Key Insights

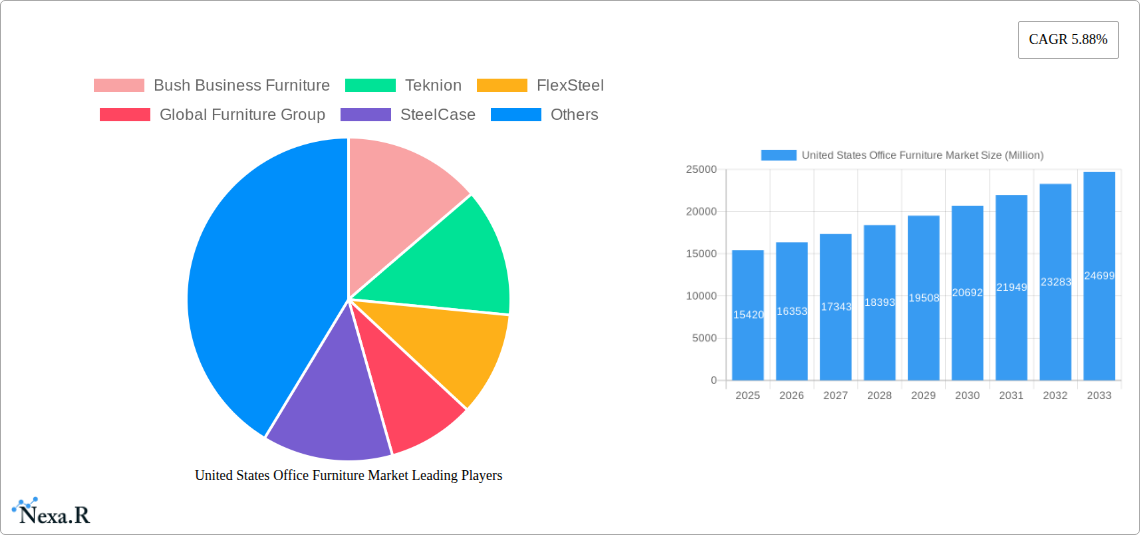

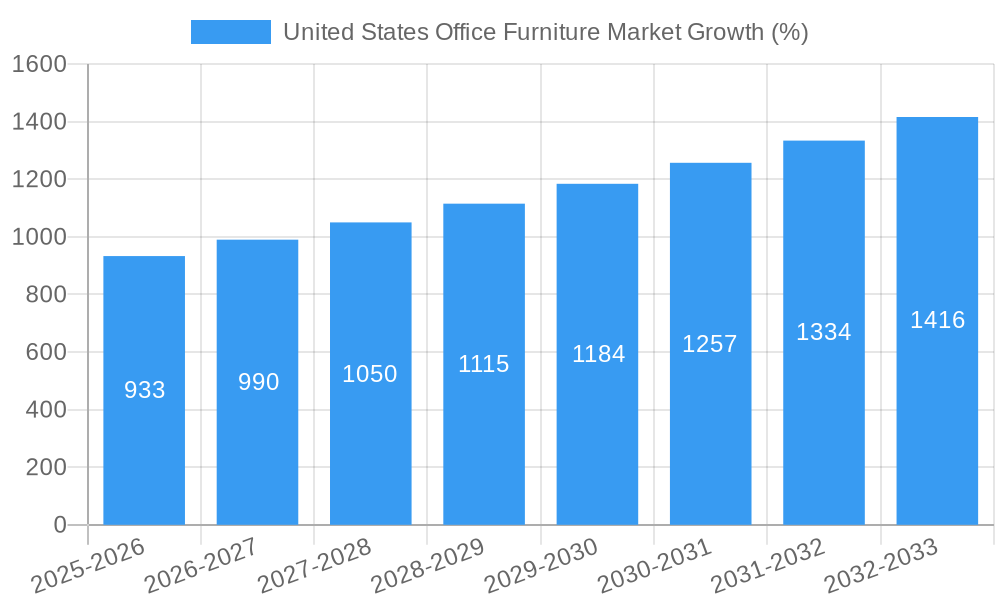

The United States office furniture market, valued at $15.42 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.88% from 2025 to 2033. This expansion is fueled by several key factors. The increasing number of startups and established businesses necessitates substantial investments in office spaces and ergonomic furniture. Furthermore, a growing emphasis on employee well-being and productivity is driving demand for high-quality, adjustable, and comfortable office chairs, desks, and other furniture pieces. The shift towards hybrid and flexible work models also contributes to market growth, as companies invest in creating functional and adaptable workspaces both in-office and remotely. Market segmentation reveals strong demand across various product categories, including seating (office chairs, ergonomic solutions being particularly popular), storage units (driven by the need for organized and efficient workspace), and tables (with conference tables and adaptable workspaces fueling this segment's growth). Distribution channels, both direct and indirect, contribute significantly to the market, with e-commerce channels playing a growing role. Major players like Steelcase, Herman Miller, and Knoll are leveraging innovation and technological advancements in design and materials to maintain market share, while newer entrants are challenging the status quo with more affordable and eco-friendly options.

The market's growth trajectory, however, is not without challenges. Economic downturns can impact business investment in new office furniture. Fluctuations in raw material prices, particularly wood and metal, pose a threat to profitability. Furthermore, increased competition and the need for continuous innovation to meet evolving customer preferences present ongoing hurdles. To mitigate these challenges, established companies are focusing on sustainable and ergonomic designs, while smaller companies are capitalizing on niche markets and direct-to-consumer sales models. The focus on enhancing workspace design to boost employee productivity and satisfaction remains a key driver, ensuring the continued growth of this significant market segment.

United States Office Furniture Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States office furniture market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by distribution channel (direct, indirect), material (wood, metal, plastics, other), and product type (seating, storage units, tables, other accessories). The market size is presented in million units.

United States Office Furniture Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the US office furniture market. We examine market concentration, revealing the market share held by major players such as Steelcase, Herman Miller, and Knoll. The report also delves into the impact of technological innovations, such as ergonomic designs and smart office solutions, on market growth. Regulatory frameworks concerning workplace safety and environmental standards are analyzed, alongside the impact of substitute products like home office furniture and co-working spaces. End-user demographics, including the shift towards hybrid work models, are examined, along with the frequency and impact of mergers and acquisitions (M&A) activity within the sector.

- Market Concentration: The US office furniture market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: The increasing adoption of ergonomic designs, smart office technology, and sustainable materials is driving innovation. However, high R&D costs pose a barrier to entry for smaller players.

- Regulatory Framework: Compliance with safety and environmental regulations influences material sourcing and product design.

- Competitive Substitutes: The rise of home office furniture and co-working spaces presents a challenge to traditional office furniture sales.

- End-User Demographics: The shift towards hybrid work models is impacting demand for office furniture, with a likely shift towards more agile and flexible solutions.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024, signifying consolidation within the market.

United States Office Furniture Market Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, utilizing both qualitative and quantitative data. The report examines historical market size (2019-2024), projecting future growth (2025-2033) based on various factors such as economic indicators, technological advancements, and changing work styles. Adoption rates of new technologies and shifting consumer preferences are discussed in detail, and a comprehensive picture of the market's evolution is presented. Specific metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rates for different product segments, are included to enhance understanding.

The market witnessed a CAGR of xx% during 2019-2024. The forecast period (2025-2033) projects a CAGR of xx%, driven by factors such as increasing office space occupancy, renewed focus on employee well-being, and the adoption of sustainable office solutions. Market penetration of ergonomic chairs and modular furniture is expected to increase significantly.

Dominant Regions, Countries, or Segments in United States Office Furniture Market

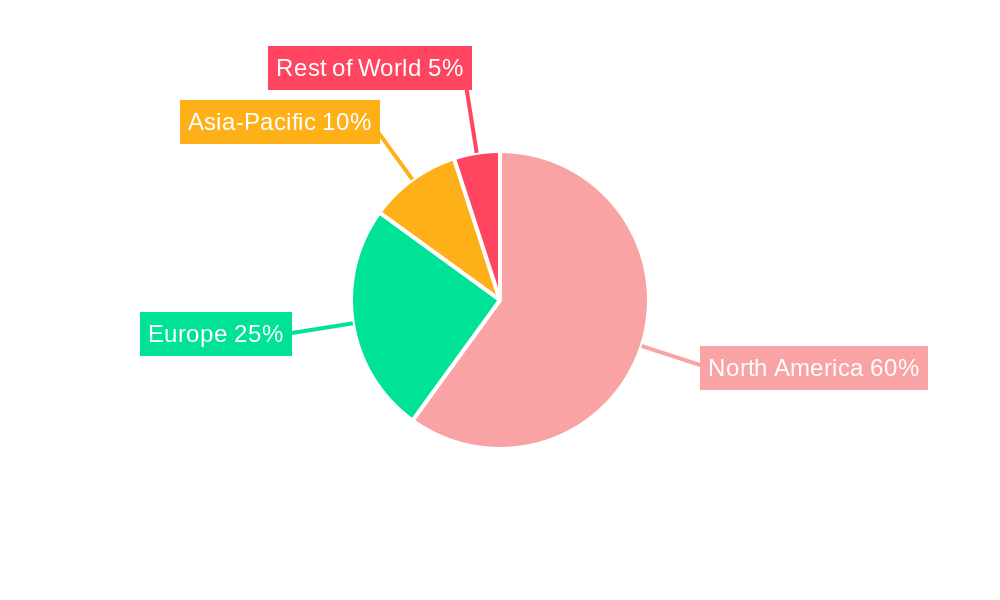

This section identifies the leading regions, countries, and segments driving market growth within the US office furniture industry. The analysis focuses on distribution channel (direct vs. indirect), material type (wood, metal, plastic, other), and product category (seating, storage, tables, accessories). The dominance of each segment is assessed by analyzing market share, growth potential, and underlying contributing factors. Key drivers are highlighted through bullet points, offering insights into economic policies, infrastructure development, and consumer preferences.

- Leading Segment: The seating segment, particularly office chairs, is projected to remain the largest segment throughout the forecast period, driven by increased workplace ergonomic concerns.

- Dominant Distribution Channel: Indirect channels (dealers, distributors) are expected to hold a larger market share due to established distribution networks.

- Material Trends: The use of sustainable and eco-friendly materials is anticipated to gain traction, influencing material choices in furniture production.

- Regional Variations: Growth may vary across regions based on economic conditions and office space development.

United States Office Furniture Market Product Landscape

This section presents an overview of the product landscape, focusing on key product innovations, applications, and performance metrics. The analysis highlights the unique selling propositions (USPs) of different products, such as adjustable height desks, smart office solutions, and environmentally friendly materials. Technological advancements impacting product design and functionality are discussed, including integration of technology, advancements in material science and increased focus on ergonomics. The ongoing evolution of product designs to meet the needs of hybrid and remote work environments will also be examined.

Key Drivers, Barriers & Challenges in United States Office Furniture Market

This section outlines the key factors driving market growth, including technological advancements (e.g., smart furniture), economic factors (e.g., office construction), and supportive government policies. Furthermore, it discusses challenges and restraints, such as supply chain disruptions, regulatory hurdles (e.g., material sourcing regulations), and intense competition from both domestic and international players. Quantifiable impacts of these challenges are addressed wherever possible.

Emerging Opportunities in United States Office Furniture Market

This section highlights emerging trends and untapped market segments presenting lucrative opportunities for growth. This includes advancements in technology, such as smart office solutions, the increased focus on sustainability and the changing demands of a hybrid workforce. The exploration of new materials, designs, and functionalities for adapting to modern office spaces and needs of remote workers will also be emphasized.

Growth Accelerators in the United States Office Furniture Market Industry

This section discusses long-term growth catalysts, focusing on technological breakthroughs, strategic partnerships, and expansion strategies. The key drivers for growth will be outlined, highlighting the synergy created by technological advancement, strategic collaborations between manufacturers and technology providers and innovative business models. The report identifies key factors that could significantly boost the long-term growth of the US Office Furniture Market.

Key Players Shaping the United States Office Furniture Market Market

- Bush Business Furniture

- Teknion

- FlexSteel

- Global Furniture Group

- SteelCase

- Herman Miller

- HNI Corporation

- La-Z-Boy Inc

- AIS

- Virco

- KI

- Knoll

- Kimball International

- Haworth

- Ashley Furniture Industries

Notable Milestones in United States Office Furniture Market Sector

- January 2023: Steelcase and the Frank Lloyd Wright Foundation released their first collection of home office furniture, signifying an expansion into the home office market and leveraging a strong brand partnership.

- January 2023: Kokuyo Co Ltd and Allsteel partnered to expand their global reach, showcasing the increasing importance of strategic alliances for market expansion.

In-Depth United States Office Furniture Market Market Outlook

The US office furniture market is poised for continued growth driven by factors such as increasing urbanization, expansion of commercial spaces, and a growing emphasis on employee well-being and productivity. Strategic opportunities exist for companies focused on sustainability, smart office technology, and adaptable furniture solutions catering to the evolving needs of hybrid work models. The market's future is bright, with significant potential for companies that can innovate and adapt to changing market dynamics.

United States Office Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastics

- 1.4. Other Materials

-

2. Products

- 2.1. Seating

- 2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 2.3. Tables (

- 2.4. Other Accessories

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Indirect

United States Office Furniture Market Segmentation By Geography

- 1. United States

United States Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The integration of technology into office furniture is becoming more common

- 3.2.2 with smart furniture that can enhance productivity and wellness. This includes desks with programmable height settings

- 3.2.3 chairs with posture monitoring features

- 3.2.4 and furniture equipped with wireless charging stations and connectivity options.

- 3.3. Market Restrains

- 3.3.1 The U.S. office furniture market is highly competitive

- 3.3.2 with numerous domestic and international players. This competition

- 3.3.3 combined with price sensitivity in certain market segments

- 3.3.4 can pressure manufacturers to lower prices

- 3.3.5 potentially impacting profitability.

- 3.4. Market Trends

- 3.4.1. The trend towards flexible and adaptable workspaces is driving demand for modular office furniture that can be easily reconfigured. This is particularly important in open-plan offices and coworking spaces where flexibility is key to accommodating different team sizes and work styles.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Office Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastics

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Seating

- 5.2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 5.2.3. Tables (

- 5.2.4. Other Accessories

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Indirect

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bush Business Furniture

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teknion

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FlexSteel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Global Furniture Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SteelCase

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herman Miller

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HNI Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 La-Z-Boy Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AIS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virco

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KI

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Knoll

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Kimball International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Haworth

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ashley Furniture Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Bush Business Furniture

List of Figures

- Figure 1: United States Office Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Office Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: United States Office Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Office Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: United States Office Furniture Market Revenue Million Forecast, by Products 2019 & 2032

- Table 4: United States Office Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: United States Office Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Office Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Office Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 8: United States Office Furniture Market Revenue Million Forecast, by Products 2019 & 2032

- Table 9: United States Office Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: United States Office Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Office Furniture Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the United States Office Furniture Market?

Key companies in the market include Bush Business Furniture, Teknion, FlexSteel, Global Furniture Group, SteelCase, Herman Miller, HNI Corporation, La-Z-Boy Inc, AIS, Virco, KI, Knoll, Kimball International, Haworth, Ashley Furniture Industries.

3. What are the main segments of the United States Office Furniture Market?

The market segments include Material, Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.42 Million as of 2022.

5. What are some drivers contributing to market growth?

The integration of technology into office furniture is becoming more common. with smart furniture that can enhance productivity and wellness. This includes desks with programmable height settings. chairs with posture monitoring features. and furniture equipped with wireless charging stations and connectivity options..

6. What are the notable trends driving market growth?

The trend towards flexible and adaptable workspaces is driving demand for modular office furniture that can be easily reconfigured. This is particularly important in open-plan offices and coworking spaces where flexibility is key to accommodating different team sizes and work styles..

7. Are there any restraints impacting market growth?

The U.S. office furniture market is highly competitive. with numerous domestic and international players. This competition. combined with price sensitivity in certain market segments. can pressure manufacturers to lower prices. potentially impacting profitability..

8. Can you provide examples of recent developments in the market?

January 2023: Steelcase and the Frank Lloyd Wright Foundation released their first collection of home office furniture as part of a collaboration announced last year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Office Furniture Market?

To stay informed about further developments, trends, and reports in the United States Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence