Key Insights

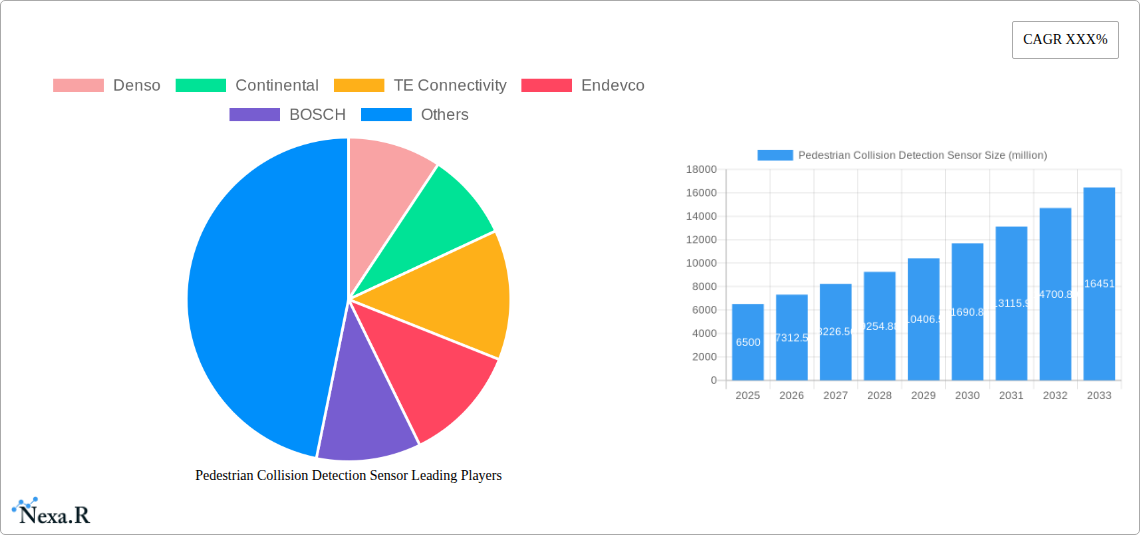

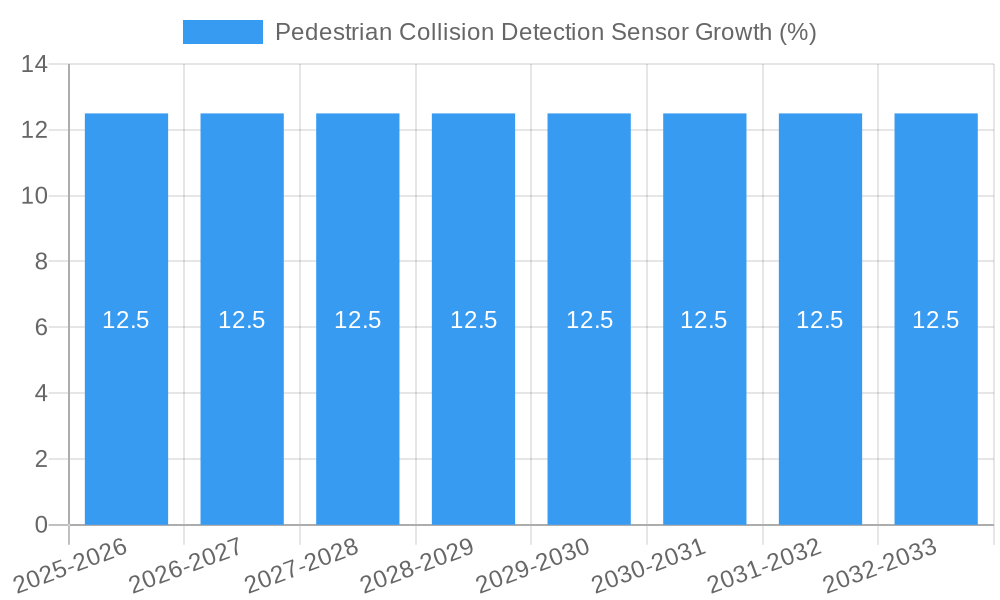

The global Pedestrian Collision Detection Sensor market is poised for significant expansion, projected to reach an estimated USD 6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This substantial market valuation underscores the escalating importance of advanced driver-assistance systems (ADAS) in enhancing road safety. The primary drivers fueling this growth are stringent government regulations mandating pedestrian safety features in vehicles, coupled with a growing consumer awareness and demand for sophisticated safety technologies. Manufacturers are actively investing in research and development to integrate more accurate and reliable pedestrian detection systems, leveraging advancements in artificial intelligence, sensor fusion, and machine learning. The increasing prevalence of autonomous driving technologies further propels the demand for these sensors, as they are foundational components for enabling vehicles to perceive and react to their surroundings, especially vulnerable road users.

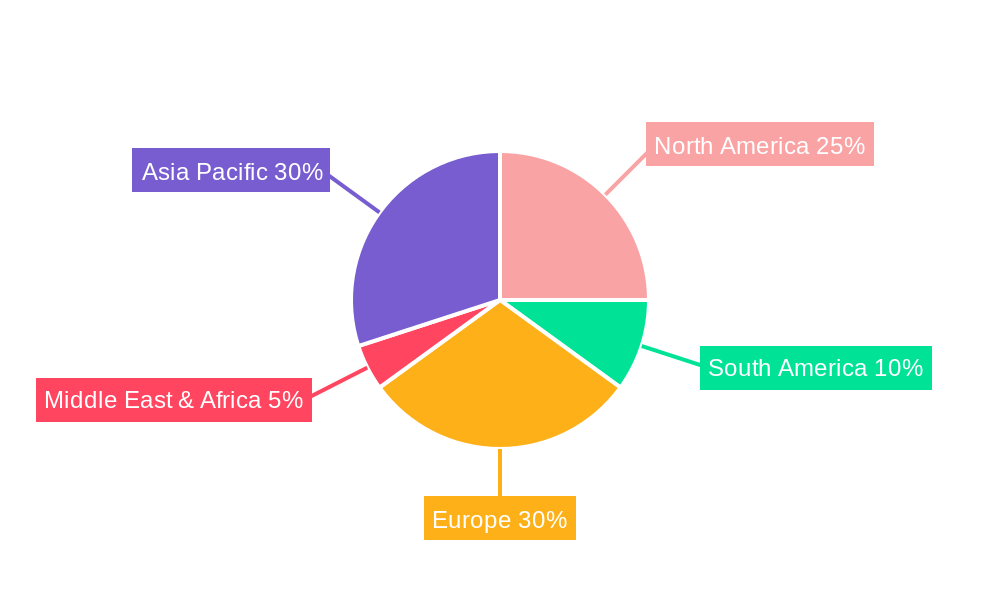

The market is segmented by application into Passenger Vehicles and Commercial Vehicles, with passenger cars currently dominating due to their higher production volumes and the widespread adoption of ADAS. In terms of sensor type, Front Collision Detection Sensors are expected to hold a larger market share, directly contributing to immediate collision avoidance. However, the increasing complexity of urban driving environments and the rise of multilane roads are fostering a growing demand for Side Collision Detection Sensors as well. Key players like Denso, Continental, TE Connectivity, and BOSCH are at the forefront, innovating and expanding their product portfolios to capture market share. The Asia Pacific region, led by China and India, is emerging as a high-growth market owing to rapid automotive industry expansion and increasing disposable incomes, while North America and Europe continue to represent mature yet substantial markets driven by regulatory frameworks and technological adoption.

This in-depth report provides a detailed analysis of the global Pedestrian Collision Detection Sensor Market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this report is an essential resource for industry professionals seeking to navigate the evolving automotive safety landscape.

Pedestrian Collision Detection Sensor Market Dynamics & Structure

The Pedestrian Collision Detection Sensor Market exhibits a moderately concentrated structure, with a handful of major players holding significant market share, alongside a growing number of specialized manufacturers. Technological innovation serves as a primary driver, with continuous advancements in sensor fusion, AI-powered algorithms, and improved object recognition capabilities enhancing detection accuracy and reliability. Regulatory frameworks, particularly stringent automotive safety standards globally, are increasingly mandating the adoption of advanced driver-assistance systems (ADAS), including pedestrian detection, thereby stimulating market growth. Competitive product substitutes, while limited in direct replacement for sophisticated sensor systems, include simpler warning systems and aftermarket solutions. End-user demographics are increasingly favoring safety-conscious consumers, especially within the Passenger Vehicles segment, as awareness of pedestrian safety concerns rises. Mergers and acquisitions (M&A) trends are observed as larger Tier-1 automotive suppliers consolidate their offerings and expand their ADAS portfolios.

- Market Concentration: Dominated by a few Tier-1 suppliers, with increasing fragmentation driven by specialized sensor technology providers.

- Technological Innovation Drivers: Advancements in AI, machine learning, radar, lidar, and camera technologies for enhanced pedestrian recognition and tracking.

- Regulatory Frameworks: Stringent safety mandates from NHTSA, Euro NCAP, and other global bodies driving adoption.

- Competitive Product Substitutes: Primarily focus on audio/visual warnings and driver alerts rather than direct collision avoidance.

- End-User Demographics: Growing demand from safety-conscious consumers, fleet operators, and government initiatives promoting road safety.

- M&A Trends: Consolidation among automotive suppliers to strengthen ADAS capabilities and market reach.

Pedestrian Collision Detection Sensor Growth Trends & Insights

The Pedestrian Collision Detection Sensor Market is poised for robust growth, driven by a confluence of factors including rising vehicle safety consciousness, stricter government regulations, and continuous technological advancements. The global market size is projected to expand significantly, with adoption rates of these critical safety systems steadily increasing across both Passenger Vehicles and Commercial Vehicles. Technological disruptions are at the forefront, with innovations in sensor accuracy, reduced latency, and improved performance in diverse environmental conditions (e.g., low light, adverse weather) being key differentiators. Consumer behavior is shifting towards prioritizing vehicles equipped with advanced ADAS features, directly impacting purchasing decisions. The market penetration of pedestrian detection systems is expected to surge as cost efficiencies improve and integration becomes more seamless. This upward trajectory is further supported by significant investments in research and development by leading automotive component manufacturers. The anticipated CAGR for the forecast period is projected to be substantial, reflecting the increasing integration of these sensors into mainstream automotive platforms and the growing demand for autonomous and semi-autonomous driving capabilities.

The increasing sophistication of Artificial Intelligence (AI) and Machine Learning (ML) algorithms plays a pivotal role in enhancing the accuracy and reliability of pedestrian collision detection. These advanced algorithms enable sensors to better differentiate between pedestrians, cyclists, and other road users, reducing false positives and improving reaction times. The integration of multiple sensor types, such as radar, lidar, and cameras (sensor fusion), creates a comprehensive perception system, offering redundancy and improved performance across various scenarios. This multi-modal approach is becoming a standard for advanced ADAS.

Furthermore, the evolving landscape of urban mobility and the increasing prevalence of electric vehicles (EVs) also contribute to market expansion. EVs, often operating silently, necessitate enhanced pedestrian detection systems to alert both drivers and pedestrians. The growth of smart cities and connected infrastructure will further integrate vehicle safety systems with the surrounding environment, creating a more holistic safety ecosystem.

The market's growth is also fueled by the expanding scope of applications beyond passenger cars, with a notable surge in demand from the Commercial Vehicles sector, including trucks and buses, where the consequences of pedestrian collisions can be more severe. Government initiatives and safety ratings from organizations like Euro NCAP and NHTSA, which increasingly incorporate pedestrian safety metrics, are compelling automakers to adopt and improve these technologies.

Dominant Regions, Countries, or Segments in Pedestrian Collision Detection Sensor

The Passenger Vehicles segment is unequivocally the dominant force driving growth within the Pedestrian Collision Detection Sensor Market. This segment's supremacy is underpinned by several critical factors, including higher production volumes, greater consumer demand for advanced safety features, and more aggressive integration of ADAS by original equipment manufacturers (OEMs). North America and Europe, with their mature automotive markets and stringent safety regulations, are leading the charge in adopting pedestrian collision detection technologies. Countries within these regions, such as the United States, Germany, and the United Kingdom, demonstrate high market penetration due to strong consumer purchasing power and established infrastructure that supports advanced vehicle technologies.

The Front Collision Detection Sensor application holds a significant share within the sensor types, primarily due to its foundational role in forward-facing ADAS features like Automatic Emergency Braking (AEB) with pedestrian detection. This type of sensor is crucial for mitigating the most common types of frontal impacts. However, the demand for Side Collision Detection Sensors is gradually increasing as automotive safety evolves to encompass a more comprehensive 360-degree awareness of the vehicle's surroundings, particularly in complex urban environments where pedestrians may emerge from blind spots.

Economic policies that encourage the adoption of advanced vehicle safety technologies, coupled with robust automotive manufacturing bases, further solidify the dominance of these regions. Significant investments in R&D and a competitive automotive industry landscape in these areas foster innovation and drive the demand for cutting-edge pedestrian detection solutions. The proactive stance of regulatory bodies in setting and enforcing safety standards also plays a crucial role, compelling OEMs to equip their vehicles with these life-saving systems.

- Dominant Segment: Passenger Vehicles, driven by higher production volumes and consumer demand for advanced safety features.

- Leading Application: Front Collision Detection Sensor, essential for AEB and forward-facing safety systems.

- Emerging Application: Side Collision Detection Sensor, gaining traction for comprehensive 360-degree vehicle awareness.

- Key Regions: North America and Europe, characterized by strong regulatory frameworks and high consumer adoption rates.

- Dominant Countries: United States, Germany, United Kingdom, leading in market penetration and technological adoption.

- Growth Drivers: Stringent safety regulations, consumer demand for ADAS, OEM mandates, and technological advancements.

- Market Share: The Passenger Vehicles segment is estimated to command approximately 75% of the global Pedestrian Collision Detection Sensor market share.

- Growth Potential: Significant growth opportunities in emerging economies and the expansion of ADAS in lower-tier vehicle models.

Pedestrian Collision Detection Sensor Product Landscape

The Pedestrian Collision Detection Sensor product landscape is characterized by continuous innovation in sensor technology and integration capabilities. Manufacturers are developing highly accurate and robust systems that leverage advanced algorithms for real-time object recognition, tracking, and threat assessment. Innovations include miniaturized sensor modules, improved power efficiency, and enhanced performance in adverse weather conditions and low-light environments. These sensors are increasingly integrated with other ADAS features, such as forward-looking cameras, radar, and lidar, to provide a comprehensive perception system for autonomous and semi-autonomous driving functions. The unique selling propositions revolve around enhanced detection range, superior accuracy, reduced false alarm rates, and seamless integration into existing vehicle architectures.

Key Drivers, Barriers & Challenges in Pedestrian Collision Detection Sensor

Key Drivers:

- Technological Advancements: Continuous improvements in AI, sensor fusion, and object recognition algorithms.

- Regulatory Mandates: Increasing government regulations and safety standards for pedestrian protection.

- Consumer Demand: Growing consumer awareness and preference for vehicles equipped with advanced safety features.

- Autonomous Driving Evolution: The push towards higher levels of vehicle autonomy necessitates sophisticated pedestrian detection.

- Industry Investments: Significant R&D investments by automotive OEMs and Tier-1 suppliers.

Barriers & Challenges:

- Cost of Implementation: High initial development and manufacturing costs can impact mass adoption, particularly in lower-cost vehicle segments.

- False Positives/Negatives: Ensuring high accuracy and minimizing erroneous detections in diverse real-world scenarios remains a challenge.

- Integration Complexity: Integrating new sensor systems with existing vehicle electronics and software architectures can be complex.

- Supply Chain Disruptions: Geopolitical factors and component shortages can impact the availability and cost of essential parts.

- Standardization: Lack of universal standardization across different sensor technologies and communication protocols can hinder interoperability.

Emerging Opportunities in Pedestrian Collision Detection Sensor

Emerging opportunities in the Pedestrian Collision Detection Sensor Market lie in the development of more cost-effective solutions for emerging economies, where the demand for vehicle safety is growing but affordability remains a concern. The integration of these sensors with V2X (Vehicle-to-Everything) communication technology presents a significant opportunity to enhance pedestrian safety by enabling vehicles to communicate with infrastructure and other road users. Furthermore, advancements in AI for predictive pedestrian behavior analysis and the development of robust systems capable of operating in highly complex urban environments with crowded pedestrian traffic represent lucrative avenues for innovation and market expansion. The increasing adoption of advanced safety features in motorcycles and electric scooters also opens new sub-segments for sensor manufacturers.

Growth Accelerators in the Pedestrian Collision Detection Sensor Industry

The Pedestrian Collision Detection Sensor Industry is propelled by several key growth accelerators. Technological breakthroughs in sensor miniaturization, power efficiency, and data processing capabilities are making these systems more viable for a wider range of vehicles. Strategic partnerships between sensor manufacturers, automotive OEMs, and AI developers are fostering collaborative innovation and accelerating the development and deployment of advanced solutions. Furthermore, market expansion strategies focused on emerging economies, coupled with supportive government policies and safety rating initiatives, are creating new growth frontiers. The increasing focus on sustainability and the electrification of vehicles also indirectly boosts the demand for advanced safety systems that can complement the unique characteristics of EVs, such as their silent operation.

Key Players Shaping the Pedestrian Collision Detection Sensor Market

- Denso

- Continental

- TE Connectivity

- Endevco

- BOSCH

- XSENSOR

- Kistler

- Murata

- ASC Sensors

- Analog Devices

- Dorman

- Hyundai Mobis

Notable Milestones in Pedestrian Collision Detection Sensor Sector

- 2019: Launch of advanced radar-based pedestrian detection systems with enhanced low-light performance.

- 2020: Increased adoption of AEB with pedestrian detection as a standard feature in new vehicle models across major markets.

- 2021: Significant breakthroughs in AI algorithms for improved pedestrian trajectory prediction and cyclist detection.

- 2022: Introduction of lidar-camera fusion systems offering superior environmental perception and object classification.

- 2023: Growing emphasis on cybersecurity for ADAS systems, including pedestrian detection, to prevent tampering.

- 2024: Development of more compact and cost-effective sensor modules for wider market accessibility.

In-Depth Pedestrian Collision Detection Sensor Market Outlook

- 2019: Launch of advanced radar-based pedestrian detection systems with enhanced low-light performance.

- 2020: Increased adoption of AEB with pedestrian detection as a standard feature in new vehicle models across major markets.

- 2021: Significant breakthroughs in AI algorithms for improved pedestrian trajectory prediction and cyclist detection.

- 2022: Introduction of lidar-camera fusion systems offering superior environmental perception and object classification.

- 2023: Growing emphasis on cybersecurity for ADAS systems, including pedestrian detection, to prevent tampering.

- 2024: Development of more compact and cost-effective sensor modules for wider market accessibility.

In-Depth Pedestrian Collision Detection Sensor Market Outlook

The Pedestrian Collision Detection Sensor Market is on an accelerated growth trajectory, driven by a confluence of technological advancements, regulatory pressures, and evolving consumer preferences for enhanced vehicle safety. The integration of AI and sensor fusion technologies will continue to be pivotal, enabling more sophisticated and reliable pedestrian detection capabilities. Emerging markets present significant untapped potential, while the ongoing evolution towards higher levels of vehicle autonomy will further solidify the importance of these systems. Strategic collaborations and continued investment in R&D are anticipated to unlock new opportunities for innovation and market expansion, ensuring a robust and dynamic future for this critical automotive safety sector.

Pedestrian Collision Detection Sensor Segmentation

-

1. Application

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Type

- 2.1. Front Collision Detection Sensor

- 2.2. Side Collision Detection Sensor

Pedestrian Collision Detection Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pedestrian Collision Detection Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front Collision Detection Sensor

- 5.2.2. Side Collision Detection Sensor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Front Collision Detection Sensor

- 6.2.2. Side Collision Detection Sensor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Front Collision Detection Sensor

- 7.2.2. Side Collision Detection Sensor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Front Collision Detection Sensor

- 8.2.2. Side Collision Detection Sensor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Front Collision Detection Sensor

- 9.2.2. Side Collision Detection Sensor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pedestrian Collision Detection Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicles

- 10.1.2. Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Front Collision Detection Sensor

- 10.2.2. Side Collision Detection Sensor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Denso

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TE Connectivity

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endevco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BOSCH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XSENSOR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kistler

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Murata

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ASC Sensors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Analog Devices

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dorman

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hyundai Mobis

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Denso

List of Figures

- Figure 1: Global Pedestrian Collision Detection Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pedestrian Collision Detection Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pedestrian Collision Detection Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pedestrian Collision Detection Sensor Revenue (million), by Type 2024 & 2032

- Figure 5: North America Pedestrian Collision Detection Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Pedestrian Collision Detection Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pedestrian Collision Detection Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pedestrian Collision Detection Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pedestrian Collision Detection Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pedestrian Collision Detection Sensor Revenue (million), by Type 2024 & 2032

- Figure 11: South America Pedestrian Collision Detection Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Pedestrian Collision Detection Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pedestrian Collision Detection Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pedestrian Collision Detection Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pedestrian Collision Detection Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pedestrian Collision Detection Sensor Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Pedestrian Collision Detection Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Pedestrian Collision Detection Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pedestrian Collision Detection Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pedestrian Collision Detection Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pedestrian Collision Detection Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pedestrian Collision Detection Sensor Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Pedestrian Collision Detection Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Pedestrian Collision Detection Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pedestrian Collision Detection Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pedestrian Collision Detection Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pedestrian Collision Detection Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pedestrian Collision Detection Sensor Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Pedestrian Collision Detection Sensor Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Pedestrian Collision Detection Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pedestrian Collision Detection Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Pedestrian Collision Detection Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pedestrian Collision Detection Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pedestrian Collision Detection Sensor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Pedestrian Collision Detection Sensor?

Key companies in the market include Denso, Continental, TE Connectivity, Endevco, BOSCH, XSENSOR, Kistler, Murata, ASC Sensors, Analog Devices, Dorman, Hyundai Mobis.

3. What are the main segments of the Pedestrian Collision Detection Sensor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pedestrian Collision Detection Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pedestrian Collision Detection Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pedestrian Collision Detection Sensor?

To stay informed about further developments, trends, and reports in the Pedestrian Collision Detection Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence