Key Insights

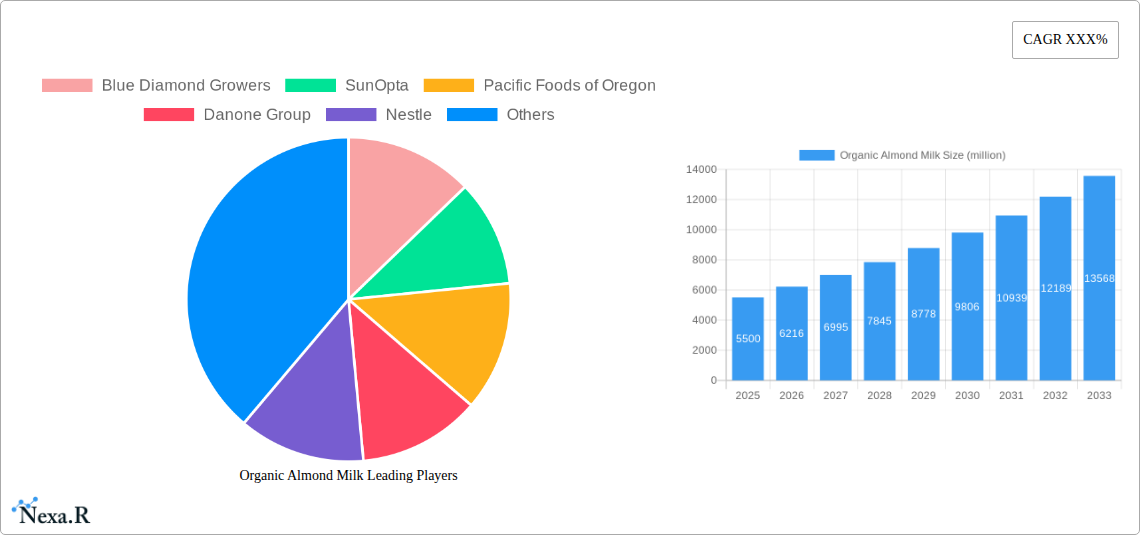

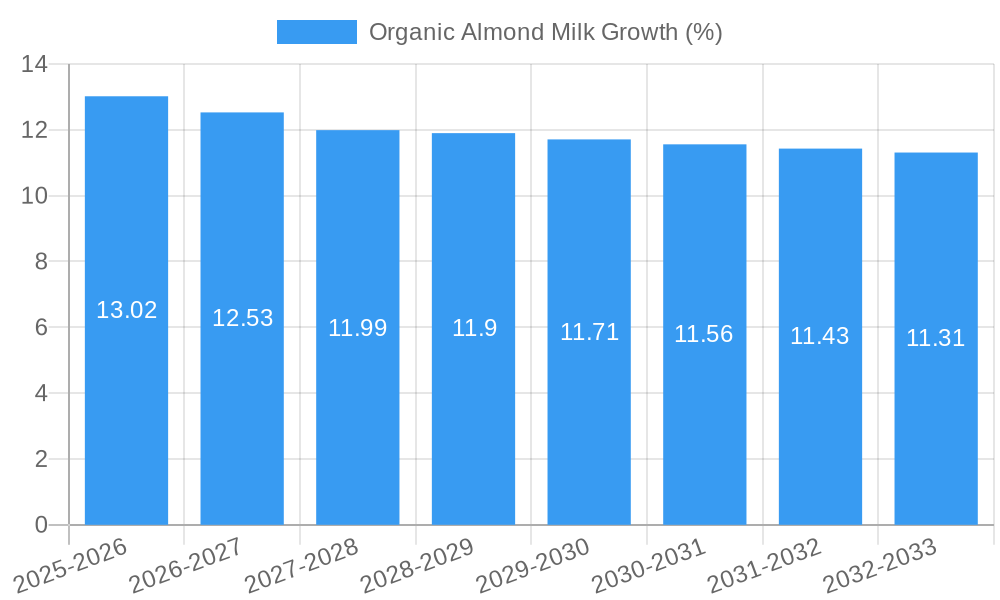

The global Organic Almond Milk market is poised for substantial growth, projected to reach an estimated USD 5,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 12.8% through 2033. This robust expansion is primarily fueled by a burgeoning consumer demand for plant-based alternatives, driven by increasing health consciousness, ethical concerns regarding animal agriculture, and a growing prevalence of lactose intolerance and dairy allergies. The "health and wellness" trend is a significant catalyst, with consumers actively seeking out products perceived as healthier and more sustainable. Online sales channels are emerging as a dominant force, owing to their convenience, wider product availability, and targeted marketing capabilities, while offline sales continue to hold ground through traditional retail channels. The liquid milk segment, being the most widely consumed form, is expected to lead the market, though advancements in milk powder formulations are also contributing to market expansion.

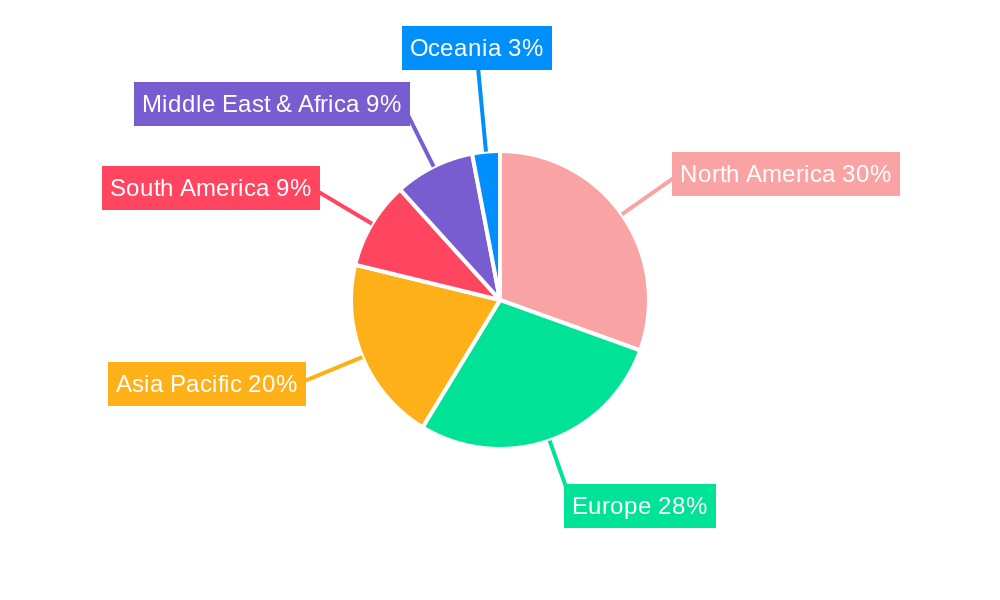

Geographically, North America and Europe are anticipated to remain the largest markets, supported by established consumer bases and advanced distribution networks for organic products. However, the Asia Pacific region is projected to witness the fastest growth, driven by rising disposable incomes, increasing urbanization, and a growing awareness of health benefits associated with organic almond milk. Key industry players like Danone Group, Nestle, and Blue Diamond Growers are actively investing in product innovation, expanding their production capacities, and focusing on sustainable sourcing to cater to evolving consumer preferences. Restraints such as the higher cost of organic produce compared to conventional alternatives and potential supply chain disruptions due to climate change could pose challenges, but the overarching positive market sentiment and supportive government initiatives for organic farming are expected to mitigate these concerns, paving the way for sustained market penetration and profitability.

This in-depth report offers a panoramic view of the global Organic Almond Milk market, providing critical insights for stakeholders across the value chain. From market dynamics and growth trajectories to regional dominance and key players, this study equips industry professionals with actionable intelligence to navigate the evolving landscape. The report is meticulously structured to deliver concise yet impactful information, leveraging high-traffic keywords and comprehensive market data.

Organic Almond Milk Market Dynamics & Structure

The organic almond milk market is characterized by a moderate level of concentration, with a few key global players holding significant market shares, alongside a dynamic landscape of smaller, innovative companies. Technological innovation is a primary driver, particularly in processing techniques that enhance shelf-life, texture, and nutritional profiles, while also reducing water consumption in almond cultivation. Regulatory frameworks, though varying by region, are increasingly focusing on organic certifications and labeling transparency, influencing production standards and consumer trust. Competitive product substitutes, including other plant-based milks (oat, soy, coconut) and conventional dairy milk, present a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are shifting towards health-conscious millennials and Gen Z consumers, urban populations, and individuals with lactose intolerance or dietary restrictions. Mergers and acquisitions (M&A) are playing a crucial role in market consolidation and expansion, with significant deal volumes observed in recent years as larger corporations seek to acquire innovative brands and expand their plant-based portfolios. Barriers to innovation include the high cost of organic certification, volatile almond prices, and the need for significant investment in sustainable sourcing and production technologies.

- Market Concentration: Moderate, with a mix of global leaders and niche players.

- Technological Innovation Drivers: Shelf-life enhancement, texture improvement, nutritional fortification, sustainable farming practices.

- Regulatory Frameworks: Growing emphasis on organic certification, food safety standards, and clear labeling.

- Competitive Product Substitutes: Oat milk, soy milk, coconut milk, dairy milk.

- End-User Demographics: Health-conscious consumers, millennials, Gen Z, urban dwellers, lactose-intolerant individuals.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

- Innovation Barriers: High certification costs, almond price volatility, investment in sustainable production.

Organic Almond Milk Growth Trends & Insights

The global organic almond milk market has witnessed remarkable expansion, driven by a confluence of evolving consumer preferences, growing health awareness, and increasing adoption of plant-based diets. The market size has evolved from an estimated \$5,200 million in 2019 to \$7,500 million in 2024, showcasing a robust historical growth trajectory. This expansion is projected to continue at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033, propelling the market value to an estimated \$13,500 million by 2033. Adoption rates are particularly high in developed economies, where consumer awareness regarding the health and environmental benefits of organic almond milk is well-established. Technological disruptions, such as advancements in almond processing for improved taste and texture, and innovations in packaging for enhanced sustainability and convenience, are significantly influencing market dynamics. Consumer behavior shifts are a pivotal factor, with a growing segment of the population actively seeking dairy alternatives due to perceived health advantages, ethical concerns related to animal welfare, and a desire for a more sustainable food system. The increasing prevalence of lactose intolerance and dairy allergies further fuels the demand for almond milk as a viable and nutritious substitute. The market penetration of organic almond milk is steadily increasing, especially within the broader plant-based milk category, as consumers become more discerning about ingredient sourcing and product quality. Insights from our extensive research indicate that the perceived health benefits, including lower saturated fat content and absence of cholesterol, coupled with the creamy texture and mild flavor, are key attractors for a wider consumer base. Furthermore, the accessibility of organic almond milk through various distribution channels, including online sales and supermarkets, has contributed to its mainstream appeal. The market is also benefiting from endorsements by health and wellness influencers and increased availability in foodservice establishments, further normalizing its consumption.

Dominant Regions, Countries, or Segments in Organic Almond Milk

North America, particularly the United States, has emerged as a dominant region in the global organic almond milk market, driven by a sophisticated consumer base with a high propensity for adopting health-conscious and plant-based dietary trends. The country's advanced retail infrastructure, encompassing both extensive offline sales channels like supermarkets and a well-developed online sales segment, ensures widespread availability. The primary segment driving this dominance is Liquid Milk, which constitutes the vast majority of organic almond milk consumption. Milk Powder, while a niche segment, is also showing potential for growth due to its longer shelf life and convenience for specific applications. Key drivers in North America include strong consumer awareness regarding the health benefits of organic products and plant-based alternatives, supported by robust marketing campaigns and product innovation. Favorable economic policies promoting sustainable agriculture and a high disposable income among the target demographic further bolster market growth.

In terms of specific countries, the United States leads due to its large population and established demand for plant-based beverages. Canada also contributes significantly, mirroring many of the trends observed in the U.S. market. The Application segment of Online Sales has witnessed exponential growth, facilitated by the convenience of e-commerce platforms and direct-to-consumer models, allowing brands to reach a broader audience and offer specialized products. Offline Sales, however, continue to hold a substantial market share, driven by impulse purchases and the traditional shopping habits of a significant portion of the population. The Type segment of Liquid Milk is the undisputed leader, offering immediate usability in various culinary applications and as a beverage.

Key drivers underpinning North America's dominance include:

- High Consumer Awareness: Extensive knowledge of health and environmental benefits.

- Developed Retail Infrastructure: Widespread availability through online and offline channels.

- Strong Purchasing Power: High disposable income among target demographics.

- Supportive Economic Policies: Incentives for organic farming and sustainable practices.

- Innovations in Product Development: Focus on taste, texture, and nutritional fortification.

Organic Almond Milk Product Landscape

The organic almond milk product landscape is characterized by continuous innovation focused on enhancing consumer appeal and addressing specific dietary needs. Key product innovations include the development of unsweetened variants, catering to health-conscious consumers, and the fortification of almond milk with essential nutrients like calcium, Vitamin D, and Vitamin B12, aligning with nutritional requirements often associated with dairy milk. Unique selling propositions often revolve around the purity of ingredients, sustainable sourcing of almonds, and allergen-friendly formulations. Technological advancements in processing aim to reduce water content and improve the creamy texture and mouthfeel, making it a more palatable substitute for traditional dairy. Applications extend beyond simple beverage consumption to include use in coffee, smoothies, baking, and cooking, underscoring its versatility.

Key Drivers, Barriers & Challenges in Organic Almond Milk

Key Drivers:

- Growing Health and Wellness Trend: Increased consumer focus on plant-based diets and dairy alternatives for perceived health benefits.

- Rising Incidence of Lactose Intolerance and Dairy Allergies: Driving demand for dairy-free options.

- Environmental Sustainability Concerns: Almond milk is often perceived as having a lower environmental footprint compared to dairy milk.

- Product Innovation and Variety: Introduction of flavored, unsweetened, and fortified variants catering to diverse preferences.

- Expanding Distribution Channels: Increased availability in supermarkets, online platforms, and foodservice.

Barriers & Challenges:

- Water Scarcity and Almond Cultivation Practices: Concerns regarding the water intensity of almond farming can impact consumer perception and supply chain stability.

- Competition from Other Plant-Based Milks: Intense competition from oat, soy, coconut, and other milk alternatives.

- Price Sensitivity: Organic almond milk can be priced higher than conventional dairy or other plant-based options, impacting affordability for some consumers.

- Supply Chain Volatility: Fluctuations in almond crop yields and prices can affect production costs and market stability.

- Stringent Organic Certification Requirements: Maintaining organic certification involves significant compliance and verification processes.

Emerging Opportunities in Organic Almond Milk

Emerging opportunities within the organic almond milk sector lie in tapping into underserved markets with tailored product offerings and expanding into innovative applications. There is a growing demand for functional almond milk fortified with probiotics for gut health and adaptogens for stress management, aligning with the trend towards holistic wellness. Untapped markets in developing economies, where awareness of plant-based diets is gaining traction, present significant growth potential. Furthermore, the development of shelf-stable, single-serve organic almond milk for on-the-go consumption and its integration into plant-based meal replacement products represent exciting avenues for expansion.

Growth Accelerators in the Organic Almond Milk Industry

Catalysts driving long-term growth in the organic almond milk industry include significant technological breakthroughs in sustainable almond cultivation, such as water-efficient irrigation techniques and regenerative farming practices, which address environmental concerns and enhance supply chain resilience. Strategic partnerships between almond growers and milk processors are crucial for ensuring a stable and high-quality supply. Furthermore, market expansion strategies focusing on emerging economies, coupled with targeted marketing campaigns emphasizing the health and environmental benefits, will accelerate adoption rates. The development of novel processing technologies that further improve taste, texture, and nutritional profile, while reducing production costs, will also be a key growth accelerator.

Key Players Shaping the Organic Almond Milk Market

- Blue Diamond Growers

- SunOpta

- Pacific Foods of Oregon

- Danone Group

- Nestle

- Orgain Inc

- Sanitarium Health Food

- Hiland Dairy

- Nutriops

- Natura Foods

- The Hain Celestial Group

- Pureharvest

- Bridge

- Mand’Or Organic Almond Milk

- Elmhurst Milked Direct

Notable Milestones in Organic Almond Milk Sector

- 2019: Increased consumer demand for plant-based alternatives surged globally, boosting organic almond milk sales.

- 2020: Major dairy companies began investing heavily in plant-based milk portfolios, including organic almond milk, through acquisitions and new product launches.

- 2021: Innovations in packaging focused on sustainability, such as recyclable materials and reduced plastic usage, gained momentum.

- 2022: Growing awareness of health benefits, particularly for lactose-intolerant consumers, solidified organic almond milk's market position.

- 2023: Advancements in almond processing technologies improved taste and texture, making organic almond milk more appealing to a wider audience.

- 2024: Emphasis on ethical sourcing and sustainable farming practices became a key differentiator for brands.

In-Depth Organic Almond Milk Market Outlook

The future outlook for the organic almond milk market remains exceptionally strong, driven by sustained consumer interest in health, wellness, and environmental sustainability. Growth accelerators, including advancements in water-efficient almond farming and innovative product formulations, will continue to propel market expansion. Strategic partnerships and investments in research and development for enhanced nutritional profiles and novel applications will further solidify its position. The increasing penetration into emerging markets and the continuous refinement of product offerings to meet evolving consumer preferences will ensure robust growth throughout the forecast period, presenting significant opportunities for stakeholders within the global organic almond milk industry.

Organic Almond Milk Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Type

- 2.1. Liquid Milk

- 2.2. Milk Powder

Organic Almond Milk Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Organic Almond Milk REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Liquid Milk

- 5.2.2. Milk Powder

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Liquid Milk

- 6.2.2. Milk Powder

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Liquid Milk

- 7.2.2. Milk Powder

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Liquid Milk

- 8.2.2. Milk Powder

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Liquid Milk

- 9.2.2. Milk Powder

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Organic Almond Milk Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Liquid Milk

- 10.2.2. Milk Powder

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Blue Diamond Growers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SunOpta

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pacific Foods of Oregon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Danone Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nestle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Orgain Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanitarium Health Food

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hiland Dairy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nutriops

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Natura Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Hain Celestial Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pureharvest

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bridge

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mand’Or Organic Almond Milk

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Elmhurst Milked Direct

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Blue Diamond Growers

List of Figures

- Figure 1: Global Organic Almond Milk Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Organic Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 3: North America Organic Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Organic Almond Milk Revenue (million), by Type 2024 & 2032

- Figure 5: North America Organic Almond Milk Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Organic Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 7: North America Organic Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Organic Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 9: South America Organic Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Organic Almond Milk Revenue (million), by Type 2024 & 2032

- Figure 11: South America Organic Almond Milk Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Organic Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 13: South America Organic Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Organic Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Organic Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Organic Almond Milk Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Organic Almond Milk Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Organic Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Organic Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Organic Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Organic Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Organic Almond Milk Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Organic Almond Milk Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Organic Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Organic Almond Milk Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Organic Almond Milk Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Organic Almond Milk Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Organic Almond Milk Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Organic Almond Milk Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Organic Almond Milk Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Organic Almond Milk Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Organic Almond Milk Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Organic Almond Milk Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Organic Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Organic Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Organic Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Organic Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Organic Almond Milk Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Organic Almond Milk Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Organic Almond Milk Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Organic Almond Milk Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Almond Milk?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Organic Almond Milk?

Key companies in the market include Blue Diamond Growers, SunOpta, Pacific Foods of Oregon, Danone Group, Nestle, Orgain Inc, Sanitarium Health Food, Hiland Dairy, Nutriops, Natura Foods, The Hain Celestial Group, Pureharvest, Bridge, Mand’Or Organic Almond Milk, Elmhurst Milked Direct.

3. What are the main segments of the Organic Almond Milk?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Almond Milk," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Almond Milk report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Almond Milk?

To stay informed about further developments, trends, and reports in the Organic Almond Milk, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence