Key Insights

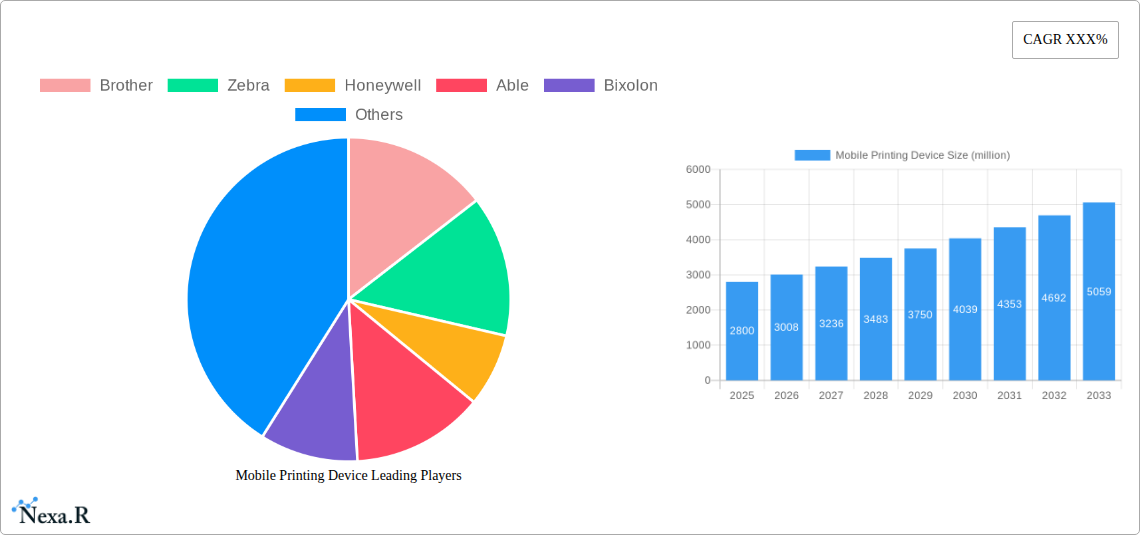

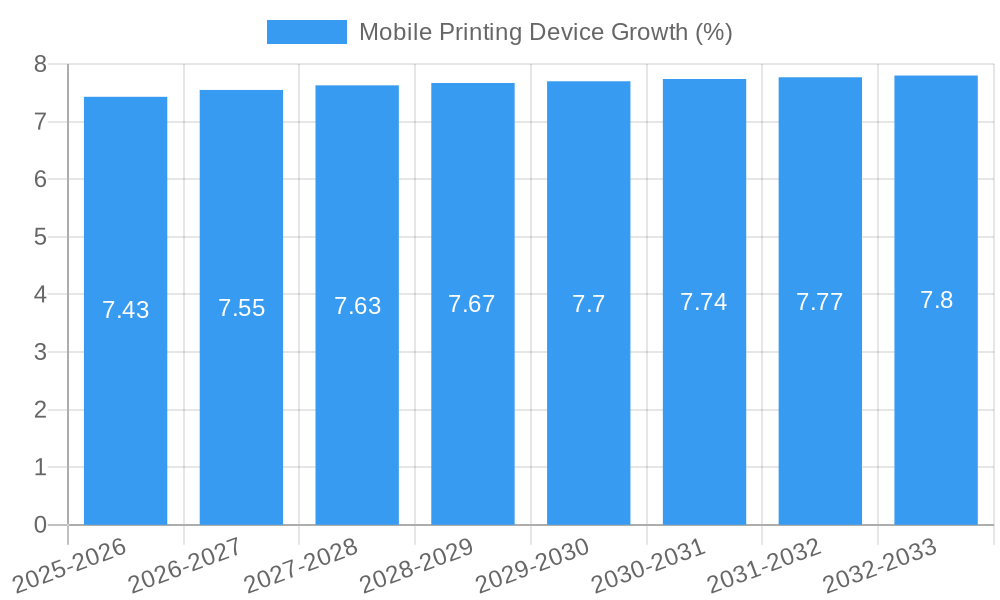

The global Mobile Printing Device market is poised for significant expansion, with an estimated market size of approximately $2,800 million in 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of around 7.5% over the forecast period of 2025-2033. The increasing demand for on-the-go printing solutions across both home and commercial applications is a primary driver. In the home segment, the proliferation of smartphones and tablets, coupled with the need for immediate document and photo printing, fuels adoption. Businesses are leveraging mobile printing for enhanced field service, inventory management, event ticketing, and secure on-site document generation, contributing to the commercial segment's substantial share. The market is further propelled by technological advancements, particularly in digital printing devices that offer enhanced portability, speed, and connectivity options like Wi-Fi and Bluetooth, making them indispensable tools for a mobile workforce and modern consumers.

The market's trajectory is shaped by several key trends and a few moderating factors. The widespread adoption of cloud printing services and the integration of mobile printing capabilities into existing mobile ecosystems are creating seamless user experiences. Furthermore, the growing emphasis on sustainability is driving the development of energy-efficient and eco-friendly mobile printing solutions. However, challenges such as the relatively higher cost of some advanced mobile printers compared to traditional desktop models and concerns around data security for sensitive prints can act as restraints. Despite these, the continuous innovation in printer miniaturization, battery life, and printing quality, alongside a broadening range of applications including specialized 3D printing devices for prototyping and custom creations, ensures a dynamic and promising future for the mobile printing device market. Key players like Brother, Zebra, Honeywell, and HP are actively investing in research and development to capture market share by offering diverse and feature-rich mobile printing solutions.

Here is a compelling, SEO-optimized report description for the Mobile Printing Device market, designed for immediate use.

Mobile Printing Device Market Dynamics & Structure

The global mobile printing device market is characterized by a moderate concentration of key players, with a dynamic interplay of technological innovation and evolving end-user demands. Companies such as Brother, Zebra, Honeywell, Able, Bixolon, Toshiba, HP, Canon, PRT, Citizen, Star, OKI, Softland India, TallyGenicom, Draeger, Zicox Print Technology, Zonerich, and Aclas are actively shaping this landscape through continuous product development. Technological innovation is primarily driven by the demand for portability, enhanced connectivity (Wi-Fi, Bluetooth, NFC), longer battery life, and improved print quality for diverse applications. Regulatory frameworks, particularly concerning data security and environmental standards, are increasingly influential. Competitive product substitutes include direct digital data transfer and cloud-based solutions, necessitating a strong focus on unique selling propositions for mobile printing devices. End-user demographics are expanding, encompassing a broad spectrum from home users and students to enterprise mobility solutions in logistics, healthcare, and retail. Mergers and acquisitions (M&A) trends, while not at extreme levels, indicate strategic consolidation and market expansion by leading players seeking to enhance their product portfolios and market reach.

- Market Concentration: Moderate, with several established global players and a growing number of niche providers.

- Technological Innovation Drivers: Miniaturization, wireless connectivity advancements, energy efficiency, and specialized print capabilities (e.g., barcode, receipt, label printing).

- Regulatory Frameworks: Growing emphasis on data privacy, secure printing, and eco-friendly manufacturing processes.

- Competitive Product Substitutes: Cloud-based document sharing, direct device-to-device data transfer, and traditional desktop printing solutions.

- End-User Demographics: Diversifying from individual consumers to enterprise field workers, delivery personnel, healthcare professionals, and retail staff.

- M&A Trends: Strategic acquisitions focused on expanding technology portfolios, entering new geographic markets, or consolidating market share in specific niches.

Mobile Printing Device Growth Trends & Insights

The global mobile printing device market is poised for significant expansion, driven by the relentless pursuit of enhanced mobility and efficiency across various industries. From its estimated market size of $13,500 million units in the Base Year: 2025, the market is projected to witness robust growth throughout the Forecast Period: 2025–2033. This upward trajectory is underpinned by an increasing adoption rate of mobile technologies in everyday life and professional settings. The Study Period: 2019–2033, encompassing the Historical Period: 2019–2024, reveals a steady climb, with the market demonstrating resilience and adaptability.

Technological disruptions are continuously reshaping the mobile printing landscape. The integration of advanced connectivity options, such as 5G and improved Bluetooth protocols, ensures seamless and rapid data transfer for printing. Furthermore, the development of more compact, lightweight, and power-efficient printing mechanisms is a key factor in driving adoption. Consumers and businesses alike are increasingly recognizing the value proposition of being able to print documents, receipts, labels, and even specialized media directly from smartphones, tablets, and other mobile devices, eliminating the need for fixed printing stations. This shift is particularly evident in sectors like logistics and field services, where mobile printing enables real-time documentation and verification processes.

Consumer behavior is also evolving to embrace the convenience and productivity gains offered by mobile printing solutions. The demand for on-the-go printing for tasks ranging from printing travel itineraries to generating on-site invoices is on the rise. This evolving preference, coupled with the decreasing cost of mobile printing hardware and the proliferation of user-friendly mobile applications, is creating a fertile ground for market expansion. The Estimated Year: 2025 serves as a crucial pivot point, with anticipated technological advancements and expanding use cases further accelerating adoption rates. The market is expected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period, driven by these converging factors. Market penetration, which was around 35% in 2024, is expected to reach over 55% by 2033, indicating a substantial opportunity for growth.

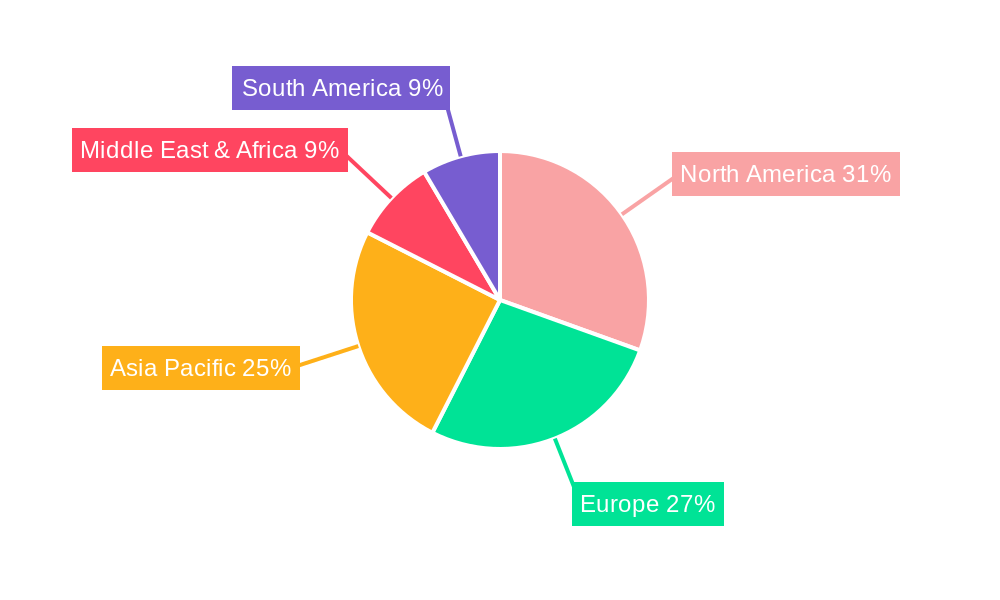

Dominant Regions, Countries, or Segments in Mobile Printing Device

The Commercial segment, under the Application classification, is the primary engine driving growth in the global mobile printing device market. This dominance is fueled by the burgeoning demand for efficient and portable printing solutions across a multitude of industries. Within the Commercial application, sub-segments such as Logistics and Supply Chain, Retail and E-commerce, and Healthcare are exhibiting particularly strong growth. The increasing reliance on mobile Point-of-Sale (mPOS) systems, inventory management, field service operations, and patient record management necessitates immediate and on-site printing capabilities, making mobile printing devices indispensable.

North America and Europe currently represent the dominant geographical regions, accounting for a significant portion of the global market share. These regions benefit from a mature technological infrastructure, a high adoption rate of mobile devices, and a strong presence of industries that extensively utilize mobile printing. For instance, the United States, a key country within North America, sees substantial demand from its vast logistics network and a rapidly growing e-commerce sector that requires efficient label printing for shipments. Similarly, European countries with advanced retail and healthcare sectors are major contributors.

The Digital Printing Device type also commands a significant share due to its versatility and widespread application. These devices, capable of high-resolution printing for various media, are crucial for businesses requiring professional-looking outputs on the go. The underlying economic policies in developed nations, which often incentivize automation and efficiency, further bolster the adoption of mobile printing solutions. Infrastructure development, particularly in terms of reliable wireless networks, plays a pivotal role in enabling seamless mobile printing operations across these dominant regions.

Looking ahead, emerging markets in Asia-Pacific are projected to witness the fastest growth. Countries like China and India, with their rapidly expanding economies, a massive mobile-first population, and a growing e-commerce ecosystem, present immense untapped potential. The increasing adoption of smart devices and the drive towards digitalization across businesses in these regions will create substantial demand for mobile printing solutions. The market share of the Commercial segment is expected to grow from an estimated 65% in 2025 to over 70% by 2033, highlighting its continued dominance.

Mobile Printing Device Product Landscape

The mobile printing device product landscape is evolving rapidly, characterized by an increasing focus on miniaturization, enhanced connectivity, and specialized functionalities. Innovations are centered around developing ultra-portable printers capable of producing high-quality prints on various media, from receipts and labels to small-format documents. Advancements in battery technology ensure extended operational life, a critical factor for field applications. Connectivity options have expanded beyond Bluetooth to include Wi-Fi, NFC, and cellular capabilities, offering greater flexibility. Unique selling propositions often lie in ruggedized designs for harsh environments, rapid print speeds, and seamless integration with mobile operating systems and enterprise software. For instance, Zebra's mobile printers are known for their durability and barcode printing capabilities, while HP's offerings focus on user-friendliness for general document printing.

Key Drivers, Barriers & Challenges in Mobile Printing Device

The mobile printing device market is propelled by several key drivers. Technological advancements in miniaturization, battery efficiency, and wireless connectivity are crucial. The increasing demand for mobility and on-the-go productivity across industries like logistics, retail, and healthcare is a significant catalyst. Furthermore, the proliferation of smartphones and tablets as primary computing devices creates a natural ecosystem for mobile printing solutions. Economic incentives favoring efficiency and automation also play a role.

However, the market faces several barriers and challenges. High initial cost for some advanced models can be a deterrent for smaller businesses. Connectivity issues and network reliability in remote areas can hinder seamless operation. Security concerns related to data transmission and printing can be a restraint. Limited print volume capabilities for some devices compared to traditional printers might be a challenge for high-demand users. Supply chain disruptions, as seen in recent years, can impact product availability and pricing. Intense competition from both established players and new entrants also presents a challenge.

Emerging Opportunities in Mobile Printing Device

Emerging opportunities in the mobile printing device sector lie in several key areas. The expansion of the Internet of Things (IoT) presents a significant avenue, with opportunities for integrating mobile printers into connected ecosystems for automated reporting and data logging. The growth of wearable technology could lead to even more compact and integrated printing solutions. Furthermore, the increasing demand for personalized and on-demand printing in retail and event management offers new application possibilities. The untapped potential in developing economies, where mobile adoption is rapidly outpacing traditional infrastructure, represents a substantial growth market. The development of eco-friendly and sustainable printing solutions also resonates with growing consumer and corporate environmental consciousness.

Growth Accelerators in the Mobile Printing Device Industry

Several catalysts are accelerating the growth of the mobile printing device industry. Technological breakthroughs in areas like energy harvesting for self-powered printers and advanced material science for lighter and more durable devices are pivotal. Strategic partnerships between mobile printing manufacturers and software developers are enhancing user experience and enabling broader integration with enterprise applications. Market expansion strategies, including aggressive market penetration in emerging economies and the development of niche product lines catering to specific industry needs (e.g., specialized medical or industrial printers), are further driving adoption. The continuous innovation in cloud printing solutions that seamlessly integrate with mobile devices also acts as a significant growth accelerator, simplifying printing from any location.

Key Players Shaping the Mobile Printing Device Market

- Brother

- Zebra

- Honeywell

- Able

- Bixolon

- Toshiba

- HP

- Canon

- PRT

- Citizen

- Star

- OKI

- Softland India

- TallyGenicom

- Draeger

- Zicox Print Technology

- Zonerich

- Aclas

Notable Milestones in Mobile Printing Device Sector

- 2019: Introduction of advanced Bluetooth 5.0 connectivity in portable printers, improving speed and range.

- 2020: Increased demand for ruggedized mobile printers for essential services during global events.

- 2021: Launch of cloud-connected mobile printers enabling remote management and firmware updates.

- 2022: Significant advancements in battery technology, extending operational life for mobile printing devices by up to 30%.

- 2023: Growing adoption of mobile printing in healthcare for on-demand patient identification and prescription printing.

- 2024: Introduction of AI-powered features for optimizing print jobs and reducing waste in mobile printing solutions.

In-Depth Mobile Printing Device Market Outlook

The future outlook for the mobile printing device market is exceptionally bright, characterized by sustained growth and continuous innovation. The market's trajectory will be significantly influenced by the ongoing digital transformation across industries, which necessitates increasingly mobile and efficient operational workflows. Growth accelerators, including the integration of 5G technology for ultra-fast connectivity, the development of sustainable printing materials, and the expansion of IoT applications, will further fuel market penetration. Strategic partnerships and a focus on user-centric design will be paramount in capturing evolving market demands. The mobile printing device market is well-positioned to capitalize on these trends, offering substantial opportunities for stakeholders to expand their reach and offerings in the coming years.

Mobile Printing Device Segmentation

-

1. Application

- 1.1. Home

- 1.2. Commercial

-

2. Type

- 2.1. Digital Printing Device

- 2.2. 3d Printing Device

- 2.3. Other

Mobile Printing Device Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mobile Printing Device REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Digital Printing Device

- 5.2.2. 3d Printing Device

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Digital Printing Device

- 6.2.2. 3d Printing Device

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Digital Printing Device

- 7.2.2. 3d Printing Device

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Digital Printing Device

- 8.2.2. 3d Printing Device

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Digital Printing Device

- 9.2.2. 3d Printing Device

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mobile Printing Device Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Digital Printing Device

- 10.2.2. 3d Printing Device

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Brother

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zebra

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Able

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bixolon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toshiba

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HP

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cannon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PRT

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Citizen

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Star

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OKI

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Softland India

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TallyGenicom

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Draeger

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zicox Print Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zonerich

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Aclas

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Brother

List of Figures

- Figure 1: Global Mobile Printing Device Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mobile Printing Device Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mobile Printing Device Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mobile Printing Device Revenue (million), by Type 2024 & 2032

- Figure 5: North America Mobile Printing Device Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Mobile Printing Device Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mobile Printing Device Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mobile Printing Device Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mobile Printing Device Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mobile Printing Device Revenue (million), by Type 2024 & 2032

- Figure 11: South America Mobile Printing Device Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Mobile Printing Device Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mobile Printing Device Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mobile Printing Device Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mobile Printing Device Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mobile Printing Device Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Mobile Printing Device Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Mobile Printing Device Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mobile Printing Device Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mobile Printing Device Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mobile Printing Device Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mobile Printing Device Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Mobile Printing Device Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Mobile Printing Device Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mobile Printing Device Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mobile Printing Device Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mobile Printing Device Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mobile Printing Device Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Mobile Printing Device Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Mobile Printing Device Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mobile Printing Device Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mobile Printing Device Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Mobile Printing Device Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Mobile Printing Device Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Mobile Printing Device Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Mobile Printing Device Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Mobile Printing Device Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mobile Printing Device Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mobile Printing Device Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Mobile Printing Device Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mobile Printing Device Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Printing Device?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Mobile Printing Device?

Key companies in the market include Brother, Zebra, Honeywell, Able, Bixolon, Toshiba, HP, Cannon, PRT, Citizen, Star, OKI, Softland India, TallyGenicom, Draeger, Zicox Print Technology, Zonerich, Aclas.

3. What are the main segments of the Mobile Printing Device?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Printing Device," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Printing Device report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Printing Device?

To stay informed about further developments, trends, and reports in the Mobile Printing Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence