Key Insights

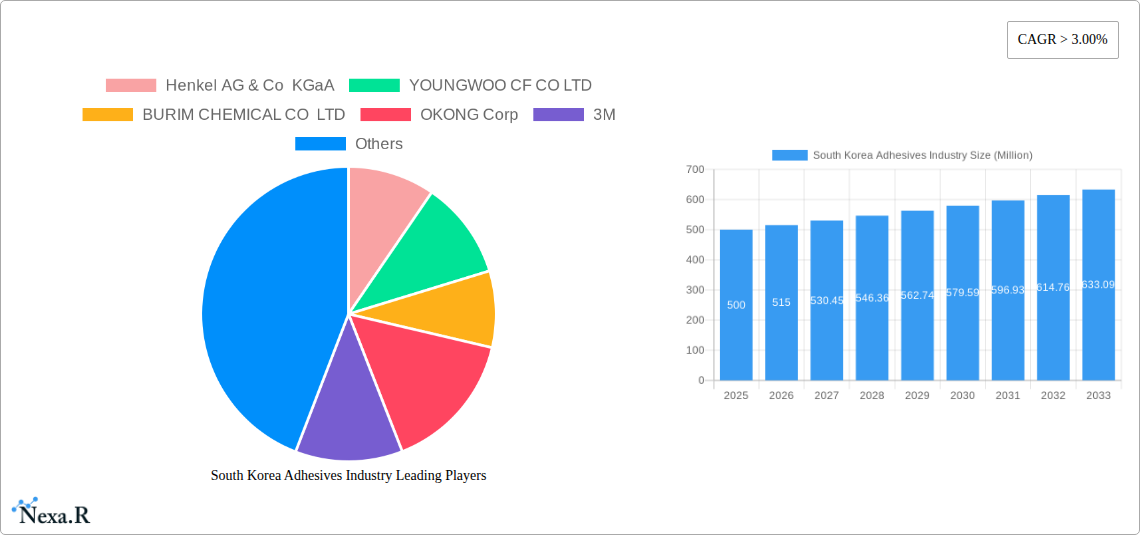

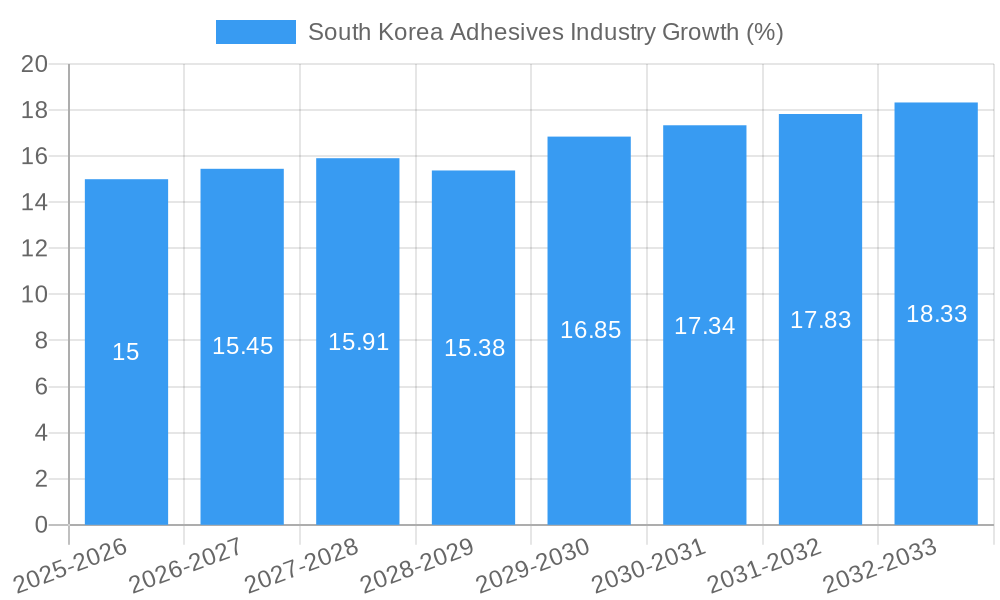

The South Korea adhesives market, valued at approximately $500 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning automotive and construction sectors in South Korea are significantly increasing demand for high-performance adhesives. Furthermore, the electronics and packaging industries' continuous innovation and the rise of advanced technologies like 5G and IoT are creating new opportunities for specialized adhesive solutions. The growing emphasis on lightweighting in automotive design and eco-friendly construction materials further bolsters market growth. While rising raw material costs present a challenge, technological advancements in adhesive formulations, particularly in areas like hot melt and UV-cured adhesives, are mitigating these restraints and enhancing overall market performance. The market is segmented by end-user industry (aerospace, automotive, building and construction, footwear and leather, healthcare, packaging, woodworking and joinery, others) and adhesive technology (hot melt, reactive, solvent-borne, UV cured, water-borne). Within resin types, acrylic, polyurethane, and epoxy adhesives hold significant market share due to their versatility and performance characteristics. Leading players such as Henkel, 3M, and HB Fuller are actively participating in the South Korean market, contributing to its competitiveness and driving innovation through product development and strategic partnerships.

The forecast period (2025-2033) anticipates continued growth, driven by ongoing infrastructural development, technological advancements in adhesive formulations, and the increasing adoption of adhesives across diverse industries. The market's segmentation offers numerous growth prospects for specialized adhesive providers catering to specific industry needs. For instance, the healthcare sector demands biocompatible and highly reliable adhesives, while the packaging industry necessitates adhesives with superior bonding strength and environmental friendliness. Competition within the market is intense, with both global and local players striving to gain market share through product innovation, efficient supply chain management, and strategic partnerships. The South Korean government's initiatives promoting industrial growth and technological advancements are expected to further support the market's expansion in the coming years.

South Korea Adhesives Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the South Korea adhesives market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking in-depth insights into this dynamic market.

South Korea Adhesives Industry Market Dynamics & Structure

The South Korea adhesives market exhibits a moderately concentrated structure, with key players such as Henkel AG & Co KGaA, 3M, and H.B. Fuller Company holding significant market share. Technological innovation, particularly in sustainable and high-performance adhesives, is a major driver. Stringent environmental regulations are shaping the industry landscape, pushing manufacturers towards eco-friendly solutions. Competitive pressures from substitute materials like welding and mechanical fasteners are present, although adhesives maintain a strong advantage in specific applications. The automotive, packaging, and construction sectors are major end-users, reflecting South Korea's robust manufacturing and infrastructure development. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong focus on sustainable (e.g., solvent-free, water-based) and high-performance adhesives.

- Regulatory Framework: Increasing emphasis on environmental regulations driving the adoption of eco-friendly adhesives.

- Competitive Substitutes: Welding and mechanical fasteners pose some competition, but adhesives maintain dominance in many applications.

- End-User Demographics: Automotive, packaging, and construction are major end-use segments.

- M&A Trends: Moderate activity, primarily for portfolio expansion and geographic reach (xx deals between 2019-2024).

South Korea Adhesives Industry Growth Trends & Insights

The South Korea adhesives market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth is attributed to increasing industrial activity, particularly in automotive and construction, coupled with rising demand for advanced adhesive solutions in electronics and packaging. Technological disruptions, including the introduction of innovative adhesive chemistries and application methods, have further accelerated market expansion. Consumer behavior shifts towards sustainable and high-performance products are influencing market trends, driving demand for eco-friendly and specialized adhesives. Market penetration of advanced adhesive technologies, such as UV-cured and reactive adhesives, is expected to increase significantly during the forecast period (2025-2033). The market is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%.

Dominant Regions, Countries, or Segments in South Korea Adhesives Industry

The South Korea adhesives market is geographically concentrated, with the majority of demand originating from major industrial hubs like Seoul and Gyeonggi-do. Within the end-user segments, the automotive, packaging, and building and construction sectors dominate, accounting for approximately xx% of the total market value in 2024. Among adhesive technologies, hot melt and water-borne adhesives hold significant market share due to their cost-effectiveness and versatility across various applications. Acrylic and polyurethane resins are the most widely used, owing to their performance characteristics and adaptability.

- Key Drivers:

- Robust industrial growth, particularly in automotive and construction.

- Increasing demand for advanced adhesive solutions in electronics and packaging.

- Government initiatives promoting infrastructure development and industrial innovation.

- Dominance Factors:

- High concentration of manufacturing and industrial activities in specific regions.

- Strong preference for cost-effective and versatile adhesive technologies.

- High demand for acrylic and polyurethane-based adhesives in key end-use sectors.

South Korea Adhesives Industry Product Landscape

The South Korea adhesives market showcases a diverse range of products catering to specific end-user needs. Recent innovations focus on enhanced performance characteristics, such as improved bonding strength, higher durability, and eco-friendliness. Product development efforts are directed towards achieving higher thermal stability, chemical resistance, and faster curing times. Key selling points include superior bonding properties, ease of application, and cost-effectiveness. The market is witnessing the emergence of specialized adhesives for niche applications, such as medical devices and aerospace components.

Key Drivers, Barriers & Challenges in South Korea Adhesives Industry

Key Drivers: The South Korean government's focus on infrastructure development and industrial automation fuels demand. The burgeoning automotive and electronics sectors drive the need for advanced adhesive solutions. Growing consumer awareness of sustainable products pushes the adoption of eco-friendly adhesives.

Key Barriers & Challenges: Fluctuations in raw material prices and supply chain disruptions impact profitability. Stringent environmental regulations necessitate continuous innovation to meet compliance requirements. Intense competition from established global and domestic players necessitates strategic differentiation.

Emerging Opportunities in South Korea Adhesives Industry

Untapped potential exists in specialized applications, including renewable energy, 3D printing, and advanced medical devices. The rise of e-commerce and sustainable packaging presents opportunities for eco-friendly adhesive solutions. Customization and value-added services are gaining traction, offering opportunities for differentiation.

Growth Accelerators in the South Korea Adhesives Industry Industry

Technological advancements in adhesive chemistries, such as bio-based adhesives, are opening up new avenues for growth. Strategic collaborations between adhesive manufacturers and end-users are streamlining supply chains and fostering innovation. Expansion into emerging markets and application segments, such as renewable energy and medical devices, hold significant growth potential.

Key Players Shaping the South Korea Adhesives Industry Market

- Henkel AG & Co KGaA

- YOUNGWOO CF CO LTD

- BURIM CHEMICAL CO LTD

- OKONG Corp

- 3M

- H B Fuller Company

- Industrial Adhesives Company MCS

- SAMYOUNG INK&PAINT INDUSTRIAL CO LTD

- AVERY DENNISON CORPORATION

- Unitech Co Ltd

Notable Milestones in South Korea Adhesives Industry Sector

- October 2021: 3M launched a new generation of acrylic adhesives, enhancing bonding performance and expanding applications.

- September 2021: Henkel introduced a solvent-free, zero-VOC adhesive range for rubber lining, addressing environmental concerns.

- July 2021: H.B. Fuller's strategic agreement with Covestro boosted the availability of sustainable adhesives.

In-Depth South Korea Adhesives Industry Market Outlook

The South Korea adhesives market is poised for robust growth driven by technological innovation, strategic partnerships, and expanding applications across various sectors. The increasing adoption of sustainable and high-performance adhesives, coupled with government support for industrial development, will further propel market expansion. Opportunities abound in specialized applications and value-added services, creating a favorable environment for both established players and new entrants. The focus on sustainable solutions and advancements in material science will continue shaping the market's trajectory in the coming years.

South Korea Adhesives Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Footwear and Leather

- 1.5. Healthcare

- 1.6. Packaging

- 1.7. Woodworking and Joinery

- 1.8. Other End-user Industries

-

2. Technology

- 2.1. Hot Melt

- 2.2. Reactive

- 2.3. Solvent-borne

- 2.4. UV Cured Adhesives

- 2.5. Water-borne

-

3. Resin

- 3.1. Acrylic

- 3.2. Cyanoacrylate

- 3.3. Epoxy

- 3.4. Polyurethane

- 3.5. Silicone

- 3.6. VAE/EVA

- 3.7. Other Resins

South Korea Adhesives Industry Segmentation By Geography

- 1. South Korea

South Korea Adhesives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Metal and Steel Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Environmental Constraints; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Adhesives Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Footwear and Leather

- 5.1.5. Healthcare

- 5.1.6. Packaging

- 5.1.7. Woodworking and Joinery

- 5.1.8. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Hot Melt

- 5.2.2. Reactive

- 5.2.3. Solvent-borne

- 5.2.4. UV Cured Adhesives

- 5.2.5. Water-borne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Cyanoacrylate

- 5.3.3. Epoxy

- 5.3.4. Polyurethane

- 5.3.5. Silicone

- 5.3.6. VAE/EVA

- 5.3.7. Other Resins

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YOUNGWOO CF CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BURIM CHEMICAL CO LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OKONG Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3M

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 H B Fuller Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Industrial Adhesives Company MCS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAMYOUNG INK&PAINT INDUSTRIAL CO LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AVERY DENNISON CORPORATION

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitech Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: South Korea Adhesives Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Adhesives Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Adhesives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Adhesives Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: South Korea Adhesives Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: South Korea Adhesives Industry Revenue Million Forecast, by Resin 2019 & 2032

- Table 5: South Korea Adhesives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Adhesives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Korea Adhesives Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 8: South Korea Adhesives Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: South Korea Adhesives Industry Revenue Million Forecast, by Resin 2019 & 2032

- Table 10: South Korea Adhesives Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Adhesives Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the South Korea Adhesives Industry?

Key companies in the market include Henkel AG & Co KGaA, YOUNGWOO CF CO LTD, BURIM CHEMICAL CO LTD, OKONG Corp, 3M, H B Fuller Company, Industrial Adhesives Company MCS, SAMYOUNG INK&PAINT INDUSTRIAL CO LTD, AVERY DENNISON CORPORATION, Unitech Co Ltd.

3. What are the main segments of the South Korea Adhesives Industry?

The market segments include End User Industry, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Metal and Steel Industries; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Environmental Constraints; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

October 2021: 3M introduced a new generation of acrylic adhesives, including 3M Scotch-Weld Low Odor Acrylic Adhesive 8700NS Series, 3M Scotch-Weld Flexible Acrylic Adhesive 8600NS Series, and 3M Scotch-Weld Nylon Bonder Structural Adhesive DP8910NS.September 2021: Henkel launched its newly developed solvent-free and zero-VOC adhesive range for rubber lining.July 2021: H.B. Fuller announced a strategic agreement with Covestro to offer sustainable adhesives in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Adhesives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Adhesives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Adhesives Industry?

To stay informed about further developments, trends, and reports in the South Korea Adhesives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence