Key Insights

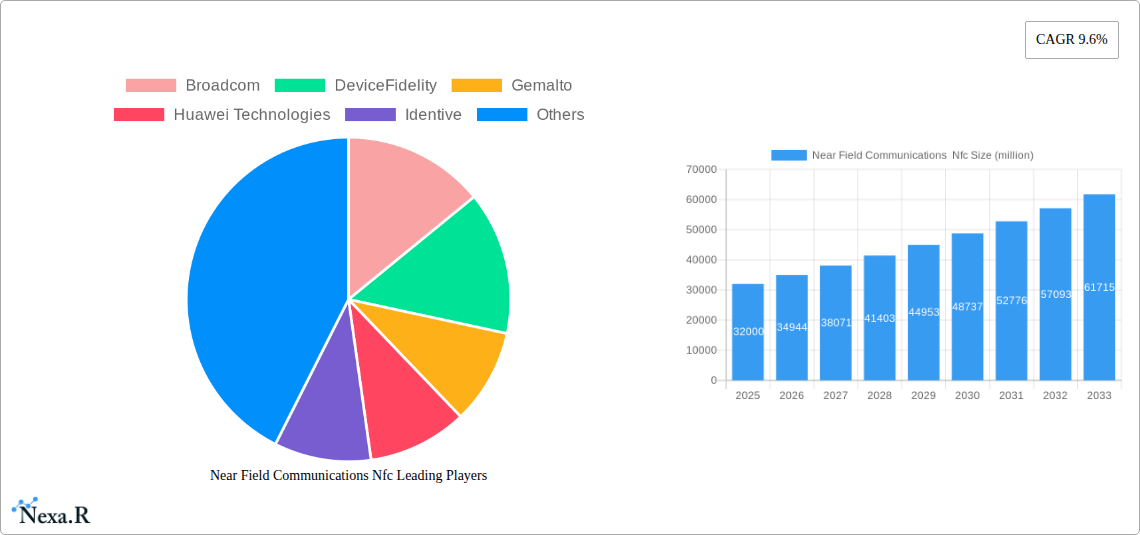

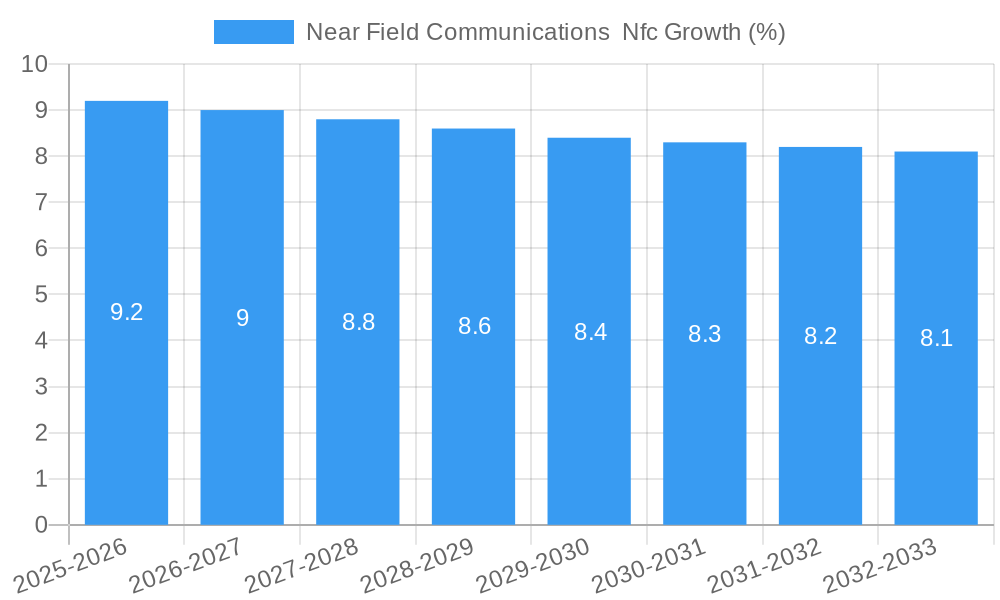

The Near Field Communications (NFC) market is poised for substantial growth, projected to reach \$58,240 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.6% during the forecast period of 2025-2033. This expansion is fueled by an increasing adoption of contactless technologies across various sectors. In the Banking & Finance sector, NFC is revolutionizing payment systems with secure and convenient mobile wallets, driving significant market penetration. The Retail industry is leveraging NFC for enhanced customer experiences, including frictionless payments and personalized promotions. The Automotive and Transportation sectors are integrating NFC for keyless entry, vehicle ignition, and transit ticketing, further boosting demand. The Medical & Healthcare industry is witnessing NFC's application in patient identification and secure data access, while Residential & Commercial segments are adopting it for smart building access and control. Consumer Electronics continue to be a primary driver, with NFC embedded in smartphones, wearables, and other devices for seamless connectivity and data transfer. The "Others" segment, encompassing a diverse range of emerging applications, also contributes to the market's dynamism.

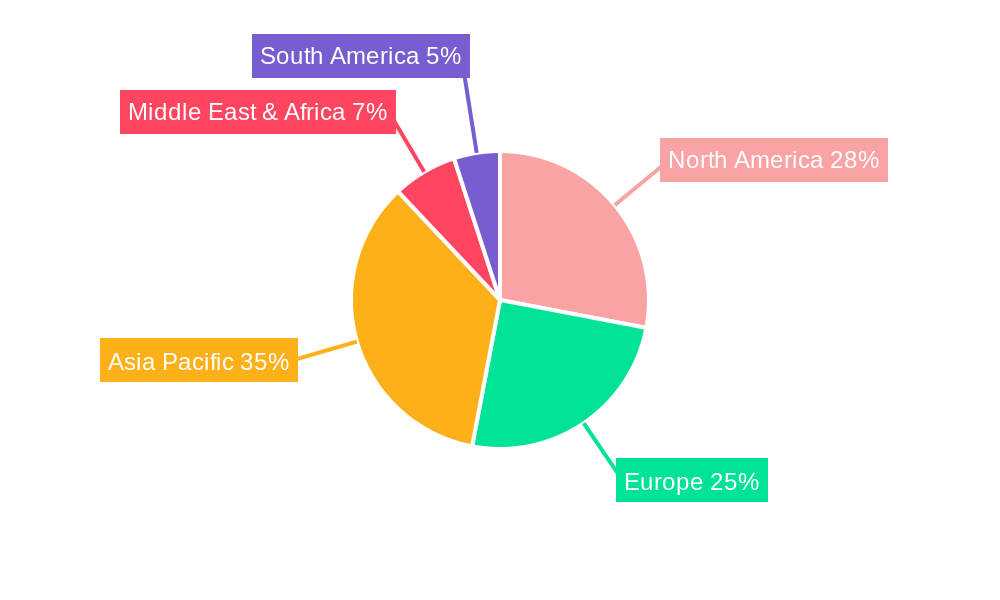

The market is characterized by a dynamic interplay of technological advancements and evolving consumer behavior. Key players such as Broadcom, Gemalto, Huawei Technologies, Infineon Technologies, NXP Semiconductors, and Samsung Electronics are at the forefront of innovation, developing advanced NFC chips and solutions. The PC & laptop segment is seeing an uptick in NFC integration for secure authentication and data sharing, complementing the established dominance of Smartphones & Tablets. While the growth trajectory is overwhelmingly positive, potential restraints could include evolving data security concerns and the need for standardized interoperability across diverse platforms. However, ongoing research and development, coupled with strategic partnerships, are actively addressing these challenges, ensuring a sustained upward trend in NFC market value and adoption worldwide. The market is expected to see strong performance across key regions like Asia Pacific, driven by China and India's rapid digital transformation, followed by North America and Europe, which continue to embrace contactless solutions.

This in-depth report provides a strategic analysis of the global Near Field Communications (NFC) market, offering crucial insights for stakeholders, investors, and industry professionals. The study spans from 2019 to 2033, with a base year of 2025, and encompasses historical trends, current dynamics, and future projections. The report meticulously dissects market size, growth drivers, technological advancements, regional dominance, and competitive landscapes within the NFC ecosystem. We leverage a wealth of data, including unit volumes, market penetration, CAGR, and the interplay between parent and child markets, to deliver actionable intelligence.

Near Field Communications Nfc Market Dynamics & Structure

The global Near Field Communications (NFC) market is characterized by a moderately concentrated structure, with leading players like NXP Semiconductors, Broadcom, and Samsung Electronics holding significant market shares. Technological innovation, particularly in miniaturization and power efficiency of NFC chips, remains a primary driver, enabling wider integration across devices and applications. The increasing adoption of contactless payment systems, fueled by enhanced security features and evolving consumer preferences for convenience, is a key growth catalyst. Regulatory frameworks, especially concerning data privacy and security in financial transactions, are increasingly influential, shaping market entry and product development. Competitive product substitutes, such as Bluetooth Low Energy (BLE) for short-range communication, pose a constant challenge, but NFC's unique proximity-based security and ease of use continue to differentiate it. End-user demographics show a growing demand from younger, tech-savvy populations and an increasing penetration in emerging economies. Mergers and acquisitions (M&A) trends are notable, with companies seeking to expand their NFC portfolios and secure market leadership. For instance, a significant volume of xx M&A deals have been observed historically, indicating consolidation and strategic partnerships aimed at leveraging synergistic capabilities. Barriers to innovation include the high cost of advanced R&D and the need for extensive interoperability testing across diverse ecosystems.

- Market Concentration: Moderately concentrated, dominated by a few key players.

- Innovation Drivers: Miniaturization, power efficiency, enhanced security protocols.

- Regulatory Landscape: Focus on data privacy (e.g., GDPR) and payment security standards.

- Competitive Substitutes: Bluetooth Low Energy (BLE), QR codes.

- End-User Demographics: Young tech-savvy consumers, expanding into emerging markets.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

- Innovation Barriers: High R&D costs, interoperability challenges.

Near Field Communications Nfc Growth Trends & Insights

The global Near Field Communications (NFC) market is poised for substantial growth, driven by its ubiquitous application in contactless payments, smart device connectivity, and secure access systems. The market size evolution showcases a steady upward trajectory, projected to reach xx million units by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. Adoption rates are accelerating across diverse sectors, from banking and retail to automotive and healthcare, as consumers and businesses increasingly recognize the convenience and security benefits of NFC technology. Technological disruptions, such as the integration of NFC in wearables, IoT devices, and even medical implants, are further expanding its reach. Consumer behavior shifts, prioritizing seamless and contactless interactions, are a significant tailwind. The market penetration of NFC in smartphones has already surpassed xx% and is expected to climb higher as more entry-level devices incorporate the technology. The growth in the parent market of the Internet of Things (IoT) and the child market of wearable technology are directly contributing to the expansion of NFC's applications. For example, the increasing demand for secure and convenient authentication in smart homes and connected cars is a significant factor. The global market for NFC tags and readers is also experiencing robust growth, driven by the need for simplified inventory management and asset tracking in retail and logistics. The projected market size for NFC chips alone is estimated to reach xx million units by 2025. Historical data from 2019-2024 indicates a consistent upward trend, with annual growth rates averaging xx%. The transition from traditional magnetic stripe transactions to contactless NFC payments has been a key driver, especially in developed economies, and is now gaining momentum in developing regions. Furthermore, the proliferation of NFC-enabled point-of-sale (POS) terminals worldwide is creating a fertile ground for increased adoption. The continuous development of more advanced NFC controllers and antenna designs contributes to improved performance and reduced form factors, making integration into smaller devices more feasible. The rise of NFC-based loyalty programs and digital ticketing solutions further diversifies its application landscape. The market's expansion is also underpinned by ongoing efforts to enhance the security of NFC transactions, addressing consumer concerns and bolstering trust in the technology. The integration of NFC into automotive infotainment systems for seamless phone pairing and digital key functionalities is another significant area of growth. The overall market sentiment is optimistic, reflecting a strong belief in NFC's enduring relevance and its potential to revolutionize various aspects of daily life.

Dominant Regions, Countries, or Segments in Near Field Communications Nfc

The Near Field Communications (NFC) market is witnessing dominant growth driven by key regions and segments that are rapidly embracing the technology. North America stands out as a leading region, propelled by high disposable incomes, advanced technological infrastructure, and a consumer base that readily adopts innovative payment and connectivity solutions. The United States, in particular, represents a significant market share, with widespread adoption of NFC in smartphones and a robust financial ecosystem that supports contactless payments.

- Key Drivers in North America:

- Economic Policies: Favorable regulatory environments for fintech and contactless payments.

- Infrastructure: Widespread availability of NFC-enabled POS terminals and public transit systems.

- Consumer Behavior: High propensity for early adoption of new technologies and preference for convenience.

- Technological Innovation: Strong presence of leading NFC chip manufacturers and solution providers.

Within the Application segment, Banking & Finance and Retail are the most dominant sectors driving market growth. The sheer volume of financial transactions and the continuous innovation in payment technologies within these sectors create a massive demand for secure and efficient NFC solutions. The transition to contactless payments in retail environments has been a significant catalyst.

- Dominance Factors in Banking & Finance/Retail:

- Market Share: These segments account for an estimated xx% of the total NFC market value.

- Growth Potential: Continued shift towards digital payments and personalized customer experiences.

- Technological Integration: Seamless integration with existing payment gateways and loyalty programs.

In terms of Type, Smartphone & Tablet is the dominant segment, as these devices are the primary enablers for a vast majority of NFC applications, including payments, transit, and access control. The high penetration of NFC-enabled smartphones globally makes this segment the bedrock of the NFC ecosystem.

- Dominance Factors in Smartphone & Tablet:

- Market Penetration: Over xx% of global smartphones are equipped with NFC capabilities.

- Application Diversity: The primary platform for a wide array of NFC use cases.

- Ecosystem Support: Developers are incentivized to create NFC-enabled applications for this large user base.

The parent market of mobile devices and the child market of digital wallets are inextricably linked to the dominance of the Smartphone & Tablet segment. As these markets expand, so too does the demand for NFC technology within them. The Asia-Pacific region is rapidly emerging as a significant growth contender, driven by increasing smartphone adoption and a growing middle class keen on adopting digital payment solutions, particularly in countries like China and India.

Near Field Communications Nfc Product Landscape

The Near Field Communications (NFC) product landscape is defined by innovative chips, tags, and readers designed for seamless, secure short-range communication. Products range from advanced NFC controllers for smartphones and wearables, enabling contactless payments and data exchange, to passive NFC tags embedded in posters, product packaging, and access cards. Performance metrics are crucial, with emphasis on read/write speeds (e.g., up to xx kbps), communication distances (typically within xx cm), and low power consumption. Unique selling propositions include enhanced security features like secure element integration for financial transactions and advanced encryption. Technological advancements are continuously improving the interoperability and reliability of NFC solutions, making them integral to the Internet of Things (IoT) ecosystem.

Key Drivers, Barriers & Challenges in Near Field Communications Nfc

Key Drivers: The primary forces propelling the NFC market include the escalating demand for secure and convenient contactless payment solutions, the growing adoption of IoT devices requiring short-range connectivity, and the increasing integration of NFC in smart devices for enhanced user experiences. Technological advancements in chip miniaturization and power efficiency, coupled with supportive government initiatives promoting digital economies, are also significant drivers. The growing penetration of smartphones equipped with NFC capabilities further fuels adoption.

Key Barriers & Challenges: Supply chain disruptions and component shortages, particularly for advanced semiconductor chips, can hinder production and increase costs, impacting market growth. Stringent regulatory hurdles and evolving data privacy laws, especially concerning financial transactions, can create compliance challenges for manufacturers and service providers. Intense competitive pressures from alternative short-range communication technologies like Bluetooth Low Energy, which offers a longer communication range, also pose a restraint. The cost of implementing NFC infrastructure, especially for small and medium-sized businesses, can also be a barrier.

Emerging Opportunities in Near Field Communications Nfc

Emerging opportunities in the NFC sector lie in the expansion of its applications beyond traditional payment systems. The healthcare industry presents a significant untapped market for NFC in patient identification, secure medical record access, and contactless device authentication. The growth of smart city initiatives offers opportunities for NFC in public transportation ticketing, smart parking, and access control for public facilities. Furthermore, the increasing consumer interest in personalized and interactive experiences is driving demand for NFC-enabled marketing campaigns and product authentication solutions, allowing consumers to instantly access product information or redeem rewards by tapping their smartphones. The integration of NFC in the metaverse and augmented reality experiences also presents a novel avenue for growth.

Growth Accelerators in the Near Field Communications Nfc Industry

Several catalysts are accelerating long-term growth within the NFC industry. Technological breakthroughs in developing ultra-low-power NFC chips and advanced antenna designs are enabling wider integration into a broader range of devices, including disposable sensors and wearables. Strategic partnerships between NFC technology providers, device manufacturers, and service providers are crucial for creating seamless ecosystems and fostering wider adoption. For instance, collaborations between smartphone giants and payment processors are driving innovation in mobile payment solutions. Market expansion strategies targeting emerging economies, where the adoption of digital payments is rapidly increasing, also serve as significant growth accelerators. The development of standardized protocols and robust security frameworks by industry consortiums further builds trust and encourages widespread deployment.

Key Players Shaping the Near Field Communications Nfc Market

- Broadcom

- DeviceFidelity

- Gemalto

- Huawei Technologies

- Identive

- Infineon Technologies

- Inside Secure

- Mediatek

- NXP Semiconductors

- On Track Innovations (OTI)

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Texas Instruments

- Toshiba

Notable Milestones in Near Field Communications Nfc Sector

- 2019: Introduction of enhanced security protocols for mobile payments, increasing consumer trust.

- 2020: Significant increase in contactless payment adoption driven by global health concerns.

- 2021: Expansion of NFC in access control systems for commercial and residential buildings.

- 2022: Growing integration of NFC in automotive applications for digital key functionalities and infotainment.

- 2023: Advancements in NFC tag technology enabling more complex data storage and interactive applications.

- 2024: Increased focus on interoperability standards to facilitate seamless integration across diverse devices and platforms.

In-Depth Near Field Communications Nfc Market Outlook

The future market potential for Near Field Communications (NFC) remains exceptionally strong, driven by ongoing technological advancements and evolving consumer demands for convenience and security. Growth accelerators such as the miniaturization of NFC chips, leading to their integration into an ever-wider array of devices from wearables to medical implants, will continue to expand the market's reach. Strategic partnerships and the development of robust ecosystems will foster greater adoption across all key segments, including banking, retail, automotive, and healthcare. Emerging opportunities in smart cities and the Internet of Things will unlock new revenue streams and application possibilities. The market is well-positioned for sustained growth, with NFC solidifying its role as a foundational technology for the connected world.

Near Field Communications Nfc Segmentation

-

1. Application

- 1.1. Banking & Finance

- 1.2. Retail

- 1.3. Automotive

- 1.4. Transportation

- 1.5. Medical & Healthcare

- 1.6. Residential & Commercial

- 1.7. Consumer Electronics

- 1.8. Others

-

2. Type

- 2.1. PC & laptop

- 2.2. Smartphone & Tablet

- 2.3. Others

Near Field Communications Nfc Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Near Field Communications Nfc REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Banking & Finance

- 5.1.2. Retail

- 5.1.3. Automotive

- 5.1.4. Transportation

- 5.1.5. Medical & Healthcare

- 5.1.6. Residential & Commercial

- 5.1.7. Consumer Electronics

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PC & laptop

- 5.2.2. Smartphone & Tablet

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Banking & Finance

- 6.1.2. Retail

- 6.1.3. Automotive

- 6.1.4. Transportation

- 6.1.5. Medical & Healthcare

- 6.1.6. Residential & Commercial

- 6.1.7. Consumer Electronics

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. PC & laptop

- 6.2.2. Smartphone & Tablet

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Banking & Finance

- 7.1.2. Retail

- 7.1.3. Automotive

- 7.1.4. Transportation

- 7.1.5. Medical & Healthcare

- 7.1.6. Residential & Commercial

- 7.1.7. Consumer Electronics

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. PC & laptop

- 7.2.2. Smartphone & Tablet

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Banking & Finance

- 8.1.2. Retail

- 8.1.3. Automotive

- 8.1.4. Transportation

- 8.1.5. Medical & Healthcare

- 8.1.6. Residential & Commercial

- 8.1.7. Consumer Electronics

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. PC & laptop

- 8.2.2. Smartphone & Tablet

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Banking & Finance

- 9.1.2. Retail

- 9.1.3. Automotive

- 9.1.4. Transportation

- 9.1.5. Medical & Healthcare

- 9.1.6. Residential & Commercial

- 9.1.7. Consumer Electronics

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. PC & laptop

- 9.2.2. Smartphone & Tablet

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Near Field Communications Nfc Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Banking & Finance

- 10.1.2. Retail

- 10.1.3. Automotive

- 10.1.4. Transportation

- 10.1.5. Medical & Healthcare

- 10.1.6. Residential & Commercial

- 10.1.7. Consumer Electronics

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. PC & laptop

- 10.2.2. Smartphone & Tablet

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Broadcom

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DeviceFidelity

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gemalto

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Huawei Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Identive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Infineon Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inside Secure

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mediatek

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NXP Semiconductors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 On Track Innovations(OTI)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Renesas Electronics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Samsung Electronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stmicroelectronics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Texas Instruments

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Toshiba

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Broadcom

List of Figures

- Figure 1: Global Near Field Communications Nfc Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Near Field Communications Nfc Revenue (million), by Application 2024 & 2032

- Figure 3: North America Near Field Communications Nfc Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Near Field Communications Nfc Revenue (million), by Type 2024 & 2032

- Figure 5: North America Near Field Communications Nfc Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Near Field Communications Nfc Revenue (million), by Country 2024 & 2032

- Figure 7: North America Near Field Communications Nfc Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Near Field Communications Nfc Revenue (million), by Application 2024 & 2032

- Figure 9: South America Near Field Communications Nfc Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Near Field Communications Nfc Revenue (million), by Type 2024 & 2032

- Figure 11: South America Near Field Communications Nfc Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Near Field Communications Nfc Revenue (million), by Country 2024 & 2032

- Figure 13: South America Near Field Communications Nfc Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Near Field Communications Nfc Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Near Field Communications Nfc Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Near Field Communications Nfc Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Near Field Communications Nfc Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Near Field Communications Nfc Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Near Field Communications Nfc Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Near Field Communications Nfc Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Near Field Communications Nfc Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Near Field Communications Nfc Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Near Field Communications Nfc Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Near Field Communications Nfc Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Near Field Communications Nfc Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Near Field Communications Nfc Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Near Field Communications Nfc Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Near Field Communications Nfc Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Near Field Communications Nfc Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Near Field Communications Nfc Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Near Field Communications Nfc Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Near Field Communications Nfc Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Near Field Communications Nfc Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Near Field Communications Nfc Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Near Field Communications Nfc Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Near Field Communications Nfc Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Near Field Communications Nfc Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Near Field Communications Nfc Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Near Field Communications Nfc Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Near Field Communications Nfc Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Near Field Communications Nfc Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Near Field Communications Nfc?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Near Field Communications Nfc?

Key companies in the market include Broadcom, DeviceFidelity, Gemalto, Huawei Technologies, Identive, Infineon Technologies, Inside Secure, Mediatek, NXP Semiconductors, On Track Innovations(OTI), Renesas Electronics, Samsung Electronics, Stmicroelectronics, Texas Instruments, Toshiba.

3. What are the main segments of the Near Field Communications Nfc?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 58240 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Near Field Communications Nfc," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Near Field Communications Nfc report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Near Field Communications Nfc?

To stay informed about further developments, trends, and reports in the Near Field Communications Nfc, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence