Key Insights

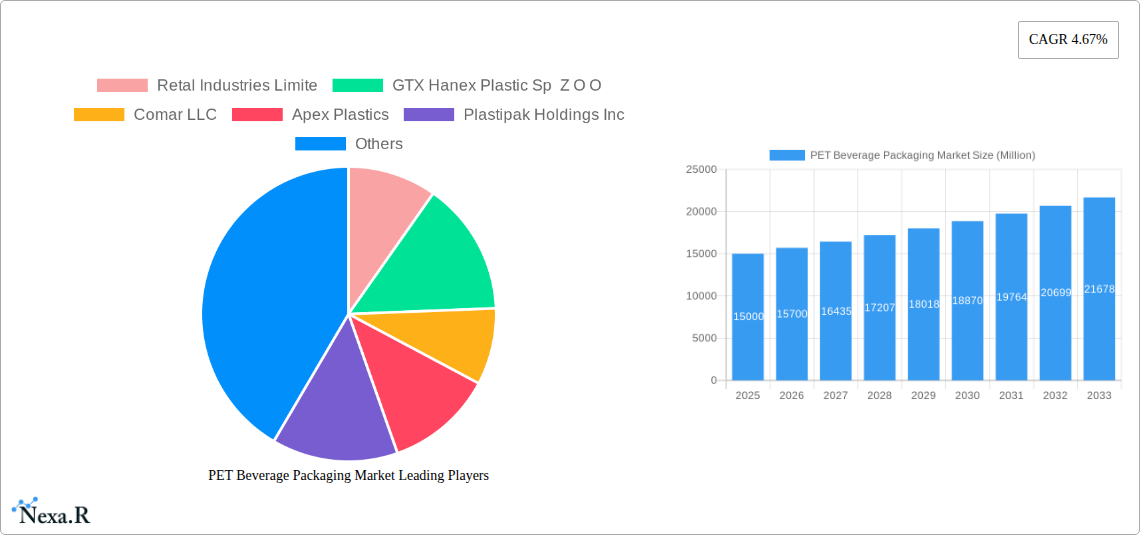

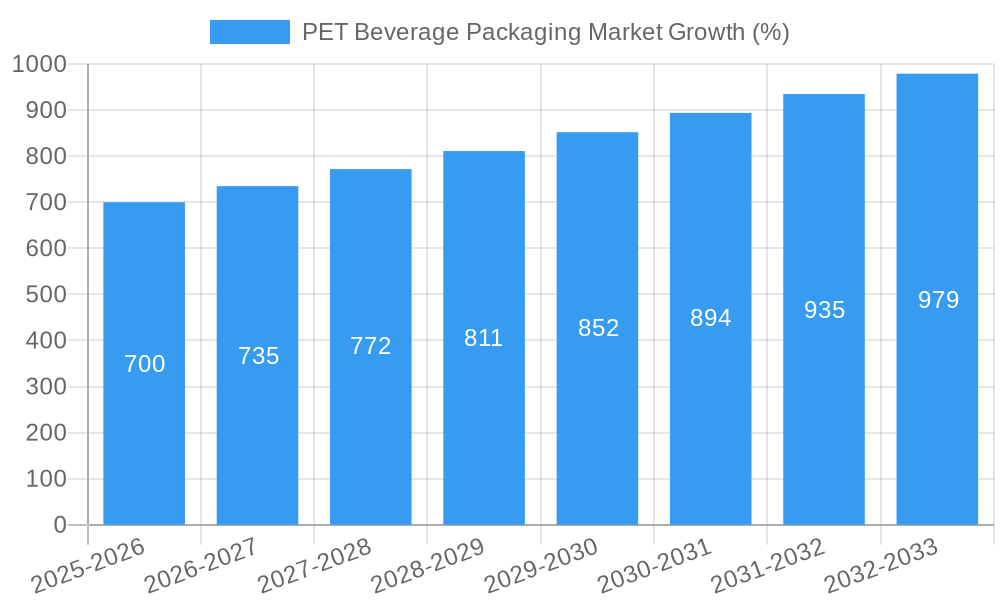

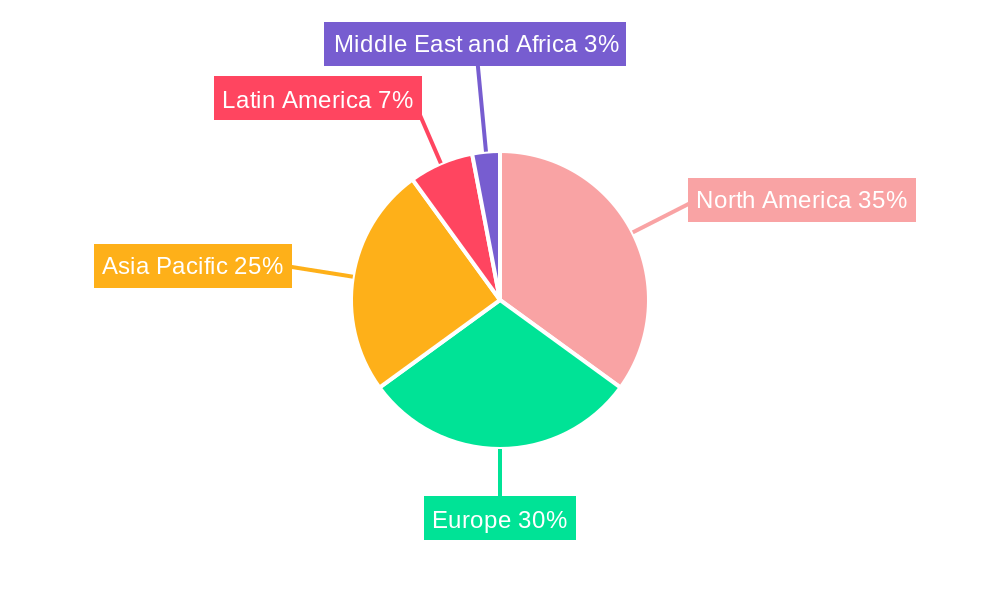

The PET beverage packaging market is experiencing robust growth, driven by the increasing demand for convenient and lightweight packaging solutions across various beverage categories. The market's Compound Annual Growth Rate (CAGR) of 4.67% from 2019 to 2024 indicates a steady expansion, projected to continue into the forecast period (2025-2033). Key drivers include the rising consumption of bottled beverages, particularly carbonated soft drinks, juices, and bottled water, fueled by changing lifestyles and consumer preferences for portability and on-the-go consumption. The rising adoption of sustainable and recyclable packaging options is also influencing market growth, with manufacturers increasingly focusing on lightweighting and eco-friendly materials to meet evolving environmental concerns. Segmentation analysis reveals that bottles dominate the product landscape, while carbonated drinks and bottled water represent significant end-user industry segments. Geographically, North America and Europe currently hold substantial market shares due to established beverage industries and high per capita consumption. However, the Asia-Pacific region is anticipated to exhibit significant growth potential in the coming years, driven by rising disposable incomes and expanding consumer bases in countries like China and India. Competitive pressures from established players like Amcor PLC, Berry Global Inc., and Silgan Holdings Inc., along with the emergence of regional players, further shapes market dynamics. While potential restraints, such as fluctuating raw material prices and concerns regarding plastic waste, exist, the overall market outlook remains positive, underpinned by the continued demand for convenient and readily available beverages in various global markets.

The projected market size for 2025 is estimated to be around $XX Billion (assuming a logical extrapolation from the available CAGR and historical data), further emphasizing the significant market value of PET beverage packaging. This substantial market value will likely be further enhanced by ongoing technological advancements leading to lighter-weight, more sustainable, and innovative PET packaging solutions. The ongoing focus on improved recycling infrastructure and consumer awareness of environmental issues presents both challenges and opportunities. Successful players will be those that can adapt to evolving consumer demands for eco-friendly packaging while maintaining cost-effectiveness and efficiency within their supply chains. The competitive landscape suggests continuous innovation in PET packaging design, production methods, and logistics to maintain market share and drive future growth.

PET Beverage Packaging Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the PET Beverage Packaging Market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. The market is segmented by product (Bottles, Jars, Lids/Caps & Closures, Other Products) and end-user industry (Carbonated Drinks, Juices, Water Bottles, Alcoholic Beverages, Energy Drinks, Other End-user Industries). The total market size is predicted to reach xx Million units by 2033.

PET Beverage Packaging Market Market Dynamics & Structure

This section analyzes the PET beverage packaging market's competitive landscape, technological advancements, and regulatory influences. The market is characterized by a moderately concentrated structure, with several major players holding significant market share. Technological innovation, driven by the demand for lightweight, sustainable, and functional packaging, is a key driver. Stringent regulatory frameworks concerning material recyclability and environmental impact significantly shape industry practices. The presence of substitute materials, such as glass and aluminum, poses a competitive challenge.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2025.

- Technological Innovation: Focus on lightweighting, improved barrier properties, and increasing the use of recycled PET (rPET) are key technological drivers.

- Regulatory Framework: Regulations on plastic waste management and recyclability are increasing globally, impacting packaging design and material selection.

- Competitive Substitutes: Glass and aluminum packaging continue to compete with PET, especially in premium segments.

- M&A Trends: The past five years have witnessed xx M&A deals in the PET beverage packaging sector, indicating consolidation within the industry. Deal values are estimated to have totaled xx Million USD.

- End-user Demographics: Growing demand from health-conscious consumers and increasing disposable incomes in emerging economies are driving market growth.

PET Beverage Packaging Market Growth Trends & Insights

The PET beverage packaging market has experienced consistent growth over the historical period (2019-2024), primarily fueled by the burgeoning demand for packaged beverages across various categories. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million units by 2033. This growth is propelled by several factors, including the rising preference for convenience, increasing urbanization, and expanding global beverage consumption. Technological advancements, such as the introduction of lightweighting techniques and improved barrier properties of PET materials, have further enhanced the market's appeal. Consumer behavior shifts toward sustainable and eco-friendly packaging options are influencing industry trends, encouraging the adoption of recycled PET (rPET) and biodegradable alternatives.

Dominant Regions, Countries, or Segments in PET Beverage Packaging Market

The North American region currently holds the largest market share in PET beverage packaging, followed by Europe and Asia-Pacific. The dominance of North America stems from high beverage consumption, advanced packaging technology, and strong regulatory support for sustainable packaging solutions. Within the product segment, bottles dominate the market, driven by their suitability for various beverages and ease of use. Among end-user industries, carbonated drinks and bottled water contribute significantly to overall market growth.

- Key Drivers in North America: High per capita beverage consumption, strong infrastructure for packaging manufacturing and distribution, and early adoption of sustainable packaging technologies.

- Key Drivers in Europe: Strict environmental regulations promoting rPET usage, robust recycling infrastructure, and a well-established beverage industry.

- Key Drivers in Asia-Pacific: Rapid economic growth, increasing urbanization, and rising disposable incomes are driving demand for packaged beverages.

- Bottles Segment Dominance: High versatility, cost-effectiveness, and ease of use contribute to the large market share of bottles in the PET packaging segment.

- Carbonated Drinks and Bottled Water: These segments are significant drivers of growth due to their high volume consumption globally.

PET Beverage Packaging Market Product Landscape

The PET beverage packaging market showcases a diverse product portfolio, including bottles, jars, lids/caps & closures, and other products. Continuous innovation focuses on enhancing barrier properties to extend shelf life, lightweighting to reduce material consumption, and incorporating recycled content for sustainability. Key features driving product adoption include improved aesthetics, enhanced functionality, and eco-friendly designs. The trend toward customized packaging solutions tailored to specific beverage types and brand identities also contributes to market expansion.

Key Drivers, Barriers & Challenges in PET Beverage Packaging Market

Key Drivers:

- Increasing demand for convenient and readily available beverages.

- Growing adoption of sustainable and eco-friendly packaging solutions.

- Technological advancements in PET packaging materials and manufacturing processes.

- Favorable regulatory frameworks promoting sustainable packaging.

Challenges & Restraints:

- Fluctuations in raw material prices (PET resin).

- Stringent environmental regulations and compliance costs.

- Competition from alternative packaging materials (glass, aluminum, etc.).

- Supply chain disruptions impacting raw material availability and timely delivery. These disruptions impacted production by approximately xx% in 2022.

Emerging Opportunities in PET Beverage Packaging Market

- Expansion into emerging markets with high growth potential.

- Development of innovative packaging designs, such as flexible pouches and on-the-go packaging.

- Increasing use of recycled PET (rPET) and bio-based PET materials to enhance sustainability.

- Growing demand for customized and personalized packaging solutions for premium brands.

Growth Accelerators in the PET Beverage Packaging Market Industry

Strategic partnerships between packaging manufacturers and beverage companies are driving innovation and market expansion. Technological advancements such as improved barrier technologies and lightweighting solutions are enhancing the efficiency and sustainability of PET packaging. Expansion into untapped markets, particularly in developing economies experiencing rapid economic growth, presents significant opportunities for market players.

Key Players Shaping the PET Beverage Packaging Market Market

- Retal Industries Limited

- GTX Hanex Plastic Sp Z O O

- Comar LLC

- Apex Plastics

- Plastipak Holdings Inc

- Nampak Ltd

- Graham Packaging

- Amcor PLC

- KHS GmbH (Salzgitter Klckner-Werke GmbH)

- Berry Global Inc

- Resilux NV

- Silgan Holdings Inc

- Esterform Packaging

- Altium Packaging

- ALPLA Group

Notable Milestones in PET Beverage Packaging Market Sector

- June 2023: Graham Packaging implemented a five-pronged strategy focused on sustainability, including energy efficiency improvements, renewable energy sourcing, increased PCR material usage, lightweighting, and supply chain collaborations to reduce GHG emissions. This initiative is projected to reduce their carbon footprint by xx% by 2030.

- March 2023: Apex Plastics expanded its product range to include Trek's premium VodaFlo bottles, broadening its market reach and catering to a wider range of client needs. This expansion is expected to increase their market share in the water bottle segment by xx%.

In-Depth PET Beverage Packaging Market Market Outlook

The PET beverage packaging market is poised for continued growth, driven by evolving consumer preferences, technological innovation, and a growing focus on sustainability. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for success. The increasing adoption of recycled content and lightweighting technologies will shape the future of the market, fostering a more environmentally responsible packaging sector. Opportunities exist for companies that can effectively balance sustainability, cost-efficiency, and consumer demand.

PET Beverage Packaging Market Segmentation

-

1. Product

- 1.1. Bottles

- 1.2. Jars

- 1.3. Lids/Caps & Closures

- 1.4. Other Products

-

2. End-user Industry

- 2.1. Carbonated Drinks

- 2.2. Juices

- 2.3. Water Bottles

- 2.4. Alcoholic Beverages

- 2.5. Energy Drinks

- 2.6. Other End-user Industries

PET Beverage Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Latin America

- 5. Middle East and Africa

PET Beverage Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Outstanding Properties of Pet Suited to Beverage Packaging; Rising Demand for Sustainable Packaging

- 3.3. Market Restrains

- 3.3.1. Regulations Against the Use of Plastics in Some Regions

- 3.4. Market Trends

- 3.4.1. Bottles to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles

- 5.1.2. Jars

- 5.1.3. Lids/Caps & Closures

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Carbonated Drinks

- 5.2.2. Juices

- 5.2.3. Water Bottles

- 5.2.4. Alcoholic Beverages

- 5.2.5. Energy Drinks

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Bottles

- 6.1.2. Jars

- 6.1.3. Lids/Caps & Closures

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Carbonated Drinks

- 6.2.2. Juices

- 6.2.3. Water Bottles

- 6.2.4. Alcoholic Beverages

- 6.2.5. Energy Drinks

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Bottles

- 7.1.2. Jars

- 7.1.3. Lids/Caps & Closures

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Carbonated Drinks

- 7.2.2. Juices

- 7.2.3. Water Bottles

- 7.2.4. Alcoholic Beverages

- 7.2.5. Energy Drinks

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Bottles

- 8.1.2. Jars

- 8.1.3. Lids/Caps & Closures

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Carbonated Drinks

- 8.2.2. Juices

- 8.2.3. Water Bottles

- 8.2.4. Alcoholic Beverages

- 8.2.5. Energy Drinks

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Bottles

- 9.1.2. Jars

- 9.1.3. Lids/Caps & Closures

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Carbonated Drinks

- 9.2.2. Juices

- 9.2.3. Water Bottles

- 9.2.4. Alcoholic Beverages

- 9.2.5. Energy Drinks

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Bottles

- 10.1.2. Jars

- 10.1.3. Lids/Caps & Closures

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Carbonated Drinks

- 10.2.2. Juices

- 10.2.3. Water Bottles

- 10.2.4. Alcoholic Beverages

- 10.2.5. Energy Drinks

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 France

- 12.1.2 Germany

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 United Kingdom

- 12.1.6 Rest of Europe

- 13. Asia Pacific PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa PET Beverage Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Retal Industries Limite

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 GTX Hanex Plastic Sp Z O O

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Comar LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Apex Plastics

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Plastipak Holdings Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nampak Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Graham Packaging

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Amcor PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Khs GmbH (Salzgitter Klckner-Werke GmbH)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Berry Global Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Resilux NV

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Silgan Holdings Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Esterform Packaging

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Altium Packaging

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 ALPLA Group

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Retal Industries Limite

List of Figures

- Figure 1: Global PET Beverage Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America PET Beverage Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America PET Beverage Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America PET Beverage Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America PET Beverage Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe PET Beverage Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe PET Beverage Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe PET Beverage Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe PET Beverage Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia PET Beverage Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia PET Beverage Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia PET Beverage Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia PET Beverage Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America PET Beverage Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 31: Latin America PET Beverage Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: Latin America PET Beverage Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America PET Beverage Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa PET Beverage Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa PET Beverage Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa PET Beverage Packaging Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa PET Beverage Packaging Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa PET Beverage Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa PET Beverage Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PET Beverage Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global PET Beverage Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: France PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United States PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: France PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Spain PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 38: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 39: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan PET Beverage Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 44: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 45: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global PET Beverage Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 47: Global PET Beverage Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: Global PET Beverage Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PET Beverage Packaging Market?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the PET Beverage Packaging Market?

Key companies in the market include Retal Industries Limite, GTX Hanex Plastic Sp Z O O, Comar LLC, Apex Plastics, Plastipak Holdings Inc, Nampak Ltd, Graham Packaging, Amcor PLC, Khs GmbH (Salzgitter Klckner-Werke GmbH), Berry Global Inc, Resilux NV, Silgan Holdings Inc, Esterform Packaging, Altium Packaging, ALPLA Group.

3. What are the main segments of the PET Beverage Packaging Market?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Outstanding Properties of Pet Suited to Beverage Packaging; Rising Demand for Sustainable Packaging.

6. What are the notable trends driving market growth?

Bottles to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Regulations Against the Use of Plastics in Some Regions.

8. Can you provide examples of recent developments in the market?

June 2023 - Graham Packaging implemented a five-pronged strategy that includes reducing energy intensity, sourcing renewable energy, increasing the use of post-consumer recycled (PCR) materials, lightweight bottles, and collaborating with suppliers to reduce GHG emissions. Graham is also exploring innovations like ceramic oven reflectors in its heating systems, which can reduce oven power consumption by 10-20%, and automated compressed air controller solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PET Beverage Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PET Beverage Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PET Beverage Packaging Market?

To stay informed about further developments, trends, and reports in the PET Beverage Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence