Key Insights

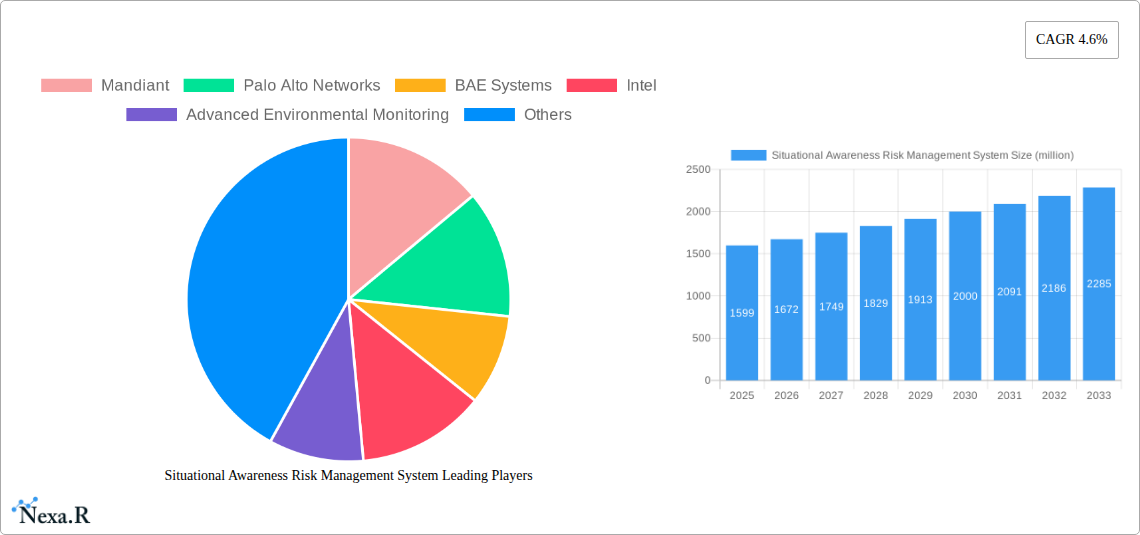

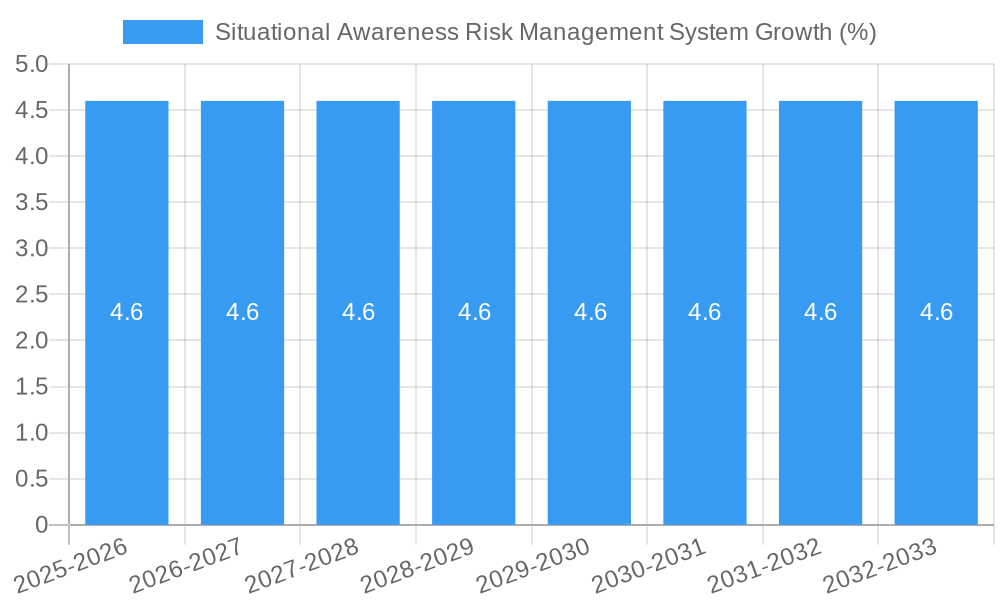

The global Situational Awareness Risk Management System market is poised for robust growth, projected to reach approximately USD 1599 million by 2025. This expansion is driven by the increasing adoption of advanced technologies across critical sectors such as defense, energy, and aerospace, where real-time threat detection and proactive risk mitigation are paramount. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.6% during the forecast period of 2025-2033, indicating sustained and healthy expansion. Key drivers include escalating geopolitical tensions, the rise of sophisticated cyber threats, and the growing need for comprehensive operational oversight in complex environments. Industries are investing heavily in solutions that offer predictive analytics and real-time monitoring to anticipate and neutralize potential risks before they escalate, thereby safeguarding assets and personnel. The demand for these systems is further amplified by stringent regulatory requirements and the continuous innovation in AI and machine learning, enabling more intelligent and automated risk management.

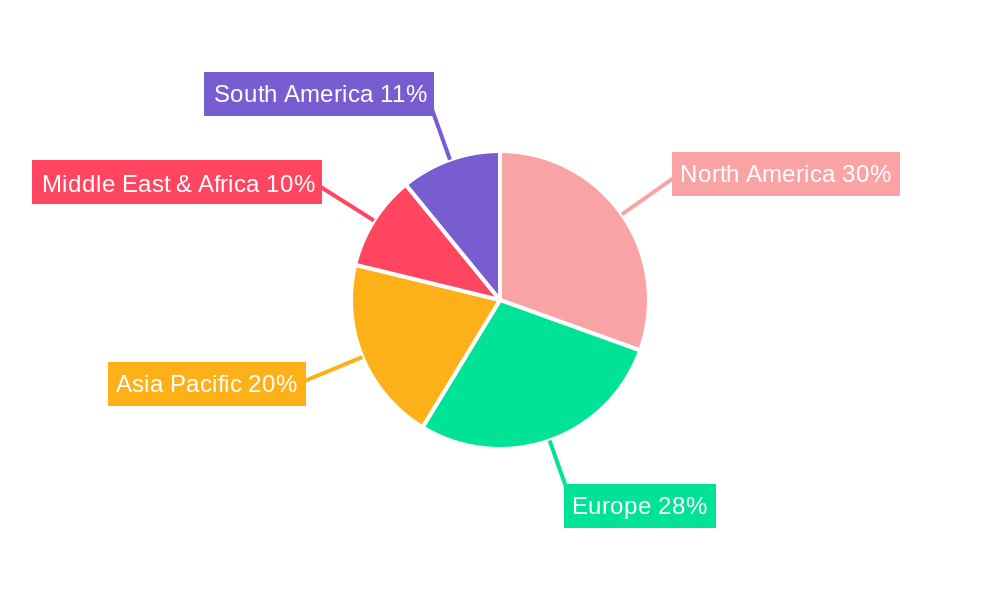

The market's segmentation reveals a strong demand for Real-Time Monitoring and Alarm Systems, essential for immediate threat identification and response. Predictive Analysis Systems are also gaining significant traction as organizations shift towards a more proactive approach to risk management, leveraging data analytics to forecast potential issues. Leading companies such as Mandiant, Palo Alto Networks, and BAE Systems are at the forefront of innovation, offering cutting-edge solutions that cater to the evolving needs of these industries. North America and Europe currently dominate the market due to significant investments in defense and aerospace sectors, coupled with a mature technological infrastructure. However, the Asia Pacific region is expected to witness the fastest growth, fueled by rapid industrialization, increasing defense spending, and the growing adoption of smart technologies. The ongoing digital transformation across various industries will continue to propel the market forward, creating substantial opportunities for solution providers.

Situational Awareness Risk Management System Market Dynamics & Structure

The Situational Awareness Risk Management System (SARMS) market is characterized by a moderately concentrated landscape, with key players like Mandiant, Palo Alto Networks, BAE Systems, Lockheed Martin, and Hexagon AB holding significant influence. Technological innovation is primarily driven by the relentless need for enhanced threat detection, real-time intelligence, and proactive risk mitigation across critical infrastructure and defense sectors. Government mandates and evolving cybersecurity threats are also pivotal drivers. While advanced analytics, AI-powered threat intelligence, and integrated sensor networks represent significant technological innovation drivers, high implementation costs and the need for specialized expertise present innovation barriers. The regulatory framework is progressively tightening, with increasing emphasis on data protection, critical infrastructure security, and interoperability standards, particularly within the Defense Industry and Energy Industry segments. Competitive product substitutes, such as standalone cybersecurity solutions and traditional risk assessment tools, exist but often lack the comprehensive, integrated nature of SARMS. End-user demographics are shifting towards a greater demand for cloud-based, scalable solutions and predictive capabilities, particularly within the growing Aerospace segment. Mergers and acquisitions (M&A) activity is expected to remain robust as larger entities seek to consolidate their market position and acquire specialized technologies, with an estimated 25-35 M&A deal volumes projected over the forecast period.

- Market Concentration: Moderate to high, with established players dominating market share.

- Technological Innovation Drivers: AI/ML for threat prediction, IoT integration, real-time data fusion, advanced analytics, and robust sensor networks.

- Regulatory Frameworks: Growing focus on critical infrastructure protection, data privacy, and cybersecurity compliance.

- Competitive Product Substitutes: Standalone cybersecurity tools, manual risk assessment platforms, and less integrated monitoring systems.

- End-User Demographics: Increasing demand for sophisticated, scalable, and predictive risk management solutions.

- M&A Trends: Ongoing consolidation to acquire specialized capabilities and expand market reach.

Situational Awareness Risk Management System Growth Trends & Insights

The global Situational Awareness Risk Management System (SARMS) market is projected for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 18.5% from 2025 to 2033. This robust expansion is fueled by the escalating complexity of global threats, ranging from cyberattacks and physical security breaches to environmental hazards and geopolitical instabilities. The base year of 2025 sees the market size estimated at $15,500 million, with projections indicating a significant increase by the end of the forecast period. The adoption rates for SARMS are accelerating across various industries, driven by the imperative for continuous operational resilience and the proactive management of multifaceted risks. Companies are increasingly recognizing that comprehensive situational awareness is no longer a luxury but a necessity for safeguarding assets, personnel, and reputation.

Technological disruptions are a constant feature of this market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing predictive analysis capabilities, enabling systems to not only detect threats in real-time but also forecast potential future risks with remarkable accuracy. This shift from reactive to proactive risk management is a key differentiator for advanced SARMS. Furthermore, the proliferation of the Internet of Things (IoT) devices provides an unprecedented volume of data, which, when effectively analyzed by SARMS, offers a granular and holistic view of the operational environment. This data fusion capability is crucial for identifying subtle anomalies and emergent threats that might otherwise go unnoticed.

Consumer behavior shifts are also playing a vital role. Decision-makers are prioritizing integrated solutions that offer a unified command and control interface, reducing operational complexity and enhancing response times. The demand for cloud-based SARMS is on the rise, offering scalability, flexibility, and cost-effectiveness, especially for organizations with fluctuating needs. The increasing awareness of the financial and reputational damage caused by security incidents is compelling businesses to invest more heavily in robust risk management systems. The Energy Industry, with its critical infrastructure and susceptibility to physical and cyber threats, is a major adopter. Similarly, the Defense Industry and Aerospace sectors are heavily investing in SARMS to maintain operational superiority and ensure mission success in dynamic environments. The market penetration is expected to deepen significantly, moving beyond large enterprises to small and medium-sized businesses that are increasingly targeted by sophisticated threat actors.

Dominant Regions, Countries, or Segments in Situational Awareness Risk Management System

The Defense Industry is a dominant segment driving the growth of the Situational Awareness Risk Management System (SARMS) market, accounting for an estimated 35% of the total market share in 2025, with a projected CAGR of 19.2% during the forecast period. This dominance is primarily attributed to the inherent need for superior intelligence, command and control, and threat mitigation in national security operations. Governments worldwide are investing heavily in advanced defense technologies to maintain a strategic advantage, protect borders, and respond effectively to evolving geopolitical challenges. The complex and dynamic nature of modern warfare necessitates comprehensive situational awareness to understand the battlefield, enemy movements, and potential threats in real-time.

Key drivers within the Defense Industry include significant government defense budgets, the increasing adoption of AI and drone technology for surveillance and reconnaissance, and the need for secure and integrated communication systems across different branches of the military. Countries like the United States, China, and various European nations are leading in their investment in SARMS for defense applications. The implementation of advanced sensor networks, satellite imagery analysis, and real-time data fusion platforms are critical for maintaining operational effectiveness.

The Energy Industry is another significant contributor, representing an estimated 25% market share in 2025, with a CAGR of 17.8%. This sector's criticality lies in its essential role in powering economies and societies. The vulnerability of energy infrastructure to physical attacks, cyber threats, and natural disasters necessitates robust risk management solutions. SARMS are employed to monitor pipelines, power grids, offshore platforms, and other critical assets, providing real-time alerts for potential breaches, equipment failures, or environmental incidents. Factors like the growing demand for renewable energy sources, the need to secure aging infrastructure, and the increasing frequency of extreme weather events are bolstering the adoption of SARMS in this sector.

The Aerospace segment, while smaller, is experiencing rapid growth, with an estimated 15% market share in 2025 and a projected CAGR of 18.9%. This growth is propelled by the increasing complexity of air traffic management, the rise of commercial space ventures, and the need for enhanced safety and security in aviation. SARMS are crucial for monitoring flight paths, detecting potential collisions, managing ground operations, and ensuring the security of airports and aerospace manufacturing facilities. The stringent safety regulations and the drive for operational efficiency in the aerospace industry are key accelerators.

The "Others" category, encompassing segments like critical infrastructure, transportation, and large-scale industrial operations, contributes the remaining 25% market share, with a CAGR of 17.5%. This diverse segment benefits from the overarching need for enhanced safety and security across various industries. For instance, smart city initiatives, the protection of public transportation networks, and the management of large industrial facilities are increasingly reliant on sophisticated situational awareness systems. Economic policies promoting infrastructure development and enhanced security measures are also contributing to the growth of this segment.

The Real-Time Monitoring and Alarm System type is the dominant application within SARMS, estimated to capture 60% of the market share in 2025, with a CAGR of 18.7%. This is due to the immediate need for threat detection and rapid response capabilities across all industries. Predictive Analysis Systems, while growing rapidly, are currently at 25% market share but are expected to witness higher growth rates as AI and ML capabilities mature and become more accessible. The "Others" type category, which includes integrated analytics and reporting tools, makes up the remaining 15%. The synergy between real-time monitoring and predictive capabilities is a key trend, with systems increasingly incorporating both to provide a comprehensive risk management solution.

Situational Awareness Risk Management System Product Landscape

The Situational Awareness Risk Management System (SARMS) product landscape is defined by advanced technological integrations and a focus on comprehensive threat intelligence. Innovations are centered around AI-powered predictive analytics, real-time data fusion from diverse sources including IoT sensors and satellite imagery, and sophisticated visualization tools that provide a unified operational picture. Key products offer capabilities such as anomaly detection, threat prediction, early warning systems, and automated response recommendations. Performance metrics highlight reduced incident response times, improved operational efficiency, and enhanced decision-making accuracy. Unique selling propositions lie in the system's ability to correlate disparate data streams, provide actionable insights, and offer end-to-end security and risk management across complex environments.

Key Drivers, Barriers & Challenges in Situational Awareness Risk Management System

Key Drivers:

- Escalating Threat Landscape: The increasing sophistication and frequency of cyberattacks, terrorism, and geopolitical instability necessitate advanced risk management.

- Critical Infrastructure Protection: Growing global focus on securing vital sectors like energy, defense, and transportation drives demand.

- Technological Advancements: AI, ML, IoT, and big data analytics enable more sophisticated threat detection and prediction.

- Regulatory Compliance: Stricter government regulations and industry standards for security and risk mitigation.

- Demand for Operational Resilience: Organizations across sectors prioritize continuous operations and minimizing disruption.

Barriers & Challenges:

- High Implementation Costs: Significant initial investment in hardware, software, and integration can be a barrier, especially for SMEs.

- Data Integration Complexity: Consolidating and analyzing vast amounts of data from diverse sources poses technical challenges.

- Skilled Workforce Shortage: A lack of trained personnel to operate and manage advanced SARMS.

- Interoperability Issues: Ensuring seamless integration with existing legacy systems and diverse technologies.

- Evolving Threat Modalities: The constant evolution of threats requires continuous system updates and adaptation.

- Supply Chain Vulnerabilities: Potential disruptions in the supply chain for critical hardware components, particularly for advanced sensors and processing units. Estimated 5-10% impact on project timelines due to such disruptions.

Emerging Opportunities in Situational Awareness Risk Management System

Emerging opportunities in the Situational Awareness Risk Management System (SARMS) market lie in the expanding application across non-traditional sectors, such as smart cities, disaster management, and supply chain logistics. The integration of extended reality (XR) technologies, including augmented and virtual reality, for immersive situational awareness training and real-time operational visualization presents a significant untapped market. Furthermore, the growing demand for federated learning and privacy-preserving AI in SARMS opens avenues for secure data sharing and collaborative threat intelligence without compromising sensitive information. The increasing focus on environmental risk assessment and climate change adaptation is also creating new use cases for sophisticated monitoring and prediction systems.

Growth Accelerators in the Situational Awareness Risk Management System Industry

Several catalysts are accelerating growth in the Situational Awareness Risk Management System (SARMS) industry. Technological breakthroughs in AI and predictive analytics, enabling more accurate and timely threat identification, are paramount. Strategic partnerships between cybersecurity firms, data analytics providers, and defense contractors are fostering the development of comprehensive, integrated solutions. Market expansion into emerging economies and underserved sectors, driven by increasing security awareness and government initiatives, is another key accelerator. The continuous evolution of cyber threats necessitates ongoing investment in advanced security solutions, creating a sustained demand for SARMS.

Key Players Shaping the Situational Awareness Risk Management System Market

- Mandiant

- Palo Alto Networks

- BAE Systems

- Intel

- Advanced Environmental Monitoring

- Lockheed Martin

- Restrata

- Hexagon AB

Notable Milestones in Situational Awareness Risk Management System Sector

- 2019 October: Mandiant launches its threat intelligence platform enhancement with AI-driven analytics.

- 2020 March: Palo Alto Networks acquires CloudGenix to bolster its network security and application awareness capabilities.

- 2021 June: BAE Systems secures a major contract for advanced intelligence and surveillance systems.

- 2022 January: Lockheed Martin announces advancements in AI for battlefield situational awareness.

- 2023 April: Hexagon AB integrates advanced geospatial intelligence into its risk management solutions.

- 2024 February: Restrata enhances its security operations center (SOC) capabilities with predictive threat modeling.

In-Depth Situational Awareness Risk Management System Market Outlook

The future outlook for the Situational Awareness Risk Management System (SARMS) market is exceptionally promising, driven by an enduring need for enhanced security and operational resilience. Continued advancements in AI and ML will further democratize predictive capabilities, making them more accessible and impactful. The integration of advanced sensor technologies, including next-generation radar and acoustic monitoring, will provide unprecedented levels of environmental and physical threat detection. Strategic collaborations and a growing ecosystem of specialized solution providers will foster innovation and create more comprehensive and interoperable SARMS. Emerging markets and the increasing adoption by mid-sized enterprises present significant growth potential, solidifying SARMS as an indispensable tool for navigating an increasingly complex and unpredictable global landscape. The market is poised for sustained expansion, with an estimated reach of $45,000 million by 2033.

Situational Awareness Risk Management System Segmentation

-

1. Application

- 1.1. Defense Industry

- 1.2. Energy Industry

- 1.3. Aerospace

- 1.4. Others

-

2. Type

- 2.1. Real-Time Monitoring and Alarm System

- 2.2. Predictive Analysis System

- 2.3. Others

Situational Awareness Risk Management System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Situational Awareness Risk Management System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Defense Industry

- 5.1.2. Energy Industry

- 5.1.3. Aerospace

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Real-Time Monitoring and Alarm System

- 5.2.2. Predictive Analysis System

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Defense Industry

- 6.1.2. Energy Industry

- 6.1.3. Aerospace

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Real-Time Monitoring and Alarm System

- 6.2.2. Predictive Analysis System

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Defense Industry

- 7.1.2. Energy Industry

- 7.1.3. Aerospace

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Real-Time Monitoring and Alarm System

- 7.2.2. Predictive Analysis System

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Defense Industry

- 8.1.2. Energy Industry

- 8.1.3. Aerospace

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Real-Time Monitoring and Alarm System

- 8.2.2. Predictive Analysis System

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Defense Industry

- 9.1.2. Energy Industry

- 9.1.3. Aerospace

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Real-Time Monitoring and Alarm System

- 9.2.2. Predictive Analysis System

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Situational Awareness Risk Management System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Defense Industry

- 10.1.2. Energy Industry

- 10.1.3. Aerospace

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Real-Time Monitoring and Alarm System

- 10.2.2. Predictive Analysis System

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mandiant

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Palo Alto Networks

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BAE Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Environmental Monitoring

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Restrata

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexagon AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Mandiant

List of Figures

- Figure 1: Global Situational Awareness Risk Management System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Situational Awareness Risk Management System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Situational Awareness Risk Management System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Situational Awareness Risk Management System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Situational Awareness Risk Management System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Situational Awareness Risk Management System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Situational Awareness Risk Management System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Situational Awareness Risk Management System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Situational Awareness Risk Management System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Situational Awareness Risk Management System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Situational Awareness Risk Management System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Situational Awareness Risk Management System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Situational Awareness Risk Management System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Situational Awareness Risk Management System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Situational Awareness Risk Management System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Situational Awareness Risk Management System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Situational Awareness Risk Management System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Situational Awareness Risk Management System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Situational Awareness Risk Management System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Situational Awareness Risk Management System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Situational Awareness Risk Management System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Situational Awareness Risk Management System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Situational Awareness Risk Management System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Situational Awareness Risk Management System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Situational Awareness Risk Management System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Situational Awareness Risk Management System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Situational Awareness Risk Management System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Situational Awareness Risk Management System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Situational Awareness Risk Management System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Situational Awareness Risk Management System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Situational Awareness Risk Management System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Situational Awareness Risk Management System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Situational Awareness Risk Management System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Situational Awareness Risk Management System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Situational Awareness Risk Management System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Situational Awareness Risk Management System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Situational Awareness Risk Management System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Situational Awareness Risk Management System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Situational Awareness Risk Management System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Situational Awareness Risk Management System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Situational Awareness Risk Management System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Situational Awareness Risk Management System?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Situational Awareness Risk Management System?

Key companies in the market include Mandiant, Palo Alto Networks, BAE Systems, Intel, Advanced Environmental Monitoring, Lockheed Martin, Restrata, Hexagon AB.

3. What are the main segments of the Situational Awareness Risk Management System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1599 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Situational Awareness Risk Management System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Situational Awareness Risk Management System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Situational Awareness Risk Management System?

To stay informed about further developments, trends, and reports in the Situational Awareness Risk Management System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence