Key Insights

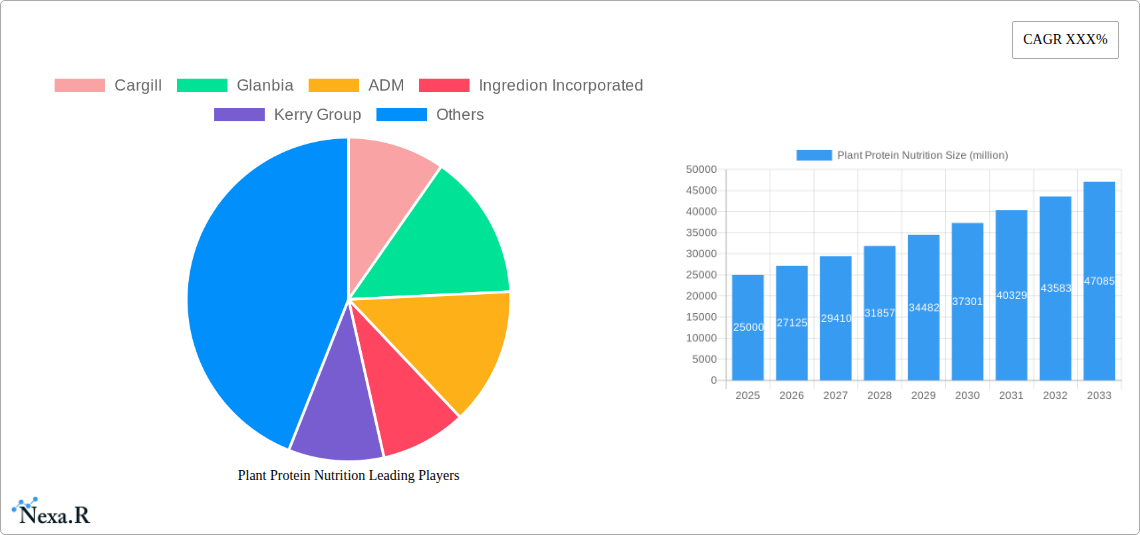

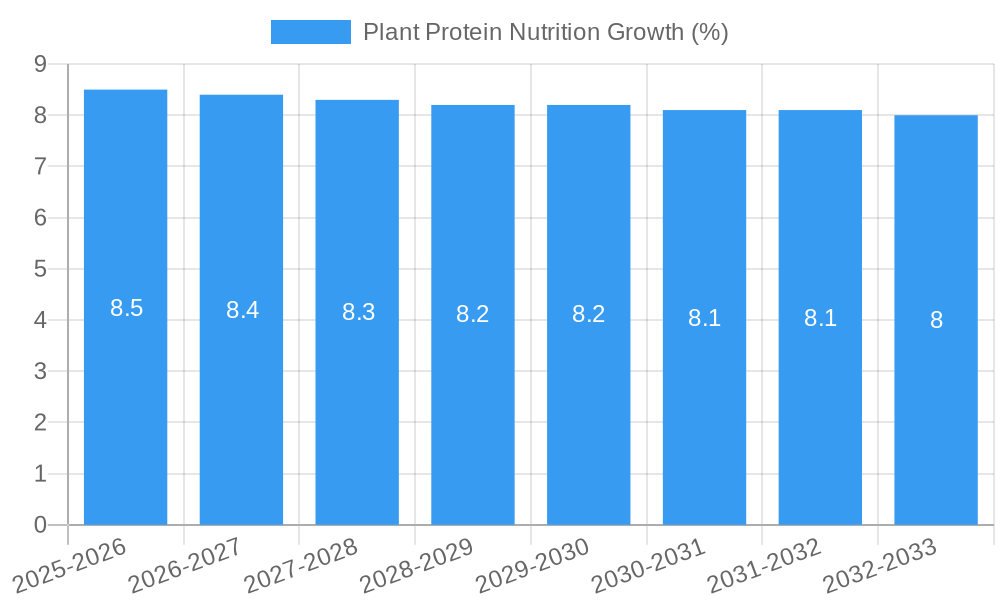

The global Plant Protein Nutrition market is poised for significant expansion, with an estimated market size of approximately $25,000 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust growth is fueled by an increasing consumer preference for healthier lifestyles, a rising incidence of chronic diseases, and a growing awareness of the environmental and ethical benefits associated with plant-based diets. The surge in demand for protein-rich foods and supplements, particularly among fitness enthusiasts and individuals seeking weight management solutions, is a primary driver. Furthermore, advancements in processing technologies are enhancing the taste, texture, and nutritional profile of plant-based protein ingredients, making them more appealing alternatives to animal-based proteins. Key applications benefiting from this trend include the meats, dairy and dairy alternatives, and beverages sectors, where plant proteins are increasingly being incorporated to meet consumer demand for cleaner labels and sustainable options.

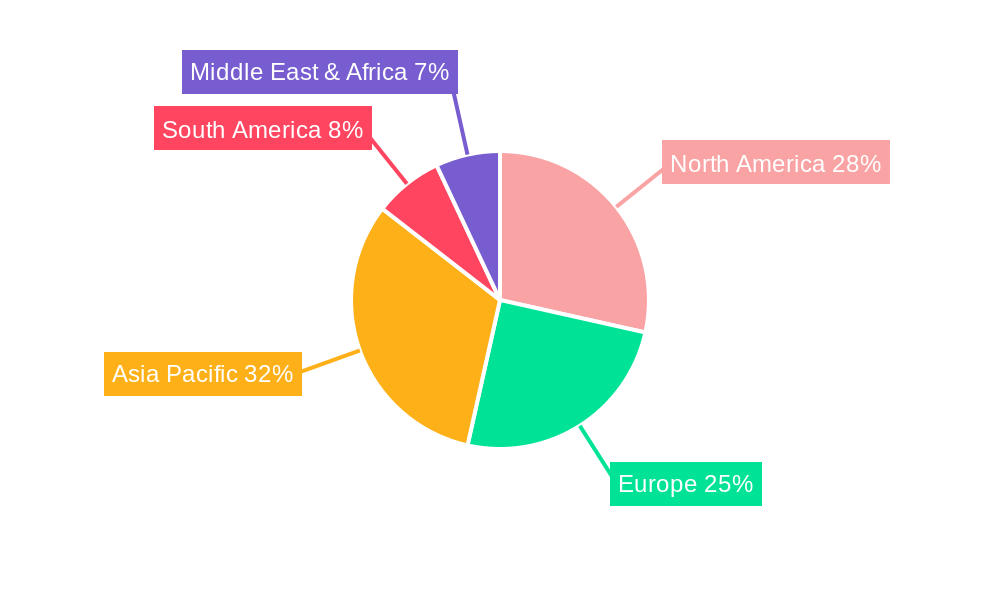

The market is characterized by a dynamic competitive landscape with major players like Cargill, Glanbia, and ADM investing heavily in research and development to innovate and expand their product portfolios. The segment of Soy Protein currently holds a dominant market share due to its established availability and versatile applications, but Wheat Protein and Pea Protein are rapidly gaining traction due to improved functionality and allergen-conscious formulations. Emerging trends such as the development of novel plant protein sources and the fortification of food products with plant proteins are expected to further shape market dynamics. However, challenges such as the relatively higher cost of some plant protein ingredients compared to conventional options and potential taste and texture limitations in certain applications could act as restraints. Despite these hurdles, the overarching shift towards healthier and more sustainable consumption patterns is expected to propel sustained growth across all market segments and regions, with Asia Pacific anticipated to be a significant growth engine due to its large population and rising disposable incomes.

Plant Protein Nutrition Market Report

This comprehensive report, "Plant Protein Nutrition Market Dynamics, Trends, and Outlook 2024-2033," offers an in-depth analysis of the global plant protein nutrition market. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this study is essential for stakeholders seeking to understand market drivers, emerging trends, and competitive landscapes. We leverage detailed market sizing, segmentation, and regional analysis to provide actionable insights. The report is designed to engage industry professionals by integrating high-traffic keywords and offering a structured presentation of valuable data.

Plant Protein Nutrition Market Dynamics & Structure

The global plant protein nutrition market is characterized by a moderately concentrated structure, with key players like Cargill, Glanbia, and ADM holding significant market shares. Technological innovation is a primary driver, fueled by advancements in processing techniques that enhance the functionality and appeal of plant-based proteins, particularly pea protein and soy protein. Regulatory frameworks are evolving to support the clean label movement and sustainability claims, positively impacting market growth. Competitive product substitutes, such as insect protein and cultured meat, are emerging but currently represent a smaller threat compared to established animal-derived proteins. End-user demographics are increasingly shifting towards health-conscious consumers, millennials, and Generation Z, who are actively seeking plant-based alternatives for health and ethical reasons. Mergers and acquisitions (M&A) are notable trends, with companies strategically acquiring innovative startups and established ingredient suppliers to expand their portfolios and market reach. For instance, several strategic acquisitions were observed in the last two years, totaling an estimated XX million units in deal value, indicating a strong consolidation drive.

- Market Concentration: Moderately concentrated, with top players holding XX% of the global market.

- Technological Innovation Drivers: Improved extraction methods, flavor masking, and texturization technologies for enhanced sensory profiles.

- Regulatory Frameworks: Growing support for plant-based claims and labeling, with increased scrutiny on nutritional equivalence.

- Competitive Product Substitutes: Emerging alternatives like insect protein and cultured meat, though currently niche.

- End-User Demographics: Driven by health-conscious consumers, vegetarians, vegans, and flexitarians, particularly in the 18-45 age bracket.

- M&A Trends: Strategic acquisitions to gain market share, expand product offerings, and secure supply chains.

Plant Protein Nutrition Growth Trends & Insights

The global plant protein nutrition market is poised for robust growth, projected to reach an estimated market size of over $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. The historical period of 2019–2024 witnessed a significant surge in adoption rates, primarily driven by a growing awareness of the health benefits associated with plant-based diets, including reduced risk of heart disease and improved weight management. Technological disruptions have played a pivotal role, with innovations in protein extraction and processing leading to improved taste, texture, and digestibility of plant-based protein ingredients. This has enabled wider application across various food and beverage categories, from plant-based meats and dairy alternatives to sports nutrition supplements. Consumer behavior shifts are fundamentally reshaping the food industry, with a marked preference for sustainable, ethically sourced, and transparently produced food options. This trend is further amplified by increasing concerns about the environmental impact of animal agriculture. The market penetration of plant-based protein products has accelerated significantly, moving beyond niche vegan markets to mainstream consumer acceptance. This evolution is supported by substantial investments in research and development by leading companies, aimed at replicating the sensory attributes and nutritional profiles of animal proteins. The estimated market size for plant protein nutrition in the base year of 2025 is projected to be around $XX billion, underscoring its rapid expansion. The increasing demand for high-quality protein sources that cater to specific dietary needs and preferences, such as those with allergies or intolerances to dairy or soy, is a key contributor to this growth trajectory. Furthermore, the burgeoning sports nutrition sector is increasingly incorporating plant-based protein powders and supplements, driven by athletes and fitness enthusiasts seeking performance enhancement and recovery benefits without animal-derived ingredients. The expanding ready-to-drink (RTD) beverage segment also presents a significant avenue for plant protein integration, offering convenient and healthy options for busy consumers. The 'Others' segment in applications, encompassing pet food and animal feed, is also showing promising growth as pet owners and livestock producers seek sustainable and nutritious alternatives. The overall outlook indicates a sustained period of expansion, driven by a confluence of consumer demand, technological advancement, and a commitment to sustainability.

Dominant Regions, Countries, or Segments in Plant Protein Nutrition

North America currently dominates the global plant protein nutrition market, with the United States leading in terms of consumption and production. This dominance is underpinned by strong economic policies that support food innovation and a highly health-conscious consumer base actively embracing plant-based diets. The region's robust demand for meat and dairy alternatives, coupled with a well-established sports nutrition industry, significantly drives market growth. The market share of plant protein in North America is estimated to be approximately XX% of the global market. Key drivers for this regional dominance include aggressive marketing campaigns by major food manufacturers, widespread availability of diverse plant-based products in retail channels, and a strong presence of key industry players.

Application Segments Driving Growth:

- Beverages: This segment holds a substantial market share, driven by the increasing popularity of plant-based protein shakes, smoothies, and RTD beverages as convenient health and wellness solutions. The market size in this segment alone is estimated at over $XX billion.

- Dairy and Dairy Alternatives: A significant growth driver, fueled by the demand for plant-based milk, yogurts, cheeses, and ice creams. Consumer preference for lactose-free and dairy-free options propels this segment, with an estimated market value exceeding $XX billion.

- Meats: The plant-based meat alternative sector is experiencing rapid expansion, offering consumers products that mimic the taste and texture of traditional meat. This segment is projected to reach over $XX billion by 2033.

Type Segments Contributing to Dominance:

- Pea Protein: This type of protein is experiencing exceptional growth due to its favorable nutritional profile, hypoallergenic properties, and sustainability. Its versatility makes it a preferred choice across various applications, contributing significantly to the overall market value.

- Soy Protein: While facing some consumer perception challenges, soy protein remains a dominant player due to its affordability, extensive research, and established presence in the food industry. Its market share is substantial, estimated at over $XX billion.

Economic policies promoting sustainable agriculture and healthy eating, coupled with well-developed retail and distribution infrastructure, further solidify North America's leadership. The region's proactive approach to new product development and market penetration strategies ensures its continued influence on the global plant protein nutrition landscape.

Plant Protein Nutrition Product Landscape

The product landscape in plant protein nutrition is characterized by continuous innovation aimed at enhancing functionality, palatability, and nutritional value. Emerging products focus on creating plant-based alternatives that closely replicate the sensory experiences of animal-derived counterparts. Innovations include the development of plant protein isolates and concentrates with improved solubility and emulsification properties, making them ideal for beverages and baked goods. Advanced texturization techniques are yielding plant-based meat and seafood products with remarkably authentic textures. Furthermore, advancements in flavor masking technologies are addressing the inherent taste challenges of certain plant proteins, particularly those derived from legumes. Unique selling propositions often revolve around "clean label" formulations, non-GMO sourcing, and allergen-free profiles. Technological advancements in enzymatic hydrolysis and fermentation are also creating novel plant protein ingredients with enhanced bioavailability and novel functionalities.

Key Drivers, Barriers & Challenges in Plant Protein Nutrition

Key Drivers:

- Growing Health and Wellness Consciousness: Consumers are increasingly opting for plant-based proteins due to perceived health benefits, including lower cholesterol, reduced saturated fat, and management of chronic diseases.

- Sustainability and Environmental Concerns: The significant environmental footprint of animal agriculture drives demand for more sustainable protein sources.

- Dietary Preferences and Ethical Considerations: The rise of veganism, vegetarianism, and flexitarianism, coupled with ethical concerns about animal welfare, fuels the plant protein market.

- Technological Advancements: Innovations in processing, ingredient formulation, and flavor masking are improving the taste, texture, and versatility of plant-based proteins.

- Government Initiatives and Support: Favorable policies and incentives promoting plant-based diets and sustainable food systems.

Barriers & Challenges:

- Taste and Texture: Replicating the taste and texture of animal proteins remains a significant challenge for some plant-based products, impacting consumer acceptance.

- Supply Chain Volatility: Dependence on agricultural yields and potential for price fluctuations in raw materials like soybeans and peas.

- Regulatory Hurdles: Inconsistent labeling regulations and challenges in meeting stringent nutritional equivalence standards in some regions.

- Consumer Misconceptions and Awareness: Lack of complete understanding regarding the nutritional completeness and benefits of various plant proteins.

- Cost Competitiveness: Plant-based protein ingredients can sometimes be more expensive than their animal-derived counterparts, affecting consumer affordability.

Emerging Opportunities in Plant Protein Nutrition

Emerging opportunities lie in the development of novel plant protein sources beyond the mainstream, such as fava bean, lentil, and algae proteins, to diversify the market and cater to specific nutritional needs. The expanding pet food industry presents a significant untapped market for plant-based protein ingredients, driven by pet owners seeking healthier and more sustainable options for their companions. Innovative applications in functional foods and beverages, designed to offer specific health benefits like gut health support or cognitive enhancement, are also gaining traction. Evolving consumer preferences for personalized nutrition will drive demand for customized plant protein blends tailored to individual dietary requirements and fitness goals. The development of high-performance plant-based proteins for specialized applications, such as sports nutrition and infant formulas, also represents a lucrative growth avenue.

Growth Accelerators in the Plant Protein Nutrition Industry

Long-term growth in the plant protein nutrition industry is being significantly accelerated by breakthroughs in biotechnology and ingredient science. Strategic partnerships between ingredient suppliers, food manufacturers, and research institutions are fostering innovation and expanding the application range of plant proteins. Market expansion strategies focusing on emerging economies, where the adoption of plant-based diets is on an upward trend, are crucial growth accelerators. The increasing investment in sustainable sourcing and processing technologies is not only enhancing product quality but also appealing to ethically-minded consumers. Furthermore, the development of plant-based alternatives for niche markets, such as medical nutrition and specialized infant formulas, is creating new avenues for growth. The growing convergence of health, environment, and ethics in consumer purchasing decisions acts as a powerful catalyst for sustained industry expansion.

Key Players Shaping the Plant Protein Nutrition Market

- Cargill

- Glanbia

- ADM

- Ingredion Incorporated

- Kerry Group

- NOW Foods

- Tate & Lyle

- Axiom Foods

- Abbott

- AMCO Proteins

- Glico Nutrition

- Roquette

- BENEO GmbH

- Burcon Nutrascience

Notable Milestones in Plant Protein Nutrition Sector

- 2022: Launch of novel plant-based protein blends with enhanced amino acid profiles by major ingredient suppliers.

- 2021: Significant increase in M&A activities, with key players acquiring innovative plant-based protein startups.

- 2020: Expansion of pea protein production capacity by leading manufacturers to meet surging demand.

- 2019: Introduction of plant-based dairy alternatives with improved taste and texture, leading to wider consumer adoption.

- 2023: Development of advanced fermentation techniques for producing novel plant protein ingredients.

- 2024: Increased focus on sustainable sourcing and transparent supply chains, influencing product development and marketing.

In-Depth Plant Protein Nutrition Market Outlook

The future outlook for the plant protein nutrition market is exceptionally promising, driven by persistent consumer demand for healthier, more sustainable, and ethically produced food options. Growth accelerators such as continuous technological innovation in ingredient functionality and flavor profiles, coupled with strategic market expansion into underserved regions, will shape its trajectory. Key strategic opportunities include the development of specialized plant proteins for functional foods and personalized nutrition, as well as further penetration into the pet food and animal feed sectors. The increasing integration of plant-based proteins into mainstream food and beverage products, supported by robust investment and favorable regulatory environments, suggests a sustained period of expansion and market dominance. The estimated market size by the end of the forecast period is expected to exceed $XX billion, underscoring its significant economic potential and impact on the global food landscape.

Plant Protein Nutrition Segmentation

-

1. Application

- 1.1. Meats

- 1.2. Dairy and Dairy Alternatives

- 1.3. Cereals & Snacks

- 1.4. Beverages

- 1.5. Others

-

2. Type

- 2.1. Soy Protein

- 2.2. Wheat Protein

- 2.3. Pea Protein

- 2.4. Potato Protein

- 2.5. Others

Plant Protein Nutrition Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant Protein Nutrition REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Meats

- 5.1.2. Dairy and Dairy Alternatives

- 5.1.3. Cereals & Snacks

- 5.1.4. Beverages

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Soy Protein

- 5.2.2. Wheat Protein

- 5.2.3. Pea Protein

- 5.2.4. Potato Protein

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Meats

- 6.1.2. Dairy and Dairy Alternatives

- 6.1.3. Cereals & Snacks

- 6.1.4. Beverages

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Soy Protein

- 6.2.2. Wheat Protein

- 6.2.3. Pea Protein

- 6.2.4. Potato Protein

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Meats

- 7.1.2. Dairy and Dairy Alternatives

- 7.1.3. Cereals & Snacks

- 7.1.4. Beverages

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Soy Protein

- 7.2.2. Wheat Protein

- 7.2.3. Pea Protein

- 7.2.4. Potato Protein

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Meats

- 8.1.2. Dairy and Dairy Alternatives

- 8.1.3. Cereals & Snacks

- 8.1.4. Beverages

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Soy Protein

- 8.2.2. Wheat Protein

- 8.2.3. Pea Protein

- 8.2.4. Potato Protein

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Meats

- 9.1.2. Dairy and Dairy Alternatives

- 9.1.3. Cereals & Snacks

- 9.1.4. Beverages

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Soy Protein

- 9.2.2. Wheat Protein

- 9.2.3. Pea Protein

- 9.2.4. Potato Protein

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plant Protein Nutrition Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Meats

- 10.1.2. Dairy and Dairy Alternatives

- 10.1.3. Cereals & Snacks

- 10.1.4. Beverages

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Soy Protein

- 10.2.2. Wheat Protein

- 10.2.3. Pea Protein

- 10.2.4. Potato Protein

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cargill

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Glanbia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ADM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ingredion Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kerry Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NOW Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tate & Lyle

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axiom Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AMCO Proteins

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Glico Nutrition

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Roquette

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BENEO GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Burcon Nutrascience

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cargill

List of Figures

- Figure 1: Global Plant Protein Nutrition Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plant Protein Nutrition Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plant Protein Nutrition Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plant Protein Nutrition Revenue (million), by Type 2024 & 2032

- Figure 5: North America Plant Protein Nutrition Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Plant Protein Nutrition Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plant Protein Nutrition Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plant Protein Nutrition Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plant Protein Nutrition Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plant Protein Nutrition Revenue (million), by Type 2024 & 2032

- Figure 11: South America Plant Protein Nutrition Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Plant Protein Nutrition Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plant Protein Nutrition Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plant Protein Nutrition Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plant Protein Nutrition Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plant Protein Nutrition Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Plant Protein Nutrition Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Plant Protein Nutrition Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plant Protein Nutrition Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plant Protein Nutrition Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plant Protein Nutrition Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plant Protein Nutrition Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Plant Protein Nutrition Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Plant Protein Nutrition Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plant Protein Nutrition Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plant Protein Nutrition Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plant Protein Nutrition Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plant Protein Nutrition Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Plant Protein Nutrition Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Plant Protein Nutrition Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plant Protein Nutrition Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant Protein Nutrition Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Plant Protein Nutrition Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Plant Protein Nutrition Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Plant Protein Nutrition Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Plant Protein Nutrition Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Plant Protein Nutrition Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plant Protein Nutrition Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plant Protein Nutrition Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Plant Protein Nutrition Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plant Protein Nutrition Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant Protein Nutrition?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Plant Protein Nutrition?

Key companies in the market include Cargill, Glanbia, ADM, Ingredion Incorporated, Kerry Group, NOW Foods, Tate & Lyle, Axiom Foods, Abbott, AMCO Proteins, Glico Nutrition, Roquette, BENEO GmbH, Burcon Nutrascience.

3. What are the main segments of the Plant Protein Nutrition?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant Protein Nutrition," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant Protein Nutrition report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant Protein Nutrition?

To stay informed about further developments, trends, and reports in the Plant Protein Nutrition, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence