Key Insights

The Mexican major home appliance market, encompassing refrigerators, freezers, dishwashers, washing machines, cookers/ovens, air conditioners, and other products, exhibits robust growth potential. While precise market size figures for Mexico are unavailable in the provided data, a CAGR of 3.5% (as given for a different region) suggests a significant expansion. Considering factors like rising disposable incomes, increasing urbanization, and a growing preference for modern conveniences, the Mexican market is projected to experience considerable growth over the forecast period (2025-2033). Key drivers include the expanding middle class, improved infrastructure supporting better distribution channels (both online and brick-and-mortar), and government initiatives promoting energy-efficient appliances. Trends like the rising demand for smart home appliances, energy-efficient models, and increased focus on sustainability are further propelling market growth. However, potential restraints include economic fluctuations, volatile raw material prices, and competition from both established international brands (such as LG, Samsung, Whirlpool, and Bosch) and local players. The market is segmented by product type and distribution channel, with multi-branded stores and online channels playing increasingly crucial roles in sales. The diverse product range caters to varied consumer needs and preferences, contributing to the market's dynamism. Understanding these factors allows for strategic planning by both manufacturers and retailers within the Mexican major home appliance sector.

The diverse distribution channels, encompassing multi-branded stores, specialty stores, and the rapidly expanding online market, highlight the evolving consumer landscape in Mexico. The strong presence of international brands suggests a competitive market, demanding innovative product offerings and effective marketing strategies. Further research into the specific regional variations within Mexico (North, Central, South) could reveal more granular insights and potential pockets of higher growth. Focus on energy efficiency and smart appliances will be crucial for brands aiming to capture a larger market share. By analyzing consumer behavior and preferences, manufacturers can strategically position their products to meet evolving demands and effectively tap into the growth opportunities presented by the Mexican major home appliance market.

Mexican Major Home Appliance Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexican major home appliance industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

Mexican Major Home Appliance Industry Market Dynamics & Structure

The Mexican major home appliance market is characterized by a moderately concentrated landscape, with both international and domestic players vying for market share. Technological innovation, driven by smart home integration and energy efficiency standards, is a key driver. The regulatory framework, including import tariffs and energy efficiency regulations, significantly impacts market dynamics. Competitive pressures from substitute products, such as refurbished appliances, also influence market growth. End-user demographics, particularly the growing middle class, are a major factor in driving demand. M&A activity has been moderate in recent years, with larger players consolidating their positions.

- Market Concentration: The top five players account for approximately xx% of the market share in 2024.

- Technological Innovation: Smart appliances, energy-efficient models, and connected home integration are key trends.

- Regulatory Framework: Government regulations on energy consumption and safety standards influence product development and pricing.

- Competitive Substitutes: The rise of refurbished appliance markets presents a competitive challenge to new appliance sales.

- End-User Demographics: The expanding middle class and urbanization are boosting demand for major home appliances.

- M&A Activity: xx M&A deals were recorded in the Mexican home appliance sector between 2019 and 2024.

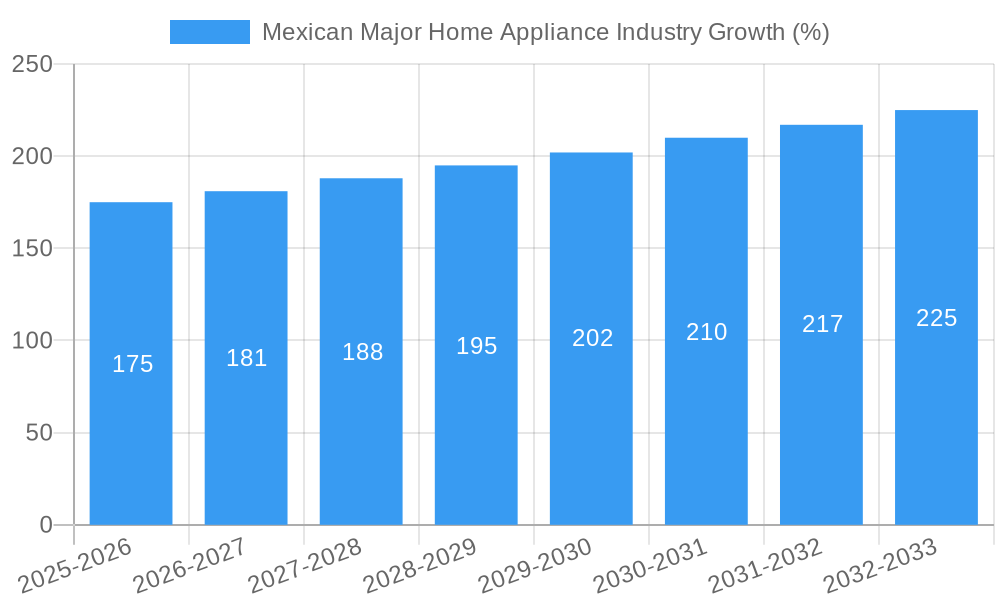

Mexican Major Home Appliance Industry Growth Trends & Insights

The Mexican major home appliance market exhibits robust growth, driven by increasing disposable incomes, rising urbanization, and a preference for modern conveniences. The market size witnessed significant expansion during the historical period (2019-2024), experiencing a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is anticipated to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%, fueled by factors such as government initiatives promoting affordable housing, and increased penetration of credit facilities. Technological advancements, such as the integration of smart features and energy-efficient designs, are further accelerating market adoption. Consumer behavior shifts toward premium appliances and online purchasing channels are also contributing to this growth. Market penetration for key appliances like refrigerators and washing machines remains relatively low, indicating considerable untapped potential.

Dominant Regions, Countries, or Segments in Mexican Major Home Appliance Industry

Within the Mexican major home appliance market, the most dominant segment by product is Refrigerators, followed closely by Washing Machines and Air Conditioners. These segments benefit from high demand driven by the expanding middle class and the need for upgraded household appliances. Geographically, urban areas and major metropolitan centers such as Mexico City, Guadalajara, and Monterrey exhibit the highest market concentration and growth rates.

- By Product: Refrigerators (xx Million units in 2024), Washing Machines (xx Million units in 2024), Air Conditioners (xx Million units in 2024) demonstrate the strongest growth.

- By Distribution Channel: Multi-branded stores currently dominate the distribution landscape, but online sales are experiencing rapid growth, representing xx% of total sales in 2024.

- Key Drivers: Rising disposable incomes, expanding middle class, government initiatives to improve housing, and increasing urbanization are key growth drivers.

Mexican Major Home Appliance Industry Product Landscape

The Mexican home appliance market showcases a diverse range of products, from basic models to sophisticated smart appliances. Refrigerators feature advanced features like temperature control zones and smart connectivity. Washing machines are increasingly incorporating energy-efficient technologies and diverse wash cycles. Cookers and ovens are witnessing a rise in multi-functional designs and smart capabilities. Air conditioners are becoming more energy efficient and user-friendly. The market shows a trend toward larger capacity appliances to cater to increasing household sizes. Innovation focuses on improved energy efficiency, user-friendliness, and smart functionalities.

Key Drivers, Barriers & Challenges in Mexican Major Home Appliance Industry

Key Drivers: Rising disposable incomes, improving infrastructure, and government incentives for energy efficiency are driving market growth. Increasing urbanization and a growing middle class also contribute significantly.

Challenges: Fluctuating currency exchange rates, import tariffs, supply chain disruptions (particularly observed post-2020), and intense competition from both domestic and international players pose significant hurdles. Furthermore, uneven distribution networks in certain regions of Mexico present a major challenge.

Emerging Opportunities in Mexican Major Home Appliance Industry

The Mexican major home appliance market presents several lucrative opportunities. Growth potential exists in expanding into less saturated rural markets, promoting energy-efficient appliances through targeted marketing campaigns, and increasing the penetration of smart home technology. Furthermore, introducing financial schemes to make appliances more accessible, particularly in rural areas, is crucial.

Growth Accelerators in the Mexican Major Home Appliance Industry

Long-term growth will be accelerated by several factors. Strategic partnerships between manufacturers and distributors, investments in research and development for advanced technologies, and the expansion of e-commerce channels are crucial for sustaining growth. Government support for energy efficiency programs and further infrastructure development also play a significant role.

Key Players Shaping the Mexican Major Home Appliance Industry Market

- LG

- Symphony

- Philips

- SHARP

- Fisher & Paykel

- Maytag

- BSH

- Hamilton Beach

- Carrier

- Whirlpool

- Bosch

- Electrolux AB

- Conair

- Samsung

- Panasonic Corporation

Notable Milestones in Mexican Major Home Appliance Industry Sector

- July 2022: Bosch commences construction of its first Mexican plant, signifying a major foreign direct investment.

- October 2022: Samsung opens its first Latin American Bespoke Home flagship store in Mexico City, showcasing premium appliance offerings.

- January 2023: Samsung launches its Bespoke Infinite Line Refrigerator in Mexico, expanding its premium product range in a key market.

In-Depth Mexican Major Home Appliance Industry Market Outlook

The Mexican major home appliance market presents considerable long-term growth potential. Continued economic expansion, rising urbanization, and the adoption of advanced technologies will drive significant demand. Strategic investments in distribution networks, product innovation, and targeted marketing initiatives will be crucial for capturing market share and achieving sustainable growth in this dynamic sector.

Mexican Major Home Appliance Industry Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Cookers/Ovens

- 1.6. Air Conditioners

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Mexican Major Home Appliance Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mexican Major Home Appliance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Refrigerators are The Leading Major Home Appliance And Subsequent Revenue Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Cookers/Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Refrigerators

- 6.1.2. Freezers

- 6.1.3. Dishwashing Machines

- 6.1.4. Washing Machines

- 6.1.5. Cookers/Ovens

- 6.1.6. Air Conditioners

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Multi-Branded Stores

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Refrigerators

- 7.1.2. Freezers

- 7.1.3. Dishwashing Machines

- 7.1.4. Washing Machines

- 7.1.5. Cookers/Ovens

- 7.1.6. Air Conditioners

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Multi-Branded Stores

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Refrigerators

- 8.1.2. Freezers

- 8.1.3. Dishwashing Machines

- 8.1.4. Washing Machines

- 8.1.5. Cookers/Ovens

- 8.1.6. Air Conditioners

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Multi-Branded Stores

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Refrigerators

- 9.1.2. Freezers

- 9.1.3. Dishwashing Machines

- 9.1.4. Washing Machines

- 9.1.5. Cookers/Ovens

- 9.1.6. Air Conditioners

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Multi-Branded Stores

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Refrigerators

- 10.1.2. Freezers

- 10.1.3. Dishwashing Machines

- 10.1.4. Washing Machines

- 10.1.5. Cookers/Ovens

- 10.1.6. Air Conditioners

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Multi-Branded Stores

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Bahrain Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Kuwait Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Oman Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Qatar Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Saudi Arabia Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. United Arab Emirates Mexican Major Home Appliance Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 LG

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Symphony

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Philips

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 SHARP

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Fisher & Paykel

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Maytag

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 BSH

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Hamilton Beach

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Carrier

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Whirlpool

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Bosch

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Electrolux AB

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Conair**List Not Exhaustive

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Samsung

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Panasonic Corporation

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 LG

List of Figures

- Figure 1: Global Mexican Major Home Appliance Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Bahrain Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Bahrain Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Kuwait Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Kuwait Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Oman Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Oman Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Qatar Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Qatar Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Saudi Arabia Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Saudi Arabia Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: United Arab Emirates Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: United Arab Emirates Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mexican Major Home Appliance Industry Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Mexican Major Home Appliance Industry Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Mexican Major Home Appliance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: North America Mexican Major Home Appliance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: North America Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Mexican Major Home Appliance Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: South America Mexican Major Home Appliance Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: South America Mexican Major Home Appliance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: South America Mexican Major Home Appliance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: South America Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Mexican Major Home Appliance Industry Revenue (Million), by Product 2024 & 2032

- Figure 27: Europe Mexican Major Home Appliance Industry Revenue Share (%), by Product 2024 & 2032

- Figure 28: Europe Mexican Major Home Appliance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Europe Mexican Major Home Appliance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Europe Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa Mexican Major Home Appliance Industry Revenue (Million), by Product 2024 & 2032

- Figure 33: Middle East & Africa Mexican Major Home Appliance Industry Revenue Share (%), by Product 2024 & 2032

- Figure 34: Middle East & Africa Mexican Major Home Appliance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 35: Middle East & Africa Mexican Major Home Appliance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 36: Middle East & Africa Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East & Africa Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Mexican Major Home Appliance Industry Revenue (Million), by Product 2024 & 2032

- Figure 39: Asia Pacific Mexican Major Home Appliance Industry Revenue Share (%), by Product 2024 & 2032

- Figure 40: Asia Pacific Mexican Major Home Appliance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific Mexican Major Home Appliance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific Mexican Major Home Appliance Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Mexican Major Home Appliance Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 18: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 24: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 43: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 51: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global Mexican Major Home Appliance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Mexican Major Home Appliance Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexican Major Home Appliance Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Mexican Major Home Appliance Industry?

Key companies in the market include LG, Symphony, Philips, SHARP, Fisher & Paykel, Maytag, BSH, Hamilton Beach, Carrier, Whirlpool, Bosch, Electrolux AB, Conair**List Not Exhaustive, Samsung, Panasonic Corporation.

3. What are the main segments of the Mexican Major Home Appliance Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Refrigerators are The Leading Major Home Appliance And Subsequent Revenue Growth.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

January 2023: Samsung Electronics announced the global launch of the Bespoke Infinite Line Refrigerator in select markets around the world. Having originally launched in Europe,1 the Bespoke Infinite Line Refrigerator will expand to countries including Mexico, Thailand, and Australia by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexican Major Home Appliance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexican Major Home Appliance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexican Major Home Appliance Industry?

To stay informed about further developments, trends, and reports in the Mexican Major Home Appliance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence