Key Insights

The global Nutritional Drink market is poised for significant expansion, projected to reach an estimated market size of approximately $95.5 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.2% anticipated from 2025 to 2033. This growth trajectory is fueled by an increasing consumer consciousness towards health and wellness, a rising prevalence of lifestyle-related diseases, and a growing demand for convenient and functional beverages. The market is experiencing a pronounced shift towards products that offer specific health benefits beyond basic hydration, such as improved immunity, energy enhancement, and targeted nutritional support for athletes and individuals with specific dietary needs. Consequently, innovation in product formulations, including the integration of natural ingredients, plant-based alternatives, and fortified beverages, is a key driver shaping market dynamics.

The market segmentation reveals distinct opportunities across various applications and product types. The "Athlete" segment is expected to witness accelerated growth, driven by the increasing participation in sports and fitness activities and a greater understanding of the role of specialized nutrition in performance enhancement and recovery. Similarly, the "Non-Athlete" segment is expanding due to its broad appeal to health-conscious consumers seeking everyday wellness solutions. Bottled and canned formats currently dominate the market due to their convenience and widespread availability, but innovations in packaging, such as resealable pouches and ready-to-drink options in bags, are gaining traction. Key industry players like Coca-Cola, Nestle, and Abbott Laboratories are actively investing in research and development, strategic acquisitions, and expanding their product portfolios to capture a larger share of this dynamic and evolving market. The market is relatively consolidated with the presence of major global players, but emerging regional brands are also carving out niches by focusing on specific dietary preferences and local tastes.

Comprehensive Nutritional Drink Market Report: Dynamics, Growth, and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Nutritional Drink market, covering its dynamics, growth trajectories, regional dominance, product landscape, key drivers, barriers, opportunities, and a detailed outlook for the forecast period of 2025–2033. Designed for industry professionals, investors, and market strategists, this report offers actionable insights and data-driven perspectives.

Report Focus: Global Nutritional Drink Market Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Nutritional Drink Market Dynamics & Structure

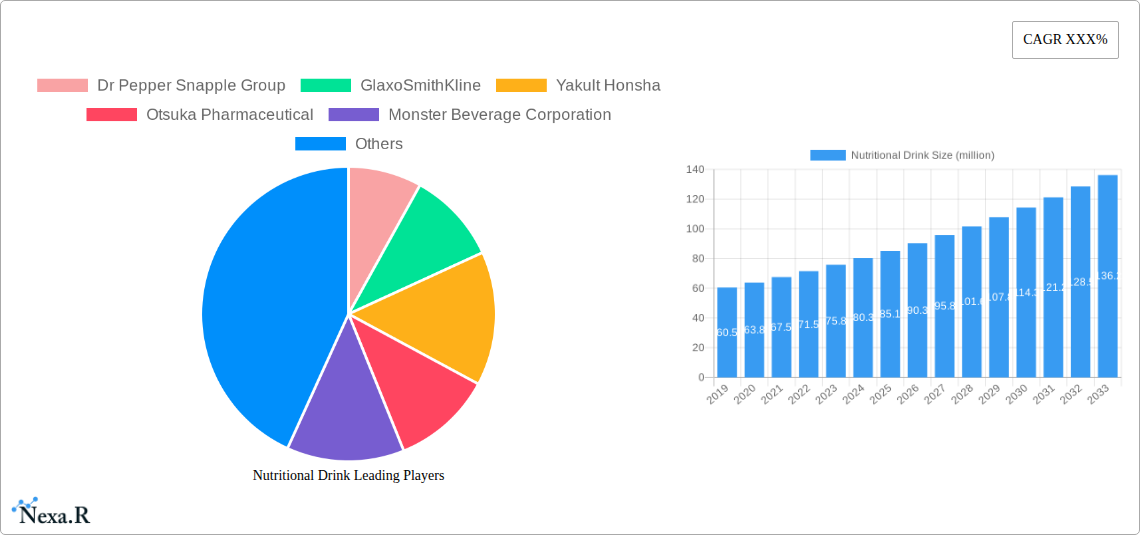

The global Nutritional Drink market exhibits a moderately concentrated structure, with key players like Nestlé, Abbott Laboratories, Coca-Cola, and GlaxoSmithKline holding significant market shares. Technological innovation is a primary driver, with ongoing advancements in ingredient science, formulation techniques, and delivery systems enhancing product efficacy and appeal. Regulatory frameworks, while evolving, aim to ensure product safety and efficacy, influencing product development and market entry strategies. Competitive product substitutes, including traditional beverages, supplements, and functional foods, pose a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are diverse, spanning athletes seeking performance enhancement, individuals with specific dietary needs, and the general population focused on health and wellness. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion, allowing key players to acquire innovative technologies, diversify their product portfolios, and gain access to new markets.

- Market Concentration: Moderately concentrated, with top players dominating.

- Technological Innovation Drivers: Ingredient advancements, novel formulations, improved bioavailability, functional ingredient integration.

- Regulatory Frameworks: Food safety standards, labeling regulations, health claim approvals.

- Competitive Product Substitutes: Traditional beverages, dietary supplements, fortified foods, meal replacement shakes.

- End-User Demographics: Athletes, elderly, children, individuals with chronic conditions, health-conscious consumers.

- M&A Trends: Strategic acquisitions for product portfolio expansion, technology integration, and market access.

Nutritional Drink Growth Trends & Insights

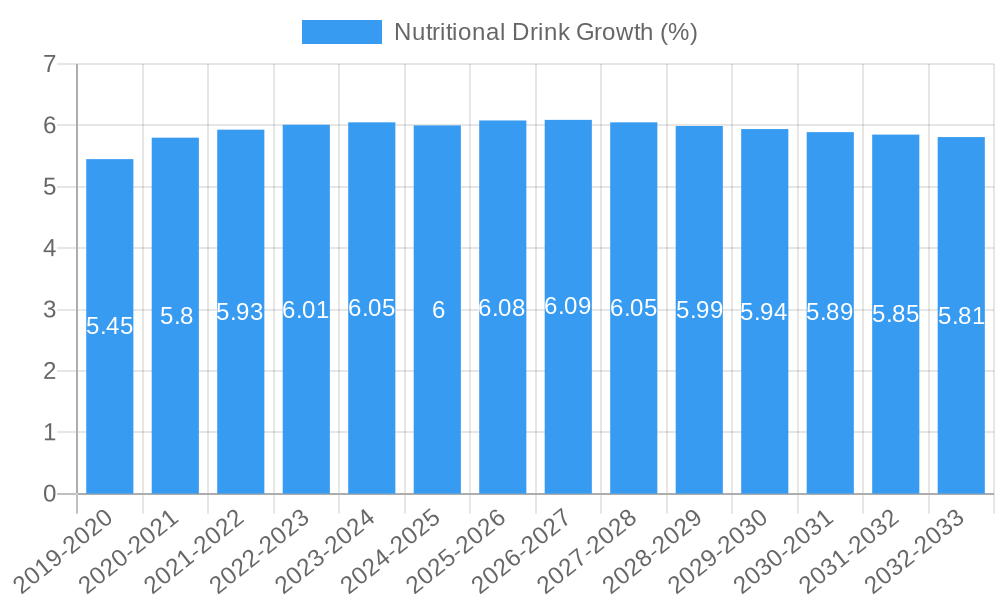

The Nutritional Drink market is poised for robust growth, projected to expand significantly from an estimated market size of XX million units in 2025. This expansion is fueled by a growing global consciousness around health and wellness, a surge in preventative healthcare practices, and an increasing demand for convenient and specialized nutrition solutions. The adoption rate of nutritional drinks is steadily increasing across various demographics, driven by endorsements from health professionals and influencers, and a greater understanding of their benefits in addressing specific nutritional gaps and lifestyle needs. Technological disruptions, including advancements in encapsulation technologies for improved nutrient delivery, personalized nutrition platforms, and the development of plant-based and organic formulations, are shaping consumer preferences and market offerings. Consumer behavior is shifting towards proactive health management, with individuals actively seeking products that support their active lifestyles, manage age-related nutritional decline, or cater to specific dietary requirements such as gluten-free, dairy-free, or vegan options. The market penetration of specialized nutritional drinks, particularly those catering to athletes and individuals with specific medical conditions, is expected to accelerate.

The market size evolution indicates a consistent upward trajectory. Historically, the period from 2019–2024 saw a steady increase in consumer interest and product availability, laying the groundwork for accelerated growth. The base year, 2025, serves as a critical benchmark for projecting future trends. The forecast period (2025–2033) is anticipated to witness a compound annual growth rate (CAGR) of approximately XX%, driven by innovations in product formulations and wider accessibility through various retail channels. Adoption rates are particularly high among urban populations and younger demographics, who are more receptive to new health trends and online purchasing channels.

Technological advancements are not limited to product composition but also extend to packaging and distribution. Sustainable packaging solutions are gaining traction, aligning with growing environmental consciousness. Furthermore, the integration of digital technologies for personalized nutrition recommendations and direct-to-consumer sales models is enhancing market reach and customer engagement. The shift in consumer behavior towards "food as medicine" and a desire for functional foods and beverages that offer tangible health benefits will continue to be a significant growth stimulant. This includes a rising preference for drinks that support gut health, boost immunity, enhance cognitive function, and aid in weight management. The rising prevalence of lifestyle-related diseases also drives the demand for nutritional interventions.

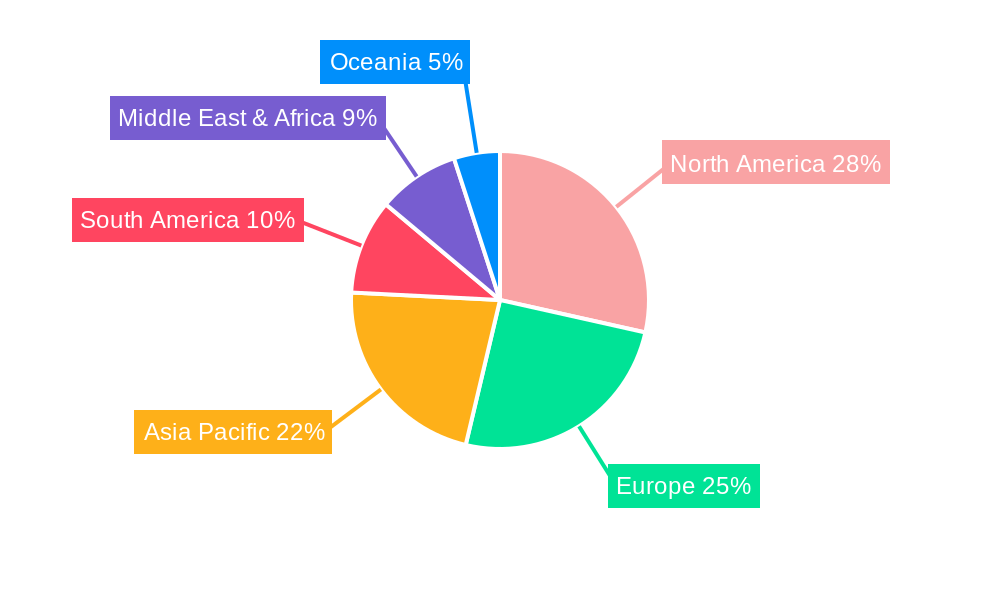

Dominant Regions, Countries, or Segments in Nutritional Drink

North America is projected to emerge as the dominant region in the global Nutritional Drink market, driven by a confluence of factors including high disposable incomes, advanced healthcare infrastructure, and a deeply ingrained health-conscious consumer culture. Within North America, the United States stands out as the leading country, characterized by a mature market with a high per capita consumption of nutritional beverages and a strong presence of key industry players. The "Athlete" application segment, encompassing sports nutrition drinks, protein shakes, and energy beverages, is a significant growth driver within this region, supported by a thriving sports and fitness industry and a large population engaged in athletic pursuits. The "Non-Athlete" segment, however, represents a vast and rapidly expanding market, driven by the general population's focus on daily wellness, immune support, and age-related nutritional needs.

The dominance of North America is further bolstered by strategic investments in research and development, leading to continuous product innovation and the introduction of specialized nutritional drinks catering to diverse dietary needs and preferences. Economic policies favoring the healthcare and food and beverage sectors, coupled with robust distribution networks and accessibility through various retail channels including supermarkets, convenience stores, pharmacies, and online platforms, contribute to market penetration.

In terms of product type, the "Bottled" segment is expected to maintain its leading position due to its convenience, portability, and widespread availability. However, the "Canned" segment is experiencing significant growth, particularly in the energy drink category, and the "Bags" segment, often associated with powdered supplements and meal replacements, is also gaining traction as consumers seek customizable nutrition solutions.

Key drivers for North American dominance include:

- High Disposable Income: Enables consumers to invest in premium and specialized nutritional products.

- Health and Wellness Trends: Strong emphasis on preventive healthcare, fitness, and functional foods.

- Advanced Healthcare Infrastructure: Facilitates research, development, and market acceptance of health-oriented products.

- Robust Distribution Networks: Wide availability across diverse retail and online channels.

- Consumer Awareness: High levels of understanding regarding the benefits of nutritional drinks.

- Innovation Hubs: Presence of leading R&D centers and a culture of product development.

The market share within North America is significant, with estimates suggesting it accounts for approximately XX% of the global nutritional drink market in 2025, with a projected growth potential of XX% during the forecast period. This growth is fueled by both organic expansion and strategic acquisitions by major corporations.

Nutritional Drink Product Landscape

The nutritional drink product landscape is characterized by relentless innovation and a diverse range of formulations designed to meet specific consumer needs. Product innovations are increasingly focusing on enhanced bioavailability of nutrients, the incorporation of functional ingredients like probiotics, prebiotics, and adaptogens, and the development of specialized diets for targeted health outcomes. Applications span from performance enhancement for athletes to nutritional support for the elderly, individuals recovering from illness, and those seeking general wellness and disease prevention. Performance metrics are driven by efficacy, taste, convenience, and ingredient transparency. Unique selling propositions often revolve around scientifically validated formulations, natural and organic ingredients, and allergen-free options. Technological advancements in ingredient processing and encapsulation are crucial in delivering stable and effective nutritional solutions.

Key Drivers, Barriers & Challenges in Nutritional Drink

Key Drivers: The nutritional drink market is propelled by a confluence of factors including the escalating global focus on preventative healthcare and wellness, a growing elderly population with specific nutritional requirements, and the increasing demand for convenient, on-the-go nutrition solutions. Technological advancements in ingredient formulation and delivery systems enhance product efficacy and appeal. Furthermore, a rising prevalence of lifestyle-related diseases fuels the demand for dietary interventions and nutritional support.

Key Barriers & Challenges: Despite the positive growth trajectory, the market faces several challenges. Stringent regulatory frameworks and the cost associated with obtaining health claims can be a significant hurdle. Intense competition from traditional beverages and other functional food categories necessitates continuous product differentiation and marketing efforts. Supply chain complexities, especially for specialized ingredients, can impact production costs and availability. Furthermore, consumer perception and skepticism regarding the efficacy or necessity of certain nutritional drinks can act as a restraint. The high cost of some premium nutritional drinks can also limit broader market penetration.

Emerging Opportunities in Nutritional Drink

Emerging opportunities in the nutritional drink sector lie in the burgeoning personalized nutrition market, leveraging AI and genetic profiling to offer customized beverage solutions. The demand for sustainable and plant-based nutritional drinks continues to rise, presenting a significant avenue for growth. Furthermore, the untapped potential in emerging economies, driven by increasing health awareness and rising disposable incomes, offers substantial expansion opportunities. Innovations in gut health and cognitive function-enhancing beverages are also garnering significant consumer interest and represent a fertile ground for new product development.

Growth Accelerators in the Nutritional Drink Industry

Technological breakthroughs in areas such as microbiome research and bioavailable nutrient delivery systems are key growth accelerators for the nutritional drink industry. Strategic partnerships between beverage manufacturers and health technology companies are fostering innovation and market penetration. Furthermore, aggressive market expansion strategies targeting underserved demographics and geographical regions, coupled with the increasing consumer trend towards functional foods and beverages that offer tangible health benefits, are significantly driving long-term growth.

Key Players Shaping the Nutritional Drink Market

- Abbott Laboratories

- Coca-Cola

- Dr Pepper Snapple Group

- GNC Holdings

- GlaxoSmithKline

- Monster Beverage Corporation

- Nestle

- Otsuka Pharmaceutical

- Red Bull

- Yakult Honsha

Notable Milestones in Nutritional Drink Sector

- 2019/01: Launch of advanced plant-based protein shakes with enhanced amino acid profiles.

- 2020/03: Introduction of gut-health focused beverages incorporating novel probiotic strains.

- 2021/07: Major player acquires a startup specializing in personalized vitamin-infused drinks.

- 2022/02: Release of energy drinks with natural caffeine sources and no added sugar.

- 2022/11: Increased investment in research for cognitive-enhancing nutritional beverages.

- 2023/05: Expansion of a fortified meal-replacement drink line for seniors.

- 2024/01: Development of sustainable packaging solutions for powdered nutritional supplements.

In-Depth Nutritional Drink Market Outlook

The nutritional drink market is set for sustained and accelerated growth, driven by a fundamental shift in consumer priorities towards proactive health management and preventative care. Growth accelerators include ongoing advancements in personalized nutrition, the expanding demand for plant-based and sustainable options, and the continuous innovation in functional ingredients that cater to specific health needs like gut health and cognitive function. Strategic collaborations and market penetration into emerging economies will further solidify the market's upward trajectory, presenting significant opportunities for stakeholders to capitalize on evolving consumer preferences and technological innovations.

Nutritional Drink Segmentation

-

1. Application

- 1.1. Athlete

- 1.2. Non Athlete

-

2. Type

- 2.1. Bottled

- 2.2. Canned

- 2.3. Bags

- 2.4. Other

Nutritional Drink Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nutritional Drink REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Athlete

- 5.1.2. Non Athlete

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bottled

- 5.2.2. Canned

- 5.2.3. Bags

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Athlete

- 6.1.2. Non Athlete

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Bottled

- 6.2.2. Canned

- 6.2.3. Bags

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Athlete

- 7.1.2. Non Athlete

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Bottled

- 7.2.2. Canned

- 7.2.3. Bags

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Athlete

- 8.1.2. Non Athlete

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Bottled

- 8.2.2. Canned

- 8.2.3. Bags

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Athlete

- 9.1.2. Non Athlete

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Bottled

- 9.2.2. Canned

- 9.2.3. Bags

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nutritional Drink Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Athlete

- 10.1.2. Non Athlete

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Bottled

- 10.2.2. Canned

- 10.2.3. Bags

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dr Pepper Snapple Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GlaxoSmithKline

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yakult Honsha

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Otsuka Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Monster Beverage Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Red Bull

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GNC Holdings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Coca-Cola

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nestle

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abbott Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dr Pepper Snapple Group

List of Figures

- Figure 1: Global Nutritional Drink Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Nutritional Drink Revenue (million), by Application 2024 & 2032

- Figure 3: North America Nutritional Drink Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Nutritional Drink Revenue (million), by Type 2024 & 2032

- Figure 5: North America Nutritional Drink Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Nutritional Drink Revenue (million), by Country 2024 & 2032

- Figure 7: North America Nutritional Drink Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Nutritional Drink Revenue (million), by Application 2024 & 2032

- Figure 9: South America Nutritional Drink Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Nutritional Drink Revenue (million), by Type 2024 & 2032

- Figure 11: South America Nutritional Drink Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Nutritional Drink Revenue (million), by Country 2024 & 2032

- Figure 13: South America Nutritional Drink Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Nutritional Drink Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Nutritional Drink Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Nutritional Drink Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Nutritional Drink Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Nutritional Drink Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Nutritional Drink Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Nutritional Drink Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Nutritional Drink Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Nutritional Drink Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Nutritional Drink Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Nutritional Drink Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Nutritional Drink Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Nutritional Drink Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Nutritional Drink Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Nutritional Drink Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Nutritional Drink Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Nutritional Drink Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Nutritional Drink Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nutritional Drink Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Nutritional Drink Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Nutritional Drink Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Nutritional Drink Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Nutritional Drink Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Nutritional Drink Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Nutritional Drink Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Nutritional Drink Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Nutritional Drink Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Nutritional Drink Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nutritional Drink?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Nutritional Drink?

Key companies in the market include Dr Pepper Snapple Group, GlaxoSmithKline, Yakult Honsha, Otsuka Pharmaceutical, Monster Beverage Corporation, Red Bull, GNC Holdings, Coca-Cola, Nestle, Abbott Laboratories.

3. What are the main segments of the Nutritional Drink?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nutritional Drink," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nutritional Drink report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nutritional Drink?

To stay informed about further developments, trends, and reports in the Nutritional Drink, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence