Key Insights

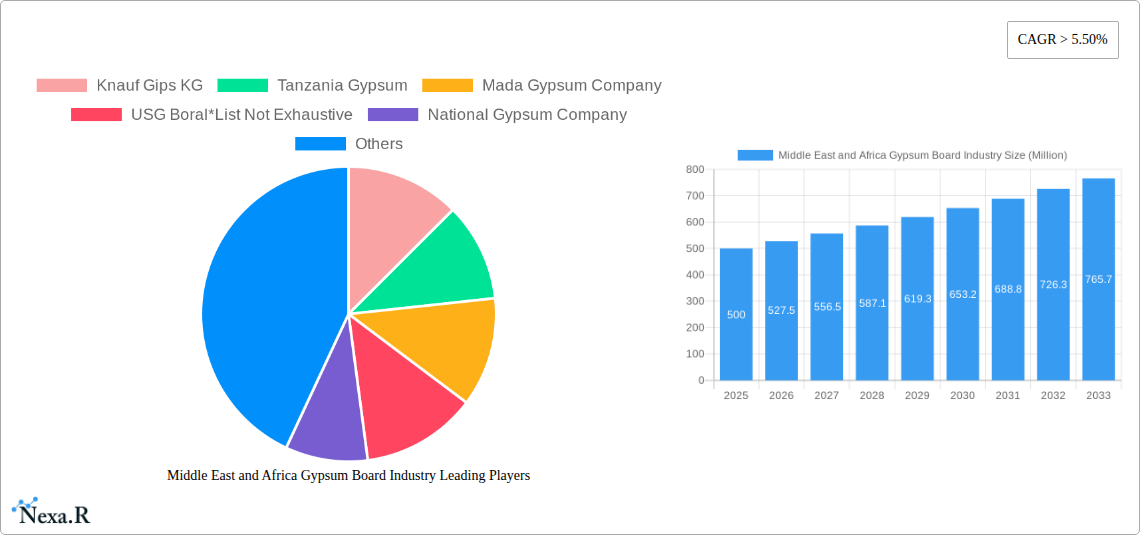

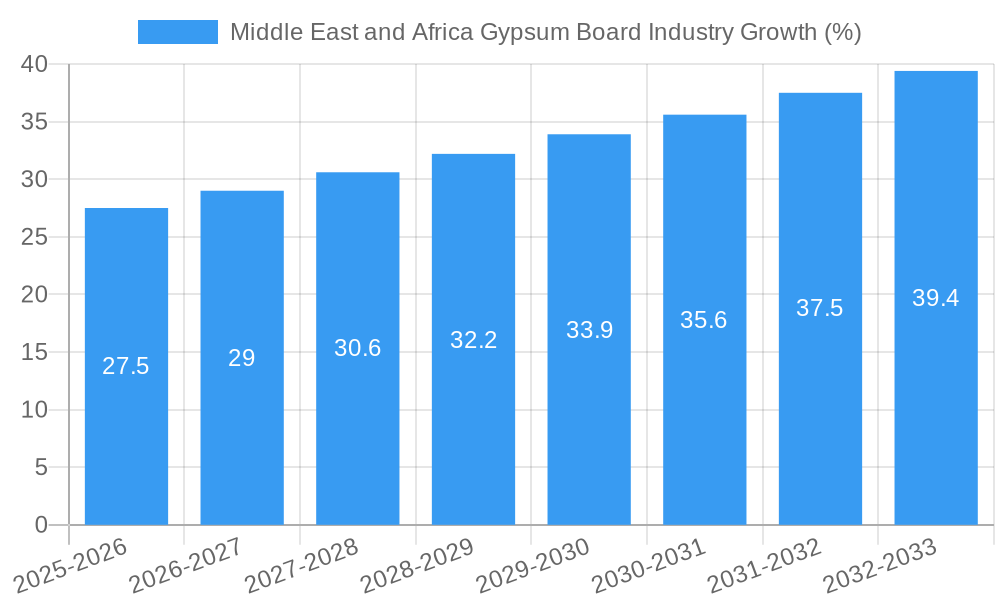

The Middle East and Africa gypsum board market, currently valued at approximately $XX million (estimated based on provided CAGR and market size), is experiencing robust growth, exceeding a 5.5% Compound Annual Growth Rate (CAGR). This expansion is driven by several key factors. The burgeoning construction industry across the region, fueled by infrastructure development projects, urbanization, and rising disposable incomes, is a primary driver. Increased demand for lightweight, fire-resistant, and cost-effective building materials is further propelling market growth. The rising popularity of drywall construction techniques over traditional methods in both residential and commercial sectors is also significantly impacting market demand. Growth is particularly strong in rapidly developing economies within Africa, where substantial investment in housing and infrastructure creates significant opportunities. However, challenges remain, including fluctuating raw material prices (gypsum), regional political instability in certain areas, and potential supply chain disruptions which can impact market growth. Segment-wise, the residential sector currently holds the largest market share, followed by commercial and industrial sectors. Pre-decorated boards are witnessing increasing adoption due to their aesthetic appeal and ease of installation, contributing to market diversification. Key players like Knauf Gips KG, Saint-Gobain (Gyproc), and others are actively expanding their presence through strategic partnerships, capacity expansions, and product innovation to cater to the growing demand. The forecast period (2025-2033) promises continued expansion driven by ongoing infrastructure projects and economic development across the region.

The competitive landscape is characterized by a mix of multinational corporations and regional players. Multinationals benefit from established brand recognition and access to advanced technologies, while local players leverage cost advantages and better understanding of regional market dynamics. The market is expected to witness increased consolidation and strategic alliances in the coming years as companies strive for market share expansion. The future growth trajectory hinges on sustained economic growth, favourable government policies supporting construction, and technological advancements in gypsum board manufacturing and application. The adoption of sustainable and eco-friendly gypsum board manufacturing practices will also play a crucial role in shaping the market's future. Further research into the specific market size of each country within the Middle East and Africa region, along with a deeper dive into individual company performance and market segmentation, would provide a more granular understanding of this dynamic market.

Middle East & Africa Gypsum Board Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa gypsum board market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033.

Middle East and Africa Gypsum Board Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Middle East and Africa gypsum board industry. The report delves into market concentration, identifying key players and their market share percentages. It also examines the influence of technological innovation, regulatory frameworks, and the presence of competitive product substitutes. End-user demographics are explored, providing a detailed understanding of demand drivers across various sectors. Finally, the report scrutinizes mergers and acquisitions (M&A) activities within the industry, quantifying deal volumes and assessing their impact on market structure.

- Market Concentration: xx% market share held by top 5 players (estimated).

- Technological Innovation: Focus on lightweight, fire-resistant, and eco-friendly gypsum boards.

- Regulatory Framework: Analysis of building codes and environmental regulations across different countries.

- Competitive Substitutes: Evaluation of alternatives like fiber cement boards and metal panels.

- End-User Demographics: Detailed breakdown of demand across residential, commercial, institutional, and industrial sectors.

- M&A Trends: Analysis of recent mergers and acquisitions, including the USD 1.02 billion acquisition of USG Boral's stake by Knauf in 2021. A total of xx M&A deals were recorded in the study period.

Middle East and Africa Gypsum Board Industry Growth Trends & Insights

This section provides a comprehensive analysis of the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the MEA gypsum board market. Utilizing robust analytical methodologies, the report delivers key insights into market dynamics, providing quantitative data such as the Compound Annual Growth Rate (CAGR) and market penetration rates. Analysis focuses on the factors driving market growth, including infrastructure development, urbanization, and construction activities across the region.

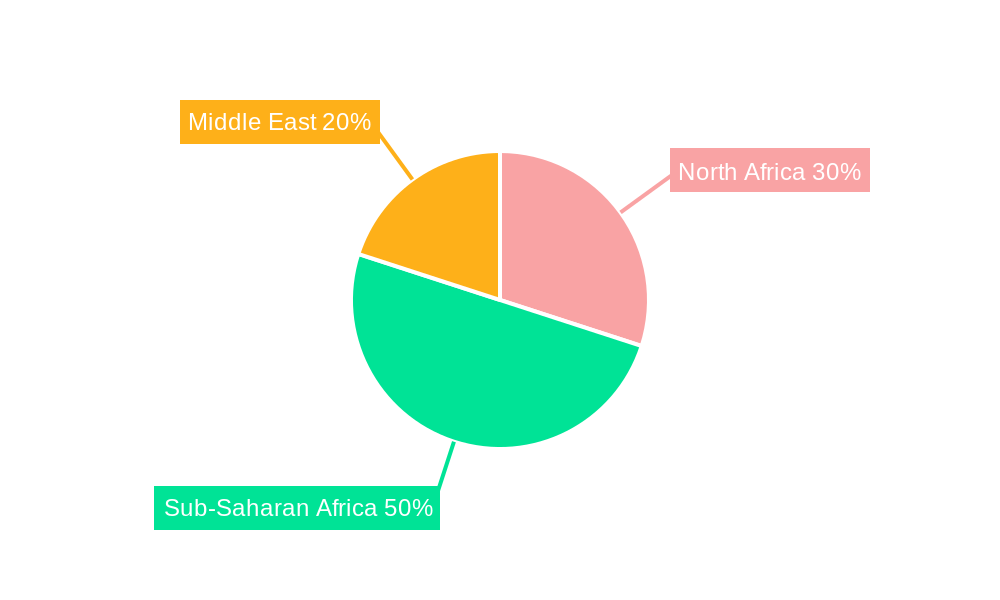

Dominant Regions, Countries, or Segments in Middle East and Africa Gypsum Board Industry

This section identifies the leading regions, countries, and market segments within the MEA gypsum board industry. It analyzes the key drivers of growth, such as economic policies, infrastructure development, and construction booms in specific areas. The analysis provides a detailed breakdown of market share and growth potential for each segment (Wall Board, Ceiling Board, Pre-decorated Board) and application sector (Residential, Institutional, Industrial, Commercial). The report pinpoints the fastest-growing segments and regions.

- Leading Regions: [Specific regions with justification for dominance, e.g., North Africa due to robust construction activity]

- Leading Countries: [Specific countries within the leading regions, supported by quantitative data]

- Dominant Segments: [Detailed breakdown of segment market shares and growth drivers. Example: Residential sector dominates due to rising urbanization.]

Middle East and Africa Gypsum Board Industry Product Landscape

This section details the latest innovations in gypsum board products, emphasizing their applications and performance metrics. It highlights the unique selling propositions (USPs) of various products and discusses technological advancements in terms of material composition, manufacturing processes, and improved performance characteristics. The analysis covers the range of products including wall boards, ceiling boards, and pre-decorated boards.

Key Drivers, Barriers & Challenges in Middle East and Africa Gypsum Board Industry

This section identifies the key drivers and challenges influencing the market's growth trajectory. Drivers include robust infrastructure development, rapid urbanization, and government initiatives promoting construction. Challenges include fluctuations in raw material prices, supply chain disruptions, and intense competition.

- Key Drivers: Government investment in infrastructure, rapid urbanization, rising disposable incomes.

- Key Challenges: Fluctuating raw material costs, import dependence, logistical constraints, competition from alternative building materials.

Emerging Opportunities in Middle East and Africa Gypsum Board Industry

This section explores untapped markets and opportunities for growth, including potential for eco-friendly gypsum board solutions and expansion into niche applications within the construction industry. It identifies evolving consumer preferences and suggests new market segments for gypsum board manufacturers to target.

Growth Accelerators in the Middle East and Africa Gypsum Board Industry Industry

This section highlights several catalysts that will drive long-term growth within the MEA gypsum board industry. It emphasizes the potential impact of technological innovations, strategic partnerships, and market expansion strategies. The growth drivers mentioned earlier in the report will be revisited here in a more summarized and synthesized manner.

Key Players Shaping the Middle East and Africa Gypsum Board Industry Market

- Knauf Gips KG

- Tanzania Gypsum

- Mada Gypsum Company

- USG Boral

- National Gypsum Company

- Saint-Gobain (Gyproc)

- Gypsemna

- AYHACO Gypsum Products Manufacturing

- Global Gypsum Co Ltd

- KCC Corporation

Notable Milestones in Middle East and Africa Gypsum Board Industry Sector

- November 2021: Saint-Gobain acquired a gypsum plant in Nairobi, Kenya, marking its first production site in the country.

- April 2021: Boral sold its 50% stake in USG Boral to Knauf for USD 1.02 billion.

In-Depth Middle East and Africa Gypsum Board Industry Market Outlook

The MEA gypsum board market exhibits strong growth potential, driven by factors such as urbanization, infrastructure development, and rising construction activity. Strategic partnerships, technological advancements, and expansion into new markets will be crucial for sustained growth in the forecast period. The market is expected to witness a CAGR of xx% during 2025-2033.

Middle East and Africa Gypsum Board Industry Segmentation

-

1. Type

- 1.1. Wall Board

- 1.2. Ceiling Board

- 1.3. Pre-decorated Board

-

2. Application

- 2.1. Residential Sector

- 2.2. Institutional Sector

- 2.3. Industrial Sector

- 2.4. Commercial Sector

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Iran

- 3.4. Nigeria

- 3.5. Egypt

- 3.6. United Arab Emirates

- 3.7. Rest of Middle-East and Africa

Middle East and Africa Gypsum Board Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Iran

- 4. Nigeria

- 5. Egypt

- 6. United Arab Emirates

- 7. Rest of Middle East and Africa

Middle East and Africa Gypsum Board Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries

- 3.3. Market Restrains

- 3.3.1. Prone to Water Damage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Ceiling Boards to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Board

- 5.1.2. Ceiling Board

- 5.1.3. Pre-decorated Board

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential Sector

- 5.2.2. Institutional Sector

- 5.2.3. Industrial Sector

- 5.2.4. Commercial Sector

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Iran

- 5.3.4. Nigeria

- 5.3.5. Egypt

- 5.3.6. United Arab Emirates

- 5.3.7. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Iran

- 5.4.4. Nigeria

- 5.4.5. Egypt

- 5.4.6. United Arab Emirates

- 5.4.7. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wall Board

- 6.1.2. Ceiling Board

- 6.1.3. Pre-decorated Board

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential Sector

- 6.2.2. Institutional Sector

- 6.2.3. Industrial Sector

- 6.2.4. Commercial Sector

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Iran

- 6.3.4. Nigeria

- 6.3.5. Egypt

- 6.3.6. United Arab Emirates

- 6.3.7. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wall Board

- 7.1.2. Ceiling Board

- 7.1.3. Pre-decorated Board

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential Sector

- 7.2.2. Institutional Sector

- 7.2.3. Industrial Sector

- 7.2.4. Commercial Sector

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Iran

- 7.3.4. Nigeria

- 7.3.5. Egypt

- 7.3.6. United Arab Emirates

- 7.3.7. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Iran Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wall Board

- 8.1.2. Ceiling Board

- 8.1.3. Pre-decorated Board

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential Sector

- 8.2.2. Institutional Sector

- 8.2.3. Industrial Sector

- 8.2.4. Commercial Sector

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Iran

- 8.3.4. Nigeria

- 8.3.5. Egypt

- 8.3.6. United Arab Emirates

- 8.3.7. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Nigeria Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wall Board

- 9.1.2. Ceiling Board

- 9.1.3. Pre-decorated Board

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential Sector

- 9.2.2. Institutional Sector

- 9.2.3. Industrial Sector

- 9.2.4. Commercial Sector

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. Iran

- 9.3.4. Nigeria

- 9.3.5. Egypt

- 9.3.6. United Arab Emirates

- 9.3.7. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Egypt Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wall Board

- 10.1.2. Ceiling Board

- 10.1.3. Pre-decorated Board

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential Sector

- 10.2.2. Institutional Sector

- 10.2.3. Industrial Sector

- 10.2.4. Commercial Sector

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. Iran

- 10.3.4. Nigeria

- 10.3.5. Egypt

- 10.3.6. United Arab Emirates

- 10.3.7. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wall Board

- 11.1.2. Ceiling Board

- 11.1.3. Pre-decorated Board

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential Sector

- 11.2.2. Institutional Sector

- 11.2.3. Industrial Sector

- 11.2.4. Commercial Sector

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. South Africa

- 11.3.3. Iran

- 11.3.4. Nigeria

- 11.3.5. Egypt

- 11.3.6. United Arab Emirates

- 11.3.7. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Middle East and Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Wall Board

- 12.1.2. Ceiling Board

- 12.1.3. Pre-decorated Board

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Residential Sector

- 12.2.2. Institutional Sector

- 12.2.3. Industrial Sector

- 12.2.4. Commercial Sector

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Saudi Arabia

- 12.3.2. South Africa

- 12.3.3. Iran

- 12.3.4. Nigeria

- 12.3.5. Egypt

- 12.3.6. United Arab Emirates

- 12.3.7. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. South Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 14. Sudan Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 15. Uganda Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 16. Tanzania Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 17. Kenya Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Knauf Gips KG

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Tanzania Gypsum

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Mada Gypsum Company

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 USG Boral*List Not Exhaustive

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 National Gypsum Company

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Saint-Gobain (Gyproc)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Gypsemna

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 AYHACO Gypsum Products Manufacturing

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Global Gypsum Co Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 KCC Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Knauf Gips KG

List of Figures

- Figure 1: Middle East and Africa Gypsum Board Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Gypsum Board Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gypsum Board Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Middle East and Africa Gypsum Board Industry?

Key companies in the market include Knauf Gips KG, Tanzania Gypsum, Mada Gypsum Company, USG Boral*List Not Exhaustive, National Gypsum Company, Saint-Gobain (Gyproc), Gypsemna, AYHACO Gypsum Products Manufacturing, Global Gypsum Co Ltd, KCC Corporation.

3. What are the main segments of the Middle East and Africa Gypsum Board Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries.

6. What are the notable trends driving market growth?

Ceiling Boards to Dominate the Market.

7. Are there any restraints impacting market growth?

Prone to Water Damage; Other Restraints.

8. Can you provide examples of recent developments in the market?

In November 2021, Saint-Gobain acquired a gypsum plant in Nairobi, Kenya. This is Saint-Gobain's first production site in Kenya.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gypsum Board Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gypsum Board Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gypsum Board Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gypsum Board Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence