Key Insights

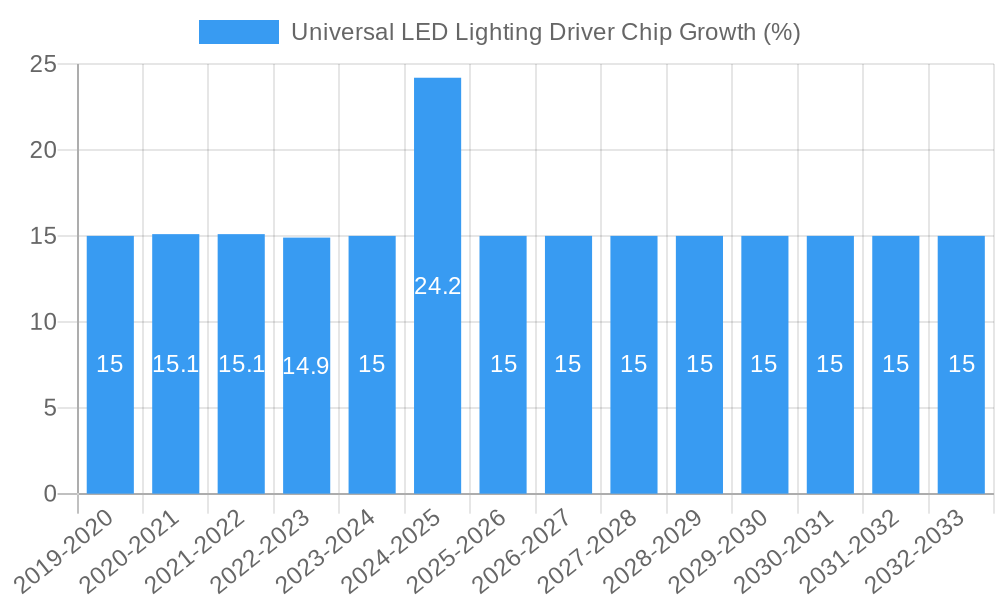

The Universal LED Lighting Driver Chip market is poised for significant expansion, projected to reach an estimated market size of $7,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% anticipated through 2033. This impressive growth is fueled by the escalating demand for energy-efficient and long-lasting lighting solutions across various sectors. The automotive industry, in particular, is a major driver, with the increasing adoption of LED technology for headlights, taillights, and interior lighting, demanding sophisticated driver chips for optimal performance and safety. General lighting applications, encompassing residential, commercial, and industrial spaces, also contribute substantially as governments and consumers alike prioritize sustainability and reduced energy consumption. The ongoing transition from traditional lighting to LED technology, coupled with advancements in smart lighting systems and the Internet of Things (IoT), further propels this market forward.

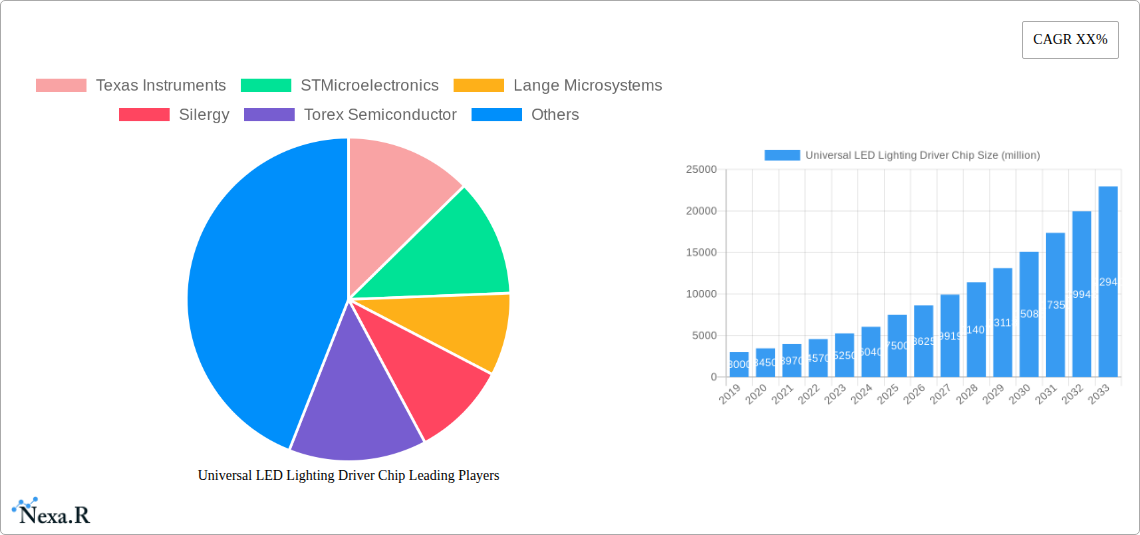

The market is segmented by application, with Automotive Lighting and General Lighting emerging as the dominant segments, collectively accounting for over 80% of the market share. The "Others" segment, encompassing specialized applications like signage, display backlighting, and horticultural lighting, is also demonstrating healthy growth. In terms of types, the market is primarily driven by both RGB LED Driver ICs, crucial for color-tunable and dynamic lighting, and DC-DC LED Driver ICs, essential for voltage conversion and efficient power management. Key players such as Texas Instruments, STMicroelectronics, and Infineon Technologies are at the forefront of innovation, investing heavily in research and development to offer more integrated, efficient, and cost-effective driver solutions. Challenges such as intense price competition and the need for constant technological upgrades are present, but the overarching trend of LED adoption and the pursuit of smarter, more sustainable lighting solutions are expected to ensure continued market ascendancy.

Here is the comprehensive, SEO-optimized report description for the Universal LED Lighting Driver Chip market.

Universal LED Lighting Driver Chip Market Dynamics & Structure

The Universal LED Lighting Driver Chip market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demands. Market concentration is moderately high, with key players like Texas Instruments, STMicroelectronics, Analog Devices, and Infineon Technologies holding significant shares, driven by their extensive R&D capabilities and established supply chains. Technological innovation is primarily fueled by the increasing demand for energy efficiency, advanced lighting control, and smart connectivity features. The development of high-efficiency DC-DC LED Driver ICs and sophisticated RGB LED Driver ICs for dynamic lighting applications are key innovation drivers. Regulatory frameworks, particularly those mandating energy-efficient lighting solutions and safety standards, are instrumental in shaping market growth. Competitive product substitutes, such as traditional lighting technologies and lower-cost, less integrated LED driver solutions, pose a challenge, but the superior performance and versatility of universal LED driver chips are increasingly favored. End-user demographics span both the industrial and consumer sectors, with automotive lighting and general lighting representing the largest application segments. Mergers and acquisitions (M&A) are a notable trend, with larger semiconductor manufacturers acquiring smaller, specialized firms to expand their product portfolios and market reach, such as Analog Devices' acquisition of Maxim Integrated, valued at over $21 billion.

- Market Concentration: Moderate to high, dominated by established semiconductor giants.

- Technological Innovation Drivers: Energy efficiency, smart lighting integration, miniaturization, advanced thermal management.

- Regulatory Frameworks: Energy efficiency standards (e.g., Energy Star), safety certifications, RoHS compliance.

- Competitive Product Substitutes: Traditional lighting, basic LED drivers, discrete component solutions.

- End-User Demographics: Automotive manufacturers, lighting fixture producers, smart home device integrators, industrial automation companies.

- M&A Trends: Strategic acquisitions to gain IP, expand product lines, and strengthen market position.

Universal LED Lighting Driver Chip Growth Trends & Insights

The Universal LED Lighting Driver Chip market is projected for robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period of 2025-2033. This expansion is primarily attributed to the relentless global push towards energy-efficient lighting solutions across all sectors. The historical period from 2019-2024 witnessed steady adoption driven by initial energy mandates and the growing popularity of LED technology. The base year of 2025 marks a significant inflection point, with increased demand for intelligent lighting systems that offer enhanced control, color rendering, and connectivity. The estimated market size for universal LED lighting driver chips in 2025 is approximately $18,500 million units, with a projected increase to over $35,000 million units by 2033.

Technological disruptions are continuously reshaping the market. The integration of advanced features such as dimming control, color tuning (especially for RGB LED Driver ICs), and communication protocols like DALI and Bluetooth Low Energy (BLE) within single driver chips is a key trend. This integration reduces system complexity and cost for end-users. Consumer behavior is also shifting, with a growing preference for smart, customizable, and energy-saving lighting solutions in both residential and commercial spaces. The automotive sector is a significant driver, with the increasing adoption of LED lighting for headlights, taillights, and interior ambient lighting, demanding highly reliable and feature-rich driver ICs. The penetration of universal LED driver chips into general lighting applications continues to grow as cost efficiencies improve and performance benefits become more apparent. The "smart home" revolution further bolsters demand for sophisticated driver ICs capable of seamless integration with smart home ecosystems. Furthermore, the development of highly integrated solutions that incorporate power management, protection circuits, and communication interfaces onto a single chip is a critical innovation. This trend addresses the demand for smaller form factors and lower bill-of-materials (BOM) costs. The growing emphasis on sustainability and reduced carbon footprints globally provides a sustained tailwind for the adoption of energy-efficient LED lighting technologies, directly benefiting the market for universal LED lighting driver chips.

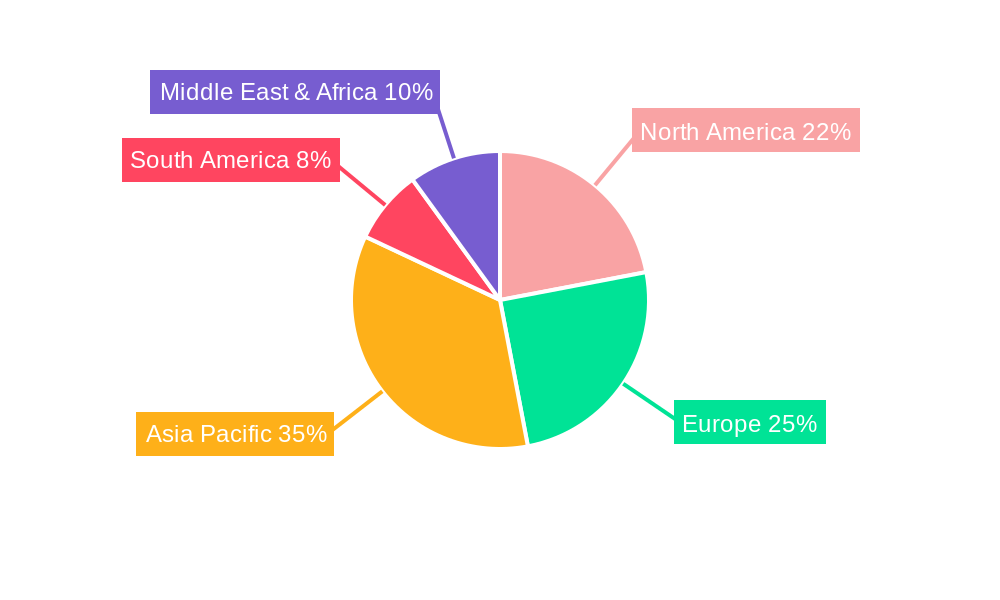

Dominant Regions, Countries, or Segments in Universal LED Lighting Driver Chip

The General Lighting application segment is a dominant force in the Universal LED Lighting Driver Chip market, projected to account for approximately 45% of the total market share in 2025, with an estimated market size of $8,325 million units. This dominance is fueled by widespread adoption in residential, commercial, and industrial spaces driven by stringent energy efficiency regulations and the ongoing replacement of traditional lighting technologies. North America and Europe are leading regions due to their proactive environmental policies and high consumer awareness regarding energy savings. For instance, the European Union's Ecodesign Directive and the US Department of Energy's Energy Star program continuously drive demand for compliant and efficient lighting solutions.

The Automotive Lighting segment is another significant and rapidly growing area, expected to capture around 35% of the market in 2025, valued at $6,475 million units. The increasing sophistication of automotive lighting systems, including adaptive headlights, matrix LED systems, and customizable interior lighting, necessitates advanced and reliable LED driver ICs. Countries with strong automotive manufacturing bases, such as Germany, Japan, South Korea, and the United States, are key contributors to this segment's growth. The transition towards electric vehicles (EVs) also indirectly fuels this segment, as EVs often incorporate more extensive and advanced LED lighting features.

Within the Types of LED driver ICs, DC-DC LED Driver ICs hold a substantial market share, estimated at 60% in 2025, with a market value of $11,100 million units. Their widespread applicability in various power conversion scenarios for LED illumination makes them a versatile choice. However, RGB LED Driver ICs are witnessing a higher CAGR due to the burgeoning demand for dynamic and color-tunable lighting in applications ranging from decorative architectural lighting to automotive interior lighting and sophisticated displays. The growth potential for RGB LED Driver ICs is significant, driven by smart lighting trends and aesthetic customization preferences.

- Dominant Application: General Lighting, driven by energy efficiency mandates and widespread adoption in residential, commercial, and industrial sectors.

- Key Regional Drivers (General Lighting): North America and Europe, due to stringent environmental policies and high consumer awareness.

- High-Growth Application: Automotive Lighting, propelled by advanced lighting features and the increasing complexity of vehicle illumination systems.

- Leading Countries (Automotive Lighting): Germany, Japan, South Korea, United States.

- Dominant Type: DC-DC LED Driver ICs, due to their broad applicability in power conversion.

- High-Growth Type: RGB LED Driver ICs, fueled by the demand for dynamic and color-tunable lighting solutions.

Universal LED Lighting Driver Chip Product Landscape

The Universal LED Lighting Driver Chip market is witnessing a surge in product innovation focused on enhanced performance, integration, and intelligence. Manufacturers are introducing highly efficient DC-DC LED Driver ICs with advanced power factor correction (PFC) capabilities, reducing energy consumption and meeting stringent energy standards. Innovations in RGB LED Driver ICs are enabling finer color control, wider color gamuts, and seamless integration with wireless communication protocols for dynamic and customizable lighting experiences in automotive interiors and smart home applications. Performance metrics such as efficiency ratings exceeding 95%, low total harmonic distortion (THD), and precise current regulation are becoming standard. Unique selling propositions include ultra-low quiescent current for battery-powered applications, integrated safety features like thermal shutdown and overvoltage protection, and miniaturized package sizes for space-constrained designs. Technological advancements in silicon carbide (SiC) and gallium nitride (GaN) are also beginning to influence the development of higher-power, more efficient LED driver solutions.

Key Drivers, Barriers & Challenges in Universal LED Lighting Driver Chip

Key Drivers: The primary forces propelling the Universal LED Lighting Driver Chip market include the escalating global demand for energy-efficient and sustainable lighting solutions, driven by government regulations and environmental consciousness. Technological advancements enabling higher integration, improved performance (efficiency, dimming precision), and smart connectivity are significant drivers. The expanding adoption of LED lighting in diverse applications, from general illumination and automotive to specialized industrial and horticultural lighting, also fuels market growth. The increasing trend towards smart homes and connected infrastructure further boosts demand for intelligent driver ICs.

Key Barriers & Challenges: Supply chain disruptions and raw material price volatility pose significant challenges, impacting production costs and lead times. Regulatory hurdles and the need for extensive testing and certification for new products in different regions can slow down market entry. Intense competition from established players and the emergence of new entrants offering cost-competitive solutions create pricing pressures. Furthermore, the rapid pace of technological evolution necessitates continuous R&D investment, posing a challenge for smaller companies. The limited availability of skilled engineers specializing in power electronics and semiconductor design can also be a constraint, with an estimated xx% shortage.

Emerging Opportunities in Universal LED Lighting Driver Chip

Emerging opportunities within the Universal LED Lighting Driver Chip sector are abundant, particularly in the realm of intelligent and connected lighting. The burgeoning smart city initiatives worldwide present a significant untapped market for sophisticated LED drivers in street lighting, public infrastructure, and traffic management systems. Innovative applications in the horticultural sector, where optimized LED spectrum control is crucial for plant growth, are also gaining traction. Evolving consumer preferences for personalized and dynamic lighting experiences in both residential and commercial spaces are driving demand for advanced RGB LED Driver ICs with enhanced controllability and aesthetic capabilities. The miniaturization of driver ICs also opens doors for their integration into a wider array of consumer electronics and wearable devices.

Growth Accelerators in the Universal LED Lighting Driver Chip Industry

Several key catalysts are accelerating growth in the Universal LED Lighting Driver Chip industry. Technological breakthroughs in power semiconductor materials like GaN and SiC are enabling the development of smaller, more efficient, and higher-performance driver ICs. Strategic partnerships between semiconductor manufacturers and lighting system integrators are fostering innovation and accelerating the adoption of new technologies. Market expansion strategies, including penetration into emerging economies with rapidly industrializing and urbanizing populations, are also significant growth drivers. The increasing focus on reliability and longevity in automotive and industrial applications is driving demand for high-quality, robust driver solutions.

Key Players Shaping the Universal LED Lighting Driver Chip Market

- Texas Instruments

- STMicroelectronics

- Lange Microsystems

- Silergy

- Torex Semiconductor

- Shanghai Bright Power Semiconductor

- Shenzhen Sunmoon MICROELECTRONICS

- FINE Made MICROELECTRONICS Group

- Analog Devices

- Infineon Technologies

- NXP

- Melexis

- On Semiconductor

Notable Milestones in Universal LED Lighting Driver Chip Sector

- 2021: Analog Devices completes its acquisition of Maxim Integrated, bolstering its analog and mixed-signal portfolio, including LED driver solutions.

- 2022: STMicroelectronics launches a new series of high-efficiency LED driver ICs designed for automotive applications, meeting stringent AEC-Q100 standards.

- 2022: Infineon Technologies introduces advanced GaN-based power ICs, paving the way for smaller and more efficient LED drivers.

- 2023: Texas Instruments expands its portfolio of smart lighting solutions with new integrated LED driver ICs offering enhanced connectivity and dimming capabilities.

- 2023: Shanghai Bright Power Semiconductor announces a breakthrough in ultra-low power LED driver technology for IoT devices.

- 2024: Lange Microsystems showcases its next-generation high-power LED driver solutions with advanced thermal management features.

- 2024: Silergy introduces highly integrated LED driver ICs for general lighting, simplifying design and reducing BOM costs.

In-Depth Universal LED Lighting Driver Chip Market Outlook

The future market outlook for Universal LED Lighting Driver Chips is exceptionally promising, driven by sustained innovation and expanding application frontiers. Growth accelerators such as the increasing integration of artificial intelligence (AI) for adaptive lighting control, the development of advanced driver ICs for LiFi communication, and the continued push for sustainable and circular economy principles in lighting design will fuel significant market expansion. The strategic focus on developing highly specialized driver solutions for niche markets like medical lighting and advanced display technologies presents substantial growth opportunities. The market is poised for continued evolution, with an emphasis on intelligent, efficient, and seamlessly integrated LED driving solutions that will shape the future of illumination across all sectors. The projected market size for 2033 is estimated to reach over $35,000 million units, reflecting the robust long-term growth trajectory.

Universal LED Lighting Driver Chip Segmentation

-

1. Application

- 1.1. Automotive Lighting

- 1.2. General Lighting

- 1.3. Others

-

2. Types

- 2.1. RGB LED Driver IC

- 2.2. DC-DC LED Driver IC

Universal LED Lighting Driver Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Universal LED Lighting Driver Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive Lighting

- 5.1.2. General Lighting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. RGB LED Driver IC

- 5.2.2. DC-DC LED Driver IC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive Lighting

- 6.1.2. General Lighting

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. RGB LED Driver IC

- 6.2.2. DC-DC LED Driver IC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive Lighting

- 7.1.2. General Lighting

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. RGB LED Driver IC

- 7.2.2. DC-DC LED Driver IC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive Lighting

- 8.1.2. General Lighting

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. RGB LED Driver IC

- 8.2.2. DC-DC LED Driver IC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive Lighting

- 9.1.2. General Lighting

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. RGB LED Driver IC

- 9.2.2. DC-DC LED Driver IC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Universal LED Lighting Driver Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive Lighting

- 10.1.2. General Lighting

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. RGB LED Driver IC

- 10.2.2. DC-DC LED Driver IC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Texas Instruments

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 STMicroelectronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lange Microsystems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silergy

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Torex Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai Bright Power Semiconductor

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen Sunmoon MICROELECTRONICS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FINE Made MICROELECTRONICS Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Analog Devices

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Infineon Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NXP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Melexis

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 On Semiconductor

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Texas Instruments

List of Figures

- Figure 1: Global Universal LED Lighting Driver Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Universal LED Lighting Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Universal LED Lighting Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Universal LED Lighting Driver Chip Revenue (million), by Types 2024 & 2032

- Figure 5: North America Universal LED Lighting Driver Chip Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Universal LED Lighting Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Universal LED Lighting Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Universal LED Lighting Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Universal LED Lighting Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Universal LED Lighting Driver Chip Revenue (million), by Types 2024 & 2032

- Figure 11: South America Universal LED Lighting Driver Chip Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Universal LED Lighting Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Universal LED Lighting Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Universal LED Lighting Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Universal LED Lighting Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Universal LED Lighting Driver Chip Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Universal LED Lighting Driver Chip Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Universal LED Lighting Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Universal LED Lighting Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Universal LED Lighting Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Universal LED Lighting Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Universal LED Lighting Driver Chip Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Universal LED Lighting Driver Chip Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Universal LED Lighting Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Universal LED Lighting Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Universal LED Lighting Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Universal LED Lighting Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Universal LED Lighting Driver Chip Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Universal LED Lighting Driver Chip Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Universal LED Lighting Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Universal LED Lighting Driver Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Universal LED Lighting Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Universal LED Lighting Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Universal LED Lighting Driver Chip?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Universal LED Lighting Driver Chip?

Key companies in the market include Texas Instruments, STMicroelectronics, Lange Microsystems, Silergy, Torex Semiconductor, Shanghai Bright Power Semiconductor, Shenzhen Sunmoon MICROELECTRONICS, FINE Made MICROELECTRONICS Group, Analog Devices, Infineon Technologies, NXP, Melexis, On Semiconductor.

3. What are the main segments of the Universal LED Lighting Driver Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Universal LED Lighting Driver Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Universal LED Lighting Driver Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Universal LED Lighting Driver Chip?

To stay informed about further developments, trends, and reports in the Universal LED Lighting Driver Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence