Key Insights

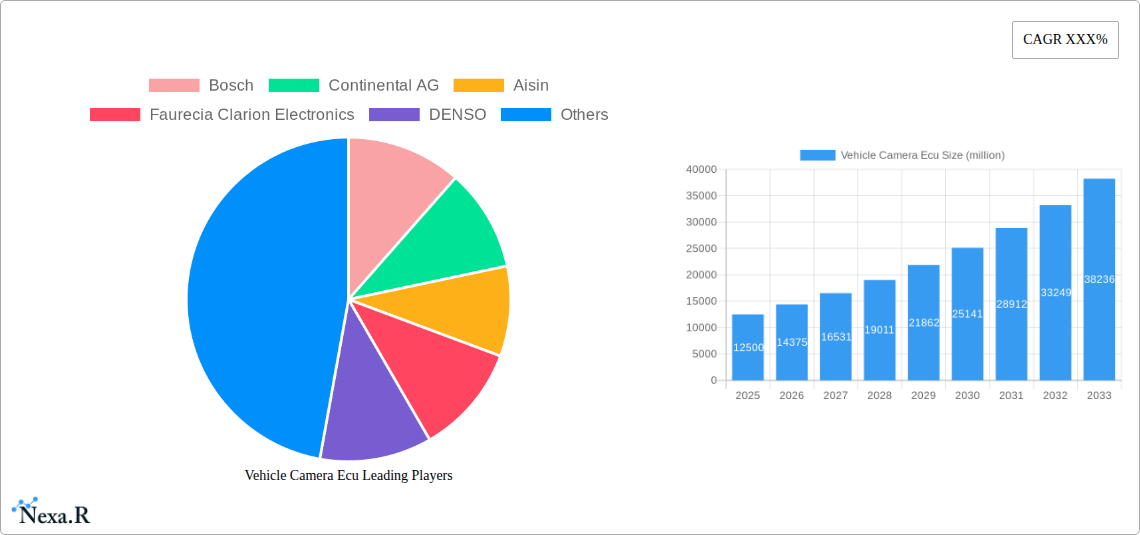

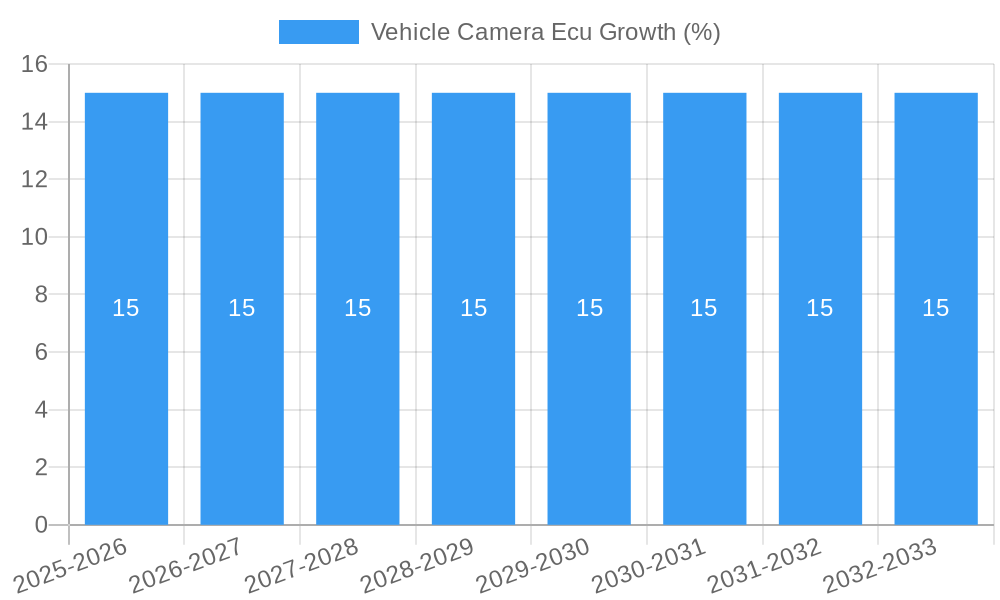

The global Vehicle Camera ECU market is projected to reach an impressive market size of approximately USD 12,500 million by 2025, demonstrating robust growth driven by increasing adoption of advanced driver-assistance systems (ADAS) and the burgeoning trend towards autonomous driving. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around 15% during the forecast period of 2025-2033, underscoring its dynamic and expanding nature. Key drivers fueling this expansion include the escalating demand for enhanced vehicle safety features, such as automatic emergency braking, lane keeping assist, and adaptive cruise control, all of which heavily rely on sophisticated camera ECU technology. Furthermore, stringent government regulations promoting vehicle safety worldwide are compelling automakers to integrate more advanced camera systems, thereby stimulating market growth. The increasing consumer awareness and preference for technologically advanced vehicles also play a significant role in driving the adoption of these ECUs.

The market segmentation by application reveals a strong dominance of Passenger Cars, which are expected to account for the largest share due to their widespread production volumes and the rapid integration of ADAS features in this segment. Commercial Vehicles are also exhibiting significant growth, driven by the need for improved fleet safety and operational efficiency. Within the type segment, Multi-Core Processors are gaining prominence due to their enhanced processing power, crucial for handling complex image processing and AI algorithms required for advanced driving functions. While the market is poised for substantial growth, restraints such as the high cost of advanced camera ECU systems and the complexity of integrating them into existing vehicle architectures could pose challenges. However, ongoing technological advancements and economies of scale are expected to mitigate these concerns over time. Key industry players like Bosch, Continental AG, DENSO, and Shanghai SenseTime are actively investing in research and development, fostering innovation and competition within this rapidly evolving landscape.

Here is a compelling, SEO-optimized report description for the Vehicle Camera ECU market, designed for maximum industry professional engagement and search engine visibility, with all specified requirements met.

Vehicle Camera ECU Market Dynamics & Structure

The global Vehicle Camera ECU market is characterized by a moderately consolidated structure, driven by significant investment in advanced driver-assistance systems (ADAS) and the burgeoning autonomous driving landscape. Technological innovation is the primary catalyst, fueled by the continuous development of higher resolution sensors, sophisticated image processing algorithms, and AI-powered perception systems. Regulatory frameworks, such as UNECE WP.29 regulations and NHTSA mandates for safety features, are increasingly mandating the integration of camera-based systems, thereby accelerating market growth. Competitive product substitutes, though evolving, remain largely focused on sensor fusion with radar and lidar, but camera-based ECUs offer unique advantages in object recognition and scene understanding. End-user demographics are shifting towards a greater appreciation for safety and convenience features across both passenger and commercial vehicle segments. Mergers and acquisitions (M&A) activity is a key dynamic, with larger Tier-1 suppliers consolidating capabilities and acquiring specialized technology firms to enhance their ADAS portfolios.

- Market Concentration: Dominated by established automotive suppliers with strong R&D capabilities and existing relationships with OEMs.

- Technological Innovation Drivers: Demand for enhanced ADAS functionalities (e.g., lane keeping, automatic emergency braking), autonomous driving readiness, and in-cabin monitoring.

- Regulatory Frameworks: Increasing safety mandates and emissions standards are indirectly driving demand for efficient camera systems.

- Competitive Product Substitutes: Fusion with radar and lidar systems, though cameras offer distinct advantages for visual data interpretation.

- End-User Demographics: Growing consumer demand for safety, convenience, and advanced infotainment features.

- M&A Trends: Strategic acquisitions by major players to gain access to cutting-edge AI, software, and sensor technologies.

Vehicle Camera ECU Growth Trends & Insights

The Vehicle Camera ECU market is poised for substantial growth, projected to expand from an estimated xx million units in 2025 to over xx million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is intrinsically linked to the accelerating adoption of advanced driver-assistance systems (ADAS) across all vehicle segments, driven by both regulatory mandates and escalating consumer demand for enhanced safety and convenience. The base year of 2025 sees a significant penetration of single-camera systems, particularly for basic ADAS functions like lane departure warning and traffic sign recognition. However, the trend is rapidly shifting towards multi-camera architectures, integrating surround-view systems, front-facing cameras for forward collision warning, and rear-view cameras for parking assistance.

Technological disruptions are a constant feature, with advancements in AI and machine learning enabling ECUs to process vast amounts of visual data in real-time, facilitating more sophisticated functionalities like pedestrian detection, adaptive cruise control, and even preliminary stages of autonomous driving. The development of specialized processors, from dual-core to advanced multi-core architectures, is crucial to handle the increasing computational demands of these sophisticated algorithms. Consumer behavior is a pivotal factor, with a growing segment of car buyers prioritizing vehicles equipped with advanced safety technologies as a key purchasing criterion. This evolving preference is compelling automakers to integrate more comprehensive camera systems as standard or high-demand options, thereby driving the adoption rates of Vehicle Camera ECUs. Furthermore, the increasing complexity of autonomous driving systems and the need for robust perception capabilities are pushing the boundaries of what camera ECUs can achieve, leading to innovations in sensor fusion, deep learning inference, and high-performance computing within these units. The transition from basic ADAS to higher levels of automation will be a significant differentiator in market penetration throughout the forecast period.

Dominant Regions, Countries, or Segments in Vehicle Camera ECU

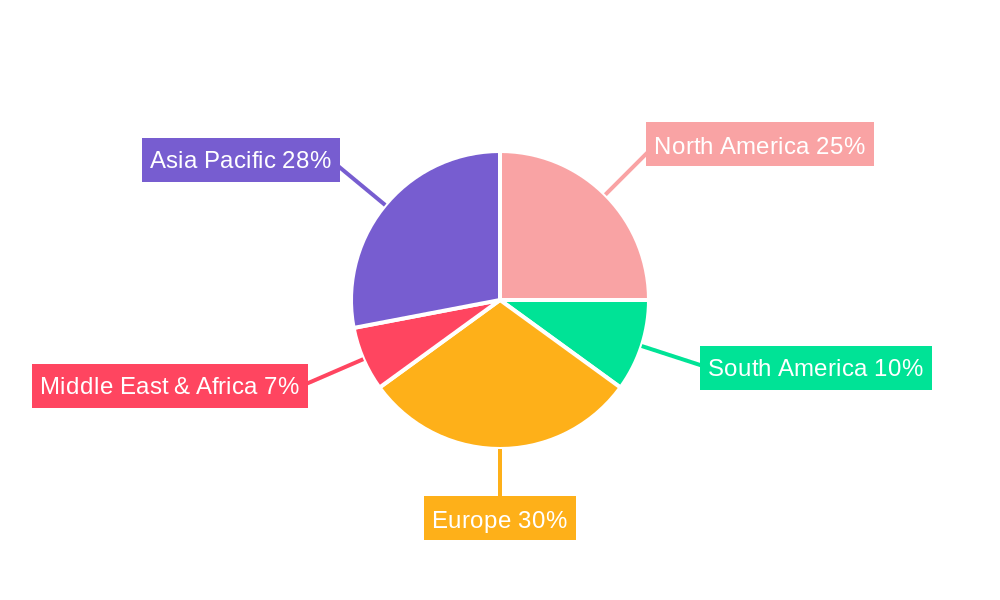

The Passenger Car segment, within the Application category, is currently the dominant force propelling the Vehicle Camera ECU market globally. This dominance is attributed to several interconnected factors including the sheer volume of passenger car production, the widespread adoption of ADAS features as standard or desirable options by consumers, and aggressive marketing strategies by OEMs emphasizing safety and advanced technology. North America and Europe are leading regions for this segment’s growth, driven by stringent safety regulations, high consumer disposable income, and a mature automotive market that readily embraces new technologies.

In terms of Type, the Multi-Core Processor segment is experiencing the fastest growth and is increasingly becoming a focal point for innovation and market share capture. This surge is directly correlated with the escalating complexity of ADAS functionalities and the nascent stages of autonomous driving. Multi-core processors are essential for handling the parallel processing demands of multiple camera inputs, complex algorithms for object detection, sensor fusion, and the real-time decision-making required for advanced driving assistance and autonomous systems. China, as the world's largest automotive market, is a significant driver for both passenger car adoption and the demand for advanced camera ECUs, particularly those featuring multi-core processors, fueled by government initiatives promoting smart mobility and electric vehicle development.

Dominant Application Segment:

- Passenger Car: Represents the largest market share due to high production volumes and consumer demand for safety and advanced features.

- Key Drivers: OEM integration of ADAS as standard/optional features, growing consumer awareness of safety benefits, and the pursuit of premium vehicle attributes.

- Regional Influence: Strong adoption in North America and Europe due to regulatory push and consumer affluence, with significant growth potential in Asia.

Dominant Type Segment & Growth Driver:

- Multi-Core Processor: Fastest-growing segment, crucial for advanced ADAS and autonomous driving capabilities.

- Key Drivers: Increased computational power for complex AI algorithms, real-time sensor fusion, and multi-camera system integration.

- Market Share & Growth Potential: Poised to capture significant market share as higher levels of automation become mainstream.

Vehicle Camera ECU Product Landscape

The Vehicle Camera ECU product landscape is characterized by rapid innovation in processing power and AI integration. Manufacturers are increasingly offering solutions featuring high-performance multi-core processors capable of handling complex deep learning algorithms for real-time object recognition, pedestrian detection, and scene understanding. Products are designed with scalability in mind, catering to a range of applications from basic ADAS to advanced autonomous driving systems. Unique selling propositions often revolve around enhanced sensor fusion capabilities, improved low-light performance, and compact, power-efficient designs essential for automotive integration. Technological advancements include the adoption of specialized AI accelerators and secure boot functionalities to ensure system integrity.

Key Drivers, Barriers & Challenges in Vehicle Camera ECU

Key Drivers:

- Advancements in ADAS and Autonomous Driving: The relentless pursuit of enhanced safety and automated driving features is the primary catalyst, driving demand for sophisticated camera ECUs.

- Stringent Safety Regulations: Government mandates and evolving safety standards globally are compelling automakers to integrate advanced camera-based systems.

- Consumer Demand for Safety and Convenience: Increasing consumer awareness and preference for vehicles equipped with advanced driver assistance and convenience features.

- Technological Innovations in AI and Processing: Breakthroughs in AI, machine learning, and high-performance processors enable more intelligent and responsive camera systems.

Barriers & Challenges:

- High Development Costs and R&D Investment: The complex nature of camera ECU development requires significant capital expenditure, posing a barrier for smaller players.

- Supply Chain Disruptions and Component Shortages: Global supply chain volatility, particularly for advanced semiconductors, can impact production and lead times.

- Cybersecurity Concerns: Ensuring the robustness of camera ECU systems against cyber threats is paramount and requires ongoing investment in security protocols.

- Integration Complexity and Standardization: Integrating diverse camera systems and ensuring interoperability across different vehicle architectures presents a significant challenge.

Emerging Opportunities in Vehicle Camera ECU

Emerging opportunities in the Vehicle Camera ECU market lie in the expansion of in-cabin monitoring systems, crucial for driver alertness detection and passenger safety, especially in ride-sharing and commercial vehicle applications. The integration of camera ECUs with augmented reality (AR) head-up displays (HUDs) presents another significant avenue for growth, offering drivers enhanced situational awareness. Furthermore, the increasing demand for advanced parking assistance systems, including 360-degree views and automated parking, is creating new market niches. Opportunities also exist in developing specialized camera solutions for niche vehicle types, such as autonomous delivery robots and agricultural machinery, where tailored perception capabilities are essential.

Growth Accelerators in the Vehicle Camera ECU Industry

The long-term growth of the Vehicle Camera ECU industry is being significantly accelerated by strategic partnerships between semiconductor manufacturers, AI software providers, and automotive Tier-1 suppliers. These collaborations foster the co-development of integrated solutions, bringing cutting-edge technologies to market more efficiently. The increasing focus on software-defined vehicles, where functionalities are increasingly determined by software rather than hardware, is another major accelerator, enabling over-the-air updates and continuous improvement of camera ECU capabilities. Market expansion strategies, particularly in emerging economies with rapidly growing automotive sectors and increasing adoption of ADAS features, are also contributing to sustained growth.

Key Players Shaping the Vehicle Camera ECU Market

- Bosch

- Continental AG

- Aisin

- Faurecia Clarion Electronics

- DENSO

- Panasonic

- Magna

- Autoliv

- Mitsubishi Electric

- Shanghai SenseTime

Notable Milestones in Vehicle Camera ECU Sector

- 2019: Introduction of advanced AI-powered object detection algorithms by leading AI firms, enhancing ECU perception capabilities.

- 2020: Increased adoption of multi-camera systems for surround-view and advanced ADAS features in premium passenger cars.

- 2021: Significant advancements in automotive-grade image signal processors (ISPs) enabling higher resolution and dynamic range for camera sensors.

- 2022: Growing interest and investment in camera-based driver monitoring systems (DMS) due to safety regulations and feature demand.

- 2023: Development of more powerful and efficient multi-core processors optimized for deep learning inference in automotive ECUs.

- 2024: Key partnerships announced between semiconductor giants and automotive suppliers to accelerate the development of next-generation autonomous driving ECUs.

In-Depth Vehicle Camera ECU Market Outlook

The Vehicle Camera ECU market is projected for sustained and robust growth, fueled by the intrinsic link to advancements in automotive safety and the inexorable march towards autonomous driving. Growth accelerators such as technological breakthroughs in AI, machine learning, and sensor fusion will continue to redefine the capabilities of these ECUs. Strategic partnerships between key industry players, from chip manufacturers to software developers and vehicle OEMs, will be crucial in streamlining innovation and market penetration. The increasing emphasis on software-defined vehicles will allow for continuous enhancement of camera ECU functionalities through over-the-air updates, extending product lifecycles and improving user experience. Emerging market expansion, particularly in developing automotive economies, presents significant untapped potential. The future of the Vehicle Camera ECU market is intrinsically tied to the evolution of intelligent mobility, making it a critical component in the automotive value chain.

Vehicle Camera Ecu Segmentation

-

1. Application

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Single Core Processor

- 2.2. Dual Core Processor

- 2.3. Multi Core Processor

Vehicle Camera Ecu Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Vehicle Camera Ecu REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Core Processor

- 5.2.2. Dual Core Processor

- 5.2.3. Multi Core Processor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Core Processor

- 6.2.2. Dual Core Processor

- 6.2.3. Multi Core Processor

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Core Processor

- 7.2.2. Dual Core Processor

- 7.2.3. Multi Core Processor

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Core Processor

- 8.2.2. Dual Core Processor

- 8.2.3. Multi Core Processor

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Core Processor

- 9.2.2. Dual Core Processor

- 9.2.3. Multi Core Processor

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Vehicle Camera Ecu Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Core Processor

- 10.2.2. Dual Core Processor

- 10.2.3. Multi Core Processor

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aisin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Faurecia Clarion Electronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DENSO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Magna

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autoliv

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shanghai SenseTime

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bosch

List of Figures

- Figure 1: Global Vehicle Camera Ecu Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Vehicle Camera Ecu Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Vehicle Camera Ecu Revenue (million), by Application 2024 & 2032

- Figure 4: North America Vehicle Camera Ecu Volume (K), by Application 2024 & 2032

- Figure 5: North America Vehicle Camera Ecu Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Vehicle Camera Ecu Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Vehicle Camera Ecu Revenue (million), by Type 2024 & 2032

- Figure 8: North America Vehicle Camera Ecu Volume (K), by Type 2024 & 2032

- Figure 9: North America Vehicle Camera Ecu Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Vehicle Camera Ecu Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Vehicle Camera Ecu Revenue (million), by Country 2024 & 2032

- Figure 12: North America Vehicle Camera Ecu Volume (K), by Country 2024 & 2032

- Figure 13: North America Vehicle Camera Ecu Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Vehicle Camera Ecu Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Vehicle Camera Ecu Revenue (million), by Application 2024 & 2032

- Figure 16: South America Vehicle Camera Ecu Volume (K), by Application 2024 & 2032

- Figure 17: South America Vehicle Camera Ecu Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Vehicle Camera Ecu Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Vehicle Camera Ecu Revenue (million), by Type 2024 & 2032

- Figure 20: South America Vehicle Camera Ecu Volume (K), by Type 2024 & 2032

- Figure 21: South America Vehicle Camera Ecu Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Vehicle Camera Ecu Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Vehicle Camera Ecu Revenue (million), by Country 2024 & 2032

- Figure 24: South America Vehicle Camera Ecu Volume (K), by Country 2024 & 2032

- Figure 25: South America Vehicle Camera Ecu Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Vehicle Camera Ecu Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Vehicle Camera Ecu Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Vehicle Camera Ecu Volume (K), by Application 2024 & 2032

- Figure 29: Europe Vehicle Camera Ecu Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Vehicle Camera Ecu Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Vehicle Camera Ecu Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Vehicle Camera Ecu Volume (K), by Type 2024 & 2032

- Figure 33: Europe Vehicle Camera Ecu Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Vehicle Camera Ecu Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Vehicle Camera Ecu Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Vehicle Camera Ecu Volume (K), by Country 2024 & 2032

- Figure 37: Europe Vehicle Camera Ecu Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Vehicle Camera Ecu Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Vehicle Camera Ecu Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Vehicle Camera Ecu Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Vehicle Camera Ecu Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Vehicle Camera Ecu Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Vehicle Camera Ecu Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Vehicle Camera Ecu Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Vehicle Camera Ecu Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Vehicle Camera Ecu Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Vehicle Camera Ecu Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Vehicle Camera Ecu Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Vehicle Camera Ecu Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Vehicle Camera Ecu Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Vehicle Camera Ecu Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Vehicle Camera Ecu Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Vehicle Camera Ecu Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Vehicle Camera Ecu Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Vehicle Camera Ecu Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Vehicle Camera Ecu Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Vehicle Camera Ecu Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Vehicle Camera Ecu Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Vehicle Camera Ecu Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Vehicle Camera Ecu Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Vehicle Camera Ecu Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Vehicle Camera Ecu Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Vehicle Camera Ecu Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Vehicle Camera Ecu Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Vehicle Camera Ecu Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Vehicle Camera Ecu Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Vehicle Camera Ecu Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Vehicle Camera Ecu Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Vehicle Camera Ecu Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Vehicle Camera Ecu Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Vehicle Camera Ecu Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Vehicle Camera Ecu Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Vehicle Camera Ecu Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Vehicle Camera Ecu Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Vehicle Camera Ecu Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Vehicle Camera Ecu Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Vehicle Camera Ecu Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Vehicle Camera Ecu Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Vehicle Camera Ecu Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Vehicle Camera Ecu Volume K Forecast, by Country 2019 & 2032

- Table 81: China Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Vehicle Camera Ecu Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Vehicle Camera Ecu Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Camera Ecu?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Vehicle Camera Ecu?

Key companies in the market include Bosch, Continental AG, Aisin, Faurecia Clarion Electronics, DENSO, Panasonic, Magna, Autoliv, Mitsubishi Electric, Shanghai SenseTime.

3. What are the main segments of the Vehicle Camera Ecu?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Camera Ecu," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Camera Ecu report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Camera Ecu?

To stay informed about further developments, trends, and reports in the Vehicle Camera Ecu, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence