Key Insights

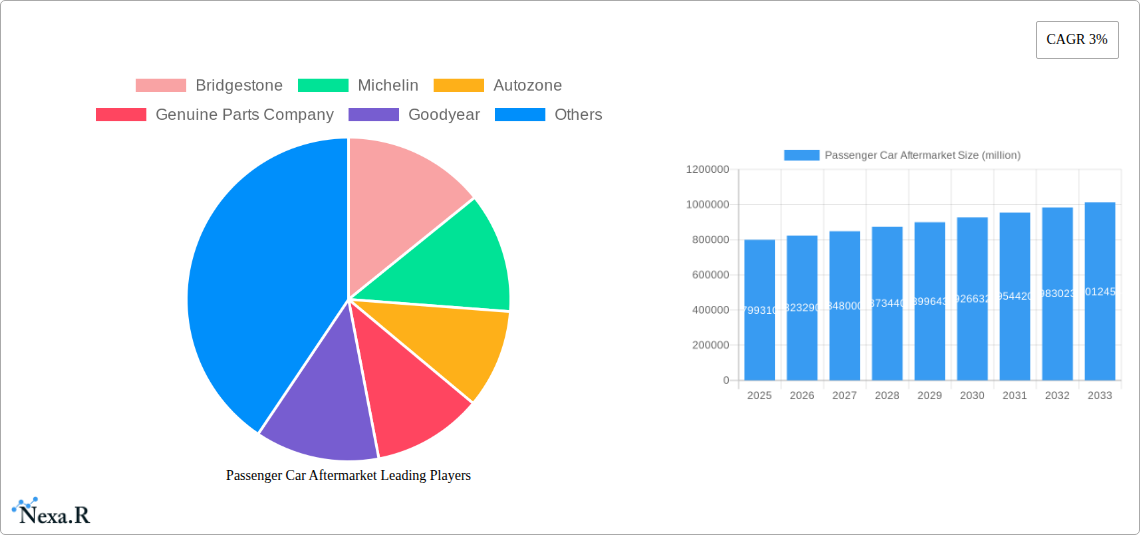

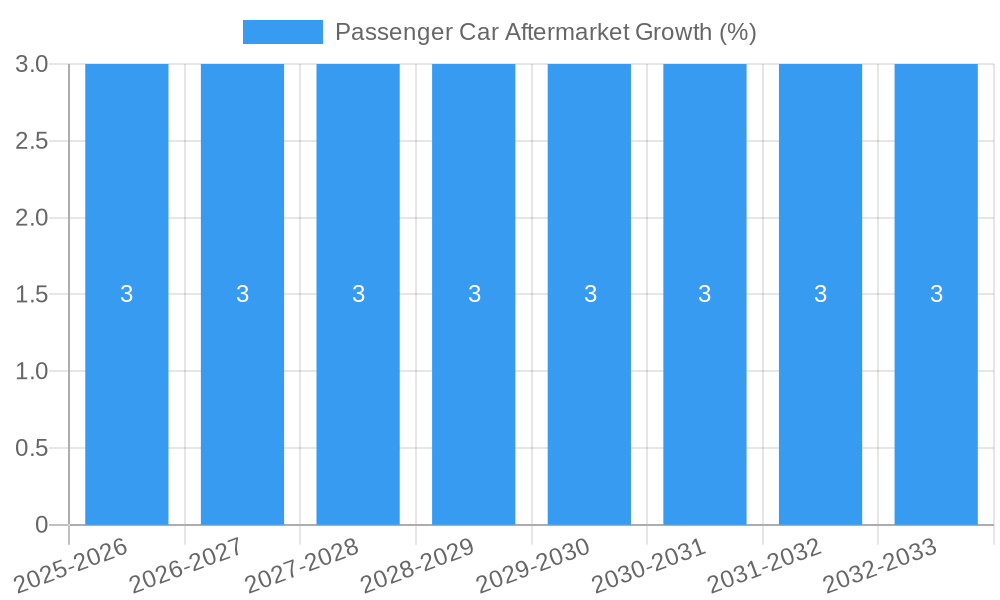

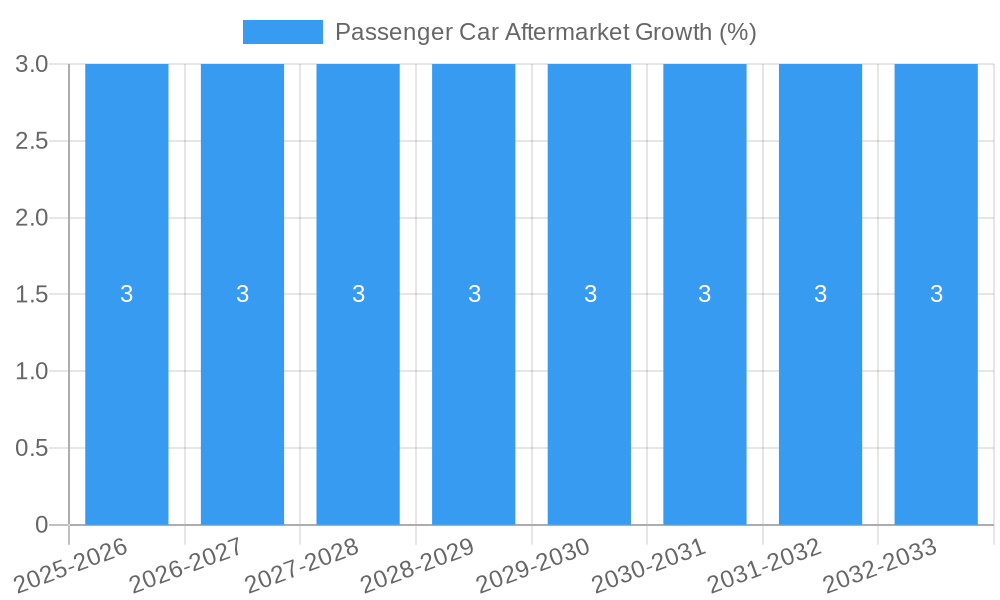

The global passenger car aftermarket is poised for robust expansion, projected to reach an estimated market size of $799,310 million by 2025. This growth trajectory is underpinned by a steady Compound Annual Growth Rate (CAGR) of 3%, signaling consistent demand for automotive parts and services throughout the forecast period. Key drivers fueling this expansion include the increasing average age of vehicles on the road, a growing consumer preference for vehicle customization and personalization, and the rising adoption of advanced automotive technologies that necessitate specialized maintenance and repair. The aftermarket segment is broadly categorized by applications such as Sedans, SUVs, and MPVs, with significant contributions from Wear and Tear Parts, Crash Relevant Parts, and essential Maintenance Services. Tire services also represent a substantial and recurring revenue stream for the industry. The ongoing technological evolution in vehicles, including electrification and advanced driver-assistance systems (ADAS), is creating new opportunities for specialized service providers and parts manufacturers, driving innovation and segment diversification.

The competitive landscape of the passenger car aftermarket is dynamic and highly fragmented, featuring a mix of global automotive giants, specialized parts manufacturers, and extensive retail and service networks. Major players such as Bridgestone, Michelin, Autozone, Goodyear, Continental, and Bosch are actively engaged in capturing market share through product innovation, strategic acquisitions, and expanding their service offerings. The aftermarket is also witnessing a surge in demand for both genuine and aftermarket parts, catering to diverse consumer needs and budgets. E-commerce platforms and online service booking are transforming the distribution and accessibility of aftermarket products and services, allowing for greater convenience and competitive pricing. Emerging economies, particularly in the Asia Pacific region, are expected to be significant growth engines due to increasing vehicle ownership and a burgeoning middle class. While market growth is generally strong, potential restraints include evolving regulatory landscapes concerning emissions and parts sourcing, as well as the initial higher cost of specialized parts for newer, technologically advanced vehicles.

Comprehensive Passenger Car Aftermarket Report: Market Dynamics, Growth Trends, and Strategic Insights (2019-2033)

This in-depth report provides a definitive analysis of the global Passenger Car Aftermarket, a vital and dynamic sector projected to witness significant expansion. With a study period spanning from 2019 to 2033, including a robust historical analysis (2019-2024), a detailed base year assessment (2025), and a comprehensive forecast period (2025-2033), this report offers unparalleled market intelligence. We delve into parent and child market structures, delivering actionable insights for stakeholders across the automotive value chain. The analysis meticulously dissects market segmentation by Application (Sedan, SUV, MPV) and Type (Wear and Tear Parts, Crash Relevant Parts, Maintenance Service, Tire Service, Others), providing granular data in millions of units.

Passenger Car Aftermarket Market Dynamics & Structure

The Passenger Car Aftermarket is characterized by a moderately concentrated market structure, with key players like Bridgestone, Michelin, Autozone, Genuine Parts Company, Goodyear, Continental, Advance Auto Parts, O'Reilly Auto Parts, Bosch, Tenneco, Belron International, Denso, Driven Brands, China Grand Automotive, Zhongsheng Group, 3M Company, Yongda Group, Monro, and Tuhu Auto holding significant market share. Technological innovation is a primary driver, particularly in the development of advanced materials for wear and tear parts, sophisticated diagnostic tools for maintenance services, and improved tire technologies. Stringent regulatory frameworks concerning emissions, safety standards, and product quality also significantly influence market development and product offerings. Competitive product substitutes, ranging from original equipment manufacturer (OEM) parts to aftermarket alternatives, create a dynamic pricing environment. End-user demographics, including an aging vehicle parc and increasing demand for personalized vehicle customization, are shaping product demand. Mergers and acquisitions (M&A) are a consistent feature, with companies like Driven Brands and Monro actively consolidating their positions through strategic acquisitions, aiming to expand their service networks and product portfolios. M&A deal volumes are estimated at 15 in the historical period, indicating a trend towards consolidation.

- Market Concentration: Moderately concentrated, with a mix of global tire giants, large auto parts retailers, and specialized service providers.

- Technological Innovation: Driven by advancements in diagnostics, materials science for durability, and connected car technologies impacting service needs.

- Regulatory Frameworks: Influence product safety, environmental compliance, and fair competition, particularly concerning parts quality and emissions.

- Competitive Product Substitutes: A robust aftermarket segment offers both cost-effective and performance-enhanced alternatives to OEM parts.

- End-User Demographics: Increasing vehicle parc lifespan and a growing demand for DIY solutions and specialized repair services.

- M&A Trends: Active consolidation to gain market share, expand service networks, and integrate new technologies.

Passenger Car Aftermarket Growth Trends & Insights

The Passenger Car Aftermarket is poised for substantial growth, driven by an expanding global vehicle parc, an increasing average age of vehicles, and a rising demand for cost-effective repair and maintenance solutions. The market size is projected to evolve from approximately 180,000 million units in 2019 to an estimated 250,000 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 2.5% during the forecast period (2025-2033). Adoption rates for advanced diagnostic tools and specialized repair services are increasing as vehicles become more complex. Technological disruptions, such as the rise of electric vehicles (EVs) and the increasing integration of software in vehicle components, are creating new avenues for aftermarket services and parts. Consumer behavior shifts are evident, with a growing preference for independent repair shops and online purchasing of auto parts, facilitated by platforms like Tuhu Auto and AutoZone. The "right to repair" movement further empowers consumers to seek aftermarket solutions.

- Market Size Evolution: Projecting significant growth from 180,000 million units (2019) to 250,000 million units (2033).

- CAGR: An estimated 2.5% during the forecast period (2025-2033).

- Adoption Rates: Increasing uptake of advanced diagnostic equipment and specialized maintenance services.

- Technological Disruptions: Impact of EV adoption and software integration on traditional aftermarket segments.

- Consumer Behavior Shifts: Growing preference for independent repair, online parts procurement, and DIY maintenance.

- Market Penetration: Deepening penetration in emerging economies with growing disposable incomes and vehicle ownership.

Dominant Regions, Countries, or Segments in Passenger Car Aftermarket

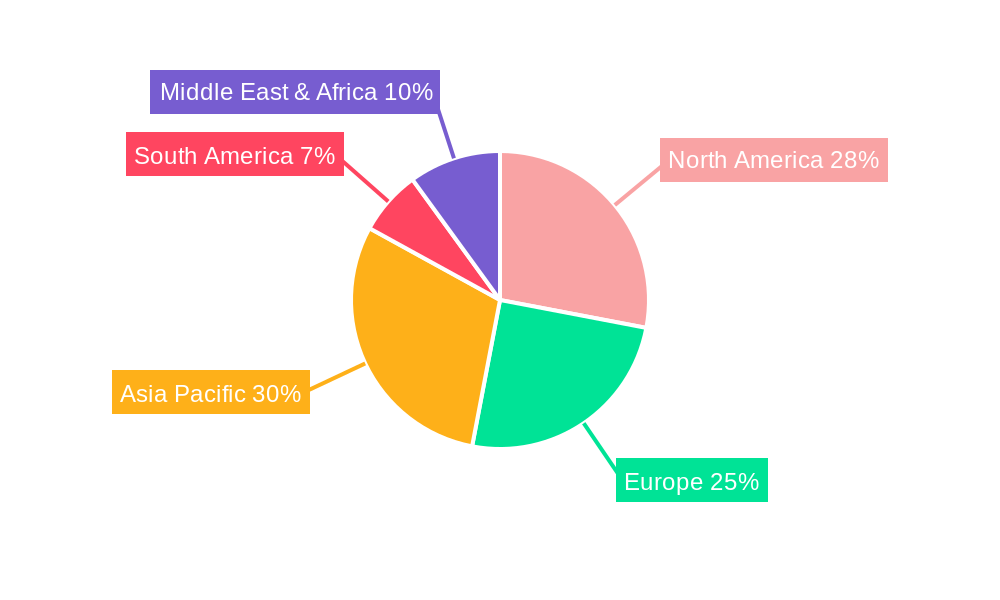

The Asia-Pacific region is emerging as the dominant force in the Passenger Car Aftermarket, driven by China's immense vehicle parc and rapid economic growth. Within Asia-Pacific, China alone is a colossal market, fueled by a massive existing vehicle population and an expanding middle class that demands both affordability and quality in aftermarket services. The SUV segment within the Application category is experiencing exceptional growth, mirroring global trends in vehicle preference. In terms of product Types, Wear and Tear Parts consistently represent the largest segment due to the inherent nature of vehicle usage. However, Maintenance Service is rapidly gaining traction, driven by increasingly complex vehicle technologies and the need for specialized expertise.

Key drivers for this dominance include:

- Economic Policies: Favorable government policies supporting automotive manufacturing and aftermarket services in countries like China.

- Infrastructure Development: Expansion of road networks and a growing vehicle population necessitate increased aftermarket support.

- Consumer Affordability: The availability of cost-effective aftermarket solutions caters to a wider consumer base.

- Vehicle Parc Growth: A substantial and growing number of passenger cars on the road ensures sustained demand.

- Technological Adoption: Increasing adoption of advanced diagnostics and repair techniques by local service providers.

- Market Share: Asia-Pacific, particularly China, is estimated to hold over 35% of the global market share for passenger car aftermarket parts and services.

- Growth Potential: High growth potential in emerging economies within the region due to a younger vehicle parc and increasing disposable incomes.

Passenger Car Aftermarket Product Landscape

The Passenger Car Aftermarket product landscape is defined by continuous innovation in materials and design, enhancing durability and performance. Key product categories include wear and tear parts such as brake pads, filters, and spark plugs, now manufactured with advanced composites and longer-lasting materials. Crash-relevant parts, including body panels and lighting systems, benefit from improved manufacturing processes and stricter safety compliance. Maintenance services are increasingly integrated with digital solutions, offering predictive maintenance and remote diagnostics. Tire service innovation focuses on sustainability, fuel efficiency, and specialized applications for diverse driving conditions. The unique selling proposition of many aftermarket products lies in their competitive pricing, readily available stock, and performance enhancements that can surpass original equipment. Technological advancements are also seen in the integration of smart sensors and IoT capabilities into various components.

Key Drivers, Barriers & Challenges in Passenger Car Aftermarket

Key Drivers: The Passenger Car Aftermarket is propelled by several key drivers including an ever-growing global vehicle parc, an increasing average age of vehicles necessitating more repairs, and the persistent demand for cost-effective alternatives to OEM parts. Technological advancements in diagnostic tools and specialized repair techniques also accelerate growth. Furthermore, favorable economic conditions in many regions contribute to increased consumer spending on vehicle maintenance.

Barriers & Challenges: Significant challenges include supply chain disruptions, which can lead to part shortages and price volatility, as witnessed in the historical period with an estimated 15% impact on delivery times. Regulatory hurdles related to product standardization and environmental compliance can pose obstacles for smaller manufacturers. Intense competitive pressures from both established global players and a proliferation of smaller workshops create pricing challenges. The shift towards electric vehicles presents a long-term challenge as they typically require less frequent traditional maintenance, impacting certain aftermarket segments.

Emerging Opportunities in Passenger Car Aftermarket

Emerging opportunities lie in the burgeoning electric vehicle (EV) aftermarket, focusing on battery diagnostics, specialized repair, and charging infrastructure support. The increasing complexity of vehicle technology presents opportunities for advanced diagnostic software and specialized training for technicians. The growth of e-commerce platforms for auto parts and the demand for DIY solutions are creating new sales channels and product demands. Furthermore, the circular economy trend is opening avenues for remanufactured parts and sustainable aftermarket solutions. The demand for personalized vehicle accessories and performance upgrades also represents a significant untapped market.

Growth Accelerators in the Passenger Car Aftermarket Industry

Growth accelerators in the Passenger Car Aftermarket industry are primarily driven by the increasing average age of vehicles on the road, a trend that inherently leads to greater demand for repairs and replacements. The expanding middle class in emerging economies, with rising disposable incomes, translates into higher vehicle ownership and subsequent aftermarket service needs. Technological advancements, particularly in diagnostic tools and the integration of IoT in vehicles, are enabling more efficient and predictive maintenance, thus boosting service revenues. Strategic partnerships between parts manufacturers, distributors, and independent repair networks are also crucial for expanding market reach and enhancing customer service.

Key Players Shaping the Passenger Car Aftermarket Market

- Bridgestone

- Michelin

- Autozone

- Genuine Parts Company

- Goodyear

- Continental

- Advance Auto Parts

- O'Reilly Auto Parts

- Bosch

- Tenneco

- Belron International

- Denso

- Driven Brands

- China Grand Automotive

- Zhongsheng Group

- 3M Company

- Yongda Group

- Monro

- Tuhu Auto

Notable Milestones in Passenger Car Aftermarket Sector

- 2019: Increased adoption of advanced driver-assistance systems (ADAS) components, driving demand for specialized calibration services.

- 2020: Global supply chain disruptions due to the pandemic, leading to temporary shortages and price increases for key auto parts.

- 2021: Rise of online retail for auto parts accelerated by changing consumer shopping habits.

- 2022: Growing focus on sustainable and remanufactured auto parts driven by environmental concerns.

- 2023: Significant investments in EV aftermarket infrastructure and specialized training programs by major players.

- January 2024: Expansion of ADAS calibration services by Belron International, reflecting growing market demand.

- March 2024: Driven Brands announces acquisition of a regional chain of auto repair shops, consolidating its service network.

- June 2024: Michelin launches new sustainable tire technology, emphasizing eco-friendly materials.

- September 2024: Tenneco introduces enhanced exhaust systems with improved emissions control technology.

In-Depth Passenger Car Aftermarket Market Outlook

The Passenger Car Aftermarket is projected for robust and sustained growth throughout the forecast period. Key growth accelerators, including the aging global vehicle parc and expanding middle-class populations in developing regions, will continue to fuel demand for parts and services. Technological advancements in diagnostics and the increasing complexity of vehicles will create new revenue streams for specialized service providers. Strategic partnerships and consolidation within the industry will further enhance market efficiency and reach. The ongoing transition towards electric vehicles presents both challenges and significant opportunities, particularly in battery maintenance and specialized repair services, ensuring the aftermarket's continued evolution and profitability. The market is well-positioned for innovation and expansion.

Passenger Car Aftermarket Segmentation

-

1. Application

- 1.1. Sedan

- 1.2. SUV

- 1.3. MPV

-

2. Types

- 2.1. Wear and Tear Parts

- 2.2. Crash Relevant Parts

- 2.3. Maintenance Service

- 2.4. Tire Service

- 2.5. Others

Passenger Car Aftermarket Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passenger Car Aftermarket REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sedan

- 5.1.2. SUV

- 5.1.3. MPV

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wear and Tear Parts

- 5.2.2. Crash Relevant Parts

- 5.2.3. Maintenance Service

- 5.2.4. Tire Service

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sedan

- 6.1.2. SUV

- 6.1.3. MPV

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wear and Tear Parts

- 6.2.2. Crash Relevant Parts

- 6.2.3. Maintenance Service

- 6.2.4. Tire Service

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sedan

- 7.1.2. SUV

- 7.1.3. MPV

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wear and Tear Parts

- 7.2.2. Crash Relevant Parts

- 7.2.3. Maintenance Service

- 7.2.4. Tire Service

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sedan

- 8.1.2. SUV

- 8.1.3. MPV

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wear and Tear Parts

- 8.2.2. Crash Relevant Parts

- 8.2.3. Maintenance Service

- 8.2.4. Tire Service

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sedan

- 9.1.2. SUV

- 9.1.3. MPV

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wear and Tear Parts

- 9.2.2. Crash Relevant Parts

- 9.2.3. Maintenance Service

- 9.2.4. Tire Service

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Passenger Car Aftermarket Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sedan

- 10.1.2. SUV

- 10.1.3. MPV

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wear and Tear Parts

- 10.2.2. Crash Relevant Parts

- 10.2.3. Maintenance Service

- 10.2.4. Tire Service

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bridgestone

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Michelin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Autozone

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genuine Parts Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Goodyear

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Continental

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Advance Auto Parts

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 O'Reilly Auto Parts

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bosch

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tenneco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Belron International

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Denso

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Driven Brands

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 China Grand Automotive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhongsheng Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 3M Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Yongda Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Monro

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Tuhu Auto

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Bridgestone

List of Figures

- Figure 1: Global Passenger Car Aftermarket Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Passenger Car Aftermarket Revenue (million), by Application 2024 & 2032

- Figure 3: North America Passenger Car Aftermarket Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Passenger Car Aftermarket Revenue (million), by Types 2024 & 2032

- Figure 5: North America Passenger Car Aftermarket Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Passenger Car Aftermarket Revenue (million), by Country 2024 & 2032

- Figure 7: North America Passenger Car Aftermarket Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Passenger Car Aftermarket Revenue (million), by Application 2024 & 2032

- Figure 9: South America Passenger Car Aftermarket Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Passenger Car Aftermarket Revenue (million), by Types 2024 & 2032

- Figure 11: South America Passenger Car Aftermarket Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Passenger Car Aftermarket Revenue (million), by Country 2024 & 2032

- Figure 13: South America Passenger Car Aftermarket Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passenger Car Aftermarket Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Passenger Car Aftermarket Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Passenger Car Aftermarket Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Passenger Car Aftermarket Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Passenger Car Aftermarket Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Passenger Car Aftermarket Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Passenger Car Aftermarket Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Passenger Car Aftermarket Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Passenger Car Aftermarket Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Passenger Car Aftermarket Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Passenger Car Aftermarket Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Passenger Car Aftermarket Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Passenger Car Aftermarket Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Passenger Car Aftermarket Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Passenger Car Aftermarket Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Passenger Car Aftermarket Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Passenger Car Aftermarket Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Passenger Car Aftermarket Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passenger Car Aftermarket Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Passenger Car Aftermarket Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Passenger Car Aftermarket Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Passenger Car Aftermarket Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Passenger Car Aftermarket Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Passenger Car Aftermarket Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Passenger Car Aftermarket Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Passenger Car Aftermarket Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Passenger Car Aftermarket Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Passenger Car Aftermarket Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Car Aftermarket?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Passenger Car Aftermarket?

Key companies in the market include Bridgestone, Michelin, Autozone, Genuine Parts Company, Goodyear, Continental, Advance Auto Parts, O'Reilly Auto Parts, Bosch, Tenneco, Belron International, Denso, Driven Brands, China Grand Automotive, Zhongsheng Group, 3M Company, Yongda Group, Monro, Tuhu Auto.

3. What are the main segments of the Passenger Car Aftermarket?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 799310 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passenger Car Aftermarket," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passenger Car Aftermarket report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passenger Car Aftermarket?

To stay informed about further developments, trends, and reports in the Passenger Car Aftermarket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence