Key Insights

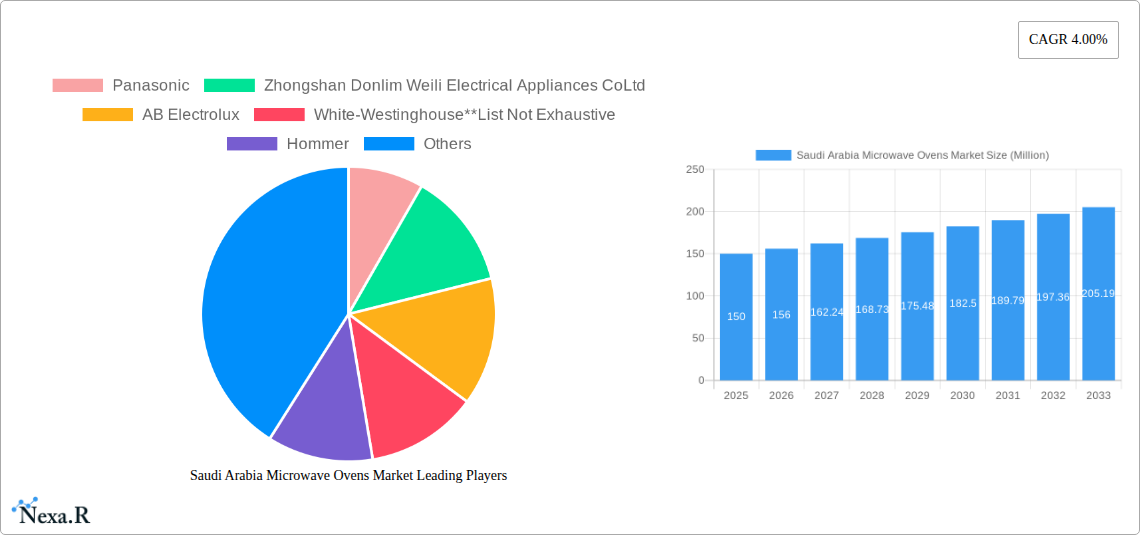

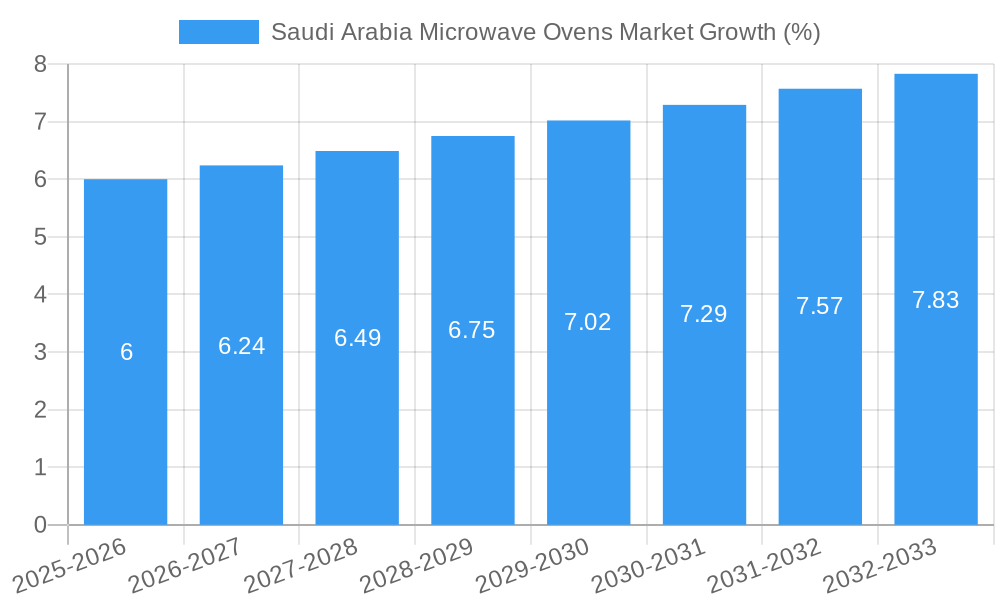

The Saudi Arabian microwave oven market, valued at approximately $150 million in 2025, exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 4% from 2025 to 2033. This growth is fueled by several key factors. Rising urbanization and a burgeoning middle class are driving increased demand for convenient kitchen appliances, with microwave ovens emerging as a staple in modern Saudi Arabian households. Furthermore, the increasing adoption of westernized lifestyles and diets, coupled with a growing preference for quick and easy meal preparation, contributes significantly to market expansion. The market is segmented by type (grill, solo, convection), distribution channel (offline, online), and end-user (residential, commercial), with residential use currently dominating the market share. The presence of prominent international and regional brands like Panasonic, Samsung, and local players like Zhongshan Donlim indicates a competitive landscape. However, factors like fluctuating oil prices and economic sensitivity might slightly restrain market growth, especially within the commercial sector. Nevertheless, the long-term outlook remains positive, driven by consistent urbanization, disposable income growth, and the evolving culinary preferences of Saudi Arabian consumers.

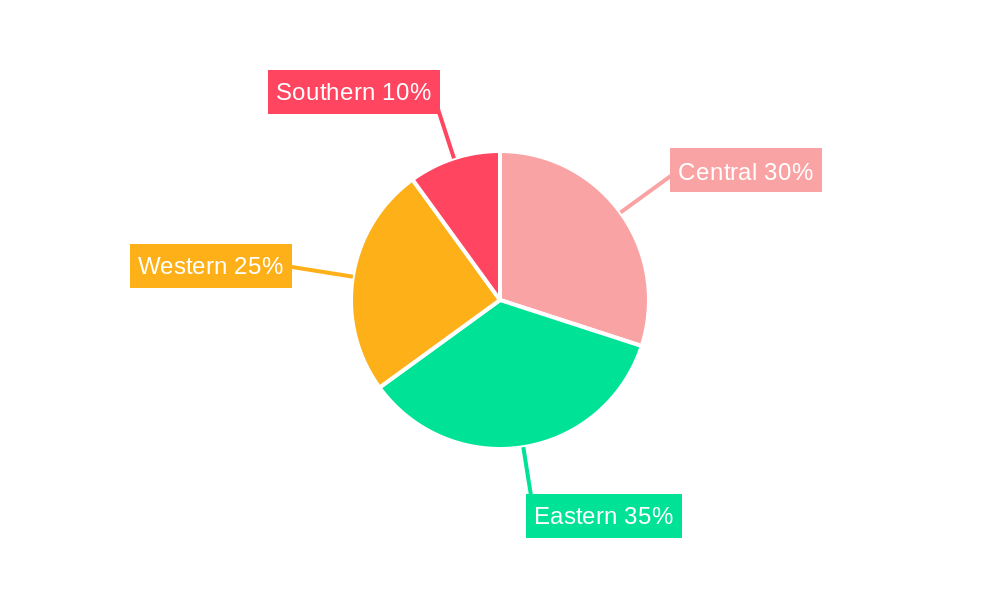

The online distribution channel is experiencing noteworthy growth, largely attributable to the increasing penetration of e-commerce and the convenience it offers to consumers. While offline channels (retail stores, electronics shops) still command a larger share, online sales are expected to gain significant traction in the coming years. The convection microwave segment is showing the fastest growth rate, driven by consumer preference for healthier cooking methods and versatility in appliance functionality. Regional variations exist, with urban areas like Riyadh, Jeddah, and Dammam exhibiting higher demand compared to more rural regions. Future market expansion will hinge on strategies aimed at capturing the increasing online market share, innovative product development focusing on energy efficiency and smart features, and targeting the growing commercial sector (hotels, restaurants, etc.) with specialized microwave oven models.

Saudi Arabia Microwave Ovens Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia microwave ovens market, covering market dynamics, growth trends, key players, and future outlook. The report segments the market by type (Grill, Solo, Convection), distribution channel (Offline, Online), and end-user (Residential, Commercial), offering granular insights for informed strategic decision-making. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

Saudi Arabia Microwave Ovens Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Saudi Arabia microwave oven market. The market exhibits a moderately concentrated structure, with key players like Panasonic, Samsung Electronics, and LG Electronics holding significant market share, while several regional and international brands such as Zhongshan Donlim Weili Electrical Appliances Co Ltd, AB Electrolux, White-Westinghouse, Hommer, Geepas, ZAGZOOG FOR HOME APPLIANCES, and Black & Decker also contributing.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2024.

- Technological Innovation: Focus is shifting towards energy-efficient models with smart features and increased capacity, driven by rising consumer demand and technological advancements. Innovation barriers include high R&D costs and the need to adapt to local preferences.

- Regulatory Framework: Saudi Arabian regulations concerning energy efficiency and safety standards significantly influence product design and market entry.

- Competitive Substitutes: Other cooking appliances, such as conventional ovens and air fryers, pose competitive challenges.

- End-User Demographics: The growing young population and increasing urbanization are boosting the demand for microwave ovens, particularly in residential settings.

- M&A Trends: The number of M&A deals in the Saudi Arabian home appliance sector has averaged xx per year during the historical period (2019-2024), with a predicted increase to xx in the forecast period.

Saudi Arabia Microwave Ovens Market Growth Trends & Insights

The Saudi Arabia microwave ovens market has witnessed significant growth during the historical period (2019-2024). The market size reached xx million units in 2024, registering a CAGR of xx% during this period. Factors such as rising disposable incomes, changing lifestyles, and increasing adoption of convenience appliances have fuelled this growth. The market penetration rate for microwave ovens in Saudi Arabia is estimated at xx% in 2024, leaving substantial room for future expansion. Technological disruptions, such as the introduction of smart microwave ovens with Wi-Fi connectivity, are further shaping market dynamics. Shifts in consumer behavior towards health-conscious cooking and premium features are also influencing product development and demand. The forecast period (2025-2033) projects continued growth, with an anticipated CAGR of xx%, reaching an estimated xx million units by 2033. This growth is driven by anticipated increases in per capita income, continued urbanization, and the growing popularity of quick and easy meal preparation.

Dominant Regions, Countries, or Segments in Saudi Arabia Microwave Ovens Market

The residential segment dominates the Saudi Arabia microwave oven market, accounting for approximately xx% of total sales in 2024. The online distribution channel is witnessing rapid growth, although offline channels remain the dominant distribution method. Among types, the solo microwave oven segment holds the largest market share due to its affordability and suitability for basic cooking needs. Growth drivers for these segments include:

- Residential Segment: Increasing urbanization and nuclear families are leading to higher demand.

- Online Channel: Growing internet and smartphone penetration, coupled with e-commerce expansion.

- Solo Microwave Ovens: Affordability and ease of use are primary drivers.

Key factors contributing to regional dominance include population density, income levels, and the availability of retail infrastructure. Further, government initiatives promoting energy-efficient appliances are expected to shape market dynamics in the future.

Saudi Arabia Microwave Ovens Market Product Landscape

Microwave ovens in Saudi Arabia offer a wide range of functionalities, from basic heating and cooking to advanced features like convection and grilling. Recent innovations include increased capacity models (as seen with LG's 56-liter launch), smart connectivity, and energy-efficient designs catering to consumer demand for convenience and health-conscious cooking. The market exhibits a strong preference for models with user-friendly interfaces and diverse cooking settings, reflecting a preference for multifunctional and energy-efficient models.

Key Drivers, Barriers & Challenges in Saudi Arabia Microwave Ovens Market

Key Drivers: Rising disposable incomes, changing lifestyles favoring convenience, increasing urbanization, and government initiatives promoting energy efficiency are key drivers. Technological advancements resulting in sophisticated features and improved performance also drive market expansion.

Key Challenges: Intense competition from established and emerging players, price sensitivity among consumers, and potential supply chain disruptions due to geopolitical factors pose challenges. Furthermore, fluctuating energy prices could impact consumer spending on appliances.

Emerging Opportunities in Saudi Arabia Microwave Ovens Market

Untapped opportunities lie in expanding into smaller towns and rural areas, catering to the growing demand from the younger population. Further, introducing innovative features such as voice control and AI-powered cooking assistance could enhance the user experience and drive market expansion. The development of specialized microwave ovens targeting specific dietary needs or cooking styles represents a significant potential.

Growth Accelerators in the Saudi Arabia Microwave Ovens Market Industry

Technological breakthroughs in energy efficiency, the development of smart microwave ovens with integrated platforms, and strategic partnerships between manufacturers and retailers are accelerating market growth. Government incentives for energy-efficient appliances and expanding retail infrastructure are also playing a significant role. Moreover, educational campaigns highlighting the benefits and versatility of microwave ovens are contributing to market expansion.

Key Players Shaping the Saudi Arabia Microwave Ovens Market Market

- Panasonic

- Zhongshan Donlim Weili Electrical Appliances Co Ltd

- AB Electrolux

- White-Westinghouse

- Hommer

- Samsung Electronics

- Geepas

- ZAGZOOG FOR HOME APPLIANCES

- Black & Decker

- LG Electronics

Notable Milestones in Saudi Arabia Microwave Ovens Market Sector

- June 2022: LG Electronics launches a 56-liter microwave oven with health features in the Saudi market.

- May 2021: LG introduces "The Spot," an online platform engaging Gen Z consumers in the region.

In-Depth Saudi Arabia Microwave Ovens Market Outlook

The Saudi Arabia microwave ovens market is poised for sustained growth throughout the forecast period, driven by positive economic indicators, increasing urbanization, and the growing preference for convenient cooking solutions. Strategic partnerships, investments in research and development, and innovative product launches will be crucial for players seeking to capitalize on the market's future potential. The market shows significant scope for expansion within the residential sector, particularly in smaller towns and cities. The growing adoption of online purchasing channels will also significantly influence market dynamics.

Saudi Arabia Microwave Ovens Market Segmentation

-

1. Type

- 1.1. Grill

- 1.2. Solo

- 1.3. Convection

-

2. Dsitribution Channel

- 2.1. Offline

- 2.2. Online

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Saudi Arabia Microwave Ovens Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Rising competition among the players

- 3.4. Market Trends

- 3.4.1. Increasing Population and the Rising Number of Households is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Grill

- 5.1.2. Solo

- 5.1.3. Convection

- 5.2. Market Analysis, Insights and Forecast - by Dsitribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zhongshan Donlim Weili Electrical Appliances CoLtd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AB Electrolux

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 White-Westinghouse**List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hommer

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Geepas

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ZAGZOOG FOR HOME APPLIANCES

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Black & Deckar

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LG Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: Saudi Arabia Microwave Ovens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Microwave Ovens Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Dsitribution Channel 2019 & 2032

- Table 4: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Microwave Ovens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Microwave Ovens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Microwave Ovens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Microwave Ovens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Dsitribution Channel 2019 & 2032

- Table 13: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: Saudi Arabia Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Microwave Ovens Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Saudi Arabia Microwave Ovens Market?

Key companies in the market include Panasonic, Zhongshan Donlim Weili Electrical Appliances CoLtd, AB Electrolux, White-Westinghouse**List Not Exhaustive, Hommer, Samsung Electronics, Geepas, ZAGZOOG FOR HOME APPLIANCES, Black & Deckar, LG Electronics.

3. What are the main segments of the Saudi Arabia Microwave Ovens Market?

The market segments include Type, Dsitribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Increasing Population and the Rising Number of Households is Driving the Market.

7. Are there any restraints impacting market growth?

Rising competition among the players.

8. Can you provide examples of recent developments in the market?

June 2022 - LG Electronics (LG), a global leader and technology innovator in home appliances, and United Yousuf Mohammed Naghi Ltd. announced the launch of its new biggest capacity microwave oven for the Saudi market. The biggest capacity is defined as 56 litres with health care features, streamlined design and innovative technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence