Key Insights

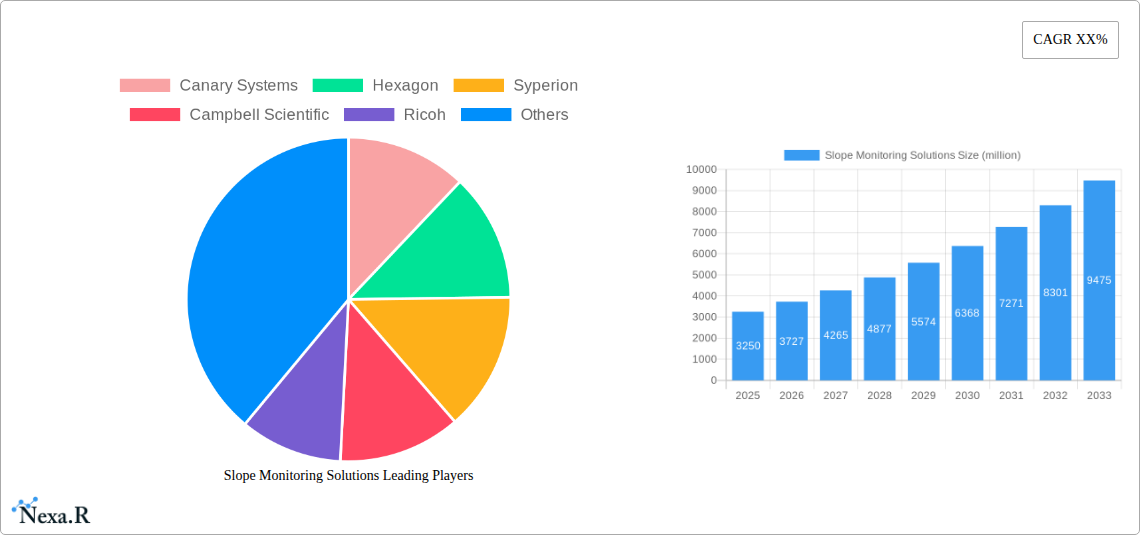

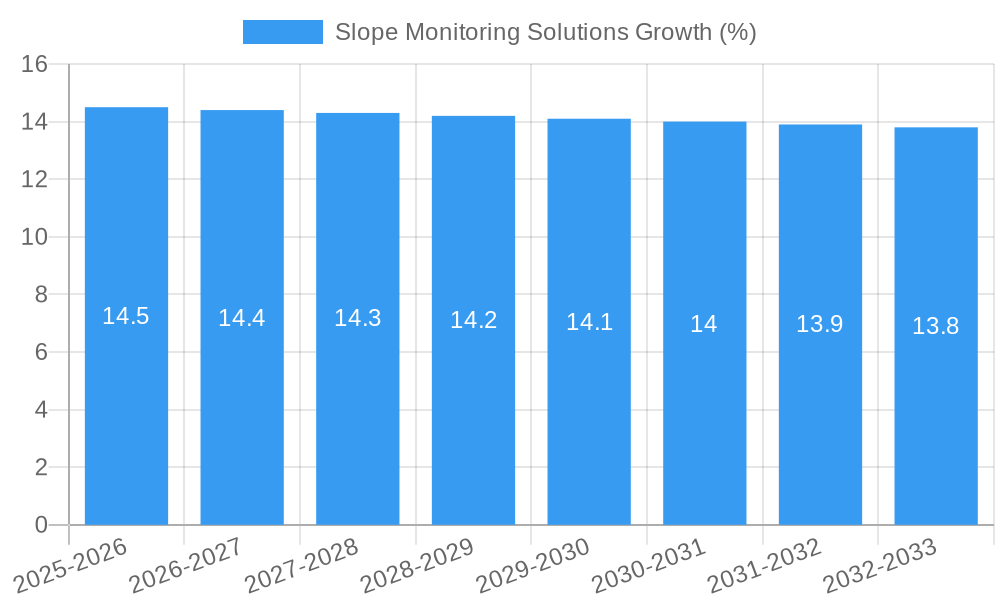

The global Slope Monitoring Solutions market is poised for robust growth, projected to reach an estimated USD 3,250 million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 14.5% through 2033. This significant expansion is fueled by an escalating global need for enhanced infrastructure safety and the proactive mitigation of geohazard risks. Increasingly stringent regulatory frameworks worldwide mandate the continuous monitoring of slopes, particularly in regions prone to landslides, seismic activity, and extreme weather events. The market is being propelled by substantial investments in infrastructure development, including transportation networks, urban expansion, and mining operations, all of which necessitate reliable slope stability assessments and real-time monitoring. Furthermore, advancements in sensor technology, data analytics, and IoT integration are making slope monitoring systems more sophisticated, accurate, and cost-effective, thereby driving adoption across both personal and commercial applications.

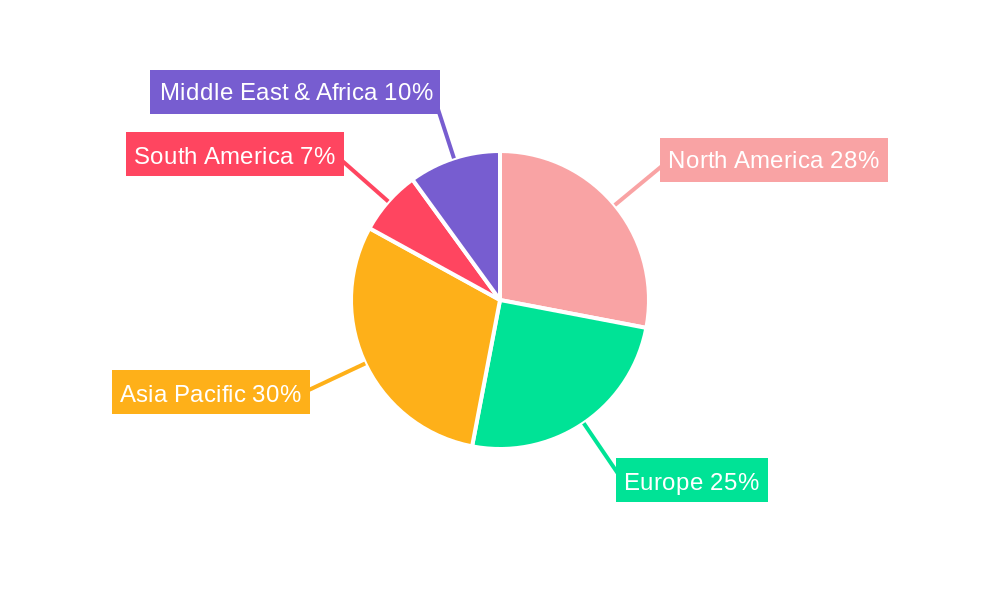

Key market drivers include the imperative to minimize economic losses and protect human lives from catastrophic slope failures. The growing awareness of climate change impacts, leading to more frequent and intense rainfall and extreme weather, is a critical factor accelerating the demand for advanced slope monitoring solutions. Geopolitical stability and economic development in regions like Asia Pacific and North America are also contributing to increased spending on infrastructure and, consequently, on related safety and monitoring systems. While the market benefits from these strong tailwinds, certain restraints such as high initial investment costs for complex systems and the need for skilled personnel for deployment and maintenance could temper the pace of adoption in some segments. However, the undeniable benefits of preventing disasters and ensuring long-term infrastructure resilience are expected to outweigh these challenges, positioning the Slope Monitoring Solutions market for sustained and impressive growth over the forecast period.

Comprehensive Report: Slope Monitoring Solutions Market Analysis 2019-2033

This in-depth report provides a critical analysis of the global Slope Monitoring Solutions market, offering actionable insights for stakeholders navigating this dynamic sector. From foundational market structure to future growth trajectories, this comprehensive study equips industry professionals with the data and intelligence needed for strategic decision-making.

Slope Monitoring Solutions Market Dynamics & Structure

The global Slope Monitoring Solutions market is characterized by a moderate to high degree of concentration, with leading players investing heavily in research and development to maintain their competitive edge. Technological innovation is the primary driver, fueled by advancements in sensor technology, data analytics, and cloud computing, enabling more accurate and real-time monitoring. Regulatory frameworks, particularly those concerning infrastructure safety and disaster preparedness, are increasingly stringent, mandating the adoption of sophisticated monitoring systems. Competitive product substitutes, while present, are largely less effective in providing the comprehensive and integrated solutions offered by specialized slope monitoring platforms. End-user demographics span crucial sectors including infrastructure development, mining, and transportation, with a growing emphasis on municipal and commercial applications. Mergers and acquisitions (M&A) are a significant trend, as larger entities seek to consolidate market share and acquire innovative technologies. For instance, several strategic acquisitions in the last five years have aimed to bolster capabilities in AI-driven analytics and remote sensing. The overall market concentration, as of the base year 2025, is estimated to be around 65% held by the top 5 companies. M&A deal volumes have averaged 10-15 significant transactions annually over the historical period 2019-2024, indicating a healthy consolidation activity. Barriers to innovation, such as high R&D costs and the need for extensive field testing, are present but are being overcome by collaborative efforts and government funding for critical infrastructure projects.

Slope Monitoring Solutions Growth Trends & Insights

The Slope Monitoring Solutions market is poised for significant expansion, driven by an increasing global awareness of landslide risks and the imperative to safeguard critical infrastructure. The market size, projected to reach approximately $5,500 million by 2033 from an estimated $2,800 million in 2025, reflects a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period 2025-2033. Adoption rates are escalating across various industries, with a notable surge in municipal projects focused on public safety and urban development. Technological disruptions, such as the integration of IoT devices, drone-based surveying, and advanced AI algorithms for predictive analysis, are fundamentally reshaping the market. These advancements are not only enhancing the accuracy and efficiency of slope monitoring but also reducing operational costs and enabling proactive intervention. Consumer behavior is shifting towards a preference for integrated, end-to-end solutions that provide comprehensive data visualization and actionable insights. The historical period (2019-2024) witnessed an average adoption rate increase of XX% annually, a trend expected to accelerate. Market penetration, currently around 30% for commercial applications, is projected to climb to over 50% by 2033. The increasing frequency of extreme weather events also acts as a significant catalyst, driving demand for reliable slope stability assessment and early warning systems. Furthermore, the evolution of sensor technology, moving towards smaller, more power-efficient, and highly accurate devices, contributes to market growth by making these solutions more accessible and cost-effective for a wider range of applications.

Dominant Regions, Countries, or Segments in Slope Monitoring Solutions

The Commercial segment, particularly within the Static Slope Monitoring System type, is currently demonstrating dominant growth in the global Slope Monitoring Solutions market. This dominance is propelled by a confluence of factors, including substantial investments in infrastructure development, mining operations, and the burgeoning renewable energy sector, all of which require continuous and reliable slope stability assessments. Economically developed regions such as North America and Europe are spearheading this growth due to robust regulatory frameworks mandating safety compliance and significant capital expenditure on maintaining and expanding existing infrastructure. For instance, in the United States, the Bipartisan Infrastructure Law is injecting substantial funds into upgrading transportation networks and critical infrastructure, directly benefiting the commercial slope monitoring sector. In Europe, stringent environmental and safety regulations for mining and construction projects necessitate advanced monitoring solutions.

Within the Commercial segment, the growth potential is further amplified by the increasing adoption of Static Slope Monitoring Systems. These systems, while less dynamic than their counterparts, offer a cost-effective and highly reliable method for long-term monitoring of stable or slowly deforming slopes. Their market share within the commercial application is estimated at 55% in 2025, with an anticipated growth rate of XX% through 2033. The mining industry, a significant contributor to the commercial segment, relies heavily on static monitoring for the safety of open-pit mines and tailings dams, where early detection of subtle movements can prevent catastrophic failures. The market share for this segment is projected to reach approximately $2,800 million by 2033.

Key drivers include favorable economic policies encouraging industrial expansion, significant investments in large-scale construction projects (e.g., dams, bridges, tunnels), and the presence of major mining conglomerates. The market share of the Commercial segment is projected to be around 60% of the total market by 2028. The growth potential within this segment is substantial, driven by both the expansion of existing operations and the development of new ventures requiring sophisticated geotechnical monitoring.

Slope Monitoring Solutions Product Landscape

The Slope Monitoring Solutions product landscape is characterized by a wave of innovation focused on enhanced data acquisition, processing, and dissemination. Key product innovations include the development of highly sensitive inclinometers and extensometers, advanced LiDAR and photogrammetry techniques for detailed terrain mapping, and the integration of IoT sensors for real-time data streaming. Cloud-based platforms are becoming standard, offering users remote access to data analytics, visualization dashboards, and early warning alerts. Unique selling propositions revolve around the precision of measurements, the reliability of data under harsh environmental conditions, and the seamless integration of diverse data sources into a single, actionable platform. Technological advancements are continuously pushing the boundaries of what is achievable in terms of early detection and predictive modeling for landslides and slope failures.

Key Drivers, Barriers & Challenges in Slope Monitoring Solutions

Key Drivers:

- Increasing frequency and severity of natural disasters: Heightened awareness of landslide risks and the economic impact of slope failures drive demand for robust monitoring solutions.

- Growing infrastructure development: Global investments in transportation, energy, and urban expansion necessitate continuous monitoring for safety and stability.

- Technological advancements: Innovations in sensor technology, AI, and cloud computing are making solutions more accurate, affordable, and accessible.

- Stringent regulatory frameworks: Government mandates for safety and environmental protection are compelling industries to adopt advanced monitoring systems.

Barriers & Challenges:

- High initial investment costs: The upfront expenditure for sophisticated monitoring systems can be a deterrent for smaller organizations.

- Data interpretation and expertise: The need for skilled geotechnical engineers to interpret complex data can be a bottleneck.

- Maintenance and operational costs: Ongoing expenses for system maintenance, calibration, and personnel can impact profitability.

- Harsh environmental conditions: Extreme weather and remote locations can pose challenges for sensor deployment and data transmission.

- Cybersecurity concerns: Protecting sensitive geotechnical data from cyber threats is a critical challenge. The impact of these challenges is estimated to affect market growth by approximately 5-7% annually.

Emerging Opportunities in Slope Monitoring Solutions

Emerging opportunities in the Slope Monitoring Solutions industry lie in the expansion of real-time, AI-driven predictive analytics, offering proactive risk mitigation rather than just detection. The integration of drone and satellite imagery with ground-based sensors presents a powerful synergy for comprehensive terrain analysis. Untapped markets, particularly in developing regions undergoing rapid infrastructure development, represent significant growth potential. Furthermore, the application of slope monitoring technologies in emerging areas such as smart cities, disaster management frameworks, and even in the monitoring of offshore structures presents novel avenues for innovation and market penetration. The increasing demand for comprehensive environmental monitoring solutions also creates opportunities for integrated geotechnical and environmental sensing.

Growth Accelerators in the Slope Monitoring Solutions Industry

The Slope Monitoring Solutions industry is being propelled by several key growth accelerators. Technological breakthroughs in miniaturized sensors, advanced communication protocols, and machine learning algorithms for predictive modeling are enhancing the capabilities and reducing the cost of monitoring systems. Strategic partnerships between technology providers, geotechnical consulting firms, and government agencies are fostering collaborative innovation and facilitating market penetration. Furthermore, an increasing global focus on climate change adaptation and resilience is driving demand for advanced hazard assessment and mitigation strategies, directly benefiting the slope monitoring sector. The continuous R&D efforts by companies like Canary Systems, Hexagon, and Campbell Scientific are crucial in this regard.

Key Players Shaping the Slope Monitoring Solutions Market

- Canary Systems

- Hexagon

- Syperion

- Campbell Scientific

- Ricoh

- Leica Geosystems

- RST Instruments

- Turnbull Infrastructure & Utilities Ltd

- Proxima Systems

- GEOKON

- Geoworld

- Advantech

- CSIRO

- Reutech Radar Systems

- Elexon Mining

Notable Milestones in Slope Monitoring Solutions Sector

- 2019: Launch of advanced AI-powered landslide prediction algorithms by CSIRO, enhancing predictive capabilities.

- 2020: Hexagon acquires a leading geotechnical software company, integrating advanced analysis tools into its surveying and monitoring solutions.

- 2021: Development of miniaturized, low-power IoT sensors by Campbell Scientific, enabling more cost-effective and widespread deployment.

- 2022: Ricoh introduces a new generation of drone-based LiDAR systems for high-resolution terrain mapping and deformation analysis.

- 2023: RST Instruments launches a cloud-based platform for real-time data visualization and alert systems, improving user accessibility.

- 2024: Leica Geosystems showcases integrated sensor networks with advanced communication capabilities for continuous, multi-parameter slope monitoring.

In-Depth Slope Monitoring Solutions Market Outlook

The future of the Slope Monitoring Solutions market is exceptionally promising, driven by a continued surge in global infrastructure projects and an amplified focus on public safety and environmental resilience. Growth accelerators such as the pervasive integration of AI for predictive analytics, the expansion of IoT networks, and the increasing demand for integrated, end-to-end monitoring platforms will redefine market capabilities. Strategic partnerships and a relentless pursuit of technological innovation will be pivotal for companies aiming to capture market share. The market is expected to witness sustained growth, with an estimated value of $5,500 million by 2033, presenting substantial strategic opportunities for both established players and emerging innovators in the field.

Slope Monitoring Solutions Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Commercial

- 1.3. Municipal

-

2. Types

- 2.1. Static Slope Monitoring System

- 2.2. Dynamic Slope Monitoring System

Slope Monitoring Solutions Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Slope Monitoring Solutions REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Commercial

- 5.1.3. Municipal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Static Slope Monitoring System

- 5.2.2. Dynamic Slope Monitoring System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Commercial

- 6.1.3. Municipal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Static Slope Monitoring System

- 6.2.2. Dynamic Slope Monitoring System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Commercial

- 7.1.3. Municipal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Static Slope Monitoring System

- 7.2.2. Dynamic Slope Monitoring System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Commercial

- 8.1.3. Municipal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Static Slope Monitoring System

- 8.2.2. Dynamic Slope Monitoring System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Commercial

- 9.1.3. Municipal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Static Slope Monitoring System

- 9.2.2. Dynamic Slope Monitoring System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Slope Monitoring Solutions Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Commercial

- 10.1.3. Municipal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Static Slope Monitoring System

- 10.2.2. Dynamic Slope Monitoring System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canary Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hexagon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Syperion

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Campbell Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ricoh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leica Geosystems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RST Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Turnbull Infrastructure & Utilities Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Proxima Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GEOKON

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geoworld

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Advantech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CSIRO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Reutech Radar Systems

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Elexon Mining

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Canary Systems

List of Figures

- Figure 1: Global Slope Monitoring Solutions Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Slope Monitoring Solutions Revenue (million), by Application 2024 & 2032

- Figure 3: North America Slope Monitoring Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Slope Monitoring Solutions Revenue (million), by Types 2024 & 2032

- Figure 5: North America Slope Monitoring Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Slope Monitoring Solutions Revenue (million), by Country 2024 & 2032

- Figure 7: North America Slope Monitoring Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Slope Monitoring Solutions Revenue (million), by Application 2024 & 2032

- Figure 9: South America Slope Monitoring Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Slope Monitoring Solutions Revenue (million), by Types 2024 & 2032

- Figure 11: South America Slope Monitoring Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Slope Monitoring Solutions Revenue (million), by Country 2024 & 2032

- Figure 13: South America Slope Monitoring Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Slope Monitoring Solutions Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Slope Monitoring Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Slope Monitoring Solutions Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Slope Monitoring Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Slope Monitoring Solutions Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Slope Monitoring Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Slope Monitoring Solutions Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Slope Monitoring Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Slope Monitoring Solutions Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Slope Monitoring Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Slope Monitoring Solutions Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Slope Monitoring Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Slope Monitoring Solutions Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Slope Monitoring Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Slope Monitoring Solutions Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Slope Monitoring Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Slope Monitoring Solutions Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Slope Monitoring Solutions Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Slope Monitoring Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Slope Monitoring Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Slope Monitoring Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Slope Monitoring Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Slope Monitoring Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Slope Monitoring Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Slope Monitoring Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Slope Monitoring Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Slope Monitoring Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Slope Monitoring Solutions Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Slope Monitoring Solutions?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Slope Monitoring Solutions?

Key companies in the market include Canary Systems, Hexagon, Syperion, Campbell Scientific, Ricoh, Leica Geosystems, RST Instruments, Turnbull Infrastructure & Utilities Ltd, Proxima Systems, GEOKON, Geoworld, Advantech, CSIRO, Reutech Radar Systems, Elexon Mining.

3. What are the main segments of the Slope Monitoring Solutions?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Slope Monitoring Solutions," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Slope Monitoring Solutions report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Slope Monitoring Solutions?

To stay informed about further developments, trends, and reports in the Slope Monitoring Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence