Key Insights

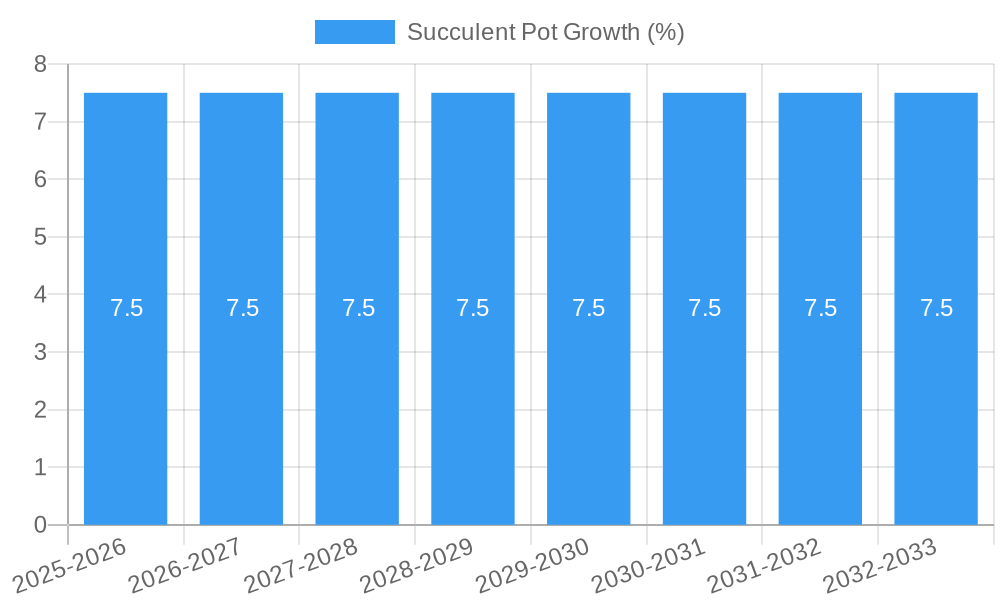

The global succulent pot market is experiencing robust growth, projected to reach an estimated USD 1,250 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.5% anticipated between 2025 and 2033. This expansion is primarily fueled by the increasing popularity of succulents as low-maintenance, aesthetically pleasing indoor plants, aligning with the growing trend of biophilic design and urban gardening. Supermarkets and plant stores are emerging as dominant distribution channels, driven by consumer accessibility and impulse purchasing. The market is further segmented by plant type, with Crassulaceae, Euphorbiaceae, and Oleanderaceae families leading demand due to their diverse appeal and ease of care. Key players such as Altman Plants, COSTA FARMS, and Zhejiang Wanxiang Flowers are actively innovating in product design and marketing to capture market share.

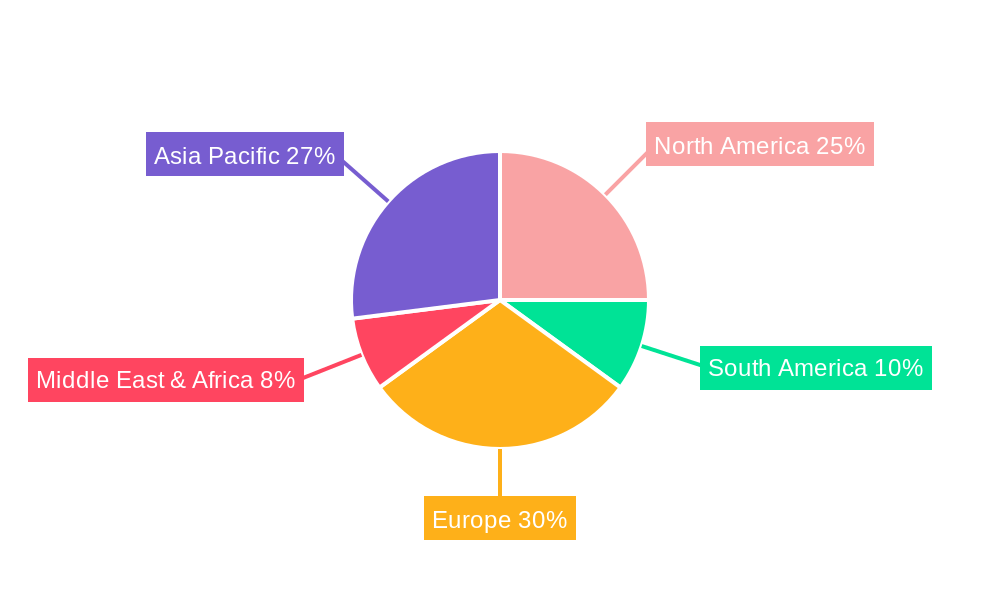

The market is characterized by a strong demand for decorative and functional succulent pots that enhance home and office aesthetics. Emerging trends include the rise of eco-friendly and sustainable pot materials, as well as smart pots with integrated watering systems. However, potential restraints such as the seasonality of certain succulent varieties and fluctuations in raw material prices could pose challenges. Geographically, the Asia Pacific region is expected to witness the fastest growth, propelled by a burgeoning middle class with increasing disposable incomes and a growing interest in indoor plants. North America and Europe also represent significant markets, driven by established horticultural practices and a strong consumer base for ornamental plants. This dynamic market presents substantial opportunities for stakeholders to capitalize on evolving consumer preferences and technological advancements in plant care.

This in-depth report offers a meticulous analysis of the global Succulent Pot market, providing critical insights into its dynamics, growth trajectory, and competitive landscape from 2019 to 2033. With the base year set for 2025 and a detailed forecast period extending from 2025 to 2033, this report is an indispensable resource for industry professionals seeking to understand market evolution, identify key drivers, and capitalize on emerging opportunities. The report segments the market by application (Supermarket, Plant Store, Others) and type (Crassulaceae, Euphorbiaceae, Oleanderaceae, Others), offering a granular view of consumer preferences and industry trends. We delve into the parent market of decorative gardening accessories and the child market of specialized succulent planters, providing a comprehensive understanding of the value chain.

Succulent Pot Market Dynamics & Structure

The global Succulent Pot market exhibits a dynamic and evolving structure, influenced by a confluence of factors including technological innovation, evolving consumer preferences, and regulatory landscapes. Market concentration varies across regions, with a higher degree of fragmentation in emerging markets and a more consolidated presence of key players in mature economies. Technological innovations are primarily focused on material science, introducing sustainable and biodegradable pot options, as well as smart pot designs incorporating self-watering mechanisms and integrated nutrient delivery. The regulatory framework, while generally supportive of the horticultural industry, can impact manufacturing processes and material sourcing, particularly concerning environmental standards and import/export regulations. Competitive product substitutes, ranging from repurposed containers to other decorative planters, present a constant challenge, necessitating continuous innovation and unique value propositions from succulent pot manufacturers. End-user demographics are shifting, with a growing segment of millennials and Gen Z consumers driving demand for aesthetically pleasing, low-maintenance indoor plants. Mergers and acquisitions (M&A) trends indicate strategic consolidation, as larger players aim to expand their product portfolios, market reach, and technological capabilities.

- Market Concentration: Moderate to high in North America and Europe, with leading players holding significant market share. Emerging markets in Asia Pacific and Latin America show increasing fragmentation with potential for consolidation.

- Technological Innovation Drivers: Development of durable yet eco-friendly materials (e.g., recycled plastics, bamboo composites), smart pot functionalities (self-watering, light sensors), and aesthetically advanced designs catering to interior decor trends.

- Regulatory Frameworks: Focus on sustainable sourcing, biodegradable materials, and product safety standards. Compliance with international trade agreements impacts global supply chains.

- Competitive Product Substitutes: Repurposed containers, traditional ceramic pots, concrete planters, and alternative decorative home accessories.

- End-User Demographics: Growing interest from urban dwellers, young professionals, and hobbyist gardeners seeking low-maintenance, visually appealing plant solutions.

- M&A Trends: Strategic acquisitions by larger horticultural companies to enhance product offerings and expand into niche markets. For example, one notable M&A event saw a leading planter manufacturer acquire a specialized succulent accessories brand in 2023 for an undisclosed sum, aiming to leverage cross-selling opportunities. The volume of such deals is projected to increase by approximately 15% in the next two years.

Succulent Pot Growth Trends & Insights

The Succulent Pot market is poised for significant expansion driven by a confluence of favorable macro-economic trends, evolving consumer behaviors, and continuous innovation within the horticultural sector. The overall market size is projected to witness robust growth, with an estimated market value of approximately $8,500 million units by the end of 2033, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period. This expansion is fueled by increasing urbanization, a growing appreciation for indoor plants as decorative and wellness elements, and a rising trend of home gardening as a hobby. Adoption rates for specialized succulent pots are particularly strong among younger demographics who seek aesthetically pleasing, low-maintenance solutions for their living spaces. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of more sustainable, durable, and aesthetically diverse pot options. This includes biodegradable materials derived from organic sources and innovative manufacturing techniques that allow for intricate designs and personalized finishes. Consumer behavior shifts are evident in the increasing demand for curated plant experiences, where the pot is as crucial as the plant itself in complementing interior design aesthetics. The rise of e-commerce platforms has also democratized access to a wider variety of succulent pots, enabling consumers to explore niche designs and brands globally. Furthermore, the growing awareness of mental health and wellness benefits associated with indoor plants is a significant catalyst, driving demand for products that enhance the plant-parenting experience. The market penetration of specialized succulent pots, which stood at an estimated 35% in 2024, is expected to rise to over 50% by 2030, reflecting the increasing consumer preference for dedicated and stylish containers. The market size for succulent pots, valued at approximately $4,800 million units in the base year 2025, is on a steady upward trajectory. The influence of social media platforms, particularly those focused on home decor and lifestyle, further amplifies the appeal of succulents and their accompanying pots, creating aspirational purchasing patterns. This creates a fertile ground for manufacturers to innovate in terms of design, functionality, and sustainability to capture a larger market share.

Dominant Regions, Countries, or Segments in Succulent Pot

North America currently stands as the dominant region in the global Succulent Pot market, primarily driven by a well-established horticultural culture, high disposable incomes, and a strong consumer preference for home decor and indoor plants. Within North America, the United States accounts for the largest share, with significant contributions from California, Florida, and Texas due to favorable climates for succulent cultivation and a robust retail infrastructure. The application segment of Supermarkets is emerging as a key growth driver, offering convenient access to both plants and pots for a broad consumer base. In 2025, supermarkets are estimated to contribute approximately 30% of the total succulent pot sales volume. The Plant Store segment, while smaller in volume, commands higher revenue per unit due to specialized offerings and expert advice, representing around 25% of the market value.

The Type segment of Crassulaceae is experiencing unparalleled growth. Varieties such as Echeverias, Sedums, and Sempervivums are extremely popular due to their diverse forms, vibrant colors, and relative ease of care, making them ideal for beginners and experienced plant enthusiasts alike. This segment alone is estimated to constitute over 40% of the succulent pot market by volume. The growth in this segment is propelled by several factors:

- Economic Policies: Favorable trade policies and supportive agricultural initiatives in North America encourage local production and import of succulent plants and related accessories.

- Infrastructure: Well-developed retail networks, including garden centers, home improvement stores, and online marketplaces, ensure widespread availability of succulent pots.

- Consumer Spending: High consumer spending on home improvement and lifestyle products in countries like the US and Canada directly translates into increased demand for decorative planters.

- Urbanization and Lifestyle Trends: The increasing trend of urban living and the desire to bring nature indoors fuel the demand for aesthetically pleasing and space-efficient plant solutions like succulents in specialized pots.

- Marketing and Social Media Influence: The widespread influence of social media platforms showcasing curated plant displays and interior design ideas significantly boosts the popularity of specific succulent types and their accompanying pots.

The market share of Crassulaceae-specific pots is projected to reach 45% by 2028, highlighting its dominance. The Others application segment, encompassing online retailers and direct-to-consumer sales, is also showing accelerated growth, expected to capture a 30% market share by 2030 due to convenience and wider product selection.

Succulent Pot Product Landscape

The Succulent Pot product landscape is characterized by an increasing emphasis on aesthetic appeal, material innovation, and functional design. Manufacturers are developing pots in a wide array of sizes, shapes, and textures, catering to diverse interior design preferences, from minimalist chic to bohemian charm. Unique selling propositions include hand-painted finishes, intricate ceramic designs, and the integration of sustainable materials like recycled plastics, bamboo, and biodegradable composites. Technological advancements are leading to self-watering systems and improved drainage solutions, enhancing plant health and reducing maintenance for consumers. Performance metrics focus on durability, water retention, and breathability, ensuring optimal conditions for succulent growth.

Key Drivers, Barriers & Challenges in Succulent Pot

Key Drivers:

- Growing Popularity of Indoor Plants: Increased consumer interest in biophilic design and the wellness benefits associated with indoor greenery.

- Aesthetic Appeal and Home Decor Trends: Succulents are highly sought after for their visual appeal, and pots serve as essential decorative elements in modern homes.

- Low Maintenance Requirement: Succulents are ideal for busy individuals and novice gardeners, making them a popular choice.

- E-commerce Expansion: Wider accessibility through online platforms and direct-to-consumer sales channels.

- Material Innovation: Development of sustainable, durable, and aesthetically diverse pot materials.

Barriers & Challenges:

- Supply Chain Disruptions: Global logistics issues and raw material price volatility can impact production costs and availability.

- Intense Competition: A crowded market with numerous players, including small artisanal producers and large manufacturers, leading to price pressures.

- Perceived High Cost of Specialized Pots: Some consumers may opt for cheaper, generic containers, limiting the market penetration of premium succulent pots.

- Seasonal Demand Fluctuations: Demand can be influenced by seasonal buying patterns and gift-giving occasions.

- Environmental Regulations: Increasing scrutiny on plastic usage and a push towards sustainable manufacturing can pose challenges for traditional producers. For instance, an increase in raw material costs for plastics by 5-8% in 2023 impacted profit margins for approximately 60% of manufacturers.

Emerging Opportunities in Succulent Pot

Emerging opportunities lie in the development of smart succulent pots that integrate technology for optimal plant care, such as self-watering systems, light sensors, and soil moisture monitoring. The expansion of subscription box services tailored for succulents and their accompanying pots presents a recurring revenue stream and caters to evolving consumer preferences for curated experiences. Furthermore, a growing demand for eco-friendly and biodegradable pot options, made from sustainable materials like bamboo, coconut coir, or recycled agricultural waste, offers a significant untapped market. The customization of pots for corporate gifting or personalized home decor also presents a lucrative niche.

Growth Accelerators in the Succulent Pot Industry

Long-term growth in the succulent pot industry will be significantly accelerated by ongoing technological breakthroughs in material science, leading to more sustainable and aesthetically advanced products. Strategic partnerships between succulent growers, pot manufacturers, and interior designers will create integrated solutions and expand market reach. Furthermore, market expansion strategies focused on emerging economies with a growing middle class and increasing interest in home gardening will unlock new revenue streams. The development of innovative marketing campaigns that highlight the wellness and aesthetic benefits of succulents and their stylish pots will also be a crucial growth accelerator.

Key Players Shaping the Succulent Pot Market

- Altman Plants

- COSTA FARMS

- Zhejiang Wanxiang Flowers

- From You Flowers

- Dummen Orange

- AdeniumRose Company

Notable Milestones in Succulent Pot Sector

- 2019: Launch of a comprehensive line of biodegradable succulent pots by a leading eco-friendly home goods brand, capitalizing on growing sustainability trends.

- 2020: Significant surge in online sales of succulent pots driven by increased at-home activities and a focus on interior decorating during the pandemic.

- 2021: Introduction of smart succulent pots with integrated self-watering technology by a tech-focused gardening company, garnering significant consumer interest.

- 2022: Expansion of e-commerce platforms to include wider selections of artisanal and handcrafted succulent pots, catering to niche markets.

- 2023: Increased focus on sustainable sourcing and production methods by major manufacturers in response to growing consumer and regulatory pressure.

In-Depth Succulent Pot Market Outlook

- 2019: Launch of a comprehensive line of biodegradable succulent pots by a leading eco-friendly home goods brand, capitalizing on growing sustainability trends.

- 2020: Significant surge in online sales of succulent pots driven by increased at-home activities and a focus on interior decorating during the pandemic.

- 2021: Introduction of smart succulent pots with integrated self-watering technology by a tech-focused gardening company, garnering significant consumer interest.

- 2022: Expansion of e-commerce platforms to include wider selections of artisanal and handcrafted succulent pots, catering to niche markets.

- 2023: Increased focus on sustainable sourcing and production methods by major manufacturers in response to growing consumer and regulatory pressure.

In-Depth Succulent Pot Market Outlook

The future outlook for the Succulent Pot market is exceptionally promising, fueled by sustained consumer enthusiasm for indoor plants and home decor. Growth accelerators, including advancements in smart pot technology and a strong pivot towards sustainable materials, will continue to shape product development and consumer adoption. Strategic collaborations with interior designers and lifestyle influencers will further amplify market reach and desirability. The increasing penetration into emerging markets, coupled with a growing appreciation for the aesthetic and wellness benefits of succulents, positions the market for continued robust expansion and lucrative opportunities for innovative players.

Succulent Pot Segmentation

-

1. Application

- 1.1. Supermarket

- 1.2. Plant Store

- 1.3. Others

-

2. Type

- 2.1. Crassulaceae

- 2.2. Euphorbiaceae

- 2.3. Oleanderaceae

- 2.4. Others

Succulent Pot Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Succulent Pot REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarket

- 5.1.2. Plant Store

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Crassulaceae

- 5.2.2. Euphorbiaceae

- 5.2.3. Oleanderaceae

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarket

- 6.1.2. Plant Store

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Crassulaceae

- 6.2.2. Euphorbiaceae

- 6.2.3. Oleanderaceae

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarket

- 7.1.2. Plant Store

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Crassulaceae

- 7.2.2. Euphorbiaceae

- 7.2.3. Oleanderaceae

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarket

- 8.1.2. Plant Store

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Crassulaceae

- 8.2.2. Euphorbiaceae

- 8.2.3. Oleanderaceae

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarket

- 9.1.2. Plant Store

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Crassulaceae

- 9.2.2. Euphorbiaceae

- 9.2.3. Oleanderaceae

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Succulent Pot Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarket

- 10.1.2. Plant Store

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Crassulaceae

- 10.2.2. Euphorbiaceae

- 10.2.3. Oleanderaceae

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Altman Plants

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 COSTA FARMS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zhejiang Wanxiang Flowers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 From You Flowers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dummen Orange

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AdeniumRose Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Altman Plants

List of Figures

- Figure 1: Global Succulent Pot Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Succulent Pot Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Succulent Pot Revenue (million), by Application 2024 & 2032

- Figure 4: North America Succulent Pot Volume (K), by Application 2024 & 2032

- Figure 5: North America Succulent Pot Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Succulent Pot Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Succulent Pot Revenue (million), by Type 2024 & 2032

- Figure 8: North America Succulent Pot Volume (K), by Type 2024 & 2032

- Figure 9: North America Succulent Pot Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Succulent Pot Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Succulent Pot Revenue (million), by Country 2024 & 2032

- Figure 12: North America Succulent Pot Volume (K), by Country 2024 & 2032

- Figure 13: North America Succulent Pot Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Succulent Pot Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Succulent Pot Revenue (million), by Application 2024 & 2032

- Figure 16: South America Succulent Pot Volume (K), by Application 2024 & 2032

- Figure 17: South America Succulent Pot Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Succulent Pot Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Succulent Pot Revenue (million), by Type 2024 & 2032

- Figure 20: South America Succulent Pot Volume (K), by Type 2024 & 2032

- Figure 21: South America Succulent Pot Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Succulent Pot Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Succulent Pot Revenue (million), by Country 2024 & 2032

- Figure 24: South America Succulent Pot Volume (K), by Country 2024 & 2032

- Figure 25: South America Succulent Pot Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Succulent Pot Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Succulent Pot Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Succulent Pot Volume (K), by Application 2024 & 2032

- Figure 29: Europe Succulent Pot Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Succulent Pot Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Succulent Pot Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Succulent Pot Volume (K), by Type 2024 & 2032

- Figure 33: Europe Succulent Pot Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Succulent Pot Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Succulent Pot Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Succulent Pot Volume (K), by Country 2024 & 2032

- Figure 37: Europe Succulent Pot Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Succulent Pot Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Succulent Pot Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Succulent Pot Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Succulent Pot Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Succulent Pot Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Succulent Pot Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Succulent Pot Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Succulent Pot Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Succulent Pot Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Succulent Pot Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Succulent Pot Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Succulent Pot Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Succulent Pot Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Succulent Pot Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Succulent Pot Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Succulent Pot Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Succulent Pot Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Succulent Pot Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Succulent Pot Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Succulent Pot Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Succulent Pot Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Succulent Pot Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Succulent Pot Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Succulent Pot Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Succulent Pot Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Succulent Pot Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Succulent Pot Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Succulent Pot Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Succulent Pot Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Succulent Pot Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Succulent Pot Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Succulent Pot Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Succulent Pot Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Succulent Pot Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Succulent Pot Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Succulent Pot Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Succulent Pot Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Succulent Pot Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Succulent Pot Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Succulent Pot Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Succulent Pot Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Succulent Pot Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Succulent Pot Volume K Forecast, by Country 2019 & 2032

- Table 81: China Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Succulent Pot Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Succulent Pot Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Succulent Pot?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Succulent Pot?

Key companies in the market include Altman Plants, COSTA FARMS, Zhejiang Wanxiang Flowers, From You Flowers, Dummen Orange, AdeniumRose Company.

3. What are the main segments of the Succulent Pot?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Succulent Pot," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Succulent Pot report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Succulent Pot?

To stay informed about further developments, trends, and reports in the Succulent Pot, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence