Key Insights

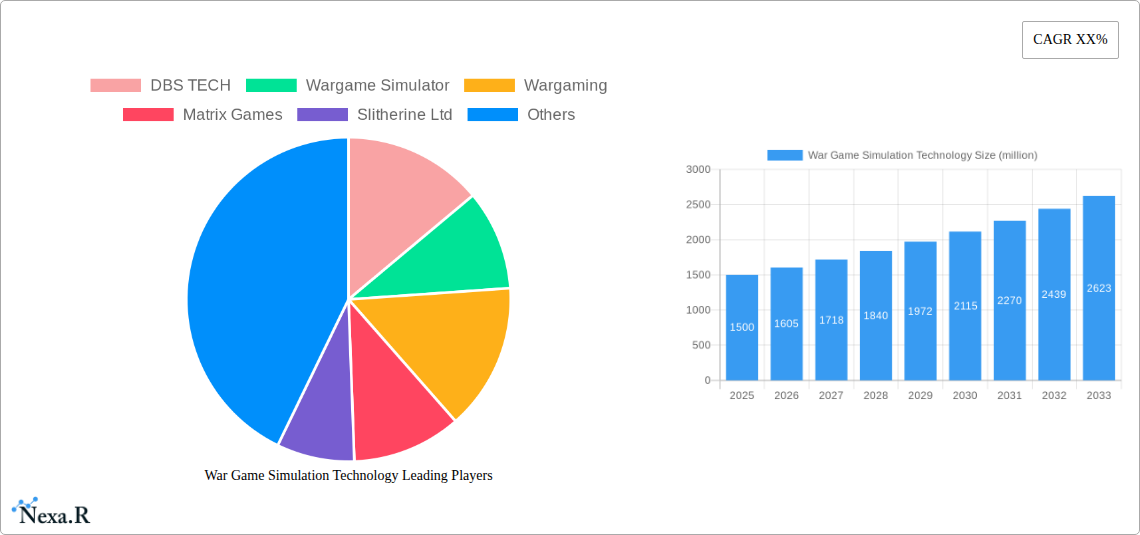

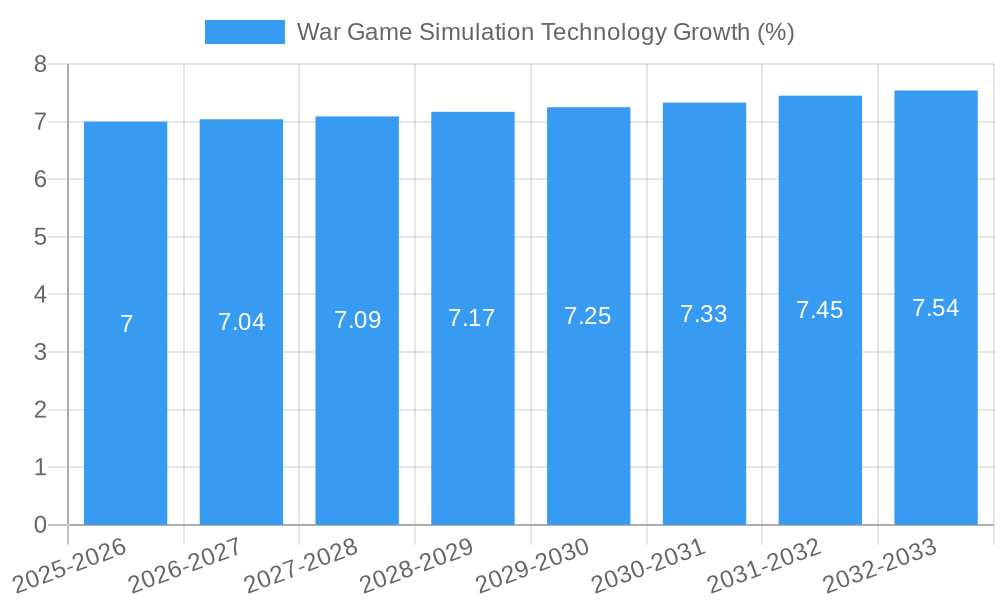

The War Game Simulation Technology market is poised for significant expansion, projected to reach an estimated $XXX million by 2025 with a robust Compound Annual Growth Rate (CAGR) of XX% through 2033. This impressive growth is fueled by a confluence of factors, primarily the escalating demand from military organizations for advanced training solutions that offer cost-effectiveness and enhanced realism compared to traditional methods. The increasing complexity of modern warfare, coupled with the need for agile and adaptable strategic planning, necessitates sophisticated simulation environments. Beyond defense, the education sector is increasingly adopting these technologies for immersive learning experiences and critical thinking development. Furthermore, the burgeoning field of Artificial Intelligence research is leveraging war game simulations to develop and test complex algorithms in dynamic, adversarial environments, driving innovation and expanding the application spectrum of this technology.

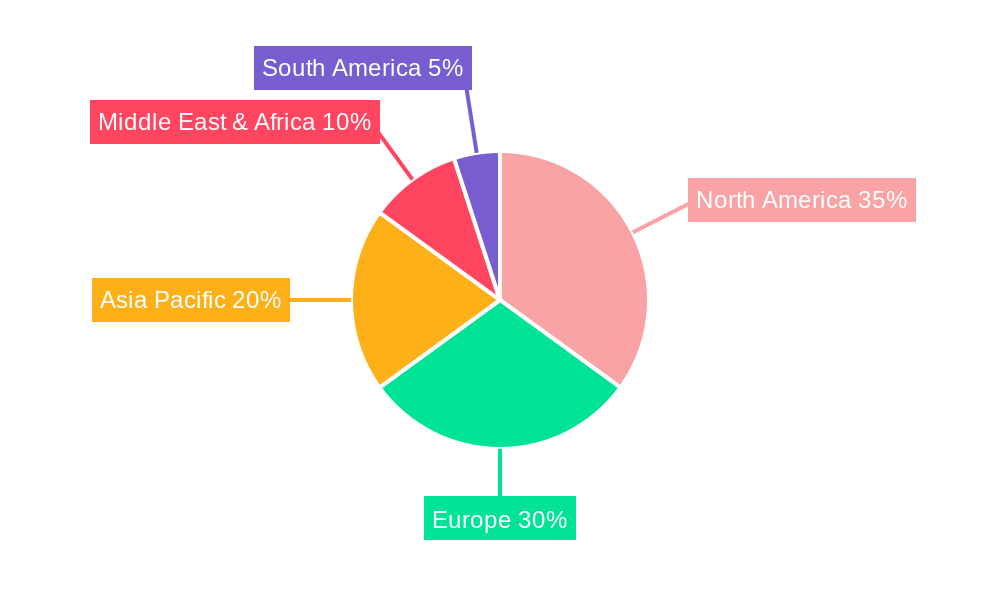

However, the market is not without its challenges. High initial investment costs for sophisticated simulation platforms and the need for specialized technical expertise to develop and maintain these systems act as significant restraints. Moreover, the continuous evolution of technology demands constant upgrades, which can be a considerable financial burden for some organizations. Despite these hurdles, the prevailing trends of digitalization, the integration of AI and machine learning for more intelligent agents, and the growing adoption of cloud-based simulation platforms are expected to overcome these limitations. The market is segmented into military, education, and artificial intelligence research applications, with quantitative simulations leading in current adoption, though qualitative simulations are gaining traction for nuanced strategy development. Geographically, North America and Europe currently dominate, with the Asia Pacific region exhibiting the highest growth potential due to increasing defense modernization and a growing tech-savvy population.

War Game Simulation Technology Market Outlook: Comprehensive Report

This comprehensive report delves into the dynamic landscape of War Game Simulation Technology, offering an in-depth analysis for industry professionals, investors, and stakeholders. With a study period spanning 2019–2033, this report provides critical insights into market trends, growth drivers, competitive intelligence, and future projections, all presented with a focus on SEO optimization and market segmentation.

War Game Simulation Technology Market Dynamics & Structure

The War Game Simulation Technology market exhibits a moderately concentrated structure, with key players like Wargaming, Slitherine Ltd, and Matrix Games driving innovation. Technological innovation, particularly in artificial intelligence (AI) for realistic adversary behavior and advanced analytics for strategic assessment, serves as a primary growth engine. Regulatory frameworks governing defense procurement and data security also influence market development. While direct competitive substitutes are limited within the specialized war gaming domain, advancements in virtual reality (VR) and augmented reality (AR) offer adjacent immersive experiences. End-user demographics are increasingly shifting towards younger, digitally native military personnel and a growing demand in academic and research institutions. Mergers and acquisitions (M&A) are expected to shape the competitive landscape, with an estimated 15-20 M&A deals annually anticipated during the forecast period to consolidate market share and acquire specialized technological expertise. Innovation barriers include the high cost of development and the need for continuous updates to reflect evolving geopolitical scenarios.

- Market Concentration: Moderately concentrated with key players like Wargaming, Slitherine Ltd, and Matrix Games.

- Technological Innovation Drivers: AI for realistic behavior, advanced analytics, VR/AR integration.

- Regulatory Frameworks: Defense procurement policies, data security standards.

- Competitive Product Substitutes: Limited direct substitutes; VR/AR offer adjacent immersive experiences.

- End-User Demographics: Digitally native military personnel, academic and research institutions.

- M&A Trends: Anticipated 15-20 deals annually, focused on market consolidation and tech acquisition.

- Innovation Barriers: High development costs, need for continuous updates.

War Game Simulation Technology Growth Trends & Insights

The War Game Simulation Technology market is projected to experience robust growth, driven by increasing defense spending, the demand for sophisticated training solutions, and the expanding applications in non-military sectors. The market size is estimated to reach $15,200 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2019 to 2033. Adoption rates are accelerating as organizations recognize the cost-effectiveness and risk reduction benefits of simulation-based training and strategic planning. Technological disruptions, including the integration of machine learning for adaptive scenarios and cloud-based platforms for enhanced accessibility and collaboration, are reshaping the market. Consumer behavior shifts are evident, with a growing preference for dynamic, data-driven, and interactive simulation experiences that provide actionable insights. The penetration of advanced simulation technologies in educational institutions and corporate training is also a significant trend, broadening the market scope beyond traditional military applications. This evolution reflects a move towards more predictive and preemptive strategic analysis, leveraging the power of digital twins and complex modeling.

Dominant Regions, Countries, or Segments in War Game Simulation Technology

The Military application segment is unequivocally the dominant force driving growth in the War Game Simulation Technology market. The increasing geopolitical tensions and the need for highly skilled personnel in modern warfare scenarios have propelled significant investments in advanced training and strategic planning tools. Within this segment, the United States stands out as the leading country due to its substantial defense budget, continuous technological innovation, and the presence of major defense contractors and simulation developers. The Quantitative Type of war game simulation, which relies on statistical models and numerical data to predict outcomes, is also seeing substantial demand, particularly for mission planning and resource allocation.

- Dominant Application: Military.

- Key Drivers in Military Segment: Geopolitical tensions, need for advanced training, defense budget allocations.

- Leading Country: United States, driven by high defense spending and technological innovation.

- Dominant Type: Quantitative, due to its applicability in strategic planning and outcome prediction.

- Market Share Contribution (Military): Estimated at **70-75%** of the total market in 2025.

- Growth Potential (Military): Forecasted to grow at a CAGR of **9.0%** during the forecast period.

- Factors Contributing to Dominance: Comprehensive military modernization programs, advanced research and development in simulation technologies, and extensive use in joint military exercises.

War Game Simulation Technology Product Landscape

The product landscape of War Game Simulation Technology is characterized by rapid innovation and increasing sophistication. Companies like DBS TECH and Every Single Soldier are pushing boundaries with AI-powered agents that exhibit complex decision-making, enhancing the realism and challenge of simulations. Applications range from tactical training for individual soldiers to high-level strategic planning for national security. Performance metrics are increasingly focused on the fidelity of the simulation environment, the accuracy of predictive analytics, and the ease of integration with existing command and control systems. Unique selling propositions include real-time adaptive scenario generation and immersive VR/AR capabilities that offer unparalleled training experiences. Technological advancements are also focusing on reducing the development cycle for new simulations and increasing the interoperability between different simulation platforms.

Key Drivers, Barriers & Challenges in War Game Simulation Technology

Key Drivers

The War Game Simulation Technology market is propelled by several key drivers. The escalating global security concerns and the modernization of defense forces worldwide necessitate advanced training and strategic planning tools. The increasing adoption of AI and machine learning is enhancing simulation fidelity and analytical capabilities. Furthermore, the cost-effectiveness of simulations compared to live training exercises and the growing application in educational and research sectors are significant growth accelerators.

Barriers & Challenges

Despite the strong growth prospects, the industry faces several challenges. The high cost of developing and maintaining sophisticated simulation platforms remains a significant barrier, especially for smaller organizations. Regulatory hurdles related to data security and intellectual property protection can also impede market entry and expansion. Intense competition among established players and the rapid pace of technological change require continuous investment and adaptation, posing a challenge to sustained market leadership. Supply chain issues for specialized hardware components can also impact production timelines. The estimated impact of these challenges on growth is a potential 2-3% reduction in projected market expansion if not adequately addressed.

Emerging Opportunities in War Game Simulation Technology

Emerging opportunities in the War Game Simulation Technology sector lie in the burgeoning demand for urban warfare simulations, a critical need given current global conflicts. The integration of blockchain technology for secure data management and outcome verification presents another significant opportunity, enhancing trust and transparency in simulation results. Furthermore, the expansion of simulation applications into cyber warfare training and critical infrastructure protection offers a vast untapped market. Evolving consumer preferences for more personalized and adaptive learning experiences within simulations also create opportunities for innovative product development. The predicted market size for these emerging applications is $3,000 million by 2033.

Growth Accelerators in the War Game Simulation Technology Industry

Catalysts driving long-term growth in the War Game Simulation Technology industry are multifaceted. Technological breakthroughs in areas such as generative AI for dynamic scenario creation and advanced physics engines are continuously enhancing simulation realism and predictive power. Strategic partnerships between simulation developers and defense contractors are crucial for integrating cutting-edge technologies into operational systems. Market expansion strategies targeting emerging economies with growing defense budgets and the increasing adoption of simulation for non-military applications like disaster response and urban planning are also significant growth accelerators. The increasing focus on human-machine teaming simulations further amplifies the market's growth trajectory.

Key Players Shaping the War Game Simulation Technology Market

- DBS TECH

- Wargame Simulator

- Wargaming

- Matrix Games

- Slitherine Ltd

- Every Single Soldier

Notable Milestones in War Game Simulation Technology Sector

- 2019: Launch of advanced AI-driven enemy behavior modules by Wargaming, significantly enhancing combat realism.

- 2020: Slitherine Ltd releases a new generation of grand strategy wargames with complex economic and diplomatic simulations.

- 2021: Matrix Games introduces VR integration for enhanced tactical decision-making in their simulation offerings.

- 2022: DBS TECH announces significant advancements in cloud-based simulation platforms, enabling remote collaboration and scalability.

- 2023: Every Single Soldier unveils AI-powered tools for dynamic scenario generation, reducing development time and increasing replayability.

- 2024: Increased investment in AI research for predictive conflict analysis across major simulation developers.

In-Depth War Game Simulation Technology Market Outlook

The future market outlook for War Game Simulation Technology is exceptionally promising, driven by a convergence of technological advancements and evolving global security demands. Growth accelerators such as AI-driven adaptive learning, the expansion into cyber warfare and critical infrastructure simulation, and the increasing adoption in academic and corporate training will fuel sustained expansion. Strategic partnerships and market expansion into new geographical territories will further bolster growth. The market is poised for significant innovation, with a projected market size of $22,500 million by 2033, representing a robust CAGR. The industry will continue to be shaped by the pursuit of greater fidelity, enhanced analytical capabilities, and broader accessibility, making it a critical sector for future strategic planning and training.

War Game Simulation Technology Segmentation

-

1. Application

- 1.1. Military

- 1.2. Education

- 1.3. Artificial Intelligence Research

- 1.4. Others

-

2. Types

- 2.1. Quantitative

- 2.2. Qualitative

War Game Simulation Technology Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

War Game Simulation Technology REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military

- 5.1.2. Education

- 5.1.3. Artificial Intelligence Research

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Quantitative

- 5.2.2. Qualitative

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military

- 6.1.2. Education

- 6.1.3. Artificial Intelligence Research

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Quantitative

- 6.2.2. Qualitative

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military

- 7.1.2. Education

- 7.1.3. Artificial Intelligence Research

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Quantitative

- 7.2.2. Qualitative

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military

- 8.1.2. Education

- 8.1.3. Artificial Intelligence Research

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Quantitative

- 8.2.2. Qualitative

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military

- 9.1.2. Education

- 9.1.3. Artificial Intelligence Research

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Quantitative

- 9.2.2. Qualitative

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific War Game Simulation Technology Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military

- 10.1.2. Education

- 10.1.3. Artificial Intelligence Research

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Quantitative

- 10.2.2. Qualitative

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DBS TECH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wargame Simulator

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wargaming

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Matrix Games

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Slitherine Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Every Single Soldier

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 DBS TECH

List of Figures

- Figure 1: Global War Game Simulation Technology Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America War Game Simulation Technology Revenue (million), by Application 2024 & 2032

- Figure 3: North America War Game Simulation Technology Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America War Game Simulation Technology Revenue (million), by Types 2024 & 2032

- Figure 5: North America War Game Simulation Technology Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America War Game Simulation Technology Revenue (million), by Country 2024 & 2032

- Figure 7: North America War Game Simulation Technology Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America War Game Simulation Technology Revenue (million), by Application 2024 & 2032

- Figure 9: South America War Game Simulation Technology Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America War Game Simulation Technology Revenue (million), by Types 2024 & 2032

- Figure 11: South America War Game Simulation Technology Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America War Game Simulation Technology Revenue (million), by Country 2024 & 2032

- Figure 13: South America War Game Simulation Technology Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe War Game Simulation Technology Revenue (million), by Application 2024 & 2032

- Figure 15: Europe War Game Simulation Technology Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe War Game Simulation Technology Revenue (million), by Types 2024 & 2032

- Figure 17: Europe War Game Simulation Technology Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe War Game Simulation Technology Revenue (million), by Country 2024 & 2032

- Figure 19: Europe War Game Simulation Technology Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa War Game Simulation Technology Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa War Game Simulation Technology Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa War Game Simulation Technology Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa War Game Simulation Technology Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa War Game Simulation Technology Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa War Game Simulation Technology Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific War Game Simulation Technology Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific War Game Simulation Technology Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific War Game Simulation Technology Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific War Game Simulation Technology Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific War Game Simulation Technology Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific War Game Simulation Technology Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global War Game Simulation Technology Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global War Game Simulation Technology Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global War Game Simulation Technology Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global War Game Simulation Technology Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global War Game Simulation Technology Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global War Game Simulation Technology Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global War Game Simulation Technology Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global War Game Simulation Technology Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global War Game Simulation Technology Revenue million Forecast, by Country 2019 & 2032

- Table 41: China War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific War Game Simulation Technology Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the War Game Simulation Technology?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the War Game Simulation Technology?

Key companies in the market include DBS TECH, Wargame Simulator, Wargaming, Matrix Games, Slitherine Ltd, Every Single Soldier.

3. What are the main segments of the War Game Simulation Technology?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "War Game Simulation Technology," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the War Game Simulation Technology report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the War Game Simulation Technology?

To stay informed about further developments, trends, and reports in the War Game Simulation Technology, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence