Key Insights

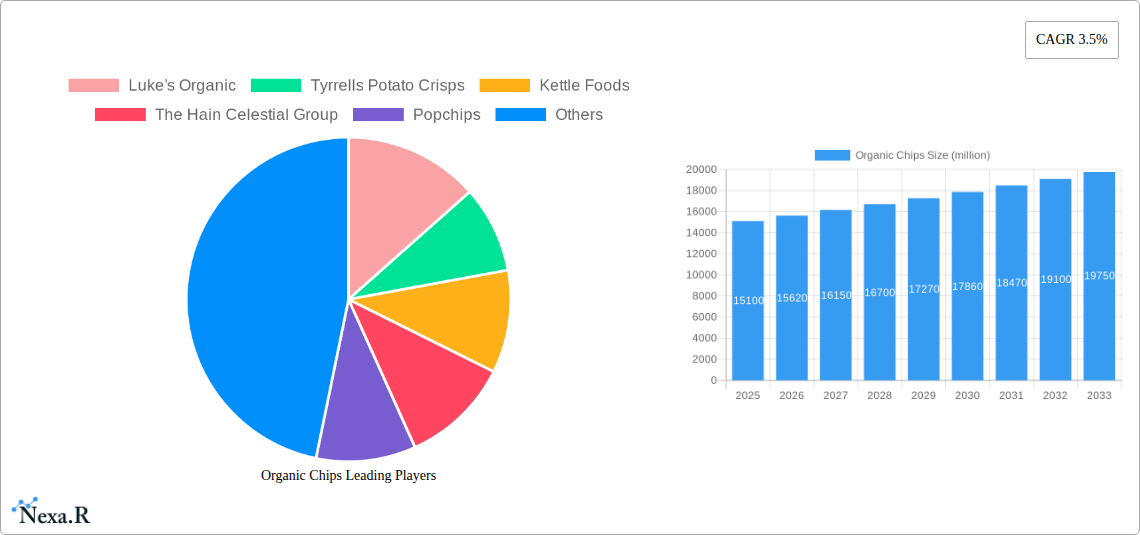

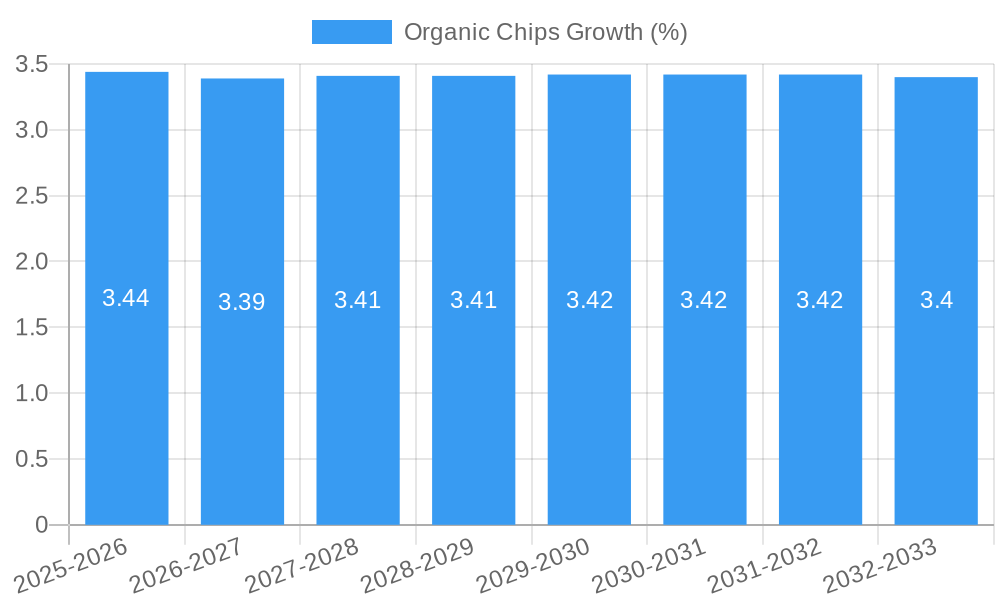

The global organic chips market is poised for substantial growth, projected to reach a market size of $20,600 million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 3.5% throughout the forecast period of 2025-2033. This robust expansion is driven by a confluence of evolving consumer preferences and increasing awareness regarding the health and environmental benefits associated with organic products. The rising demand for healthier snacking alternatives, free from artificial additives, pesticides, and genetically modified organisms, is a primary catalyst. Consumers are increasingly seeking transparent food sourcing and are willing to pay a premium for products that align with their wellness goals and ethical considerations. This trend is particularly evident in developed economies where disposable incomes are higher, and a strong emphasis is placed on preventive healthcare and sustainable consumption. The convenience of organic chip options across various retail channels further bolsters market penetration, making them more accessible to a wider consumer base.

Several key drivers are propelling the organic chips market forward. The growing health consciousness among consumers worldwide, coupled with an increased prevalence of lifestyle-related diseases, is a significant factor. Consumers are actively seeking "better-for-you" options, and organic chips fit this demand perfectly. Furthermore, the expanding distribution networks, encompassing online platforms and specialized organic stores, are enhancing product accessibility. The rising popularity of plant-based diets and the increasing adoption of gluten-free and non-GMO product choices also contribute positively to market growth. However, the market also faces certain restraints, including the higher production costs associated with organic farming, which translate to a premium pricing strategy for organic chips compared to conventional alternatives. This price sensitivity can be a barrier for some consumer segments. Despite these challenges, the persistent demand for clean-label products and the innovative product development by key market players are expected to overcome these hurdles, ensuring sustained market expansion.

Comprehensive Organic Chips Market Analysis: 2019-2033

This in-depth report provides a thorough examination of the global organic chips market, offering critical insights for industry stakeholders. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study delves into market dynamics, growth trends, regional dominance, product innovation, and key players. It is structured to deliver actionable intelligence, leveraging high-traffic keywords like "organic snacks," "healthy chips," "plant-based snacks," and "natural food market" to maximize SEO visibility. The analysis also incorporates parent and child market perspectives, detailing the influence of broader healthy food trends on the specialized organic chips sector. All quantitative values are presented in million units for clear comprehension.

Organic Chips Market Dynamics & Structure

The global organic chips market is characterized by a moderately concentrated structure, with a blend of established food conglomerates and agile niche players. Technological innovation is primarily driven by advancements in processing techniques that preserve nutrient content and texture, alongside the development of novel flavor profiles and ingredient sourcing. Regulatory frameworks, focusing on organic certification standards and labeling requirements, play a crucial role in shaping market entry and consumer trust. Competitive product substitutes include other organic snack categories such as pretzels, popcorn, and fruit snacks, as well as conventional, non-organic chips. End-user demographics reveal a growing consumer base influenced by health consciousness, environmental sustainability, and a preference for transparent ingredient sourcing. Mergers & Acquisitions (M&A) trends are visible, with larger companies acquiring smaller, innovative organic brands to expand their healthy product portfolios.

- Market Concentration: Moderate, with key players holding significant but not dominant shares.

- Technological Innovation Drivers: Enhanced processing, new flavor development, sustainable ingredient sourcing.

- Regulatory Frameworks: Organic certification (e.g., USDA Organic), ingredient transparency mandates.

- Competitive Product Substitutes: Organic pretzels, popcorn, fruit snacks, conventional chips.

- End-User Demographics: Health-conscious consumers, environmentally aware individuals, millennials, Gen Z.

- M&A Trends: Acquisitions of smaller organic brands by larger food corporations, strategic partnerships.

- Innovation Barriers: High R&D costs for novel ingredients, stringent organic certification processes, scaling production while maintaining organic integrity.

Organic Chips Growth Trends & Insights

The organic chips market is poised for robust expansion, fueled by a confluence of evolving consumer preferences and industry advancements. The market size for organic chips is projected to experience substantial growth, escalating from approximately $5,200 million units in 2024 to an estimated $9,500 million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 7.5%. Adoption rates are steadily increasing as consumers become more aware of the health benefits associated with organic produce and the absence of synthetic pesticides and GMOs. Technological disruptions are playing a vital role, with innovations in sustainable farming practices and advanced processing technologies enhancing the nutritional value and shelf-life of organic ingredients used in chip production. Consumer behavior shifts are a significant driver, with a discernible trend towards mindful snacking and a willingness to pay a premium for healthier, ethically sourced food options. The "better-for-you" snack trend, encompassing organic and natural ingredients, continues to gain momentum, pushing organic chips from a niche product to a mainstream category. Furthermore, the growing appeal of plant-based diets and the increasing demand for gluten-free and allergen-friendly options within the organic segment are contributing to accelerated adoption. The increasing accessibility of organic chips through various retail channels, including online platforms, further bolsters their market penetration.

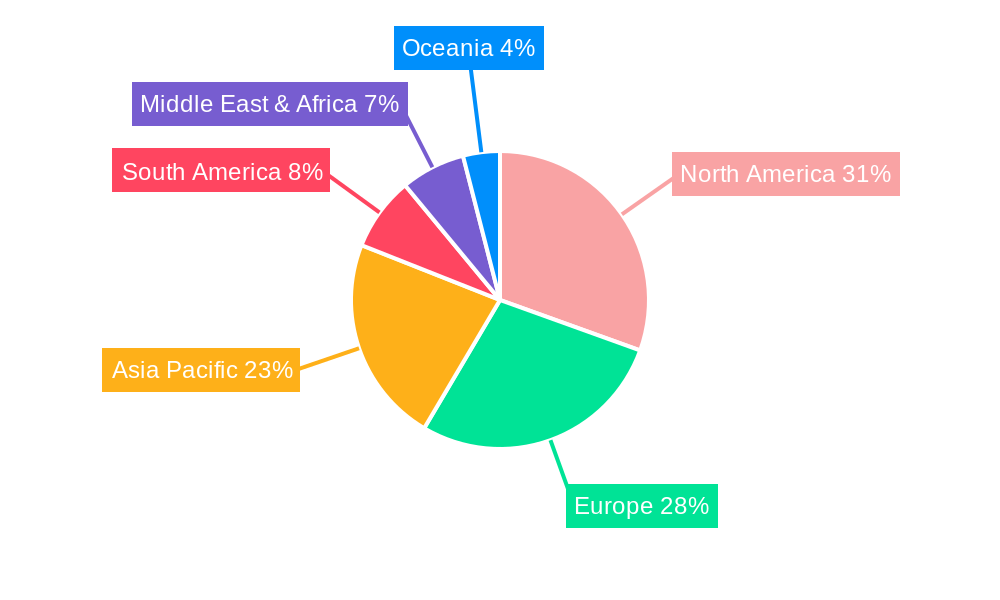

Dominant Regions, Countries, or Segments in Organic Chips

North America, particularly the United States, is identified as the dominant region driving growth in the organic chips market. This leadership is attributed to a highly developed consumer base with a strong predisposition towards healthy and sustainable food choices. The Supermarkets & Hypermarkets segment within the Application category is the primary distribution channel, commanding the largest market share due to its extensive reach and the ability to cater to bulk purchases of everyday staples like snacks. The Vegetable type segment, encompassing popular options like sweet potato, kale, and beet chips, is a leading driver of growth within the Type category, aligning with the rising popularity of vegetable-based snacks and the perceived health advantages.

Dominant Region: North America (specifically the United States).

- Key Drivers: High consumer spending power, strong health and wellness consciousness, robust organic certification infrastructure, extensive retail networks.

- Market Share: Estimated to hold over 40% of the global organic chips market share in 2025.

- Growth Potential: Continued innovation in product offerings and expanding distribution channels will sustain its dominance.

Dominant Application Segment: Supermarkets & Hypermarkets.

- Key Drivers: Widespread availability, convenient one-stop shopping experience, promotional activities, wider product assortment.

- Market Share: Expected to account for approximately 55% of the organic chips market in 2025.

- Growth Potential: E-commerce growth will offer competition, but traditional retail's convenience will ensure continued dominance.

Dominant Type Segment: Vegetable.

- Key Drivers: Perceived health benefits, diverse flavor profiles, appeal to health-conscious consumers, innovation in vegetable varieties.

- Market Share: Estimated to capture around 60% of the organic chips market in 2025.

- Growth Potential: Ongoing consumer demand for nutrient-dense snacks and new vegetable-based product introductions will fuel sustained growth.

Organic Chips Product Landscape

The organic chips product landscape is defined by continuous innovation, focusing on diverse vegetable bases, unique flavor fusions, and enhanced nutritional profiles. Product innovations include the incorporation of ancient grains and legumes, offering higher protein and fiber content. Applications range from standalone healthy snacks to ingredients in salads and other dishes. Performance metrics are increasingly centered on ingredient transparency, organic certifications, and the absence of artificial additives. Unique selling propositions often revolve around sustainable sourcing, non-GMO ingredients, and artisanal production methods. Technological advancements are enabling the creation of crisper textures and longer shelf lives without compromising on the natural qualities of the ingredients.

Key Drivers, Barriers & Challenges in Organic Chips

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of the link between diet and well-being is a primary driver, increasing demand for "better-for-you" snack options.

- Demand for Natural & Organic Ingredients: Consumers are actively seeking products free from pesticides, herbicides, and GMOs, directly benefiting the organic chips market.

- Plant-Based Trend: The increasing popularity of plant-based diets aligns perfectly with the ingredient base of many organic vegetable and fruit chips.

- Sustainability Concerns: Consumers are increasingly prioritizing environmentally friendly products, and organic farming practices often align with these values.

Barriers & Challenges:

- Higher Production Costs: Organic farming and certification processes can lead to higher raw material and manufacturing costs, translating to premium pricing for consumers.

- Supply Chain Volatility: Sourcing consistent, high-quality organic ingredients can be challenging due to seasonal availability and smaller-scale organic farming operations.

- Price Sensitivity: While demand for organic is growing, some consumer segments remain price-sensitive, making it difficult to compete with conventional snack options.

- Regulatory Hurdles: Navigating and adhering to diverse organic certification standards across different regions can be complex and costly for manufacturers.

- Competitive Landscape: Intense competition from both established snack brands introducing healthier lines and other emerging organic snack categories.

Emerging Opportunities in Organic Chips

Emerging opportunities in the organic chips market lie in the untapped potential of lesser-known vegetables and exotic fruits as base ingredients, offering novel flavor profiles and enhanced nutritional benefits. There is significant scope for innovation in plant-based protein-enriched organic chips, catering to fitness-conscious consumers. Furthermore, the development of functional organic chips, incorporating ingredients with specific health benefits like prebiotics or adaptogens, presents a lucrative avenue. Expanding into emerging economies with growing middle classes and increasing awareness of health and wellness also represents a substantial opportunity. Innovations in sustainable packaging solutions will also resonate strongly with the environmentally conscious organic consumer.

Growth Accelerators in the Organic Chips Industry

Long-term growth in the organic chips industry will be significantly accelerated by ongoing technological breakthroughs in processing that enhance nutrient retention and texture. Strategic partnerships between organic farmers and snack manufacturers will ensure a stable and high-quality supply chain. Market expansion strategies, including targeted marketing campaigns emphasizing health and environmental benefits, will drive increased consumer adoption. The development of convenient, single-serving organic chip packs for on-the-go consumption will further boost accessibility and appeal. Continued investment in research and development for new flavor profiles and ingredient combinations will keep the product offering fresh and exciting for consumers.

Key Players Shaping the Organic Chips Market

- Luke’s Organic

- Tyrrells Potato Crisps

- Kettle Foods

- The Hain Celestial Group

- Popchips

- Rhythm Superfoods

- General Mills

Notable Milestones in Organic Chips Sector

- 2019: Increased consumer demand for plant-based snacks led to the launch of new vegetable-based organic chips by several brands.

- 2020: Growing awareness of health and wellness, amplified by global events, boosted sales of organic and healthy snack options.

- 2021: The Hain Celestial Group expanded its organic snack portfolio through strategic acquisitions.

- 2022: Kettle Foods introduced innovative flavor combinations in its organic potato chip line, gaining significant market traction.

- 2023: Rhythm Superfoods saw a surge in popularity for its kale chips, highlighting the demand for nutrient-dense alternatives.

- 2024: Increased focus on sustainable packaging solutions within the organic snack industry, with brands experimenting with compostable and recyclable materials.

In-Depth Organic Chips Market Outlook

The future outlook for the organic chips market is exceptionally promising, driven by sustained growth accelerators. Technological advancements in sustainable agriculture and food processing will continue to enhance product quality and affordability. Strategic alliances and market expansion initiatives will broaden consumer access and brand visibility. The industry is expected to witness further innovation in product development, with a focus on functional ingredients and diverse vegetable and fruit bases. The increasing consumer preference for transparent sourcing and environmentally conscious brands will solidify the market's growth trajectory, positioning organic chips as a cornerstone of the modern healthy snack landscape.

Organic Chips Segmentation

-

1. Application

- 1.1. Supermarkets & Hypermarkets

- 1.2. Convenience Stores

- 1.3. Online Stores

- 1.4. Others

-

2. Type

- 2.1. Vegetable

- 2.2. Fruits

- 2.3. Cereals

- 2.4. Others

Organic Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Organic Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarkets & Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Online Stores

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Vegetable

- 5.2.2. Fruits

- 5.2.3. Cereals

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Organic Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarkets & Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Online Stores

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Vegetable

- 6.2.2. Fruits

- 6.2.3. Cereals

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Organic Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarkets & Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Online Stores

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Vegetable

- 7.2.2. Fruits

- 7.2.3. Cereals

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Organic Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarkets & Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Online Stores

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Vegetable

- 8.2.2. Fruits

- 8.2.3. Cereals

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Organic Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarkets & Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Online Stores

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Vegetable

- 9.2.2. Fruits

- 9.2.3. Cereals

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Organic Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarkets & Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Online Stores

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Vegetable

- 10.2.2. Fruits

- 10.2.3. Cereals

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Luke’s Organic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tyrrells Potato Crisps

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kettle Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Hain Celestial Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Popchips

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rhythm Superfoods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Mills

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Luke’s Organic

List of Figures

- Figure 1: Global Organic Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Organic Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America Organic Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Organic Chips Revenue (million), by Type 2024 & 2032

- Figure 5: North America Organic Chips Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Organic Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America Organic Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Organic Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America Organic Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Organic Chips Revenue (million), by Type 2024 & 2032

- Figure 11: South America Organic Chips Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Organic Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America Organic Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Organic Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Organic Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Organic Chips Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Organic Chips Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Organic Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Organic Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Organic Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Organic Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Organic Chips Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Organic Chips Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Organic Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Organic Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Organic Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Organic Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Organic Chips Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Organic Chips Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Organic Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Organic Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Organic Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Organic Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Organic Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Organic Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Organic Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Organic Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Organic Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Organic Chips Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Organic Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Organic Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Chips?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Organic Chips?

Key companies in the market include Luke’s Organic, Tyrrells Potato Crisps, Kettle Foods, The Hain Celestial Group, Popchips, Rhythm Superfoods, General Mills.

3. What are the main segments of the Organic Chips?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20600 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Chips?

To stay informed about further developments, trends, and reports in the Organic Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence