Key Insights

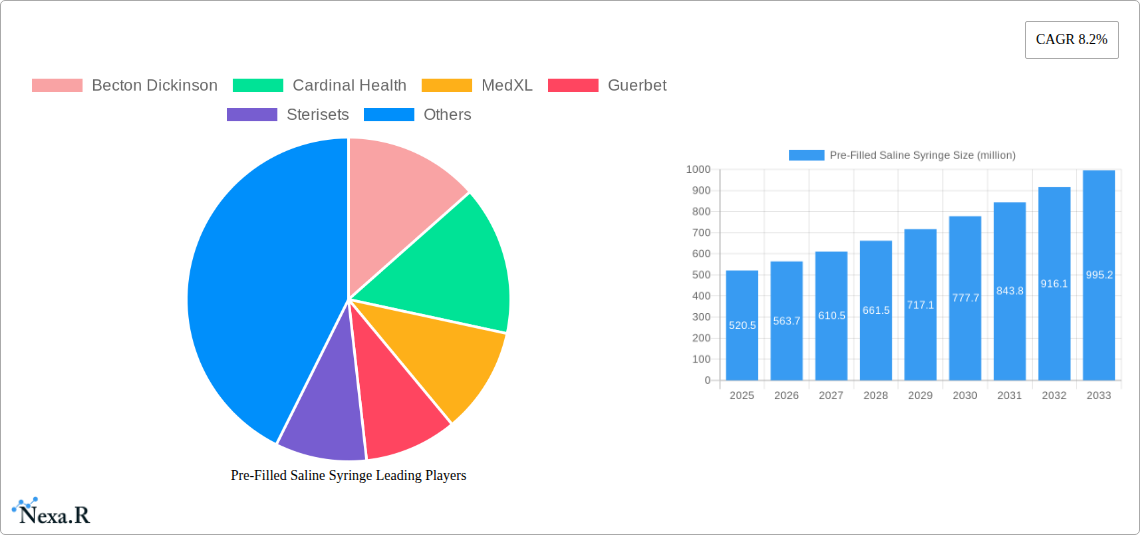

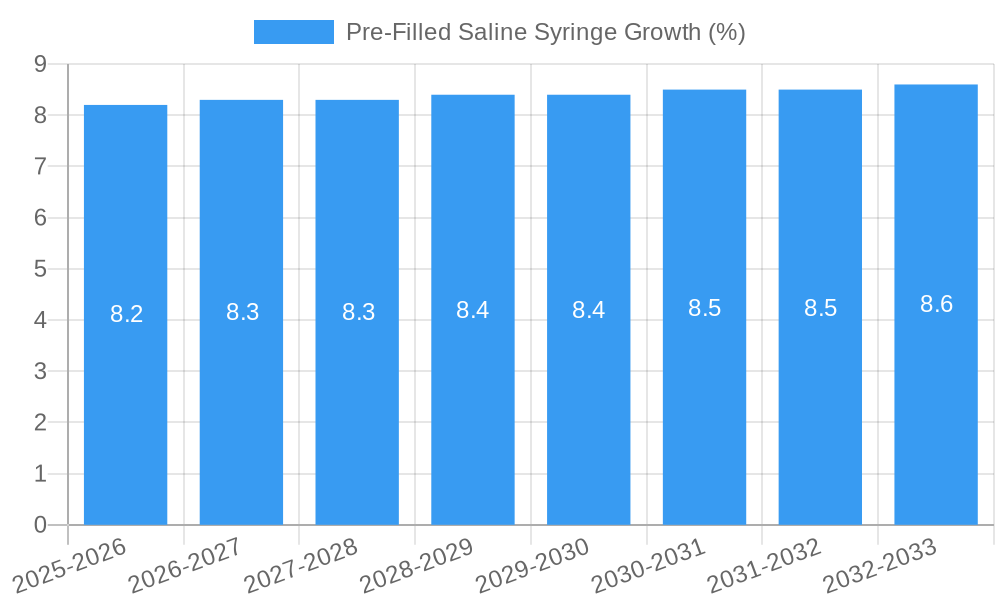

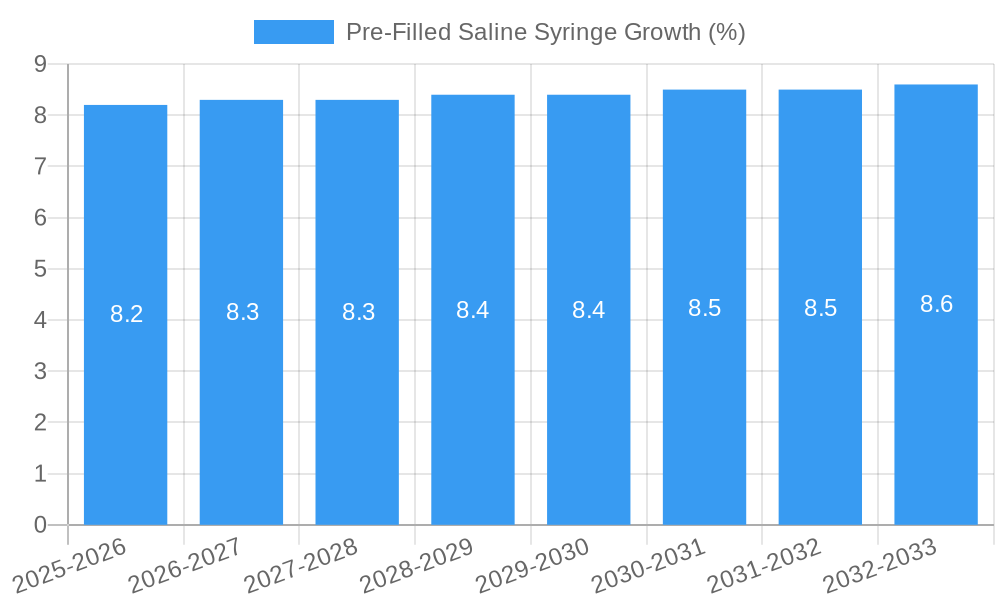

The global pre-filled saline syringe market is poised for significant expansion, currently valued at an impressive $520.5 million. This robust market is projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2025 to 2033, underscoring a dynamic and upward trajectory. This growth is primarily fueled by an increasing demand for convenience, reduced medication errors, and enhanced patient safety across various healthcare settings. Hospitals, outpatient clinics, and homecare are witnessing a surge in the adoption of pre-filled saline syringes due to their efficiency in drug delivery and preparation, minimizing the risk of contamination and dosage inaccuracies. Furthermore, the pharmaceutical industry's increasing focus on developing ready-to-use drug formulations, coupled with a rising prevalence of chronic diseases and an aging global population requiring regular medical interventions, are key drivers propelling the market forward. The inherent benefits of pre-filled syringes, such as improved workflow for healthcare professionals and a more predictable patient experience, are solidifying their position as a preferred choice in modern healthcare.

Several critical trends are shaping the pre-filled saline syringe market. The expanding applications in chronic disease management, including diabetes and autoimmune disorders, are creating sustained demand. Technological advancements, leading to more sophisticated syringe designs with enhanced safety features and improved accuracy, are also contributing to market growth. The increasing preference for single-use, sterile pre-filled syringes in both clinical and at-home settings to prevent infections and ensure precise dosing further strengthens this trend. Despite the optimistic outlook, the market faces certain restraints. High manufacturing costs associated with sterile production and advanced packaging can pose a challenge. Additionally, stringent regulatory hurdles in certain regions and the availability of alternative drug delivery systems, such as vials and ampoules, may temper the growth rate to some extent. However, the overwhelming advantages of pre-filled saline syringes in terms of safety, efficiency, and patient compliance are expected to outweigh these limitations, driving sustained market expansion and innovation in the coming years.

Pre-Filled Saline Syringe Market Analysis Report: Growth, Trends, and Opportunities (2019-2033)

This comprehensive report provides an in-depth analysis of the global Pre-Filled Saline Syringe market, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and emerging opportunities. Spanning the historical period of 2019-2024 and forecasting to 2033 with a base year of 2025, this report is an essential resource for industry professionals seeking to understand and capitalize on this rapidly evolving sector. We delve into the parent and child market structures, delivering actionable intelligence for stakeholders.

Pre-Filled Saline Syringe Market Dynamics & Structure

The global Pre-Filled Saline Syringe market exhibits a moderately concentrated structure, with a few key players dominating a significant share. Becton Dickinson and Cardinal Health are prominent leaders, leveraging extensive distribution networks and established product portfolios. Technological innovation, particularly in syringe materials, needle safety features, and advanced sterilization techniques, serves as a primary driver of market growth. Regulatory frameworks, such as FDA approvals and ISO certifications, play a crucial role in market entry and product acceptance, ensuring patient safety and efficacy. Competitive product substitutes, including multi-dose vials and traditional syringes, are gradually being displaced by the convenience and reduced risk of cross-contamination offered by pre-filled saline syringes. End-user demographics are shifting towards an aging global population and an increasing prevalence of chronic diseases, driving demand for self-administration and homecare solutions. Mergers and acquisitions (M&A) trends are relatively stable, with larger entities acquiring smaller innovators to expand their product offerings and market reach. For instance, in 2023, one notable M&A transaction involved a significant acquisition in the reusable medical device sterilization segment, indirectly impacting the sterile consumables market.

- Market Concentration: Moderate, with top 5 players holding an estimated 60% market share.

- Technological Innovation: Focus on enhanced safety (e.g., needle-less systems, auto-retracting needles), improved material science for reduced leachables, and integrated labeling solutions.

- Regulatory Landscape: Strict adherence to FDA, EMA, and other regional health authority guidelines is paramount for market access.

- Competitive Substitutes: Traditional syringes and multi-dose vials are losing ground due to safety and convenience advantages of pre-filled formats.

- End-User Demographics: Rising prevalence of chronic diseases and aging populations are key demand drivers.

- M&A Activity: Strategic acquisitions to gain market share and technological expertise.

Pre-Filled Saline Syringe Growth Trends & Insights

The global Pre-Filled Saline Syringe market is poised for robust expansion, driven by several compelling trends. The market size, valued at approximately $4,500 million units in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. This growth is propelled by increasing adoption rates across various healthcare settings, including hospitals, outpatient clinics, and homecare. Technological disruptions are at the forefront, with advancements in manufacturing processes leading to cost efficiencies and improved product quality. Furthermore, a significant shift in consumer behavior towards self-administration of medications and a greater emphasis on patient convenience and safety are fostering the demand for pre-filled saline syringes. The prevalence of needle-stick injuries in traditional syringe use continues to be a major concern, further accelerating the transition to safer pre-filled alternatives. Homecare settings, in particular, are witnessing exponential growth as healthcare systems aim to reduce hospital stays and manage chronic conditions in patient residences. The pharmaceuticals industry's increasing reliance on pre-filled syringes for the accurate and safe delivery of a wide array of injectable drugs is another significant contributor to market expansion. The overall market penetration of pre-filled saline syringes is expected to exceed 70% by 2033.

- Market Size Evolution: Projected to reach over $8,000 million units by 2033.

- Adoption Rates: Steadily increasing across hospitals, clinics, and homecare settings due to enhanced safety and convenience.

- Technological Disruptions: Innovations in manufacturing automation and material science are improving efficiency and product performance.

- Consumer Behavior Shifts: Growing preference for self-administration and reduced risk of needle-stick injuries.

- CAGR: Estimated at 7.5% for the forecast period.

- Market Penetration: Expected to surpass 70% by 2033.

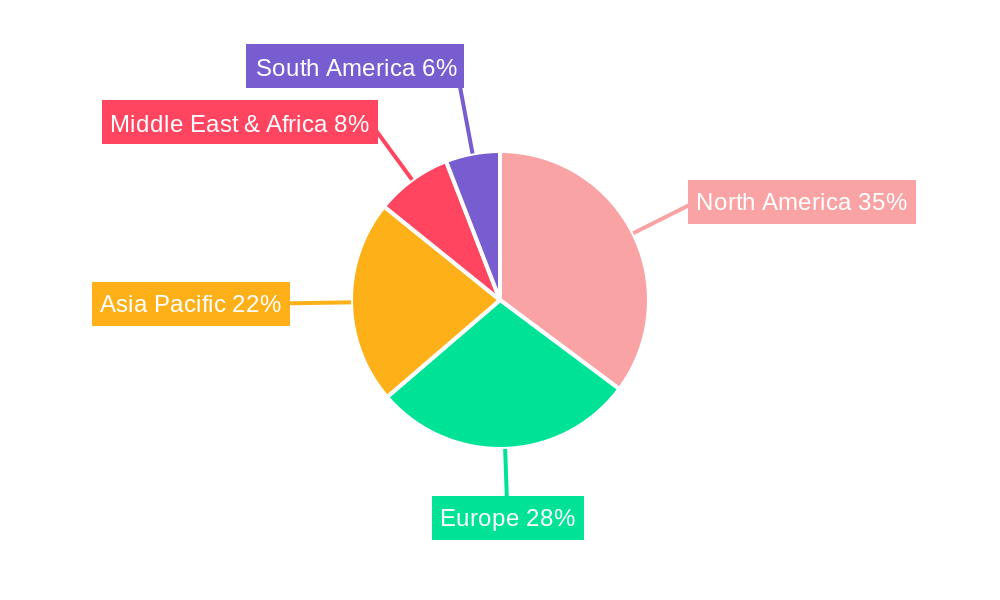

Dominant Regions, Countries, or Segments in Pre-Filled Saline Syringe

North America currently dominates the global Pre-Filled Saline Syringe market, driven by its well-established healthcare infrastructure, high disposable income, and a strong emphasis on patient safety and technological adoption. The United States, in particular, accounts for a substantial market share due to its large patient population, high prevalence of chronic diseases, and the presence of leading pharmaceutical companies and healthcare providers. The Hospitals application segment is the largest contributor to market growth, owing to the widespread use of saline syringes for intravenous fluid administration, medication preparation, and wound irrigation.

- Regional Dominance: North America leads, followed by Europe and Asia Pacific.

- Country Dominance: The United States holds the largest market share within North America.

- Application Dominance: Hospitals are the primary end-users, accounting for an estimated 55% of the market.

- Key Drivers in Hospitals: High volume of procedures, stringent infection control protocols, and demand for efficient medication delivery.

- Growth Potential in Outpatient Clinics: Increasing shift of healthcare services towards outpatient settings and a growing demand for convenience.

- Emerging Market in Homecare: Driven by an aging population, rising prevalence of chronic diseases, and the push for remote patient monitoring.

In the parent market, North America's dominance is underpinned by significant healthcare spending, advanced research and development capabilities, and favorable reimbursement policies for innovative medical devices. Within the child market, the 5ml Syringe Size is currently the most sought-after, catering to a wide range of therapeutic and general-purpose applications. However, the 3ml Syringe Size is witnessing rapid growth due to its suitability for pediatric applications and the increasing use of smaller dose injectable drugs.

- Syringe Size Dominance: 5ml Syringe Size holds the largest market share, estimated at 40%.

- Growth in 3ml Syringe Size: Significant growth projected due to pediatric applications and smaller dose drug delivery.

- Other Size Syringes: Catering to specialized medical needs and emerging drug formulations.

Asia Pacific is emerging as a high-growth region, propelled by increasing healthcare expenditure, improving healthcare infrastructure, and a growing awareness of advanced medical technologies. Government initiatives to enhance healthcare access and affordability in countries like China and India are further fueling market expansion.

Pre-Filled Saline Syringe Product Landscape

The Pre-Filled Saline Syringe market is characterized by continuous product innovation focused on enhancing user safety, improving drug compatibility, and streamlining the administration process. Manufacturers are investing in features such as advanced needle protection mechanisms, ergonomic designs for easier handling, and the use of inert materials to prevent drug degradation. The introduction of sterile, single-use pre-filled saline syringes significantly reduces the risk of cross-contamination and needle-stick injuries, making them a preferred choice in healthcare settings. Products are designed to be compatible with a wide range of injectable medications, ensuring versatility and broad applicability. Performance metrics emphasize sterility assurance, accurate volume delivery, and ease of aspiration and injection.

Key Drivers, Barriers & Challenges in Pre-Filled Saline Syringe

The Pre-Filled Saline Syringe market is propelled by a confluence of technological advancements, increasing healthcare expenditure, and a growing emphasis on patient safety and convenience. The rising prevalence of chronic diseases necessitates more frequent and accessible medication administration, directly benefiting the demand for pre-filled syringes. Furthermore, government initiatives promoting better healthcare access and awareness campaigns highlighting the benefits of sterile, pre-filled formats are crucial growth accelerators.

- Technological Advancements: Innovations in syringe design, materials, and manufacturing processes.

- Increasing Healthcare Expenditure: Growing investment in healthcare infrastructure globally.

- Patient Safety Focus: Reduction of needle-stick injuries and cross-contamination.

- Convenience & Ease of Use: Simplifies medication administration, especially in homecare.

- Rising Chronic Disease Prevalence: Increased need for regular injectable treatments.

However, the market also faces several challenges. High manufacturing costs associated with sterile production and quality control can be a barrier to entry for smaller players. Stringent regulatory approvals across different regions add complexity and time to market entry. The presence of established traditional syringe markets and the initial investment required for adoption in some healthcare facilities can also pose restraints. Moreover, potential supply chain disruptions for essential raw materials and components can impact production volumes.

- High Manufacturing Costs: Sterilization and quality control processes are expensive.

- Stringent Regulatory Hurdles: Navigating diverse regional approval processes.

- Price Sensitivity: Competition from lower-cost traditional syringes.

- Supply Chain Vulnerabilities: Dependence on raw material availability.

- Limited Awareness in Emerging Markets: Education and adoption challenges.

Emerging Opportunities in Pre-Filled Saline Syringe

The Pre-Filled Saline Syringe market presents several burgeoning opportunities. The increasing demand for homecare solutions, driven by an aging population and advancements in remote patient monitoring, opens up significant avenues for expansion. The development of specialized pre-filled syringes for niche therapeutic areas, such as biopharmaceuticals and biosimilars, represents a lucrative segment. Furthermore, exploring untapped markets in developing economies with improving healthcare infrastructure and rising disposable incomes offers substantial growth potential. The integration of smart technologies, such as dose tracking and connectivity features, could also redefine the future of pre-filled syringes, enhancing patient adherence and providing valuable data for healthcare providers.

Growth Accelerators in the Pre-Filled Saline Syringe Industry

Several key factors are acting as significant growth accelerators for the Pre-Filled Saline Syringe industry. The relentless pursuit of enhanced patient safety, particularly in reducing needle-stick injuries, remains a primary driver. Continuous technological breakthroughs in material science and manufacturing automation are leading to more cost-effective and high-quality products. Strategic partnerships between syringe manufacturers and pharmaceutical companies are crucial for developing and commercializing pre-filled dosage forms for new and existing drugs. Market expansion strategies, including targeting emerging economies with growing healthcare needs, are also contributing to sustained growth.

Key Players Shaping the Pre-Filled Saline Syringe Market

- Becton Dickinson

- Cardinal Health

- MedXL

- Guerbet

- Sterisets

- DBM

- Weigao

Notable Milestones in Pre-Filled Saline Syringe Sector

- 2019: Introduction of novel auto-retracting safety mechanisms in several leading pre-filled syringe models, significantly reducing needle-stick injury risks.

- 2020: Increased demand for pre-filled saline syringes for flushing and dilution purposes due to pandemic-related supply chain issues of multi-dose vials.

- 2021: Major investment by Becton Dickinson in expanding its pre-filled syringe manufacturing capacity to meet growing global demand.

- 2022: Emergence of advanced polymer materials offering improved compatibility with sensitive biologic drugs in pre-filled syringes.

- 2023: Growing regulatory focus on sustainability in medical device manufacturing, leading to increased interest in recyclable packaging for pre-filled saline syringes.

- 2024: Continued advancements in automated filling and assembly lines, improving production efficiency and reducing per-unit costs.

In-Depth Pre-Filled Saline Syringe Market Outlook

The future outlook for the Pre-Filled Saline Syringe market remains exceptionally positive, driven by a confluence of escalating healthcare demands and ongoing technological innovation. The persistent global trend towards patient empowerment through self-administration of medications, coupled with an expanding aging demographic and the increasing incidence of chronic conditions, will continue to fuel demand. Strategic collaborations between pharmaceutical giants and specialized syringe manufacturers will be pivotal in introducing a wider array of pre-filled drug delivery systems. Furthermore, the penetration into underserved emerging markets, buoyed by improving healthcare infrastructure and rising disposable incomes, presents a substantial avenue for future growth and market expansion.

Pre-Filled Saline Syringe Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Outpatient Clinics

- 1.3. Homecare Settings

- 1.4. Pharmaceuticals Company

-

2. Types

- 2.1. 3ml Syringe Size

- 2.2. 5ml Syringe Size

- 2.3. 10ml Syringe Size

- 2.4. Other Size

Pre-Filled Saline Syringe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pre-Filled Saline Syringe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Outpatient Clinics

- 5.1.3. Homecare Settings

- 5.1.4. Pharmaceuticals Company

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 3ml Syringe Size

- 5.2.2. 5ml Syringe Size

- 5.2.3. 10ml Syringe Size

- 5.2.4. Other Size

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Outpatient Clinics

- 6.1.3. Homecare Settings

- 6.1.4. Pharmaceuticals Company

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 3ml Syringe Size

- 6.2.2. 5ml Syringe Size

- 6.2.3. 10ml Syringe Size

- 6.2.4. Other Size

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Outpatient Clinics

- 7.1.3. Homecare Settings

- 7.1.4. Pharmaceuticals Company

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 3ml Syringe Size

- 7.2.2. 5ml Syringe Size

- 7.2.3. 10ml Syringe Size

- 7.2.4. Other Size

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Outpatient Clinics

- 8.1.3. Homecare Settings

- 8.1.4. Pharmaceuticals Company

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 3ml Syringe Size

- 8.2.2. 5ml Syringe Size

- 8.2.3. 10ml Syringe Size

- 8.2.4. Other Size

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Outpatient Clinics

- 9.1.3. Homecare Settings

- 9.1.4. Pharmaceuticals Company

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 3ml Syringe Size

- 9.2.2. 5ml Syringe Size

- 9.2.3. 10ml Syringe Size

- 9.2.4. Other Size

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pre-Filled Saline Syringe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Outpatient Clinics

- 10.1.3. Homecare Settings

- 10.1.4. Pharmaceuticals Company

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 3ml Syringe Size

- 10.2.2. 5ml Syringe Size

- 10.2.3. 10ml Syringe Size

- 10.2.4. Other Size

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cardinal Health

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MedXL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guerbet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sterisets

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DBM

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Weigao

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson

List of Figures

- Figure 1: Global Pre-Filled Saline Syringe Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pre-Filled Saline Syringe Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pre-Filled Saline Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pre-Filled Saline Syringe Revenue (million), by Types 2024 & 2032

- Figure 5: North America Pre-Filled Saline Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Pre-Filled Saline Syringe Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pre-Filled Saline Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pre-Filled Saline Syringe Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pre-Filled Saline Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pre-Filled Saline Syringe Revenue (million), by Types 2024 & 2032

- Figure 11: South America Pre-Filled Saline Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Pre-Filled Saline Syringe Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pre-Filled Saline Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pre-Filled Saline Syringe Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pre-Filled Saline Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pre-Filled Saline Syringe Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Pre-Filled Saline Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Pre-Filled Saline Syringe Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pre-Filled Saline Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pre-Filled Saline Syringe Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pre-Filled Saline Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pre-Filled Saline Syringe Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Pre-Filled Saline Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Pre-Filled Saline Syringe Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pre-Filled Saline Syringe Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pre-Filled Saline Syringe Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pre-Filled Saline Syringe Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pre-Filled Saline Syringe Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Pre-Filled Saline Syringe Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Pre-Filled Saline Syringe Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pre-Filled Saline Syringe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pre-Filled Saline Syringe Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Pre-Filled Saline Syringe Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Pre-Filled Saline Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Pre-Filled Saline Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Pre-Filled Saline Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Pre-Filled Saline Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pre-Filled Saline Syringe Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pre-Filled Saline Syringe Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Pre-Filled Saline Syringe Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pre-Filled Saline Syringe Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pre-Filled Saline Syringe?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the Pre-Filled Saline Syringe?

Key companies in the market include Becton Dickinson, Cardinal Health, MedXL, Guerbet, Sterisets, DBM, Weigao.

3. What are the main segments of the Pre-Filled Saline Syringe?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 520.5 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pre-Filled Saline Syringe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pre-Filled Saline Syringe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pre-Filled Saline Syringe?

To stay informed about further developments, trends, and reports in the Pre-Filled Saline Syringe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence