Key Insights

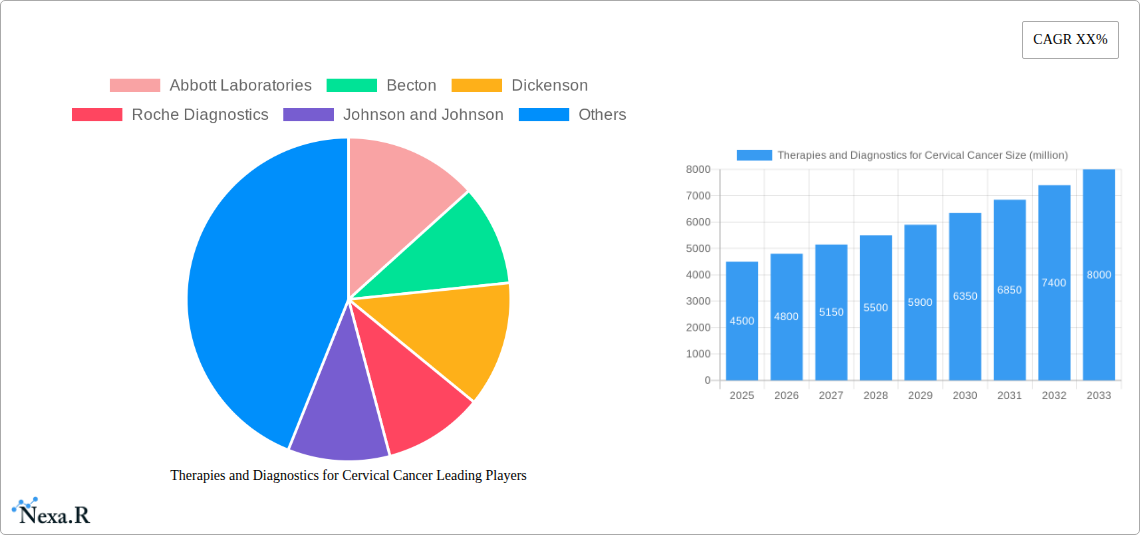

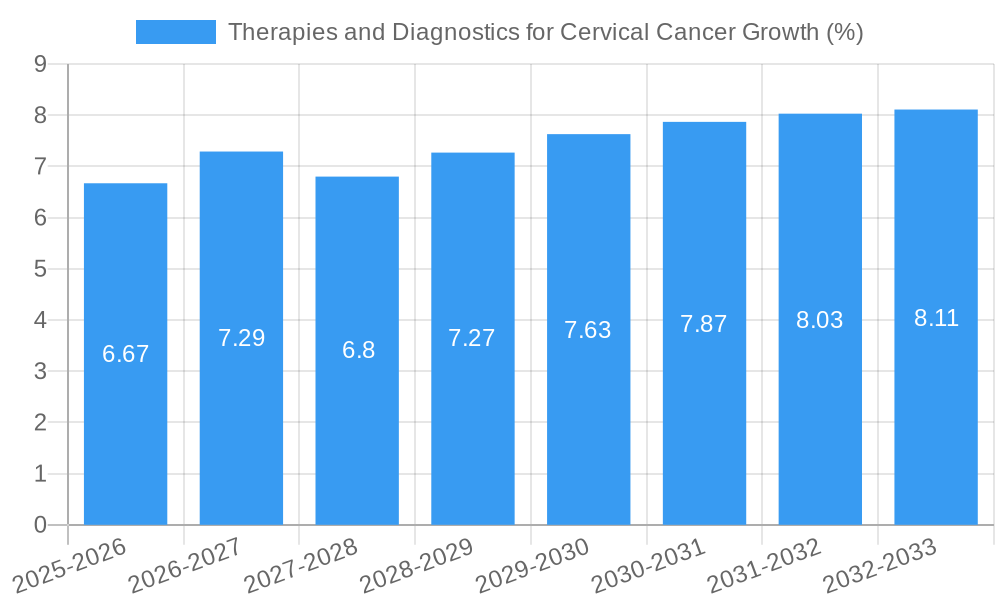

The global market for Therapies and Diagnostics for Cervical Cancer is poised for significant expansion, driven by an increasing global incidence of cervical cancer and a growing emphasis on early detection and preventative measures. The market, valued at an estimated XXX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This robust growth is underpinned by escalating healthcare expenditure, advancements in diagnostic technologies, and the growing adoption of screening programs worldwide. Key drivers include the rising prevalence of HPV infections, a primary cause of cervical cancer, and the subsequent demand for effective diagnostic tools and therapeutic interventions. Furthermore, government initiatives and awareness campaigns aimed at promoting cervical cancer screening are playing a pivotal role in shaping market dynamics. The increasing R&D investments by leading pharmaceutical and diagnostic companies to develop innovative treatments and more accurate diagnostic methods further contribute to market acceleration.

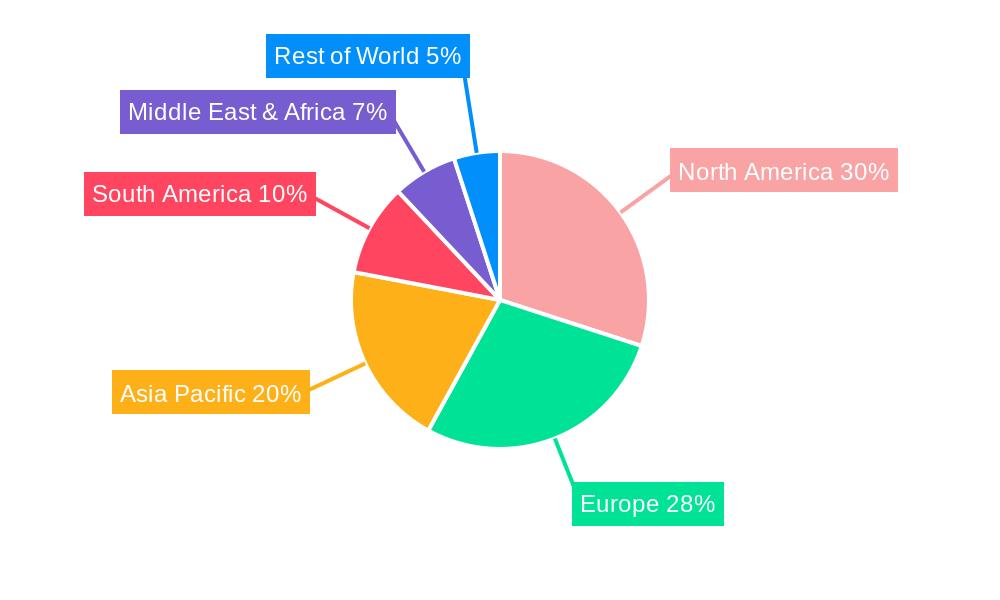

The market segmentation reveals diverse opportunities across various applications and types of diagnostic and therapeutic procedures. Drug manufacturers, hospitals, and research institutions represent substantial application segments, reflecting the comprehensive healthcare ecosystem involved in managing cervical cancer. On the diagnostic front, Pap smear tests and colposcopy remain foundational, while the increasing sophistication of diagnostic techniques is anticipated to boost the adoption of more advanced methods. The therapeutic landscape is also evolving with novel drug development and improved treatment protocols. Geographically, North America and Europe are expected to dominate the market due to well-established healthcare infrastructures and high screening rates. However, the Asia Pacific region is anticipated to exhibit the fastest growth, fueled by increasing awareness, expanding healthcare access, and rising disposable incomes. Despite the positive outlook, market restraints such as the cost of advanced diagnostics and therapies, along with disparities in healthcare access in certain regions, warrant strategic consideration for market players aiming for widespread impact.

This comprehensive report provides an in-depth analysis of the global Therapies and Diagnostics for Cervical Cancer market. It delves into the intricate dynamics, growth trajectories, and future potential of this vital healthcare sector. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers a data-driven perspective on market evolution, technological advancements, and strategic imperatives.

Therapies and Diagnostics for Cervical Cancer Market Dynamics & Structure

The cervical cancer diagnostics market is characterized by a moderate to high market concentration, with key players like Roche Diagnostics, Abbott Laboratories, and Becton, Dickinson and Company holding significant shares. Technological innovation serves as a primary driver, with advancements in HPV testing, liquid-based cytology, and molecular diagnostics significantly improving early detection rates. The evolving regulatory frameworks, particularly the increasing emphasis on screening guidelines by organizations like the WHO and CDC, are shaping market access and demand. Competitive product substitutes, while limited in terms of direct replacements for established diagnostic methods, exist in the form of emerging AI-powered imaging analysis and next-generation sequencing technologies. End-user demographics are shifting towards a greater awareness of preventive healthcare, driving demand for accessible and accurate screening tools. Merger and acquisition (M&A) trends indicate strategic consolidation, with larger entities acquiring innovative startups to expand their portfolios and technological capabilities. For instance, recent M&A activities in the diagnostic sector have focused on companies with proprietary AI algorithms for pathology analysis, reflecting a strong trend towards integrating advanced digital solutions.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Technological Innovation Drivers: Advanced HPV genotyping, liquid-based cytology, multiplex assays, and AI in diagnostics.

- Regulatory Frameworks: Stringent but supportive of evidence-based advancements and screening mandates.

- Competitive Product Substitutes: Emerging AI-powered analysis, advanced sequencing, and novel biomarker identification.

- End-User Demographics: Growing awareness, demand for personalized medicine, and increased focus on preventive healthcare.

- M&A Trends: Strategic acquisitions of innovative technologies and companies with strong market presence.

Therapies and Diagnostics for Cervical Cancer Growth Trends & Insights

The global market for cervical cancer therapies and diagnostics is projected to witness robust growth, driven by escalating incidences of cervical cancer, particularly in low and middle-income countries, and a growing emphasis on early detection and preventive measures. The market size is anticipated to expand significantly, fueled by the increasing adoption of advanced diagnostic technologies like HPV testing and molecular diagnostics. These methods offer higher sensitivity and specificity compared to traditional Pap smear tests, leading to earlier and more accurate diagnoses. The market penetration of these advanced diagnostics is steadily increasing as healthcare infrastructure improves and screening programs become more widespread. Technological disruptions, including the development of point-of-care diagnostics and the integration of artificial intelligence (AI) in image analysis and risk stratification, are poised to further revolutionize the market. Consumer behavior is shifting towards a more proactive approach to health, with individuals increasingly seeking regular screening and personalized treatment options. The CAGR is estimated to be in the range of 7-9% over the forecast period. The adoption of HPV vaccination programs globally is a significant long-term factor that, while potentially reducing the incidence of cervical cancer, also stimulates the demand for continued screening and diagnosis of existing cases or other HPV-related conditions. The increasing focus on precision medicine, tailoring therapies based on the molecular profile of the tumor, will also contribute to market expansion. The introduction of novel immunotherapies and targeted drug delivery systems represents another significant growth driver in the therapeutic segment of the market. The estimated market size for therapies and diagnostics for cervical cancer is projected to reach approximately $15,000 million by 2025, with significant growth expected in the coming years.

Dominant Regions, Countries, or Segments in Therapies and Diagnostics for Cervical Cancer

North America and Europe currently dominate the cervical cancer therapies and diagnostics market, primarily due to well-established healthcare infrastructure, high adoption rates of advanced diagnostic technologies, and extensive government-backed screening programs. Countries like the United States and Germany are at the forefront, driven by significant investments in healthcare research and development and the presence of major market players. The Application segment of Hospitals and Clinics represents the largest share, accounting for approximately 45% of the market. These institutions are the primary sites for screening, diagnosis, and treatment of cervical cancer, and they are increasingly investing in state-of-the-art diagnostic equipment and therapeutic agents. Drug Manufacturers also constitute a substantial segment, with their focus on developing innovative chemotherapy, targeted therapy, and immunotherapy drugs for cervical cancer treatment. The Types segment of Pap Smear Tests historically held the largest market share but is gradually being complemented and, in some cases, superseded by more advanced diagnostics like HPV testing. However, Pap smears remain a cornerstone of screening programs, especially in resource-limited settings, due to their cost-effectiveness. Colposcopy Tests play a crucial role in further investigation following abnormal Pap smears or HPV detection, contributing significantly to the diagnostic workflow. The ECC Procedure (Endocervical Curettage) is primarily used for diagnostic confirmation and staging of cervical cancer. Emerging markets in Asia-Pacific, particularly China and India, are exhibiting rapid growth due to increasing awareness, expanding healthcare access, and a rising burden of cervical cancer. Government initiatives to improve cancer screening coverage and a growing number of private diagnostic centers are key drivers in these regions. The market share for North America is estimated at 35%, followed by Europe at 30%. The Asia-Pacific region is projected to experience the highest CAGR of approximately 9-11% over the forecast period.

- Dominant Regions: North America and Europe, with significant contributions from Asia-Pacific.

- Key Countries: United States, Germany, United Kingdom, China, India.

- Dominant Application Segment: Hospitals and Clinics (approx. 45% market share).

- Leading Diagnostic Type: HPV Testing and Pap Smear Tests are crucial, with HPV testing showing higher growth.

- Growth Drivers in Emerging Markets: Increased awareness, expanding healthcare infrastructure, and government initiatives.

Therapies and Diagnostics for Cervical Cancer Product Landscape

The product landscape for cervical cancer therapies and diagnostics is characterized by continuous innovation and a growing array of sophisticated tools. In diagnostics, advancements include highly sensitive HPV DNA and mRNA tests for persistent infection detection, as well as multiplex PCR assays capable of identifying multiple high-risk HPV genotypes simultaneously. Liquid-based cytology (LBC) has largely replaced conventional Pap smears, offering improved sample quality and enabling co-testing with HPV. The therapeutic landscape is evolving with the introduction of targeted therapies that act on specific molecular pathways involved in cancer growth, alongside advancements in immunotherapy, such as checkpoint inhibitors, which harness the patient's immune system to fight cancer.

Key Drivers, Barriers & Challenges in Therapies and Diagnostics for Cervical Cancer

Key Drivers:

- Rising Incidence and Mortality: The persistent global burden of cervical cancer necessitates advanced diagnostic and therapeutic solutions.

- Technological Advancements: Innovations in HPV testing, molecular diagnostics, and targeted therapies are enhancing accuracy and efficacy.

- Government Initiatives and Awareness Campaigns: Increased screening mandates and public health campaigns are driving demand for diagnostic services.

- Growing Healthcare Expenditure: Rising investments in healthcare infrastructure, particularly in developing nations, are expanding market reach.

Barriers & Challenges:

- Cost of Advanced Diagnostics and Therapies: High prices can limit accessibility, especially in resource-constrained settings.

- Limited Infrastructure and Skilled Personnel: Insufficient healthcare facilities and trained professionals in some regions hinder widespread adoption.

- Patient Compliance and Awareness Gaps: Varying levels of patient engagement in screening and treatment adherence.

- Regulatory Hurdles: Lengthy approval processes for new diagnostic tests and therapeutic agents.

- Competition from Established Players: Intense competition among major companies can affect market dynamics and pricing.

Emerging Opportunities in Therapies and Diagnostics for Cervical Cancer

Emerging opportunities lie in the development of point-of-care diagnostic devices for cervical cancer screening, enabling rapid testing in primary care settings and remote areas. The integration of artificial intelligence (AI) and machine learning for automated analysis of Pap smears and colposcopy images presents a significant opportunity to improve diagnostic accuracy and efficiency. Furthermore, the exploration of novel biomarkers beyond HPV for early detection and risk stratification, as well as the advancement of personalized therapeutic approaches based on tumor genomics, hold immense potential for market expansion and improved patient outcomes. The growing focus on HPV vaccination programs also creates an opportunity for complementary diagnostic tools to monitor vaccine effectiveness and detect breakthrough infections.

Growth Accelerators in the Therapies and Diagnostics for Cervical Cancer Industry

Growth accelerators in the therapies and diagnostics for cervical cancer industry are primarily driven by the continuous push for early detection and prevention. The increasing adoption of high-risk HPV testing as a primary screening method, often in conjunction with cytology (co-testing), is a significant catalyst. Technological breakthroughs in molecular diagnostics, enabling faster and more accurate detection of oncogenic HPV strains, are also propelling market growth. Strategic partnerships between diagnostic manufacturers, pharmaceutical companies, and healthcare providers are facilitating wider access to innovative solutions and treatment protocols. Furthermore, the growing emphasis on precision medicine and the development of targeted therapies based on specific genetic mutations of cervical cancer cells are creating new avenues for growth and improved therapeutic efficacy. The market is also benefiting from increased government funding for cancer research and public health programs aimed at reducing cervical cancer incidence and mortality.

Key Players Shaping the Therapies and Diagnostics for Cervical Cancer Market

- Abbott Laboratories

- Becton, Dickinson and Company

- Roche Diagnostics

- Johnson and Johnson

- Merck

- Pfizer

- Bristol-Myers Squibb

- Digene

- Dendreon

- SANOFI

Notable Milestones in Therapies and Diagnostics for Cervical Cancer Sector

- 2020: FDA approval of new HPV tests with enhanced genotyping capabilities.

- 2021: Launch of novel immunotherapy treatments demonstrating significant efficacy in advanced cervical cancer.

- 2022: Increased adoption of AI-powered algorithms for cervical cytology analysis in leading research institutions.

- 2023: Expansion of HPV vaccination programs globally, impacting future screening needs and therapeutic demand.

- 2024: Introduction of liquid biopsy techniques for potential non-invasive diagnosis and monitoring of cervical cancer.

In-Depth Therapies and Diagnostics for Cervical Cancer Market Outlook

- 2020: FDA approval of new HPV tests with enhanced genotyping capabilities.

- 2021: Launch of novel immunotherapy treatments demonstrating significant efficacy in advanced cervical cancer.

- 2022: Increased adoption of AI-powered algorithms for cervical cytology analysis in leading research institutions.

- 2023: Expansion of HPV vaccination programs globally, impacting future screening needs and therapeutic demand.

- 2024: Introduction of liquid biopsy techniques for potential non-invasive diagnosis and monitoring of cervical cancer.

In-Depth Therapies and Diagnostics for Cervical Cancer Market Outlook

The future of the therapies and diagnostics for cervical cancer market is exceptionally promising, driven by sustained innovation and a global commitment to eradicating this preventable disease. Growth accelerators will continue to be fueled by the increasing integration of advanced molecular diagnostics, including rapid HPV testing and the exploration of novel biomarkers. The therapeutic landscape will witness further evolution with the development of more sophisticated targeted therapies and immunotherapies, offering improved patient outcomes and reduced side effects. Strategic collaborations and strategic market expansion into underserved regions will be critical for sustained growth. The continued focus on preventive strategies, including robust vaccination programs and accessible screening, will shape the long-term trajectory of the market, creating a dynamic and evolving environment for stakeholders.

Therapies and Diagnostics for Cervical Cancer Segmentation

-

1. Application

- 1.1. Drug Manufacturers

- 1.2. Hospitals and Clinics

- 1.3. Private and Government Research Institutes

- 1.4. Academic Institutes

-

2. Types

- 2.1. Pap Smear Tests

- 2.2. Colposcopy Tests

- 2.3. ECC Procedure

Therapies and Diagnostics for Cervical Cancer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Therapies and Diagnostics for Cervical Cancer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug Manufacturers

- 5.1.2. Hospitals and Clinics

- 5.1.3. Private and Government Research Institutes

- 5.1.4. Academic Institutes

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pap Smear Tests

- 5.2.2. Colposcopy Tests

- 5.2.3. ECC Procedure

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug Manufacturers

- 6.1.2. Hospitals and Clinics

- 6.1.3. Private and Government Research Institutes

- 6.1.4. Academic Institutes

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pap Smear Tests

- 6.2.2. Colposcopy Tests

- 6.2.3. ECC Procedure

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug Manufacturers

- 7.1.2. Hospitals and Clinics

- 7.1.3. Private and Government Research Institutes

- 7.1.4. Academic Institutes

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pap Smear Tests

- 7.2.2. Colposcopy Tests

- 7.2.3. ECC Procedure

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug Manufacturers

- 8.1.2. Hospitals and Clinics

- 8.1.3. Private and Government Research Institutes

- 8.1.4. Academic Institutes

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pap Smear Tests

- 8.2.2. Colposcopy Tests

- 8.2.3. ECC Procedure

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug Manufacturers

- 9.1.2. Hospitals and Clinics

- 9.1.3. Private and Government Research Institutes

- 9.1.4. Academic Institutes

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pap Smear Tests

- 9.2.2. Colposcopy Tests

- 9.2.3. ECC Procedure

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Therapies and Diagnostics for Cervical Cancer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug Manufacturers

- 10.1.2. Hospitals and Clinics

- 10.1.3. Private and Government Research Institutes

- 10.1.4. Academic Institutes

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pap Smear Tests

- 10.2.2. Colposcopy Tests

- 10.2.3. ECC Procedure

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abbott Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dickenson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Roche Diagnostics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson and Johnson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pfizer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bristol-Myers Squibb

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Digene

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dendreon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SANOFI

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Abbott Laboratories

List of Figures

- Figure 1: Global Therapies and Diagnostics for Cervical Cancer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Types 2024 & 2032

- Figure 5: North America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Types 2024 & 2032

- Figure 11: South America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Therapies and Diagnostics for Cervical Cancer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Therapies and Diagnostics for Cervical Cancer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Therapies and Diagnostics for Cervical Cancer Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Therapies and Diagnostics for Cervical Cancer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Therapies and Diagnostics for Cervical Cancer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Therapies and Diagnostics for Cervical Cancer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Therapies and Diagnostics for Cervical Cancer?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Therapies and Diagnostics for Cervical Cancer?

Key companies in the market include Abbott Laboratories, Becton, Dickenson, Roche Diagnostics, Johnson and Johnson, Merck, Pfizer, Bristol-Myers Squibb, Digene, Dendreon, SANOFI.

3. What are the main segments of the Therapies and Diagnostics for Cervical Cancer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Therapies and Diagnostics for Cervical Cancer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Therapies and Diagnostics for Cervical Cancer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Therapies and Diagnostics for Cervical Cancer?

To stay informed about further developments, trends, and reports in the Therapies and Diagnostics for Cervical Cancer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence