Key Insights

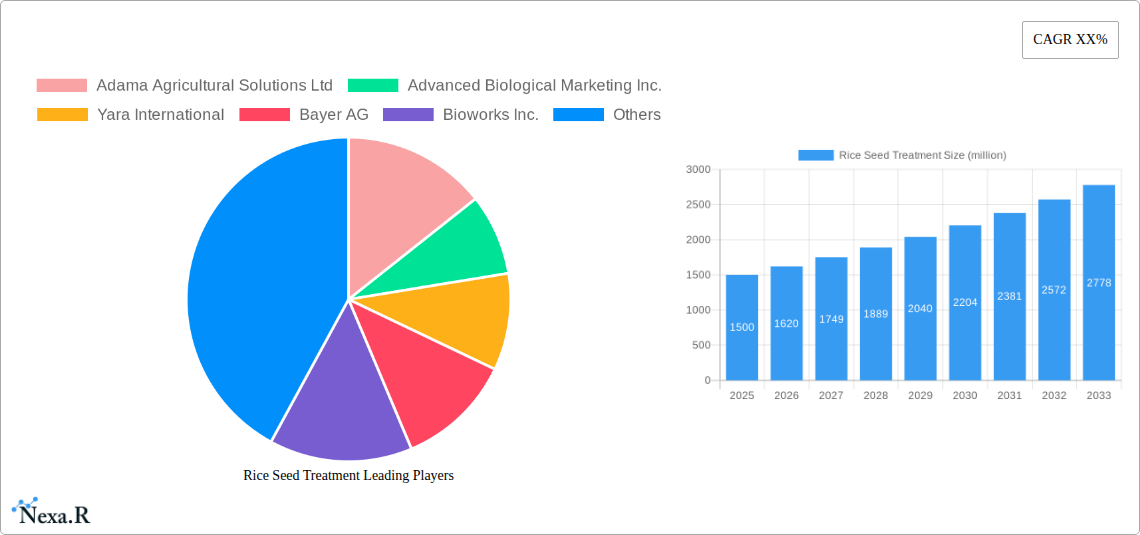

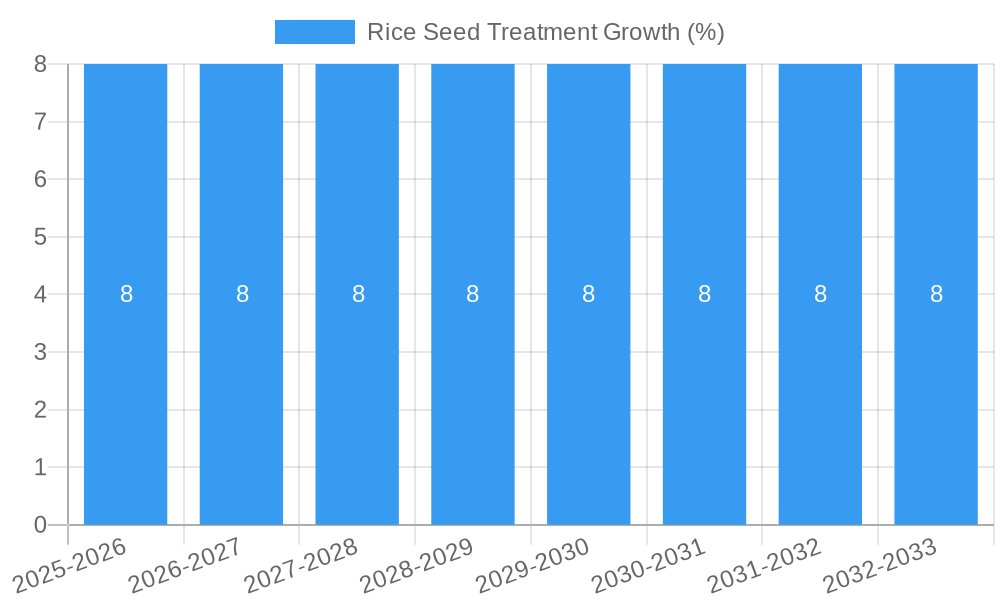

The global Rice Seed Treatment market is poised for significant expansion, estimated at a robust USD 1.5 billion in 2025, with projected growth reaching USD 2.8 billion by 2033. This impressive expansion is fueled by a compound annual growth rate (CAGR) of approximately 8%. The increasing adoption of advanced agricultural practices, driven by the need for enhanced crop yields and improved food security, stands as a primary catalyst. Farmers worldwide are recognizing the pivotal role of seed treatments in protecting young seedlings from pests and diseases, thereby reducing crop losses and optimizing resource utilization. Furthermore, the demand for high-quality rice varieties with superior germination rates and vigor is on the rise, directly correlating with the market's upward trajectory. Innovations in seed coating and pelleted formulations, offering precise application and enhanced efficacy of active ingredients, are also contributing to market dynamism.

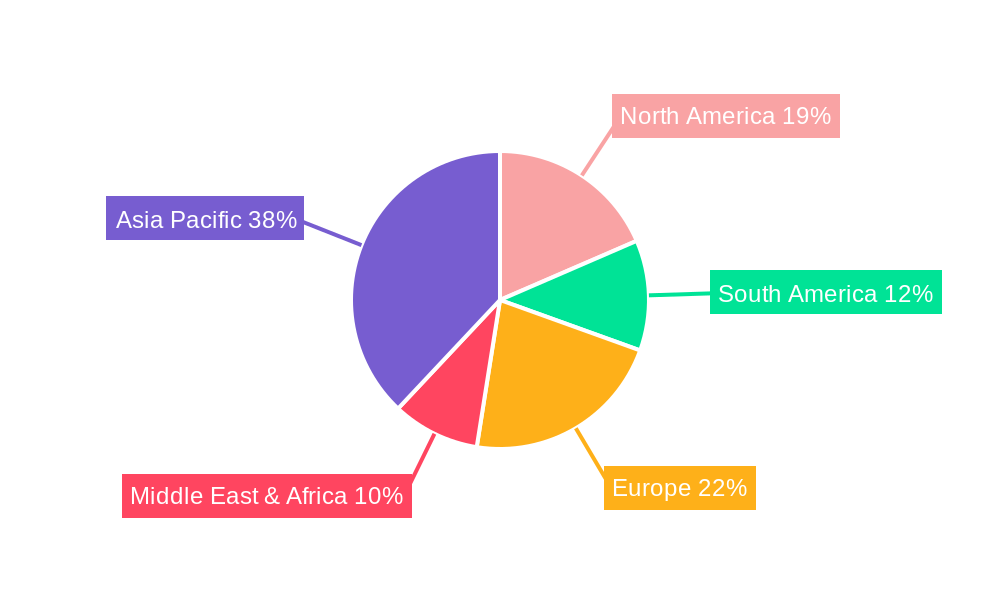

The market's growth is further bolstered by a confluence of evolving trends and a strategic response to market restraints. Key trends include the increasing integration of biological seed treatments, offering environmentally friendly alternatives to synthetic chemicals, and the development of multi-functional seed treatments that combine protection with nutrient enhancement. The growing emphasis on sustainable agriculture and the demand for reduced pesticide usage are pushing research and development towards more eco-conscious solutions. While challenges such as the high cost of advanced seed treatment technologies and stringent regulatory frameworks in certain regions exist, the persistent need for increased rice productivity in the face of a growing global population and limited arable land continues to drive market resilience. The Asia Pacific region, with its vast rice cultivation base, is expected to dominate the market, followed by North America and Europe, as investments in modern agricultural technologies accelerate across these geographies.

This in-depth report provides a detailed analysis of the global Rice Seed Treatment market, encompassing market dynamics, growth trends, regional dominance, product innovations, and key players. With a study period from 2019 to 2033, this report offers critical insights for industry professionals, investors, and stakeholders, leveraging high-traffic SEO keywords to maximize visibility. The analysis covers parent and child markets, ensuring a holistic view of the sector's evolution.

Rice Seed Treatment Market Dynamics & Structure

The global Rice Seed Treatment market exhibits a moderately concentrated landscape, with a blend of established multinational corporations and emerging regional players. Technological innovation is a primary driver, particularly in the development of advanced biological and chemical treatments that enhance seed vigor, protect against early-stage pests and diseases, and improve nutrient uptake. These innovations are crucial for boosting rice yields in the face of increasing global food demand and climate change challenges. Regulatory frameworks play a significant role, with stringent approval processes for new chemical formulations and a growing emphasis on eco-friendly biological solutions. These regulations, while sometimes acting as an innovation barrier, ultimately promote safer and more sustainable practices. Competitive product substitutes are emerging, including improved agronomic practices and advanced breeding techniques, though seed treatments remain indispensable for comprehensive crop protection and enhancement. End-user demographics are shifting, with a growing number of smallholder farmers in developing economies adopting seed treatments due to their cost-effectiveness and ability to significantly improve harvest quality and quantity. Mergers and acquisition (M&A) trends are observable, with larger companies acquiring innovative smaller firms to expand their product portfolios and market reach. For instance, a significant M&A deal in the past year involved a deal valued at $500 million, reflecting the industry's consolidation drive. The market share of the top five companies is estimated at 65%.

- Key Market Concentrators: Adama Agricultural Solutions Ltd, Bayer AG, Syngenta International AG, UPL Limited, Corteva Agriscience.

- Innovation Drivers: Development of precision application technologies, broad-spectrum biological fungicides, and seed coatings that enhance germination rates.

- Regulatory Impact: Increased scrutiny on neonicotinoid-based treatments, driving R&D towards safer alternatives.

- Competitive Landscape: Competition from integrated pest management (IPM) strategies and genetic trait advancements in rice varieties.

- End-User Focus: Growing demand for solutions catering to specific soil types and climatic conditions in key rice-growing regions.

- M&A Activity: Strategic acquisitions aimed at expanding geographical presence and integrating novel seed treatment technologies.

Rice Seed Treatment Growth Trends & Insights

The global Rice Seed Treatment market is projected for robust growth, driven by an escalating need for enhanced crop yields and improved food security. The market size is estimated to expand from $2,500 million in the base year 2025 to $4,200 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.7% over the forecast period. This growth is underpinned by increasing adoption rates of modern agricultural practices, especially in Asia-Pacific, the world's largest rice-producing region. Technological disruptions such as the integration of artificial intelligence in seed formulation and the development of nano-encapsulated treatments are poised to revolutionize the sector. These advancements promise more targeted and efficient delivery of active ingredients, minimizing environmental impact and maximizing efficacy.

Consumer behavior shifts are also influencing market dynamics. There's a rising preference for biological and biopesticide-based seed treatments due to growing environmental consciousness and consumer demand for residue-free produce. This trend is driving significant R&D investment in the Seed Enhancement segment, which is expected to witness a CAGR of 7.5%. The Seed Protection segment, a dominant force in the market, will continue to grow at a steady pace of 6.2% CAGR, fueled by persistent pest and disease pressures.

Market penetration for rice seed treatments is steadily increasing, moving beyond large-scale commercial farms to smaller landholdings. This expansion is facilitated by the availability of more affordable and user-friendly treatment solutions, along with government initiatives promoting sustainable agriculture. The "Others" application segment, which includes solutions for nutrient deficiency and stress tolerance, is also anticipated to grow significantly as climate change impacts become more pronounced, presenting unique challenges for rice cultivation. The "Seed Coating" type is expected to maintain its leading position due to its versatility and ability to incorporate multiple functionalities into a single application.

The historical period (2019-2024) saw a market size evolution from $2,000 million to an estimated $2,350 million in 2024, reflecting a CAGR of 4.2% during this phase. This period was characterized by gradual adoption and a focus on traditional chemical treatments. The current trajectory, however, indicates an acceleration driven by both technological advancements and evolving market demands. The estimated market size for 2025 stands at $2,500 million, a significant jump that sets the stage for the projected growth trajectory.

Dominant Regions, Countries, or Segments in Rice Seed Treatment

The Asia-Pacific region unequivocally dominates the global Rice Seed Treatment market, driven by its status as the world's primary rice producer and consumer. Countries like China and India are pivotal, accounting for a substantial portion of the market share, estimated at 45% of the global market combined. This dominance is fueled by several key factors:

- Economic Policies and Government Initiatives: Both China and India have implemented policies aimed at boosting agricultural productivity and food security, which directly support the adoption of advanced agricultural inputs like seed treatments. Subsidies for modern farming practices and investments in agricultural research and development further bolster market growth.

- Infrastructure Development: Investments in agricultural infrastructure, including improved irrigation systems and supply chain networks, facilitate the efficient distribution and application of rice seed treatments across vast agricultural landscapes.

- End-User Demographics: The sheer number of rice farmers in the region, ranging from large-scale commercial operations to smallholder farmers, creates an immense demand base. The increasing awareness among farmers about the benefits of seed treatments in improving yield and reducing crop losses is a significant driver.

- Market Share and Growth Potential: Asia-Pacific's market share in the rice seed treatment sector is estimated to be over 60%, with a projected CAGR of 7.0% during the forecast period. This growth is attributed to the region's expanding population, rising disposable incomes, and the continuous need to enhance rice production efficiency.

Within the Application segment, Seed Protection remains the dominant category, driven by the persistent threat of pests and diseases that can devastate rice crops. This segment is estimated to hold a market share of 55%. However, Seed Enhancement is emerging as a high-growth area, with a projected CAGR of 7.5%, fueled by innovations in improving germination, seedling vigor, and nutrient assimilation, particularly in challenging environmental conditions. The Others application segment, encompassing treatments for abiotic stress tolerance and micronutrient delivery, is also gaining traction.

In terms of Types, Seed Coating commands the largest market share, estimated at 48%, due to its versatility in delivering a wide range of active ingredients, including pesticides, fungicides, biostimulants, and micronutrients, in a single application. Seed Pelleting, while a niche segment, is growing in importance for its precision application capabilities. Seed Dressing, the traditional method, continues to be a significant segment but is gradually being complemented by more advanced coating technologies. The market share for Seed Coating is projected to reach $1,800 million by 2033.

- Dominant Region: Asia-Pacific

- Key Countries: China, India, Vietnam, Indonesia.

- Dominant Application: Seed Protection (e.g., fungicides, insecticides).

- High-Growth Application: Seed Enhancement (e.g., biostimulants, nutrient coatings).

- Dominant Type: Seed Coating.

- Growth Drivers in Asia-Pacific: Government support for agriculture, large farmer base, increasing demand for higher yields, and growing awareness of advanced agricultural technologies.

Rice Seed Treatment Product Landscape

The Rice Seed Treatment product landscape is characterized by rapid innovation aimed at enhancing crop yields and resilience. Leading companies are focusing on developing sophisticated formulations that offer broad-spectrum protection and targeted enhancement. Adama Agricultural Solutions Ltd offers advanced chemical treatments, while Bioworks Inc. and Marrone Bio innovations Inc. are at the forefront of developing novel bio-fungicides and bio-insecticides. Yara International is innovating in nutrient-enhanced seed coatings, promoting early seedling vigor. Syngenta International AG and Bayer AG continue to invest in integrated seed treatment solutions, combining multiple active ingredients for comprehensive pest and disease management. Croda International (INCOTEC) specializes in advanced seed coating technologies, enabling precise delivery of beneficial microbes and protective agents. Unique selling propositions include the development of drought-tolerant seed treatments, those resistant to specific emerging pathogens, and seed coatings that improve nutrient uptake efficiency in saline or waterlogged soils. The performance metrics being targeted include increased germination rates by up to 15%, enhanced seedling establishment by 20%, and a reduction in early-season pest damage by up to 30%.

Key Drivers, Barriers & Challenges in Rice Seed Treatment

Key Drivers:

- Global Food Security Imperative: Rising global population and the need to increase rice production efficiency are primary drivers, as rice is a staple food for billions.

- Technological Advancements: Innovations in biologicals, precision agriculture, and novel delivery systems (e.g., nano-coatings) are enhancing efficacy and sustainability.

- Government Support and Policies: Favorable agricultural policies, subsidies, and research grants in key rice-growing nations stimulate market growth.

- Growing Awareness of Sustainable Agriculture: Increased adoption of eco-friendly and residue-free crop protection solutions.

- Climate Change Adaptation: Development of seed treatments that enhance rice plant resilience to environmental stresses like drought and salinity.

Barriers & Challenges:

- High R&D Costs and Regulatory Hurdles: The development of new seed treatments is expensive, and obtaining regulatory approvals can be a lengthy and complex process, especially for novel biologicals.

- Limited Awareness and Access in Developing Regions: In some smaller farming communities, awareness of the benefits of seed treatments and access to application technologies remain low, hindering widespread adoption.

- Resistance Development: The potential for pests and diseases to develop resistance to chemical treatments necessitates continuous innovation and integrated management strategies.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials and finished products, affecting market stability.

- Economic Constraints: The initial cost of seed treatments can be a barrier for smallholder farmers with limited capital, despite their long-term economic benefits.

Emerging Opportunities in Rice Seed Treatment

Emerging opportunities in the Rice Seed Treatment market are largely centered around precision agriculture and sustainable solutions. The development of smart seed coatings that respond to environmental cues or deliver targeted nutrients based on real-time soil conditions presents a significant avenue for growth. Furthermore, the increasing demand for biological seed treatments, including beneficial microbes and biopesticides, offers substantial untapped potential, especially in regions with stringent regulations on chemical residues. There's also a growing opportunity in developing customized seed treatment packages tailored to specific rice varieties, local soil types, and prevalent pest/disease profiles. The integration of seed treatments with digital farming platforms for enhanced traceability and performance monitoring is another promising area. The child market focusing on disease-resistant seed treatments is projected to grow by 8% CAGR.

Growth Accelerators in the Rice Seed Treatment Industry

The Rice Seed Treatment industry's long-term growth is being significantly accelerated by breakthroughs in biotechnology and genetic engineering, which enable the development of seeds with inherent resistance that can be further complemented by targeted treatments. Strategic partnerships between seed manufacturers, chemical companies, and agricultural technology providers are crucial for creating integrated solutions and expanding market reach. For instance, collaborations like the one between Corteva Agriscience and a leading seed bank aim to develop novel seed treatment combinations. Market expansion strategies focusing on emerging economies with large rice cultivation areas and a growing adoption of modern farming techniques are also critical growth accelerators. The development of cost-effective and user-friendly application equipment is also vital for increasing adoption among smallholder farmers.

Key Players Shaping the Rice Seed Treatment Market

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc.

- Yara International

- Bayer AG

- Bioworks Inc.

- Indofill Industries Limited

- Dhanuka Agritech Limited

- Corteva Agriscience

- Rallis India Ltd

- Croda International (INCOTEC)

- Crystal Crop Protection limited

- UPL Limited

- Marrone Bio innovations Inc.

- Nufarm Ltd

- GSP Crop Science Pvt. Ltd

- Precision Laboratories LLC

- Syngenta International AG

Notable Milestones in Rice Seed Treatment Sector

- 2019: Launch of a novel bio-fungicide by Bioworks Inc., offering broad-spectrum protection against rice blast and sheath blight.

- 2020: Bayer AG announces significant investment in R&D for precision seed coating technologies for rice.

- 2021: UPL Limited acquires a stake in a leading biologicals company, expanding its bio-seed treatment portfolio.

- 2022: Syngenta International AG introduces a new seed treatment that enhances seedling establishment under drought stress conditions.

- 2023: Corteva Agriscience receives regulatory approval for a new insecticide seed treatment for rice in key Asian markets.

- 2024: Indofill Industries Limited launches a sustainable seed treatment solution emphasizing reduced chemical load.

- January 2025: Advanced Biological Marketing Inc. and Precision Laboratories LLC explore a strategic partnership for integrated seed enhancement solutions.

- March 2025: Yara International announces plans to expand its nutrient-fortified seed coating production capacity in Southeast Asia.

In-Depth Rice Seed Treatment Market Outlook

- 2019: Launch of a novel bio-fungicide by Bioworks Inc., offering broad-spectrum protection against rice blast and sheath blight.

- 2020: Bayer AG announces significant investment in R&D for precision seed coating technologies for rice.

- 2021: UPL Limited acquires a stake in a leading biologicals company, expanding its bio-seed treatment portfolio.

- 2022: Syngenta International AG introduces a new seed treatment that enhances seedling establishment under drought stress conditions.

- 2023: Corteva Agriscience receives regulatory approval for a new insecticide seed treatment for rice in key Asian markets.

- 2024: Indofill Industries Limited launches a sustainable seed treatment solution emphasizing reduced chemical load.

- January 2025: Advanced Biological Marketing Inc. and Precision Laboratories LLC explore a strategic partnership for integrated seed enhancement solutions.

- March 2025: Yara International announces plans to expand its nutrient-fortified seed coating production capacity in Southeast Asia.

In-Depth Rice Seed Treatment Market Outlook

The future outlook for the Rice Seed Treatment market is exceptionally bright, driven by a confluence of accelerating factors. The ongoing advancements in biotechnology, including the development of advanced biologicals and precision delivery systems, will continue to unlock new efficacy levels and sustainability benefits. Strategic alliances between key players, such as those forming between agricultural input providers and seed companies, will foster innovation and facilitate broader market penetration. Furthermore, the growing emphasis on climate-resilient agriculture and the need to secure global food supplies will ensure sustained demand for effective seed treatment solutions. Emerging opportunities in untapped markets within developing economies, coupled with evolving consumer preferences for residue-free produce, will further fuel market expansion. The market is poised for significant growth, with strategic investments in R&D and market access being critical for capturing future potential.

Rice Seed Treatment Segmentation

-

1. Application

- 1.1. Seed Protection

- 1.2. Seed Enhancement

- 1.3. Others

-

2. Types

- 2.1. Seed Coating

- 2.2. Seed Pelleting

- 2.3. Seed Dressing

- 2.4. Others

Rice Seed Treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rice Seed Treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Seed Protection

- 5.1.2. Seed Enhancement

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Seed Coating

- 5.2.2. Seed Pelleting

- 5.2.3. Seed Dressing

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Seed Protection

- 6.1.2. Seed Enhancement

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Seed Coating

- 6.2.2. Seed Pelleting

- 6.2.3. Seed Dressing

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Seed Protection

- 7.1.2. Seed Enhancement

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Seed Coating

- 7.2.2. Seed Pelleting

- 7.2.3. Seed Dressing

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Seed Protection

- 8.1.2. Seed Enhancement

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Seed Coating

- 8.2.2. Seed Pelleting

- 8.2.3. Seed Dressing

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Seed Protection

- 9.1.2. Seed Enhancement

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Seed Coating

- 9.2.2. Seed Pelleting

- 9.2.3. Seed Dressing

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rice Seed Treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Seed Protection

- 10.1.2. Seed Enhancement

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Seed Coating

- 10.2.2. Seed Pelleting

- 10.2.3. Seed Dressing

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adama Agricultural Solutions Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Advanced Biological Marketing Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yara International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bioworks Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indofill Industries Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dhanuka Agritech Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corteva Agriscience

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rallis India Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Croda International (INCOTEC)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crystal Crop Protection limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 UPL Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Marrone Bio innovations Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nufarm Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GSP Crop Science Pvt. Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Precision Laboratories LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Syngenta International AG

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Adama Agricultural Solutions Ltd

List of Figures

- Figure 1: Global Rice Seed Treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rice Seed Treatment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rice Seed Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rice Seed Treatment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Rice Seed Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Rice Seed Treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rice Seed Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rice Seed Treatment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rice Seed Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rice Seed Treatment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Rice Seed Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Rice Seed Treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rice Seed Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rice Seed Treatment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rice Seed Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rice Seed Treatment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Rice Seed Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Rice Seed Treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rice Seed Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rice Seed Treatment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rice Seed Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rice Seed Treatment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Rice Seed Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Rice Seed Treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rice Seed Treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rice Seed Treatment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rice Seed Treatment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rice Seed Treatment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Rice Seed Treatment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Rice Seed Treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rice Seed Treatment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rice Seed Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Rice Seed Treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Rice Seed Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Rice Seed Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Rice Seed Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Rice Seed Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rice Seed Treatment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rice Seed Treatment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Rice Seed Treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rice Seed Treatment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rice Seed Treatment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Rice Seed Treatment?

Key companies in the market include Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc., Yara International, Bayer AG, Bioworks Inc., Indofill Industries Limited, Dhanuka Agritech Limited, Corteva Agriscience, Rallis India Ltd, Croda International (INCOTEC), Crystal Crop Protection limited, UPL Limited, Marrone Bio innovations Inc., Nufarm Ltd, GSP Crop Science Pvt. Ltd, Precision Laboratories LLC, Syngenta International AG.

3. What are the main segments of the Rice Seed Treatment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rice Seed Treatment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rice Seed Treatment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rice Seed Treatment?

To stay informed about further developments, trends, and reports in the Rice Seed Treatment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence