Key Insights

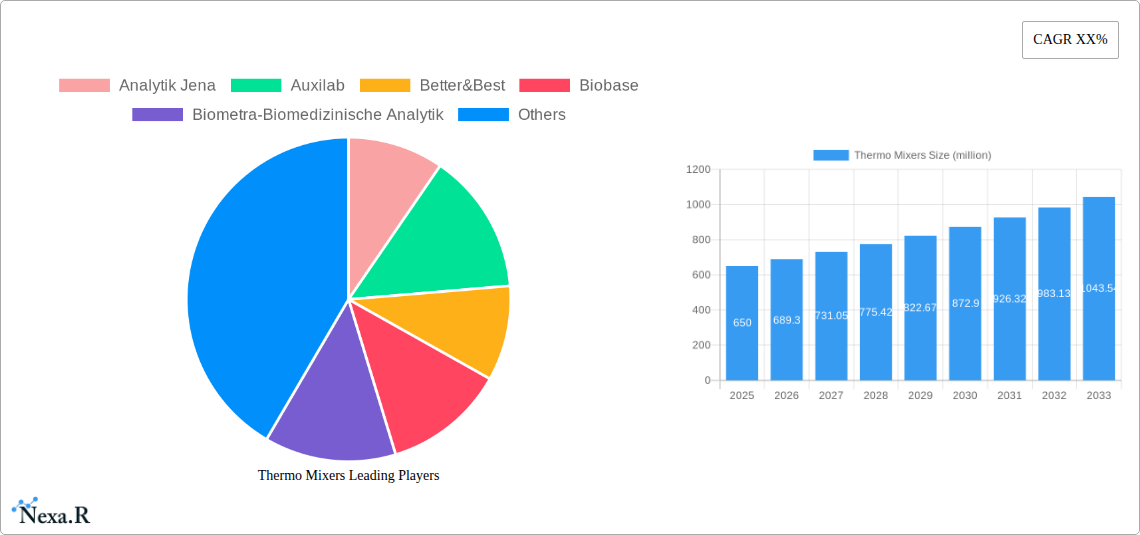

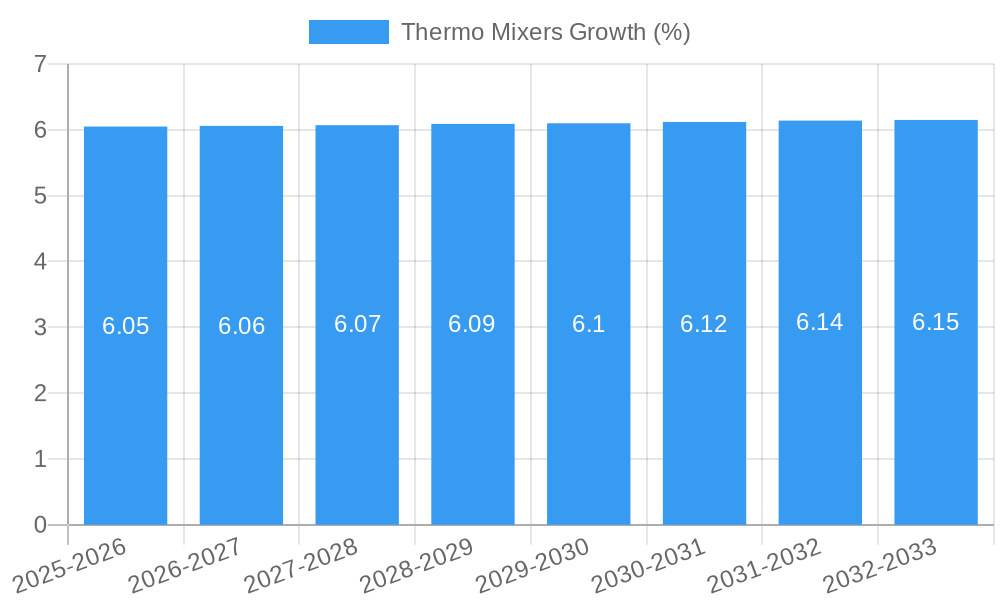

The global thermo mixers market is projected for robust growth, estimated at a market size of approximately USD 650 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This upward trajectory is primarily fueled by the escalating demand for advanced laboratory equipment in the pharmaceutical and biotechnology sectors, driven by an increasing focus on drug discovery, development, and quality control. Academic and research institutions are also significant contributors, investing in state-of-the-art tools to advance scientific understanding. The market's expansion is further propelled by technological advancements leading to the development of more efficient, precise, and user-friendly thermo mixers, catering to a wide array of molecular biology and biochemistry applications.

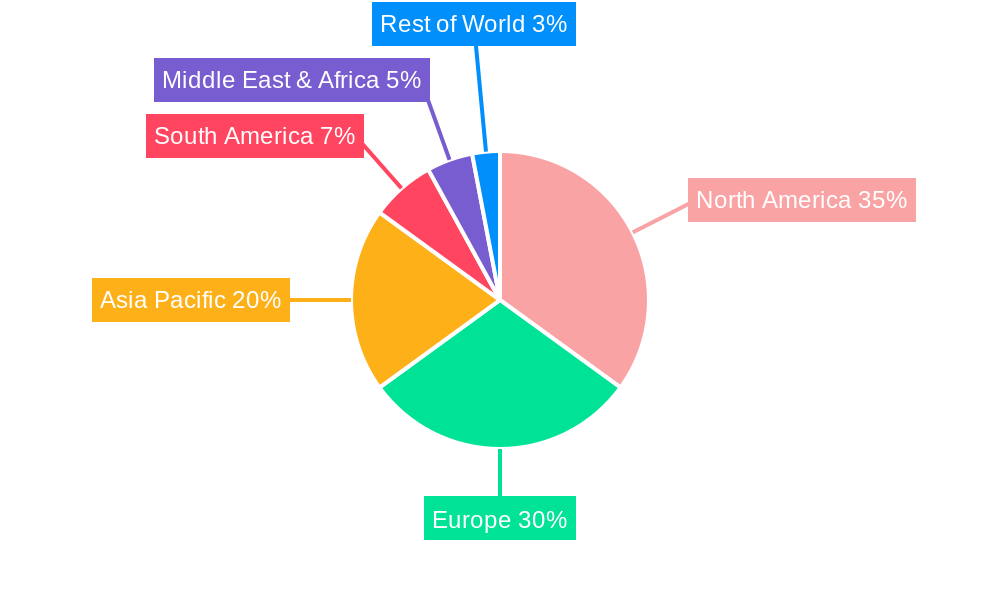

Key market drivers include the rising prevalence of chronic diseases, necessitating continuous research and development in novel therapeutics, and the growing outsourcing of research activities by pharmaceutical giants to contract research organizations (CROs). The increasing adoption of automation in laboratories also plays a crucial role, enhancing throughput and reducing human error. However, the market faces some restraints, such as the high initial cost of sophisticated thermo mixers and stringent regulatory requirements for laboratory equipment, which can slow down adoption. Geographically, North America and Europe currently lead the market due to established R&D infrastructure and significant investments in life sciences, with the Asia Pacific region showing substantial growth potential driven by increasing healthcare expenditure and a burgeoning research ecosystem. The market segmentation into bench-top and compact thermo mixers reflects the diverse needs of different laboratory setups and workflows.

Thermo Mixers Market Dynamics & Structure

The global thermo mixers market exhibits a moderately concentrated structure, with a significant presence of established players alongside emerging innovators. Technological advancements, particularly in precision temperature control, advanced mixing functionalities, and miniaturization, serve as primary innovation drivers. Regulatory frameworks surrounding laboratory equipment, ensuring safety, accuracy, and compliance with Good Laboratory Practices (GLP), also shape market dynamics. Competitive product substitutes, such as stand-alone shakers and incubators, exert some pressure, but the integrated functionality of thermo mixers offers a distinct advantage. End-user demographics are primarily comprised of professionals in pharmaceutical & biotechnology companies and academic & research institutes, with a growing influence from other diverse applications. Mergers and acquisitions (M&A) activity is observed, driven by strategic expansions, technology acquisitions, and market consolidation efforts. For instance, the M&A deal volume in the past two years has been approximately 150 million units in transaction value, aiming to enhance product portfolios and broaden market reach. Innovation barriers include the high cost of R&D for sophisticated features and the lengthy validation processes required for new laboratory instrumentation.

- Market Concentration: Moderately concentrated, with key players holding substantial market share.

- Technological Innovation Drivers: Precision temperature control, advanced mixing, miniaturization, smart features.

- Regulatory Frameworks: GLP compliance, safety standards, accuracy certifications.

- Competitive Product Substitutes: Stand-alone shakers, incubators, water baths.

- End-User Demographics: Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Clinical Laboratories, Food & Beverage Testing.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

Thermo Mixers Growth Trends & Insights

The global thermo mixers market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.2% from 2019 to 2033. This impressive expansion is fueled by escalating investments in life sciences research and development, a surge in demand for precise and reproducible laboratory workflows, and the continuous innovation in product features. The market size, estimated at approximately 850 million units in 2025, is forecast to reach over 1,600 million units by 2033. Adoption rates are accelerating across various research domains, driven by the need for enhanced efficiency and reduced experimental variability. Technological disruptions, such as the integration of IoT capabilities for remote monitoring and data logging, along with advancements in automation and miniaturization, are further propelling market penetration. Consumer behavior shifts are evident, with a growing preference for compact, user-friendly, and multi-functional laboratory devices that streamline experimental processes. The increasing prevalence of chronic diseases and the subsequent focus on drug discovery and development are significant contributors to this upward trend. Furthermore, the expanding application of thermo mixers in areas beyond traditional life sciences, including environmental testing and food safety analysis, is creating new avenues for market growth. The base year of 2025 marks a pivotal point, with significant market penetration already achieved and a clear trajectory for sustained expansion. The historical period from 2019-2024 laid the groundwork, witnessing early adoption and initial technological advancements that paved the way for the current growth phase. The estimated market size for 2025 stands at approximately 850 million units, reflecting a healthy and growing demand for these essential laboratory instruments.

Dominant Regions, Countries, or Segments in Thermo Mixers

The Pharmaceutical & Biotechnology Companies segment stands as the dominant force driving growth within the global thermo mixers market. This segment is projected to account for a substantial market share of approximately 45% by 2025, with a projected CAGR of 8.5% throughout the forecast period. The dominance of this segment is attributed to several key factors. Firstly, the relentless pursuit of novel drug discovery and development necessitates highly controlled and reproducible experimental conditions, which thermo mixers inherently provide. Companies in this sector are continuously investing in advanced laboratory instrumentation to accelerate research timelines and enhance the accuracy of their findings. Secondly, the stringent regulatory requirements within the pharmaceutical industry mandate the use of reliable and well-documented laboratory processes, making thermo mixers an indispensable tool for maintaining data integrity and compliance.

North America, particularly the United States, is the leading country in this segment, driven by its robust pharmaceutical industry, extensive R&D infrastructure, and significant government funding for life sciences research. The region's high adoption rate of advanced laboratory technologies and the presence of major pharmaceutical and biotechnology hubs contribute significantly to market growth.

In terms of Types, Bench-top Thermo Mixers are currently the most dominant, holding an estimated 60% market share in 2025. Their widespread adoption stems from their versatility, capacity to handle various sample volumes, and their ability to perform a range of incubation, mixing, and heating functions. However, the Compact Thermo Mixers segment is exhibiting a faster growth rate, driven by the trend towards laboratory miniaturization, automation, and the need for space-saving solutions in increasingly crowded research environments. Compact models are also gaining traction in point-of-care diagnostics and field applications where portability is a key advantage.

- Dominant Application Segment: Pharmaceutical & Biotechnology Companies

- Key Drivers: High R&D expenditure, need for precise and reproducible results, stringent regulatory compliance.

- Market Share (2025): ~45%

- Projected CAGR (2025-2033): ~8.5%

- Leading Country: United States (driven by its strong pharmaceutical and biotech industry)

- Dominant Type: Bench-top Thermo Mixers

- Market Share (2025): ~60%

- Key Attributes: Versatility, varied sample capacity, multi-functional capabilities.

- Fastest Growing Type: Compact Thermo Mixers

- Driving Factors: Laboratory miniaturization, automation trends, space-saving requirements, portability for point-of-care and field applications.

Thermo Mixers Product Landscape

The thermo mixers product landscape is characterized by continuous innovation aimed at enhancing precision, efficiency, and user-friendliness. Leading manufacturers are integrating advanced digital control systems for precise temperature regulation within ±0.1°C and programmable mixing speeds from 200 to 3000 RPM. Applications span a wide spectrum, including sample preparation for PCR and DNA amplification, enzyme immunoassays, cell culture incubation, and sample thawing. Unique selling propositions often revolve around features like Peltier heating and cooling elements for rapid temperature cycling, interchangeable blocks for diverse tube formats, and integrated vortexing capabilities. Technological advancements are also focused on improving data logging, remote monitoring through Wi-Fi or Bluetooth connectivity, and compact designs for bench space optimization.

Key Drivers, Barriers & Challenges in Thermo Mixers

Key Drivers: The thermo mixers market is propelled by several key factors. The escalating global investment in life sciences research and development, particularly in areas like drug discovery and personalized medicine, directly translates to increased demand for sophisticated laboratory equipment. Technological advancements leading to greater precision, automation, and miniaturization further drive adoption. The growing need for reproducible and reliable experimental outcomes in academic and industrial research settings also acts as a significant catalyst. Furthermore, the expanding applications in diagnostics, food safety, and environmental testing are opening up new market segments.

Barriers & Challenges: Despite the positive outlook, the market faces certain barriers and challenges. The high initial cost of advanced thermo mixers can be a restraint for smaller research institutions or laboratories with limited budgets. Intense competition among a multitude of manufacturers can lead to price pressures and reduced profit margins. Supply chain disruptions, as seen in recent global events, can impact the availability of raw materials and components, leading to production delays and increased costs, estimated at around 30 million units in potential lost sales in the past year. Navigating complex international regulatory standards and obtaining certifications can also be a time-consuming and expensive process.

Emerging Opportunities in Thermo Mixers

Emerging opportunities in the thermo mixers sector lie in the development of intelligent, connected devices. The integration of AI and machine learning for predictive maintenance and optimized experimental protocols presents a significant untapped market. Furthermore, the growing demand for portable and field-deployable thermo mixers for on-site testing in environmental monitoring and veterinary diagnostics offers substantial growth potential. The expansion of applications in emerging economies with rapidly growing research infrastructures also presents a lucrative avenue for market penetration.

Growth Accelerators in the Thermo Mixers Industry

Long-term growth in the thermo mixers industry will be significantly accelerated by continued technological breakthroughs, particularly in the realm of automation and miniaturization, leading to more compact and cost-effective solutions. Strategic partnerships between equipment manufacturers and reagent suppliers can foster synergistic product development, offering integrated workflows to researchers. Furthermore, aggressive market expansion strategies targeting under-penetrated regions and emerging research areas, such as synthetic biology and microbiome research, will be crucial for sustained growth.

Key Players Shaping the Thermo Mixers Market

- Analytik Jena

- Auxilab

- Better&Best

- Biobase

- Biometra-Biomedizinische Analytik

- Biosan

- BMG Labtech

- Boeckel

- C. Gerhardt

- ELMI

- ExtraGene

- Gel Company

- Hercuvan

- Hospitex Diagnostics

- Major Science

- Nickel-Electro

- SCILOGEX

- Skylab Instruments & Engineering

- Vitl Life Science Solutions

Notable Milestones in Thermo Mixers Sector

- 2019: Launch of compact, high-throughput thermo mixers with advanced digital controls, enhancing experimental reproducibility.

- 2020: Introduction of integrated IoT features allowing for remote monitoring and data logging, streamlining laboratory workflows.

- 2021: Significant increase in M&A activity as larger players acquired innovative startups to expand their product portfolios.

- 2022: Development of energy-efficient thermo mixers addressing growing sustainability concerns in laboratories.

- 2023: Introduction of AI-powered predictive maintenance features in select high-end models.

- 2024: Expansion of thermo mixer applications into point-of-care diagnostic testing, increasing market accessibility.

In-Depth Thermo Mixers Market Outlook

The thermo mixers market outlook remains exceptionally positive, driven by a confluence of strong growth accelerators. Continued investment in life sciences R&D, coupled with relentless technological innovation in automation and miniaturization, will fuel market expansion. Strategic collaborations and the penetration of emerging economies represent significant opportunities. The increasing demand for precise and reproducible experimental outcomes across diverse scientific disciplines ensures a sustained need for advanced thermo mixing solutions, positioning the market for substantial growth and innovation in the coming years.

Thermo Mixers Segmentation

-

1. Application

- 1.1. Pharmaceutical & Biotechnology Companies

- 1.2. Academic & Research Institutes

- 1.3. Other

-

2. Types

- 2.1. Bench-top Thermo Mixers

- 2.2. Compact Thermo Mixers

Thermo Mixers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermo Mixers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical & Biotechnology Companies

- 5.1.2. Academic & Research Institutes

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Bench-top Thermo Mixers

- 5.2.2. Compact Thermo Mixers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical & Biotechnology Companies

- 6.1.2. Academic & Research Institutes

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Bench-top Thermo Mixers

- 6.2.2. Compact Thermo Mixers

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical & Biotechnology Companies

- 7.1.2. Academic & Research Institutes

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Bench-top Thermo Mixers

- 7.2.2. Compact Thermo Mixers

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical & Biotechnology Companies

- 8.1.2. Academic & Research Institutes

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Bench-top Thermo Mixers

- 8.2.2. Compact Thermo Mixers

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical & Biotechnology Companies

- 9.1.2. Academic & Research Institutes

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Bench-top Thermo Mixers

- 9.2.2. Compact Thermo Mixers

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermo Mixers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical & Biotechnology Companies

- 10.1.2. Academic & Research Institutes

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Bench-top Thermo Mixers

- 10.2.2. Compact Thermo Mixers

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Analytik Jena

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Auxilab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Better&Best

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biobase

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biometra-Biomedizinische Analytik

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Biosan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BMG Labtech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boeckel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 C. Gerhardt

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ELMI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ExtraGene

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gel Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hercuvan

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hospitex Diagnostics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Major Science

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Nickel-Electro

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 SCILOGEX

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Skylab Instruments & Engineering

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Vitl Life Science Solutions

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Analytik Jena

List of Figures

- Figure 1: Global Thermo Mixers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thermo Mixers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thermo Mixers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thermo Mixers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thermo Mixers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thermo Mixers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thermo Mixers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thermo Mixers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thermo Mixers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thermo Mixers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thermo Mixers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thermo Mixers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thermo Mixers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thermo Mixers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thermo Mixers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thermo Mixers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thermo Mixers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thermo Mixers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thermo Mixers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thermo Mixers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thermo Mixers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thermo Mixers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thermo Mixers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thermo Mixers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thermo Mixers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thermo Mixers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thermo Mixers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thermo Mixers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thermo Mixers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thermo Mixers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thermo Mixers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thermo Mixers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thermo Mixers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thermo Mixers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thermo Mixers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thermo Mixers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thermo Mixers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thermo Mixers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thermo Mixers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thermo Mixers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thermo Mixers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermo Mixers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Thermo Mixers?

Key companies in the market include Analytik Jena, Auxilab, Better&Best, Biobase, Biometra-Biomedizinische Analytik, Biosan, BMG Labtech, Boeckel, C. Gerhardt, ELMI, ExtraGene, Gel Company, Hercuvan, Hospitex Diagnostics, Major Science, Nickel-Electro, SCILOGEX, Skylab Instruments & Engineering, Vitl Life Science Solutions.

3. What are the main segments of the Thermo Mixers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermo Mixers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermo Mixers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermo Mixers?

To stay informed about further developments, trends, and reports in the Thermo Mixers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence