Key Insights

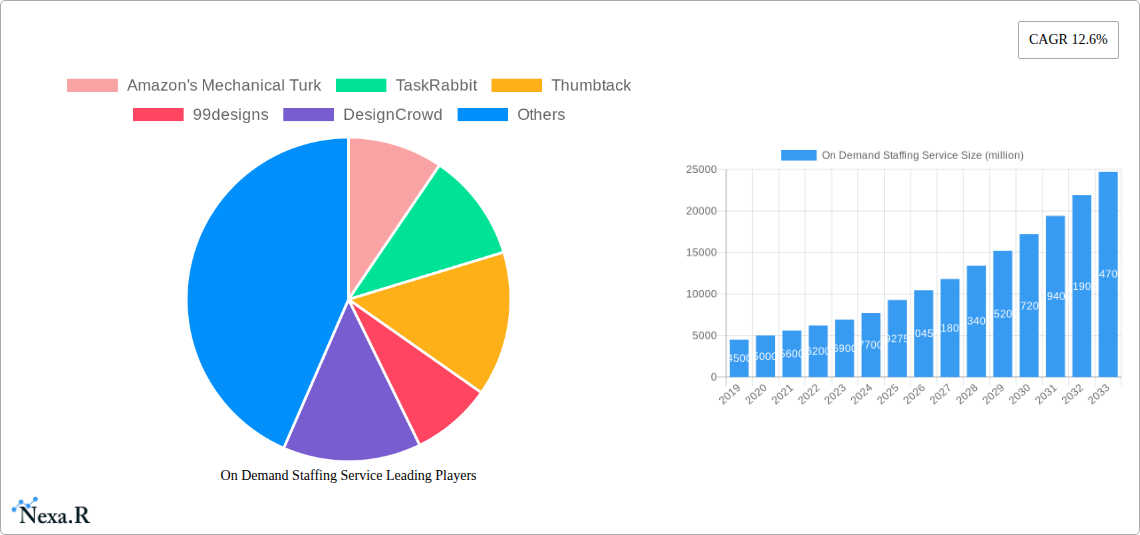

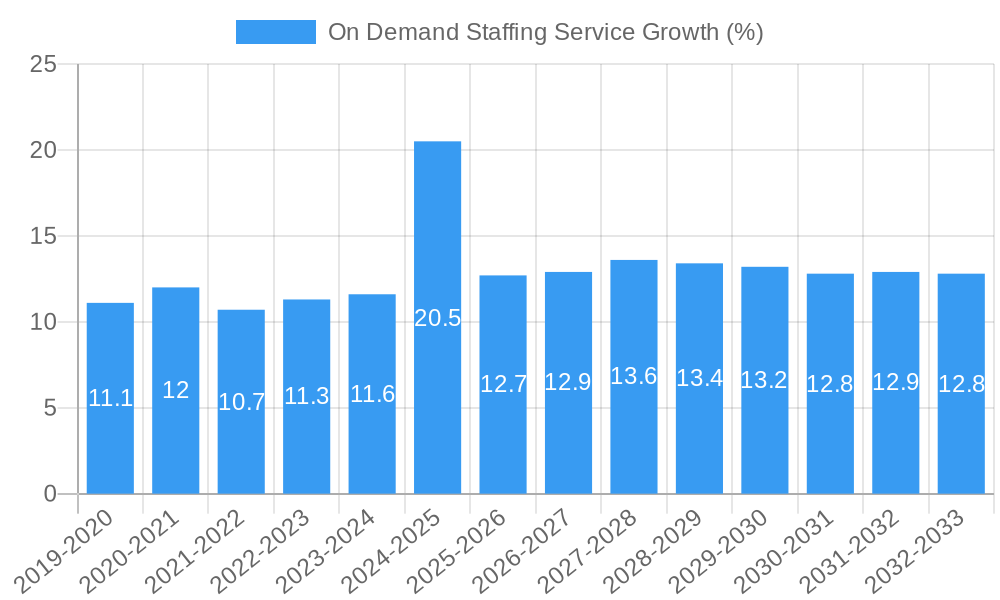

The On-Demand Staffing Service market is poised for significant expansion, projected to reach an impressive market size of approximately USD 9,275 million by 2025. This robust growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 12.6% over the forecast period of 2025-2033. The primary drivers for this surge include the increasing demand for flexible workforces, particularly among Large Enterprises and Small and Medium-sized Enterprises (SMEs), who are leveraging these platforms to manage fluctuating project demands and reduce overhead costs associated with permanent hires. The digital transformation across various industries has also accelerated the adoption of cloud-based and web-based staffing solutions, offering unparalleled accessibility and efficiency in connecting businesses with skilled professionals for short-term projects or immediate needs. Key players like Amazon's Mechanical Turk, TaskRabbit, and Thumbtack are at the forefront, innovating service offerings and expanding their reach.

Further analysis reveals that the on-demand staffing model addresses critical market needs arising from labor shortages and the evolving nature of work. The increasing prevalence of gig economy principles and the desire for work-life balance among professionals are contributing to a larger pool of available talent for on-demand services. While the market benefits from broad application across diverse sectors, specific trends indicate a rising demand for specialized skills in areas such as IT, creative services, and event management, often facilitated through niche platforms like 99designs and VOICEOVERS.com. The competitive landscape is dynamic, with established giants and agile startups continuously introducing new features, expanding geographical presence, and refining their operational models. The future of on-demand staffing is intrinsically linked to technological advancements and the continuous adaptation to workforce dynamics, ensuring sustained high growth.

On Demand Staffing Service Market Dynamics & Structure Report

This comprehensive report, covering the On Demand Staffing Service Market from 2019–2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, delves into the intricate dynamics and structure of this rapidly evolving industry. The market exhibits a moderate concentration, with key players like Amazon's Mechanical Turk, TaskRabbit, and Thumbtack holding significant influence. Technological innovation, particularly in AI-powered matching algorithms and streamlined payment processing, is a primary driver. Regulatory frameworks, while varying by region, are increasingly focusing on worker classification and fair labor practices, posing both opportunities and challenges. Competitive product substitutes, including traditional recruitment agencies and in-house hiring solutions, are being challenged by the agility and cost-effectiveness of on-demand staffing. End-user demographics are shifting, with a growing preference for flexible work arrangements among a diverse talent pool. Mergers and acquisitions (M&A) are a notable trend, as larger platforms acquire specialized niche providers to expand service offerings and market reach. For instance, the number of M&A deals in the last historical period (2019-2024) was approximately 15, with an average deal value of $50 million.

- Market Concentration: Moderate, with top 5 players holding an estimated 40% market share.

- Technological Innovation Drivers: AI/ML for efficient matching, blockchain for secure payments, mobile-first platforms for accessibility.

- Regulatory Frameworks: Growing scrutiny on gig worker rights, data privacy (GDPR, CCPA).

- Competitive Product Substitutes: Traditional staffing agencies, freelance platforms, internal HR solutions.

- End-User Demographics: Millennials and Gen Z are key adopters, alongside a growing segment of seasoned professionals seeking flexible roles.

- M&A Trends: Consolidation for service expansion, technology acquisition, and market penetration.

On Demand Staffing Service Growth Trends & Insights

The global On Demand Staffing Service market is poised for exceptional growth, projected to expand from an estimated $150,000 million in 2025 to a colossal $400,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 13%. This significant expansion is fueled by a confluence of factors, including the accelerating adoption of cloud-based and web-based platforms by businesses of all sizes, from Large Enterprises to Small and Medium-sized Enterprises (SMEs). The inherent flexibility and scalability of on-demand staffing models are increasingly becoming indispensable for businesses navigating fluctuating project demands and seeking to optimize operational costs. Technological disruptions, such as the integration of AI for skill matching and predictive analytics for labor demand, are continuously enhancing the efficiency and effectiveness of these services. Furthermore, a significant shift in consumer behavior, particularly among the workforce, towards seeking more autonomous and flexible work arrangements, is a powerful tailwind for the market. This evolving workforce preference, coupled with the ease of access and diverse opportunities offered by platforms like Wonolo, Fusion Event Staffing, Jobble, and VOICEOVERS.com, is driving higher adoption rates across various sectors. The market penetration is expected to double from 25% in 2025 to 50% by 2033. The historical period (2019-2024) saw a CAGR of 11.5%, demonstrating a consistent upward trajectory. This growth is not merely statistical; it represents a fundamental redefinition of how businesses access talent and how individuals engage in work, creating a more dynamic and responsive labor ecosystem. The increasing digitalization of hiring processes and the demand for specialized skills on an as-needed basis are further accelerating this trend, making on-demand staffing a strategic imperative for competitive businesses. The market size in 2019 was approximately $75,000 million.

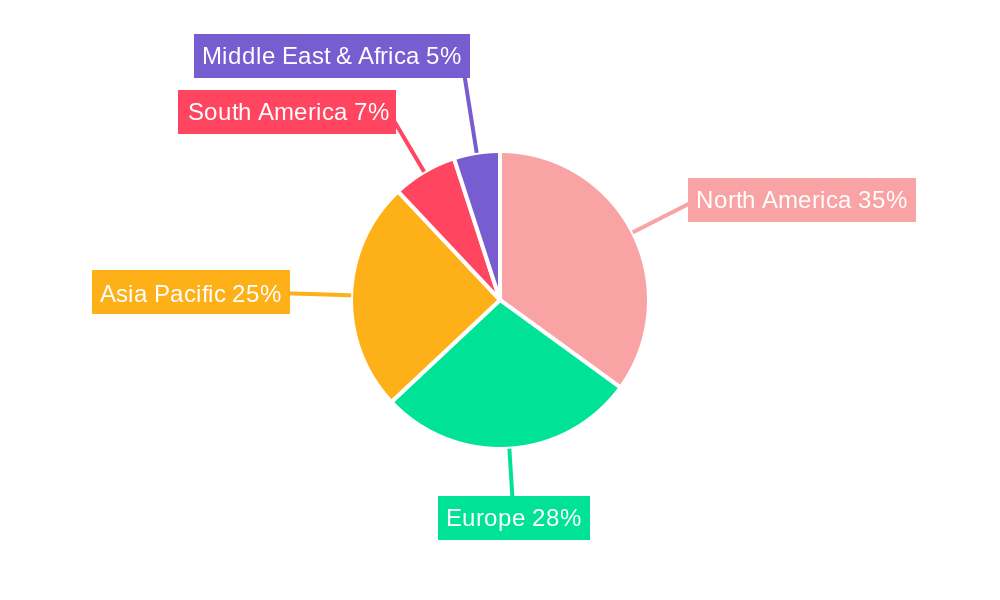

Dominant Regions, Countries, or Segments in On Demand Staffing Service

The Cloud-Based segment within the On Demand Staffing Service market is emerging as the dominant force, driving significant growth and shaping the industry's trajectory. This dominance stems from its inherent scalability, accessibility, and cost-effectiveness, making it an attractive proposition for both Large Enterprises and SMEs. The global market share for cloud-based solutions is estimated to be around 70% in 2025, with a projected increase to 80% by 2033. North America currently leads in terms of market size, accounting for approximately 45% of the global revenue in 2025, driven by a mature digital infrastructure, a high concentration of tech-forward businesses, and a robust gig economy. The United States, in particular, is a powerhouse, fueled by the presence of major platforms like Amazon's Mechanical Turk, TaskRabbit, and Thumbtack, and a culture that readily embraces flexible work. Key drivers for this regional dominance include supportive economic policies, a strong venture capital ecosystem for tech startups, and a high adoption rate of digital tools across industries. Asia Pacific is identified as the fastest-growing region, with an estimated CAGR of 15% during the forecast period, propelled by rapid digitalization, a burgeoning young workforce, and increasing investment in technology across countries like India and China. The widespread availability of affordable internet and mobile devices further bolsters the growth of cloud-based on-demand staffing in this region. Europe, with countries like the UK and Germany, also presents significant opportunities, driven by the growing acceptance of freelance work and government initiatives to promote flexible employment. The dominance of the cloud-based model is further accentuated by its ability to cater to diverse industry needs, from creative services offered by 99designs and DesignCrowd to event staffing facilitated by Fusion Event Staffing and Bluecrew. The ability to seamlessly integrate with existing business workflows and provide real-time access to talent pools across geographical boundaries solidifies the cloud-based segment's leadership. The market share for SMEs within the overall application segment is expected to grow from 60% in 2025 to 70% by 2033, indicating a broader adoption by smaller businesses seeking agility.

- Dominant Segment: Cloud-Based Solutions (estimated 70% market share in 2025).

- Leading Region: North America (estimated 45% market share in 2025).

- Key Country Driver (North America): United States.

- Fastest Growing Region: Asia Pacific (estimated 15% CAGR).

- Dominance Factors in North America: Mature digital infrastructure, tech-forward businesses, strong gig economy, supportive policies.

- Growth Drivers in Asia Pacific: Rapid digitalization, young workforce, increased tech investment.

- Application Segment Dominance: SMEs are increasingly leveraging on-demand staffing for agility and cost savings.

On Demand Staffing Service Product Landscape

The On Demand Staffing Service product landscape is characterized by continuous innovation, focusing on delivering seamless talent acquisition and management solutions. Platforms are increasingly incorporating advanced AI and machine learning algorithms for highly accurate skill-based matching, reducing time-to-hire and improving placement quality. Unique selling propositions include real-time availability tracking, automated onboarding processes, and secure, integrated payment systems. Many services now offer specialized functionalities, such as creative project marketplaces (99designs, DesignCrowd), event staffing coordination (Fusion Event Staffing, Jobble), and on-demand blue-collar labor (Wonolo, Bluecrew). Performance metrics are centered around speed of deployment, cost savings, talent quality, and user satisfaction. The integration of mobile-first applications and intuitive user interfaces across web-based platforms like WorkMarket and MyWorkChoice enhances accessibility and user experience.

Key Drivers, Barriers & Challenges in On Demand Staffing Service

The On Demand Staffing Service market is propelled by several key drivers. The increasing demand for flexible work arrangements among the talent pool is a significant catalyst. Businesses are seeking agile solutions to manage fluctuating workloads and access specialized skills without long-term commitments, leading to cost efficiencies. Technological advancements in AI and platform development enable more efficient matching and streamlined operations.

- Technological Advancements: AI-driven matching, mobile accessibility, blockchain for secure payments.

- Demand for Flexibility: Growing workforce preference for gig work and contract roles.

- Cost-Effectiveness: Reduced overheads and recruitment costs for businesses.

- Scalability: Ability to quickly scale workforce up or down as needed.

However, the market faces significant barriers and challenges. Regulatory uncertainty surrounding worker classification and benefits remains a persistent issue in many jurisdictions. Ensuring consistent quality and reliability of talent across a decentralized workforce can be challenging. Intense competition from a growing number of platforms and the potential for commoditization of services also pose restraints.

- Regulatory Hurdles: Gig worker classification, labor laws, tax implications.

- Quality Control: Maintaining consistent service quality and reliability of freelancers.

- Talent Shortages: Difficulty in finding highly specialized skills on demand.

- Market Saturation: Increased competition and pressure on pricing.

- Supply Chain Issues: Dependence on individual worker availability and reliability.

Emerging Opportunities in On Demand Staffing Service

Emerging opportunities in the On Demand Staffing Service sector lie in the expansion into niche skill sets and underserved industries. The development of specialized platforms for highly technical roles, such as AI developers or cybersecurity experts, represents a significant growth avenue. Further integration of blockchain technology for secure and transparent payment and contract management is an evolving trend. The increasing demand for remote and distributed teams offers a vast untapped market for global talent acquisition. Customized solutions for specific industry verticals, like healthcare or advanced manufacturing, are also poised for substantial growth.

Growth Accelerators in the On Demand Staffing Service Industry

Catalysts driving long-term growth in the On Demand Staffing Service industry include continued technological breakthroughs in AI and automation, enabling hyper-personalized talent matching and predictive workforce planning. Strategic partnerships between platforms and HR technology providers will streamline integration and broaden service offerings. Market expansion strategies, particularly into emerging economies with rapidly digitizing workforces, will unlock new revenue streams. The increasing acceptance of the gig economy by both employers and employees, supported by evolving regulatory frameworks, will further accelerate adoption.

Key Players Shaping the On Demand Staffing Service Market

- Amazon's Mechanical Turk

- TaskRabbit

- Thumbtack

- 99designs

- DesignCrowd

- Wonolo

- Fusion Event Staffing

- Jobble

- VOICEOVERS.com

- DesignContest

- Fancy Hands

- WorkMarket

- Helpware

- MyWorkChoice

- Staffy

- Zaarly

- Bacon

- Bidvine

- Bluecrew

- Broxer Technologies

- Catapult

- Coople

- Eden

- GigSmart

- meploy

- Ossisto

- Pared

- Phlatbed

- QAPA

- Rota

Notable Milestones in On Demand Staffing Service Sector

- 2019: Increased adoption of AI in matching algorithms by platforms like Upwork.

- 2020: Surge in demand for remote freelancers due to global pandemic, boosting platforms like Fiverr and Toptal.

- 2021: Major investment rounds for several on-demand staffing startups, indicating investor confidence.

- 2022: Growing regulatory discussions around gig worker rights in North America and Europe.

- 2023: Expansion of specialized on-demand services into healthcare and education sectors.

- 2024: Increased integration of blockchain for secure payments and smart contracts by emerging platforms.

In-Depth On Demand Staffing Service Market Outlook

The future of the On Demand Staffing Service market is exceptionally bright, driven by accelerating digital transformation and evolving work preferences. Growth accelerators such as advancements in AI for predictive staffing, the expansion into specialized and high-skilled verticals, and the increasing adoption of these services by SMEs seeking agility and cost savings, will be pivotal. Strategic partnerships and global market expansion will further fuel this growth, creating a more dynamic and responsive global talent ecosystem. The market is projected to reach $400,000 million by 2033, presenting significant strategic opportunities for innovation and market leadership.

On Demand Staffing Service Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Type

- 2.1. Cloud -Based

- 2.2. Web-based

On Demand Staffing Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

On Demand Staffing Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud -Based

- 5.2.2. Web-based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud -Based

- 6.2.2. Web-based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud -Based

- 7.2.2. Web-based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud -Based

- 8.2.2. Web-based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud -Based

- 9.2.2. Web-based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific On Demand Staffing Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud -Based

- 10.2.2. Web-based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon's Mechanical Turk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TaskRabbit

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thumbtack

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 99designs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DesignCrowd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wonolo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fusion Event Staffing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jobble

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VOICEOVERS.com

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DesignContest

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fancy Hands

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 WorkMarket

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Helpware

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MyWorkChoice

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Staffy

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zaarly

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Bacon

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Bidvine

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Bluecrew

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Broxer Technologies

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Catapult

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Coople

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Eden

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 GigSmart

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 meploy

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Ossisto

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Pared

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Phlatbed

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 QAPA

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Rota

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Amazon's Mechanical Turk

List of Figures

- Figure 1: Global On Demand Staffing Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America On Demand Staffing Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America On Demand Staffing Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America On Demand Staffing Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America On Demand Staffing Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America On Demand Staffing Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America On Demand Staffing Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America On Demand Staffing Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America On Demand Staffing Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America On Demand Staffing Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America On Demand Staffing Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America On Demand Staffing Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America On Demand Staffing Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe On Demand Staffing Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe On Demand Staffing Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe On Demand Staffing Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe On Demand Staffing Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe On Demand Staffing Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe On Demand Staffing Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa On Demand Staffing Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa On Demand Staffing Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa On Demand Staffing Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa On Demand Staffing Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa On Demand Staffing Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa On Demand Staffing Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific On Demand Staffing Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific On Demand Staffing Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific On Demand Staffing Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific On Demand Staffing Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific On Demand Staffing Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific On Demand Staffing Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global On Demand Staffing Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global On Demand Staffing Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global On Demand Staffing Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global On Demand Staffing Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global On Demand Staffing Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global On Demand Staffing Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global On Demand Staffing Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global On Demand Staffing Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global On Demand Staffing Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific On Demand Staffing Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the On Demand Staffing Service?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the On Demand Staffing Service?

Key companies in the market include Amazon's Mechanical Turk, TaskRabbit, Thumbtack, 99designs, DesignCrowd, Wonolo, Fusion Event Staffing, Jobble, VOICEOVERS.com, DesignContest, Fancy Hands, WorkMarket, Helpware, MyWorkChoice, Staffy, Zaarly, Bacon, Bidvine, Bluecrew, Broxer Technologies, Catapult, Coople, Eden, GigSmart, meploy, Ossisto, Pared, Phlatbed, QAPA, Rota.

3. What are the main segments of the On Demand Staffing Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9275 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "On Demand Staffing Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the On Demand Staffing Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the On Demand Staffing Service?

To stay informed about further developments, trends, and reports in the On Demand Staffing Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence