Key Insights

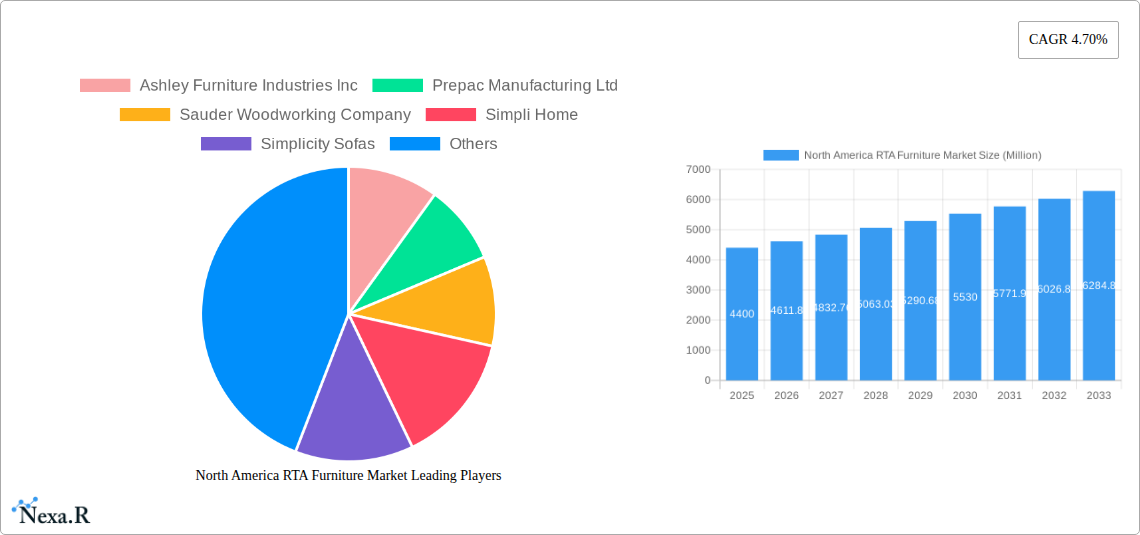

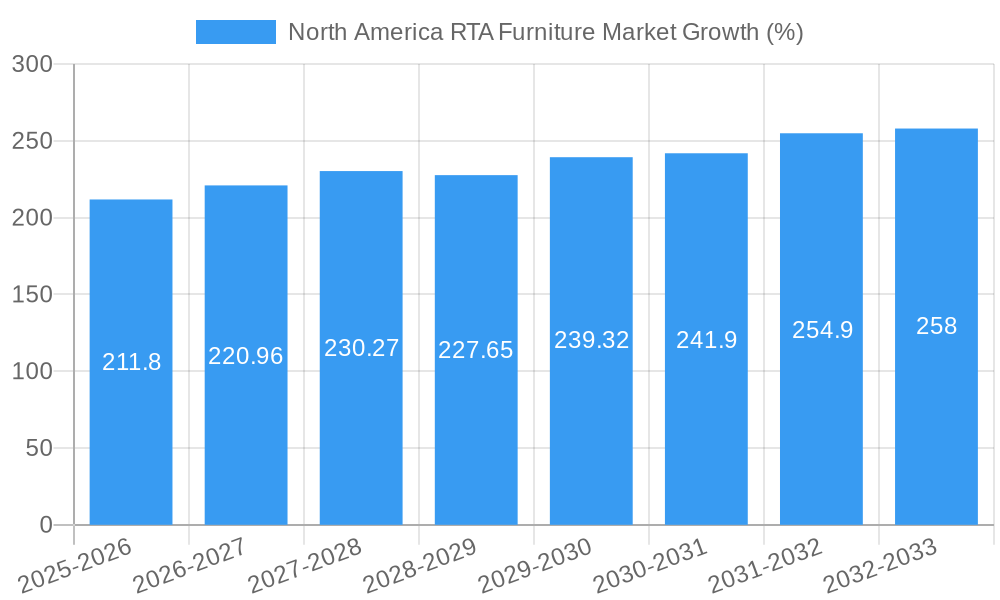

The North American Ready-To-Assemble (RTA) furniture market, valued at $4.40 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing popularity of e-commerce and online furniture retail significantly contributes to market growth, providing consumers with convenient access to a wider selection and competitive pricing. Furthermore, the rising demand for affordable and space-saving furniture solutions, particularly among younger generations and urban dwellers, strongly supports the RTA market's expansion. The preference for customizable and easily assembled furniture caters to individual preferences and diverse living spaces. Growth is also spurred by the increasing popularity of compact living and apartment living, demanding furniture that is easy to assemble and move. The market segmentation reflects this, with strong demand across various materials (wood, metal, plastic), distribution channels (B2B, B2C), and product types (residential, commercial). Competition among established players like Ashley Furniture Industries, IKEA, and Sauder Woodworking, alongside emerging brands, ensures a dynamic and innovative market landscape.

The market's trajectory, however, faces certain restraints. Fluctuations in raw material prices, particularly wood and metal, can impact production costs and pricing. Concerns about the environmental impact of furniture production and disposal increasingly influence consumer choices, requiring manufacturers to adopt sustainable practices. Furthermore, the growing complexity of global supply chains and potential logistical challenges could affect the availability and timely delivery of RTA furniture. Despite these challenges, the market’s overall positive outlook remains strong, driven by ongoing consumer demand for convenience, affordability, and customization. The continued expansion of e-commerce and the development of innovative product designs with improved assembly processes will further propel market growth in the coming years. Geographic growth will likely be concentrated in the US, given its larger market share, followed by Canada and Mexico.

North America RTA Furniture Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America Ready-to-Assemble (RTA) furniture market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by product type (Residential, Commercial), material type (Wood, Metal, Plastic, Other), distribution channel (B2B, B2C), and country (United States, Canada, Mexico). Key players analyzed include Ashley Furniture Industries Inc, Prepac Manufacturing Ltd, Sauder Woodworking Company, Simpli Home, Simplicity Sofas, Bush Industries Inc, Cabinet Joint, IKEA, The Cabinet Spot Inc, Home Reserve LLC, Egga Furniture, Walker Edison, South Shore Furniture, Bestar Inc, Whalen Furniture Manufacturing, and Flexsteel Industries Inc. The market size is presented in million units.

North America RTA Furniture Market Dynamics & Structure

The North American RTA furniture market is characterized by moderate concentration, with a few major players holding significant market share, but a large number of smaller manufacturers also competing. Technological innovations, particularly in manufacturing processes and materials, are key drivers, alongside changing consumer preferences toward affordability and convenience. Regulatory frameworks related to material safety and environmental standards impact market dynamics. Substitute products, such as used furniture or custom-made pieces, present competition. The market is driven by evolving end-user demographics, particularly among younger generations who are more price-conscious. M&A activity has been moderate, with consolidation expected to increase in the coming years.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, sustainable materials, and improved assembly designs.

- Regulatory Framework: Compliance with safety and environmental regulations (e.g., CARB standards) is crucial.

- Competitive Substitutes: Used furniture, custom-made furniture, and other home décor solutions pose competitive threats.

- End-User Demographics: Growing demand from millennials and Gen Z, driven by affordability and space-saving designs.

- M&A Trends: A modest number of acquisitions occurred between 2019-2024 (xx deals), with increased consolidation predicted for 2025-2033.

North America RTA Furniture Market Growth Trends & Insights

The North America RTA furniture market experienced steady growth between 2019 and 2024, driven by increasing urbanization, rising disposable incomes, and the preference for convenient and affordable furniture solutions. The market is projected to continue its growth trajectory throughout the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, such as the adoption of 3D printing and virtual reality for design visualization, are expected to further enhance market growth. Shifting consumer behavior towards online purchasing and the growing popularity of minimalist home décor are also contributing factors. Market penetration is expected to increase from xx% in 2024 to xx% by 2033.

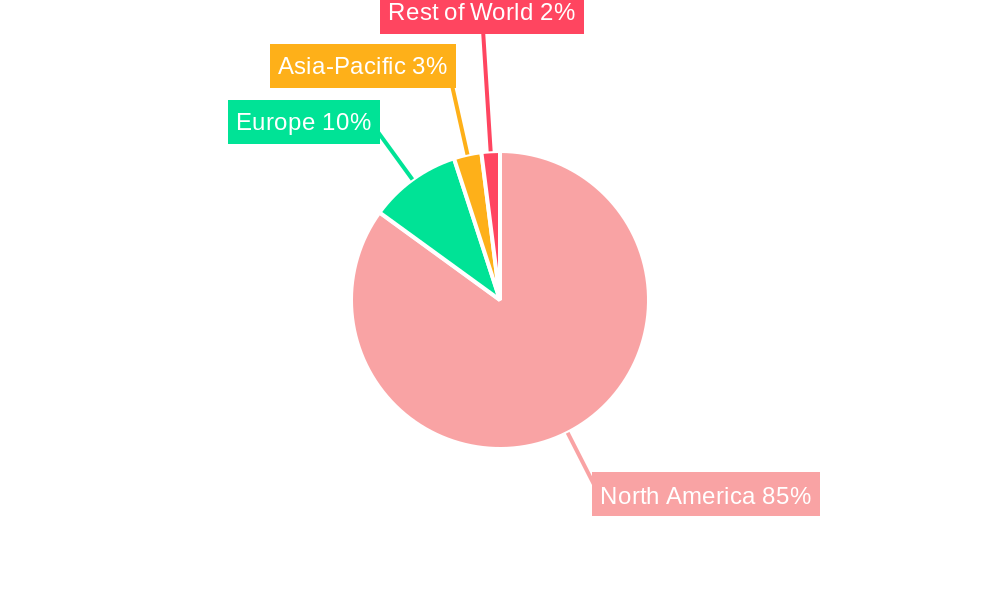

Dominant Regions, Countries, or Segments in North America RTA Furniture Market

The United States dominates the North American RTA furniture market, accounting for the largest market share due to its high population density, robust e-commerce infrastructure, and strong consumer spending. Within the segments, the residential sector is the largest, followed by the commercial segment. Wood furniture continues to hold a significant share of the market, driven by its aesthetic appeal and versatility. B2C retail channels are dominant, although B2B sales are also significant, particularly for commercial projects.

- Key Drivers (US): High disposable income, thriving e-commerce, strong home improvement sector.

- Key Drivers (Canada): Growing urbanization, increasing consumer spending on home furnishings.

- Key Drivers (Mexico): Expanding middle class, increasing demand for affordable furniture options.

- Dominant Segment (Product Type): Residential (xx million units in 2025)

- Dominant Segment (Material Type): Wood Furniture (xx million units in 2025)

- Dominant Segment (Distribution Channel): B2C/Retail Channels (xx million units in 2025)

North America RTA Furniture Market Product Landscape

RTA furniture products are increasingly incorporating sustainable and eco-friendly materials, advanced joinery techniques for easier assembly, and customizable design options. Manufacturers are focused on improving product aesthetics and functionality while maintaining affordability and ease of assembly. Technological advancements like smart home integration are starting to emerge, allowing for greater control and customization. The unique selling propositions often revolve around ease of assembly, affordability, and stylish designs.

Key Drivers, Barriers & Challenges in North America RTA Furniture Market

Key Drivers: Rising urbanization, increasing disposable incomes, the convenience and affordability of RTA furniture, growing online retail penetration, and preferences for smaller, space-saving furniture.

Challenges: Fluctuations in raw material prices, increasing shipping costs, competition from established furniture brands, and ensuring consistent quality across a range of products.

Emerging Opportunities in North America RTA Furniture Market

Emerging opportunities lie in the growing demand for customizable furniture, sustainable and eco-friendly RTA furniture, and the expansion into untapped markets. Smart home integration, innovative assembly mechanisms, and exploring new material options presents opportunities. Targeting niche consumer segments with specific design aesthetics (e.g., minimalist, bohemian) offers further potential for growth.

Growth Accelerators in the North America RTA Furniture Market Industry

Technological breakthroughs in manufacturing and design are key growth accelerators, alongside strategic partnerships between manufacturers and online retailers. Market expansion into underserved regions and exploration of new materials, designs, and functionalities will continue to drive growth. Focus on sustainability and eco-friendly production methods is also a crucial factor.

Key Players Shaping the North America RTA Furniture Market Market

- Ashley Furniture Industries Inc

- Prepac Manufacturing Ltd

- Sauder Woodworking Company

- Simpli Home

- Simplicity Sofas

- Bush Industries Inc

- Cabinet Joint

- IKEA

- The Cabinet Spot Inc

- Home Reserve LLC

- Egga Furniture

- Walker Edison

- South Shore Furniture

- Bestar Inc

- Whalen Furniture Manufacturing

- Flexsteel Industries Inc

Notable Milestones in North America RTA Furniture Market Sector

- 2021 (Q3): IKEA launches a new line of sustainable RTA furniture.

- 2022 (Q1): Ashley Furniture Industries Inc. invests in automated manufacturing technology.

- 2023 (Q2): Prepac Manufacturing Ltd partners with a major online retailer to expand distribution.

- 2024 (Q4): Sauder Woodworking Company introduces a new range of customizable RTA furniture.

In-Depth North America RTA Furniture Market Market Outlook

The North America RTA furniture market is poised for continued growth, driven by increasing demand, technological advancements, and strategic market expansion. Opportunities exist in developing innovative products, enhancing the online shopping experience, and focusing on sustainable and eco-friendly manufacturing practices. Strategic partnerships and efficient supply chain management will be crucial for long-term success. The market is expected to reach xx million units by 2033, presenting significant potential for established players and new entrants alike.

North America RTA Furniture Market Segmentation

-

1. Product Type

-

1.1. Residential

- 1.1.1. Tables

- 1.1.2. Chairs and Sofas

- 1.1.3. Storage Units/Cabinets

- 1.1.4. Beds

- 1.1.5. Other Residential Products

-

1.2. Commercial

- 1.2.1. Workstations

- 1.2.2. Other Commercial Products

-

1.1. Residential

-

2. Material Type

- 2.1. Wood Furniture

- 2.2. Metal Furniture

- 2.3. Plastic Furniture

- 2.4. Other Materials Furniture

-

3. Distribution Channel

- 3.1. B2B/Directly from the Manufacturers

-

3.2. By B2C/Retail Channels

- 3.2.1. Home Centers

- 3.2.2. Specialty Stores

- 3.2.3. Online

- 3.2.4. Other Distribution Channels

North America RTA Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America RTA Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Urbanization

- 3.2.2 Population Growth

- 3.2.3 and Changing Lifestyles Drive RTA Furniture Market Growth in North America; Residential Real Estate Market in North America Adapts to Changing Customer Preferences

- 3.3. Market Restrains

- 3.3.1. US Production Faces Fresh Challenges in 2024 as Steel Prices Surge.; The United States Adopts Mandatory Tip-over Standard for Furniture

- 3.4. Market Trends

- 3.4.1. Integration of Smart Features into Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America RTA Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Residential

- 5.1.1.1. Tables

- 5.1.1.2. Chairs and Sofas

- 5.1.1.3. Storage Units/Cabinets

- 5.1.1.4. Beds

- 5.1.1.5. Other Residential Products

- 5.1.2. Commercial

- 5.1.2.1. Workstations

- 5.1.2.2. Other Commercial Products

- 5.1.1. Residential

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Wood Furniture

- 5.2.2. Metal Furniture

- 5.2.3. Plastic Furniture

- 5.2.4. Other Materials Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. B2B/Directly from the Manufacturers

- 5.3.2. By B2C/Retail Channels

- 5.3.2.1. Home Centers

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America RTA Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America RTA Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America RTA Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America RTA Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Ashley Furniture Industries Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Prepac Manufacturing Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sauder Woodworking Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Simpli Home

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Simplicity Sofas

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bush Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cabinet Joint

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IKEA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Cabinet Spot Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Home Reserve LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Egga Furniture

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Walker Edison

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 South Shore Furniture

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bestar Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Whalen Furniture Manufacturing

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Flexsteel Industries Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Ashley Furniture Industries Inc

List of Figures

- Figure 1: North America RTA Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America RTA Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: North America RTA Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America RTA Furniture Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America RTA Furniture Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: North America RTA Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: North America RTA Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America RTA Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America RTA Furniture Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America RTA Furniture Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 13: North America RTA Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: North America RTA Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America RTA Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America RTA Furniture Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America RTA Furniture Market?

Key companies in the market include Ashley Furniture Industries Inc, Prepac Manufacturing Ltd, Sauder Woodworking Company, Simpli Home, Simplicity Sofas, Bush Industries Inc, Cabinet Joint, IKEA, The Cabinet Spot Inc, Home Reserve LLC, Egga Furniture, Walker Edison, South Shore Furniture, Bestar Inc, Whalen Furniture Manufacturing, Flexsteel Industries Inc.

3. What are the main segments of the North America RTA Furniture Market?

The market segments include Product Type, Material Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization. Population Growth. and Changing Lifestyles Drive RTA Furniture Market Growth in North America; Residential Real Estate Market in North America Adapts to Changing Customer Preferences.

6. What are the notable trends driving market growth?

Integration of Smart Features into Furniture.

7. Are there any restraints impacting market growth?

US Production Faces Fresh Challenges in 2024 as Steel Prices Surge.; The United States Adopts Mandatory Tip-over Standard for Furniture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America RTA Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America RTA Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America RTA Furniture Market?

To stay informed about further developments, trends, and reports in the North America RTA Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence