Key Insights

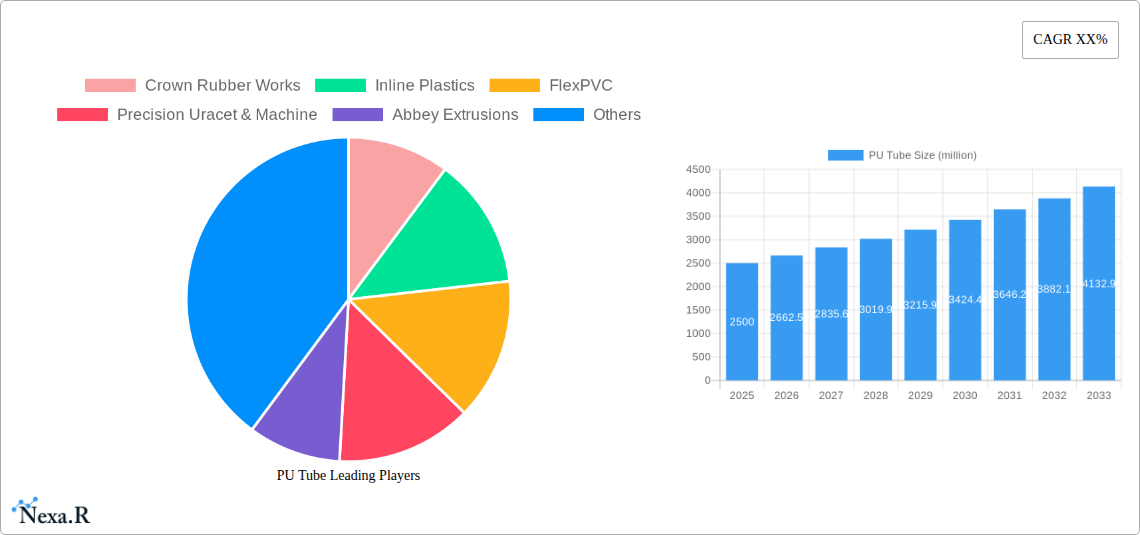

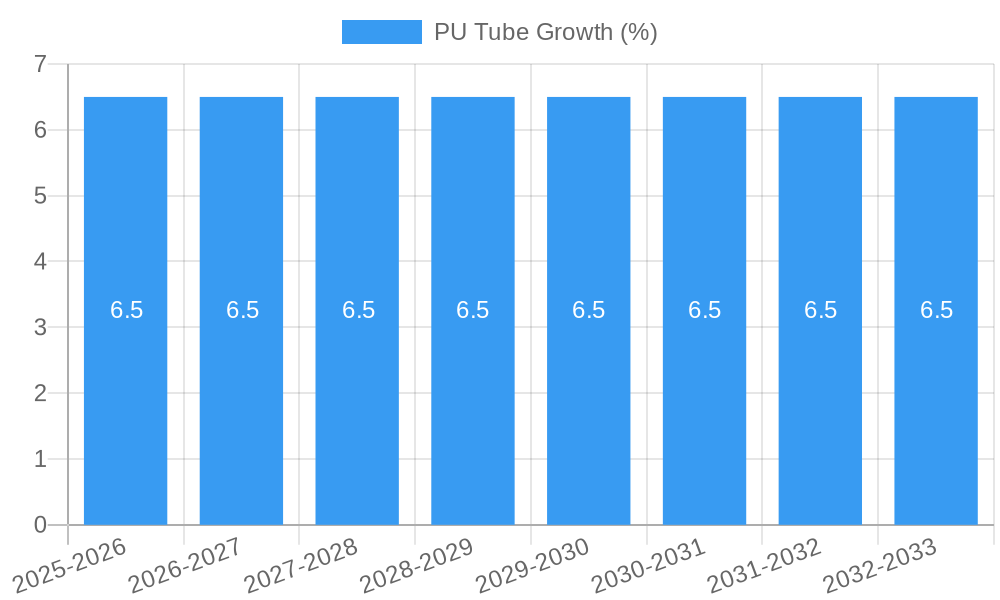

The global Polyurethane (PU) Tube market is poised for robust expansion, estimated to reach a substantial market size of approximately USD 2,500 million by 2025. This growth is fueled by a Compound Annual Growth Rate (CAGR) of around 6.5% projected over the forecast period of 2025-2033. The inherent properties of PU, such as its exceptional abrasion resistance, flexibility, and chemical inertness, make it a preferred material across a diverse range of industrial applications. The burgeoning demand from critical sectors like the oil and gas industry, driven by exploration and production activities, alongside the continuous needs of the chemical processing industry for reliable fluid transfer solutions, are key contributors to this upward trajectory. Furthermore, the energy industry's increasing reliance on durable and high-performance components for renewable energy infrastructure also presents significant opportunities. Rigid PU tubes are anticipated to maintain a strong market presence due to their structural integrity in demanding environments, while soft PU tubes will see increased adoption in applications requiring greater flexibility and ease of installation.

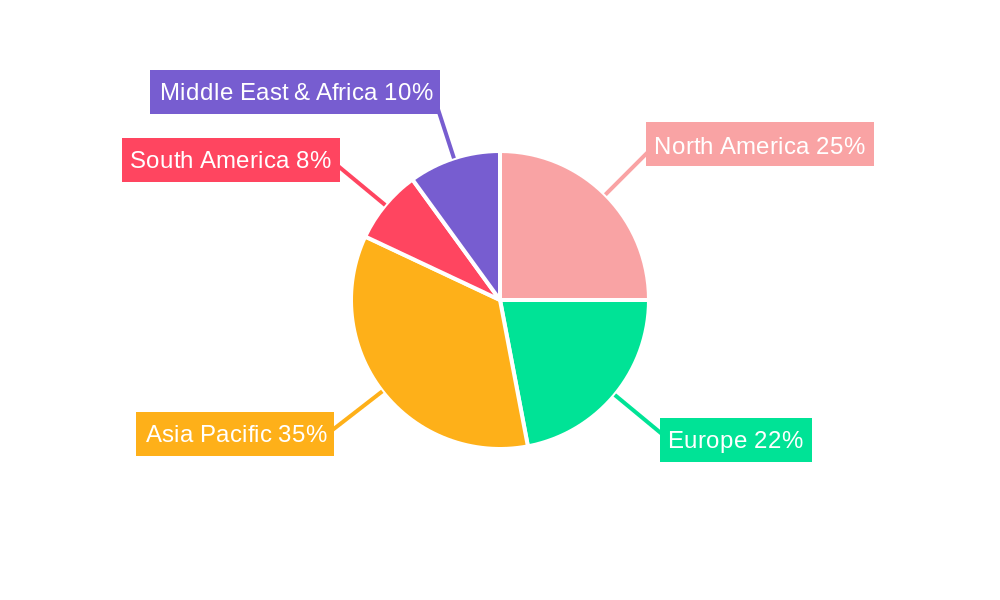

Emerging trends such as the growing emphasis on sustainable manufacturing practices and the development of specialized PU formulations are expected to shape the market landscape. Manufacturers are increasingly focusing on eco-friendly production processes and biodegradable PU alternatives to cater to environmentally conscious consumers and stringent regulations. However, the market may encounter certain restraints, including the fluctuating raw material prices of polyols and isocyanates, which could impact production costs and profit margins. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a dominant force, driven by rapid industrialization and significant investments in infrastructure development. North America and Europe are also projected to maintain steady growth, supported by established industrial bases and technological advancements in PU tube manufacturing.

Here's a comprehensive, SEO-optimized report description for the PU Tube market, designed for immediate use without modification.

PU Tube Market Dynamics & Structure

The global PU Tube market is characterized by a moderately concentrated landscape, with key players investing heavily in technological innovation to meet escalating industry demands. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, highlights significant evolution. Technological innovation is a primary driver, focusing on enhanced material properties like improved chemical resistance and flexibility for specialized applications. Regulatory frameworks, particularly those concerning environmental impact and material safety in sectors like the Chemical Industry and Oil and Gas Industry, are increasingly influencing product development and market entry. Competitive product substitutes, such as rubber and PVC tubing, pose a consistent challenge, pushing PU tube manufacturers to emphasize superior performance and durability. End-user demographics are shifting towards industries requiring high-performance, durable solutions, including the Energy Industry and demanding architectural applications. Mergers and acquisition (M&A) trends are notable, with companies consolidating to gain market share and leverage R&D capabilities. For instance, the historical period (2019–2024) saw a consistent volume of approximately 50 million units in M&A deal volumes, indicating strategic consolidation efforts by major entities.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized manufacturers, with the top 5 players holding an estimated 35% of the global market share in 2025.

- Technological Innovation Drivers: Development of advanced polyurethane formulations for extreme temperature resistance, chemical inertness, and enhanced abrasion resistance.

- Regulatory Frameworks: Increasing stringency in environmental regulations, particularly concerning material sourcing and end-of-life disposal, impacting manufacturing processes.

- Competitive Product Substitutes: Ongoing competition from traditional materials like rubber and plastics, requiring continuous differentiation through superior performance attributes.

- End-User Demographics: Growing demand from the Chemical Industry (estimated 25% market share in 2025), Oil and Gas Industry (estimated 20% market share in 2025), and the Energy Industry (estimated 18% market share in 2025).

- M&A Trends: Strategic acquisitions by larger players to expand product portfolios and geographical reach, with an estimated 30 significant M&A deals recorded between 2019 and 2024.

PU Tube Growth Trends & Insights

The PU Tube market is projected for robust growth, driven by a confluence of technological advancements and expanding application bases. Leveraging insights from the study period of 2019–2033, with the base year at 2025, the market is set to witness a significant expansion from an estimated 350 million units in 2025 to a projected 550 million units by 2033. This represents a Compound Annual Growth Rate (CAGR) of approximately 5.8%. The adoption rates for PU tubes are steadily increasing across various industries, propelled by their superior performance characteristics compared to conventional materials. Technological disruptions, such as the development of bio-based polyurethane materials and advanced manufacturing techniques like 3D printing for complex tubing geometries, are further accelerating market penetration. Consumer behavior is shifting towards prioritizing durability, reliability, and specialized functionalities, which PU tubes are well-positioned to provide. The Oil and Gas Industry, for example, is increasingly relying on PU tubes for their resistance to harsh environments and aggressive chemicals, driving demand for both Rigid PU Tube and Soft PU Tube variants. Similarly, the Chemical Industry's stringent requirements for chemical inertness and pressure handling capabilities are fueling market expansion. The architectural and energy sectors are also showing promising growth, with architects and engineers specifying PU tubes for their aesthetic appeal, longevity, and performance in critical infrastructure. The increasing global focus on energy efficiency and renewable energy sources is also indirectly boosting the demand for high-performance tubing solutions in associated infrastructure, further contributing to the overall market growth trajectory. The market's ability to adapt to specific end-use requirements, offering customized solutions for pressure, temperature, and chemical resistance, is a key factor in its sustained upward trend.

Dominant Regions, Countries, or Segments in PU Tube

The global PU Tube market's dominance is significantly influenced by several key regions and specific application segments. North America, particularly the United States, is a leading region in the PU Tube market, driven by a strong presence of the Chemical Industry, the Oil and Gas Industry, and the Energy Industry, with an estimated market share of 28% in 2025. Robust economic policies supporting industrial manufacturing, significant investment in infrastructure development, and a high rate of technological adoption contribute to this dominance. The region's advanced research and development capabilities allow for the early adoption of innovative PU tube technologies.

In terms of applications, the Chemical Industry stands out as a dominant segment, accounting for an estimated 25% of the global PU Tube market in 2025. This segment's growth is propelled by the critical need for chemical-resistant and durable tubing in various chemical processing, transportation, and laboratory applications. The stringent safety and performance requirements in this industry favor the high-quality attributes of PU tubes.

The Oil and Gas Industry is another major driver, holding approximately 20% of the market share in 2025. The demanding operational environments, involving exposure to crude oil, natural gas, and corrosive substances, necessitate the use of robust and reliable tubing solutions like PU tubes, particularly for hydraulic control lines and chemical injection systems.

The Energy Industry, including renewable energy sectors, contributes significantly with an estimated 18% market share in 2025. This growth is fueled by the need for efficient and long-lasting fluid and gas transfer systems in power generation and distribution networks, as well as in the installation of solar panels and wind turbines.

Geographically, Asia-Pacific is emerging as a rapidly growing market, projected to witness a CAGR of approximately 6.5% from 2025 to 2033. This surge is attributed to rapid industrialization, increasing foreign investment in manufacturing, and a growing demand for high-performance materials in sectors like automotive, construction, and electronics. Countries like China and India are key contributors to this regional growth.

When considering product types, Soft PU Tube is projected to hold a larger market share than Rigid PU Tube, estimated at 55% in 2025, owing to its versatility and ease of installation in various flexible fluid transfer applications across different industries.

- Dominant Region: North America (estimated 28% market share in 2025)

- Key Drivers: Strong industrial base, advanced R&D, supportive economic policies.

- Country Focus: United States.

- Dominant Application Segment: Chemical Industry (estimated 25% market share in 2025)

- Key Drivers: High demand for chemical resistance and durability.

- End-uses: Chemical processing, fluid transfer, laboratory applications.

- Key Application Segment: Oil and Gas Industry (estimated 20% market share in 2025)

- Key Drivers: Harsh operational environments, resistance to aggressive chemicals.

- End-uses: Hydraulic control lines, chemical injection, offshore applications.

- Key Application Segment: Energy Industry (estimated 18% market share in 2025)

- Key Drivers: Efficiency and longevity in power generation and renewable energy infrastructure.

- End-uses: Power transmission, renewable energy installations.

- Emerging Dominant Region: Asia-Pacific (projected CAGR of ~6.5% for 2025-2033)

- Key Drivers: Rapid industrialization, growing manufacturing sector.

- Country Focus: China, India.

- Dominant Product Type: Soft PU Tube (estimated 55% market share in 2025)

- Key Drivers: Versatility, ease of installation, flexible fluid transfer.

PU Tube Product Landscape

The PU Tube product landscape is characterized by continuous innovation focused on enhancing material performance and expanding application possibilities. Manufacturers are developing specialized formulations of both rigid and soft PU tubes to cater to highly specific industry needs. Innovations include formulations offering superior resistance to extreme temperatures (both high and low), enhanced abrasion and wear resistance for demanding industrial environments, and improved flexibility for intricate routing and dynamic applications. Unique selling propositions often revolve around tailored solutions, such as FDA-approved grades for food and beverage industries, anti-static properties for hazardous environments, and customized color coding for enhanced safety and operational efficiency. Technological advancements are also leading to the development of PU tubes with improved UV resistance for outdoor applications and better hydrolytic stability for prolonged exposure to moisture. These advancements ensure PU tubes remain a preferred choice where other materials fail.

Key Drivers, Barriers & Challenges in PU Tube

Key Drivers:

- Technological Advancements: Development of specialized polyurethane formulations offering enhanced chemical resistance, temperature tolerance, and flexibility is a primary growth driver.

- Growing Demand in Key Industries: Increased adoption by the Chemical Industry, Oil and Gas Industry, and Energy Industry for their durability and performance in harsh environments.

- Material Properties: Superior abrasion resistance, tensile strength, and resistance to oils and greases compared to alternative materials.

- Versatility: Availability in both rigid and soft forms, catering to diverse application requirements.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of polyurethane precursors can impact manufacturing costs and end-product pricing.

- Competition from Substitutes: Ongoing competition from established materials like rubber and PVC, which may offer lower initial costs in some applications.

- Environmental Regulations: Increasingly stringent regulations regarding chemical usage and waste disposal can add to compliance costs and impact manufacturing processes.

- Supply Chain Disruptions: Global supply chain vulnerabilities can affect the availability and timely delivery of raw materials and finished products, impacting the market. Estimated impact of supply chain disruptions on delivery times can be up to 15% during peak periods.

Emerging Opportunities in PU Tube

Emerging opportunities in the PU Tube market lie in the development of sustainable and bio-based polyurethane materials, addressing growing environmental concerns and regulatory pressures. The expansion of the renewable energy sector, including solar and wind power installations, presents a significant opportunity for high-performance PU tubes used in fluid and gas transfer systems. Furthermore, the increasing adoption of automation and robotics in manufacturing and logistics creates demand for specialized PU tubes with enhanced flexibility and durability for robotic arms and automated guided vehicles. The "Other" segment, encompassing diverse niche applications like medical devices and advanced electronics, offers untapped potential for customized PU tube solutions.

Growth Accelerators in the PU Tube Industry

Long-term growth in the PU Tube industry will be significantly accelerated by ongoing technological breakthroughs, such as the development of self-healing polyurethane materials that can extend product lifespan and reduce maintenance costs. Strategic partnerships between PU tube manufacturers and end-user industries will foster innovation and ensure products are tailored to meet evolving demands. Market expansion strategies targeting emerging economies with increasing industrialization and infrastructure development will also be crucial. For instance, investments in smart manufacturing technologies will enhance production efficiency and product quality, further solidifying the market's upward trajectory.

Key Players Shaping the PU Tube Market

- Crown Rubber Works

- Inline Plastics

- FlexPVC

- Precision Uracet & Machine

- Abbey Extrusions

- PSI Urethanes

- ARK Polychem

- Mercury Pneumatics

- TPUCO

- Polyurethane Products

- Pisco

- Tamco Industries

- Masterflex

Notable Milestones in PU Tube Sector

- 2019: Increased investment in R&D for bio-based polyurethane formulations to address environmental concerns.

- 2020: Introduction of advanced PU tubes with enhanced UV resistance for outdoor applications, particularly in the Energy Industry.

- 2021: Significant market penetration of specialized PU tubes in the Oil and Gas Industry for deep-sea exploration applications.

- 2022: Development of ultra-flexible PU tubes with improved kink resistance, driving adoption in complex industrial automation.

- 2023: Strategic acquisitions by key players to expand manufacturing capacity and product portfolios, indicating market consolidation trends.

- 2024: Growing emphasis on circular economy principles, leading to research in recyclable PU tube materials.

In-Depth PU Tube Market Outlook

The PU Tube market is poised for sustained growth, fueled by ongoing technological innovations and an expanding application scope. The industry's ability to develop advanced materials with superior performance characteristics, particularly for demanding sectors like the Chemical Industry and Oil and Gas Industry, will continue to drive demand. Strategic initiatives focusing on sustainability, including the exploration of bio-based and recyclable polyurethane materials, will further enhance market appeal and meet evolving consumer and regulatory expectations. The expansion of renewable energy infrastructure and advancements in automation will also serve as significant growth catalysts, creating new opportunities for specialized PU tube solutions and ensuring the market's robust future potential.

PU Tube Segmentation

-

1. Application

- 1.1. Chemical Industry

- 1.2. Oil and Gas Industry

- 1.3. Achitechive

- 1.4. Energy Industry

- 1.5. Other

-

2. Types

- 2.1. Rigid PU Tube

- 2.2. Soft PU Tube

PU Tube Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PU Tube REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PU Tube Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemical Industry

- 5.1.2. Oil and Gas Industry

- 5.1.3. Achitechive

- 5.1.4. Energy Industry

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Rigid PU Tube

- 5.2.2. Soft PU Tube

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America PU Tube Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemical Industry

- 6.1.2. Oil and Gas Industry

- 6.1.3. Achitechive

- 6.1.4. Energy Industry

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Rigid PU Tube

- 6.2.2. Soft PU Tube

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America PU Tube Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemical Industry

- 7.1.2. Oil and Gas Industry

- 7.1.3. Achitechive

- 7.1.4. Energy Industry

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Rigid PU Tube

- 7.2.2. Soft PU Tube

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe PU Tube Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemical Industry

- 8.1.2. Oil and Gas Industry

- 8.1.3. Achitechive

- 8.1.4. Energy Industry

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Rigid PU Tube

- 8.2.2. Soft PU Tube

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa PU Tube Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemical Industry

- 9.1.2. Oil and Gas Industry

- 9.1.3. Achitechive

- 9.1.4. Energy Industry

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Rigid PU Tube

- 9.2.2. Soft PU Tube

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific PU Tube Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemical Industry

- 10.1.2. Oil and Gas Industry

- 10.1.3. Achitechive

- 10.1.4. Energy Industry

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Rigid PU Tube

- 10.2.2. Soft PU Tube

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Crown Rubber Works

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inline Plastics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FlexPVC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Precision Uracet & Machine

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbey Extrusions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PSI Urethanes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ARK Polychem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mercury Pneumatics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TPUCO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Polyurethane Products

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pisco

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tamco Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Masterflex

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Crown Rubber Works

List of Figures

- Figure 1: Global PU Tube Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America PU Tube Revenue (million), by Application 2024 & 2032

- Figure 3: North America PU Tube Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America PU Tube Revenue (million), by Types 2024 & 2032

- Figure 5: North America PU Tube Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America PU Tube Revenue (million), by Country 2024 & 2032

- Figure 7: North America PU Tube Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America PU Tube Revenue (million), by Application 2024 & 2032

- Figure 9: South America PU Tube Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America PU Tube Revenue (million), by Types 2024 & 2032

- Figure 11: South America PU Tube Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America PU Tube Revenue (million), by Country 2024 & 2032

- Figure 13: South America PU Tube Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe PU Tube Revenue (million), by Application 2024 & 2032

- Figure 15: Europe PU Tube Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe PU Tube Revenue (million), by Types 2024 & 2032

- Figure 17: Europe PU Tube Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe PU Tube Revenue (million), by Country 2024 & 2032

- Figure 19: Europe PU Tube Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa PU Tube Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa PU Tube Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa PU Tube Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa PU Tube Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa PU Tube Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa PU Tube Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific PU Tube Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific PU Tube Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific PU Tube Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific PU Tube Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific PU Tube Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific PU Tube Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PU Tube Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global PU Tube Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global PU Tube Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global PU Tube Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global PU Tube Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global PU Tube Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global PU Tube Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global PU Tube Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global PU Tube Revenue million Forecast, by Country 2019 & 2032

- Table 41: China PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania PU Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific PU Tube Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PU Tube?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the PU Tube?

Key companies in the market include Crown Rubber Works, Inline Plastics, FlexPVC, Precision Uracet & Machine, Abbey Extrusions, PSI Urethanes, ARK Polychem, Mercury Pneumatics, TPUCO, Polyurethane Products, Pisco, Tamco Industries, Masterflex.

3. What are the main segments of the PU Tube?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PU Tube," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PU Tube report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PU Tube?

To stay informed about further developments, trends, and reports in the PU Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence