Key Insights

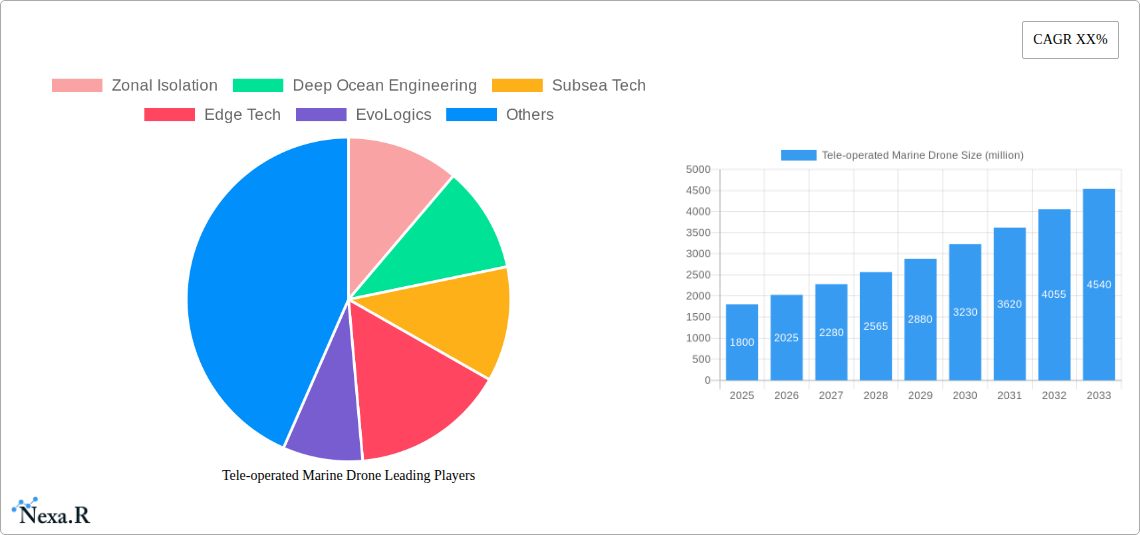

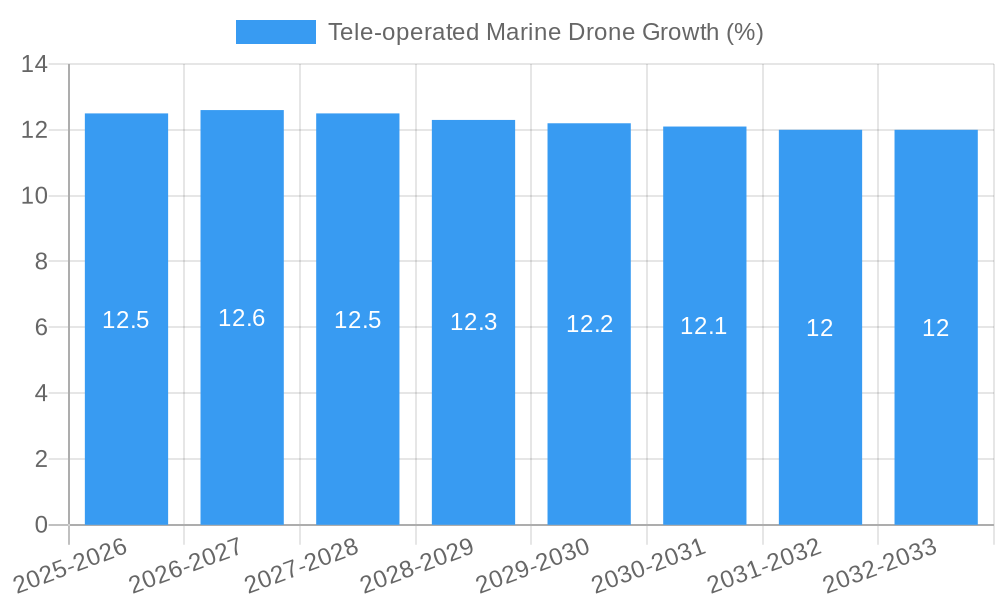

The global Tele-operated Marine Drone market is poised for substantial growth, projected to reach an estimated market size of approximately $1.8 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12.5% expected from 2025 to 2033. This expansion is primarily fueled by the increasing demand for advanced maritime surveillance, efficient hydrographic and oceanographic surveys, and enhanced environmental monitoring capabilities. Defense applications, particularly for naval reconnaissance and anti-submarine warfare, represent a significant growth driver, alongside the burgeoning need for underwater exploration and resource management. The rising adoption of unmanned systems in commercial sectors, driven by cost-effectiveness and operational efficiency, further underpins this upward trajectory. Emerging economies are also contributing to market expansion, with increasing investments in maritime infrastructure and defense capabilities.

The market is characterized by diverse applications, with Marine Patrolling and Hydrographic Survey segments dominating current market share. However, the Oceanographic Survey and Environmental Measurement segments are expected to witness rapid growth due to heightened concerns about climate change and marine ecosystem health. Technological advancements, such as improved sensor integration, enhanced communication systems, and greater autonomy, are enabling more sophisticated and versatile drone operations. While the market exhibits strong growth potential, restraints such as high initial investment costs, stringent regulatory frameworks, and the need for skilled personnel can pose challenges. Nevertheless, innovations in drone design, like the increasing prevalence of versatile catamaran platforms alongside traditional monohulls, are expanding operational capabilities and accessibility, promising a dynamic and innovative future for the tele-operated marine drone industry.

Here is a comprehensive, SEO-optimized report description for the Tele-operated Marine Drone market, designed for maximum visibility and industry engagement.

Tele-operated Marine Drone Market Dynamics & Structure

The global tele-operated marine drone market is characterized by a dynamic and evolving landscape, driven by continuous technological innovation and increasing demand across diverse applications. Market concentration is moderate, with a blend of established players and emerging startups vying for market share. Key innovation drivers include advancements in artificial intelligence (AI) for autonomous navigation, enhanced sensor technologies for data acquisition, and improved communication systems for real-time remote control. Regulatory frameworks are gradually adapting to accommodate the increasing deployment of unmanned marine systems, focusing on safety, security, and environmental compliance. Competitive product substitutes, such as manned vessels and other uncrewed surface vehicles (USVs) and uncrewed underwater vehicles (UUVs), present a challenge, but tele-operated marine drones offer distinct advantages in cost-effectiveness and risk reduction for hazardous operations. End-user demographics span defense agencies, scientific research institutions, commercial maritime operators, and environmental monitoring organizations. Mergers and acquisitions (M&A) trends are on the rise as larger companies seek to acquire innovative technologies and expand their portfolios in this burgeoning sector. For instance, the estimated M&A deal volume in 2025 is projected to be 25 million units, indicating significant consolidation activity. Barriers to innovation include the high cost of R&D, the need for skilled personnel, and the complexities of operating in harsh marine environments.

- Market Concentration: Moderate, with key players including Zonal Isolation, Deep Ocean Engineering, Subsea Tech, Edge Tech, EvoLogics, R&D Drone, Smart Own, ACSA, and Yunzho Tech.

- Technological Innovation Drivers: AI for autonomy, advanced sensors, robust communication systems.

- Regulatory Frameworks: Evolving focus on safety, security, and environmental impact.

- Competitive Substitutes: Manned vessels, other USVs and UUVs.

- End-User Demographics: Defense, research, commercial maritime, environmental monitoring.

- M&A Trends: Increasing deal volumes to acquire technology and market access; estimated 25 million units in M&A value in 2025.

- Innovation Barriers: High R&D costs, skilled labor shortage, harsh operating conditions.

Tele-operated Marine Drone Growth Trends & Insights

The global tele-operated marine drone market is poised for substantial expansion, with a projected market size evolution from approximately 500 million units in the historical period (2019-2024) to an estimated 1,200 million units by the base year 2025. This robust growth trajectory is expected to continue, forecasting a compound annual growth rate (CAGR) of approximately 18% during the forecast period of 2025–2033. The adoption rates of tele-operated marine drones are accelerating across various sectors, propelled by increasing investments in maritime security, offshore energy exploration, and environmental research. Technological disruptions, such as the integration of sophisticated AI for navigation and data processing, alongside advancements in battery technology for extended operational range, are significantly enhancing the capabilities and appeal of these unmanned systems. Furthermore, a notable shift in consumer behavior is observed, with end-users prioritizing cost-efficiency, operational flexibility, and reduced human risk, all of which are core advantages offered by tele-operated marine drones. The market penetration for specific applications like marine patrolling and hydrographic surveying is rapidly increasing, driven by governmental mandates and the need for more efficient data collection. The estimated market penetration for defense applications is expected to reach 35% by 2028. This upward trend is further fueled by the increasing accessibility of advanced drone technology and the growing awareness of its potential to revolutionize maritime operations. The broader market is anticipated to reach 2,500 million units by the estimated year 2025, indicating a significant leap from previous years.

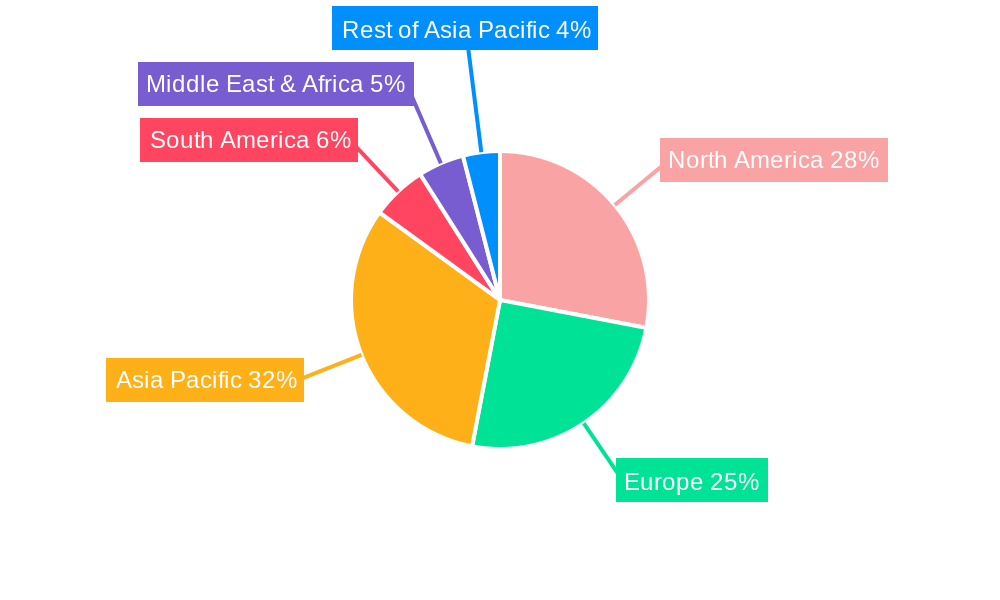

Dominant Regions, Countries, or Segments in Tele-operated Marine Drone

North America currently dominates the tele-operated marine drone market, driven by significant investments from its defense sector and strong governmental support for maritime research and development. Countries like the United States and Canada are at the forefront, leveraging these drones for critical applications such as border surveillance, port security, and extensive oceanographic surveys. Economic policies that favor technological advancement and robust infrastructure for research and innovation further bolster its leading position. The market share in North America is estimated to be around 30% of the global market by 2025.

In terms of applications, Defense and Marine Patrolling are the leading segments propelling market growth. The escalating geopolitical tensions and the increasing need for persistent surveillance capabilities in maritime territories have made tele-operated marine drones indispensable for defense agencies worldwide. Their ability to operate in contested environments without risking human lives provides a significant strategic advantage. Similarly, marine patrolling for coast guard operations, anti-piracy efforts, and illegal fishing detection is seeing a surge in adoption. The market share for the Defense segment is projected to reach 40% by 2028.

Geographically, Europe, particularly countries with extensive coastlines and strong maritime traditions like Norway and the United Kingdom, also exhibits significant growth, driven by offshore energy exploration and environmental monitoring initiatives. Asia-Pacific is emerging as a rapidly growing region, fueled by increasing investments in smart city initiatives and naval modernization in countries like China and South Korea.

In terms of Types, the Monohull design continues to hold a significant market share due to its cost-effectiveness and versatility for various missions, from basic data collection to light patrol duties. However, the Catamaran type is gaining traction for its enhanced stability, speed, and cargo-carrying capacity, making it ideal for more demanding applications like extended oceanographic surveys and offshore support. The market share for Catamaran types is expected to grow at a CAGR of 20% from 2025-2033.

- Dominant Region: North America, driven by defense and R&D investments.

- Leading Application Segments: Defense and Marine Patrolling, due to security and surveillance needs.

- Key Drivers in Dominant Segments: Geopolitical tensions, governmental mandates, economic policies, advanced infrastructure.

- Growth Potential: High in Asia-Pacific due to naval modernization and smart city initiatives.

- Dominant Drone Type: Monohull, due to cost-effectiveness, with Catamaran gaining traction for advanced applications.

Tele-operated Marine Drone Product Landscape

The product landscape for tele-operated marine drones is characterized by rapid innovation, focusing on enhanced modularity, extended endurance, and sophisticated sensor integration. Companies are developing drones with improved hull designs for better stability and maneuverability in diverse sea states. Key technological advancements include the integration of AI-powered navigation systems for semi-autonomous and fully autonomous operations, reducing reliance on constant human input. Furthermore, high-resolution imaging, sonar, and environmental sensing payloads are becoming standard, enabling comprehensive data collection for applications ranging from detailed hydrographic surveys to real-time environmental monitoring. Unique selling propositions often lie in specialized payload capabilities, extended operational range powered by advanced battery or hybrid systems, and robust, weather-resistant designs. The estimated market value of advanced sensor integration in 2025 is 300 million units.

Key Drivers, Barriers & Challenges in Tele-operated Marine Drone

The tele-operated marine drone market is propelled by several key drivers. Technological advancements in AI, sensor technology, and battery life are enhancing drone capabilities and reducing operational costs. Growing demand from defense and security sectors for persistent surveillance and reconnaissance operations, coupled with increasing interest in offshore energy exploration and environmental monitoring, further fuels market expansion. The cost-effectiveness and reduced risk associated with deploying unmanned systems compared to manned vessels are also significant catalysts.

- Key Drivers:

- Advancements in AI and sensor technology.

- Increased demand from defense and security sectors.

- Growing needs in offshore energy and environmental monitoring.

- Cost-effectiveness and reduced operational risk.

Key challenges and restraints include high initial investment costs for sophisticated drone systems and infrastructure, the need for skilled operators and maintenance personnel, and stringent regulatory hurdles in certain regions related to operation in shared waterways and airspace. Supply chain disruptions for specialized components can also impact production timelines. The estimated impact of regulatory hurdles on market entry is approximately 15% in new markets.

- Key Challenges & Restraints:

- High initial investment costs.

- Shortage of skilled personnel.

- Stringent and evolving regulatory frameworks.

- Supply chain complexities for specialized components.

Emerging Opportunities in Tele-operated Marine Drone

Emerging opportunities in the tele-operated marine drone sector are abundant, particularly in the integration of advanced AI for enhanced autonomy and predictive maintenance. The burgeoning aquaculture industry presents a significant untapped market for monitoring fish health, environmental conditions, and site security. Furthermore, the development of specialized drone swarms for complex tasks such as large-scale search and rescue operations or coordinated environmental clean-up efforts is a promising area. Evolving consumer preferences are also leaning towards data-driven insights, creating demand for drones capable of sophisticated real-time data analysis and reporting. The estimated market potential for aquaculture applications by 2030 is 500 million units.

Growth Accelerators in the Tele-operated Marine Drone Industry

Long-term growth in the tele-operated marine drone industry will be significantly accelerated by continued breakthroughs in battery technology, enabling longer flight and operational times, and the development of advanced communication systems that ensure reliable connectivity in remote offshore environments. Strategic partnerships between drone manufacturers, sensor providers, and end-users will foster collaborative innovation and accelerate product development tailored to specific industry needs. Furthermore, market expansion strategies focusing on emerging economies and new application verticals, such as underwater infrastructure inspection and data relay for remote sensing satellites, will unlock substantial growth potential. The increasing adoption of 5G technology is also expected to play a crucial role in enabling enhanced real-time control and data transmission.

Key Players Shaping the Tele-operated Marine Drone Market

- Zonal Isolation

- Deep Ocean Engineering

- Subsea Tech

- Edge Tech

- EvoLogics

- R&D Drone

- Smart Own

- ACSA

- Yunzho Tech

Notable Milestones in Tele-operated Marine Drone Sector

- 2019: Launch of advanced multi-function USV by Subsea Tech, expanding operational capabilities for hydrographic surveys.

- 2020: EvoLogics introduces a new generation of autonomous underwater vehicles (AUVs) with enhanced navigation for deep-sea exploration.

- 2021: Edge Tech showcases a novel AI-driven obstacle avoidance system for marine drones, improving safety in congested waterways.

- 2022: Zonal Isolation secures a significant defense contract for long-endurance patrol drones.

- 2023: Deep Ocean Engineering unveils a modular drone system adaptable for various environmental monitoring tasks.

- 2024 (Early): R&D Drone and Smart Own announce a strategic partnership to integrate advanced communication modules into their drone platforms.

- 2024 (Mid): ACSA and Yunzho Tech collaborate on developing cost-effective tele-operated drones for emerging market applications.

In-Depth Tele-operated Marine Drone Market Outlook

The future outlook for the tele-operated marine drone market is exceptionally bright, fueled by ongoing technological innovation and expanding application horizons. Growth accelerators will continue to be driven by significant advancements in AI for enhanced autonomy, improved battery efficiency for extended mission durations, and the development of robust, secure communication networks. Strategic collaborations between key industry players and research institutions will foster rapid development of specialized solutions. Market expansion will increasingly focus on untapped regions and new verticals, such as precision maritime logistics and underwater resource mapping. The increasing demand for sustainable and efficient maritime operations positions tele-operated marine drones as a critical component of future marine ecosystems, promising sustained growth and market leadership for innovative companies. The total market potential by 2033 is projected to exceed 6,000 million units.

Tele-operated Marine Drone Segmentation

-

1. Application

- 1.1. Marine Patrolling

- 1.2. Hydrographic Survey

- 1.3. Oceanographic Survey

- 1.4. Environmental Measurement

- 1.5. Healthcare

- 1.6. Defense

- 1.7. Entertainment and Media

- 1.8. Other Applications

-

2. Types

- 2.1. Monohull

- 2.2. Catamaran

Tele-operated Marine Drone Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tele-operated Marine Drone REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Marine Patrolling

- 5.1.2. Hydrographic Survey

- 5.1.3. Oceanographic Survey

- 5.1.4. Environmental Measurement

- 5.1.5. Healthcare

- 5.1.6. Defense

- 5.1.7. Entertainment and Media

- 5.1.8. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Monohull

- 5.2.2. Catamaran

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Marine Patrolling

- 6.1.2. Hydrographic Survey

- 6.1.3. Oceanographic Survey

- 6.1.4. Environmental Measurement

- 6.1.5. Healthcare

- 6.1.6. Defense

- 6.1.7. Entertainment and Media

- 6.1.8. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Monohull

- 6.2.2. Catamaran

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Marine Patrolling

- 7.1.2. Hydrographic Survey

- 7.1.3. Oceanographic Survey

- 7.1.4. Environmental Measurement

- 7.1.5. Healthcare

- 7.1.6. Defense

- 7.1.7. Entertainment and Media

- 7.1.8. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Monohull

- 7.2.2. Catamaran

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Marine Patrolling

- 8.1.2. Hydrographic Survey

- 8.1.3. Oceanographic Survey

- 8.1.4. Environmental Measurement

- 8.1.5. Healthcare

- 8.1.6. Defense

- 8.1.7. Entertainment and Media

- 8.1.8. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Monohull

- 8.2.2. Catamaran

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Marine Patrolling

- 9.1.2. Hydrographic Survey

- 9.1.3. Oceanographic Survey

- 9.1.4. Environmental Measurement

- 9.1.5. Healthcare

- 9.1.6. Defense

- 9.1.7. Entertainment and Media

- 9.1.8. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Monohull

- 9.2.2. Catamaran

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tele-operated Marine Drone Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Marine Patrolling

- 10.1.2. Hydrographic Survey

- 10.1.3. Oceanographic Survey

- 10.1.4. Environmental Measurement

- 10.1.5. Healthcare

- 10.1.6. Defense

- 10.1.7. Entertainment and Media

- 10.1.8. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Monohull

- 10.2.2. Catamaran

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zonal Isolation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deep Ocean Engineering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Subsea Tech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Edge Tech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EvoLogics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 R&D Drone

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Smart Own

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ACSA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yunzho Tech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Zonal Isolation

List of Figures

- Figure 1: Global Tele-operated Marine Drone Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tele-operated Marine Drone Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tele-operated Marine Drone Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tele-operated Marine Drone Revenue (million), by Types 2024 & 2032

- Figure 5: North America Tele-operated Marine Drone Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Tele-operated Marine Drone Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tele-operated Marine Drone Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tele-operated Marine Drone Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tele-operated Marine Drone Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tele-operated Marine Drone Revenue (million), by Types 2024 & 2032

- Figure 11: South America Tele-operated Marine Drone Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Tele-operated Marine Drone Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tele-operated Marine Drone Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tele-operated Marine Drone Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tele-operated Marine Drone Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tele-operated Marine Drone Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Tele-operated Marine Drone Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Tele-operated Marine Drone Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tele-operated Marine Drone Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tele-operated Marine Drone Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tele-operated Marine Drone Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tele-operated Marine Drone Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Tele-operated Marine Drone Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Tele-operated Marine Drone Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tele-operated Marine Drone Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tele-operated Marine Drone Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tele-operated Marine Drone Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tele-operated Marine Drone Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Tele-operated Marine Drone Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Tele-operated Marine Drone Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tele-operated Marine Drone Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tele-operated Marine Drone Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Tele-operated Marine Drone Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Tele-operated Marine Drone Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Tele-operated Marine Drone Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Tele-operated Marine Drone Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Tele-operated Marine Drone Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tele-operated Marine Drone Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tele-operated Marine Drone Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Tele-operated Marine Drone Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tele-operated Marine Drone Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tele-operated Marine Drone?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Tele-operated Marine Drone?

Key companies in the market include Zonal Isolation, Deep Ocean Engineering, Subsea Tech, Edge Tech, EvoLogics, R&D Drone, Smart Own, ACSA, Yunzho Tech.

3. What are the main segments of the Tele-operated Marine Drone?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tele-operated Marine Drone," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tele-operated Marine Drone report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tele-operated Marine Drone?

To stay informed about further developments, trends, and reports in the Tele-operated Marine Drone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence