Key Insights

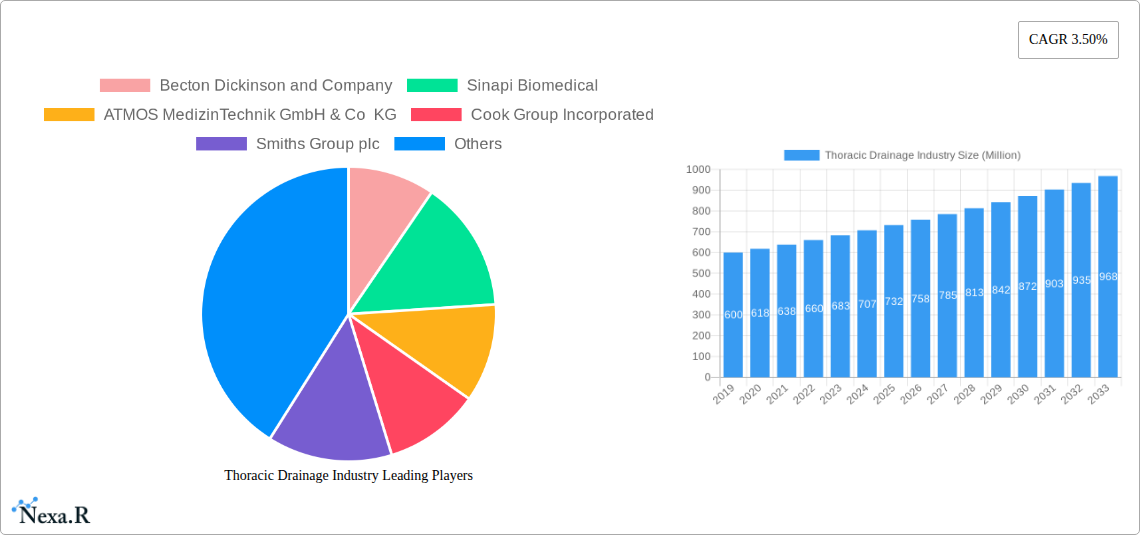

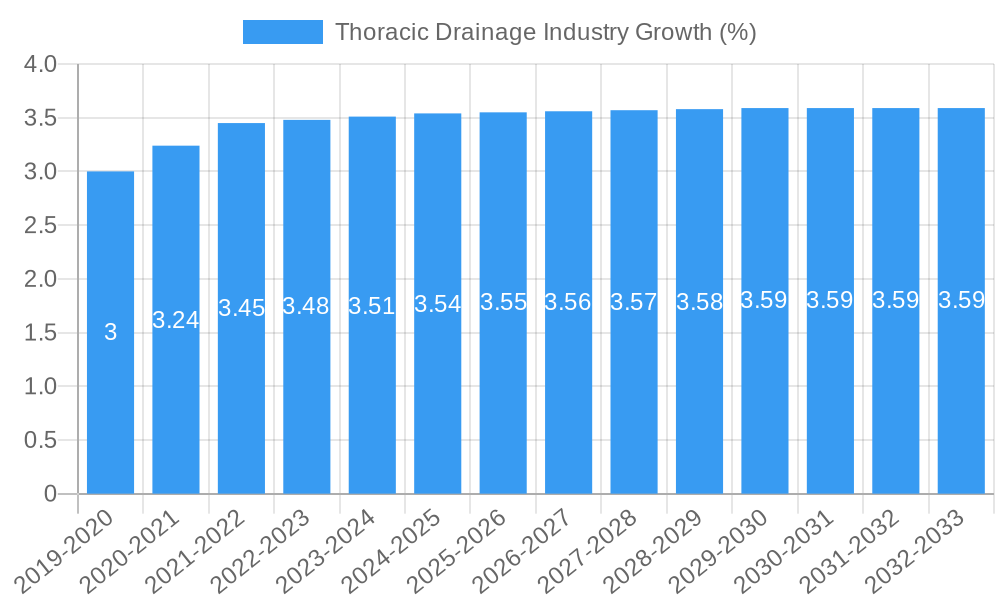

The global Thoracic Drainage market is poised for significant expansion, projected to reach a substantial XX million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 3.50%. This growth is primarily fueled by the increasing incidence of respiratory diseases, a rising volume of thoracic surgeries, and advancements in minimally invasive procedures. The growing elderly population, more susceptible to conditions requiring thoracic drainage, further bolsters market demand. Technological innovations, such as the development of advanced drainage systems with enhanced safety features and improved patient comfort, are also key growth enablers. Furthermore, the expanding healthcare infrastructure, particularly in emerging economies, and increasing awareness regarding the efficacy of thoracic drainage procedures contribute to this upward trajectory.

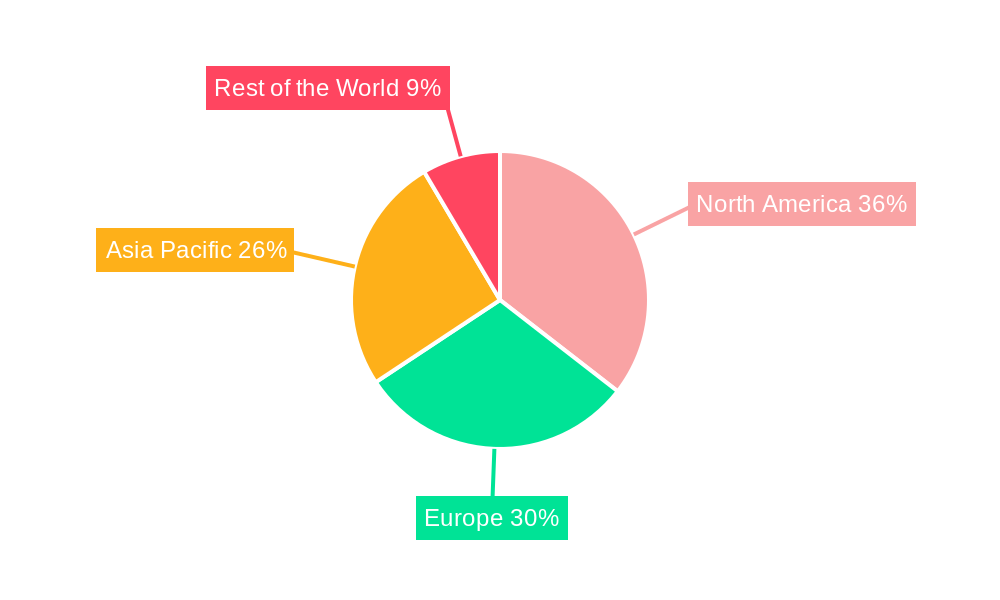

The market segmentation reveals a dynamic landscape. The "Thoracic Drainage Systems" and "Thoracic Drainage Kits" segments are anticipated to dominate, reflecting their essential role in patient care. "Pleural Drainage Catheters" and "Trocar Drains" are also expected to witness steady growth due to their specialized applications. In terms of application, "Cardiac Surgery" and "Oncology & Pain Management" are leading segments, driven by the high prevalence of cardiovascular diseases and cancer. "Thoracic Surgery & Pulmonology" and "General Intensive Care Emergency Medicine" also represent substantial market shares. Hospitals & Clinics are the primary end-users, leveraging these devices in critical care settings and surgical interventions. Geographically, North America and Europe currently hold significant market shares, owing to advanced healthcare facilities and high adoption rates of new technologies. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by increasing healthcare expenditure, a large patient pool, and improving access to medical devices.

Thoracic Drainage Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides an unparalleled analysis of the global Thoracic Drainage industry, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to navigate and capitalize on this rapidly evolving market. We meticulously examine parent and child market segments, providing quantitative data in million units for actionable intelligence.

Thoracic Drainage Industry Market Dynamics & Structure

The global Thoracic Drainage industry exhibits a moderately concentrated market structure, characterized by a blend of established multinational corporations and specialized regional players. Technological innovation is a primary driver, fueled by advancements in minimally invasive techniques and digital monitoring systems designed to improve patient outcomes and reduce healthcare burdens. Stringent regulatory frameworks, primarily governed by bodies like the FDA and EMA, ensure product safety and efficacy, acting as both a barrier to entry for new entrants and a quality assurance for existing ones. Competitive product substitutes, while present in the form of alternative drainage methods, are increasingly being outperformed by sophisticated thoracic drainage solutions. End-user demographics are shifting, with an aging global population and rising incidence of respiratory and cardiac conditions bolstering demand. Mergers and acquisitions (M&A) trends reveal strategic consolidation, with larger players acquiring innovative smaller companies to expand their product portfolios and market reach.

- Market Concentration: Dominated by a few key players, but with significant presence of niche manufacturers.

- Technological Innovation Drivers: Miniaturization of devices, digital integration for remote monitoring, improved biocompatibility of materials.

- Regulatory Frameworks: FDA, EMA, CE Marking, adherence to ISO standards.

- Competitive Product Substitutes: Traditional chest tubes, less sophisticated drainage systems.

- End-User Demographics: Increasing prevalence of lung cancer, COPD, pneumothorax, and post-cardiac surgery complications.

- M&A Trends: Strategic acquisitions for technology integration and market share expansion.

Thoracic Drainage Industry Growth Trends & Insights

The Thoracic Drainage industry is poised for robust growth, driven by escalating healthcare expenditures globally and a significant increase in the incidence of conditions requiring thoracic intervention. The market size is projected to expand from an estimated $xx million units in 2025 to $xx million units by 2033, exhibiting a compound annual growth rate (CAGR) of xx%. Adoption rates for advanced thoracic drainage systems, particularly digital and connected devices, are accelerating as healthcare providers recognize their potential to enhance patient care and streamline clinical workflows. Technological disruptions, such as the development of closed-loop drainage systems and novel antimicrobial coatings, are further reshaping the market by improving safety profiles and reducing infection risks. Consumer behavior shifts are also playing a role, with a growing emphasis on patient comfort and reduced hospital stay durations favoring minimally invasive and effective drainage solutions. The increasing demand for specialized thoracic drainage products in emerging economies, coupled with supportive government initiatives aimed at improving healthcare infrastructure, is expected to be a significant growth catalyst.

Dominant Regions, Countries, or Segments in Thoracic Drainage Industry

North America currently stands as the dominant region in the Thoracic Drainage industry, driven by advanced healthcare infrastructure, high per capita healthcare spending, and a significant prevalence of cardiovascular and pulmonary diseases. The United States, in particular, accounts for a substantial share of the global market. Within product segments, Thoracic Drainage Systems (encompassing a broad range of devices) and Pleural Drainage Catheters are leading the growth, fueled by advancements in materials and design for improved patient comfort and efficacy.

In terms of applications, Cardiac Surgery and Thoracic Surgery & Pulmonology are the primary growth engines. The rising number of cardiac surgeries, organ transplants, and minimally invasive thoracic procedures directly translates to increased demand for effective thoracic drainage solutions. The Hospitals & Clinics end-user segment represents the largest market share due to the concentration of surgical procedures and intensive care units within these facilities.

Key drivers for this regional dominance include:

- Economic Policies: Favorable reimbursement policies for advanced medical devices and procedures.

- Infrastructure: Well-established hospital networks and advanced surgical centers equipped with cutting-edge technology.

- R&D Investment: Significant investment in medical device innovation by both public and private sectors.

- Disease Prevalence: Higher incidence rates of lung cancer, COPD, pneumothorax, and other conditions requiring thoracic drainage.

The growth potential in other regions, such as Europe and Asia-Pacific, is also substantial, with the latter expected to exhibit the highest growth rate due to improving healthcare access, increasing disposable incomes, and a growing awareness of advanced medical treatments.

Thoracic Drainage Industry Product Landscape

The Thoracic Drainage industry is characterized by continuous product innovation, focusing on enhanced safety, efficacy, and patient comfort. Thoracic Drainage Systems, the overarching product category, are evolving to incorporate digital monitoring capabilities, allowing for real-time data on fluid output and pressure. Pleural Drainage Catheters are seeing advancements in material science, leading to thinner, more flexible, and biocompatible designs that minimize patient discomfort and reduce the risk of complications. Trocar Drains are being refined for quicker insertion and improved securement. These product advancements are directly addressing critical needs in Cardiac Surgery, Oncology & Pain Management, Thoracic Surgery & Pulmonology, and General Intensive Care Emergency Medicine, ultimately improving treatment outcomes across a wide spectrum of critical care scenarios.

Key Drivers, Barriers & Challenges in Thoracic Drainage Industry

Key Drivers:

- Increasing prevalence of respiratory and cardiovascular diseases: Rising global incidence of conditions like COPD, lung cancer, pneumothorax, and post-operative complications in cardiac surgery fuels demand.

- Advancements in minimally invasive surgical techniques: These techniques often necessitate sophisticated drainage solutions for effective fluid and air management.

- Technological innovation in digital monitoring and connectivity: Smart drainage systems offer real-time data for improved patient management and reduced complications.

- Growing healthcare expenditure and improving access to healthcare: Especially in emerging economies, leading to increased adoption of advanced medical devices.

- Aging global population: Elderly individuals are more susceptible to conditions requiring thoracic interventions.

Barriers & Challenges:

- Stringent regulatory approvals and compliance: Obtaining necessary certifications (e.g., FDA, CE) can be time-consuming and costly.

- High cost of advanced thoracic drainage systems: Can be a barrier to adoption in resource-limited settings.

- Risk of healthcare-associated infections: Requires robust infection control protocols and well-designed devices to minimize.

- Supply chain disruptions: Global events can impact the availability of raw materials and finished products.

- Competition from established players: New entrants face challenges in gaining market share against well-entrenched companies.

Emerging Opportunities in Thoracic Drainage Industry

Emerging opportunities in the Thoracic Drainage industry lie in the development of more intelligent, user-friendly, and patient-centric solutions. The untapped potential of remote patient monitoring for thoracic drainage, particularly for post-discharge care, presents a significant avenue for growth. Innovative applications in managing pleural effusions in chronic conditions and expanding the use of thoracic drainage in pre-hospital emergency settings are also promising. Furthermore, catering to the specific needs of pediatric patients and developing cost-effective solutions for emerging markets will unlock substantial value.

Growth Accelerators in the Thoracic Drainage Industry Industry

Several catalysts are accelerating long-term growth in the Thoracic Drainage industry. Breakthroughs in biomaterials are leading to the development of safer and more durable drainage devices with reduced inflammatory responses. Strategic partnerships between medical device manufacturers and healthcare providers are fostering collaborative innovation and accelerating the adoption of new technologies. Market expansion strategies targeting underdeveloped regions with growing healthcare needs are also a significant growth driver. The increasing focus on value-based healthcare is incentivizing the adoption of advanced drainage systems that demonstrate improved patient outcomes and reduced total cost of care.

Key Players Shaping the Thoracic Drainage Industry Market

- Becton Dickinson and Company

- Sinapi Biomedical

- ATMOS MedizinTechnik GmbH & Co KG

- Cook Group Incorporated

- Smiths Group plc

- Getinge AB

- Cardinal Health

- Vygon SA

- Teleflex Incorporated

- Utah Medical Products Inc

Notable Milestones in Thoracic Drainage Industry Sector

- April 2022: Merit Medical Systems, Inc. launched ReSolve Thoracostomy Tray, a comprehensive solution for minimally invasive thoracostomy, streamlining the procedure and enhancing patient experience.

- December 2020: Medela LLC announced its Thopaz+ Digital Chest Drainage and Monitoring System effectively blocks aerosolized viral particles, including SARS-CoV-2, underscoring advancements in infection control and patient safety.

In-Depth Thoracic Drainage Industry Market Outlook

The future of the Thoracic Drainage industry is exceptionally promising, driven by continuous technological advancements and an expanding global demand for effective respiratory and cardiac care solutions. Growth accelerators such as the development of sophisticated digital drainage systems, advancements in antimicrobial coatings, and the increasing adoption of minimally invasive procedures will significantly shape market expansion. Strategic opportunities lie in catering to the burgeoning needs of emerging economies, enhancing remote patient monitoring capabilities, and developing specialized drainage solutions for pediatric and geriatric populations. The industry is set for sustained growth as innovation continues to prioritize patient outcomes, operational efficiency, and cost-effectiveness in healthcare delivery.

Thoracic Drainage Industry Segmentation

-

1. Product

- 1.1. Thoracic Drainage Systems

- 1.2. Thoracic Drainage Kits

- 1.3. Pleural Drainage Catheters

- 1.4. Trocar Drains

- 1.5. Others

-

2. Application

- 2.1. Cardiac Surgery

- 2.2. Oncology & Pain Management

- 2.3. Thoracic Surgery & Pulmonology

- 2.4. General Intensive Care Emergency Medicine

- 2.5. Others

-

3. End-User

- 3.1. Hospitals & Clinics

- 3.2. Ambulatory Surgery Centers

- 3.3. Others

Thoracic Drainage Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Thoracic Drainage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Heart and Thoracic Surgeries; High Prevalence of Cardiovascular Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Availability of Skilled Physicians; Stringent Regulatory Guidelines

- 3.4. Market Trends

- 3.4.1. Thoracic Surgery & Pulmonology Segment is Expected to Register a Significant Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Thoracic Drainage Systems

- 5.1.2. Thoracic Drainage Kits

- 5.1.3. Pleural Drainage Catheters

- 5.1.4. Trocar Drains

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiac Surgery

- 5.2.2. Oncology & Pain Management

- 5.2.3. Thoracic Surgery & Pulmonology

- 5.2.4. General Intensive Care Emergency Medicine

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals & Clinics

- 5.3.2. Ambulatory Surgery Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Thoracic Drainage Systems

- 6.1.2. Thoracic Drainage Kits

- 6.1.3. Pleural Drainage Catheters

- 6.1.4. Trocar Drains

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiac Surgery

- 6.2.2. Oncology & Pain Management

- 6.2.3. Thoracic Surgery & Pulmonology

- 6.2.4. General Intensive Care Emergency Medicine

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospitals & Clinics

- 6.3.2. Ambulatory Surgery Centers

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Thoracic Drainage Systems

- 7.1.2. Thoracic Drainage Kits

- 7.1.3. Pleural Drainage Catheters

- 7.1.4. Trocar Drains

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiac Surgery

- 7.2.2. Oncology & Pain Management

- 7.2.3. Thoracic Surgery & Pulmonology

- 7.2.4. General Intensive Care Emergency Medicine

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospitals & Clinics

- 7.3.2. Ambulatory Surgery Centers

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Thoracic Drainage Systems

- 8.1.2. Thoracic Drainage Kits

- 8.1.3. Pleural Drainage Catheters

- 8.1.4. Trocar Drains

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiac Surgery

- 8.2.2. Oncology & Pain Management

- 8.2.3. Thoracic Surgery & Pulmonology

- 8.2.4. General Intensive Care Emergency Medicine

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospitals & Clinics

- 8.3.2. Ambulatory Surgery Centers

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Thoracic Drainage Systems

- 9.1.2. Thoracic Drainage Kits

- 9.1.3. Pleural Drainage Catheters

- 9.1.4. Trocar Drains

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cardiac Surgery

- 9.2.2. Oncology & Pain Management

- 9.2.3. Thoracic Surgery & Pulmonology

- 9.2.4. General Intensive Care Emergency Medicine

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Hospitals & Clinics

- 9.3.2. Ambulatory Surgery Centers

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. North America Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. South America Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Brazil

- 11.1.2 Mexico

- 11.1.3 Rest of South America

- 12. Europe Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Taiwan

- 13.1.6 Australia

- 13.1.7 Rest of Asia-Pacific

- 14. MEA Thoracic Drainage Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Middle East

- 14.1.2 Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Becton Dickinson and Company

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Sinapi Biomedical

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 ATMOS MedizinTechnik GmbH & Co KG

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Cook Group Incorporated

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Smiths Group plc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Getinge AB

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Cardinal Health

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Vygon SA*List Not Exhaustive

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Teleflex Incorporated

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Utah Medical Products Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Thoracic Drainage Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Thoracic Drainage Industry Volume Breakdown (K Units, %) by Region 2024 & 2032

- Figure 3: North America Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 5: North America Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: South America Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: South America Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 9: South America Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Europe Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 13: Europe Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Asia Pacific Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Asia Pacific Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 17: Asia Pacific Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: MEA Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: MEA Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 21: MEA Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: MEA Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Thoracic Drainage Industry Revenue (Million), by Product 2024 & 2032

- Figure 24: North America Thoracic Drainage Industry Volume (K Units), by Product 2024 & 2032

- Figure 25: North America Thoracic Drainage Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: North America Thoracic Drainage Industry Volume Share (%), by Product 2024 & 2032

- Figure 27: North America Thoracic Drainage Industry Revenue (Million), by Application 2024 & 2032

- Figure 28: North America Thoracic Drainage Industry Volume (K Units), by Application 2024 & 2032

- Figure 29: North America Thoracic Drainage Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America Thoracic Drainage Industry Volume Share (%), by Application 2024 & 2032

- Figure 31: North America Thoracic Drainage Industry Revenue (Million), by End-User 2024 & 2032

- Figure 32: North America Thoracic Drainage Industry Volume (K Units), by End-User 2024 & 2032

- Figure 33: North America Thoracic Drainage Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 34: North America Thoracic Drainage Industry Volume Share (%), by End-User 2024 & 2032

- Figure 35: North America Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 37: North America Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Thoracic Drainage Industry Revenue (Million), by Product 2024 & 2032

- Figure 40: Europe Thoracic Drainage Industry Volume (K Units), by Product 2024 & 2032

- Figure 41: Europe Thoracic Drainage Industry Revenue Share (%), by Product 2024 & 2032

- Figure 42: Europe Thoracic Drainage Industry Volume Share (%), by Product 2024 & 2032

- Figure 43: Europe Thoracic Drainage Industry Revenue (Million), by Application 2024 & 2032

- Figure 44: Europe Thoracic Drainage Industry Volume (K Units), by Application 2024 & 2032

- Figure 45: Europe Thoracic Drainage Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Europe Thoracic Drainage Industry Volume Share (%), by Application 2024 & 2032

- Figure 47: Europe Thoracic Drainage Industry Revenue (Million), by End-User 2024 & 2032

- Figure 48: Europe Thoracic Drainage Industry Volume (K Units), by End-User 2024 & 2032

- Figure 49: Europe Thoracic Drainage Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 50: Europe Thoracic Drainage Industry Volume Share (%), by End-User 2024 & 2032

- Figure 51: Europe Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 53: Europe Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Thoracic Drainage Industry Revenue (Million), by Product 2024 & 2032

- Figure 56: Asia Pacific Thoracic Drainage Industry Volume (K Units), by Product 2024 & 2032

- Figure 57: Asia Pacific Thoracic Drainage Industry Revenue Share (%), by Product 2024 & 2032

- Figure 58: Asia Pacific Thoracic Drainage Industry Volume Share (%), by Product 2024 & 2032

- Figure 59: Asia Pacific Thoracic Drainage Industry Revenue (Million), by Application 2024 & 2032

- Figure 60: Asia Pacific Thoracic Drainage Industry Volume (K Units), by Application 2024 & 2032

- Figure 61: Asia Pacific Thoracic Drainage Industry Revenue Share (%), by Application 2024 & 2032

- Figure 62: Asia Pacific Thoracic Drainage Industry Volume Share (%), by Application 2024 & 2032

- Figure 63: Asia Pacific Thoracic Drainage Industry Revenue (Million), by End-User 2024 & 2032

- Figure 64: Asia Pacific Thoracic Drainage Industry Volume (K Units), by End-User 2024 & 2032

- Figure 65: Asia Pacific Thoracic Drainage Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 66: Asia Pacific Thoracic Drainage Industry Volume Share (%), by End-User 2024 & 2032

- Figure 67: Asia Pacific Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 69: Asia Pacific Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: Rest of the World Thoracic Drainage Industry Revenue (Million), by Product 2024 & 2032

- Figure 72: Rest of the World Thoracic Drainage Industry Volume (K Units), by Product 2024 & 2032

- Figure 73: Rest of the World Thoracic Drainage Industry Revenue Share (%), by Product 2024 & 2032

- Figure 74: Rest of the World Thoracic Drainage Industry Volume Share (%), by Product 2024 & 2032

- Figure 75: Rest of the World Thoracic Drainage Industry Revenue (Million), by Application 2024 & 2032

- Figure 76: Rest of the World Thoracic Drainage Industry Volume (K Units), by Application 2024 & 2032

- Figure 77: Rest of the World Thoracic Drainage Industry Revenue Share (%), by Application 2024 & 2032

- Figure 78: Rest of the World Thoracic Drainage Industry Volume Share (%), by Application 2024 & 2032

- Figure 79: Rest of the World Thoracic Drainage Industry Revenue (Million), by End-User 2024 & 2032

- Figure 80: Rest of the World Thoracic Drainage Industry Volume (K Units), by End-User 2024 & 2032

- Figure 81: Rest of the World Thoracic Drainage Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 82: Rest of the World Thoracic Drainage Industry Volume Share (%), by End-User 2024 & 2032

- Figure 83: Rest of the World Thoracic Drainage Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Rest of the World Thoracic Drainage Industry Volume (K Units), by Country 2024 & 2032

- Figure 85: Rest of the World Thoracic Drainage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Rest of the World Thoracic Drainage Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thoracic Drainage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Thoracic Drainage Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Global Thoracic Drainage Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Thoracic Drainage Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: Global Thoracic Drainage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Thoracic Drainage Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 7: Global Thoracic Drainage Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Global Thoracic Drainage Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 9: Global Thoracic Drainage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Thoracic Drainage Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Canada Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Mexico Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 21: Brazil Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Mexico Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 27: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 29: Germany Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: France Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 35: Italy Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Spain Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 43: China Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: Japan Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: India Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: South Korea Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Taiwan Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Taiwan Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 53: Australia Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Australia Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia-Pacific Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia-Pacific Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 57: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 59: Middle East Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Middle East Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 61: Africa Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Africa Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 63: Global Thoracic Drainage Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 64: Global Thoracic Drainage Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 65: Global Thoracic Drainage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Thoracic Drainage Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 67: Global Thoracic Drainage Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 68: Global Thoracic Drainage Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 69: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 71: United States Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: United States Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 73: Canada Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Canada Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 75: Mexico Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Mexico Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 77: Global Thoracic Drainage Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 78: Global Thoracic Drainage Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 79: Global Thoracic Drainage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 80: Global Thoracic Drainage Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 81: Global Thoracic Drainage Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 82: Global Thoracic Drainage Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 83: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 85: Germany Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Germany Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 87: United Kingdom Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: United Kingdom Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 89: France Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: France Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 91: Italy Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Italy Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 93: Spain Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Spain Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 95: Rest of Europe Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Europe Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 97: Global Thoracic Drainage Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 98: Global Thoracic Drainage Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 99: Global Thoracic Drainage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 100: Global Thoracic Drainage Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 101: Global Thoracic Drainage Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 102: Global Thoracic Drainage Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 103: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 105: China Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: China Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 107: Japan Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Japan Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 109: India Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: India Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 111: Australia Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Australia Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 113: South Korea Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: South Korea Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 115: Rest of Asia Pacific Thoracic Drainage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Rest of Asia Pacific Thoracic Drainage Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 117: Global Thoracic Drainage Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 118: Global Thoracic Drainage Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 119: Global Thoracic Drainage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 120: Global Thoracic Drainage Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 121: Global Thoracic Drainage Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 122: Global Thoracic Drainage Industry Volume K Units Forecast, by End-User 2019 & 2032

- Table 123: Global Thoracic Drainage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 124: Global Thoracic Drainage Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thoracic Drainage Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Thoracic Drainage Industry?

Key companies in the market include Becton Dickinson and Company, Sinapi Biomedical, ATMOS MedizinTechnik GmbH & Co KG, Cook Group Incorporated, Smiths Group plc, Getinge AB, Cardinal Health, Vygon SA*List Not Exhaustive, Teleflex Incorporated, Utah Medical Products Inc.

3. What are the main segments of the Thoracic Drainage Industry?

The market segments include Product, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Heart and Thoracic Surgeries; High Prevalence of Cardiovascular Diseases.

6. What are the notable trends driving market growth?

Thoracic Surgery & Pulmonology Segment is Expected to Register a Significant Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

Lack of Availability of Skilled Physicians; Stringent Regulatory Guidelines.

8. Can you provide examples of recent developments in the market?

In April 2022, Merit Medical Systems, Inc. launched ReSolve Thoracostomy Tray. The new tray contains all products needed for performing a thoracostomy, a minimally invasive technique that allows patients to avoid an open surgical procedure to drain fluids or air from the chest.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thoracic Drainage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thoracic Drainage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thoracic Drainage Industry?

To stay informed about further developments, trends, and reports in the Thoracic Drainage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence