Key Insights

The global stomach tube market is poised for significant expansion, projected to reach an estimated value of \$5.8 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.2% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the increasing prevalence of chronic diseases, a growing elderly population prone to swallowing difficulties, and advancements in enteral feeding technologies. The rising incidence of conditions such as dysphagia, gastrointestinal disorders, and malnutrition across various patient demographics, including pediatrics and critically ill individuals in ICUs, directly contributes to the sustained demand for stomach tubes. Furthermore, the expanding applications in managing eating disorders and providing nutritional support in home healthcare settings are key growth drivers. Manufacturers are focusing on developing innovative, minimally invasive, and patient-friendly feeding tube solutions, which are expected to further stimulate market growth.

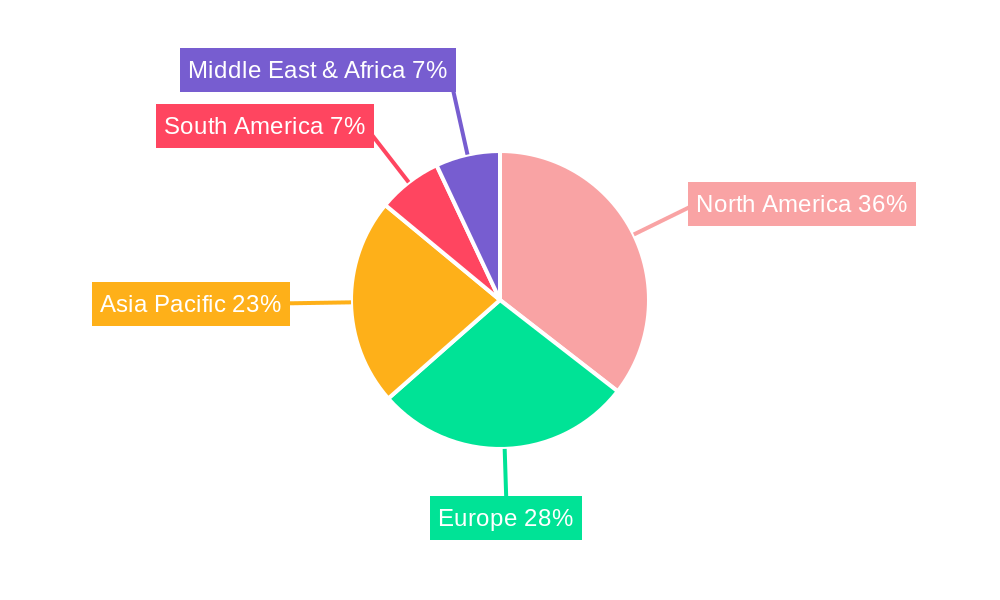

The market is segmented by application and type, offering diverse opportunities. The "Children" and "Dementia" segments, driven by specific nutritional needs and care requirements, are expected to witness considerable growth. In terms of type, Nasojejunal Feeding Tubes and Gastrostomy or Gastric Feeding Tubes are anticipated to dominate the market share due to their widespread adoption and established efficacy in clinical practice. Geographically, North America currently leads the market, attributed to its advanced healthcare infrastructure and high adoption rates of medical devices. However, the Asia Pacific region is projected to emerge as the fastest-growing market, propelled by increasing healthcare expenditure, improving access to medical care, and a burgeoning patient base in countries like China and India. Despite the positive outlook, challenges such as the risk of infections associated with feeding tube use and the availability of alternative feeding methods may pose moderate restraints to the market's full potential.

Comprehensive Report on the Global Stomach Tube Market: Dynamics, Trends, and Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the global stomach tube market, encompassing its historical evolution, current dynamics, and projected trajectory through 2033. Leveraging cutting-edge analytical tools and extensive primary and secondary research, this study offers actionable insights for stakeholders across the healthcare and medical device industries. With a base year of 2025 and a forecast period spanning 2025–2033, the report delves into the intricate factors shaping market growth, including technological advancements, evolving patient needs, and regulatory landscapes. The report covers critical segments such as pediatric care (Children), patient demographics with dementia, individuals with eating disorders, intensive care units (ICU), and other applications. It also analyzes the market by product type, including Nasojejunal Feeding Tubes, Gastrostomy or Gastric Feeding Tubes, Gastrojejunal Feeding Tubes, and Jejunal Feeding Tubes. The parent market for enteral feeding devices and the child market for specific feeding tube types are meticulously examined to provide a holistic understanding of market interdependencies and growth potential.

Stomach Tube Market Dynamics & Structure

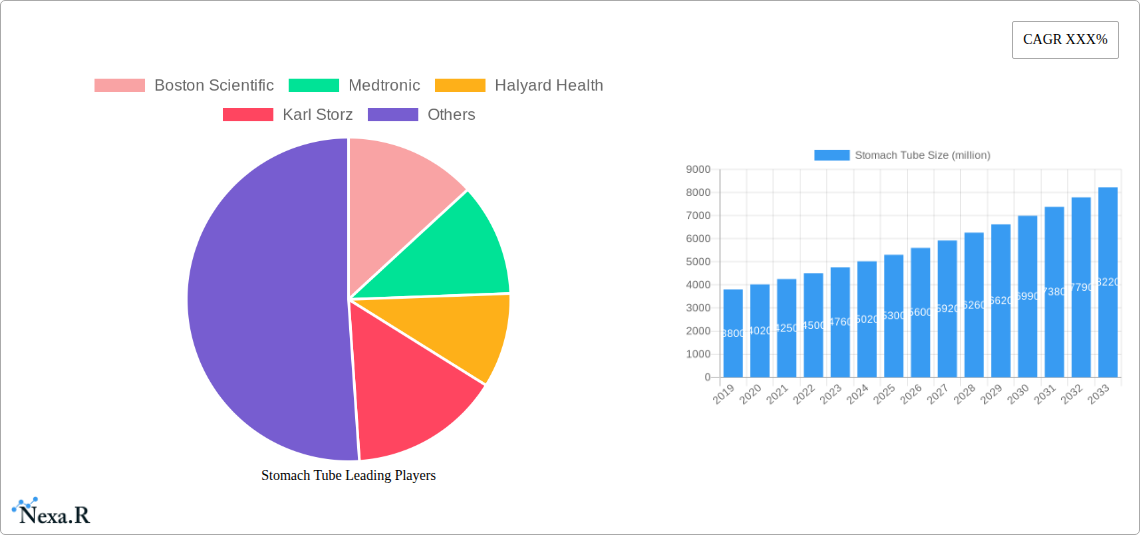

The global stomach tube market exhibits a moderately concentrated structure, with key players like Boston Scientific, Medtronic, Halyard Health, Karl Storz, Nestle Health Science, Cook Group, and Bard Medical dominating significant market shares. Technological innovation remains a primary driver, with advancements in material science, biocompatibility, and minimally invasive insertion techniques continuously pushing the boundaries of product efficacy and patient comfort. Regulatory frameworks, such as FDA approvals and CE marking, play a crucial role in market entry and product validation, ensuring safety and performance standards are met. Competitive product substitutes, including alternative feeding methods and advanced drug delivery systems, present a dynamic competitive landscape, necessitating continuous innovation and differentiation. End-user demographics are shifting, with an aging global population and a rising incidence of chronic diseases contributing to increased demand for enteral nutrition solutions. Mergers and acquisitions (M&A) are strategic tools employed by market leaders to consolidate market positions, expand product portfolios, and access new technologies.

- Market Concentration: Moderately concentrated with a few key global players.

- Technological Innovation Drivers: Advancements in materials, biocompatibility, and insertion techniques.

- Regulatory Frameworks: FDA, CE marking, and regional healthcare regulations are pivotal.

- Competitive Product Substitutes: Alternative feeding methods and advanced drug delivery systems.

- End-User Demographics: Growing elderly population and prevalence of chronic diseases.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

- Innovation Barriers: High R&D costs, lengthy approval processes, and clinical validation requirements.

- Market Share of Leading Players (Estimated 2025): Boston Scientific (xx%), Medtronic (xx%), Halyard Health (xx%), Nestle Health Science (xx%).

- M&A Deal Volumes (Historical 2019-2024): xx deals with an estimated value of $xxx million.

Stomach Tube Growth Trends & Insights

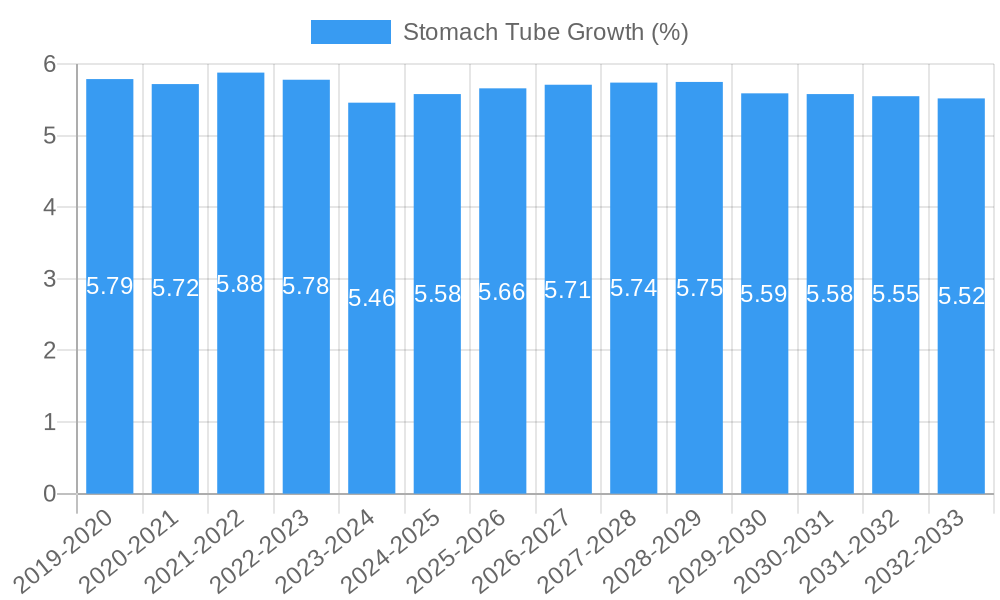

The global stomach tube market is poised for robust growth, driven by a confluence of factors that are reshaping patient care and nutritional support strategies. The market size has witnessed a steady expansion, fueled by increasing awareness of the benefits of enteral nutrition in managing various medical conditions and improving patient outcomes. Adoption rates of stomach tubes are escalating, particularly in critical care settings like ICUs, where they are indispensable for providing nutrition and medication to critically ill patients. Technological disruptions, such as the development of smaller, more flexible, and longer-dwelling tubes, are enhancing patient comfort and compliance, further boosting adoption. Consumer behavior shifts are also influencing the market; for instance, a greater emphasis on home-based care and patient-centered approaches is driving demand for devices that facilitate easier and safer use outside traditional hospital settings. The rising prevalence of conditions requiring long-term nutritional support, including cancer, gastrointestinal disorders, and neurological diseases, directly translates to an augmented demand for stomach tubes. The integration of smart features, like temperature monitoring and securement mechanisms, is also enhancing the perceived value and efficacy of these devices. The CAGR for the stomach tube market is projected to be around xx% during the forecast period, indicating sustained and significant expansion. Market penetration is deepening across both developed and emerging economies, as healthcare infrastructure improves and access to advanced medical devices becomes more widespread. The global stomach tube market size is projected to reach approximately $xxxx million by 2033, a substantial increase from an estimated $xxxx million in 2025. This growth trajectory is underpinned by continuous product innovation and a growing understanding of the critical role of enteral nutrition in comprehensive patient management.

Dominant Regions, Countries, or Segments in Stomach Tube

The North America region consistently emerges as a dominant force in the global stomach tube market. This leadership is attributable to several interconnected factors, including a highly developed healthcare infrastructure, significant healthcare expenditure, and a robust presence of leading medical device manufacturers and research institutions. The United States, in particular, accounts for a substantial portion of the regional market share, driven by a high incidence of chronic diseases, an aging population, and advanced reimbursement policies that favor the use of medical devices for nutritional support.

From an application perspective, the ICU segment stands out as a primary growth driver. Critically ill patients in intensive care units often require artificial nutritional support to maintain their physiological functions and facilitate recovery. The prolonged stays and complex medical needs of ICU patients necessitate reliable and efficient methods for delivering nutrition and medications, making stomach tubes an indispensable tool. The increasing number of ICU beds globally and the rising acuity of patients admitted to these units further underscore the significance of this segment.

In terms of product type, Gastrostomy or Gastric Feeding Tubes represent a substantial segment due to their widespread application in long-term nutritional management for patients unable to swallow or digest food normally. These tubes offer a direct route to the stomach, facilitating the administration of liquid diets and medications. Their versatility in treating a range of conditions, from stroke-related dysphagia to severe gastric motility disorders, contributes to their sustained market dominance.

- Dominant Region: North America, with the United States as a leading country.

- Key Drivers: High healthcare spending, advanced healthcare infrastructure, strong presence of key players, and favorable reimbursement policies.

- Market Share (Estimated 2025): North America (xx%), Europe (xx%), Asia Pacific (xx%), Rest of the World (xx%).

- Dominant Application Segment: ICU.

- Key Drivers: High incidence of critical illnesses, prolonged patient stays, and essential role in critical care nutrition.

- Market Share (Estimated 2025): ICU (xx%), Children (xx%), Dementia (xx%), Eating Disorders (xx%), Others (xx%).

- Dominant Product Type: Gastrostomy or Gastric Feeding Tube.

- Key Drivers: Versatility in long-term nutritional management, treatment of dysphagia and gastric motility disorders.

- Market Share (Estimated 2025): Gastrostomy or Gastric Feeding Tube (xx%), Nasojejunal Feeding Tube (xx%), Gastrojejunal Feeding Tube (xx%), Jejunal Feeding Tube (xx%).

- Growth Potential in Emerging Markets: Asia Pacific is exhibiting significant growth due to improving healthcare access and rising disposable incomes.

- Economic Policies Impact: Government initiatives to improve healthcare access and promote medical device adoption in developing nations.

Stomach Tube Product Landscape

The stomach tube product landscape is characterized by continuous innovation aimed at enhancing patient safety, comfort, and therapeutic efficacy. Manufacturers are focusing on developing tubes made from advanced biocompatible materials that minimize tissue irritation and allergic reactions. Innovations in tube design include features such as smaller diameters for less invasive insertion, enhanced flexibility to navigate tortuous anatomy, and improved radiopaque markers for accurate placement and monitoring. Unique selling propositions often revolve around specific functionalities, such as antimicrobial coatings to reduce infection risk, kink-resistant designs for unimpeded flow, and securement systems that prevent accidental dislodgement. Technological advancements are also leading to the development of specialized tubes for niche applications, including those designed for pediatric patients with specific anatomical considerations or for delivering specialized enteral formulas. The performance metrics that differentiate products include ease of insertion, patient tolerance, flow rate consistency, and long-term durability.

Key Drivers, Barriers & Challenges in Stomach Tube

Key Drivers:

- Increasing prevalence of chronic diseases: Conditions like cancer, neurological disorders, and gastrointestinal diseases necessitate long-term nutritional support.

- Aging global population: Elderly individuals are more susceptible to conditions requiring enteral feeding.

- Technological advancements: Development of minimally invasive, more comfortable, and safer feeding tubes.

- Growing awareness of enteral nutrition benefits: Increased understanding of its role in patient recovery and improved outcomes.

- Expansion of home healthcare: Demand for devices suitable for at-home use.

Barriers & Challenges:

- High cost of advanced devices: Can limit access in resource-constrained settings.

- Risk of complications: Including infection, tube blockage, and dislodgement, requiring careful management.

- Stringent regulatory approvals: Lengthy and costly processes for new product launches.

- Reimbursement challenges: Inconsistent or insufficient reimbursement policies in some regions.

- Availability of alternatives: Although less common for long-term use, other feeding methods can be a substitute in specific scenarios.

- Supply chain disruptions: Global events can impact the availability of raw materials and finished products.

- Competitive pressures: Intense competition among established and emerging players.

Emerging Opportunities in Stomach Tube

Emerging opportunities in the stomach tube market lie in the development of smart feeding tubes integrated with digital health technologies. These could include sensors for real-time monitoring of nutrient delivery, gastric pressure, and patient vitals, allowing for personalized and optimized nutritional support. The untapped potential in emerging economies, particularly in Asia Pacific and Latin America, presents a significant growth avenue as healthcare infrastructure and patient access improve. Furthermore, there is an increasing demand for patient-friendly, at-home enteral feeding solutions, creating opportunities for manufacturers to develop user-friendly devices and comprehensive support programs for caregivers. The growing field of personalized medicine also opens doors for specialized feeding tubes designed for specific patient populations with unique dietary and physiological needs.

Growth Accelerators in the Stomach Tube Industry

Long-term growth in the stomach tube industry will be significantly accelerated by breakthroughs in biomaterials research, leading to more durable, flexible, and biocompatible tubes with reduced complication rates. Strategic partnerships between medical device manufacturers, pharmaceutical companies, and academic institutions will foster collaborative innovation, leading to novel product development and enhanced delivery systems. Market expansion strategies, particularly targeting underserved populations in developing regions and expanding the application of tubes in non-traditional settings like palliative care, will drive substantial growth. The increasing adoption of telemedicine and remote patient monitoring will also create opportunities for stomach tubes that can be integrated into connected healthcare ecosystems.

Key Players Shaping the Stomach Tube Market

- Boston Scientific

- Medtronic

- Halyard Health

- Karl Storz

- Nestle Health Science

- Cook Group

- Bard Medical

Notable Milestones in Stomach Tube Sector

- 2019: Introduction of novel antimicrobial-coated gastrostomy tubes, reducing infection rates in ICUs.

- 2020: Development of ultra-thin jejunal feeding tubes for premature infants, improving nutritional delivery in neonates.

- 2021: Significant increase in M&A activities as larger players consolidated portfolios to expand offerings.

- 2022: Launch of advanced biocompatible materials for enhanced patient comfort and reduced tissue trauma.

- 2023: Emergence of smart feeding tubes with early-stage monitoring capabilities for home healthcare.

- Early 2024: Increased focus on sustainable manufacturing practices for medical devices.

- Mid-2024: Regulatory bodies expedited approvals for innovative enteral feeding devices due to increased demand in critical care.

- Late 2024: Expansion of nasojejunal feeding tubes for bariatric patients, offering improved access and reduced complications.

In-Depth Stomach Tube Market Outlook

The future of the stomach tube market is exceptionally promising, fueled by a persistent demand for effective nutritional support solutions across diverse patient demographics. Growth accelerators such as advancements in smart technologies for remote monitoring and data analytics, coupled with strategic market expansion into developing economies, will solidify its upward trajectory. Continued investment in research and development by key players will undoubtedly lead to the introduction of next-generation stomach tubes offering enhanced patient outcomes and user convenience. The increasing recognition of enteral nutrition as a cornerstone of comprehensive patient care, particularly in managing chronic illnesses and critical conditions, ensures a sustained and robust market outlook. Opportunities for strategic partnerships and the development of integrated healthcare solutions will further propel market growth, making the stomach tube sector a vital component of the evolving healthcare landscape.

Stomach Tube Segmentation

-

1. Application

- 1.1. Children

- 1.2. Dementia

- 1.3. Eating disorders

- 1.4. ICU

- 1.5. Others

-

2. Type

- 2.1. Nasojejunal Feeding Tube

- 2.2. Gastrostomy or Gastric Feeding Tube

- 2.3. Gastrojejunal Feeding Tube

- 2.4. Jejunal Feeding Tube

Stomach Tube Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Stomach Tube REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Children

- 5.1.2. Dementia

- 5.1.3. Eating disorders

- 5.1.4. ICU

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Nasojejunal Feeding Tube

- 5.2.2. Gastrostomy or Gastric Feeding Tube

- 5.2.3. Gastrojejunal Feeding Tube

- 5.2.4. Jejunal Feeding Tube

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Children

- 6.1.2. Dementia

- 6.1.3. Eating disorders

- 6.1.4. ICU

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Nasojejunal Feeding Tube

- 6.2.2. Gastrostomy or Gastric Feeding Tube

- 6.2.3. Gastrojejunal Feeding Tube

- 6.2.4. Jejunal Feeding Tube

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Children

- 7.1.2. Dementia

- 7.1.3. Eating disorders

- 7.1.4. ICU

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Nasojejunal Feeding Tube

- 7.2.2. Gastrostomy or Gastric Feeding Tube

- 7.2.3. Gastrojejunal Feeding Tube

- 7.2.4. Jejunal Feeding Tube

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Children

- 8.1.2. Dementia

- 8.1.3. Eating disorders

- 8.1.4. ICU

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Nasojejunal Feeding Tube

- 8.2.2. Gastrostomy or Gastric Feeding Tube

- 8.2.3. Gastrojejunal Feeding Tube

- 8.2.4. Jejunal Feeding Tube

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Children

- 9.1.2. Dementia

- 9.1.3. Eating disorders

- 9.1.4. ICU

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Nasojejunal Feeding Tube

- 9.2.2. Gastrostomy or Gastric Feeding Tube

- 9.2.3. Gastrojejunal Feeding Tube

- 9.2.4. Jejunal Feeding Tube

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Stomach Tube Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Children

- 10.1.2. Dementia

- 10.1.3. Eating disorders

- 10.1.4. ICU

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Nasojejunal Feeding Tube

- 10.2.2. Gastrostomy or Gastric Feeding Tube

- 10.2.3. Gastrojejunal Feeding Tube

- 10.2.4. Jejunal Feeding Tube

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Boston Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Halyard Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Karl Storz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nestle Health Science

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cook Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bard Medical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Boston Scientific

List of Figures

- Figure 1: Global Stomach Tube Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Stomach Tube Revenue (million), by Application 2024 & 2032

- Figure 3: North America Stomach Tube Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Stomach Tube Revenue (million), by Type 2024 & 2032

- Figure 5: North America Stomach Tube Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Stomach Tube Revenue (million), by Country 2024 & 2032

- Figure 7: North America Stomach Tube Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Stomach Tube Revenue (million), by Application 2024 & 2032

- Figure 9: South America Stomach Tube Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Stomach Tube Revenue (million), by Type 2024 & 2032

- Figure 11: South America Stomach Tube Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Stomach Tube Revenue (million), by Country 2024 & 2032

- Figure 13: South America Stomach Tube Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Stomach Tube Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Stomach Tube Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Stomach Tube Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Stomach Tube Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Stomach Tube Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Stomach Tube Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Stomach Tube Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Stomach Tube Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Stomach Tube Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Stomach Tube Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Stomach Tube Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Stomach Tube Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Stomach Tube Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Stomach Tube Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Stomach Tube Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Stomach Tube Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Stomach Tube Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Stomach Tube Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stomach Tube Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Stomach Tube Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Stomach Tube Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Stomach Tube Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Stomach Tube Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Stomach Tube Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Stomach Tube Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Stomach Tube Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Stomach Tube Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Stomach Tube Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stomach Tube?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Stomach Tube?

Key companies in the market include Boston Scientific, Medtronic, Medtronic, Halyard Health, Karl Storz, Nestle Health Science, Cook Group, Bard Medical.

3. What are the main segments of the Stomach Tube?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stomach Tube," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stomach Tube report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stomach Tube?

To stay informed about further developments, trends, and reports in the Stomach Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence