Key Insights

The global organic acid cosmetic preservatives market is poised for significant expansion, projected to reach a substantial market size of approximately $1.8 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth trajectory is primarily fueled by the escalating consumer demand for safer and more natural cosmetic formulations. As awareness surrounding the potential health risks associated with synthetic preservatives grows, formulators are increasingly turning to organic acids like benzoic acid, salicylates, and sorbic acid as effective and consumer-preferred alternatives. The "clean beauty" movement, emphasizing transparency and the use of minimally processed ingredients, is a powerful driver, pushing manufacturers to reformulate their products with organic acid-based preservative systems. This trend is further amplified by stringent regulatory landscapes in key regions that favor or mandate the use of less sensitizing and more biodegradable ingredients. The personal care and cosmetic segments are expected to dominate, benefiting from new product launches and the sustained popularity of preservative-free or naturally preserved cosmetics.

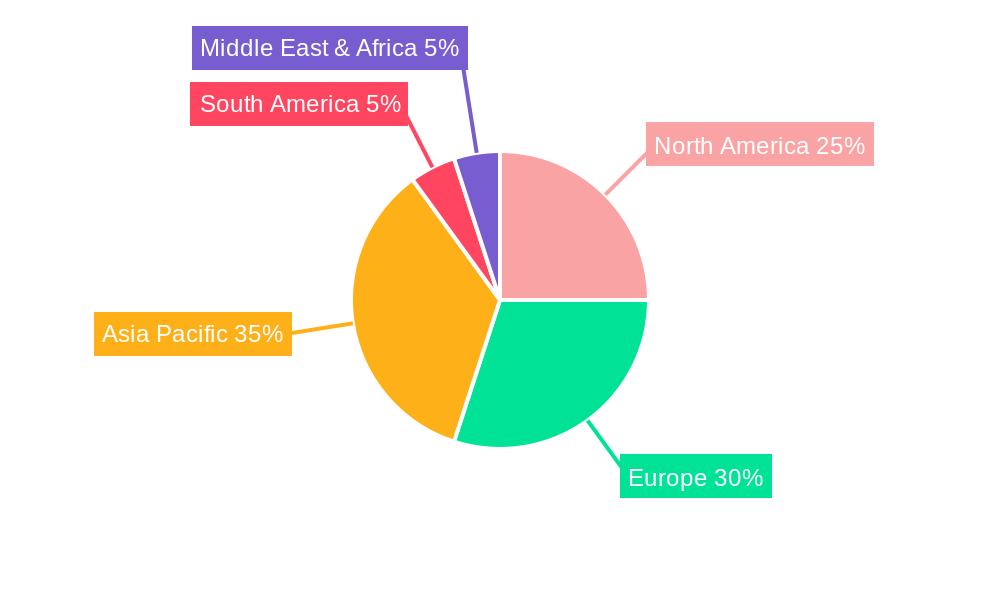

Despite the promising outlook, the market faces certain restraints. The higher cost of sourcing and processing organic acids compared to some conventional synthetic preservatives can present a challenge, particularly for mass-market products. Additionally, achieving broad-spectrum efficacy against a wide range of microorganisms with solely organic acid-based systems can sometimes require complex formulation strategies or combinations, potentially impacting formulation ease and cost-effectiveness. However, ongoing research and development into novel extraction techniques and synergistic preservative blends are actively addressing these limitations. The market is also witnessing innovation in delivery systems to enhance the stability and efficacy of organic acids. Geographically, Asia Pacific, led by China and India, is emerging as a high-growth region due to its rapidly expanding middle class, increasing disposable income, and growing adoption of Western cosmetic trends. North America and Europe remain mature but significant markets, driven by established consumer preferences for premium and safe cosmetic products.

Organic Acid Cosmetic Preservatives Market Research Report 2024-2033

This comprehensive report delivers an in-depth analysis of the global Organic Acid Cosmetic Preservatives market, a critical segment within the broader personal care ingredients and cosmetic preservatives landscape. Focusing on the benzoic acid, salicylates, and sorbic acid sub-segments, this study provides actionable insights for manufacturers, formulators, and investors navigating this dynamic industry. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report offers unparalleled clarity on market trajectory.

Organic Acid Cosmetic Preservatives Market Dynamics & Structure

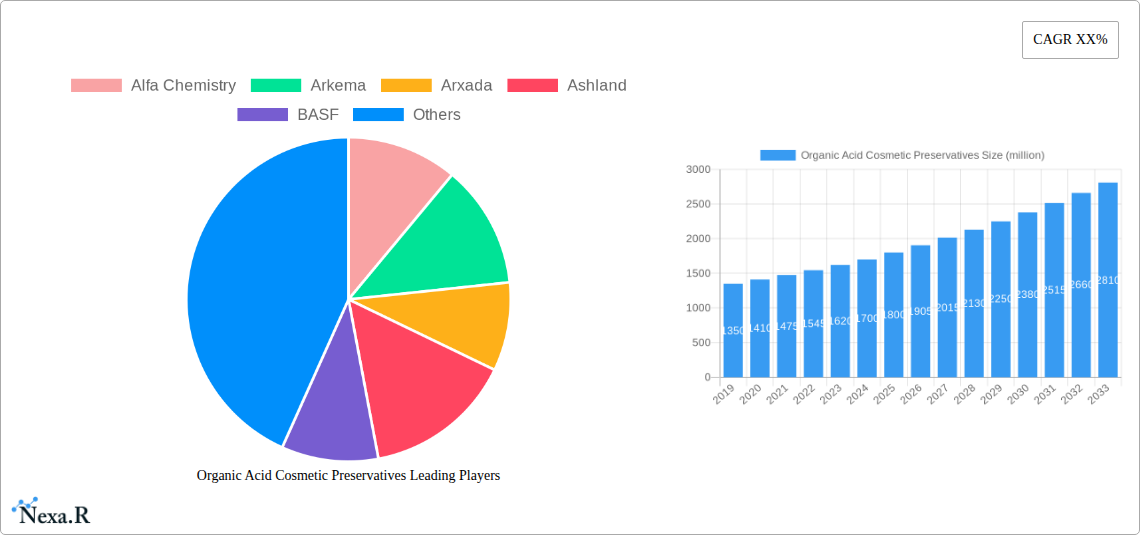

The Organic Acid Cosmetic Preservatives market exhibits a moderately consolidated structure, characterized by the presence of both large multinational corporations and specialized regional players. Technological innovation is a significant driver, with continuous research focused on developing more potent, versatile, and naturally derived preservative systems to meet evolving consumer demands for clean beauty and natural cosmetics. Regulatory frameworks, particularly those governed by bodies like the FDA and European Chemicals Agency (ECHA), play a crucial role in shaping product development and market access, often dictating acceptable concentrations and purity standards for cosmetic ingredients. Competitive product substitutes, such as parabens, formaldehyde-releasers, and newer synthetic preservative blends, present a constant challenge, necessitating ongoing product differentiation and efficacy validation. End-user demographics are increasingly influenced by a growing awareness of ingredient safety and sustainability, favoring products perceived as gentler and more environmentally friendly. Merger and acquisition (M&A) trends indicate a strategic consolidation aimed at expanding product portfolios, gaining market share, and enhancing research and development capabilities. For instance, in the historical period (2019-2024), an estimated 5-7 significant M&A deals occurred within the preservatives sector, indicating active strategic maneuvering. Barriers to innovation include the rigorous testing required for new ingredient approval and the substantial investment needed for scaled production of novel organic acid derivatives.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Technological Innovation Drivers: Demand for natural and clean label preservatives, enhanced efficacy, and broader spectrum antimicrobial activity.

- Regulatory Frameworks: Stringent approval processes and evolving ingredient safety guidelines.

- Competitive Product Substitutes: Parabens, isothiazolinones, formaldehyde-releasers, and emerging "green" alternatives.

- End-User Demographics: Growing preference for sustainable, ethically sourced, and non-toxic ingredients.

- M&A Trends: Strategic acquisitions to broaden product offerings and enhance R&D capabilities.

- Innovation Barriers: High R&D costs, lengthy regulatory approval cycles, and the need for extensive toxicological and dermatological testing.

Organic Acid Cosmetic Preservatives Growth Trends & Insights

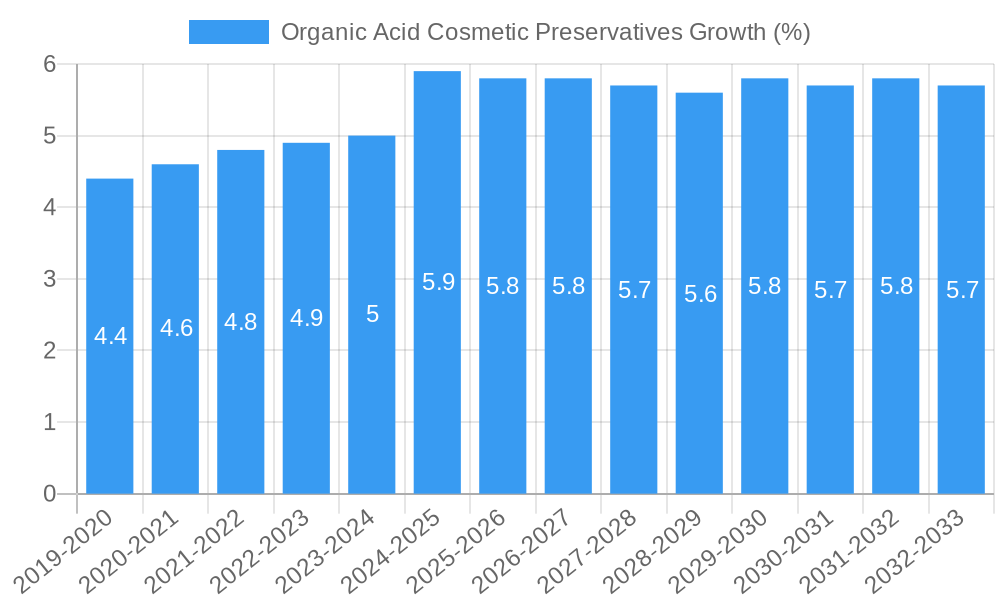

The global Organic Acid Cosmetic Preservatives market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This growth is underpinned by several key trends, including the escalating consumer demand for natural and organic cosmetics, driving the adoption of preservatives that align with these values. The increasing awareness of the potential adverse effects of synthetic preservatives, coupled with stringent regulatory scrutiny on certain traditional antimicrobial agents, has further accelerated the shift towards organic acid-based solutions. The estimated market size in 2025 is projected to be around USD 1.85 billion, with a significant upward trajectory. Technological advancements in extraction and synthesis of organic acids, leading to improved efficacy and cost-effectiveness, are also pivotal. Furthermore, the personal care segment, particularly skincare and haircare, represents the largest application area, accounting for an estimated 65% of the market share in 2025. The cosmetic segment follows, driven by demand in color cosmetics and fragrances, with an anticipated 28% market share. The "Other" application segment, encompassing products like household cleaners and industrial applications where preservation is critical, is expected to contribute the remaining 7%. Consumer behavior shifts towards transparency and ingredient traceability are fueling the demand for preservatives with clearly understood origins and safety profiles, a niche where organic acids excel. The adoption rates of organic acid preservatives are expected to climb as formulators discover their versatility and compatibility with a wide range of cosmetic formulations. Market penetration in emerging economies, particularly in Asia-Pacific, is anticipated to be a significant growth catalyst, driven by rising disposable incomes and a burgeoning middle class with a growing interest in premium personal care products. The historical growth (2019-2024) demonstrated a steady upward trend, with an average CAGR of 5.2%, setting a strong foundation for future expansion.

Dominant Regions, Countries, or Segments in Organic Acid Cosmetic Preservatives

North America and Europe currently dominate the global Organic Acid Cosmetic Preservatives market, primarily driven by a well-established personal care and cosmetic industry, stringent regulatory oversight, and a highly informed consumer base prioritizing ingredient safety and sustainability. North America, with an estimated market share of 32% in 2025, is characterized by its large consumer base and significant investment in research and development by key players like BASF, Evonik, and Ashland. The United States leads the region, with a strong demand for natural and organic certified products, which directly translates to higher adoption of organic acid preservatives like benzoic acid and its derivatives. Europe, holding approximately 30% of the global market share in 2025, is influenced by strict regulations like REACH and a deep-rooted consumer preference for "free-from" claims. Germany, France, and the United Kingdom are key markets within Europe, with a growing emphasis on biodegradable and eco-friendly cosmetic ingredients. The personal care application segment, projected to capture an estimated 65% of the total market value in 2025, is the primary growth engine. This is attributed to the extensive use of organic acid preservatives in skincare formulations, such as moisturizers, serums, and sunscreens, where consumer trust in ingredient safety is paramount. Within the Types segment, benzoic acid and its salts (like sodium benzoate) are expected to maintain their leadership position, accounting for an estimated 40% of the market in 2025 due to their broad-spectrum antimicrobial activity and cost-effectiveness. Salicylates, particularly salicylic acid and its derivatives, are crucial in acne treatment and exfoliation products, contributing around 25% of the market. Sorbic acid and its salts are prominent in food and cosmetic applications, holding approximately 20% of the market. The "Other" types, which include less common organic acids and proprietary blends, constitute the remaining 15%. Asia-Pacific is identified as the fastest-growing region, with an anticipated CAGR of 7.8% between 2025 and 2033. This growth is fueled by a rapidly expanding middle class, increasing disposable incomes, and a growing awareness of personal grooming and beauty products. Countries like China, India, and South Korea are emerging as significant consumers and manufacturers of cosmetic ingredients, including organic acid preservatives. Government initiatives promoting domestic manufacturing and a shift towards higher-quality ingredients are further accelerating this regional growth.

- Dominant Region: North America & Europe

- Leading Country (North America): United States

- Leading Countries (Europe): Germany, France, United Kingdom

- Dominant Application Segment: Personal Care (estimated 65% market share in 2025)

- Leading Type Segment: Benzoic Acid (estimated 40% market share in 2025)

- Fastest Growing Region: Asia-Pacific (CAGR of 7.8% during 2025-2033)

- Key Growth Drivers in Asia-Pacific: Rising disposable incomes, increasing awareness of personal grooming, government support for domestic manufacturing.

Organic Acid Cosmetic Preservatives Product Landscape

The product landscape for organic acid cosmetic preservatives is characterized by a focus on enhanced efficacy, broader antimicrobial spectrum, and improved sustainability profiles. Manufacturers are increasingly developing synergistic blends of organic acids, such as benzoic acid and sorbic acid, to achieve comprehensive protection against bacteria, yeasts, and molds. Innovations include the development of water-soluble and more stable forms of these acids, facilitating easier incorporation into diverse cosmetic formulations, from water-based serums to oil-based creams. Performance metrics like minimum inhibitory concentration (MIC) against a wide range of microbial contaminants are crucial selling points. The demand for natural preservatives derived from plant-based sources is also a significant trend, with companies exploring extracts rich in organic acids. For instance, some manufacturers are offering preservative systems based on fruit acids or fermentation-derived compounds, appealing to the clean beauty movement. Technological advancements are also enabling the creation of preservatives with superior compatibility with other cosmetic ingredients, minimizing formulation challenges and ensuring product stability and shelf-life.

Key Drivers, Barriers & Challenges in Organic Acid Cosmetic Preservatives

The Organic Acid Cosmetic Preservatives market is propelled by several key drivers. The ever-increasing consumer demand for natural and organic cosmetics is paramount, pushing formulators to seek preservatives perceived as safer and more sustainable. Stringent regulations on traditional preservatives, coupled with growing scientific evidence highlighting potential health concerns associated with some synthetic alternatives, further bolster the adoption of organic acids. Technological advancements in synthesis and purification processes are making these preservatives more cost-effective and efficient.

- Key Drivers:

- Consumer preference for "clean beauty" and natural ingredients.

- Regulatory pressure and restrictions on certain synthetic preservatives.

- Growing awareness of ingredient safety and potential health impacts.

- Advancements in preservative efficacy and formulation compatibility.

Conversely, significant barriers and challenges exist. The perception of lower efficacy compared to some traditional broad-spectrum synthetic preservatives can be a hurdle for certain applications requiring robust preservation. The cost of some naturally derived or specially processed organic acids can be higher than conventional alternatives, impacting product pricing. Furthermore, consumer education regarding the safety and efficacy of organic acid preservatives remains critical to overcome potential misconceptions. Supply chain disruptions and the sourcing of raw materials can also pose challenges, particularly for specialized organic acids.

- Key Barriers & Challenges:

- Perceived limitations in broad-spectrum efficacy for highly sensitive formulations.

- Higher cost of production for certain organic acid variants.

- Need for ongoing consumer education and trust-building.

- Potential supply chain volatility and raw material sourcing complexities.

- Navigating diverse global regulatory landscapes for ingredient approval.

Emerging Opportunities in Organic Acid Cosmetic Preservatives

Emerging opportunities in the Organic Acid Cosmetic Preservatives sector lie in the development of novel, multi-functional organic acid blends that offer enhanced antimicrobial protection alongside other benefits, such as antioxidant or anti-inflammatory properties. The growing interest in biodegradable and compostable packaging creates a demand for preservatives that are also environmentally benign throughout their lifecycle. Untapped markets in developing economies, where the demand for Western-style personal care products is rapidly increasing, present significant growth potential. The expansion into the "Other" application segment, including organic and natural cleaning products and personal hygiene items, also offers lucrative avenues for innovation and market penetration.

Growth Accelerators in the Organic Acid Cosmetic Preservatives Industry

Long-term growth in the Organic Acid Cosmetic Preservatives industry will be significantly accelerated by breakthroughs in biotechnology and green chemistry, enabling the cost-effective and sustainable production of a wider range of organic acids. Strategic partnerships between ingredient manufacturers and cosmetic brands will be crucial for co-developing innovative preservative solutions tailored to specific product lines and consumer demands. Market expansion strategies, particularly targeting emerging economies with tailored product offerings and educational campaigns, will drive significant growth. Investment in robust clinical trials demonstrating the safety and efficacy of organic acid preservatives will further solidify their market position and build consumer confidence.

Key Players Shaping the Organic Acid Cosmetic Preservatives Market

- Alfa Chemistry

- Arkema

- Arxada

- Ashland

- BASF

- Brenntag Specialties

- CD Formulation

- Connect Chemicals

- Creative BioMart

- DSM

- Eastman

- Evonik

- Galactic

- Innomost

- Jarchem Innovative Ingredients

- Vantage

- LANXESS

- Protameen Chemicals

- Seqens

- The Herbarie

- Thor

- Vink Chemicals

- Zhejiang Shengxiao Chemicals

Notable Milestones in Organic Acid Cosmetic Preservatives Sector

- 2020: Increased regulatory scrutiny on parabens and formaldehyde-releasers by major global health organizations, spurring demand for alternatives.

- 2021: Launch of novel plant-derived preservative blends by several key players, emphasizing natural sourcing and efficacy.

- 2022: Significant investment in R&D for biodegradable and water-soluble organic acid preservatives to improve formulation compatibility.

- 2023: Growing consumer adoption of "clean beauty" products, leading to a substantial market share increase for organic acid preservatives in skincare and makeup.

- 2024: Strategic acquisitions and mergers aimed at consolidating market position and expanding product portfolios within the cosmetic preservatives sector.

In-Depth Organic Acid Cosmetic Preservatives Market Outlook

The future outlook for the Organic Acid Cosmetic Preservatives market is exceptionally positive, driven by a confluence of sustained consumer demand for natural and safe ingredients, evolving regulatory landscapes, and ongoing technological innovation. Growth accelerators such as advancements in biotechnology for sustainable production, strategic collaborations between ingredient suppliers and cosmetic brands, and targeted market expansion into emerging economies will significantly shape the industry's trajectory. The market is expected to witness continued innovation in multi-functional preservative systems and a greater emphasis on fully biodegradable and environmentally conscious solutions, ensuring its relevance and growth in the coming years. The estimated market size in 2025 is USD 1.85 billion, with projected growth to reach approximately USD 3.2 billion by 2033, exhibiting a healthy CAGR.

Organic Acid Cosmetic Preservatives Segmentation

-

1. Application

- 1.1. Personal Care

- 1.2. Cosmetic

- 1.3. Other

-

2. Types

- 2.1. Benzoic Acid

- 2.2. Salicylates

- 2.3. Sorbic Acid

- 2.4. Other

Organic Acid Cosmetic Preservatives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Organic Acid Cosmetic Preservatives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal Care

- 5.1.2. Cosmetic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Benzoic Acid

- 5.2.2. Salicylates

- 5.2.3. Sorbic Acid

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal Care

- 6.1.2. Cosmetic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Benzoic Acid

- 6.2.2. Salicylates

- 6.2.3. Sorbic Acid

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal Care

- 7.1.2. Cosmetic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Benzoic Acid

- 7.2.2. Salicylates

- 7.2.3. Sorbic Acid

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal Care

- 8.1.2. Cosmetic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Benzoic Acid

- 8.2.2. Salicylates

- 8.2.3. Sorbic Acid

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal Care

- 9.1.2. Cosmetic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Benzoic Acid

- 9.2.2. Salicylates

- 9.2.3. Sorbic Acid

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Organic Acid Cosmetic Preservatives Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal Care

- 10.1.2. Cosmetic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Benzoic Acid

- 10.2.2. Salicylates

- 10.2.3. Sorbic Acid

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Alfa Chemistry

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arxada

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ashland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brenntag Specialties

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CD Formulation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Connect Chemicals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Creative BioMart

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DSM

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eastman

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Evonik

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Galactic

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Innomost

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Jarchem Innovative Ingredients

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Vantage

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 LANXESS

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Protameen Chemicals

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Seqens

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 The Herbarie

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Thor

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Vink Chemicals

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Zhejiang Shengxiao Chemicals

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Alfa Chemistry

List of Figures

- Figure 1: Global Organic Acid Cosmetic Preservatives Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Organic Acid Cosmetic Preservatives Revenue (million), by Application 2024 & 2032

- Figure 3: North America Organic Acid Cosmetic Preservatives Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Organic Acid Cosmetic Preservatives Revenue (million), by Types 2024 & 2032

- Figure 5: North America Organic Acid Cosmetic Preservatives Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Organic Acid Cosmetic Preservatives Revenue (million), by Country 2024 & 2032

- Figure 7: North America Organic Acid Cosmetic Preservatives Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Organic Acid Cosmetic Preservatives Revenue (million), by Application 2024 & 2032

- Figure 9: South America Organic Acid Cosmetic Preservatives Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Organic Acid Cosmetic Preservatives Revenue (million), by Types 2024 & 2032

- Figure 11: South America Organic Acid Cosmetic Preservatives Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Organic Acid Cosmetic Preservatives Revenue (million), by Country 2024 & 2032

- Figure 13: South America Organic Acid Cosmetic Preservatives Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Organic Acid Cosmetic Preservatives Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Organic Acid Cosmetic Preservatives Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Organic Acid Cosmetic Preservatives Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Organic Acid Cosmetic Preservatives Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Organic Acid Cosmetic Preservatives Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Organic Acid Cosmetic Preservatives Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Organic Acid Cosmetic Preservatives Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Organic Acid Cosmetic Preservatives Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Organic Acid Cosmetic Preservatives Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Organic Acid Cosmetic Preservatives Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Organic Acid Cosmetic Preservatives Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Organic Acid Cosmetic Preservatives Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Organic Acid Cosmetic Preservatives Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Organic Acid Cosmetic Preservatives Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Organic Acid Cosmetic Preservatives Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Acid Cosmetic Preservatives?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Organic Acid Cosmetic Preservatives?

Key companies in the market include Alfa Chemistry, Arkema, Arxada, Ashland, BASF, Brenntag Specialties, CD Formulation, Connect Chemicals, Creative BioMart, DSM, Eastman, Evonik, Galactic, Innomost, Jarchem Innovative Ingredients, Vantage, LANXESS, Protameen Chemicals, Seqens, The Herbarie, Thor, Vink Chemicals, Zhejiang Shengxiao Chemicals.

3. What are the main segments of the Organic Acid Cosmetic Preservatives?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Acid Cosmetic Preservatives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Acid Cosmetic Preservatives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Acid Cosmetic Preservatives?

To stay informed about further developments, trends, and reports in the Organic Acid Cosmetic Preservatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence