Key Insights

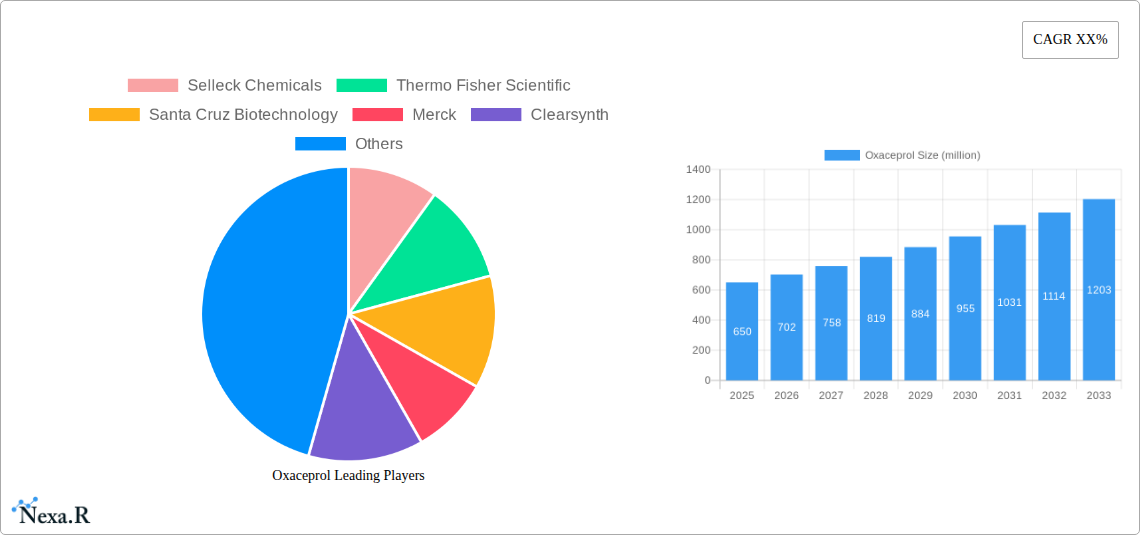

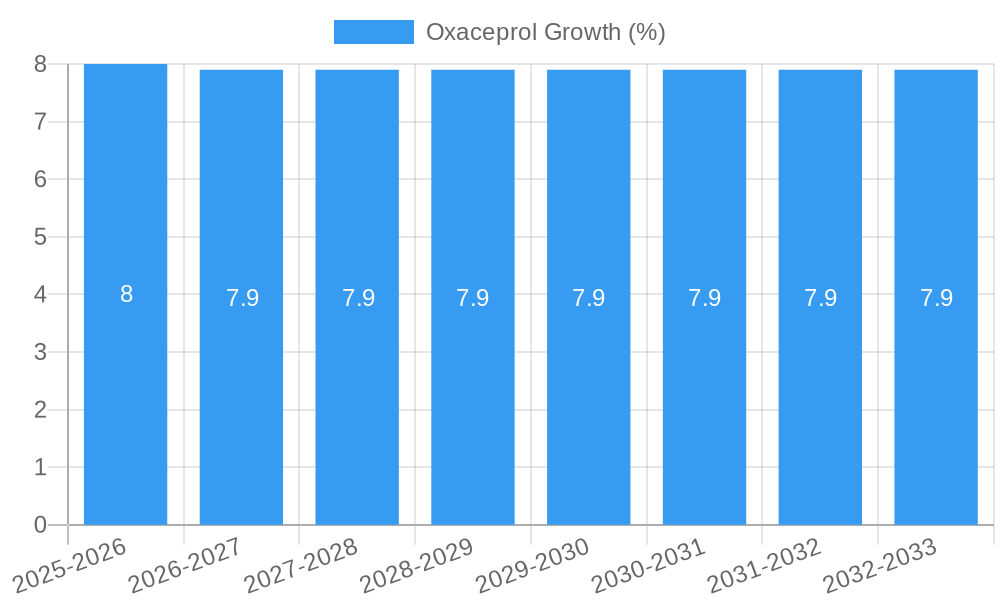

The global Oxaceprol market is poised for significant growth, projected to reach an estimated market size of $650 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8%. This expansion is primarily fueled by the increasing prevalence of osteoarthritis and other inflammatory conditions requiring effective therapeutic interventions. The demand for high-purity Oxaceprol, particularly grades exceeding 99%, is on an upward trajectory, driven by stringent regulatory requirements and a growing preference for advanced pharmaceutical formulations in research and medical applications. Key market drivers include a rising awareness of Oxaceprol's chondroprotective properties and its favorable safety profile compared to traditional anti-inflammatory drugs. Technological advancements in synthesis and purification techniques are also contributing to market expansion by ensuring the availability of consistent, high-quality Oxaceprol.

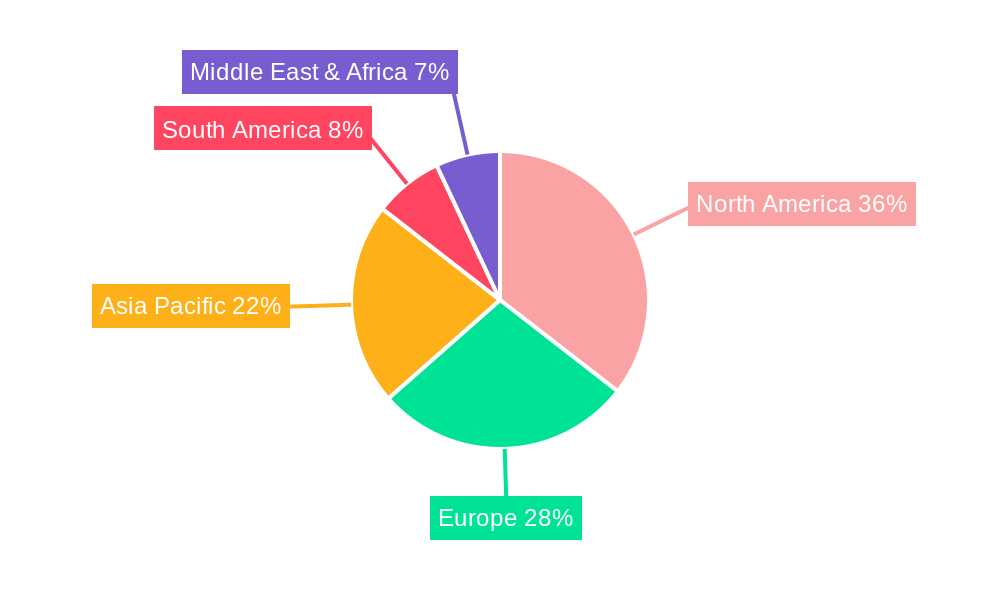

Despite the promising outlook, the Oxaceprol market faces certain restraints, including the relatively high cost of production for ultra-pure grades and the availability of alternative treatments. However, ongoing research and development efforts are focused on optimizing manufacturing processes to reduce costs and enhance efficacy, which are expected to mitigate these challenges. Geographically, North America is anticipated to lead the market due to its advanced healthcare infrastructure and high expenditure on pharmaceutical research. The Asia Pacific region is expected to exhibit the fastest growth, spurred by increasing healthcare spending, a growing patient population, and the expansion of domestic pharmaceutical manufacturing capabilities. Key players like Selleck Chemicals, Thermo Fisher Scientific, and Merck are actively involved in expanding their product portfolios and geographical reach, further stimulating market dynamics. The market segmentation by purity levels highlights a clear trend towards premium products, indicating a shift towards more sophisticated therapeutic solutions.

Oxaceprol Market Research Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth Oxaceprol market research report offers a detailed examination of the global Oxaceprol market, providing critical insights for industry professionals, researchers, and stakeholders. The report covers market dynamics, growth trends, regional analysis, product landscape, key drivers, emerging opportunities, and a competitive overview. Leveraging extensive data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report delivers a robust market outlook, vital for strategic decision-making in the pharmaceutical and chemical industries.

Oxaceprol Market Dynamics & Structure

The Oxaceprol market is characterized by a moderate concentration, with a few key players holding significant market share. Technological innovation plays a crucial role in market evolution, driven by advancements in synthesis processes and the development of higher purity grades. Regulatory frameworks, particularly concerning pharmaceutical applications and quality control, are essential determinants of market access and growth. Competitive product substitutes exist, primarily in the broader category of anti-inflammatory agents, though Oxaceprol's specific mechanisms of action offer unique therapeutic advantages. End-user demographics are largely defined by the medical and research communities, with a growing interest from the latter for novel drug discovery and development. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, enhance their manufacturing capabilities, and gain a stronger foothold in key geographical markets.

- Market Concentration: Moderate, with key players focusing on R&D and specialized production.

- Technological Innovation Drivers: Purity enhancements, novel synthesis routes, and expanding application research.

- Regulatory Frameworks: Stringent pharmaceutical quality standards and patent landscape influence market entry and product development.

- Competitive Product Substitutes: Broad spectrum NSAIDs and other chondroprotective agents.

- End-User Demographics: Primarily medical institutions, academic research laboratories, and contract research organizations (CROs).

- M&A Trends: Strategic acquisitions to bolster market presence and integrate upstream/downstream capabilities.

Oxaceprol Growth Trends & Insights

The Oxaceprol market is poised for steady growth, driven by increasing research applications and its recognized role in managing osteoarthritic conditions. The market size is projected to expand from an estimated $XXX million in 2025 to $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Adoption rates are steadily increasing, particularly within the medical segment where its efficacy in improving joint function and reducing pain is being further elucidated through ongoing clinical studies. Technological disruptions, such as advancements in enantioselective synthesis, are contributing to the availability of higher purity Oxaceprol, thereby enhancing its therapeutic profile and appeal for sophisticated research. Consumer behavior shifts within the healthcare sector, favoring treatments with improved safety profiles and targeted mechanisms of action, further bolster Oxaceprol's market penetration. The growing prevalence of osteoarthritis globally, coupled with an aging population, provides a robust foundation for sustained market expansion.

Dominant Regions, Countries, or Segments in Oxaceprol

The Medical application segment is anticipated to be the dominant force in the global Oxaceprol market throughout the forecast period. This dominance is underpinned by the increasing incidence of osteoarthritis and other degenerative joint diseases worldwide, creating a substantial patient pool seeking effective and well-tolerated treatment options. North America and Europe currently lead in terms of market share, attributed to well-established healthcare infrastructures, high disposable incomes, and a proactive approach to managing chronic conditions. The demand for Min Purity 98%-99% Oxaceprol is particularly strong within the medical sector, as this purity level often strikes a balance between efficacy and cost-effectiveness for pharmaceutical formulations.

- Dominant Segment: Medical Application

- Key Drivers: Rising global prevalence of osteoarthritis, aging population, increased healthcare expenditure, and growing awareness of Oxaceprol's therapeutic benefits.

- Market Share Contribution: Estimated to hold xx% of the total market value in 2025.

- Growth Potential: Significant, driven by ongoing clinical research and expanding treatment guidelines.

- Leading Regions:

- North America: Strong regulatory approvals, advanced healthcare systems, and robust R&D investments.

- Europe: Extensive clinical trials, high patient acceptance, and supportive reimbursement policies for osteoarthritis management.

- Dominant Purity Type: Min Purity 98%-99%

- Rationale: Optimal balance of quality and cost for pharmaceutical applications, meeting stringent regulatory requirements for therapeutic use.

- Market Penetration: Expected to account for xx% of the total Oxaceprol sales volume by 2025.

Oxaceprol Product Landscape

The Oxaceprol product landscape is characterized by a focus on enhancing purity and exploring novel delivery mechanisms. Innovations in synthesis are yielding Oxaceprol with improved stereochemical purity, leading to enhanced therapeutic efficacy and reduced potential for side effects in medical applications. Research institutions are leveraging highly pure Oxaceprol grades for advanced studies in molecular biology, drug discovery, and the development of new therapeutic interventions for inflammatory and degenerative diseases. Unique selling propositions include its mechanism of action, which targets collagen synthesis, offering a distinct advantage over traditional anti-inflammatory agents.

Key Drivers, Barriers & Challenges in Oxaceprol

Key Drivers:

- Increasing prevalence of osteoarthritis: A major catalyst for demand in the medical sector.

- Growing R&D investments: Fueling exploration of new applications and enhanced synthesis.

- Advancements in pharmaceutical synthesis: Enabling higher purity and more cost-effective production.

- Supportive regulatory pathways for pharmaceutical ingredients: Facilitating market entry for compliant Oxaceprol.

Barriers & Challenges:

- Competition from established NSAIDs: Widespread availability and lower cost of some alternatives.

- Stringent regulatory approval processes: For new pharmaceutical formulations and indications.

- Supply chain complexities: Ensuring consistent quality and availability of raw materials for synthesis.

- Cost of high-purity Oxaceprol: Can be a limiting factor for some research applications and markets.

Emerging Opportunities in Oxaceprol

Emerging opportunities in the Oxaceprol market lie in the exploration of its neuroprotective properties and potential applications in treating other inflammatory conditions beyond osteoarthritis. Further research into its effect on extracellular matrix metabolism could unlock new therapeutic avenues. The increasing demand for high-purity compounds in academic and pharmaceutical research presents a significant opportunity for specialized manufacturers. Additionally, the growing awareness of targeted therapies in regenerative medicine could pave the way for novel formulations and applications of Oxaceprol. The expansion into emerging economies with increasing healthcare expenditure also presents a substantial growth prospect.

Growth Accelerators in the Oxaceprol Industry

Long-term growth in the Oxaceprol industry will be significantly accelerated by breakthroughs in understanding its full therapeutic spectrum, including potential anti-fibrotic and anti-inflammatory effects beyond joint health. Strategic partnerships between Oxaceprol manufacturers and pharmaceutical companies will be crucial for developing and commercializing novel drug formulations. Furthermore, market expansion strategies focused on regions with a rising burden of chronic diseases and improving healthcare infrastructure will drive sustained growth. Continuous innovation in manufacturing processes to reduce production costs and improve environmental sustainability will also act as key growth accelerators.

Key Players Shaping the Oxaceprol Market

Selleck Chemicals Thermo Fisher Scientific Santa Cruz Biotechnology Merck Clearsynth BOC Sciences Oakwood Products Biosynth Carbosynth Adooq Bioscience CSNpharm Taiclone

Notable Milestones in Oxaceprol Sector

- 2019: Increased research publications exploring Oxaceprol's chondroprotective mechanisms.

- 2020: Advancements in stereoselective synthesis techniques for higher purity Oxaceprol.

- 2021: Growing interest in Oxaceprol for preclinical studies in neuroinflammation.

- 2022: Expansion of Oxaceprol offerings by key chemical suppliers to cater to research demands.

- 2023: Emerging studies hinting at Oxaceprol's potential in fibrotic disease models.

- 2024: Increased patent filings related to novel Oxaceprol formulations and therapeutic applications.

In-Depth Oxaceprol Market Outlook

The future of the Oxaceprol market is exceptionally promising, driven by a confluence of increasing therapeutic validation and expanding research frontiers. Growth accelerators such as ongoing clinical trials validating its efficacy in osteoarthritis, alongside investigations into its potential in neurodegenerative and fibrotic conditions, will significantly broaden its market applicability. Strategic collaborations between academic institutions and pharmaceutical giants are expected to unlock innovative drug delivery systems and novel therapeutic indications, propelling market expansion. The burgeoning demand for high-purity chemical entities in drug discovery and development further solidifies Oxaceprol's position as a valuable research tool and potential therapeutic agent. This robust pipeline of innovation and expanding application scope points towards sustained and significant market growth in the coming years.

Oxaceprol Segmentation

-

1. Application

- 1.1. Research

- 1.2. Medical

-

2. Types

- 2.1. Min Purity Less Than 98%

- 2.2. Min Purity 98%-99%

- 2.3. Min Purity More Than 99%

Oxaceprol Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oxaceprol REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Research

- 5.1.2. Medical

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Min Purity Less Than 98%

- 5.2.2. Min Purity 98%-99%

- 5.2.3. Min Purity More Than 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Research

- 6.1.2. Medical

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Min Purity Less Than 98%

- 6.2.2. Min Purity 98%-99%

- 6.2.3. Min Purity More Than 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Research

- 7.1.2. Medical

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Min Purity Less Than 98%

- 7.2.2. Min Purity 98%-99%

- 7.2.3. Min Purity More Than 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Research

- 8.1.2. Medical

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Min Purity Less Than 98%

- 8.2.2. Min Purity 98%-99%

- 8.2.3. Min Purity More Than 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Research

- 9.1.2. Medical

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Min Purity Less Than 98%

- 9.2.2. Min Purity 98%-99%

- 9.2.3. Min Purity More Than 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Oxaceprol Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Research

- 10.1.2. Medical

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Min Purity Less Than 98%

- 10.2.2. Min Purity 98%-99%

- 10.2.3. Min Purity More Than 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Selleck Chemicals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Santa Cruz Biotechnology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clearsynth

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BOC Sciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oakwood Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Biosynth Carbosynth

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adooq Bioscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSNpharm

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Taiclone

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Selleck Chemicals

List of Figures

- Figure 1: Global Oxaceprol Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Oxaceprol Revenue (million), by Application 2024 & 2032

- Figure 3: North America Oxaceprol Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Oxaceprol Revenue (million), by Types 2024 & 2032

- Figure 5: North America Oxaceprol Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Oxaceprol Revenue (million), by Country 2024 & 2032

- Figure 7: North America Oxaceprol Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oxaceprol Revenue (million), by Application 2024 & 2032

- Figure 9: South America Oxaceprol Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Oxaceprol Revenue (million), by Types 2024 & 2032

- Figure 11: South America Oxaceprol Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Oxaceprol Revenue (million), by Country 2024 & 2032

- Figure 13: South America Oxaceprol Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Oxaceprol Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Oxaceprol Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Oxaceprol Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Oxaceprol Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Oxaceprol Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Oxaceprol Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Oxaceprol Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Oxaceprol Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Oxaceprol Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Oxaceprol Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Oxaceprol Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Oxaceprol Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Oxaceprol Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Oxaceprol Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Oxaceprol Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Oxaceprol Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Oxaceprol Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Oxaceprol Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oxaceprol Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Oxaceprol Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Oxaceprol Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Oxaceprol Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Oxaceprol Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Oxaceprol Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Oxaceprol Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Oxaceprol Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Oxaceprol Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Oxaceprol Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxaceprol?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Oxaceprol?

Key companies in the market include Selleck Chemicals, Thermo Fisher Scientific, Santa Cruz Biotechnology, Merck, Clearsynth, BOC Sciences, Oakwood Products, Biosynth Carbosynth, Adooq Bioscience, CSNpharm, Taiclone.

3. What are the main segments of the Oxaceprol?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oxaceprol," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oxaceprol report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oxaceprol?

To stay informed about further developments, trends, and reports in the Oxaceprol, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence