Key Insights

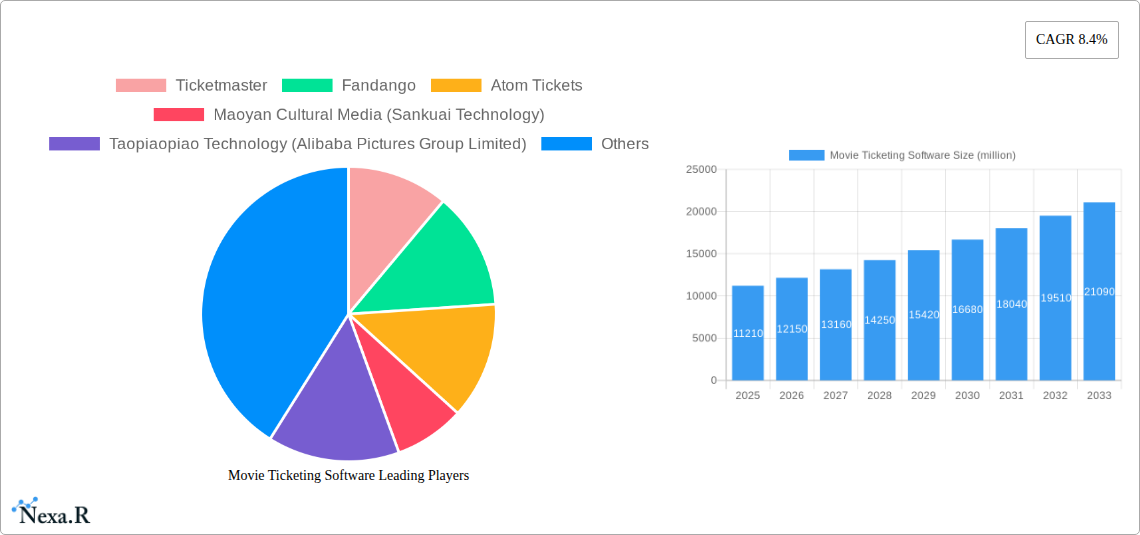

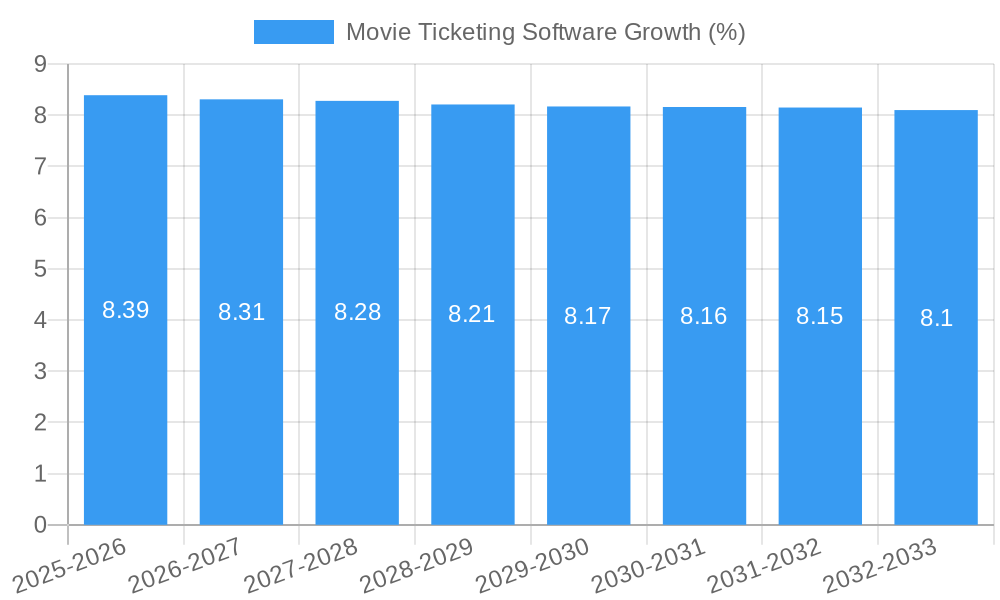

The global Movie Ticketing Software market is poised for robust growth, projected to reach a substantial market size of $11,210 million by 2025. This impressive valuation is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 8.4% anticipated throughout the forecast period of 2025-2033. This sustained expansion is primarily driven by the increasing digitization of cinema operations, the growing demand for convenient online booking solutions, and the proliferation of smart devices facilitating seamless ticket purchases. The market is witnessing a significant shift towards integrated platforms that offer not only ticket sales but also features like personalized recommendations, loyalty programs, and integrated payment gateways. The evolution of cinematic experiences, with the rise of advanced formats like IMAX and Dolby, further fuels the adoption of sophisticated ticketing software capable of managing diverse seating configurations and pricing models.

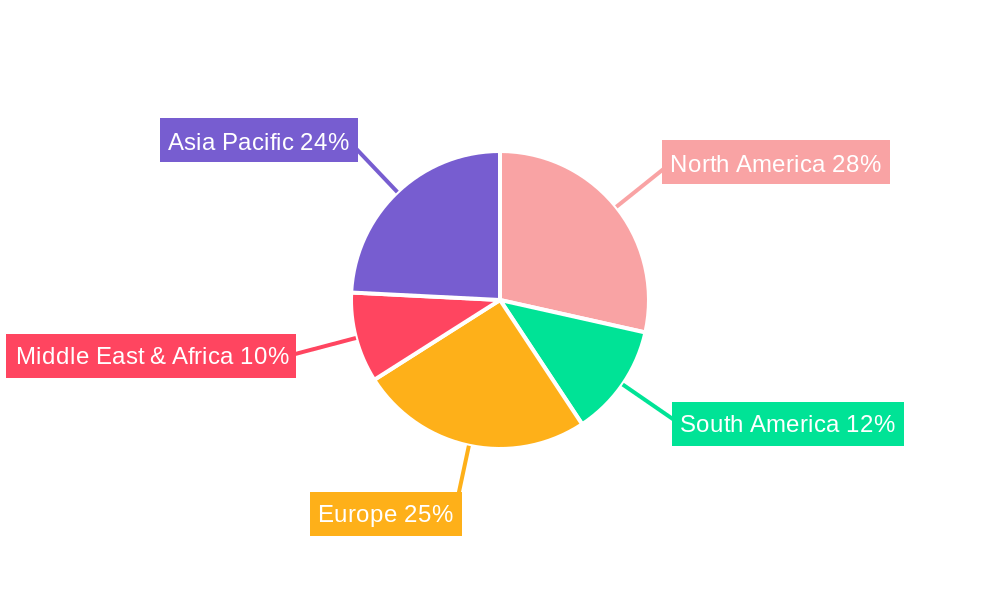

The market is broadly segmented by application, with "For Individual" users constituting the largest share due to the widespread adoption of mobile ticketing. The "For Family" segment also presents considerable growth potential, driven by group bookings and bundled offers. In terms of type, while traditional 2D and 3D formats remain dominant, the increasing popularity of premium experiences like IMAX and Dolby is influencing software development towards enhanced visual and audio integration capabilities. Geographically, North America and Asia Pacific are expected to lead the market in terms of value, with China and the United States at the forefront of adoption. However, rapid urbanization and a growing middle class in regions like South America and parts of the Middle East & Africa present significant untapped opportunities. Key players like Ticketmaster, Fandango, and Maoyan Cultural Media are actively innovating to capture market share, focusing on user experience, AI-driven personalization, and strategic partnerships with cinema chains.

Unlocking the Future of Cinema: A Comprehensive Report on the Global Movie Ticketing Software Market (2019-2033)

This definitive report provides an in-depth analysis of the global Movie Ticketing Software market, offering critical insights for industry professionals, investors, and stakeholders. Spanning from 2019 to 2033, with a base year of 2025 and a comprehensive forecast period, this research delves into market dynamics, growth trajectories, regional dominance, product innovations, key players, and emerging opportunities. Leveraging a robust methodology and incorporating high-traffic keywords such as "movie ticketing software," "online movie tickets," "cinema management software," "ticket booking platforms," and "digital ticketing solutions," this report is optimized for maximum search engine visibility. We explore the parent market of broader entertainment ticketing and the child market of specific cinema solutions, providing a holistic view of market penetration and future potential. All monetary values are presented in millions of units for clarity and ease of comparison.

Movie Ticketing Software Market Dynamics & Structure

The global movie ticketing software market exhibits a moderate to high degree of concentration, driven by established players and significant technological innovation. Key drivers include the increasing adoption of mobile ticketing, the demand for seamless customer experiences, and advancements in data analytics for personalized recommendations. Regulatory frameworks, while generally supportive of digital transformation, can pose challenges related to data privacy and payment security in certain regions. Competitive product substitutes, such as direct cinema box office sales and third-party event ticketing platforms, exert pressure but are increasingly being integrated into broader ticketing ecosystems. End-user demographics are evolving, with a growing preference for digital channels among millennials and Gen Z, while families seek integrated booking and loyalty programs. Mergers and acquisitions (M&A) trends indicate consolidation, with larger players acquiring innovative startups to expand their feature sets and market reach. For instance, recent M&A activities in the broader entertainment ticketing space, valued at an estimated $500 million in the historical period, indicate strategic moves to capture market share.

- Market Concentration: Dominated by a few key players, with a growing presence of regional specialists.

- Technological Innovation Drivers: Mobile-first design, AI-powered recommendations, contactless payment integration, and enhanced analytics.

- Regulatory Frameworks: Data privacy laws (e.g., GDPR, CCPA), payment gateway regulations, and accessibility standards.

- Competitive Product Substitutes: Traditional box office sales, event ticketing platforms, and subscription-based movie services.

- End-User Demographics: Shifting towards digital-savvy younger generations, with a growing interest in family-friendly features and group bookings.

- M&A Trends: Strategic acquisitions of niche technologies and regional leaders to expand service offerings and geographical footprints.

Movie Ticketing Software Growth Trends & Insights

The movie ticketing software market is poised for robust growth, driven by evolving consumer behaviors and technological advancements. The market size is projected to expand from an estimated $2,500 million in 2024 to a significant $5,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates for online and mobile ticketing solutions are accelerating, with an estimated 70% of all movie tickets purchased digitally in the base year 2025. Technological disruptions, such as the integration of augmented reality (AR) for seat previews and virtual reality (VR) for immersive pre-show experiences, are beginning to shape the industry. Consumer behavior shifts are characterized by an increasing demand for convenience, personalized offers, and integrated entertainment experiences that go beyond simple ticket purchase. The rise of dynamic pricing models and loyalty program integration further enhances user engagement.

- Market Size Evolution: Projected to reach $5,500 million by 2033, from an estimated $2,500 million in 2024.

- Adoption Rates: Over 70% of movie tickets are expected to be purchased digitally by 2025, with continued upward trajectory.

- Technological Disruptions: AR/VR integration for enhanced pre-show experiences, AI-driven personalization, and blockchain for secure ticketing.

- Consumer Behavior Shifts: Increased demand for convenience, personalized deals, integrated loyalty programs, and seamless cross-platform booking.

- Market Penetration: High in developed markets, with significant untapped potential in emerging economies.

Dominant Regions, Countries, or Segments in Movie Ticketing Software

The Application: For Individual segment, representing the largest share of the movie ticketing software market, is a primary driver of growth, projected to account for an estimated 60% of the market value by 2025. This dominance is fueled by the increasing individual propensity for online purchases and the desire for personalized movie-watching experiences. Countries like the United States and China lead in this segment due to their mature digital infrastructure and large, tech-savvy populations.

The Type: 2D/3D category also holds significant sway, encompassing a broad range of cinematic experiences. However, IMAX and Dolby formats are demonstrating higher growth rates due to consumer willingness to pay a premium for enhanced visual and auditory experiences. The increasing number of IMAX and Dolby-equipped cinemas globally is a key driver.

Key Drivers of Dominance:

- United States: High internet penetration, strong entertainment culture, and early adoption of digital ticketing platforms.

- China: Rapid digital transformation, massive population, and the dominance of super-apps like WeChat integrating ticketing services.

- India: Growing middle class, increasing cinema-going culture, and strong performance of platforms like BookMyShow.

- Europe: Stringent data privacy regulations fostering trust in secure digital transactions, coupled with a growing demand for premium formats.

Growth Potential and Market Share:

- For Individual: Estimated market share of 60% in 2025, with steady growth driven by convenience and personalization.

- For Family: Growing segment, estimated to capture 25% of the market by 2025, driven by group booking features and bundled offers.

- 2D/3D: Dominant ticket type, but with evolving preferences towards premium formats.

- IMAX & Dolby: Higher growth rates, indicating a consumer preference for premium cinematic experiences, estimated to collectively grow at a CAGR of 10% during the forecast period.

- Others (e.g., 4DX): Niche but growing segment, contributing to market diversification and innovation.

Movie Ticketing Software Product Landscape

The product landscape of movie ticketing software is characterized by a continuous stream of innovations aimed at enhancing user experience and operational efficiency. Solutions are increasingly integrated with advanced features like personalized recommendations powered by AI, dynamic pricing, loyalty program management, and contactless payment options. The integration of mobile applications with in-app purchasing, seat selection, and digital wallet compatibility has become standard. Furthermore, cloud-based solutions are prevalent, offering scalability and flexibility for cinema operators of all sizes. Unique selling propositions often lie in robust analytics dashboards for cinemas, offering insights into customer behavior and sales trends, as well as seamless integration with other point-of-sale systems.

Key Drivers, Barriers & Challenges in Movie Ticketing Software

Key Drivers:

- Technological Advancements: The relentless evolution of mobile technology, AI, and cloud computing fuels the development of more sophisticated and user-friendly ticketing solutions.

- Convenience & Accessibility: Consumers increasingly demand the ease of booking movie tickets anytime, anywhere, through their smartphones or computers.

- Data Analytics: The ability to gather and analyze customer data provides valuable insights for personalized marketing and operational optimization for cinemas.

- Increased Internet & Smartphone Penetration: Wider access to the internet and the ubiquitous use of smartphones in emerging economies create vast new markets.

Barriers & Challenges:

- Cybersecurity Threats: The risk of data breaches and online fraud poses a significant concern for both users and providers, demanding robust security measures.

- Digital Divide: In certain regions, limited internet access and digital literacy can hinder the widespread adoption of online ticketing platforms.

- Integration Complexity: Integrating new ticketing software with existing legacy systems in cinemas can be technically challenging and costly.

- Competition: The market is highly competitive, with established giants and emerging startups vying for market share, leading to pricing pressures. Supply chain issues related to hardware for box office systems in some regions have added to operational challenges.

Emerging Opportunities in Movie Ticketing Software

Emerging opportunities in the movie ticketing software market are centered around enhancing the holistic cinema experience beyond just ticket purchase. This includes the integration of pre-show entertainment booking, food and beverage ordering, and loyalty program management within a single platform. Untapped markets in developing economies, with their burgeoning middle classes and increasing disposable income, present significant growth potential. Innovative applications like personalized movie recommendations based on viewing history and social media trends, virtual reality previews, and interactive promotional campaigns are poised to captivate audiences. Furthermore, the rise of subscription models and bundled entertainment packages, incorporating movie tickets with other leisure activities, offers a new avenue for revenue generation and customer engagement.

Growth Accelerators in the Movie Ticketing Software Industry

Several catalysts are driving long-term growth in the movie ticketing software industry. Technological breakthroughs, such as the widespread adoption of 5G networks, will enable faster and more seamless mobile ticketing experiences. Strategic partnerships between ticketing platforms and content providers, or even other entertainment verticals like gaming and streaming services, can create lucrative cross-promotional opportunities. Market expansion strategies targeting underserved geographical regions and demographic segments will be crucial. The continuous development of advanced analytics and AI for hyper-personalization will foster greater customer loyalty and drive repeat business. The increasing focus on offering integrated solutions that manage the entire customer journey, from discovery to post-movie engagement, will solidify market leadership.

Key Players Shaping the Movie Ticketing Software Market

- Ticketmaster

- Fandango

- Atom Tickets

- Maoyan Cultural Media (Sankuai Technology)

- Taopiaopiao Technology (Alibaba Pictures Group Limited)

- Vista Cinema

- BookMyShow

- TIX ID

- Mtime

- Usheru

- MoviePass

- TicketNew

- TicketSoft

- Veezi

- Savoy Systems

- Diamond Ticketing Systems

- Influx Worldwide

- Compeso

- Omniterm

- The Boxoffice Company

- TicketTool

Notable Milestones in Movie Ticketing Software Sector

- 2019: Widespread adoption of contactless payment options in ticketing platforms.

- 2020: Accelerated shift towards online and mobile ticket purchases due to global health concerns.

- 2021: Increased integration of AI for personalized movie recommendations and dynamic pricing models.

- 2022: Major players began exploring augmented reality (AR) features for virtual seat previews and cinema navigation.

- 2023: Consolidation trends intensified with key acquisitions to expand service portfolios and market reach. Estimated M&A deal volume reached $400 million.

- 2024: Enhanced focus on subscription models and integrated entertainment packages, including food and beverage ordering.

In-Depth Movie Ticketing Software Market Outlook

The movie ticketing software market is set for a period of sustained and dynamic growth, driven by a confluence of technological innovation and evolving consumer preferences. Growth accelerators include the increasing demand for seamless, personalized digital experiences, the expansion of premium cinematic formats like IMAX and Dolby, and the strategic penetration into emerging markets. The industry will witness further integration of AI for hyper-personalized recommendations and operational optimization for cinemas. Strategic partnerships and market expansion will be key to capturing untapped potential, particularly in regions with rapidly growing middle classes. The future outlook points towards ticketing platforms becoming comprehensive entertainment hubs, managing not just ticket sales but also integrated F&B ordering, loyalty programs, and even pre-show entertainment, solidifying their indispensable role in the modern cinema ecosystem.

Movie Ticketing Software Segmentation

-

1. Application

- 1.1. For Individual

- 1.2. For Family

- 1.3. Others

-

2. Type

- 2.1. 2D/3D

- 2.2. Imax

- 2.3. Dolby

- 2.4. Others

Movie Ticketing Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Movie Ticketing Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. For Individual

- 5.1.2. For Family

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 2D/3D

- 5.2.2. Imax

- 5.2.3. Dolby

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. For Individual

- 6.1.2. For Family

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 2D/3D

- 6.2.2. Imax

- 6.2.3. Dolby

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. For Individual

- 7.1.2. For Family

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 2D/3D

- 7.2.2. Imax

- 7.2.3. Dolby

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. For Individual

- 8.1.2. For Family

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 2D/3D

- 8.2.2. Imax

- 8.2.3. Dolby

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. For Individual

- 9.1.2. For Family

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 2D/3D

- 9.2.2. Imax

- 9.2.3. Dolby

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Movie Ticketing Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. For Individual

- 10.1.2. For Family

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 2D/3D

- 10.2.2. Imax

- 10.2.3. Dolby

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ticketmaster

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fandango

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Atom Tickets

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Maoyan Cultural Media (Sankuai Technology)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taopiaopiao Technology (Alibaba Pictures Group Limited)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vista Cinema

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BookMyShow

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TIX ID

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mtime

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Usheru

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MoviePass

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TicketNew

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TicketSoft

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Veezi

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Savoy Systems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Diamond Ticketing Systems

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Influx Worldwide

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Compeso

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Omniterm

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 The Boxoffice Company

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 TicketTool

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Ticketmaster

List of Figures

- Figure 1: Global Movie Ticketing Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Movie Ticketing Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Movie Ticketing Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Movie Ticketing Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Movie Ticketing Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Movie Ticketing Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Movie Ticketing Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Movie Ticketing Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Movie Ticketing Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Movie Ticketing Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Movie Ticketing Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Movie Ticketing Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Movie Ticketing Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Movie Ticketing Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Movie Ticketing Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Movie Ticketing Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Movie Ticketing Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Movie Ticketing Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Movie Ticketing Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Movie Ticketing Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Movie Ticketing Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Movie Ticketing Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Movie Ticketing Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Movie Ticketing Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Movie Ticketing Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Movie Ticketing Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Movie Ticketing Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Movie Ticketing Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Movie Ticketing Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Movie Ticketing Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Movie Ticketing Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Movie Ticketing Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Movie Ticketing Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Movie Ticketing Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Movie Ticketing Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Movie Ticketing Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Movie Ticketing Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Movie Ticketing Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Movie Ticketing Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Movie Ticketing Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Movie Ticketing Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Movie Ticketing Software?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Movie Ticketing Software?

Key companies in the market include Ticketmaster, Fandango, Atom Tickets, Maoyan Cultural Media (Sankuai Technology), Taopiaopiao Technology (Alibaba Pictures Group Limited), Vista Cinema, BookMyShow, TIX ID, Mtime, Usheru, MoviePass, TicketNew, TicketSoft, Veezi, Savoy Systems, Diamond Ticketing Systems, Influx Worldwide, Compeso, Omniterm, The Boxoffice Company, TicketTool.

3. What are the main segments of the Movie Ticketing Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11210 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Movie Ticketing Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Movie Ticketing Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Movie Ticketing Software?

To stay informed about further developments, trends, and reports in the Movie Ticketing Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence