Key Insights

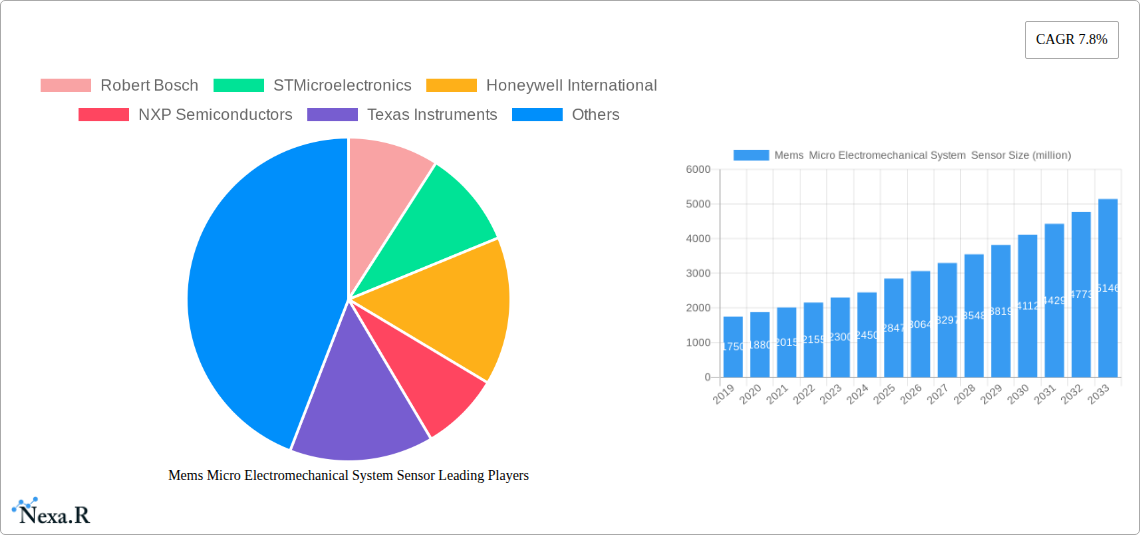

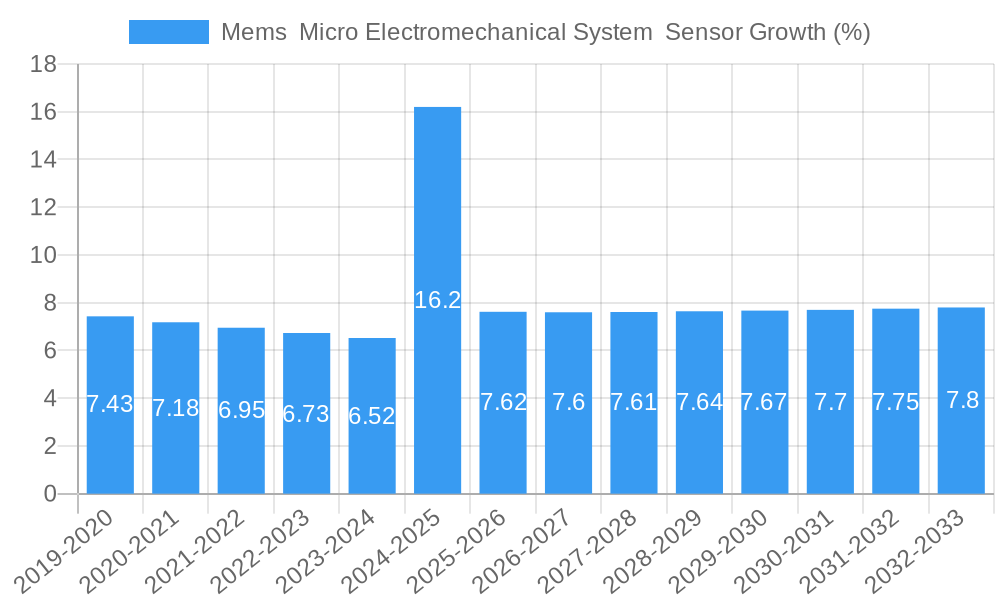

The MEMS (Micro-Electro-Mechanical Systems) sensor market is poised for significant expansion, projected to reach an impressive USD 2847 million by 2025 and experience a robust CAGR of 7.8% throughout the forecast period of 2025-2033. This growth is fueled by the pervasive integration of these miniature marvels across a diverse range of industries. Consumer electronics, a primary driver, continues to demand MEMS sensors for smartphones, wearables, and smart home devices, enhancing functionalities like touch sensing, motion detection, and environmental monitoring. The automotive sector is another substantial contributor, with MEMS sensors being indispensable for advanced driver-assistance systems (ADAS), airbag deployment, tire pressure monitoring, and powertrain control, all of which are experiencing rapid adoption and innovation. Industrial applications, including automation, robotics, and predictive maintenance, are also leveraging MEMS technology for enhanced precision and efficiency. Furthermore, the healthcare industry is increasingly incorporating MEMS for medical devices, diagnostics, and implantable sensors, promising more sophisticated and less invasive patient care.

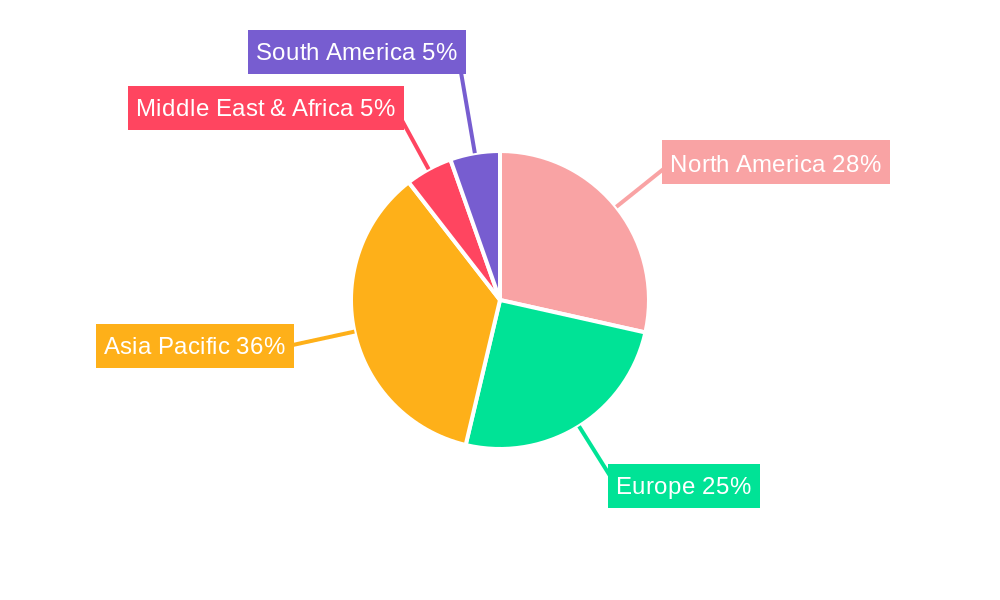

The strategic importance of MEMS sensors is further underscored by ongoing technological advancements and evolving market dynamics. Innovations in miniaturization, sensitivity, power efficiency, and cost-effectiveness are continuously expanding their application scope. The increasing demand for sophisticated sensing capabilities in the Internet of Things (IoT) ecosystem, smart cities, and augmented/virtual reality (AR/VR) experiences will continue to propel market expansion. While the market is characterized by a healthy competitive landscape with established players like Robert Bosch, STMicroelectronics, and Honeywell International, the burgeoning demand also presents opportunities for new entrants. Regional analysis indicates strong growth across North America, Europe, and Asia Pacific, with China, the United States, and Germany being significant markets. The market's trajectory suggests a future where MEMS sensors are not just components but integral enablers of next-generation technologies, driving innovation and shaping industries.

This in-depth market research report provides a definitive analysis of the global MEMS Micro-Electromechanical System (MEMS) sensor market. Covering the study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report offers unparalleled insights into market dynamics, growth trajectories, and future opportunities. Explore parent and child market segments, leveraging high-traffic keywords like automotive MEMS sensors, consumer electronics MEMS, industrial MEMS applications, healthcare MEMS devices, and aerospace MEMS technology to maximize search engine visibility and engage industry professionals. All quantitative data is presented in million units.

MEMS Micro Electromechanical System Sensor Market Dynamics & Structure

The MEMS micro-electromechanical system sensor market is characterized by a moderately concentrated landscape, with key players such as Robert Bosch, STMicroelectronics, Honeywell International, NXP Semiconductors, and Texas Instruments holding significant influence. Technological innovation is the primary driver, propelled by miniaturization, increased sensitivity, and lower power consumption requirements across diverse applications. Regulatory frameworks, particularly concerning safety and environmental standards in the automotive and industrial sectors, play a crucial role in shaping product development and market access. Competitive product substitutes, while evolving, primarily stem from advancements in traditional sensor technologies. End-user demographics are increasingly sophisticated, demanding integrated, intelligent, and cost-effective sensing solutions. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and technology acquisition.

- Market Concentration: Top 5 players hold an estimated 45% market share.

- Technological Innovation: Focus on AI integration, advanced packaging, and novel materials.

- Regulatory Frameworks: Stringent compliance for automotive safety (e.g., ISO 26262) and industrial automation.

- Competitive Substitutes: Growing demand for CMOS-based sensors in specific niches.

- End-User Demographics: Rising demand from IoT device manufacturers and smart city initiatives.

- M&A Trends: An average of 8-10 significant deals annually in the past five years.

MEMS Micro Electromechanical System Sensor Growth Trends & Insights

The global MEMS micro-electromechanical system sensor market is poised for robust expansion, driven by the ever-increasing integration of smart technologies across virtually every industry. The market size is projected to witness a significant upward trajectory, with a compound annual growth rate (CAGR) of approximately 9.5% during the forecast period of 2025–2033. This impressive growth is fueled by the accelerating adoption rates of MEMS sensors in emerging applications such as wearable devices, advanced driver-assistance systems (ADAS), and sophisticated industrial automation. Technological disruptions, including the development of novel transduction mechanisms and the integration of artificial intelligence directly at the sensor level, are further accelerating market penetration. Consumer behavior shifts towards personalized experiences, data-driven decision-making, and enhanced safety are creating a fertile ground for MEMS sensor proliferation. The growing demand for energy-efficient and compact sensing solutions, particularly within the Internet of Things (IoT) ecosystem, will continue to be a pivotal factor in market growth. The ongoing miniaturization trend, coupled with advancements in fabrication processes, is enabling the development of highly specialized MEMS sensors capable of performing complex functions with unprecedented accuracy. Furthermore, the increasing awareness of environmental monitoring and the need for precise data in healthcare diagnostics are creating new avenues for market expansion. The market penetration of MEMS sensors in automotive applications, particularly in autonomous driving technologies, is expected to surge, driving substantial revenue growth. Similarly, the industrial sector's relentless pursuit of efficiency and predictive maintenance will necessitate a higher density of MEMS sensors for real-time monitoring and control. The healthcare industry's demand for more accurate and non-invasive diagnostic tools will also contribute significantly to market growth. The telecommunications sector, with its focus on 5G infrastructure and advanced networking, will see increased deployment of MEMS-based components for signal management and performance optimization.

Dominant Regions, Countries, or Segments in MEMS Micro Electromechanical System Sensor

The Automotive segment, encompassing a wide array of applications from powertrain management to ADAS and infotainment, is the dominant driver of growth within the global MEMS micro-electromechanical system sensor market. This dominance is attributed to stringent safety regulations, the increasing sophistication of vehicles, and the rapid adoption of autonomous driving technologies. North America and Europe, with their advanced automotive industries and proactive regulatory environments, are leading the charge in adopting these sophisticated sensing solutions.

- Dominant Segment (Application): Automotive

- Key Drivers:

- Increasing demand for ADAS and autonomous driving features.

- Stringent government regulations for vehicle safety.

- Growing adoption of electric vehicles (EVs) requiring advanced battery management and control systems.

- Integration of in-cabin sensing for enhanced passenger experience and safety.

- Market Share: Automotive segment accounts for an estimated 35% of the total MEMS sensor market in 2025.

- Growth Potential: High, driven by ongoing innovation in vehicle connectivity and automation.

- Key Drivers:

The Consumer Electronics segment, however, is the largest in terms of unit volume, driven by the ubiquitous presence of smartphones, wearables, smart home devices, and gaming consoles. Asia Pacific, particularly China, is the epicenter of consumer electronics manufacturing and adoption, making it the dominant region for MEMS sensor consumption within this segment.

- Dominant Segment (Application): Consumer Electronics

- Key Drivers:

- Ubiquitous adoption of smartphones and wearable devices.

- Growth of the smart home ecosystem and IoT devices.

- Demand for enhanced user experiences in gaming and personal devices.

- Miniaturization and cost-effectiveness of MEMS sensors.

- Market Share: Consumer Electronics segment accounts for an estimated 30% of the total MEMS sensor market in 2025.

- Growth Potential: Moderate to high, influenced by new product introductions and evolving consumer preferences.

- Key Drivers:

In terms of Type, Mechanical Sensors (including accelerometers, gyroscopes, and pressure sensors) are currently the most prevalent, underpinning the functionality of the aforementioned dominant application segments. However, Optical Sensors and Chemical Sensors are exhibiting rapid growth due to their expanding applications in advanced imaging, environmental monitoring, and healthcare diagnostics.

MEMS Micro Electromechanical System Sensor Product Landscape

The MEMS micro-electromechanical system sensor product landscape is characterized by continuous innovation in sensitivity, accuracy, size, and power efficiency. Key product innovations include highly integrated inertial measurement units (IMUs) for advanced motion sensing, micro-pressure sensors for precise environmental and medical monitoring, and bio-MEMS sensors for point-of-care diagnostics. Applications span from sophisticated gesture recognition in consumer electronics and accurate navigation in automotive systems to critical atmospheric monitoring in aerospace and precise drug delivery in healthcare. The unique selling proposition of these products lies in their ability to perform complex sensing functions at the micro-scale, enabling the development of smaller, lighter, and more capable devices.

Key Drivers, Barriers & Challenges in MEMS Micro Electromechanical System Sensor

The MEMS micro-electromechanical system sensor market is propelled by several key drivers, including the exponential growth of the Internet of Things (IoT) ecosystem, the increasing demand for smart functionalities in automotive and consumer electronics, and advancements in AI and machine learning that necessitate robust sensing capabilities. Miniaturization and the drive for lower power consumption in portable devices are also significant catalysts.

- Key Drivers:

- Explosive growth of IoT devices.

- Advancements in automotive safety and autonomous driving.

- Demand for compact and power-efficient consumer electronics.

- Technological breakthroughs in material science and fabrication.

Conversely, the market faces significant barriers and challenges. High research and development costs, coupled with complex fabrication processes, can impede new entrants. Intense price competition, particularly in high-volume consumer applications, and supply chain disruptions, as seen in recent global events, pose ongoing challenges. Stringent industry-specific regulations and the need for extensive testing and validation also present hurdles.

- Key Barriers & Challenges:

- High R&D and fabrication costs.

- Intense price competition.

- Supply chain vulnerabilities and raw material availability.

- Complex qualification and certification processes.

- Talent shortages in specialized MEMS engineering.

Emerging Opportunities in MEMS Micro Electromechanical System Sensor

Emerging opportunities in the MEMS micro-electromechanical system sensor sector are vast and diverse. The burgeoning fields of personalized medicine and point-of-care diagnostics present significant potential for advanced bio-MEMS sensors. The ongoing expansion of smart cities, with their focus on intelligent infrastructure and environmental monitoring, will drive demand for sophisticated sensing networks. Furthermore, the development of next-generation virtual and augmented reality (VR/AR) devices will require highly precise and responsive motion and environmental sensors. The increasing focus on sustainability and climate change is also creating opportunities for MEMS sensors in advanced energy management and environmental monitoring solutions.

Growth Accelerators in the MEMS Micro Electromechanical System Sensor Industry

Several catalysts are accelerating long-term growth in the MEMS micro-electromechanical system sensor industry. Continuous technological breakthroughs in materials, such as advanced piezoelectric and piezoresistive materials, are enhancing sensor performance. Strategic partnerships between sensor manufacturers and end-product developers are fostering co-innovation and faster time-to-market. Market expansion strategies, including the penetration into developing economies and the exploration of novel niche applications, are further driving growth. The development of more sophisticated sensor fusion algorithms and AI integration at the edge will also unlock new capabilities and market demand.

Key Players Shaping the Mems Micro Electromechanical System Sensor Market

- Robert Bosch

- STMicroelectronics

- Honeywell International

- NXP Semiconductors

- Texas Instruments

- Silex Microsystem

- Panasonic Corporation

- SilTerra Malaysia

- Asia Pacific Microsystems

- Sensata Technologies Holding

Notable Milestones in Mems Micro Electromechanical System Sensor Sector

- 2019: Launch of advanced inertial sensors for 5G smartphones by STMicroelectronics, enabling enhanced motion tracking.

- 2020: Honeywell International unveils new MEMS pressure sensors for high-precision industrial applications.

- 2021: Robert Bosch announces significant investment in MEMS sensor manufacturing capacity to meet automotive demand.

- 2022: Texas Instruments introduces low-power MEMS microphones for consumer audio devices.

- 2023: NXP Semiconductors expands its automotive MEMS radar sensor portfolio for advanced ADAS features.

- 2024: Silex Microsystem partners with a leading medical device company for bio-MEMS sensor development.

- 2025 (Estimated): Major players are expected to announce new generations of AI-enabled MEMS sensors with enhanced edge processing capabilities.

In-Depth Mems Micro Electromechanical System Sensor Market Outlook

- 2019: Launch of advanced inertial sensors for 5G smartphones by STMicroelectronics, enabling enhanced motion tracking.

- 2020: Honeywell International unveils new MEMS pressure sensors for high-precision industrial applications.

- 2021: Robert Bosch announces significant investment in MEMS sensor manufacturing capacity to meet automotive demand.

- 2022: Texas Instruments introduces low-power MEMS microphones for consumer audio devices.

- 2023: NXP Semiconductors expands its automotive MEMS radar sensor portfolio for advanced ADAS features.

- 2024: Silex Microsystem partners with a leading medical device company for bio-MEMS sensor development.

- 2025 (Estimated): Major players are expected to announce new generations of AI-enabled MEMS sensors with enhanced edge processing capabilities.

In-Depth Mems Micro Electromechanical System Sensor Market Outlook

The future market outlook for MEMS micro-electromechanical system sensors is exceptionally bright, fueled by relentless innovation and the pervasive integration of sensing capabilities across all facets of modern life. Growth accelerators such as the continued miniaturization of devices, the increasing sophistication of autonomous systems, and the burgeoning demand for data-driven insights across industries will propel the market forward. Strategic opportunities lie in the expansion of bio-MEMS for personalized healthcare, the development of ultra-low power MEMS for extended IoT device battery life, and the integration of novel sensing modalities like chemical and biological detection into mainstream consumer products. The market is expected to witness significant growth in emerging economies as smart technologies become more accessible and affordable.

Mems Micro Electromechanical System Sensor Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Industrial

- 1.4. Aerospace and Defense

- 1.5. Healthcare

- 1.6. Telecommunication

- 1.7. Others

-

2. Type

- 2.1. Optical Sensors

- 2.2. Mechanical Sensors

- 2.3. Chemical Sensors

- 2.4. Biological Sensors

- 2.5. Thermal Sensors

- 2.6. Other

Mems Micro Electromechanical System Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mems Micro Electromechanical System Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Industrial

- 5.1.4. Aerospace and Defense

- 5.1.5. Healthcare

- 5.1.6. Telecommunication

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Optical Sensors

- 5.2.2. Mechanical Sensors

- 5.2.3. Chemical Sensors

- 5.2.4. Biological Sensors

- 5.2.5. Thermal Sensors

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Automotive

- 6.1.3. Industrial

- 6.1.4. Aerospace and Defense

- 6.1.5. Healthcare

- 6.1.6. Telecommunication

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Optical Sensors

- 6.2.2. Mechanical Sensors

- 6.2.3. Chemical Sensors

- 6.2.4. Biological Sensors

- 6.2.5. Thermal Sensors

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Automotive

- 7.1.3. Industrial

- 7.1.4. Aerospace and Defense

- 7.1.5. Healthcare

- 7.1.6. Telecommunication

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Optical Sensors

- 7.2.2. Mechanical Sensors

- 7.2.3. Chemical Sensors

- 7.2.4. Biological Sensors

- 7.2.5. Thermal Sensors

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Automotive

- 8.1.3. Industrial

- 8.1.4. Aerospace and Defense

- 8.1.5. Healthcare

- 8.1.6. Telecommunication

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Optical Sensors

- 8.2.2. Mechanical Sensors

- 8.2.3. Chemical Sensors

- 8.2.4. Biological Sensors

- 8.2.5. Thermal Sensors

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Automotive

- 9.1.3. Industrial

- 9.1.4. Aerospace and Defense

- 9.1.5. Healthcare

- 9.1.6. Telecommunication

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Optical Sensors

- 9.2.2. Mechanical Sensors

- 9.2.3. Chemical Sensors

- 9.2.4. Biological Sensors

- 9.2.5. Thermal Sensors

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mems Micro Electromechanical System Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronics

- 10.1.2. Automotive

- 10.1.3. Industrial

- 10.1.4. Aerospace and Defense

- 10.1.5. Healthcare

- 10.1.6. Telecommunication

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Optical Sensors

- 10.2.2. Mechanical Sensors

- 10.2.3. Chemical Sensors

- 10.2.4. Biological Sensors

- 10.2.5. Thermal Sensors

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Robert Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 STMicroelectronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NXP Semiconductors

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Silex Microsystem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SilTerra Malaysia

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Asia Pacific Microsystems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sensata Technologies Holding

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Robert Bosch

List of Figures

- Figure 1: Global Mems Micro Electromechanical System Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mems Micro Electromechanical System Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mems Micro Electromechanical System Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mems Micro Electromechanical System Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Mems Micro Electromechanical System Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Mems Micro Electromechanical System Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mems Micro Electromechanical System Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mems Micro Electromechanical System Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mems Micro Electromechanical System Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mems Micro Electromechanical System Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Mems Micro Electromechanical System Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Mems Micro Electromechanical System Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mems Micro Electromechanical System Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mems Micro Electromechanical System Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mems Micro Electromechanical System Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mems Micro Electromechanical System Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Mems Micro Electromechanical System Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Mems Micro Electromechanical System Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mems Micro Electromechanical System Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mems Micro Electromechanical System Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mems Micro Electromechanical System Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mems Micro Electromechanical System Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mems Micro Electromechanical System Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Mems Micro Electromechanical System Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Mems Micro Electromechanical System Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mems Micro Electromechanical System Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Mems Micro Electromechanical System Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mems Micro Electromechanical System Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mems Micro Electromechanical System Sensor?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Mems Micro Electromechanical System Sensor?

Key companies in the market include Robert Bosch, STMicroelectronics, Honeywell International, NXP Semiconductors, Texas Instruments, Silex Microsystem, Panasonic Corporation, SilTerra Malaysia, Asia Pacific Microsystems, Sensata Technologies Holding.

3. What are the main segments of the Mems Micro Electromechanical System Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2847 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mems Micro Electromechanical System Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mems Micro Electromechanical System Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mems Micro Electromechanical System Sensor?

To stay informed about further developments, trends, and reports in the Mems Micro Electromechanical System Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence