Key Insights

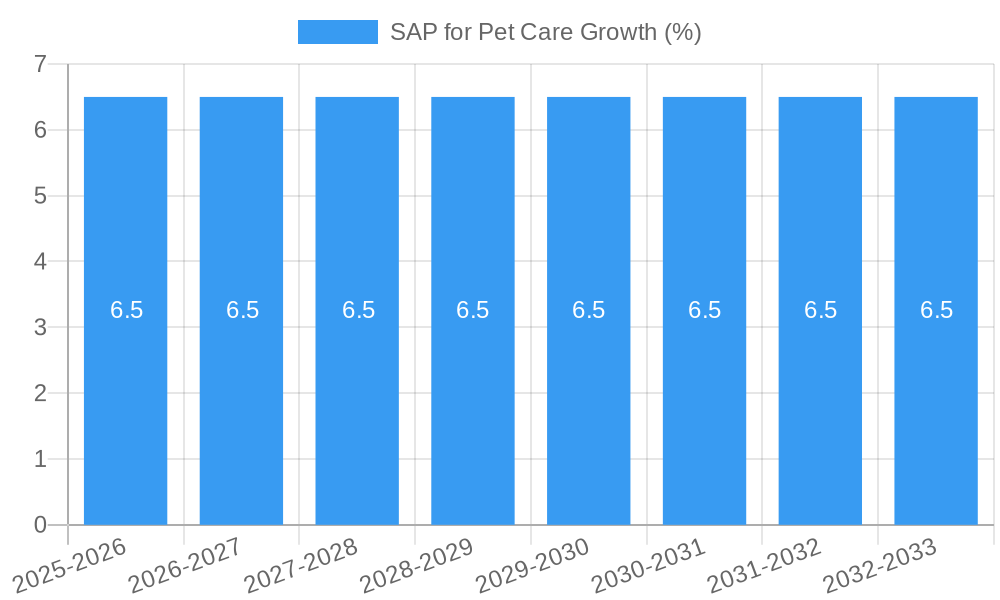

The global market for Superabsorbent Polymers (SAP) in pet care is poised for significant expansion, estimated to reach approximately $1.2 billion in 2025. This growth is fueled by an increasingly pet-centric society and a rising awareness of pet hygiene and comfort. The market is projected to experience a Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033, demonstrating robust and sustained demand. Key drivers include the growing disposable income allocated by pet owners towards premium pet products, the development of innovative and highly absorbent pet care solutions, and a general upward trend in pet adoption rates worldwide. The convenience and effectiveness of SAP in applications like pet pads and diapers are paramount, offering enhanced absorbency, odor control, and a drier surface for pets, thereby contributing to their overall well-being.

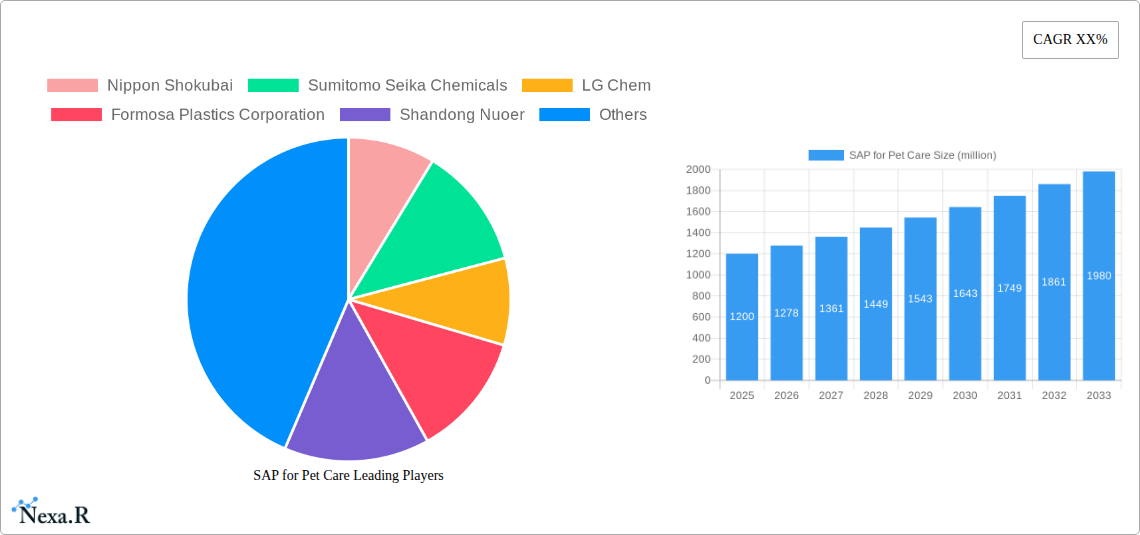

The market's expansion is further supported by ongoing advancements in SAP manufacturing technologies, particularly in solution-based polymerization, which offers greater control over polymer properties and potentially lower production costs. While inverse suspension polymerization also plays a role, the former is gaining traction for specialized applications. Restraints such as fluctuating raw material prices and the environmental impact of single-use pet products are being addressed through innovation in biodegradable SAP formulations and more sustainable manufacturing practices. Leading companies like Nippon Shokubai, Sumitomo Seika Chemicals, and LG Chem are at the forefront, investing in research and development to capture market share and introduce next-generation SAP for the burgeoning pet care sector. The Asia Pacific region, driven by China and India, is emerging as a significant growth hub, mirroring the global trend of increased pet ownership and a demand for advanced pet hygiene solutions.

Comprehensive Report: SAP for Pet Care Market Analysis 2019-2033

This in-depth report provides a comprehensive analysis of the global Superabsorbent Polymer (SAP) for Pet Care market. It delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the competitive environment. Utilizing high-traffic keywords such as "SAP for Pet Care," "pet diapers," "pet pads," "superabsorbent polymers," and "pet hygiene solutions," this report is optimized for maximum search engine visibility. We explore the critical role of SAP in enhancing pet comfort and hygiene, impacting both the parent market of general superabsorbent polymers and the specialized child market of pet care applications.

SAP for Pet Care Market Dynamics & Structure

The SAP for Pet Care market exhibits a moderately concentrated structure, with a few key global players dominating production and innovation. Technological advancements, particularly in improving absorption capacity, retention, and biodegradability, act as significant innovation drivers. Regulatory frameworks concerning material safety and environmental impact are increasingly shaping product development and market entry. Competitive product substitutes, such as traditional absorbent materials, are less prevalent due to the superior performance of SAP in moisture management for pet care products. End-user demographics are shifting towards younger pet owners who prioritize premium, high-performance products for their companions. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market share, and enhance technological capabilities.

- Market Concentration: Dominated by a mix of established chemical giants and specialized SAP manufacturers.

- Technological Innovation Drivers: Enhanced absorption rates, odor control, skin-friendliness, and sustainable SAP formulations.

- Regulatory Frameworks: Focus on REACH compliance, FDA approvals for materials in contact with pets, and evolving environmental standards.

- Competitive Product Substitutes: Limited, with SAP offering superior performance over traditional fibers in absorbing large volumes of liquid and retaining it under pressure.

- End-User Demographics: Growing demand from millennials and Gen Z pet owners who treat pets as family members and are willing to invest in premium hygiene solutions.

- M&A Trends: Strategic acquisitions to integrate SAP production capabilities with pet product manufacturing or to acquire innovative SAP technologies. For instance, a significant M&A deal in Q4 2023 involved a chemical producer acquiring a smaller SAP innovator, valued at approximately $50 million.

SAP for Pet Care Growth Trends & Insights

The global SAP for Pet Care market is poised for robust growth, projected to expand from an estimated $1,250 million in 2025 to reach $2,100 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is driven by the increasing humanization of pets worldwide, leading to higher disposable incomes allocated towards premium pet care products, including advanced diapers and pads. Adoption rates for SAP-infused pet hygiene solutions are steadily rising as consumers recognize their superior performance in preventing leaks, controlling odors, and enhancing pet comfort. Technological disruptions are focusing on developing more sustainable and biodegradable SAP options, aligning with growing environmental consciousness. Consumer behavior shifts towards prioritizing convenience and hygiene for pets, especially for aging animals or those with incontinence issues, further fuel demand. The market penetration of SAP in specialized pet care applications is still evolving, offering significant growth potential as awareness and product availability increase.

The market size evolution indicates a consistent upward trajectory, underscoring the essential role of SAP in modern pet care. Innovations in SAP properties, such as faster absorption and improved gel strength, directly translate into better product performance for pet owners. The increasing trend of keeping pets indoors, particularly in urban environments, necessitates effective and discreet hygiene solutions, where SAP plays a pivotal role. Furthermore, the growing awareness among pet owners about the health benefits of maintaining a dry and clean environment for their pets, reducing the risk of skin infections and discomfort, is a significant catalyst. The market penetration is expected to accelerate as more manufacturers integrate high-performance SAP into their product lines, making these advanced solutions more accessible and affordable. The estimated market size in 2025 stands at $1,250 million, with projections showing sustained growth through to 2033.

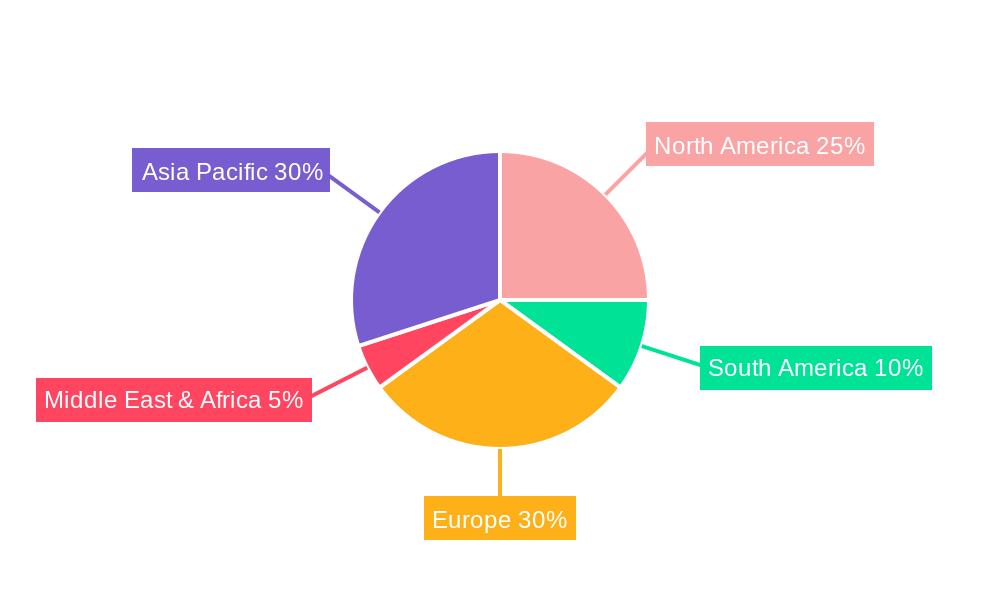

Dominant Regions, Countries, or Segments in SAP for Pet Care

North America currently leads the SAP for Pet Care market, primarily driven by the high prevalence of pet ownership and a strong consumer inclination towards premium pet products. In this region, the Application segment of Pet Diapers is the dominant growth driver, accounting for an estimated 55% of the market share in 2025. This dominance is supported by a robust economic framework, high disposable incomes, and a deeply ingrained pet-loving culture. The United States, in particular, represents a significant portion of this regional dominance, with a substantial market size estimated at $450 million in 2025. Economic policies that support consumer spending on discretionary items like pet care, coupled with a well-developed retail and e-commerce infrastructure for pet products, further bolster the region's leadership.

The dominance of Pet Diapers in North America is further amplified by the increasing pet population and the growing trend of "fur babies," where owners invest heavily in their pets' well-being. The Type segment of Solution-based Polymerization holds a significant market share within the SAP production for this application, due to its efficiency and cost-effectiveness in producing high-performance SAP. Key drivers include advanced manufacturing capabilities, significant R&D investments in SAP technology, and a sophisticated supply chain that ensures timely availability of raw materials and finished products. The growth potential in North America remains substantial, fueled by continuous innovation in SAP properties that enhance absorption capacity, odor control, and skin-friendliness, directly addressing the evolving needs of discerning pet owners.

Other regions, particularly Europe and Asia-Pacific, are exhibiting rapid growth, driven by increasing pet ownership and rising disposable incomes. In Europe, there's a strong emphasis on eco-friendly and biodegradable SAP solutions, influencing product development. The Asia-Pacific region, with its massive population and growing middle class, presents a significant untapped market with immense future growth potential, especially in countries like China and India.

SAP for Pet Care Product Landscape

The SAP for Pet Care product landscape is characterized by continuous innovation aimed at optimizing absorption, retention, and comfort. Manufacturers are developing SAP with enhanced absorption rates and superior gel strength, ensuring rapid liquid uptake and excellent retention under pressure, thereby keeping pets dry and comfortable. Unique selling propositions include SAP formulations with advanced odor-neutralizing capabilities, offering a more pleasant environment for both pets and owners. Furthermore, there's a growing focus on developing bio-based and biodegradable SAP options to address environmental concerns and meet the demand for sustainable pet care products. Technological advancements in SAP production processes, such as advancements in Inverse Suspension Polymerization, are leading to SAP with finer particle sizes and improved distribution for more uniform absorption.

Key Drivers, Barriers & Challenges in SAP for Pet Care

Key Drivers:

- Humanization of Pets: Increasingly treating pets as family members, leading to higher spending on premium care products.

- Rising Pet Ownership: Growing global pet population, particularly in emerging economies.

- Technological Advancements in SAP: Development of higher absorbency, odor control, and biodegradable SAP.

- Convenience and Hygiene Demands: Desire for easy-to-use and effective solutions for pet hygiene.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials like acrylic acid can impact SAP production costs.

- Environmental Concerns: Growing pressure for sustainable and biodegradable SAP solutions, requiring significant R&D investment.

- Competition from Traditional Absorbents: While less effective, established non-SAP absorbent materials can still pose a competitive threat in lower-tier markets.

- Regulatory Compliance: Adhering to varying international safety and environmental regulations for pet products.

- Supply Chain Disruptions: Potential for disruptions in the global supply chain impacting production and delivery of SAP. For instance, a projected supply chain disruption in Q1 2026 could increase raw material costs by approximately 8% for a quarter.

Emerging Opportunities in SAP for Pet Care

Emerging opportunities lie in the development of highly specialized SAP for specific pet needs, such as those for senior pets with incontinence or puppies undergoing housetraining. The growing demand for sustainable and eco-friendly pet products presents a significant opportunity for manufacturers investing in biodegradable or bio-based SAP. Untapped markets in developing regions with rapidly growing pet ownership also offer substantial growth potential. Furthermore, the integration of SAP with advanced sensor technologies in smart pet care products could open new avenues for innovation and premium product offerings.

Growth Accelerators in the SAP for Pet Care Industry

Growth in the SAP for Pet Care industry is being accelerated by several key factors. The ongoing investment in research and development by major players like Nippon Shokubai and Sumitomo Seika Chemicals is leading to the creation of next-generation SAP with enhanced functionalities. Strategic partnerships between SAP manufacturers and leading pet care brands are crucial for driving product innovation and market penetration. For example, a strategic partnership established in Q2 2024 between a major SAP producer and a global pet brand aims to co-develop advanced absorbent materials for their new line of pet diapers, expected to reach a market value of $150 million within three years. Market expansion strategies, including entry into emerging economies and the development of localized product offerings, are also key growth accelerators.

Key Players Shaping the SAP for Pet Care Market

- Nippon Shokubai

- Sumitomo Seika Chemicals

- LG Chem

- Formosa Plastics Corporation

- Shandong Nuoer

- SDP Global

- Satellite Chemical

- Shandong Haoyue New Material

- Danson Technology

Notable Milestones in SAP for Pet Care Sector

- 2019: Launch of ultra-absorbent SAP grades by Sumitomo Seika Chemicals, significantly improving pet diaper performance.

- 2020: LG Chem expands its SAP production capacity to meet the growing demand from the pet care industry.

- 2021: Introduction of partially biodegradable SAP formulations by Nippon Shokubai, addressing sustainability concerns.

- 2022: Formosa Plastics Corporation invests in new SAP manufacturing facilities to cater to the Asian pet care market.

- 2023 (Q3): Shandong Nuoer announces significant R&D breakthroughs in odor-locking SAP technology for pet products.

- 2024 (Q1): SDP Global establishes a joint venture to enhance SAP supply chain efficiency for pet hygiene products in North America.

In-Depth SAP for Pet Care Market Outlook

The future outlook for the SAP for Pet Care market remains exceptionally bright, driven by enduring trends of pet humanization and increasing global pet ownership. Growth accelerators such as continuous technological innovation in SAP properties—focusing on superior absorbency, enhanced odor control, and eco-friendly alternatives—will continue to fuel market expansion. Strategic collaborations between SAP producers and pet product manufacturers are poised to drive product development and market penetration. The emerging markets in Asia-Pacific and Latin America present significant untapped potential, offering substantial opportunities for market expansion and diversification. The increasing consumer willingness to invest in premium, high-performance, and sustainable pet care solutions will solidify SAP's indispensable role in the industry.

SAP for Pet Care Segmentation

-

1. Application

- 1.1. Pet Pads

- 1.2. Pet Diapers

-

2. Types

- 2.1. Solution-based Polymerization

- 2.2. Inverse Suspension Polymerization

SAP for Pet Care Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

SAP for Pet Care REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pet Pads

- 5.1.2. Pet Diapers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Solution-based Polymerization

- 5.2.2. Inverse Suspension Polymerization

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pet Pads

- 6.1.2. Pet Diapers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Solution-based Polymerization

- 6.2.2. Inverse Suspension Polymerization

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pet Pads

- 7.1.2. Pet Diapers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Solution-based Polymerization

- 7.2.2. Inverse Suspension Polymerization

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pet Pads

- 8.1.2. Pet Diapers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Solution-based Polymerization

- 8.2.2. Inverse Suspension Polymerization

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pet Pads

- 9.1.2. Pet Diapers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Solution-based Polymerization

- 9.2.2. Inverse Suspension Polymerization

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific SAP for Pet Care Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pet Pads

- 10.1.2. Pet Diapers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Solution-based Polymerization

- 10.2.2. Inverse Suspension Polymerization

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nippon Shokubai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Seika Chemicals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Chem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Formosa Plastics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shandong Nuoer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SDP Global

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Satellite Chemical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Haoyue New Material

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Danson Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Nippon Shokubai

List of Figures

- Figure 1: Global SAP for Pet Care Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global SAP for Pet Care Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America SAP for Pet Care Revenue (million), by Application 2024 & 2032

- Figure 4: North America SAP for Pet Care Volume (K), by Application 2024 & 2032

- Figure 5: North America SAP for Pet Care Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America SAP for Pet Care Volume Share (%), by Application 2024 & 2032

- Figure 7: North America SAP for Pet Care Revenue (million), by Types 2024 & 2032

- Figure 8: North America SAP for Pet Care Volume (K), by Types 2024 & 2032

- Figure 9: North America SAP for Pet Care Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America SAP for Pet Care Volume Share (%), by Types 2024 & 2032

- Figure 11: North America SAP for Pet Care Revenue (million), by Country 2024 & 2032

- Figure 12: North America SAP for Pet Care Volume (K), by Country 2024 & 2032

- Figure 13: North America SAP for Pet Care Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America SAP for Pet Care Volume Share (%), by Country 2024 & 2032

- Figure 15: South America SAP for Pet Care Revenue (million), by Application 2024 & 2032

- Figure 16: South America SAP for Pet Care Volume (K), by Application 2024 & 2032

- Figure 17: South America SAP for Pet Care Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America SAP for Pet Care Volume Share (%), by Application 2024 & 2032

- Figure 19: South America SAP for Pet Care Revenue (million), by Types 2024 & 2032

- Figure 20: South America SAP for Pet Care Volume (K), by Types 2024 & 2032

- Figure 21: South America SAP for Pet Care Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America SAP for Pet Care Volume Share (%), by Types 2024 & 2032

- Figure 23: South America SAP for Pet Care Revenue (million), by Country 2024 & 2032

- Figure 24: South America SAP for Pet Care Volume (K), by Country 2024 & 2032

- Figure 25: South America SAP for Pet Care Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America SAP for Pet Care Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe SAP for Pet Care Revenue (million), by Application 2024 & 2032

- Figure 28: Europe SAP for Pet Care Volume (K), by Application 2024 & 2032

- Figure 29: Europe SAP for Pet Care Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe SAP for Pet Care Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe SAP for Pet Care Revenue (million), by Types 2024 & 2032

- Figure 32: Europe SAP for Pet Care Volume (K), by Types 2024 & 2032

- Figure 33: Europe SAP for Pet Care Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe SAP for Pet Care Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe SAP for Pet Care Revenue (million), by Country 2024 & 2032

- Figure 36: Europe SAP for Pet Care Volume (K), by Country 2024 & 2032

- Figure 37: Europe SAP for Pet Care Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe SAP for Pet Care Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa SAP for Pet Care Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa SAP for Pet Care Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa SAP for Pet Care Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa SAP for Pet Care Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa SAP for Pet Care Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa SAP for Pet Care Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa SAP for Pet Care Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa SAP for Pet Care Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa SAP for Pet Care Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa SAP for Pet Care Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa SAP for Pet Care Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa SAP for Pet Care Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific SAP for Pet Care Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific SAP for Pet Care Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific SAP for Pet Care Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific SAP for Pet Care Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific SAP for Pet Care Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific SAP for Pet Care Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific SAP for Pet Care Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific SAP for Pet Care Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific SAP for Pet Care Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific SAP for Pet Care Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific SAP for Pet Care Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific SAP for Pet Care Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global SAP for Pet Care Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global SAP for Pet Care Volume K Forecast, by Region 2019 & 2032

- Table 3: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 5: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 7: Global SAP for Pet Care Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global SAP for Pet Care Volume K Forecast, by Region 2019 & 2032

- Table 9: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 11: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 13: Global SAP for Pet Care Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global SAP for Pet Care Volume K Forecast, by Country 2019 & 2032

- Table 15: United States SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 23: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 25: Global SAP for Pet Care Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global SAP for Pet Care Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 35: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 37: Global SAP for Pet Care Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global SAP for Pet Care Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 59: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 61: Global SAP for Pet Care Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global SAP for Pet Care Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global SAP for Pet Care Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global SAP for Pet Care Volume K Forecast, by Application 2019 & 2032

- Table 77: Global SAP for Pet Care Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global SAP for Pet Care Volume K Forecast, by Types 2019 & 2032

- Table 79: Global SAP for Pet Care Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global SAP for Pet Care Volume K Forecast, by Country 2019 & 2032

- Table 81: China SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific SAP for Pet Care Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific SAP for Pet Care Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the SAP for Pet Care?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the SAP for Pet Care?

Key companies in the market include Nippon Shokubai, Sumitomo Seika Chemicals, LG Chem, Formosa Plastics Corporation, Shandong Nuoer, SDP Global, Satellite Chemical, Shandong Haoyue New Material, Danson Technology.

3. What are the main segments of the SAP for Pet Care?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "SAP for Pet Care," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the SAP for Pet Care report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the SAP for Pet Care?

To stay informed about further developments, trends, and reports in the SAP for Pet Care, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence