Key Insights

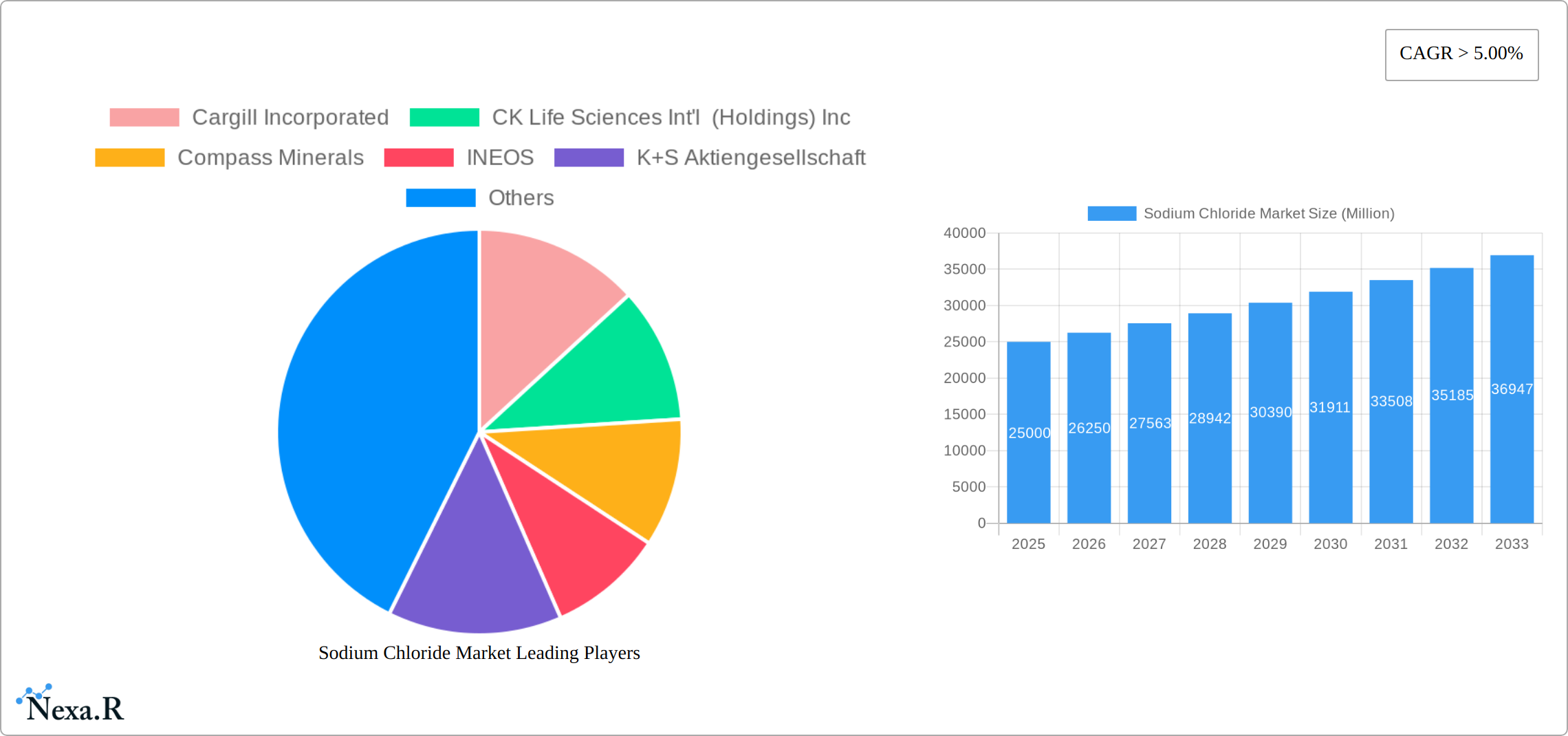

The global sodium chloride market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for sodium chloride in various industrial applications, such as chemical processing, water treatment, and food preservation, is a significant contributor. Furthermore, growth in the construction industry, a major consumer of de-icing salts, fuels market expansion. The rising global population and increasing urbanization are also contributing factors, driving demand for processed foods and consequently sodium chloride. Competition among established players like Cargill Incorporated, K+S Aktiengesellschaft, and Tata Chemicals Europe is intense, fostering innovation and driving down prices. However, fluctuating raw material prices and environmental concerns surrounding salt extraction and disposal pose potential challenges. Regional variations in market growth are expected, with developed economies potentially showing more moderate growth compared to emerging markets experiencing rapid industrialization. Future growth will depend on the balance between increasing industrial demand and the implementation of sustainable extraction and consumption practices.

The market segmentation reveals significant opportunities within various end-use sectors. While precise segment-wise data is not provided, it can be reasonably assumed that the food and beverage industry holds a significant share, followed by industrial chemicals and water treatment. Geographically, regions with large industrial bases and extensive infrastructure projects, such as North America, Europe, and Asia-Pacific, are likely to dominate the market. However, the burgeoning industrialization in developing economies offers promising prospects for future market expansion. The presence of numerous major players suggests a competitive landscape, with companies focusing on technological advancements, efficient supply chains, and sustainable practices to gain a competitive edge. The forecast period, 2025-2033, presents a period of substantial growth potential for the sodium chloride market, subject to mitigating the challenges mentioned earlier.

Sodium Chloride Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Sodium Chloride Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is designed for industry professionals, investors, and researchers seeking a detailed understanding of this vital chemical market.

Sodium Chloride Market Dynamics & Structure

The global sodium chloride market, a parent market encompassing various segments like food-grade salt, industrial-grade salt, and pharmaceutical-grade salt (child markets), is characterized by moderate market concentration. While a few large players dominate, numerous smaller regional players cater to niche markets. Technological innovation is primarily focused on improving production efficiency, reducing environmental impact, and enhancing product purity. Stringent regulatory frameworks, particularly concerning food safety and environmental regulations, significantly influence market operations. The market experiences competition from alternative chemicals for specific applications, although sodium chloride's versatility and low cost maintain its dominant position. End-user demographics encompass diverse sectors, including food processing, water treatment, chemical manufacturing, and pharmaceuticals. The market has witnessed several M&A activities in recent years, reflecting consolidation trends and expansion strategies among major players.

- Market Concentration: Moderately concentrated, with a few large players holding significant market share (xx%).

- Technological Innovation: Focused on improved production efficiency and environmental sustainability.

- Regulatory Frameworks: Stringent food safety and environmental regulations impacting market dynamics.

- Competitive Substitutes: Limited, with sodium chloride maintaining a dominant position due to its versatility and low cost.

- M&A Activity: xx major deals recorded between 2019 and 2024, indicating consolidation trends within the market. Deal volume is expected to increase by xx% in the forecast period.

- End-User Demographics: Diverse, spanning food processing (xx Million units), water treatment (xx Million units), chemical manufacturing (xx Million units), and pharmaceuticals (xx Million units).

Sodium Chloride Market Growth Trends & Insights

The global sodium chloride market exhibits steady growth, driven by increasing demand from various industries. The market size, valued at xx Million units in 2024, is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%. This growth is fueled by rising global populations, expanding industrialization, and increasing demand for processed foods. Technological advancements in production processes and sustainable sourcing are enhancing market efficiency. Shifting consumer preferences toward healthier and more sustainably produced food products are influencing market dynamics. Market penetration across emerging economies remains significant, offering substantial growth potential.

Dominant Regions, Countries, or Segments in Sodium Chloride Market

The Asia-Pacific region currently holds the largest market share in the global sodium chloride market, followed by North America and Europe. This dominance stems from factors such as high population density, rapid industrialization, and robust economic growth. China and India, in particular, are major contributors to regional growth due to their substantial demand across multiple sectors. The food and beverage industry, along with chemical manufacturing, are key drivers within these regions.

- Key Drivers in Asia-Pacific: Rapid industrialization, high population growth, and expanding food processing industries.

- Key Drivers in North America: Strong demand from the food and water treatment sectors.

- Key Drivers in Europe: Well-established chemical manufacturing and food processing sectors.

- Market Share: Asia-Pacific (xx%), North America (xx%), Europe (xx%), Other Regions (xx%).

- Growth Potential: Highest growth potential is observed in emerging economies within Asia-Pacific and Africa.

Sodium Chloride Market Product Landscape

The sodium chloride market offers a range of products, including food-grade salt, industrial-grade salt, and pharmaceutical-grade salt, each tailored to specific applications. Innovations focus on enhancing purity, consistency, and functionality. For instance, iodized salt for nutritional enrichment is gaining prominence. The development of specialized grades for specific industrial processes also contributes to product diversification. Technological advancements include improved crystallization techniques, resulting in higher quality products with reduced impurities.

Key Drivers, Barriers & Challenges in Sodium Chloride Market

Key Drivers:

- Increasing demand from the food and beverage industry.

- Growing industrial applications.

- Expansion in water treatment and desalination.

Challenges & Restraints:

- Price fluctuations due to raw material costs and supply chain disruptions.

- Stringent environmental regulations on salt production.

- Competition from alternative de-icing agents in the winter road maintenance sector.

- Supply chain vulnerability to geopolitical events and climate change.

Emerging Opportunities in Sodium Chloride Market

- Growing demand for high-purity sodium chloride in pharmaceuticals and biotechnology.

- Exploration of innovative applications in water softening and other industrial processes.

- Expansion into emerging markets with rising consumption patterns.

- Development of sustainable and eco-friendly production methods.

Growth Accelerators in the Sodium Chloride Market Industry

The sodium chloride market's long-term growth is projected to be accelerated by advancements in production technology, strategic collaborations between manufacturers and end-users, and expansion into new geographic markets. This includes leveraging digital technologies for efficient supply chain management and exploring new applications in emerging industries. Sustainable production methods that minimize environmental impact will also drive future growth.

Key Players Shaping the Sodium Chloride Market Market

- Cargill Incorporated

- CK Life Sciences Int'l (Holdings) Inc

- Compass Minerals

- INEOS

- K+S Aktiengesellschaft

- Nouryon

- Pon Pure Chemicals Group

- Rio Tinto

- Südwestdeutsche Salzwerke AG

- Swiss Salt Works AG

- Tata Chemicals Europe

- Wacker Chemie AG *List Not Exhaustive

Notable Milestones in Sodium Chloride Market Sector

- January 2024: Dampier Salt's Lake MacLeod site sale to Leichhardt Industrials Group for USD 251 million signals consolidation within the Australian salt market.

- January 2022: B. Braun's FDA approval for a sodium chloride injection manufacturing plant expands pharmaceutical-grade salt production capacity in the US.

- January 2022: Nouryon's 15-year agreement with Suzano showcases increasing integration of sustainable practices within the sodium chlorate production (a derivative of sodium chloride) process.

In-Depth Sodium Chloride Market Market Outlook

The future of the sodium chloride market appears bright, with sustained growth expected across various segments and regions. Strategic partnerships, technological innovation, and a focus on sustainable practices will shape market evolution. The expanding global population, increasing industrialization, and growing demand for processed food will continue to drive demand. Companies that prioritize sustainability and invest in innovative production technologies will likely gain a competitive edge in the coming years.

Sodium Chloride Market Segmentation

-

1. Grade

- 1.1. Rock Salt

- 1.2. Solar Salt

- 1.3. Vacuum Salt

-

2. Application

- 2.1. Chemical Production

- 2.2. Deicing

- 2.3. Water Conditioning

- 2.4. Agriculture

- 2.5. Food Processing

- 2.6. Pharmaceutical

- 2.7. Other Applications

Sodium Chloride Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Vietnam

- 1.6. Malaysia

- 1.7. Indonesia

- 1.8. Thailand

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Turkey

- 3.7. Italy

- 3.8. NORDIC

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Qatar

- 5.4. Nigeria

- 5.5. United Arab Emirates

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Sodium Chloride Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe

- 3.4. Market Trends

- 3.4.1. The Chemical Production Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Rock Salt

- 5.1.2. Solar Salt

- 5.1.3. Vacuum Salt

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Chemical Production

- 5.2.2. Deicing

- 5.2.3. Water Conditioning

- 5.2.4. Agriculture

- 5.2.5. Food Processing

- 5.2.6. Pharmaceutical

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Rock Salt

- 6.1.2. Solar Salt

- 6.1.3. Vacuum Salt

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Chemical Production

- 6.2.2. Deicing

- 6.2.3. Water Conditioning

- 6.2.4. Agriculture

- 6.2.5. Food Processing

- 6.2.6. Pharmaceutical

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Rock Salt

- 7.1.2. Solar Salt

- 7.1.3. Vacuum Salt

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Chemical Production

- 7.2.2. Deicing

- 7.2.3. Water Conditioning

- 7.2.4. Agriculture

- 7.2.5. Food Processing

- 7.2.6. Pharmaceutical

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Rock Salt

- 8.1.2. Solar Salt

- 8.1.3. Vacuum Salt

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Chemical Production

- 8.2.2. Deicing

- 8.2.3. Water Conditioning

- 8.2.4. Agriculture

- 8.2.5. Food Processing

- 8.2.6. Pharmaceutical

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Rock Salt

- 9.1.2. Solar Salt

- 9.1.3. Vacuum Salt

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Chemical Production

- 9.2.2. Deicing

- 9.2.3. Water Conditioning

- 9.2.4. Agriculture

- 9.2.5. Food Processing

- 9.2.6. Pharmaceutical

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Sodium Chloride Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Rock Salt

- 10.1.2. Solar Salt

- 10.1.3. Vacuum Salt

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Chemical Production

- 10.2.2. Deicing

- 10.2.3. Water Conditioning

- 10.2.4. Agriculture

- 10.2.5. Food Processing

- 10.2.6. Pharmaceutical

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CK Life Sciences Int'l (Holdings) Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Compass Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 INEOS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 K+S Aktiengesellschaft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nouryon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pon Pure Chemicals Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rio Tinto

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Südwestdeutsche Salzwerke AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Swiss Salt Works AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tata Chemicals Europe

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wacker Chemie AG*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Sodium Chloride Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Sodium Chloride Market Revenue (Million), by Grade 2024 & 2032

- Figure 3: Asia Pacific Sodium Chloride Market Revenue Share (%), by Grade 2024 & 2032

- Figure 4: Asia Pacific Sodium Chloride Market Revenue (Million), by Application 2024 & 2032

- Figure 5: Asia Pacific Sodium Chloride Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: Asia Pacific Sodium Chloride Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sodium Chloride Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America Sodium Chloride Market Revenue (Million), by Grade 2024 & 2032

- Figure 9: North America Sodium Chloride Market Revenue Share (%), by Grade 2024 & 2032

- Figure 10: North America Sodium Chloride Market Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Sodium Chloride Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Sodium Chloride Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Sodium Chloride Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sodium Chloride Market Revenue (Million), by Grade 2024 & 2032

- Figure 15: Europe Sodium Chloride Market Revenue Share (%), by Grade 2024 & 2032

- Figure 16: Europe Sodium Chloride Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Sodium Chloride Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Sodium Chloride Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Sodium Chloride Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Sodium Chloride Market Revenue (Million), by Grade 2024 & 2032

- Figure 21: South America Sodium Chloride Market Revenue Share (%), by Grade 2024 & 2032

- Figure 22: South America Sodium Chloride Market Revenue (Million), by Application 2024 & 2032

- Figure 23: South America Sodium Chloride Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: South America Sodium Chloride Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Sodium Chloride Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Sodium Chloride Market Revenue (Million), by Grade 2024 & 2032

- Figure 27: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Grade 2024 & 2032

- Figure 28: Middle East and Africa Sodium Chloride Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Sodium Chloride Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sodium Chloride Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 3: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Sodium Chloride Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 6: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global Sodium Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Vietnam Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Malaysia Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Thailand Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 18: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Sodium Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 24: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Sodium Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United Kingdom Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Turkey Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: NORDIC Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 36: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Global Sodium Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Argentina Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Sodium Chloride Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 43: Global Sodium Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Sodium Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Saudi Arabia Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Qatar Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Nigeria Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: United Arab Emirates Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Egypt Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East and Africa Sodium Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Chloride Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Sodium Chloride Market?

Key companies in the market include Cargill Incorporated, CK Life Sciences Int'l (Holdings) Inc, Compass Minerals, INEOS, K+S Aktiengesellschaft, Nouryon, Pon Pure Chemicals Group, Rio Tinto, Südwestdeutsche Salzwerke AG, Swiss Salt Works AG, Tata Chemicals Europe, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Sodium Chloride Market?

The market segments include Grade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe.

6. What are the notable trends driving market growth?

The Chemical Production Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe.

8. Can you provide examples of recent developments in the market?

January 2024: Dampier Salt, an Australian salt company whose 68% stakes are held by Rio Tinto, announced that it will be selling one of its three production sites, the Lake MacLeod site, to Leichhardt Industrials Group in Australia for USD 251 million.January 2022: B. Braun received FDA permission for a pharmaceutical manufacturing plant in Florida. B. Braun Medical's Daytona Beach manufacturing plant is expected to produce 0.9% sodium chloride for injection, which will be offered in 1,000 ml and 500 ml Excel Plus IV bags from Bethlehem, Pennsylvania.January 2022: Nouryon signed a 15-year agreement with Suzano, a eucalyptus pulp producing company. Nouryon is projected to commission its sustainable integrated manufacturing model for the new Suzano eucalyptus pulp mill in Ribas do Rio Pardo, Brazil. Nouryon will use renewable electricity from Suzano's new pulp mill to produce sodium chlorate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Chloride Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Chloride Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Chloride Market?

To stay informed about further developments, trends, and reports in the Sodium Chloride Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence