Key Insights

The United States hydrogen generation market is projected for significant expansion, fueled by robust demand across diverse sectors and supportive governmental initiatives focused on economic decarbonization. With an estimated market size of $204.86 billion in the base year 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.6%. This growth is predominantly propelled by the expanding renewable energy sector, driving the adoption of green hydrogen production. Substantial investments in renewable energy infrastructure and stringent emission reduction targets position the U.S. as a key market for hydrogen technologies. Primary growth drivers include the increasing adoption of hydrogen fuel cell vehicles, rising industrial demand for hydrogen (particularly in oil refining, chemical processing, and iron & steel production), and the development of advanced hydrogen storage and transportation solutions. Growing environmental awareness, coupled with increased R&D funding, will further accelerate market growth.

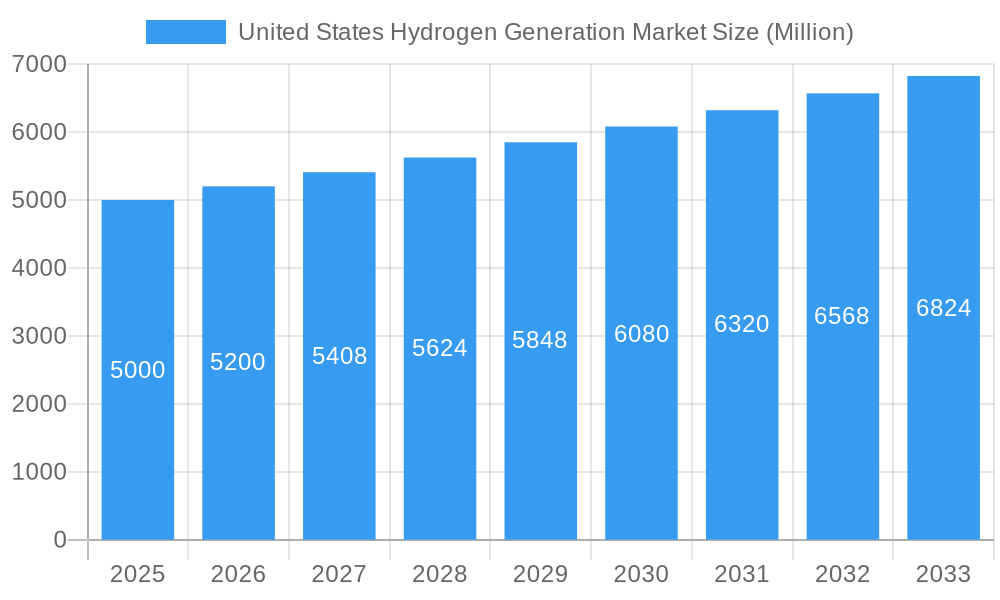

United States Hydrogen Generation Market Market Size (In Billion)

While steam methane reforming (SMR) currently leads the technology segment due to established infrastructure and cost-effectiveness, a discernible shift towards greener alternatives like electrolysis-based green hydrogen production is evident, spurred by government incentives and corporate sustainability goals. Despite challenges such as high capital expenditure for green hydrogen production and the necessity for comprehensive hydrogen infrastructure, the long-term outlook for the U.S. hydrogen generation market is exceptionally favorable. Ongoing technological innovations and conducive government policies are expected to surmount these obstacles, driving sustained market growth. The competitive landscape features both established industry leaders and emerging innovators, fostering a dynamic and inventive market environment.

United States Hydrogen Generation Market Company Market Share

United States Hydrogen Generation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States hydrogen generation market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key drivers and barriers, emerging opportunities, and key players. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report offers invaluable insights for industry professionals, investors, and policymakers seeking to navigate this rapidly evolving sector. The market is segmented by source (blue, green, grey hydrogen), technology (Steam Methane Reforming (SMR), Coal Gasification, Others), and application (oil refining, chemical processing, iron & steel production, others). The total market size is projected to reach xx Million by 2033.

United States Hydrogen Generation Market Dynamics & Structure

The US hydrogen generation market is characterized by a moderately concentrated landscape with several major players vying for market share. Technological innovation, particularly in electrolysis and fuel cell technology, is a key driver, alongside supportive government policies aimed at decarbonization. Regulatory frameworks, including emission standards and incentives for renewable hydrogen, significantly influence market growth. Competitive product substitutes, such as natural gas and other fuels, pose challenges, while end-user demographics, primarily driven by industrial sectors, play a significant role in shaping demand. M&A activity within the sector has been moderate, with several strategic partnerships and acquisitions aiming to expand market access and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant advancements in PEM electrolysis and alkaline electrolysis are driving cost reductions and efficiency gains.

- Regulatory Framework: The Inflation Reduction Act and other state-level incentives are boosting the adoption of green hydrogen.

- Competitive Substitutes: Natural gas remains a significant competitor, although the carbon footprint difference is increasingly driving a shift towards hydrogen.

- End-User Demographics: Heavy industry (refining, chemical processing, steel) accounts for xx% of demand, with increasing interest from transportation and energy storage.

- M&A Activity: xx major M&A deals recorded between 2019-2024, signifying consolidation and strategic expansion.

United States Hydrogen Generation Market Growth Trends & Insights

The US hydrogen generation market is experiencing robust growth, driven by the increasing demand for cleaner energy sources and the government’s push for decarbonization. The market size expanded from xx Million in 2019 to xx Million in 2024, registering a CAGR of xx%. This growth is expected to continue, with a projected CAGR of xx% from 2025 to 2033, driven by the increasing adoption of hydrogen in various applications and technological advancements. The market penetration of green hydrogen is anticipated to significantly increase, driven by declining costs and supportive policy measures. Consumer behavior shifts, including a growing preference for sustainable solutions, are further fueling market expansion. Technological disruptions, such as improvements in electrolysis technology and advancements in hydrogen storage and transportation, also contribute to the market's positive trajectory.

Dominant Regions, Countries, or Segments in United States Hydrogen Generation Market

The California, Texas, and the Northeast regions are currently dominating the US hydrogen generation market. This dominance is primarily attributed to existing industrial infrastructure, supportive state-level policies, and access to renewable energy resources. Within these regions, Green hydrogen is witnessing rapid growth fueled by government incentives and a focus on decarbonization. Furthermore, the Steam Methane Reforming (SMR) technology still dominates the grey hydrogen production, but its market share is expected to decline due to environmental concerns. The Oil Refining and Chemical Processing sectors represent the largest application segments, while the Iron & Steel production sector is expected to demonstrate high growth potential in the coming years.

- Key Drivers:

- Supportive Government Policies: Federal and state-level incentives, including tax credits and grants for green hydrogen projects.

- Existing Industrial Infrastructure: Well-established industrial clusters provide ideal locations for hydrogen production and utilization.

- Renewable Energy Resources: Abundant solar and wind resources are lowering the cost of green hydrogen production.

- Dominance Factors:

- California: Strong renewable energy portfolio standard and supportive policies for hydrogen development.

- Texas: Large industrial sector and access to natural gas resources for blue hydrogen production.

- Northeast: Growing focus on decarbonizing the transportation and industrial sectors.

United States Hydrogen Generation Market Product Landscape

The US hydrogen generation market exhibits a dynamic product landscape encompassing diverse technologies for production and storage. Production methods include established techniques like steam methane reforming (SMR) alongside rapidly advancing technologies like electrolysis (alkaline, PEM, and solid oxide). Storage solutions range from compressed gas and liquid hydrogen to emerging options like metal hydrides and ammonia carriers. The sector is characterized by continuous innovation, with improvements driving increased efficiency, reduced costs, and enhanced scalability. Recent advancements include high-efficiency electrolyzers boasting superior energy conversion rates, advanced materials for durable and safer storage systems, and innovative approaches to hydrogen transportation and distribution. Key product differentiators now include enhanced durability, significantly lower operating costs, superior safety features, and reduced environmental impact compared to earlier generation systems. The market is witnessing a shift towards green hydrogen production, driven by growing environmental concerns and supportive government policies.

Key Drivers, Barriers & Challenges in United States Hydrogen Generation Market

Key Drivers:

- Stringent Decarbonization Goals: Ambitious federal and state-level targets for greenhouse gas emission reductions are fueling substantial investment in low-carbon and green hydrogen technologies.

- Rapid Technological Advancements: Significant cost reductions and substantial improvements in the efficiency of electrolyzers are making green hydrogen increasingly cost-competitive with traditional fossil fuel-based hydrogen production.

- Enhanced Energy Security and Independence: Hydrogen offers a promising pathway towards diversifying energy sources, reducing reliance on volatile fossil fuel imports, and strengthening national energy security.

- Growing Industrial Demand: Industries such as refining, fertilizer production, and steel manufacturing are exploring hydrogen as a decarbonization solution, driving market growth.

Challenges:

- High Capital Expenditure: The initial investment required for establishing large-scale hydrogen production facilities remains substantial, presenting a barrier to entry for smaller players.

- Inadequate Infrastructure: The lack of a comprehensive and widely accessible hydrogen pipeline network and refueling infrastructure significantly limits widespread adoption, particularly in transportation sectors.

- Intermittency of Renewable Energy Sources: The inherent intermittency of renewable energy sources used to power green hydrogen production necessitates robust and cost-effective energy storage solutions to ensure a consistent and reliable supply. The development and deployment of such solutions remain a significant challenge.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding hydrogen production, storage, and transportation can create uncertainty for investors and hinder market development.

Emerging Opportunities in United States Hydrogen Generation Market

Significant opportunities exist in expanding hydrogen applications beyond its current uses. Key areas include heavy-duty transportation (long-haul trucking, shipping), aviation fuel, industrial process heat, and long-duration energy storage solutions for grid stabilization. The development of innovative, cost-effective hydrogen storage and transportation technologies (e.g., liquid organic hydrogen carriers (LOHCs)) is crucial. Furthermore, integrating hydrogen with existing energy systems (power plants, gas grids) and utilizing untapped renewable energy resources in rural areas present substantial growth potential. The burgeoning blue hydrogen market, leveraging carbon capture and storage (CCS) technologies, also offers opportunities for reducing emissions from existing SMR plants.

Growth Accelerators in the United States Hydrogen Generation Market Industry

Several factors are accelerating growth in the US hydrogen generation market. These include continuous technological breakthroughs in electrolysis, specifically focused on dramatically lowering the cost of green hydrogen production. Simultaneous advancements in hydrogen storage and transportation are also critical. Strategic partnerships between major energy companies, innovative technology providers, and end-users are fostering a collaborative environment driving innovation and accelerating market adoption. Government policies, including tax incentives, grants, and loan programs, are providing crucial financial support. Crucially, the expansion of dedicated hydrogen infrastructure, encompassing pipelines, refueling stations, and storage facilities, is essential for widespread adoption, particularly within the transportation sector.

Key Players Shaping the United States Hydrogen Generation Market Market

- Air Products and Chemicals Inc

- Fuel Cell Energy Inc

- Enapter S r l

- Engie S A

- Air Liquide SA

- McPhy Energy S A

- Messer Group GmbH

- Cummins Inc

- Linde Plc

- ITM Power Plc

- Taiyo Nippon Sanso Holding Corporation

Notable Milestones in United States Hydrogen Generation Market Sector

- September 2022: Linde announced plans to build a substantial 35-megawatt PEM electrolyzer facility in Niagara Falls, New York, significantly expanding its green hydrogen production capabilities and demonstrating large-scale investment in the sector.

- August 2022: The collaboration between NREL and Toyota on a one-megawatt PEM fuel cell power generation system showcased the potential of large-scale power production from hydrogen fuel cells, highlighting technological advancements in this area.

- Ongoing Developments: Numerous other significant projects involving hydrogen production, storage, and utilization are underway across the United States, showcasing the rapidly evolving nature of this market.

In-Depth United States Hydrogen Generation Market Market Outlook

The US hydrogen generation market is poised for significant growth, driven by supportive government policies, technological advancements, and increasing demand for clean energy solutions. Strategic investments in infrastructure development, coupled with ongoing innovation in production and storage technologies, will unlock substantial market potential across various sectors. The focus on green hydrogen production will likely accelerate, leading to further decarbonization efforts and contributing to a more sustainable energy future.

United States Hydrogen Generation Market Segmentation

-

1. Source

- 1.1. Blue hydrogen

- 1.2. Green hydrogen

- 1.3. Grey Hydrogen

-

2. Technology

- 2.1. Steam Methane Reforming (SMR)

- 2.2. Coal Gasification

- 2.3. Others

-

3. Application

- 3.1. Oil Refining

- 3.2. Chemical Processing

- 3.3. Iron & Steel Production

- 3.4. Others

United States Hydrogen Generation Market Segmentation By Geography

- 1. United States

United States Hydrogen Generation Market Regional Market Share

Geographic Coverage of United States Hydrogen Generation Market

United States Hydrogen Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Costs For Hydrogen Energy Storage

- 3.4. Market Trends

- 3.4.1. Grey to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hydrogen Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Blue hydrogen

- 5.1.2. Green hydrogen

- 5.1.3. Grey Hydrogen

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Methane Reforming (SMR)

- 5.2.2. Coal Gasification

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil Refining

- 5.3.2. Chemical Processing

- 5.3.3. Iron & Steel Production

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Air Products and Chemicals Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fuel Cell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enapter S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engie S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Air Liquide SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 McPhy Energy S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Messer Group GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cummins Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linde Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ITM Power Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Taiyo Nippon Sanso Holding Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Air Products and Chemicals Inc

List of Figures

- Figure 1: United States Hydrogen Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Hydrogen Generation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Hydrogen Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: United States Hydrogen Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hydrogen Generation Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the United States Hydrogen Generation Market?

Key companies in the market include Air Products and Chemicals Inc, Fuel Cell Energy Inc, Enapter S r l, Engie S A, Air Liquide SA, McPhy Energy S A, Messer Group GmbH, Cummins Inc, Linde Plc, ITM Power Plc, Taiyo Nippon Sanso Holding Corporation.

3. What are the main segments of the United States Hydrogen Generation Market?

The market segments include Source, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.86 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies.

6. What are the notable trends driving market growth?

Grey to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Costs For Hydrogen Energy Storage.

8. Can you provide examples of recent developments in the market?

In September 2022, Linde announced plans to build a 35-megawatt PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in Niagara Falls, New York. The new plant will be the largest electrolyzer installed by Linde globally and will more than double Linde's green liquid hydrogen production capacity in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hydrogen Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hydrogen Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hydrogen Generation Market?

To stay informed about further developments, trends, and reports in the United States Hydrogen Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence