Key Insights

The global Microwell Plates market is experiencing robust growth, projected to reach an estimated USD 2,300 million by 2025. This expansion is primarily fueled by the escalating demand in critical sectors like pharmaceuticals and biotechnology, driven by the surge in drug discovery and development activities, especially in personalized medicine and diagnostics. The increasing prevalence of infectious diseases and the growing need for rapid and efficient diagnostic tools further bolster market penetration. Furthermore, advancements in lab automation and high-throughput screening (HTS) technologies are creating new avenues for market development, as microwell plates are integral to these sophisticated laboratory workflows. The research laboratories segment, in particular, is a significant contributor, with continuous investment in life sciences research globally.

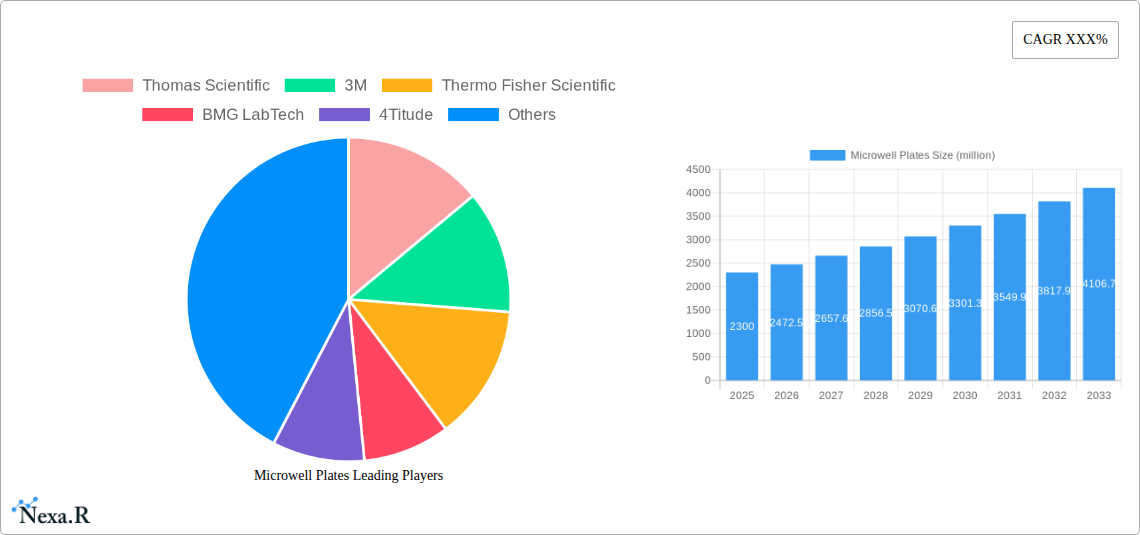

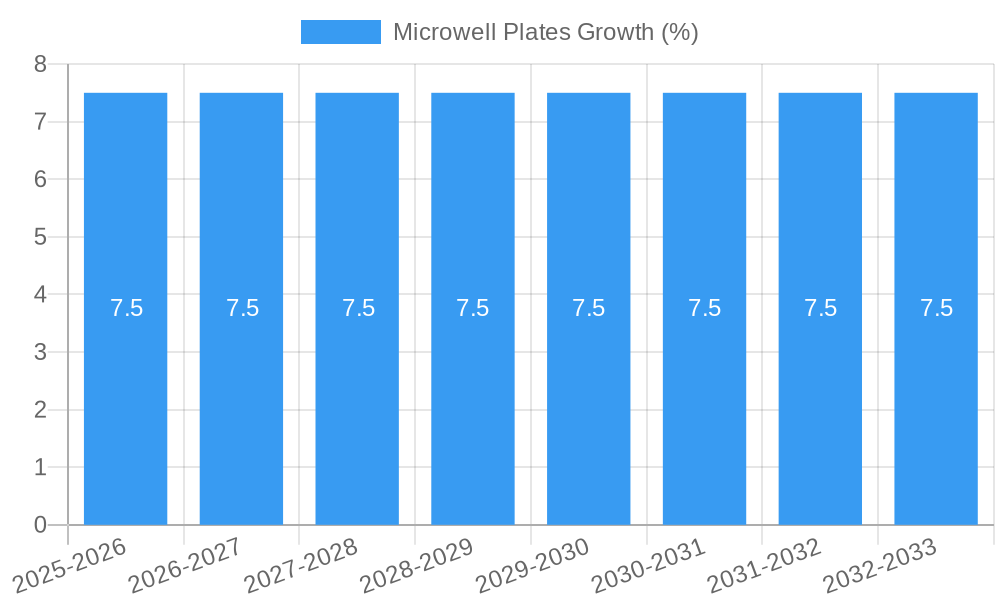

The market is characterized by a dynamic landscape shaped by ongoing technological innovations and evolving application needs. While the plastics segment holds a dominant share due to its cost-effectiveness and versatility, glass microwell plates are gaining traction in specialized applications requiring superior optical clarity and inertness. Emerging trends include the development of specialized microwell plates with advanced features like surface coatings for cell culture, improved sample recovery, and integration with microfluidic devices. However, the market faces certain restraints, including the high cost of advanced microwell plate technologies and stringent regulatory requirements for certain medical applications. Despite these challenges, the overall outlook for the Microwell Plates market remains highly positive, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033, indicating sustained and significant expansion driven by innovation and expanding applications.

Here is a compelling, SEO-optimized report description for Microwell Plates, designed to maximize visibility and engage industry professionals:

Microwell Plates Market Analysis: Growth, Trends, and Opportunities (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Microwell Plates market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers and challenges, emerging opportunities, and future outlook. Leveraging the latest industry data and forecasts from 2019 to 2033, with a base year of 2025, this report provides critical insights for stakeholders seeking to understand and capitalize on the evolving microwell plates sector. We explore the parent market and child markets, offering a holistic view of the industry's structure and potential.

Microwell Plates Market Dynamics & Structure

The global microwell plates market exhibits a moderately concentrated structure, with key players like Thermo Fisher Scientific, Corning, and Bio-Rad holding significant market share. Technological innovation is a primary driver, fueled by advancements in materials science and automated laboratory processes, leading to the development of specialized plates for high-throughput screening, diagnostics, and drug discovery. Regulatory frameworks, particularly stringent quality control and compliance standards in the pharmaceutical and medical segments, influence product development and market entry. Competitive product substitutes, such as microarrays and lab-on-a-chip devices, pose a growing challenge, necessitating continuous innovation in microwell plate design and functionality. End-user demographics are shifting towards research laboratories and the pharmaceutical industry, driven by increased R&D spending and the demand for precision in biological assays. Mergers and acquisitions (M&A) trends indicate consolidation among key players seeking to expand their product portfolios and geographical reach. For instance, recent M&A activities have focused on acquiring companies with expertise in specialized coatings and advanced manufacturing techniques. Innovation barriers include the high cost of advanced manufacturing technologies and the need for extensive validation to meet stringent regulatory requirements.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation Drivers: Advancements in materials, automation, and assay development.

- Regulatory Frameworks: Stringent requirements in pharmaceutical and medical applications.

- Competitive Product Substitutes: Microarrays, lab-on-a-chip technologies.

- End-User Demographics: Growing demand from research labs and the pharmaceutical sector.

- M&A Trends: Strategic acquisitions to enhance product offerings and market presence.

- Innovation Barriers: High investment in advanced manufacturing and validation costs.

Microwell Plates Growth Trends & Insights

The microwell plates market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is underpinned by increasing global investments in life sciences research and development, particularly in the pharmaceutical and biotechnology sectors. The rising prevalence of chronic diseases and infectious agents is spurring demand for advanced diagnostic tools and drug discovery platforms, where microwell plates are indispensable. The adoption of automation and high-throughput screening technologies in research laboratories is a significant market penetrator, enabling faster and more efficient experimental workflows. Consumer behavior is also evolving, with a greater emphasis on personalized medicine and targeted therapies, which require highly specific and sensitive assay capabilities offered by advanced microwell plate designs. Technological disruptions, such as the integration of novel surface coatings for enhanced cell adhesion and the development of plates for CRISPR-based gene editing applications, are further accelerating market penetration. The forecast period is expected to see a substantial increase in the utilization of microwell plates for omics research, including genomics, proteomics, and metabolomics. The overall market size is estimated to reach approximately $3.5 billion by 2033, up from an estimated $1.8 billion in 2025. The demand for single-use and sterile microwell plates is also on the rise, driven by concerns over contamination and the need for reproducible results in sensitive assays. This trend is particularly evident in clinical diagnostics and drug manufacturing quality control.

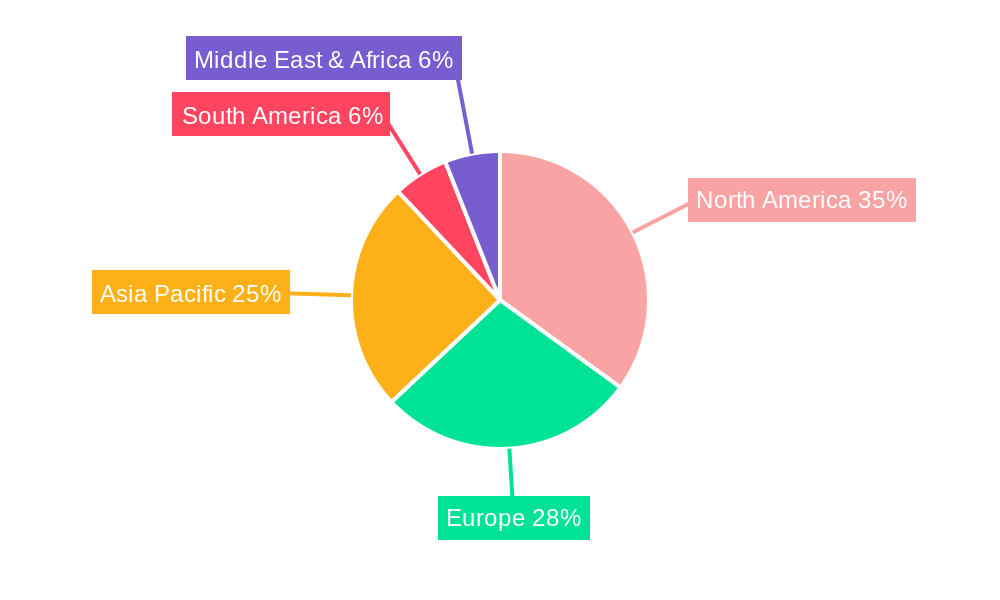

Dominant Regions, Countries, or Segments in Microwell Plates

The Pharmaceutical application segment is emerging as a dominant force in the global microwell plates market, projected to capture over 35% of the market share by 2033. This dominance is propelled by substantial and sustained investments in pharmaceutical R&D, drug discovery, and clinical trials worldwide. The increasing burden of chronic diseases, coupled with the continuous pursuit of novel therapeutics, necessitates the use of advanced microwell plates for high-throughput screening, drug efficacy testing, and toxicity assessments. Countries with strong pharmaceutical manufacturing bases and robust research infrastructures, such as the United States, are leading this growth. The U.S. market alone is expected to contribute significantly to the global demand due to its extensive network of research institutions, biotechnology firms, and leading pharmaceutical companies.

Key drivers for the dominance of the pharmaceutical segment include:

- Explosive Growth in Biologics and Biosimilars: The development and manufacturing of biologics and biosimilars, a rapidly expanding sub-segment within pharmaceuticals, heavily rely on microwell plates for cell culture, protein expression, and quality control assays.

- Advancements in Drug Discovery Technologies: Innovations like combinatorial chemistry, fragment-based drug discovery, and AI-driven drug design are all reliant on the efficient and scalable screening capabilities offered by microwell plates.

- Increased Outsourcing of R&D Activities: The rise of Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) globally, many of which are based in Asia-Pacific and Europe, further fuels the demand for microwell plates as they cater to diverse pharmaceutical clients.

- Precision Medicine Initiatives: The global push towards personalized medicine requires highly specific and sensitive assays, driving the demand for specialized microwell plates with advanced surface chemistries and formats.

- Regulatory Imperatives: Stringent regulatory requirements from bodies like the FDA and EMA necessitate meticulous and reproducible assay results, for which microwell plates are essential.

The Plastics type segment, particularly those made from polystyrene and polypropylene, continues to be the most prevalent due to their cost-effectiveness, disposability, and versatility across various applications. These materials are ideal for single-use scenarios, minimizing the risk of cross-contamination and simplifying laboratory workflows. The market penetration of plastic microwell plates remains exceptionally high, driven by their widespread adoption in research laboratories, diagnostic facilities, and the food and beverage industry for quality testing. The technological advancements in plastic molding and surface treatments are further enhancing their performance and expanding their applicability in more demanding research protocols.

Microwell Plates Product Landscape

The microwell plate product landscape is characterized by a continuous stream of innovations focused on enhancing assay sensitivity, specificity, and throughput. Manufacturers are developing plates with advanced surface coatings, such as tissue culture-treated surfaces for improved cell adhesion and growth, hydrophilic or hydrophobic coatings for precise liquid handling, and specialized coatings for protein binding or DNA/RNA hybridization. Novel well formats, including ultra-low volume wells for precious sample conservation and deep well plates for sample storage and manipulation, are gaining traction. Performance metrics like well-to-well crosstalk reduction, optical clarity for imaging applications, and inertness to various reagents are paramount. Unique selling propositions often lie in the development of sterile, individually packaged plates for critical applications, and plates with integrated features for automation compatibility. Technological advancements include the introduction of advanced polymer materials with superior optical properties and chemical resistance, as well as the use of precision molding techniques to ensure uniform well dimensions and flatness, crucial for automated liquid handling and microscopy.

Key Drivers, Barriers & Challenges in Microwell Plates

Key Drivers:

- Growing R&D Expenditure: Increased global investment in pharmaceutical research, biotechnology, and life sciences accelerates demand.

- Advancements in Assay Technologies: Development of sensitive and high-throughput assays necessitates specialized microwell plates.

- Rising Incidence of Chronic Diseases: Drives demand for diagnostics and drug discovery platforms.

- Technological Innovations: New materials, surface coatings, and well formats improve performance and expand applications.

- Automation in Laboratories: Integration of microwell plates into automated workflows for efficiency.

Barriers & Challenges:

- High Cost of Specialized Plates: Advanced materials and surface treatments can significantly increase plate costs.

- Regulatory Hurdles: Stringent compliance requirements for medical and pharmaceutical applications can delay product launches.

- Competition from Alternative Technologies: Microarrays and lab-on-a-chip devices offer alternative solutions for specific applications.

- Supply Chain Disruptions: Geopolitical factors and material shortages can impact production and availability, with an estimated impact of up to 10% on production timelines during critical periods.

- Waste Management: The single-use nature of many microwell plates raises environmental concerns, driving demand for sustainable alternatives.

Emerging Opportunities in Microwell Plates

Emerging opportunities in the microwell plates market lie in the development of sustainable and biodegradable plate materials to address environmental concerns. The increasing focus on personalized medicine presents a significant opportunity for highly customizable microwell plates designed for specific patient diagnostics and targeted therapy development. Furthermore, the burgeoning field of organ-on-a-chip technology demands advanced microwell plate designs that can mimic complex biological environments, creating a new frontier for innovation. The expansion of diagnostic testing into point-of-care settings also opens avenues for compact, disposable, and user-friendly microwell plate formats. The integration of advanced sensor technologies within microwell plates for real-time monitoring of biological processes is another promising area.

Growth Accelerators in the Microwell Plates Industry

Growth in the microwell plates industry is being significantly accelerated by technological breakthroughs in materials science, leading to plates with superior chemical inertness and optical clarity. Strategic partnerships between plate manufacturers and assay developers are crucial for co-creating optimized solutions for emerging research areas like single-cell analysis and CRISPR gene editing. Furthermore, the expansion of research infrastructure in emerging economies, particularly in Asia-Pacific, driven by government initiatives and increased private investment, is a major market expansion strategy that is fueling long-term growth. The increasing adoption of automation in pharmaceutical and academic labs globally acts as a significant catalyst for the demand of standardized and high-quality microwell plates.

Key Players Shaping the Microwell Plates Market

- Thomas Scientific

- 3M

- Thermo Fisher Scientific

- BMG LabTech

- 4Titude

- ReproCELL

- Merek

- Berthold Technologies

- Watson Biolab

- Bio-Rad

- Corning

Notable Milestones in Microwell Plates Sector

- 2019: Introduction of novel surface coatings for enhanced cell adhesion in research applications.

- 2020: Development of ultra-low volume microwell plates for precious sample conservation.

- 2021: Launch of biodegradable microwell plates to address environmental concerns.

- 2022: Integration of advanced optical properties for improved microscopy and imaging.

- 2023: Significant advancements in sterile packaging for critical diagnostic applications.

- 2024: Emergence of microwell plates with integrated sensing capabilities for real-time biological monitoring.

In-Depth Microwell Plates Market Outlook

The future of the microwell plates market is exceptionally bright, driven by a confluence of sustained R&D investment, technological advancements, and the expanding frontiers of life sciences. Growth accelerators such as the development of biocompatible and biodegradable materials, coupled with the increasing demand for personalized medicine applications, will shape the market. Strategic alliances between key players and research institutions will foster innovation and expand market reach. The continuous drive towards automation in laboratories worldwide will further solidify the indispensable role of high-quality, reliable microwell plates. The market is on track for sustained growth, presenting significant opportunities for stakeholders to invest in and benefit from this critical segment of the scientific instrumentation landscape, with an estimated market value of $3.5 billion by 2033.

Microwell Plates Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Medical

- 1.3. Pharmaceutical

- 1.4. Research Labs

- 1.5. Others

-

2. Type

- 2.1. Plastics

- 2.2. Glass

- 2.3. Silicone

- 2.4. Others

Microwell Plates Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Microwell Plates REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Medical

- 5.1.3. Pharmaceutical

- 5.1.4. Research Labs

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plastics

- 5.2.2. Glass

- 5.2.3. Silicone

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Medical

- 6.1.3. Pharmaceutical

- 6.1.4. Research Labs

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plastics

- 6.2.2. Glass

- 6.2.3. Silicone

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Medical

- 7.1.3. Pharmaceutical

- 7.1.4. Research Labs

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plastics

- 7.2.2. Glass

- 7.2.3. Silicone

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Medical

- 8.1.3. Pharmaceutical

- 8.1.4. Research Labs

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plastics

- 8.2.2. Glass

- 8.2.3. Silicone

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Medical

- 9.1.3. Pharmaceutical

- 9.1.4. Research Labs

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plastics

- 9.2.2. Glass

- 9.2.3. Silicone

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Microwell Plates Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage

- 10.1.2. Medical

- 10.1.3. Pharmaceutical

- 10.1.4. Research Labs

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plastics

- 10.2.2. Glass

- 10.2.3. Silicone

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thomas Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 3M

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermo Fisher Scientific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BMG LabTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 4Titude

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ReproCELL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merek

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berthold Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Watson Biolab

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio-Rad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Corning

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Thomas Scientific

List of Figures

- Figure 1: Global Microwell Plates Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Microwell Plates Revenue (million), by Application 2024 & 2032

- Figure 3: North America Microwell Plates Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Microwell Plates Revenue (million), by Type 2024 & 2032

- Figure 5: North America Microwell Plates Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Microwell Plates Revenue (million), by Country 2024 & 2032

- Figure 7: North America Microwell Plates Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Microwell Plates Revenue (million), by Application 2024 & 2032

- Figure 9: South America Microwell Plates Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Microwell Plates Revenue (million), by Type 2024 & 2032

- Figure 11: South America Microwell Plates Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Microwell Plates Revenue (million), by Country 2024 & 2032

- Figure 13: South America Microwell Plates Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Microwell Plates Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Microwell Plates Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Microwell Plates Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Microwell Plates Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Microwell Plates Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Microwell Plates Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Microwell Plates Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Microwell Plates Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Microwell Plates Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Microwell Plates Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Microwell Plates Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Microwell Plates Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Microwell Plates Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Microwell Plates Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Microwell Plates Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Microwell Plates Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Microwell Plates Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Microwell Plates Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Microwell Plates Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Microwell Plates Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Microwell Plates Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Microwell Plates Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Microwell Plates Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Microwell Plates Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Microwell Plates Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Microwell Plates Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Microwell Plates Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Microwell Plates Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microwell Plates?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Microwell Plates?

Key companies in the market include Thomas Scientific, 3M, Thermo Fisher Scientific, BMG LabTech, 4Titude, ReproCELL, Merek, Berthold Technologies, Watson Biolab, Bio-Rad, Corning.

3. What are the main segments of the Microwell Plates?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microwell Plates," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microwell Plates report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microwell Plates?

To stay informed about further developments, trends, and reports in the Microwell Plates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence