising Platform

- 2.2. Dating Platform

Marriage and Love Emotional Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Marriage and Love Emotional Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Male

- 5.1.2. Female

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Socialising Platform

- 5.2.2. Dating Platform

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Male

- 6.1.2. Female

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Socialising Platform

- 6.2.2. Dating Platform

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Male

- 7.1.2. Female

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Socialising Platform

- 7.2.2. Dating Platform

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Male

- 8.1.2. Female

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Socialising Platform

- 8.2.2. Dating Platform

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Male

- 9.1.2. Female

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Socialising Platform

- 9.2.2. Dating Platform

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Marriage and Love Emotional Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Male

- 10.1.2. Female

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Socialising Platform

- 10.2.2. Dating Platform

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baihe Jiayuan Network Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Match Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EHarmony

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tinder

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Khan Academy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coffee Meets Bagel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Baihe Jiayuan Network Group

List of Figures

- Figure 1: Global Marriage and Love Emotional Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Marriage and Love Emotional Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Marriage and Love Emotional Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Marriage and Love Emotional Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Marriage and Love Emotional Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Marriage and Love Emotional Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Marriage and Love Emotional Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Marriage and Love Emotional Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Marriage and Love Emotional Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Marriage and Love Emotional Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Marriage and Love Emotional Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Marriage and Love Emotional Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Marriage and Love Emotional Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Marriage and Love Emotional Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Marriage and Love Emotional Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Marriage and Love Emotional Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Marriage and Love Emotional Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Marriage and Love Emotional Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Marriage and Love Emotional Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Marriage and Love Emotional Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Marriage and Love Emotional Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Marriage and Love Emotional Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Marriage and Love Emotional Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Marriage and Love Emotional Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Marriage and Love Emotional Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Marriage and Love Emotional Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Marriage and Love Emotional Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Marriage and Love Emotional Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Marriage and Love Emotional Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Marriage and Love Emotional Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Marriage and Love Emotional Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Marriage and Love Emotional Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Marriage and Love Emotional Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Marriage and Love Emotional Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Marriage and Love Emotional Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Marriage and Love Emotional Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Marriage and Love Emotional Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Marriage and Love Emotional Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Marriage and Love Emotional Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Marriage and Love Emotional Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Marriage and Love Emotional Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Marriage and Love Emotional Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Marriage and Love Emotional Service?

Key companies in the market include Baihe Jiayuan Network Group, Match Group, EHarmony, Tinder, Khan Academy, Coffee Meets Bagel.

3. What are the main segments of the Marriage and Love Emotional Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Marriage and Love Emotional Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Marriage and Love Emotional Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Marriage and Love Emotional Service?

To stay informed about further developments, trends, and reports in the Marriage and Love Emotional Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence