Key Insights

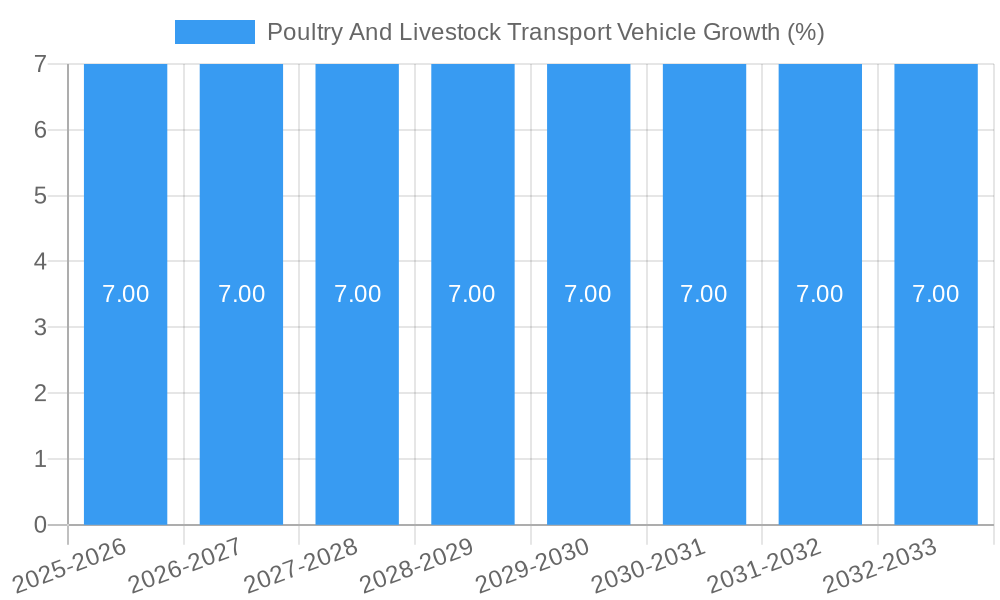

The global Poultry and Livestock Transport Vehicle market is poised for robust expansion, projected to reach a substantial market size by 2033, driven by a healthy Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033. This growth is underpinned by the ever-increasing global demand for protein, necessitating efficient and humane transportation of poultry and livestock from farms to processing facilities and markets. Key drivers include the growing global population, rising disposable incomes in developing economies, and a greater emphasis on food safety and animal welfare standards, which in turn require specialized and advanced transport solutions. Furthermore, advancements in vehicle technology, such as improved climate control systems, biosecurity features, and GPS tracking, are enhancing operational efficiency and reducing livestock stress, thereby stimulating market demand. The market is segmented by application into short-distance and long-distance transport, with both segments expected to witness steady growth due to the dispersed nature of agricultural production and consumption centers.

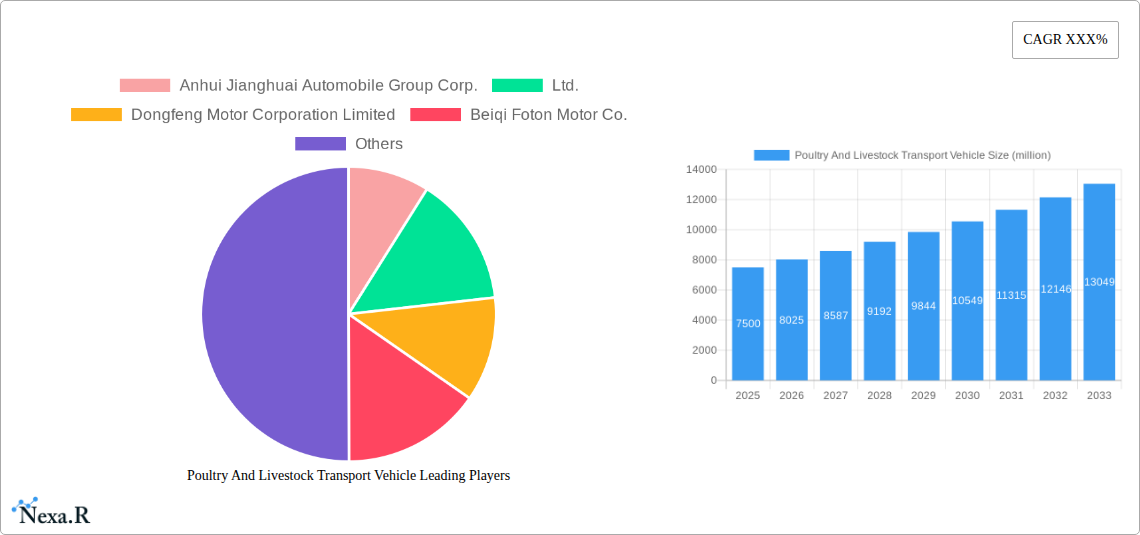

The market's trajectory is also influenced by evolving vehicle types, with both Open Poultry and Livestock Transport Vehicles and Enclosed Poultry and Livestock Transport Vehicles playing crucial roles. While open vehicles cater to certain regions and shorter hauls, the demand for enclosed, climate-controlled, and specialized vehicles is on the rise, particularly for long-distance transport and sensitive livestock. However, the market faces certain restraints, including the high initial cost of advanced transport vehicles, stringent regulatory landscapes concerning animal welfare and emissions in various regions, and the fluctuating prices of raw materials impacting manufacturing costs. Despite these challenges, major players like Anhui Jianghuai Automobile Group Corp.,Ltd., Dongfeng Motor Corporation Limited, and Beiqi Foton Motor Co.,Ltd. are actively investing in research and development to innovate and expand their product portfolios. The Asia Pacific region, particularly China and India, is expected to be a dominant force in market growth, owing to its large agricultural base and expanding meat consumption.

This comprehensive report delves into the dynamic poultry and livestock transport vehicle market, providing in-depth analysis and actionable insights for industry stakeholders. Covering the historical period of 2019–2024, base and estimated year of 2025, and a robust forecast period of 2025–2033, this report is your definitive guide to understanding market evolution, growth drivers, and future potential. We explore the intricate market structure, meticulously analyze growth trends, identify dominant regions and segments, and spotlight key players and innovations.

Poultry And Livestock Transport Vehicle Market Dynamics & Structure

The poultry and livestock transport vehicle market exhibits a moderate to high concentration, with a few key players dominating production. Technological innovation is a primary driver, focusing on enhanced animal welfare, biosecurity, fuel efficiency, and smart tracking systems. Regulatory frameworks, particularly concerning animal transportation regulations and emission standards, significantly influence vehicle design and operational practices. Competitive product substitutes, such as alternative logistics solutions and less specialized vehicles, present a minor challenge, as the core requirement for dedicated transport remains strong. End-user demographics are evolving, with increased demand for specialized, high-capacity vehicles driven by the expansion of commercial animal agriculture and the growing need for efficient supply chains. Mergers and acquisitions (M&A) are a notable trend, aimed at expanding market reach, acquiring technological capabilities, and consolidating market share. For instance, the last five years have seen an estimated 5-7 significant M&A deals, with an average deal value in the range of $50 million to $150 million, reflecting strategic consolidation. Innovation barriers include the high capital investment required for R&D and the long product development cycles inherent in heavy-duty vehicle manufacturing.

- Market Concentration: Dominated by a mix of large automotive conglomerates and specialized vehicle manufacturers.

- Technological Innovation Drivers: Animal welfare enhancements (e.g., ventilation, temperature control), biosecurity features, GPS tracking, and fuel-efficient powertrains.

- Regulatory Frameworks: Stringent animal welfare laws, emission standards (Euro VI, EPA Tier 4), and food safety regulations shape vehicle design.

- Competitive Product Substitutes: Limited, with specialized vehicles offering superior efficiency and compliance for animal transport.

- End-User Demographics: Commercial farms, abattoirs, feed producers, and agricultural cooperatives are primary customers.

- M&A Trends: Strategic acquisitions to gain market share and access new technologies.

Poultry And Livestock Transport Vehicle Growth Trends & Insights

The poultry and livestock transport vehicle market is projected for steady growth, underpinned by increasing global demand for meat and animal products. The market size, estimated at approximately $7,500 million in 2025, is expected to expand at a Compound Annual Growth Rate (CAGR) of around 4.5% over the forecast period, reaching an estimated $11,000 million by 2033. Adoption rates for specialized vehicles are high, driven by the need for compliance with animal welfare regulations and the economic benefits of efficient transportation. Technological disruptions, such as the integration of AI for route optimization and real-time livestock monitoring, are beginning to influence the market, promising to enhance operational efficiency and reduce animal stress. Consumer behavior shifts, including a growing preference for ethically sourced and safely transported animal products, are indirectly boosting demand for sophisticated transport solutions. The market penetration of advanced features like climate control and real-time health monitoring is increasing, particularly in developed economies. The historical market size in 2019 was approximately $6,000 million, demonstrating a consistent upward trajectory.

- Market Size Evolution: Projected growth from an estimated $7,500 million in 2025 to $11,000 million by 2033.

- Adoption Rates: High adoption of specialized vehicles due to regulatory compliance and efficiency gains.

- Technological Disruptions: Integration of AI for optimization, real-time monitoring for animal welfare, and advanced telematics.

- Consumer Behavior Shifts: Increasing demand for ethically sourced and safely transported animal products, driving investment in advanced transport.

- Market Penetration: Growing adoption of features like climate control and health monitoring in premium vehicles.

- CAGR: Estimated at approximately 4.5% for the forecast period.

Dominant Regions, Countries, or Segments in Poultry And Livestock Transport Vehicle

The Short-distance Transport segment within the poultry and livestock transport vehicle market is expected to be a significant growth driver, particularly in regions with concentrated agricultural activity and robust local supply chains. This segment is projected to account for an estimated 60% of the total market revenue by 2025, valued at approximately $4,500 million. Key drivers for its dominance include the frequent movement of livestock from farms to local markets, processing plants, and distribution hubs. Economic policies supporting domestic agriculture, coupled with expanding rural infrastructure, further bolster the demand for reliable short-distance transport solutions. Enclosed Poultry and Livestock Transport Vehicles are also witnessing substantial growth within this segment, driven by stringent biosecurity concerns and the need to protect animals from environmental stressors and potential disease transmission.

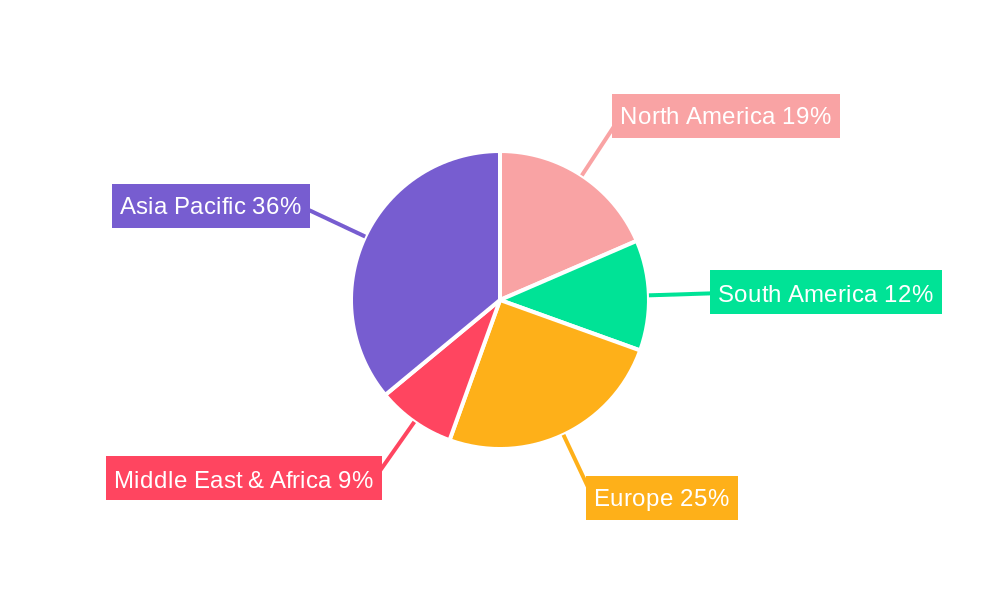

In terms of geographic dominance, Asia Pacific is emerging as a critical market, driven by rapid industrialization, a burgeoning population, and a substantial increase in meat consumption. Countries like China and India, with their vast agricultural sectors, are major contributors to this growth. The region's market share is estimated to be around 35% in 2025, valued at approximately $2,625 million. Government initiatives promoting food security and modernization of agricultural practices are accelerating the adoption of advanced poultry and livestock transport vehicles. Infrastructure development, including improved road networks, further facilitates efficient logistics for both short-distance and long-distance transport. The Long-distance Transport segment, while smaller in volume, is crucial for inter-state and international trade, requiring specialized vehicles with enhanced features for animal comfort and safety over extended journeys. The market share for Long-distance Transport is estimated at 40%, valued at $3,000 million in 2025.

- Dominant Segment (Application): Short-distance Transport (estimated 60% market share in 2025, valued at $4,500 million).

- Key Drivers: Frequent farm-to-market movements, strong local supply chains, expanding rural infrastructure.

- Dominant Segment (Type): Enclosed Poultry and Livestock Transport Vehicle (increasing demand due to biosecurity and animal welfare).

- Dominant Region: Asia Pacific (estimated 35% market share in 2025, valued at $2,625 million).

- Key Drivers: Growing population, rising meat consumption, agricultural modernization initiatives, infrastructure development.

- Long-distance Transport Segment: Significant for trade, requiring advanced features (estimated 40% market share in 2025, valued at $3,000 million).

Poultry And Livestock Transport Vehicle Product Landscape

The poultry and livestock transport vehicle product landscape is characterized by continuous innovation aimed at improving animal welfare, operational efficiency, and compliance with evolving regulations. Manufacturers are increasingly integrating advanced features such as climate control systems for precise temperature and humidity regulation, optimized ventilation for optimal air circulation, and GPS tracking for real-time location monitoring and route optimization. Biosecurity is paramount, with many vehicles featuring specialized cleaning systems and designs that minimize contamination risks. Durability and payload capacity remain critical, with a focus on lightweight yet robust materials. Unique selling propositions often revolve around customized configurations for specific animal types and transportation needs, alongside advanced safety features to prevent injury during transit. Technological advancements are also seen in fuel-efficient engines and chassis designs, reducing operational costs for fleet operators.

Key Drivers, Barriers & Challenges in Poultry And Livestock Transport Vehicle

Key Drivers:

- Rising Global Demand for Animal Protein: Increasing population and per capita income are boosting consumption of meat, poultry, and dairy, necessitating more efficient transport.

- Stricter Animal Welfare and Biosecurity Regulations: Governments worldwide are implementing tougher rules, driving demand for specialized vehicles equipped to meet these standards.

- Technological Advancements: Innovations in vehicle design, telematics, and climate control enhance efficiency, safety, and animal comfort.

- Growth of Commercial Animal Agriculture: Expansion of large-scale farming operations requires greater investment in specialized logistics.

- Government Support and Subsidies: Policies aimed at modernizing agricultural sectors and improving food supply chains often include support for transport infrastructure.

Barriers & Challenges:

- High Initial Investment Cost: Specialized poultry and livestock transport vehicles are expensive, posing a significant financial barrier for some operators, especially smallholders.

- Fluctuations in Feedstock and Fuel Prices: Volatile input costs can impact the profitability of transportation services, affecting fleet upgrades and expansion.

- Infrastructure Limitations: In some regions, inadequate road networks and logistics facilities can hinder efficient long-distance transport.

- Maintenance and Repair Complexity: Advanced features require specialized maintenance, which may not be readily available in all areas.

- Environmental Concerns and Emissions Regulations: Meeting increasingly stringent emission standards adds to manufacturing costs and operational complexities.

- Supply Chain Disruptions: Global events can disrupt the supply of raw materials and components, impacting production timelines.

Emerging Opportunities in Poultry And Livestock Transport Vehicle

Emerging opportunities in the poultry and livestock transport vehicle market lie in the growing demand for sustainable and technologically advanced solutions. The development of electric and hybrid-powered transport vehicles presents a significant untapped market, addressing environmental concerns and potentially lowering operational costs. Furthermore, the integration of IoT sensors and AI-driven analytics for real-time animal health monitoring and predictive maintenance offers substantial value. There's also a growing niche for modular and customizable transport solutions that can be adapted for different animal species and specialized cargo needs. The expansion of precision agriculture practices also presents opportunities for vehicles equipped with advanced tracking and data management capabilities, integrating seamlessly into broader farm management systems.

Growth Accelerators in the Poultry And Livestock Transport Vehicle Industry

Key catalysts driving long-term growth in the poultry and livestock transport vehicle industry include continued advancements in autonomous driving and smart logistics technologies, which promise to revolutionize fleet management and operational efficiency. Strategic partnerships between vehicle manufacturers, technology providers, and agricultural enterprises are crucial for co-developing integrated solutions that address specific industry challenges. Market expansion into emerging economies, driven by increasing meat consumption and government support for agricultural modernization, will also significantly contribute to growth. The ongoing focus on improving animal welfare standards globally will continue to fuel demand for premium, technologically equipped transport vehicles, creating a sustained growth trajectory.

Key Players Shaping the Poultry And Livestock Transport Vehicle Market

- Anhui Jianghuai Automobile Group Corp.,Ltd.

- Dongfeng Motor Corporation Limited

- Beiqi Foton Motor Co.,Ltd.

- SAIC-Hongyan Automobile Co.,Ltd.

- Chengli Automobile Group Co.,Ltd.

- Xinxiang Guoyu Trailer Vehicle Co.,Ltd.

- Luoyang CIMC Lingyu Automobile Co.,Ltd.

- CNHTC

- FAW Jiefang Group Co.,Ltd

- Hubei Ruili Automobile Co.,Ltd.

Notable Milestones in Poultry And Livestock Transport Vehicle Sector

- 2019: Increased focus on biosecurity features following global disease outbreaks, leading to new designs with enhanced sanitation.

- 2020: Introduction of more advanced climate control systems in enclosed vehicles, improving animal comfort during transit.

- 2021: Growing adoption of telematics and GPS tracking for fleet management and route optimization.

- 2022: Significant investment in R&D for fuel-efficient and alternative fuel powertrains (e.g., electric, CNG) by major manufacturers.

- 2023: Expansion of M&A activities as larger players seek to consolidate market share and acquire technological capabilities.

- 2024: Increased demand for specialized vehicles adhering to stricter animal welfare regulations in key markets.

In-Depth Poultry And Livestock Transport Vehicle Market Outlook

- 2019: Increased focus on biosecurity features following global disease outbreaks, leading to new designs with enhanced sanitation.

- 2020: Introduction of more advanced climate control systems in enclosed vehicles, improving animal comfort during transit.

- 2021: Growing adoption of telematics and GPS tracking for fleet management and route optimization.

- 2022: Significant investment in R&D for fuel-efficient and alternative fuel powertrains (e.g., electric, CNG) by major manufacturers.

- 2023: Expansion of M&A activities as larger players seek to consolidate market share and acquire technological capabilities.

- 2024: Increased demand for specialized vehicles adhering to stricter animal welfare regulations in key markets.

In-Depth Poultry And Livestock Transport Vehicle Market Outlook

The future market outlook for poultry and livestock transport vehicles is exceptionally positive, fueled by sustained global demand for animal protein and a continuous drive towards enhanced animal welfare and operational efficiency. Growth accelerators such as technological breakthroughs in electric mobility, AI-powered logistics, and advanced monitoring systems will redefine industry standards. Strategic collaborations and market expansion into rapidly developing agricultural economies present significant avenues for revenue growth. The report forecasts a robust market trajectory, indicating substantial opportunities for innovation and investment in specialized, compliant, and technologically superior transport solutions.

Poultry And Livestock Transport Vehicle Segmentation

-

1. Application

- 1.1. Short-distance Transport

- 1.2. Long-distance Transport

-

2. Type

- 2.1. Open Poultry and Livestock Transport Vehicle

- 2.2. Enclosed Poultry and Livestock Transport Vehicle

Poultry And Livestock Transport Vehicle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Poultry And Livestock Transport Vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Short-distance Transport

- 5.1.2. Long-distance Transport

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Open Poultry and Livestock Transport Vehicle

- 5.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Short-distance Transport

- 6.1.2. Long-distance Transport

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Open Poultry and Livestock Transport Vehicle

- 6.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Short-distance Transport

- 7.1.2. Long-distance Transport

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Open Poultry and Livestock Transport Vehicle

- 7.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Short-distance Transport

- 8.1.2. Long-distance Transport

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Open Poultry and Livestock Transport Vehicle

- 8.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Short-distance Transport

- 9.1.2. Long-distance Transport

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Open Poultry and Livestock Transport Vehicle

- 9.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Poultry And Livestock Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Short-distance Transport

- 10.1.2. Long-distance Transport

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Open Poultry and Livestock Transport Vehicle

- 10.2.2. Enclosed Poultry and Livestock Transport Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Anhui Jianghuai Automobile Group Corp.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ltd.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dongfeng Motor Corporation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beiqi Foton Motor Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SAIC-Hongyan Automobile Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chengli Automobile Group Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xinxiang Guoyu Trailer Vehicle Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Luoyang CIMC Lingyu Automobile Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CNHTC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 FAW Jiefang Group Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hubei Ruili Automobile Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Anhui Jianghuai Automobile Group Corp.

List of Figures

- Figure 1: Global Poultry And Livestock Transport Vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Poultry And Livestock Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 3: North America Poultry And Livestock Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Poultry And Livestock Transport Vehicle Revenue (million), by Type 2024 & 2032

- Figure 5: North America Poultry And Livestock Transport Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Poultry And Livestock Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 7: North America Poultry And Livestock Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Poultry And Livestock Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 9: South America Poultry And Livestock Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Poultry And Livestock Transport Vehicle Revenue (million), by Type 2024 & 2032

- Figure 11: South America Poultry And Livestock Transport Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Poultry And Livestock Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 13: South America Poultry And Livestock Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Poultry And Livestock Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Poultry And Livestock Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Poultry And Livestock Transport Vehicle Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Poultry And Livestock Transport Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Poultry And Livestock Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Poultry And Livestock Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Poultry And Livestock Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Poultry And Livestock Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Poultry And Livestock Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Poultry And Livestock Transport Vehicle Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Poultry And Livestock Transport Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Poultry And Livestock Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Poultry And Livestock Transport Vehicle Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Poultry And Livestock Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Poultry And Livestock Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poultry And Livestock Transport Vehicle?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Poultry And Livestock Transport Vehicle?

Key companies in the market include Anhui Jianghuai Automobile Group Corp., Ltd., Dongfeng Motor Corporation Limited, Beiqi Foton Motor Co., Ltd., SAIC-Hongyan Automobile Co., Ltd., Chengli Automobile Group Co., Ltd., Xinxiang Guoyu Trailer Vehicle Co., Ltd., Luoyang CIMC Lingyu Automobile Co., Ltd., CNHTC, FAW Jiefang Group Co., Ltd, Hubei Ruili Automobile Co., Ltd..

3. What are the main segments of the Poultry And Livestock Transport Vehicle?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poultry And Livestock Transport Vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poultry And Livestock Transport Vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poultry And Livestock Transport Vehicle?

To stay informed about further developments, trends, and reports in the Poultry And Livestock Transport Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence