Key Insights

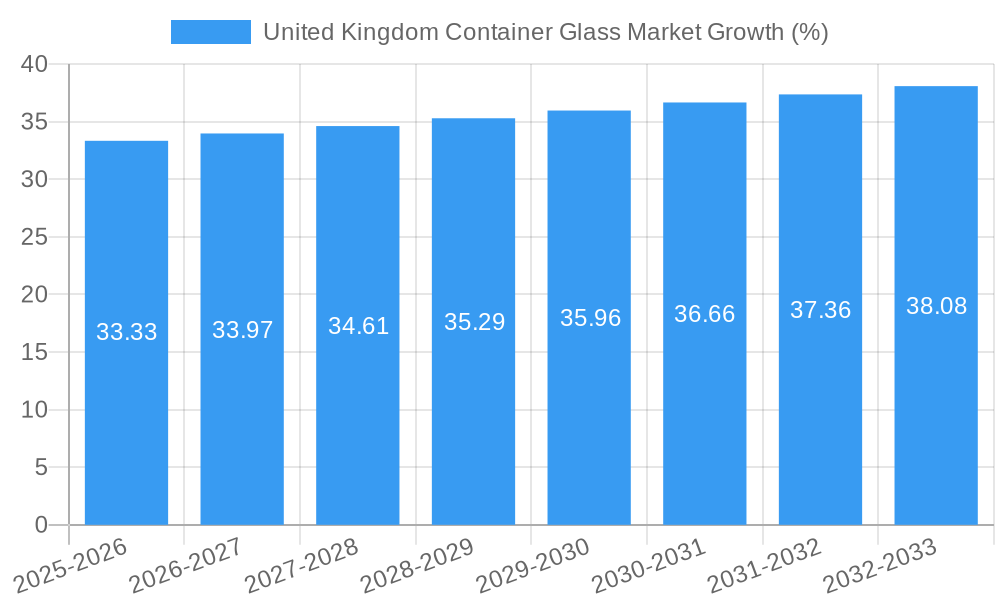

The United Kingdom container glass market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 2.21%, presents a compelling investment opportunity driven by several key factors. The market's value, estimated at approximately £X million in 2025 (assuming a reasonable market size based on comparable European markets and industry reports), is projected to experience steady growth through 2033. This growth is fueled by the increasing demand for sustainable packaging solutions. Consumers are increasingly opting for eco-friendly alternatives, recognizing glass's recyclability and inert nature, compared to plastic. Furthermore, the burgeoning food and beverage sector, particularly craft breweries and premium spirits brands, contributes significantly to demand, as glass packaging enhances product prestige and shelf appeal. The growth is also supported by advancements in glass manufacturing technologies, leading to improved efficiency and reduced production costs.

However, the market faces certain challenges. Fluctuations in raw material prices (e.g., silica sand, soda ash) and energy costs can significantly impact profitability. Competition from alternative packaging materials, such as lightweight plastics and aluminum, remains a considerable constraint. To mitigate these challenges, manufacturers are focusing on developing innovative glass packaging solutions, such as lightweight designs and enhanced recyclability features, to maintain a competitive edge. The market segmentation, although not explicitly provided, is likely divided by type of container (bottles, jars, etc.), end-use industry (food & beverage, pharmaceuticals, cosmetics), and geographic region within the UK. This segmentation presents opportunities for targeted marketing and product development strategies for players like Verallia Packaging, Ciner Glass Ltd, O-I Glass Inc, and others operating within the UK market.

United Kingdom Container Glass Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Kingdom container glass market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the UK Packaging Market and the child market is the UK Container Glass Market.

United Kingdom Container Glass Market Dynamics & Structure

This section analyzes the competitive landscape of the UK container glass market, examining market concentration, technological advancements, regulatory influences, substitute products, end-user demographics, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with key players holding significant market share. Technological innovation focuses on sustainability and improved production efficiency. Stringent environmental regulations drive the adoption of eco-friendly practices. The market faces competition from alternative packaging materials like plastic and metal. End-user industries include food & beverage, pharmaceuticals, cosmetics, and spirits. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, resulting in a xx% change in market concentration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on lightweighting, sustainable materials, and improved production efficiency.

- Regulatory Framework: Stringent environmental regulations impacting production and material sourcing.

- Competitive Substitutes: Plastic, metal, and other packaging materials.

- End-User Demographics: Diverse, including food & beverage, pharmaceuticals, cosmetics, and spirits industries.

- M&A Trends: Moderate activity in recent years, with xx deals resulting in a xx% change in market concentration.

- Innovation Barriers: High capital expenditure requirements for new technologies and stringent regulatory compliance.

United Kingdom Container Glass Market Growth Trends & Insights

The UK container glass market has experienced steady growth over the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to rising demand from various end-use sectors, particularly the food and beverage industry. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements such as lightweighting and improved production efficiency are driving market adoption. Consumer preferences for sustainable and eco-friendly packaging are also positively influencing market growth. Shifts in consumer behavior towards premiumization and increased demand for convenience are further fueling market expansion.

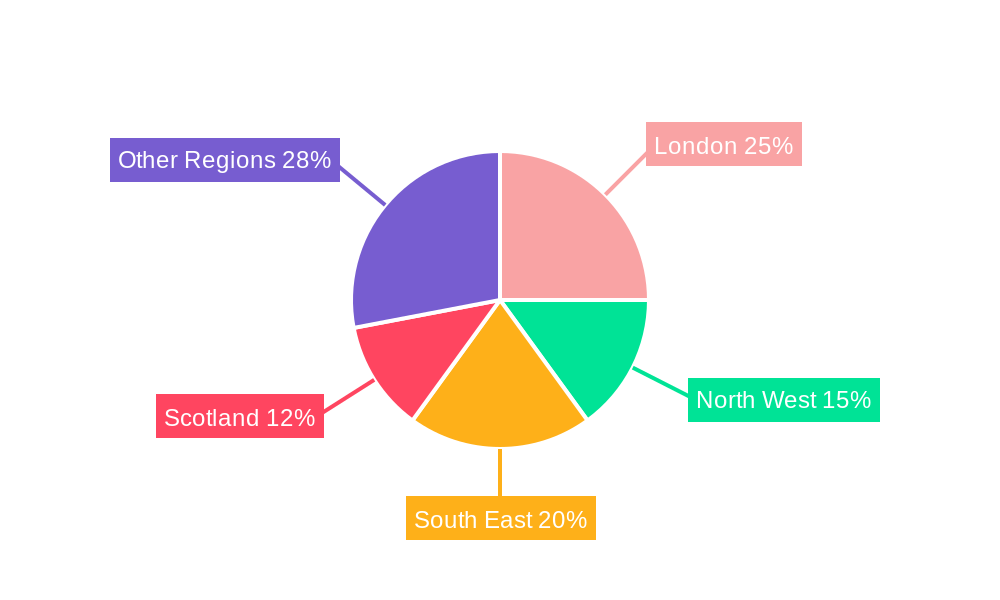

Dominant Regions, Countries, or Segments in United Kingdom Container Glass Market

The South East region of the UK dominates the container glass market, driven by a high concentration of end-use industries and robust economic activity. This dominance is characterized by high market share (xx%) and strong growth potential, exceeding the national average. Key drivers include strong consumer spending, a well-developed infrastructure, and government initiatives promoting sustainable packaging solutions. Other regions, such as the North West and Midlands, also contribute significantly, but the South East's superior economic performance and industry concentration solidify its leading position.

- Key Drivers in the South East:

- High concentration of end-user industries

- Robust economic activity and consumer spending

- Well-developed infrastructure and logistics

- Government support for sustainable packaging

- Dominance Factors: High market share (xx%), superior economic performance, industry concentration.

- Growth Potential: High, exceeding the national average.

United Kingdom Container Glass Market Product Landscape

The UK container glass market features a diverse range of products, including bottles, jars, and other specialized containers. Innovations focus on lightweighting for reduced transportation costs and improved sustainability, utilizing advanced manufacturing techniques to enhance product durability and aesthetics. The application of diverse finishes and decorations, such as opaque, frosted, glitter, and pearlescent effects, broadens product differentiation and appeal. Key performance metrics include weight reduction, improved strength-to-weight ratio, and enhanced recyclability.

Key Drivers, Barriers & Challenges in United Kingdom Container Glass Market

Key Drivers:

- Growing demand from food and beverage industries.

- Increasing consumer preference for sustainable packaging.

- Technological advancements in glass manufacturing.

- Government initiatives promoting recycling and sustainable packaging.

Challenges and Restraints:

- High raw material costs (e.g., energy, sand)

- Competition from alternative packaging materials (e.g., plastics)

- Supply chain disruptions

- Fluctuations in energy prices potentially impacting manufacturing costs. The impact is estimated at xx% fluctuation in production costs based on historical energy price volatility.

Emerging Opportunities in United Kingdom Container Glass Market

Emerging opportunities lie in the development of innovative, sustainable glass packaging solutions for niche markets, such as premium spirits and cosmetics. The increasing demand for customized and decorated glass containers presents further opportunities. Exploring new applications for recycled glass content also offers potential growth avenues.

Growth Accelerators in the United Kingdom Container Glass Market Industry

Long-term growth will be driven by technological advancements in lightweighting and sustainable glass production. Strategic partnerships between glass manufacturers and packaging designers to create innovative products will accelerate market expansion. Furthermore, focusing on niche markets and creating eco-friendly solutions will be crucial growth catalysts.

Key Players Shaping the United Kingdom Container Glass Market Market

- Verallia Packaging (Verallia SA)

- Ciner Glass Ltd

- O-I Glass Inc

- Ardagh Group

- Glassworks International Limited

- Gaasch Packaging

- Berlin Packaging

- Vidrala SA

- Beatson Clark

- Stoelzle Flaconnage Ltd

- List Not Exhaustive

Notable Milestones in United Kingdom Container Glass Market Sector

- August 2024: Beatson Clark launched an in-house decoration service, offering a wider range of customized glass packaging options.

- August 2024: Verallia UK unveiled ECOVA, a sustainable premium spirit bottle range, showcasing commitment to eco-friendly innovation and improved pallet efficiency.

In-Depth United Kingdom Container Glass Market Market Outlook

The UK container glass market exhibits promising future potential, driven by sustainability trends, increasing demand from diverse sectors, and ongoing technological innovations. Strategic partnerships, investment in eco-friendly production technologies, and expansion into niche markets will present significant opportunities for growth and market share gains. The market is expected to witness robust growth in the coming years, driven by the factors mentioned previously.

United Kingdom Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholi

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End User Verticals

-

1.1. Beverage

United Kingdom Container Glass Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market

- 3.4. Market Trends

- 3.4.1. Beverage is Expected to Account For Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End User Verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Verallia Packaging (Verallia SA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ciner Glass Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 O-I Glass Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ardagh Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Glassworks International Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gaasch Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berlin Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vidrala SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beatson Clark

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stoelzle Flaconnage Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Verallia Packaging (Verallia SA)

List of Figures

- Figure 1: United Kingdom Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: United Kingdom Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United Kingdom Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: United Kingdom Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Container Glass Market?

The projected CAGR is approximately 2.21%.

2. Which companies are prominent players in the United Kingdom Container Glass Market?

Key companies in the market include Verallia Packaging (Verallia SA), Ciner Glass Ltd, O-I Glass Inc, Ardagh Group, Glassworks International Limited, Gaasch Packaging, Berlin Packaging, Vidrala SA, Beatson Clark, Stoelzle Flaconnage Ltd*List Not Exhaustive.

3. What are the main segments of the United Kingdom Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market.

6. What are the notable trends driving market growth?

Beverage is Expected to Account For Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Production of the Soft Drinks and Other Beverages in the Country; Rising Retail and Tourism in the Country to Expand the Market.

8. Can you provide examples of recent developments in the market?

August 2024: Beatson Clark, a glass manufacturer based in the UK, launched an in-house decoration service. This new facility enables Beatson Clark to spray glass packaging in any color, achieving stunning effects like opaque, frosted, glitter, vignette, and pearlescent. Located in Rotherham, UK, this container glass producer provides a versatile service, decorating not only its own bottles and jars but also customer-provided glass containers, depending on their suitability.August 2024: Verallia UK, committed to sustainable innovation, unveiled ECOVA, a premium spirit bottle standard of sustainable off-the-shelf glass packaging. The name ECOVA, merging 'ecology' and 'value', underscores the range's sustainability focus. Featuring four new designs, Patet, Caeli, Vita, and Terra, each weighing 500g, the innovative design boosts the average pallet capacity by 200 bottles. This enhancement minimizes shipping packaging for UK customers. The creation of the ECOVA range was driven by the goal of lightening bottle weight, thereby curbing carbon emissions for both Verallia UK and its clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Container Glass Market?

To stay informed about further developments, trends, and reports in the United Kingdom Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence