Key Insights

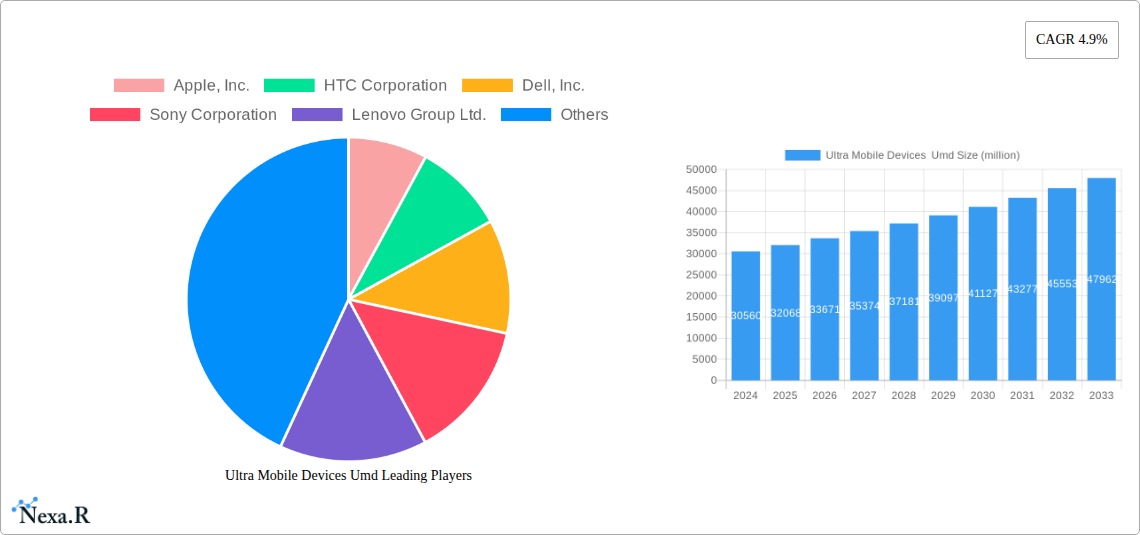

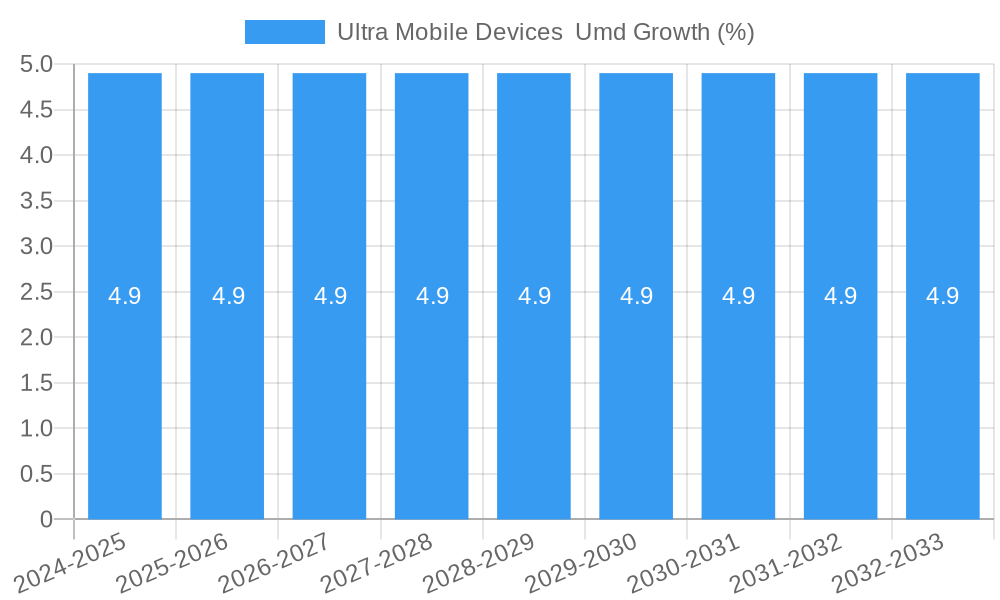

The global Ultra Mobile Devices (UMD) market is poised for substantial growth, projected to reach a significant market size of $32,068 million by 2025. This expansion is driven by a compelling Compound Annual Growth Rate (CAGR) of 4.9% throughout the forecast period. The market's dynamism is fueled by several key drivers including the relentless innovation in consumer electronics, the increasing demand for portable and powerful computing solutions across various industries, and the burgeoning digital transformation initiatives in sectors like healthcare and education. The UMD market is characterized by a diverse range of applications, with Telecommunication & IT, Consumer Electronics, and Retail emerging as dominant segments. The ongoing integration of advanced technologies like 5G, AI, and enhanced connectivity is further propelling the adoption of UMDs for a multitude of purposes, from personal productivity and entertainment to enterprise-level solutions.

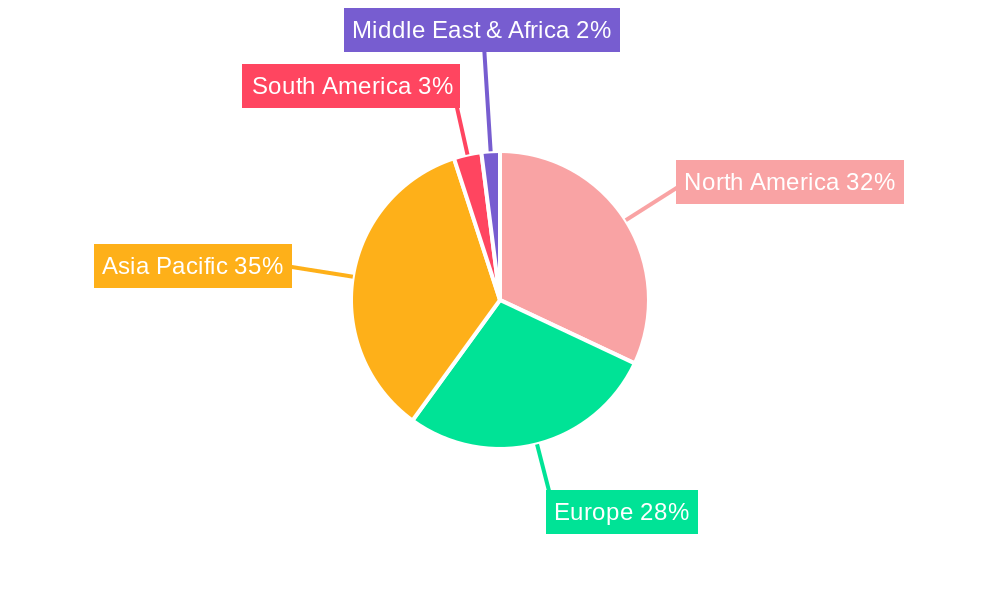

The UMD landscape is being shaped by significant trends such as the increasing demand for ultra-thin and lightweight devices, longer battery life, and advanced display technologies. Convertibles and detachable form factors are gaining considerable traction as users seek greater flexibility and versatility in their computing devices, blurring the lines between traditional laptops and tablets. However, challenges such as the high cost of advanced components and intense market competition from established players like Apple, Samsung, and Lenovo present considerable restraints. Despite these hurdles, the market is expected to witness sustained innovation and strategic collaborations among key companies, leading to the development of more sophisticated and user-centric ultra-mobile solutions across North America, Europe, and the Asia Pacific, with the latter poised to be a major growth engine.

Ultra Mobile Devices (UMD) Market: A Comprehensive Analysis 2019-2033

This in-depth report provides a critical analysis of the global Ultra Mobile Devices (UMD) market, encompassing laptops, tablets, detachables, and convertibles. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report offers unparalleled insights into market dynamics, growth trajectories, and competitive landscapes for industry professionals. We dissect the market by application segments including Telecommunication & IT, Consumer Electronics, Retail, Healthcare, Education, and Others, providing a holistic view of UMD adoption across diverse sectors.

Ultra Mobile Devices Umd Market Dynamics & Structure

The global Ultra Mobile Devices (UMD) market exhibits a moderately consolidated structure, with a few dominant players like Samsung Electronics Co., Ltd. and Apple, Inc. holding significant market share. However, the landscape is continually reshaped by intense technological innovation, driven by advancements in processing power, battery efficiency, and display technologies. Regulatory frameworks, particularly concerning data privacy and device security, play a crucial role in shaping product development and market entry. Competitive product substitutes, such as smartphones with increasingly larger screens and desktop-grade performance, pose a constant challenge. End-user demographics are shifting towards younger, tech-savvy consumers who prioritize portability, versatility, and seamless connectivity. Mergers and acquisitions (M&A) trends, though not as frequent as in other tech sectors, are strategically employed by key players to acquire innovative technologies or expand market reach.

- Market Concentration: Dominated by a few key players, but with growing influence from emerging brands in specific niches.

- Technological Innovation: Driven by advancements in AI integration, 5G connectivity, sustainable materials, and foldable display technologies.

- Regulatory Landscape: Emphasis on cybersecurity, data protection (e.g., GDPR, CCPA), and e-waste management.

- Competitive Substitutes: The evolving capabilities of high-end smartphones and the increasing power of cloud-based computing present ongoing competitive pressures.

- End-User Demographics: Growing demand from students, remote workers, and content creators seeking powerful yet portable computing solutions.

- M&A Activity: Focus on acquiring companies with expertise in specialized software, AI, or advanced battery technologies.

Ultra Mobile Devices Umd Growth Trends & Insights

The Ultra Mobile Devices (UMD) market is poised for robust growth, projected to expand from an estimated 350 million units in 2025 to over 520 million units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. This expansion is fueled by the escalating demand for devices that blend the portability of tablets with the productivity of laptops, catering to the evolving needs of a hybrid workforce and the increasing penetration of digital education. Technological disruptions, such as the widespread adoption of 5G, advancements in AI-powered features, and the development of more energy-efficient processors, are significantly enhancing the appeal and functionality of UMDs. Consumer behavior shifts are evident, with a growing preference for versatile devices that can seamlessly transition between work, entertainment, and creative tasks. Market penetration is expected to deepen, particularly in developing economies where the demand for affordable yet powerful computing solutions is high. The historical period (2019-2024) witnessed a steady, albeit slower, growth trajectory, marked by initial consumer apprehension and a higher price point for early-adopter devices. However, increasing affordability, a wider product portfolio, and the undeniable utility of UMDs in various professional and personal contexts have created a fertile ground for sustained expansion. The introduction of innovative form factors, such as foldable and rollable screens, is also expected to invigorate the market, attracting new user segments and driving upgrade cycles. Furthermore, the growing reliance on cloud computing and advanced software applications further amplifies the need for devices that can effectively leverage these technologies, positioning UMDs as a central hub for digital interaction. The seamless integration of stylus support and enhanced security features are also contributing factors to the projected market upturn.

Dominant Regions, Countries, or Segments in Ultra Mobile Devices Umd

The Consumer Electronics segment, particularly within the Telecommunication & IT application realm, stands as a primary driver of growth in the Ultra Mobile Devices (UMD) market, with a significant market share projected to reach approximately 45% of the total market value by 2033. This dominance is further amplified by the robust performance of Tablets and Laptops within the UMD category, collectively accounting for over 70% of all units shipped. Geographically, North America and Asia-Pacific are the leading regions, driven by high disposable incomes, advanced technological infrastructure, and a strong adoption rate of new technologies.

Key Dominance Factors:

North America:

- Market Share: Estimated 28% of global UMD market by value in 2025.

- Key Drivers: High consumer spending power, early adoption of innovative technologies, significant presence of enterprise clients in sectors like IT and Healthcare driving demand for mobile productivity solutions.

- Infrastructure: Widespread availability of high-speed internet and 5G networks.

- Growth Potential: Continued demand from remote work trends and the education sector.

Asia-Pacific:

- Market Share: Projected to reach 32% of global UMD market by value by 2033.

- Key Drivers: Rapid economic development, a burgeoning middle class, massive smartphone penetration leading to an increased demand for complementary computing devices, and government initiatives promoting digital transformation in sectors like Education and Healthcare.

- Infrastructure: Significant investments in digital infrastructure and expansion of 5G networks.

- Growth Potential: Untapped potential in emerging economies within the region, coupled with a strong manufacturing base for UMDs.

Consumer Electronics (Application Segment):

- Market Share: Expected to constitute over 40% of the UMD market by revenue in 2025.

- Key Drivers: High consumer demand for entertainment, content creation, and personal productivity devices.

- Product Focus: Driven by innovations in screen technology, battery life, and user experience for personal use.

- Growth Potential: Continuous product refresh cycles and the integration of new features like AR/VR capabilities.

Tablets & Laptops (Type Segment):

- Market Share: These two categories are anticipated to represent a combined market share of over 70% of UMD units shipped by 2033.

- Key Drivers: Tablets offer unparalleled portability and touch-based interaction, while Laptops provide robust computing power for demanding tasks.

- Versatility: The evolution of detachable and convertible form factors bridges the gap, offering a hybrid computing experience.

- Growth Potential: Continued innovation in processing power, display quality, and battery life for both categories.

North America:

- Market Share: Estimated 28% of global UMD market by value in 2025.

- Key Drivers: High consumer spending power, early adoption of innovative technologies, significant presence of enterprise clients in sectors like IT and Healthcare driving demand for mobile productivity solutions.

- Infrastructure: Widespread availability of high-speed internet and 5G networks.

- Growth Potential: Continued demand from remote work trends and the education sector.

Asia-Pacific:

- Market Share: Projected to reach 32% of global UMD market by value by 2033.

- Key Drivers: Rapid economic development, a burgeoning middle class, massive smartphone penetration leading to an increased demand for complementary computing devices, and government initiatives promoting digital transformation in sectors like Education and Healthcare.

- Infrastructure: Significant investments in digital infrastructure and expansion of 5G networks.

- Growth Potential: Untapped potential in emerging economies within the region, coupled with a strong manufacturing base for UMDs.

Consumer Electronics (Application Segment):

- Market Share: Expected to constitute over 40% of the UMD market by revenue in 2025.

- Key Drivers: High consumer demand for entertainment, content creation, and personal productivity devices.

- Product Focus: Driven by innovations in screen technology, battery life, and user experience for personal use.

- Growth Potential: Continuous product refresh cycles and the integration of new features like AR/VR capabilities.

Tablets & Laptops (Type Segment):

- Market Share: These two categories are anticipated to represent a combined market share of over 70% of UMD units shipped by 2033.

- Key Drivers: Tablets offer unparalleled portability and touch-based interaction, while Laptops provide robust computing power for demanding tasks.

- Versatility: The evolution of detachable and convertible form factors bridges the gap, offering a hybrid computing experience.

- Growth Potential: Continued innovation in processing power, display quality, and battery life for both categories.

Ultra Mobile Devices Umd Product Landscape

The UMD product landscape is characterized by a relentless pursuit of enhanced performance and user experience. Innovations are centered on ultra-thin and lightweight designs, extended battery life, and high-resolution, often touch-enabled, displays. Advanced processors, including those with integrated AI capabilities, are becoming standard, enabling faster multitasking and more intelligent user interactions. The integration of 5G connectivity ensures seamless and high-speed data access, crucial for remote work and cloud-based applications. Unique selling propositions often lie in the versatility of detachable and convertible form factors, allowing users to adapt their devices to various scenarios, from note-taking to full-fledged content creation. Technological advancements in foldable displays and the development of more durable and sustainable materials are also shaping the future of UMDs, promising even greater portability and unique user interactions.

Key Drivers, Barriers & Challenges in Ultra Mobile Devices Umd

Key Drivers:

- Growing Demand for Remote Work and Hybrid Models: The sustained adoption of flexible work arrangements fuels the need for portable and powerful computing solutions.

- Technological Advancements: Continuous improvements in processors, battery technology, display quality, and connectivity (e.g., 5G) enhance the appeal and functionality of UMDs.

- Digital Transformation in Education: The increasing reliance on digital learning tools and resources drives demand for versatile devices among students and educators.

- Consumer Preference for Versatility: Users seek devices that can seamlessly switch between productivity and entertainment tasks.

Barriers & Challenges:

- High Cost of Premium Devices: While prices are decreasing, high-end UMDs can still be a significant investment for a large segment of the population.

- Intense Competition from Smartphones and Laptops: The expanding capabilities of smartphones and the established performance of traditional laptops create a competitive market.

- Supply Chain Disruptions: Geopolitical factors, component shortages, and logistical challenges can impact production and availability, as seen during the historical period from 2019-2024.

- Evolving Regulatory Requirements: Increasingly stringent regulations around data privacy, security, and environmental impact can add complexity and cost to product development and market entry.

- Battery Life Limitations: Despite advancements, achieving all-day power for intensive tasks remains a challenge for some UMD models.

- High Cost of Premium Devices: While prices are decreasing, high-end UMDs can still be a significant investment for a large segment of the population.

- Intense Competition from Smartphones and Laptops: The expanding capabilities of smartphones and the established performance of traditional laptops create a competitive market.

- Supply Chain Disruptions: Geopolitical factors, component shortages, and logistical challenges can impact production and availability, as seen during the historical period from 2019-2024.

- Evolving Regulatory Requirements: Increasingly stringent regulations around data privacy, security, and environmental impact can add complexity and cost to product development and market entry.

- Battery Life Limitations: Despite advancements, achieving all-day power for intensive tasks remains a challenge for some UMD models.

Emerging Opportunities in Ultra Mobile Devices Umd

Emerging opportunities in the UMD market lie in the expansion of foldable and flexible display technologies, promising a new era of device form factors and user interactions. The integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities will unlock personalized user experiences, predictive analytics, and enhanced productivity tools. Untapped markets in developing economies present significant growth potential, driven by increasing digital literacy and the need for affordable, versatile computing solutions. Furthermore, the burgeoning field of augmented reality (AR) and virtual reality (VR) offers new avenues for UMD integration, creating immersive educational and entertainment experiences. The growing demand for specialized UMDs tailored for niche applications in fields like medical imaging, on-site field service, and creative design also represents a promising frontier.

Growth Accelerators in the Ultra Mobile Devices Umd Industry

Several factors are acting as significant growth accelerators for the UMD industry. The continued push towards 5G integration is a major catalyst, enabling faster data speeds and lower latency, which enhances cloud-based productivity and real-time collaboration. Strategic partnerships between hardware manufacturers and software developers are crucial for optimizing operating systems and applications for the unique capabilities of UMDs. Market expansion strategies, particularly focusing on emerging economies and addressing specific industry verticals like healthcare and education with tailored solutions, will drive significant volume growth. Furthermore, advancements in battery technology, leading to longer usage times and faster charging capabilities, directly address a key consumer pain point and accelerate adoption. The increasing focus on sustainable manufacturing practices and the development of eco-friendly devices will also resonate with a growing environmentally conscious consumer base.

Key Players Shaping the Ultra Mobile Devices Umd Market

- Apple, Inc.

- Samsung Electronics Co., Ltd.

- Google Inc.

- Microsoft Corporation

- Lenovo Group Ltd.

- ASUSTeK Computer Inc.

- Sony Corporation

- Dell, Inc.

- Hewlett-Packard Company

- HTC Corporation

Notable Milestones in Ultra Mobile Devices Umd Sector

- 2019: Introduction of advanced 2-in-1 laptops with improved performance and battery life, blurring the lines between traditional laptops and tablets.

- 2020: Significant surge in demand for detachable and convertible devices driven by the global shift to remote work and online education.

- 2021: Major manufacturers begin integrating 5G connectivity into higher-end UMD models, offering unparalleled connectivity.

- 2022: Advancements in foldable display technology lead to the introduction of innovative and highly portable UMD form factors.

- 2023: Increased focus on sustainable manufacturing and materials in UMD production, appealing to environmentally conscious consumers.

- 2024: Expansion of AI-powered features and improved battery optimization across a wider range of UMD models.

In-Depth Ultra Mobile Devices Umd Market Outlook

The outlook for the Ultra Mobile Devices (UMD) market remains exceptionally positive, driven by sustained innovation and evolving consumer and enterprise needs. Growth accelerators such as the pervasive adoption of 5G, strategic collaborations for software optimization, and targeted market expansion into burgeoning economies will propel future growth. The industry is strategically positioned to capitalize on the ongoing digital transformation across various sectors, offering a compelling blend of portability, performance, and versatility. Future market potential is significant, particularly with advancements in foldable technologies and AI integration. Strategic opportunities lie in developing highly specialized UMD solutions for niche industries and catering to the increasing demand for eco-friendly and sustainable devices.

Ultra Mobile Devices Umd Segmentation

-

1. Application

- 1.1. Telecommunication & IT

- 1.2. Consumer Electronics

- 1.3. Retail

- 1.4. Healthcare

- 1.5. Education

- 1.6. Others

-

2. Type

- 2.1. Laptops

- 2.2. Tablets

- 2.3. Detachable

- 2.4. Convertibles

Ultra Mobile Devices Umd Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultra Mobile Devices Umd REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Telecommunication & IT

- 5.1.2. Consumer Electronics

- 5.1.3. Retail

- 5.1.4. Healthcare

- 5.1.5. Education

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Laptops

- 5.2.2. Tablets

- 5.2.3. Detachable

- 5.2.4. Convertibles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Telecommunication & IT

- 6.1.2. Consumer Electronics

- 6.1.3. Retail

- 6.1.4. Healthcare

- 6.1.5. Education

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Laptops

- 6.2.2. Tablets

- 6.2.3. Detachable

- 6.2.4. Convertibles

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Telecommunication & IT

- 7.1.2. Consumer Electronics

- 7.1.3. Retail

- 7.1.4. Healthcare

- 7.1.5. Education

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Laptops

- 7.2.2. Tablets

- 7.2.3. Detachable

- 7.2.4. Convertibles

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Telecommunication & IT

- 8.1.2. Consumer Electronics

- 8.1.3. Retail

- 8.1.4. Healthcare

- 8.1.5. Education

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Laptops

- 8.2.2. Tablets

- 8.2.3. Detachable

- 8.2.4. Convertibles

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Telecommunication & IT

- 9.1.2. Consumer Electronics

- 9.1.3. Retail

- 9.1.4. Healthcare

- 9.1.5. Education

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Laptops

- 9.2.2. Tablets

- 9.2.3. Detachable

- 9.2.4. Convertibles

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultra Mobile Devices Umd Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Telecommunication & IT

- 10.1.2. Consumer Electronics

- 10.1.3. Retail

- 10.1.4. Healthcare

- 10.1.5. Education

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Laptops

- 10.2.2. Tablets

- 10.2.3. Detachable

- 10.2.4. Convertibles

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Apple Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HTC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dell Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sony Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lenovo Group Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ASUSTeK Computer Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Google Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Samsung Electronics Co. Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Microsoft Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hewlett-Packard Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Apple Inc.

List of Figures

- Figure 1: Global Ultra Mobile Devices Umd Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ultra Mobile Devices Umd Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ultra Mobile Devices Umd Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ultra Mobile Devices Umd Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ultra Mobile Devices Umd Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ultra Mobile Devices Umd Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ultra Mobile Devices Umd Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ultra Mobile Devices Umd Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ultra Mobile Devices Umd Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ultra Mobile Devices Umd Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ultra Mobile Devices Umd Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ultra Mobile Devices Umd Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ultra Mobile Devices Umd Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ultra Mobile Devices Umd Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ultra Mobile Devices Umd Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ultra Mobile Devices Umd Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ultra Mobile Devices Umd Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ultra Mobile Devices Umd Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ultra Mobile Devices Umd Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ultra Mobile Devices Umd Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ultra Mobile Devices Umd Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ultra Mobile Devices Umd Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ultra Mobile Devices Umd Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ultra Mobile Devices Umd Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ultra Mobile Devices Umd Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ultra Mobile Devices Umd Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ultra Mobile Devices Umd Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ultra Mobile Devices Umd Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ultra Mobile Devices Umd Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ultra Mobile Devices Umd Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ultra Mobile Devices Umd Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra Mobile Devices Umd Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ultra Mobile Devices Umd Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ultra Mobile Devices Umd Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ultra Mobile Devices Umd Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ultra Mobile Devices Umd Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ultra Mobile Devices Umd Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ultra Mobile Devices Umd Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ultra Mobile Devices Umd Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ultra Mobile Devices Umd Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ultra Mobile Devices Umd Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra Mobile Devices Umd?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Ultra Mobile Devices Umd?

Key companies in the market include Apple, Inc., HTC Corporation, Dell, Inc., Sony Corporation, Lenovo Group Ltd., ASUSTeK Computer Inc., Google Inc., Samsung Electronics Co., Ltd., Microsoft Corporation, Hewlett-Packard Company.

3. What are the main segments of the Ultra Mobile Devices Umd?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 320680 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra Mobile Devices Umd," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra Mobile Devices Umd report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra Mobile Devices Umd?

To stay informed about further developments, trends, and reports in the Ultra Mobile Devices Umd, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence