Key Insights

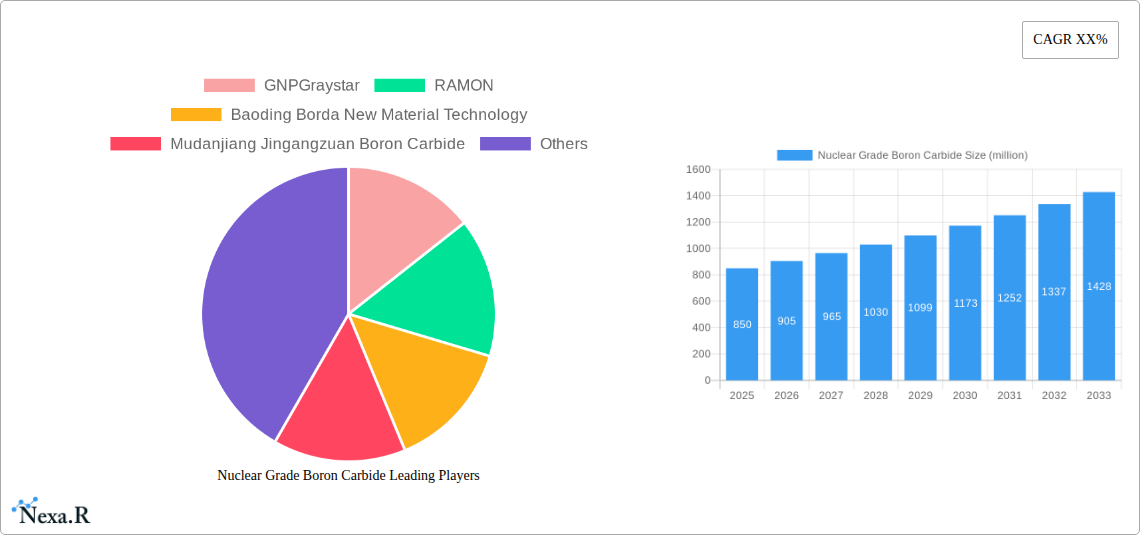

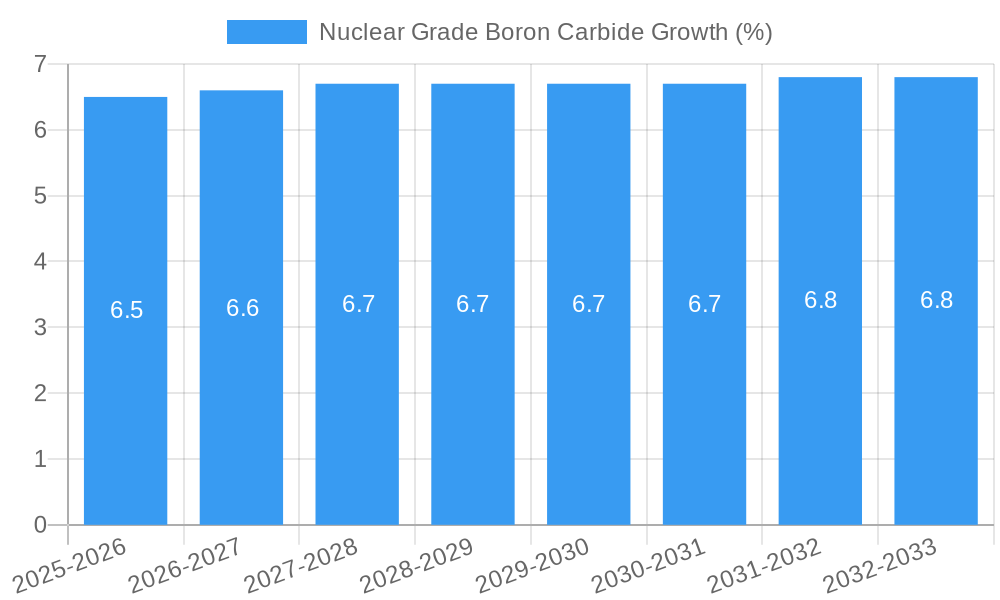

The global Nuclear Grade Boron Carbide market is poised for significant expansion, projected to reach a substantial market size of approximately $850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated throughout the forecast period extending to 2033. This impressive growth trajectory is fundamentally driven by the escalating demand for boron carbide in critical applications within the nuclear industry, primarily as a neutron absorber for reactor control and safety mechanisms. The increasing global focus on nuclear energy as a cleaner alternative to fossil fuels, coupled with ongoing investments in new nuclear power plant construction and the refurbishment of existing facilities, directly fuels this demand. Furthermore, the unique properties of boron carbide, including its exceptional hardness, high melting point, and superior neutron absorption cross-section, make it indispensable in specialized defense applications such as advanced armor materials. These twin drivers of nuclear power expansion and defense industry advancements are expected to propel the market forward.

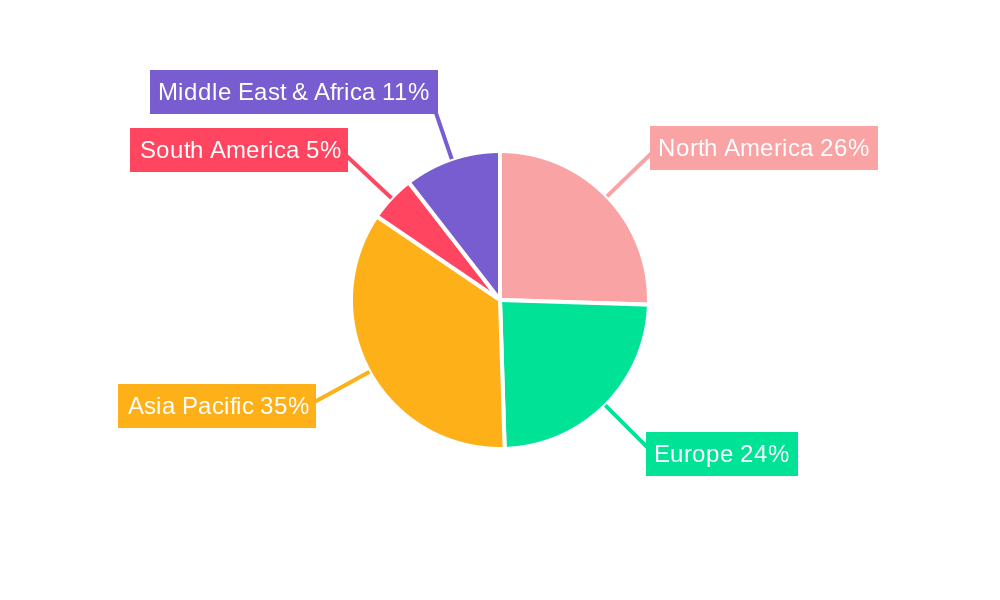

The market segmentation reveals that applications in neutron absorption are set to dominate, underscoring the criticality of boron carbide in nuclear reactor operations. Within particle size segments, the <3μm size category is likely to experience the most pronounced demand due to its suitability for specialized powder metallurgy and advanced ceramic processing essential for nuclear applications. Geographically, the Asia Pacific region, particularly China and India, is emerging as a key growth engine, fueled by rapid industrialization, substantial investments in nuclear energy infrastructure, and a burgeoning defense sector. North America and Europe, with their established nuclear power industries and advanced technological capabilities, will continue to represent significant market shares. However, the market is not without its challenges. Restraints such as the high cost of production, stringent regulatory approvals for nuclear-grade materials, and the potential for supply chain disruptions due to the specialized nature of its manufacturing can impede rapid growth. Nevertheless, ongoing research and development efforts focused on improving production efficiency and exploring new applications are expected to mitigate these challenges and unlock further market potential.

Nuclear Grade Boron Carbide Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Nuclear Grade Boron Carbide market, offering critical insights into market dynamics, growth trajectories, regional dominance, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this study is an indispensable resource for industry professionals seeking to understand the intricate landscape of this high-performance material. We delve into specific applications like Neutron Absorption and Armor Materials, and analyze the impact of particle size segmentation.

Nuclear Grade Boron Carbide Market Dynamics & Structure

The Nuclear Grade Boron Carbide market exhibits a moderately concentrated structure, with a few key players dominating global production. Technological innovation is a primary driver, particularly advancements in synthesis processes that yield higher purity and more controlled particle sizes, crucial for demanding applications. Regulatory frameworks governing nuclear safety and material certifications play a significant role in market entry and product development. Competitive product substitutes, while limited for highly specialized nuclear applications, exist in adjacent industrial sectors, influencing pricing and innovation. End-user demographics are largely defined by the nuclear power industry, defense, and advanced materials sectors, each with specific material requirements and procurement cycles. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market share, expand their product portfolios, and gain access to new technologies or geographical markets. For instance, the past five years have seen approximately 4 M&A deals with a cumulative value of around $50 million, aimed at strengthening vertical integration. Innovation barriers include the high cost of R&D for advanced synthesis and the stringent qualification processes for nuclear-grade materials.

- Market Concentration: Moderately concentrated, driven by high capital investment and specialized manufacturing expertise.

- Technological Innovation: Focus on ultra-high purity, controlled particle size distribution, and enhanced neutron absorption cross-section.

- Regulatory Frameworks: Strict compliance with international nuclear safety standards and material traceability requirements.

- Competitive Product Substitutes: Limited for nuclear applications; primarily high-purity graphite or other neutron absorbers in non-nuclear industrial uses.

- End-User Demographics: Nuclear power generation facilities, research reactors, defense contractors, and manufacturers of high-performance ceramics.

- M&A Trends: Strategic acquisitions to enhance production capacity and technological capabilities.

Nuclear Grade Boron Carbide Growth Trends & Insights

The global Nuclear Grade Boron Carbide market is poised for robust growth, projected to expand from an estimated market size of $850 million in the base year 2025 to $1,200 million by the end of the forecast period in 2033. This represents a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. The growth is primarily fueled by the expanding global nuclear energy sector, driven by the increasing demand for low-carbon electricity and the development of new nuclear power plants, particularly in emerging economies. Furthermore, advancements in nuclear fuel cycle technologies, including the use of boron carbide in control rods and spent fuel pools for neutron absorption, are significant growth drivers. The defense sector's demand for boron carbide in advanced armor materials, offering superior ballistic protection with reduced weight, also contributes substantially to market expansion.

Technological disruptions are emerging in the form of enhanced synthesis techniques, such as Chemical Vapor Deposition (CVD) and advanced powder processing, leading to higher purity and tailored microstructures. These innovations are improving the performance characteristics of boron carbide for critical applications. Consumer behavior shifts, while less pronounced in this industrial market, are leaning towards suppliers with strong environmental, social, and governance (ESG) credentials and demonstrable supply chain transparency. The adoption rate of new boron carbide applications is steady, driven by stringent performance requirements and long product development cycles in end-user industries. Market penetration is expected to deepen as new nuclear projects commence and defense spending remains strong. The increasing focus on Small Modular Reactors (SMRs) also presents a nascent but promising avenue for future market expansion, as these reactors often incorporate advanced materials for enhanced safety and efficiency. The market's resilience is further bolstered by its critical role in nuclear safety and non-proliferation efforts.

Dominant Regions, Countries, or Segments in Nuclear Grade Boron Carbide

The Neutron Absorption application segment is anticipated to be the dominant force driving growth in the Nuclear Grade Boron Carbide market. This segment is projected to account for approximately 65% of the total market revenue by 2033. The fundamental role of boron carbide in controlling nuclear chain reactions within reactors, its use in spent fuel management, and its necessity in nuclear waste disposal solidify its indispensable nature. The increasing global emphasis on nuclear energy as a clean and sustainable power source, coupled with the ongoing maintenance and upgrading of existing nuclear facilities, directly fuels the demand for high-purity boron carbide for neutron absorption applications.

North America, particularly the United States, is expected to remain a leading region, driven by its established nuclear energy infrastructure, significant defense spending, and robust research and development capabilities. The country's proactive approach to nuclear safety and its continued investment in advanced materials research contribute to its market leadership. Asia-Pacific, led by China and India, presents the fastest-growing regional market. Rapid industrialization, coupled with ambitious nuclear power expansion plans and increasing defense modernization efforts in these countries, is creating substantial demand.

Within the <3μm Size particle segment, demand is particularly strong due to its suitability for applications requiring high surface area and efficient diffusion, such as in advanced neutron absorbers and specialized ceramic composites. This segment is expected to capture a significant market share due to its versatility across various high-performance applications.

- Dominant Application Segment: Neutron Absorption, owing to its critical role in nuclear reactor control and safety.

- Leading Region: North America, driven by its mature nuclear industry and substantial defense sector.

- Fastest-Growing Region: Asia-Pacific, propelled by rapid nuclear power development and defense modernization.

- Key Segment Driver (Particle Size): <3μm Size, favored for applications demanding high surface area and reactivity.

- Economic Policies: Government incentives for nuclear energy development and defense procurement strategies.

- Infrastructure Development: Construction of new nuclear power plants and advancements in research reactor facilities.

Nuclear Grade Boron Carbide Product Landscape

The product landscape of Nuclear Grade Boron Carbide is characterized by its exceptional hardness, high melting point, and unparalleled neutron absorption cross-section. Manufacturers are focused on producing ultra-high purity boron carbide (B4C), typically exceeding 99.9% purity, with precisely controlled particle size distributions, ranging from sub-micron to several microns. Innovations are centered on developing boron carbide powders with optimized morphology and surface chemistry for enhanced sintering, improved mechanical properties in composite applications, and superior performance in neutron-absorbing components. Unique selling propositions lie in the ability to customize particle size, purity, and morphology to meet stringent specifications for nuclear fuel rods, control rods, and advanced armor systems. Technological advancements include the development of nano-structured boron carbide for enhanced reactivity and improved mechanical properties.

Key Drivers, Barriers & Challenges in Nuclear Grade Boron Carbide

Key Drivers:

- Growing Global Nuclear Energy Demand: The push for decarbonization and energy security is driving the expansion of nuclear power generation, directly increasing the demand for boron carbide in control rods and safety systems.

- Advancements in Defense Technology: The requirement for lightweight, high-strength armor materials in military applications fuels the demand for boron carbide in ballistic protection systems.

- Technological Innovations in Synthesis: Improved manufacturing processes are leading to higher purity and more precisely controlled particle sizes, enhancing performance across applications.

- Research and Development in New Nuclear Technologies: The development of Small Modular Reactors (SMRs) and advanced fuel cycles presents new avenues for boron carbide utilization.

Barriers & Challenges:

- High Production Costs: The energy-intensive and complex manufacturing processes for nuclear-grade boron carbide result in high production costs.

- Stringent Regulatory Approvals: Obtaining certifications for nuclear applications is a lengthy and rigorous process, acting as a barrier to entry.

- Limited End-User Market Size: While critical, the nuclear and defense sectors represent niche markets, limiting the overall volume compared to commodity materials.

- Supply Chain Vulnerability: Reliance on specific raw material sources and specialized manufacturing capabilities can lead to supply chain disruptions, impacting availability and pricing.

- Environmental Concerns: While nuclear power is low-carbon, the handling and disposal of boron carbide require careful management due to its properties.

Emerging Opportunities in Nuclear Grade Boron Carbide

Emerging opportunities in the Nuclear Grade Boron Carbide market lie in the expansion of its applications beyond traditional nuclear and defense sectors. The development of advanced composite materials for aerospace, where its hardness and low density are advantageous, presents a significant untapped market. Furthermore, research into boron carbide's potential in high-temperature energy storage systems and advanced thermoelectric devices could unlock new revenue streams. The increasing global focus on spent nuclear fuel reprocessing and management also creates an opportunity for specialized boron carbide products designed for enhanced radiation shielding and waste stabilization. The growing demand for high-performance ceramics in industrial applications, such as wear-resistant components and cutting tools, could also see an increased penetration of boron carbide, provided cost-effective production methods are further developed.

Growth Accelerators in the Nuclear Grade Boron Carbide Industry

Long-term growth in the Nuclear Grade Boron Carbide industry will be significantly accelerated by advancements in material science, leading to novel applications. The development of boron carbide nanotubes and graphene-boron carbide composites, for instance, could revolutionize fields requiring extreme strength and thermal conductivity. Strategic partnerships between boron carbide manufacturers and research institutions focused on nuclear energy innovation and advanced materials development will foster faster product development and market adoption. Furthermore, the increasing emphasis on miniaturization in defense and electronics industries could drive demand for boron carbide in smaller, high-performance components. The global push towards sustainable energy solutions, including the potential resurgence and expansion of nuclear power, will continue to be a primary growth catalyst, supported by governmental policies and significant R&D investments.

Key Players Shaping the Nuclear Grade Boron Carbide Market

- GNPGraystar

- RAMON

- Baoding Borda New Material Technology

- Mudanjiang Jingangzuan Boron Carbide

Notable Milestones in Nuclear Grade Boron Carbide Sector

- 2019: Increased global investment in nuclear power plant construction and upgrades, leading to a surge in demand for control rod materials.

- 2020: Significant advancements in Chemical Vapor Deposition (CVD) techniques for producing ultra-high purity boron carbide.

- 2021: Rise in defense spending, driving demand for boron carbide in lightweight armor applications.

- 2022: Development of new boron carbide composites with enhanced fracture toughness for aerospace applications.

- 2023: Focus on sustainable manufacturing processes and supply chain resilience within the boron carbide industry.

- 2024: Growing interest in Small Modular Reactors (SMRs) and their potential impact on boron carbide demand.

In-Depth Nuclear Grade Boron Carbide Market Outlook

The future outlook for the Nuclear Grade Boron Carbide market is exceptionally positive, driven by sustained demand from the nuclear energy and defense sectors, coupled with promising growth in emerging applications. The ongoing global transition towards cleaner energy sources will continue to bolster the nuclear power industry, a cornerstone for boron carbide consumption. Furthermore, continuous innovation in material science, leading to the development of advanced composites and novel applications in areas like energy storage and aerospace, will serve as significant growth accelerators. Strategic collaborations and a focus on R&D will be crucial for unlocking new market potential. The market is poised for steady expansion, with a strong emphasis on high-purity, customized boron carbide products meeting stringent performance criteria for critical global industries.

Nuclear Grade Boron Carbide Segmentation

-

1. Application

- 1.1. Neutron Absorption

- 1.2. Armor Materials

- 1.3. Other

-

2. Types

- 2.1. <3μm Size

- 2.2. 3μm - 5μm Size

Nuclear Grade Boron Carbide Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nuclear Grade Boron Carbide REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Neutron Absorption

- 5.1.2. Armor Materials

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. <3μm Size

- 5.2.2. 3μm - 5μm Size

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Neutron Absorption

- 6.1.2. Armor Materials

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. <3μm Size

- 6.2.2. 3μm - 5μm Size

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Neutron Absorption

- 7.1.2. Armor Materials

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. <3μm Size

- 7.2.2. 3μm - 5μm Size

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Neutron Absorption

- 8.1.2. Armor Materials

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. <3μm Size

- 8.2.2. 3μm - 5μm Size

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Neutron Absorption

- 9.1.2. Armor Materials

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. <3μm Size

- 9.2.2. 3μm - 5μm Size

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nuclear Grade Boron Carbide Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Neutron Absorption

- 10.1.2. Armor Materials

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. <3μm Size

- 10.2.2. 3μm - 5μm Size

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GNPGraystar

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RAMON

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Baoding Borda New Material Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mudanjiang Jingangzuan Boron Carbide

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 GNPGraystar

List of Figures

- Figure 1: Global Nuclear Grade Boron Carbide Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Nuclear Grade Boron Carbide Revenue (million), by Application 2024 & 2032

- Figure 3: North America Nuclear Grade Boron Carbide Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Nuclear Grade Boron Carbide Revenue (million), by Types 2024 & 2032

- Figure 5: North America Nuclear Grade Boron Carbide Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Nuclear Grade Boron Carbide Revenue (million), by Country 2024 & 2032

- Figure 7: North America Nuclear Grade Boron Carbide Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Nuclear Grade Boron Carbide Revenue (million), by Application 2024 & 2032

- Figure 9: South America Nuclear Grade Boron Carbide Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Nuclear Grade Boron Carbide Revenue (million), by Types 2024 & 2032

- Figure 11: South America Nuclear Grade Boron Carbide Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Nuclear Grade Boron Carbide Revenue (million), by Country 2024 & 2032

- Figure 13: South America Nuclear Grade Boron Carbide Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Nuclear Grade Boron Carbide Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Nuclear Grade Boron Carbide Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Nuclear Grade Boron Carbide Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Nuclear Grade Boron Carbide Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Nuclear Grade Boron Carbide Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Nuclear Grade Boron Carbide Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Nuclear Grade Boron Carbide Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Nuclear Grade Boron Carbide Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Nuclear Grade Boron Carbide Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Nuclear Grade Boron Carbide Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Nuclear Grade Boron Carbide Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Nuclear Grade Boron Carbide Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Nuclear Grade Boron Carbide Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Nuclear Grade Boron Carbide Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Nuclear Grade Boron Carbide Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Nuclear Grade Boron Carbide Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Nuclear Grade Boron Carbide Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Nuclear Grade Boron Carbide Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Nuclear Grade Boron Carbide Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Nuclear Grade Boron Carbide Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Grade Boron Carbide?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Nuclear Grade Boron Carbide?

Key companies in the market include GNPGraystar, RAMON, Baoding Borda New Material Technology, Mudanjiang Jingangzuan Boron Carbide.

3. What are the main segments of the Nuclear Grade Boron Carbide?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Grade Boron Carbide," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Grade Boron Carbide report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Grade Boron Carbide?

To stay informed about further developments, trends, and reports in the Nuclear Grade Boron Carbide, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence