Key Insights

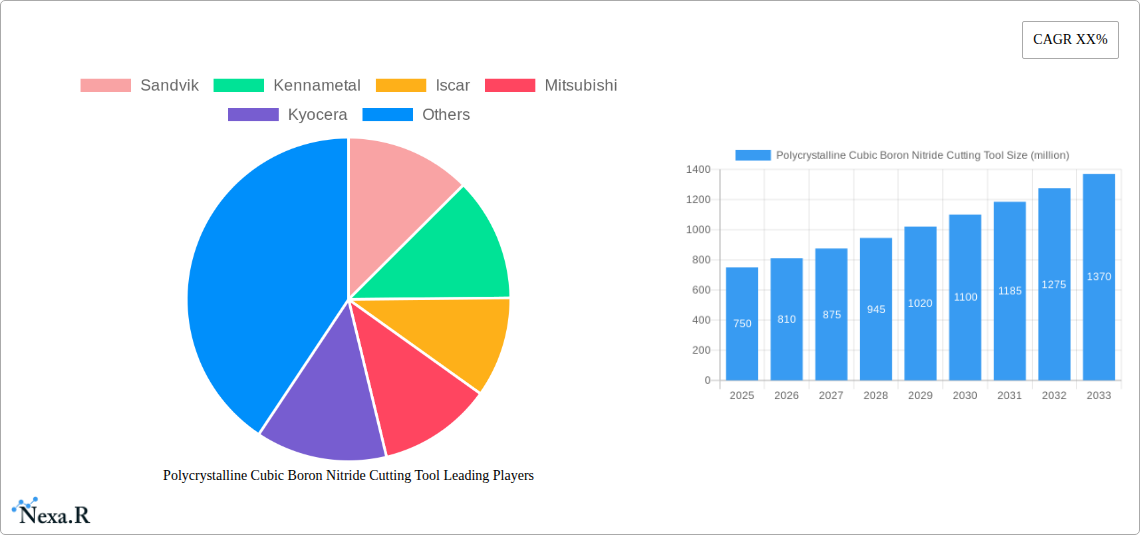

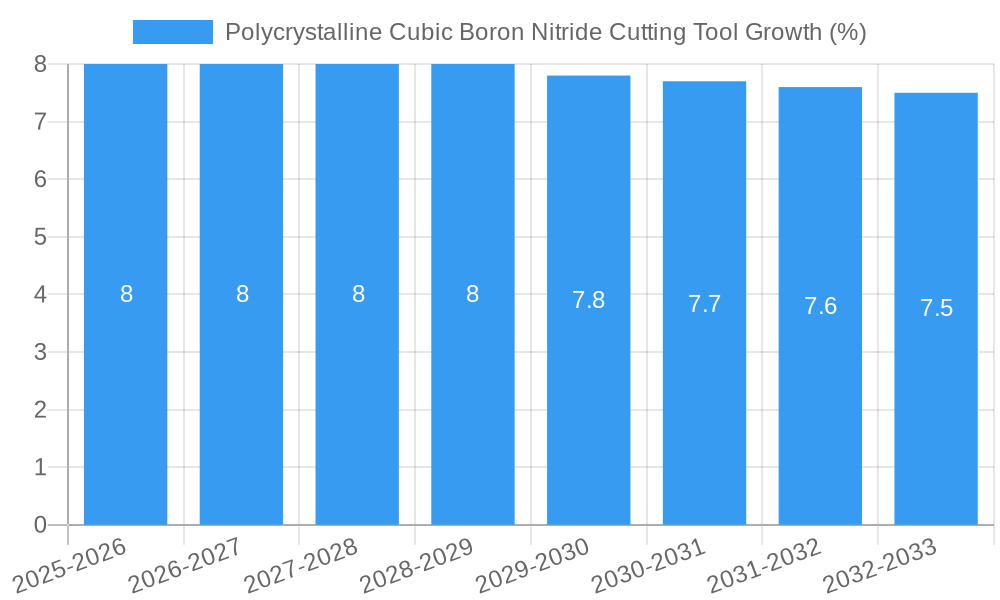

The Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market is poised for robust expansion, driven by its exceptional hardness, thermal stability, and wear resistance, making it indispensable for machining challenging materials. The market, estimated to be valued at approximately USD 750 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of around 8% through 2033. This significant growth is fueled by the increasing demand from key end-use industries, including automotive manufacturing, where PCBN tools are crucial for machining engine blocks, transmissions, and other critical components requiring high precision and surface finish. The aerospace sector also represents a substantial driver, utilizing PCBN for its ability to efficiently cut hard alloys like titanium and Inconel used in aircraft manufacturing. Furthermore, the burgeoning electronics and semiconductor industry's need for high-precision machining of hard and brittle materials further bolsters market demand. Innovations in PCBN tool design, such as advanced coating technologies and optimized geometries, are continuously enhancing their performance, leading to improved productivity and reduced manufacturing costs for end-users, thereby solidifying their competitive edge.

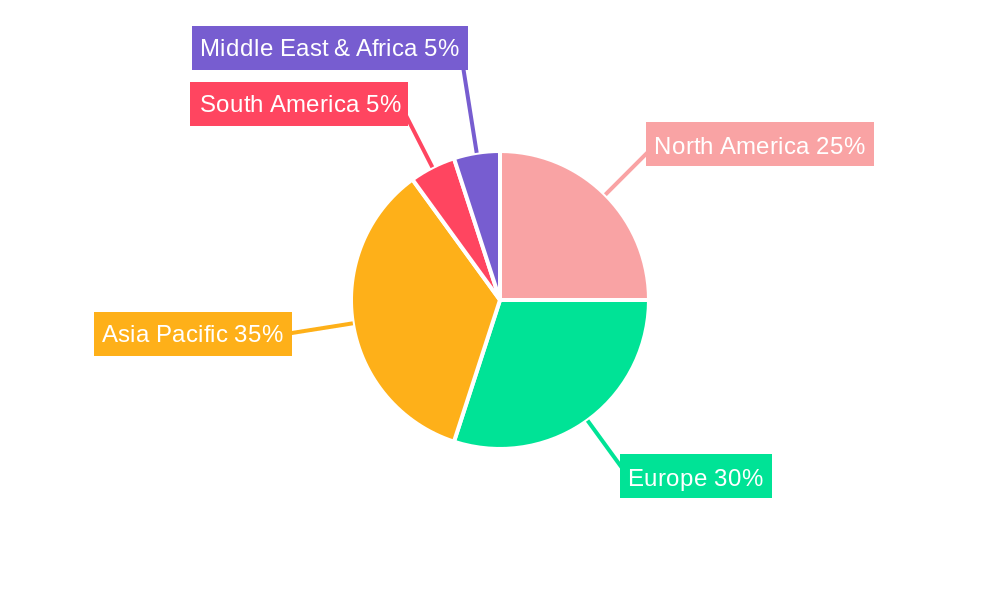

The market is segmented by type into stationary and indexable tools, with indexable tools likely holding a larger share due to their flexibility and cost-effectiveness in various applications. Geographically, Asia Pacific, led by China and India, is expected to emerge as the fastest-growing region, owing to the rapid industrialization, expanding manufacturing base, and increasing adoption of advanced machining technologies in these economies. North America and Europe, with their well-established automotive and aerospace industries, will continue to be significant markets. However, the market faces certain restraints, including the high cost of raw materials for PCBN production and the availability of alternative cutting tool materials like Tungsten Carbide and Ceramics, which, while less performant in some applications, can be more cost-effective. Despite these challenges, the inherent superior properties of PCBN for specialized, high-performance machining applications ensure its continued and growing importance in the global manufacturing landscape.

Report Description: Polycrystalline Cubic Boron Nitride Cutting Tool Market Analysis 2019–2033

This comprehensive report offers an in-depth analysis of the global Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market, providing critical insights for stakeholders across the metal processing, aerospace, automobile manufacturing, and electronics and semiconductors industries. Spanning a study period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, emerging opportunities, growth accelerators, and the competitive landscape. We leverage advanced analytical frameworks to deliver actionable intelligence for strategic decision-making, encompassing both parent and child market segments to provide a holistic view. All quantitative values are presented in million units, ensuring clarity and precision.

Polycrystalline Cubic Boron Nitride Cutting Tool Market Dynamics & Structure

The Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market exhibits a moderately consolidated structure, with a few key players commanding a significant market share. Major contributors include Sandvik, Kennametal, Iscar, Mitsubishi, Kyocera, Sumitomo, TaeguTec, Korloy, YG-1, Ingersoll Cutting Tools, Beijing Worldia Diamond Tools, ZhengZhou Diamond Precision Manufacturing, Weihai Weiying Tool, and Shenzhen Juntec Ultra-Hard Tools. Technological innovation remains a primary driver, with continuous advancements in PCBN compositions and tool geometries enhancing wear resistance, thermal conductivity, and cutting speeds, particularly for demanding ferrous and hardened material applications. Regulatory frameworks, while generally supportive of industrial growth, can influence material sourcing and environmental compliance. Competitive product substitutes, such as Tungsten Carbide and Ceramic cutting tools, present a constant challenge, especially in less demanding applications where cost-effectiveness is paramount. End-user demographics are shifting towards industries requiring high-precision machining and increased throughput, such as the aerospace and automotive sectors. Mergers and acquisitions (M&A) trends, while not overtly dominant, have seen strategic consolidation to enhance market reach and technological capabilities. For instance, a projected xx M&A deals are anticipated within the forecast period, aiming to integrate specialized expertise or expand product portfolios. Innovation barriers include the high cost of raw material synthesis and the specialized manufacturing processes required for PCBN inserts.

- Market Concentration: Moderately consolidated, with leading players holding substantial market influence.

- Technological Innovation: Driven by advancements in material science and cutting edge geometries, improving performance in demanding applications.

- Regulatory Frameworks: Primarily focused on material sourcing, environmental standards, and quality control.

- Competitive Substitutes: Tungsten Carbide and Ceramic cutting tools offer alternative solutions based on application requirements.

- End-User Demographics: Growing demand from high-precision manufacturing sectors like aerospace and automotive.

- M&A Trends: Strategic acquisitions focused on technological integration and market expansion.

- Innovation Barriers: High capital investment for material synthesis and specialized manufacturing processes.

Polycrystalline Cubic Boron Nitride Cutting Tool Growth Trends & Insights

The Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market is poised for robust growth over the forecast period of 2025–2033, exhibiting a projected Compound Annual Growth Rate (CAGR) of approximately xx%. This expansion is underpinned by a significant increase in the adoption of advanced machining solutions across diverse industrial segments. The market size, estimated at $xx million in the base year 2025, is expected to reach $xx million by 2033, reflecting a sustained upward trajectory. Technological disruptions are playing a pivotal role, with manufacturers continuously refining PCBN compositions to achieve superior hardness, thermal stability, and wear resistance. This translates into enhanced cutting performance, reduced cycle times, and improved surface finish, directly impacting productivity in critical applications. For instance, the development of novel binderless PCBN grades and advanced chip breaker designs is revolutionizing the machining of difficult-to-cut materials like high-strength steels and superalloys.

Consumer behavior shifts are also contributing to this growth. End-users are increasingly prioritizing tools that offer longer tool life, higher precision, and greater operational efficiency, driven by the need to reduce manufacturing costs and meet stringent quality standards. The push towards automation and Industry 4.0 initiatives further fuels the demand for high-performance cutting tools that can reliably operate in automated production lines. Market penetration is deepening across both established and emerging economies as manufacturing capabilities evolve. The aerospace industry's demand for machining complex components from lightweight yet strong alloys, coupled with the automotive sector's drive for mass production of high-performance engines and chassis, are significant growth catalysts. Moreover, the electronics and semiconductors industry's need for precise machining of hard materials in miniaturized components is opening new avenues for PCBN cutting tools. The historical period from 2019–2024 has laid a strong foundation, witnessing steady growth driven by initial technological advancements and a gradual increase in awareness of PCBN's superior capabilities. The estimated year of 2025 marks a significant inflection point, from which accelerated growth is anticipated due to widespread industrial adoption and ongoing innovation.

Dominant Regions, Countries, or Segments in Polycrystalline Cubic Boron Nitride Cutting Tool

The Metal Processing segment emerges as the dominant force driving growth within the Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market, accounting for an estimated xx% of the total market value in the base year 2025. This dominance stems from the fundamental need for efficient and precise machining of ferrous metals, including hardened steels, cast iron, and other challenging alloys, which are ubiquitous in industrial manufacturing. Within this broad segment, the automobile manufacturing industry represents a substantial child market, contributing significantly to the overall demand for PCBN tools due to its extensive use in engine block machining, crankshaft grinding, and the production of various automotive components requiring high wear resistance and precision.

Geographically, North America and Europe currently lead the PCBN cutting tool market, driven by their well-established industrial bases, advanced manufacturing technologies, and stringent quality standards, particularly in the aerospace and automotive sectors. The United States, with its robust aerospace and automotive manufacturing capabilities, and Germany, a powerhouse in automotive engineering and machine tool production, are key countries contributing to this regional dominance. Market share in these regions is further bolstered by the presence of leading global manufacturers and a strong ecosystem of research and development. However, the Asia Pacific region, particularly China, is exhibiting the fastest growth rate due to rapid industrialization, increasing investments in advanced manufacturing, and a burgeoning automotive and electronics sector. The country's significant metal processing capacity and growing demand for high-performance cutting tools position it as a critical future market.

The Indexable type of PCBN cutting tools holds a larger market share compared to Stationary tools, attributed to their versatility, ease of replacement, and cost-effectiveness in high-volume production environments. The ability to quickly change worn inserts without removing the entire tool holder significantly reduces downtime, a critical factor in optimizing manufacturing efficiency across all application segments. The growth potential within the Electronics and Semiconductors segment, though currently smaller in market share, is considerable, driven by the increasing demand for precision machining of hard and brittle materials in microelectronics fabrication.

- Dominant Segment: Metal Processing (xx% market share in 2025), with a significant contribution from Automobile Manufacturing.

- Leading Regions: North America and Europe, characterized by advanced manufacturing and stringent quality demands.

- Fastest Growing Region: Asia Pacific, propelled by rapid industrialization and expanding manufacturing capabilities.

- Key Countries: United States, Germany, and China are pivotal markets.

- Dominant Type: Indexable PCBN tools, favored for their efficiency and cost-effectiveness in production environments.

- Emerging Segment: Electronics and Semiconductors, showing substantial growth potential for precision machining applications.

- Key Drivers: Economic policies promoting industrial growth, investment in advanced manufacturing infrastructure, and the pursuit of high-precision, high-throughput production.

Polycrystalline Cubic Boron Nitride Cutting Tool Product Landscape

The product landscape of Polycrystalline Cubic Boron Nitride (PCBN) cutting tools is characterized by continuous innovation aimed at enhancing performance and expanding application scope. Manufacturers are developing advanced PCBN grades with tailored microstructures and binder systems to optimize hardness, toughness, and thermal conductivity, enabling superior cutting speeds and extended tool life. Applications span the machining of hardened steels (up to 65 HRC), cast iron, powder metallurgy parts, and superalloys, crucial for industries such as automotive, aerospace, and heavy machinery. Unique selling propositions often lie in specific geometries designed for efficient chip evacuation and reduced cutting forces, as well as specialized coatings that further improve wear resistance and reduce friction. Technological advancements include the integration of PCBN with other superhard materials and the development of precision-engineered insert geometries for high-speed machining and finish operations.

Key Drivers, Barriers & Challenges in Polycrystalline Cubic Boron Nitride Cutting Tool

The Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market is primarily propelled by the increasing demand for high-performance machining solutions capable of efficiently processing hard and abrasive materials. Technological advancements in PCBN synthesis and tool design, leading to enhanced wear resistance, thermal stability, and cutting speeds, are significant drivers. The growing automotive industry's need for precision components and the aerospace sector's requirement for machining exotic alloys further fuel market expansion. Industry 4.0 initiatives and automation trends also necessitate reliable, high-precision cutting tools.

However, the market faces several key challenges and restraints. The high cost of raw materials and sophisticated manufacturing processes for PCBN tools can be a barrier to adoption for smaller enterprises or in cost-sensitive applications. Supply chain disruptions, particularly for rare earth elements or specialized binders used in PCBN, can impact availability and lead to price volatility. Stringent environmental regulations regarding material processing and waste disposal can also increase operational costs. Intense competition from alternative cutting tool materials like Tungsten Carbide and advanced Ceramics, especially in less demanding applications, poses a continuous threat.

Emerging Opportunities in Polycrystalline Cubic Boron Nitride Cutting Tool

Emerging opportunities in the Polycrystalline Cubic Boron Nitride (PCBN) cutting tool sector are predominantly driven by the expansion of niche applications and advancements in material science. The increasing complexity of components in electric vehicles, requiring the machining of advanced materials like silicon carbide, presents a significant untapped market for specialized PCBN tooling. Furthermore, the growing trend towards additive manufacturing (3D printing) of metal components necessitates advanced post-processing techniques, where PCBN tools can play a crucial role in achieving desired surface finishes and dimensional accuracy. Evolving consumer preferences for lighter, more durable, and high-performance products across various industries will continue to demand materials that require sophisticated machining, thereby creating new avenues for PCBN tool development and application.

Growth Accelerators in the Polycrystalline Cubic Boron Nitride Cutting Tool Industry

Several catalysts are accelerating long-term growth in the PCBN cutting tool industry. Key among these is ongoing technological breakthroughs in PCBN composite development, leading to improved performance characteristics such as enhanced fracture toughness and superior thermal shock resistance. Strategic partnerships between PCBN tool manufacturers and machine tool builders are crucial for developing integrated solutions that optimize machining processes and unlock new levels of productivity. Market expansion strategies, including the penetration of emerging economies with a focus on industrial upgrading and the development of tailored tooling solutions for specific regional manufacturing needs, are vital. The increasing adoption of smart manufacturing and predictive maintenance technologies will also drive demand for highly reliable and durable PCBN tools that contribute to overall operational efficiency.

Key Players Shaping the Polycrystalline Cubic Boron Nitride Cutting Tool Market

- Sandvik

- Kennametal

- Iscar

- Mitsubishi

- Kyocera

- Sumitomo

- TaeguTec

- Korloy

- YG-1

- Ingersoll Cutting Tools

- Beijing Worldia Diamond Tools

- ZhengZhou Diamond Precision Manufacturing

- Weihai Weiying Tool

- Shenzhen Juntec Ultra-Hard Tools

Notable Milestones in Polycrystalline Cubic Boron Nitride Cutting Tool Sector

- 2019: Introduction of new PCBN grades with enhanced binderless compositions for superior wear resistance in high-speed machining applications.

- 2020: Launch of advanced PCBN inserts with innovative chip breaker geometries to improve chip control and reduce cutting forces in the automotive industry.

- 2021: Increased investment in R&D for PCBN tooling tailored for machining advanced composite materials used in aerospace.

- 2022: Strategic collaborations formed between leading PCBN manufacturers and machine tool builders to offer optimized machining solutions.

- 2023: Development of specialized PCBN tools for the precise finishing of critical components in the electronics and semiconductor industry.

- 2024: Significant advancements in PCBN coating technologies to further enhance tool life and reduce friction during machining operations.

- 2025 (Estimated): Expected market launch of next-generation PCBN composites with unprecedented thermal stability and hardness for extreme machining conditions.

In-Depth Polycrystalline Cubic Boron Nitride Cutting Tool Market Outlook

The future outlook for the Polycrystalline Cubic Boron Nitride (PCBN) cutting tool market is highly promising, driven by an interplay of technological advancements, evolving industry demands, and strategic market expansion. Growth accelerators, including the continuous refinement of PCBN material science for enhanced performance and the growing adoption of automation and Industry 4.0 in manufacturing, will continue to shape market dynamics. The increasing demand for precision machining in sectors like aerospace and electric vehicle manufacturing presents substantial future market potential. Strategic opportunities lie in developing specialized tooling solutions for emerging materials and applications, alongside forging deeper partnerships with original equipment manufacturers (OEMs) to integrate cutting-edge tooling into advanced manufacturing processes. The PCBN cutting tool sector is well-positioned for sustained growth, offering significant value to industries requiring superior material processing capabilities.

Polycrystalline Cubic Boron Nitride Cutting Tool Segmentation

-

1. Application

- 1.1. Metal Processing

- 1.2. Aerospace

- 1.3. Automobile Manufacturing

- 1.4. Electronics and Semiconductors

- 1.5. Others

-

2. Types

- 2.1. Stationary

- 2.2. Indexable

Polycrystalline Cubic Boron Nitride Cutting Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Polycrystalline Cubic Boron Nitride Cutting Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metal Processing

- 5.1.2. Aerospace

- 5.1.3. Automobile Manufacturing

- 5.1.4. Electronics and Semiconductors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Stationary

- 5.2.2. Indexable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Metal Processing

- 6.1.2. Aerospace

- 6.1.3. Automobile Manufacturing

- 6.1.4. Electronics and Semiconductors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Stationary

- 6.2.2. Indexable

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Metal Processing

- 7.1.2. Aerospace

- 7.1.3. Automobile Manufacturing

- 7.1.4. Electronics and Semiconductors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Stationary

- 7.2.2. Indexable

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Metal Processing

- 8.1.2. Aerospace

- 8.1.3. Automobile Manufacturing

- 8.1.4. Electronics and Semiconductors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Stationary

- 8.2.2. Indexable

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Metal Processing

- 9.1.2. Aerospace

- 9.1.3. Automobile Manufacturing

- 9.1.4. Electronics and Semiconductors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Stationary

- 9.2.2. Indexable

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Metal Processing

- 10.1.2. Aerospace

- 10.1.3. Automobile Manufacturing

- 10.1.4. Electronics and Semiconductors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Stationary

- 10.2.2. Indexable

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sandvik

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kennametal

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Iscar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kyocera

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sumitomo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TaeguTec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Korloy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 YG-1

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ingersoll Cutting Tools

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beijing Worldia Diamond Tools

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ZhengZhou Diamond Precision Manufacturing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Weihai Weiying Tool

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shenzhen Juntec Ultra-Hard Tools

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Sandvik

List of Figures

- Figure 1: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Application 2024 & 2032

- Figure 3: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Types 2024 & 2032

- Figure 5: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Application 2024 & 2032

- Figure 9: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Types 2024 & 2032

- Figure 11: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Polycrystalline Cubic Boron Nitride Cutting Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Polycrystalline Cubic Boron Nitride Cutting Tool Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polycrystalline Cubic Boron Nitride Cutting Tool?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Polycrystalline Cubic Boron Nitride Cutting Tool?

Key companies in the market include Sandvik, Kennametal, Iscar, Mitsubishi, Kyocera, Sumitomo, TaeguTec, Korloy, YG-1, Ingersoll Cutting Tools, Beijing Worldia Diamond Tools, ZhengZhou Diamond Precision Manufacturing, Weihai Weiying Tool, Shenzhen Juntec Ultra-Hard Tools.

3. What are the main segments of the Polycrystalline Cubic Boron Nitride Cutting Tool?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polycrystalline Cubic Boron Nitride Cutting Tool," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polycrystalline Cubic Boron Nitride Cutting Tool report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polycrystalline Cubic Boron Nitride Cutting Tool?

To stay informed about further developments, trends, and reports in the Polycrystalline Cubic Boron Nitride Cutting Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence