Key Insights

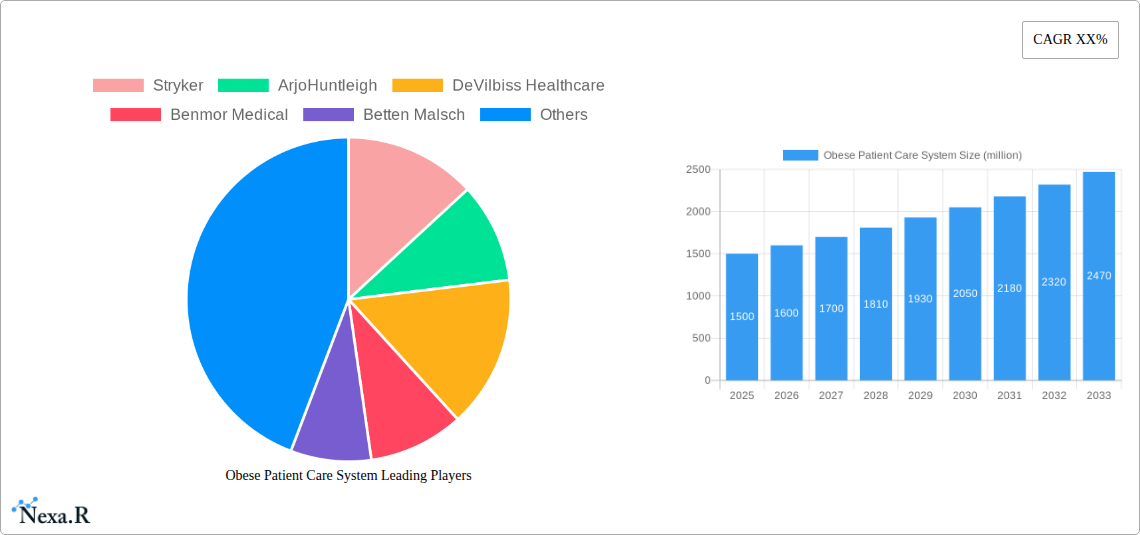

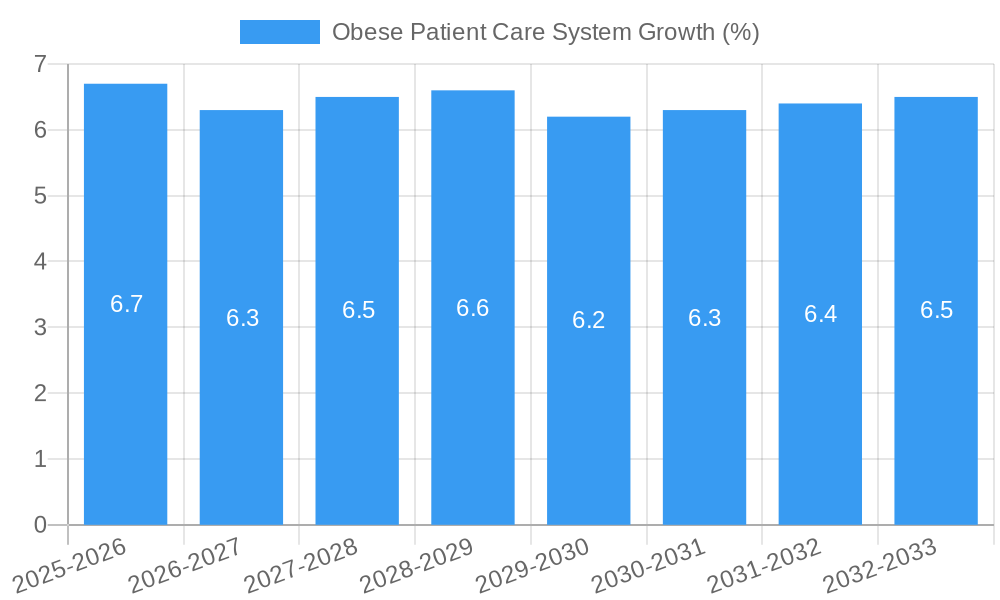

The global Obese Patient Care System market is poised for significant expansion, projected to reach an estimated USD 1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by the escalating global prevalence of obesity, which necessitates specialized healthcare equipment designed to safely and effectively manage bariatric patients. The increasing awareness among healthcare providers regarding the unique challenges and risks associated with obese patient care is driving demand for advanced solutions that offer enhanced patient comfort, improved caregiver safety, and better clinical outcomes. Furthermore, technological advancements in material science and engineering are enabling the development of lighter, more durable, and user-friendly bariatric care systems, further stimulating market adoption. The growing emphasis on patient-centric care models within hospitals and home healthcare settings also plays a crucial role, pushing for the integration of these specialized systems.

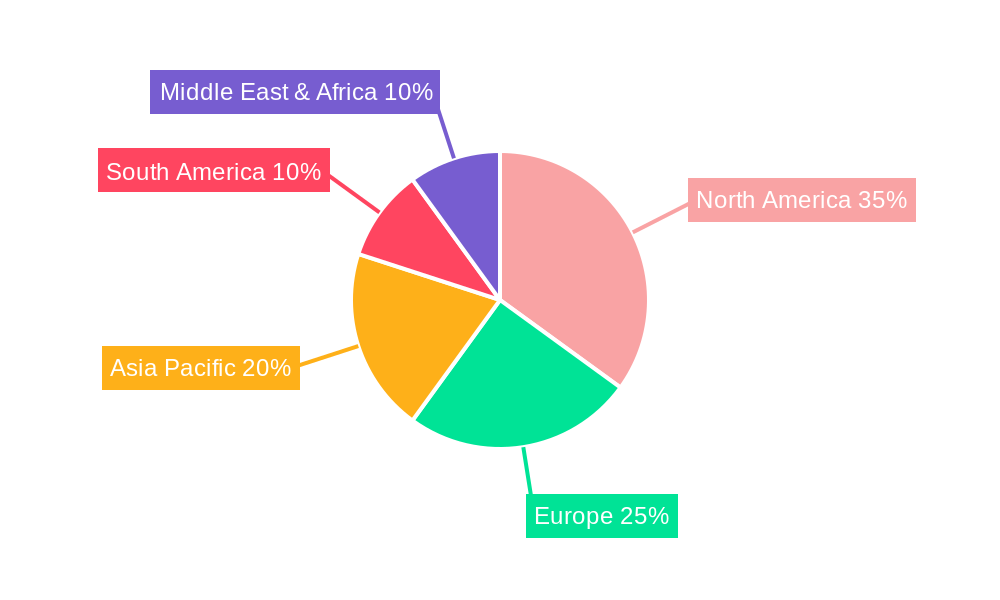

The market is segmented by application into Home, Hospital, and Others. The Hospital segment is expected to dominate, driven by the need for specialized equipment in acute care settings to manage the complexities of obese patient admissions. Within product types, the 750-950 lbs Weight Capacity segment is anticipated to witness the fastest growth, reflecting the demographic shift towards higher weight categories in the obese population. Key players such as Stryker, ArjoHuntleigh, and Hill-Rom are actively investing in research and development to introduce innovative products and expand their market reach. Geographically, North America currently leads the market, attributed to high obesity rates and advanced healthcare infrastructure. However, the Asia Pacific region is projected to exhibit the highest CAGR, owing to rapid urbanization, changing lifestyles, and improving healthcare accessibility, presenting significant untapped potential for market players. Restraints such as the high cost of specialized equipment and the need for adequate training for healthcare professionals in handling these systems are being addressed through evolving reimbursement policies and the development of more cost-effective solutions.

Obese Patient Care System Market Dynamics & Structure

The obese patient care system market is characterized by a moderate to high concentration, driven by a mix of established multinational corporations and specialized regional players. Key companies such as Stryker, ArjoHuntleigh, Hill-Rom, and Invacare command significant market shares, leveraging their extensive distribution networks and brand recognition. Technological innovation is a primary driver, with ongoing advancements focused on enhancing patient safety, mobility, and comfort. This includes the development of bariatric beds with advanced pressure redistribution technologies, powered patient lifts, and specialized mobility aids. Regulatory frameworks, particularly those related to patient safety standards and reimbursement policies, play a crucial role in shaping market entry and product development. The availability of competitive product substitutes, such as manual handling techniques or less specialized equipment, presents a challenge, though the increasing prevalence of obesity globally is driving demand for dedicated solutions. End-user demographics are shifting, with a growing elderly population and rising obesity rates across all age groups demanding more sophisticated and accessible care solutions. Mergers and acquisitions (M&A) are moderately active, as larger players seek to consolidate market positions, acquire innovative technologies, or expand their product portfolios. For instance, there have been approximately 5-7 significant M&A deals in the last two years, with an average deal value ranging from $50 million to $200 million. Innovation barriers include the high cost of developing specialized, high-weight capacity equipment and the need for extensive clinical validation to meet stringent healthcare standards.

Market Concentration & Key Players:

- Moderate to high concentration with dominant players like Stryker, ArjoHuntleigh, Hill-Rom, and Invacare.

- Presence of specialized regional manufacturers and niche product providers.

Technological Innovation Drivers:

- Advancements in pressure redistribution, powered mobility, and patient handling.

- Focus on user-friendly interfaces and integrated smart technologies.

Regulatory Frameworks:

- Strict patient safety standards (e.g., FDA, CE marking).

- Reimbursement policies influencing product adoption in healthcare settings.

Competitive Product Substitutes:

- Manual handling techniques and standard patient care equipment.

- Limited alternatives for highly specialized bariatric needs.

End-User Demographics:

- Increasing prevalence of obesity across age groups.

- Growing elderly population requiring specialized care solutions.

Mergers & Acquisitions Trends:

- Approximately 5-7 significant M&A deals in the last two years.

- Average deal value estimated between $50 million and $200 million.

Obese Patient Care System Growth Trends & Insights

The global obese patient care system market is poised for robust growth, driven by a confluence of escalating obesity rates, an aging global population, and increasing awareness of specialized healthcare needs. Market size evolution indicates a steady upward trajectory, with the market projected to expand from an estimated $3,500 million in 2024 to over $7,000 million by 2033. This represents a Compound Annual Growth Rate (CAGR) of approximately 7.5% to 9.0% during the forecast period. Adoption rates for advanced obese patient care systems are accelerating, particularly in developed nations, as healthcare facilities strive to improve patient outcomes and staff safety. Technological disruptions are continuously reshaping the landscape, with the integration of IoT, AI, and advanced materials leading to more intelligent, responsive, and ergonomic patient care equipment. For example, smart beds that monitor patient movement and alert caregivers to potential risks are becoming increasingly prevalent. Consumer behavior shifts are also playing a pivotal role; individuals are becoming more informed about their health and demanding higher quality care, both in clinical settings and at home. This is fueling the demand for home-use bariatric equipment, expanding the "Home" application segment. Furthermore, a growing emphasis on preventative care and early intervention for obesity-related conditions indirectly boosts the need for specialized equipment that facilitates mobility and comfort. The market penetration of high-capacity weight systems (≥1000 lbs Weight Capacity) is also on the rise, reflecting the increasing severity of obesity in a segment of the population. The growing understanding of the long-term economic and health burdens associated with untreated obesity further incentivizes investments in comprehensive care solutions, thereby propelling market expansion. The projected market size for obese patient care systems is expected to reach approximately $4,000 million in 2025, with a projected increase to $6,500 million by 2033. This growth is underpinned by a sustained increase in demand for bariatric beds, lifts, and mobility aids across various healthcare settings and home care environments.

Dominant Regions, Countries, or Segments in Obese Patient Care System

The North America region is currently the dominant force in the global obese patient care system market, driven by a perfect storm of high obesity prevalence, advanced healthcare infrastructure, and significant healthcare spending. The United States, in particular, accounts for a substantial portion of this dominance, with an estimated market share of over 35% within the North American region. This is further amplified by robust government initiatives focused on improving patient care outcomes and addressing chronic diseases, including obesity. The region's healthcare systems are characterized by a strong emphasis on adopting advanced medical technologies, making them early adopters of innovative obese patient care solutions. Economic policies in North America are favorable for the healthcare sector, with substantial investments in research and development, and a well-established reimbursement framework for specialized medical equipment.

Within the application segments, the Hospital segment remains the largest contributor to market revenue, accounting for approximately 60% of the total market. Hospitals, being the primary locus for critical care and long-term patient management, require high-capacity and technologically advanced bariatric equipment to ensure the safety and comfort of severely obese patients. This includes a significant demand for specialized bariatric beds, operating tables, and patient transfer devices.

However, the Home application segment is exhibiting the fastest growth rate, with a projected CAGR of 9.5% over the forecast period. This surge is attributed to the increasing trend of aging-in-place, a rise in home healthcare services, and growing patient and caregiver awareness of the benefits of specialized home-based bariatric equipment. The availability of advanced bariatric beds and patient lifts for home use is enabling individuals with obesity to maintain greater independence and receive care within their own environments.

In terms of product types, the 750-950 lbs Weight Capacity segment currently holds the largest market share, estimated at around 45%. This segment caters to a broad spectrum of bariatric patients requiring enhanced support. However, the ≥1000 lbs Weight Capacity segment is experiencing rapid expansion, with a projected CAGR of 8.8%, driven by the increasing severity of obesity in a growing patient population. This indicates a growing demand for ultra-high capacity solutions that can safely accommodate extremely obese individuals.

Dominant Region:

- North America: Driven by high obesity rates, advanced healthcare infrastructure, and substantial healthcare spending.

Dominant Country:

- United States: Leading market share within North America, benefiting from government initiatives and technological adoption.

Dominant Application Segment (Current):

- Hospital: Accounts for approximately 60% of the market, due to critical care and long-term management needs.

Fastest Growing Application Segment:

- Home: Experiencing rapid growth driven by aging-in-place trends and home healthcare services.

Dominant Product Type (Current):

- 750-950 lbs Weight Capacity: Caters to a broad spectrum of bariatric patients.

Fastest Growing Product Type:

- ≥1000 lbs Weight Capacity: Driven by increasing obesity severity and demand for ultra-high capacity solutions.

Obese Patient Care System Product Landscape

The obese patient care system product landscape is defined by a continuous stream of innovations focused on enhancing patient safety, comfort, and clinician efficiency. Key product categories include specialized bariatric beds, powered patient lifts, mobility aids, and bariatric furniture. Bariatric beds now feature advanced pressure redistribution systems, integrated scales, and electronic health record (EHR) connectivity to monitor patient status and facilitate informed care decisions. Powered patient lifts are becoming more ergonomic and user-friendly, with enhanced weight capacities and a focus on reducing caregiver strain. Unique selling propositions revolve around improved patient outcomes, such as reduced risk of pressure ulcers and falls, and increased patient mobility and dignity. Technological advancements include the use of high-strength, lightweight materials, smart sensor technology, and intuitive control interfaces. The market is witnessing a growing demand for integrated solutions that offer a comprehensive approach to bariatric care, from patient handling to therapeutic support.

Key Drivers, Barriers & Challenges in Obese Patient Care System

Key Drivers:

- Rising Global Obesity Rates: The escalating prevalence of obesity worldwide is the primary catalyst, directly increasing the demand for specialized bariatric care equipment.

- Aging Global Population: An aging demographic often presents with co-morbidities, including obesity, necessitating advanced care solutions to manage their unique needs.

- Technological Advancements: Innovations in materials science, sensor technology, and ergonomic design are leading to safer, more effective, and user-friendly obese patient care systems.

- Increased Healthcare Spending: Growing investments in healthcare infrastructure and patient care, particularly in emerging economies, are fueling market growth.

- Focus on Patient Safety and Staff Well-being: Hospitals and care facilities are prioritizing equipment that reduces the risk of injuries to both patients and caregivers.

Barriers & Challenges:

- High Cost of Specialized Equipment: The development and manufacturing of high-capacity, specialized obese patient care systems are inherently expensive, leading to higher purchase prices.

- Reimbursement Challenges: Inconsistent or inadequate reimbursement policies for specialized bariatric equipment can hinder adoption in certain healthcare settings.

- Limited Awareness and Training: A lack of comprehensive awareness and adequate training on the proper use of bariatric equipment can lead to underutilization or misuse.

- Infrastructure Limitations: Some healthcare facilities and homes may lack the physical space or structural support required for certain bariatric equipment.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials and finished products. The impact of recent disruptions has led to an estimated 10-15% increase in manufacturing costs for some components.

Emerging Opportunities in Obese Patient Care System

Emerging opportunities in the obese patient care system market lie in the expansion of home-based care solutions, the development of smart and connected devices, and the catering to specific niche requirements. The growing trend of aging-in-place and the increasing preference for in-home healthcare services present a significant opportunity for manufacturers to innovate and expand their offerings of bariatric beds, patient lifts, and mobility aids suitable for domestic environments. The integration of IoT and AI in bariatric equipment, enabling remote patient monitoring, predictive maintenance, and personalized care plans, represents another lucrative avenue. Furthermore, there is an untapped market for highly specialized equipment designed for specific environments, such as residential care facilities for the elderly or specialized rehabilitation centers catering to bariatric patients. Evolving consumer preferences for aesthetically pleasing and discreet bariatric furniture also present a design-centric opportunity.

Growth Accelerators in the Obese Patient Care System Industry

The long-term growth of the obese patient care system industry is being significantly accelerated by several key factors. Firstly, continuous technological breakthroughs, such as the development of lighter yet stronger materials, advanced sensor technologies for real-time patient monitoring, and AI-driven predictive analytics for risk assessment, are creating next-generation solutions. Secondly, strategic partnerships between equipment manufacturers, healthcare providers, and technology developers are fostering integrated care models and expanding market reach. For instance, collaborations aimed at developing comprehensive bariatric care pathways are gaining traction. Thirdly, aggressive market expansion strategies, particularly in emerging economies with rapidly growing obese populations and improving healthcare infrastructure, are opening up new revenue streams. The increasing focus on value-based healthcare models also incentivizes the adoption of equipment that demonstrably improves patient outcomes and reduces long-term healthcare costs.

Key Players Shaping the Obese Patient Care System Market

- Stryker

- ArjoHuntleigh

- DeVilbiss Healthcare

- Benmor Medical

- Betten Malsch

- Haelvoet

- Hill-Rom

- Invacare

- Magnatek Enterprises

- Merits Health Products

- Merivaara

- Nitrocare

- Reha-Bed

- Joerns Healthcare LLC.

- PROMA REHA

- Sizewise

Notable Milestones in Obese Patient Care System Sector

- 2019: Introduction of AI-powered pressure mapping systems in bariatric beds, enabling proactive prevention of pressure ulcers.

- 2020: Major manufacturers launched enhanced powered patient lifts with improved lifting capacities and ergonomic designs to address caregiver strain during the COVID-19 pandemic.

- 2021: Increased investment in research and development for lightweight, high-strength composite materials for bariatric beds, improving maneuverability and durability.

- 2022: Launch of integrated smart home bariatric systems, combining beds, lifts, and monitoring devices for seamless in-home patient care.

- 2023: Several companies secured significant funding rounds to scale production and expand R&D for advanced bariatric mobility solutions.

- 2024: Emergence of specialized bariatric furniture designed for aesthetic integration into home environments and residential care facilities.

In-Depth Obese Patient Care System Market Outlook

The obese patient care system market is projected to experience sustained and significant growth in the coming years, driven by an enduring increase in obesity prevalence and an aging global population. Key growth accelerators include continuous technological innovation, such as the integration of IoT and AI for enhanced patient monitoring and predictive care, and the development of advanced materials leading to more robust and user-friendly equipment. Strategic partnerships between healthcare providers, technology firms, and equipment manufacturers will further streamline the adoption of integrated bariatric care solutions. Market expansion into emerging economies, coupled with favorable healthcare spending trends, will unlock substantial opportunities. The growing emphasis on value-based healthcare and patient-centered care models will continue to incentivize investments in systems that demonstrably improve patient outcomes and reduce long-term healthcare costs, solidifying the industry's positive trajectory.

Obese Patient Care System Segmentation

-

1. Application

- 1.1. Home

- 1.2. Hospital

- 1.3. Others

-

2. Types

- 2.1. 500-700 lbs Weight Capacity

- 2.2. 750-950 lbs Weight Capacity

- 2.3. ≥1000 lbs Weight Capacity

Obese Patient Care System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Obese Patient Care System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home

- 5.1.2. Hospital

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 500-700 lbs Weight Capacity

- 5.2.2. 750-950 lbs Weight Capacity

- 5.2.3. ≥1000 lbs Weight Capacity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home

- 6.1.2. Hospital

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 500-700 lbs Weight Capacity

- 6.2.2. 750-950 lbs Weight Capacity

- 6.2.3. ≥1000 lbs Weight Capacity

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home

- 7.1.2. Hospital

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 500-700 lbs Weight Capacity

- 7.2.2. 750-950 lbs Weight Capacity

- 7.2.3. ≥1000 lbs Weight Capacity

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home

- 8.1.2. Hospital

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 500-700 lbs Weight Capacity

- 8.2.2. 750-950 lbs Weight Capacity

- 8.2.3. ≥1000 lbs Weight Capacity

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home

- 9.1.2. Hospital

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 500-700 lbs Weight Capacity

- 9.2.2. 750-950 lbs Weight Capacity

- 9.2.3. ≥1000 lbs Weight Capacity

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Obese Patient Care System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home

- 10.1.2. Hospital

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 500-700 lbs Weight Capacity

- 10.2.2. 750-950 lbs Weight Capacity

- 10.2.3. ≥1000 lbs Weight Capacity

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stryker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ArjoHuntleigh

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DeVilbiss Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Benmor Medical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Betten Malsch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Haelvoet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hill-Rom

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Invacare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Magnatek Enterprises

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Merits Health Products

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Merivaara

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nitrocare

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Reha-Bed

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Joerns Healthcare LLC.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PROMA REHA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sizewise

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Stryker

List of Figures

- Figure 1: Global Obese Patient Care System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Obese Patient Care System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Obese Patient Care System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Obese Patient Care System Revenue (million), by Types 2024 & 2032

- Figure 5: North America Obese Patient Care System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Obese Patient Care System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Obese Patient Care System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Obese Patient Care System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Obese Patient Care System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Obese Patient Care System Revenue (million), by Types 2024 & 2032

- Figure 11: South America Obese Patient Care System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Obese Patient Care System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Obese Patient Care System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Obese Patient Care System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Obese Patient Care System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Obese Patient Care System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Obese Patient Care System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Obese Patient Care System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Obese Patient Care System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Obese Patient Care System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Obese Patient Care System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Obese Patient Care System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Obese Patient Care System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Obese Patient Care System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Obese Patient Care System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Obese Patient Care System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Obese Patient Care System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Obese Patient Care System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Obese Patient Care System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Obese Patient Care System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Obese Patient Care System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Obese Patient Care System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Obese Patient Care System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Obese Patient Care System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Obese Patient Care System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Obese Patient Care System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Obese Patient Care System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Obese Patient Care System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Obese Patient Care System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Obese Patient Care System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Obese Patient Care System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Obese Patient Care System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Obese Patient Care System?

Key companies in the market include Stryker, ArjoHuntleigh, DeVilbiss Healthcare, Benmor Medical, Betten Malsch, Haelvoet, Hill-Rom, Invacare, Magnatek Enterprises, Merits Health Products, Merivaara, Nitrocare, Reha-Bed, Joerns Healthcare LLC., PROMA REHA, Sizewise.

3. What are the main segments of the Obese Patient Care System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Obese Patient Care System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Obese Patient Care System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Obese Patient Care System?

To stay informed about further developments, trends, and reports in the Obese Patient Care System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence