Key Insights

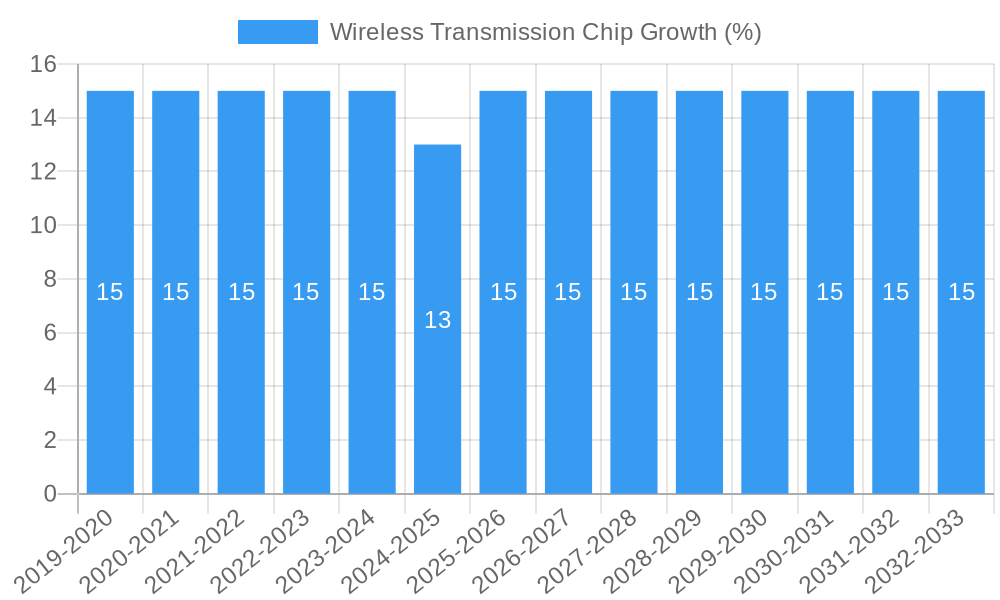

The global Wireless Transmission Chip market is poised for significant expansion, projected to reach an estimated USD 12,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% through 2033. This growth is primarily fueled by the escalating adoption of smart home devices, the pervasive integration of connectivity in the automotive sector, and the continuous demand from a broad spectrum of other applications. The proliferation of the Internet of Things (IoT) ecosystem, characterized by an ever-increasing number of connected devices, serves as a primary demand driver. As consumers and industries alike embrace the convenience and efficiency offered by wireless communication, the need for sophisticated and high-performance wireless transmission chips continues to surge. Wi-Fi and Bluetooth chips, integral to the seamless functioning of most modern electronic gadgets, are expected to dominate the market share, driven by their widespread application in consumer electronics, industrial automation, and telecommunications infrastructure.

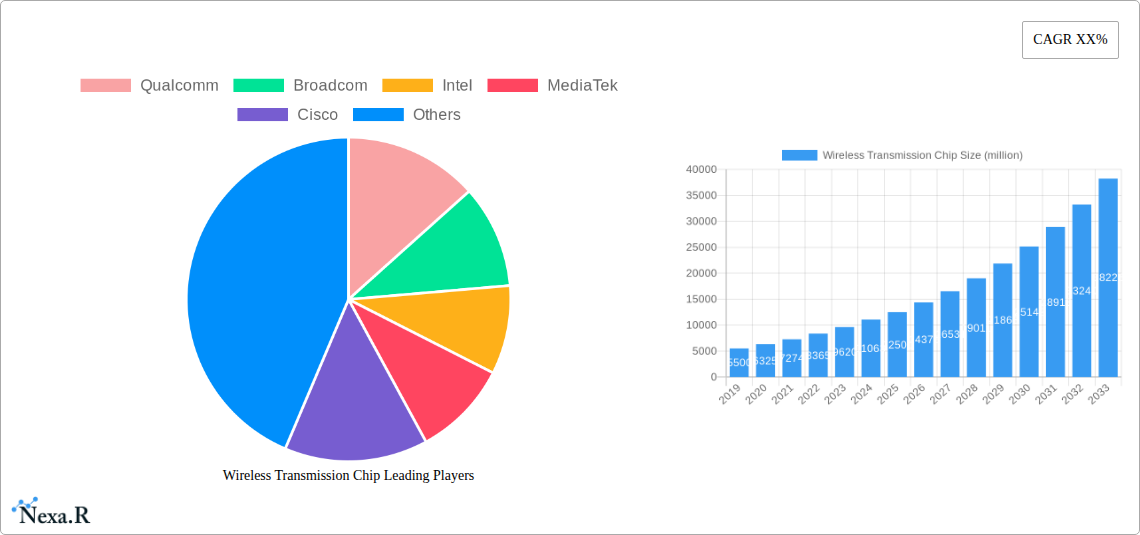

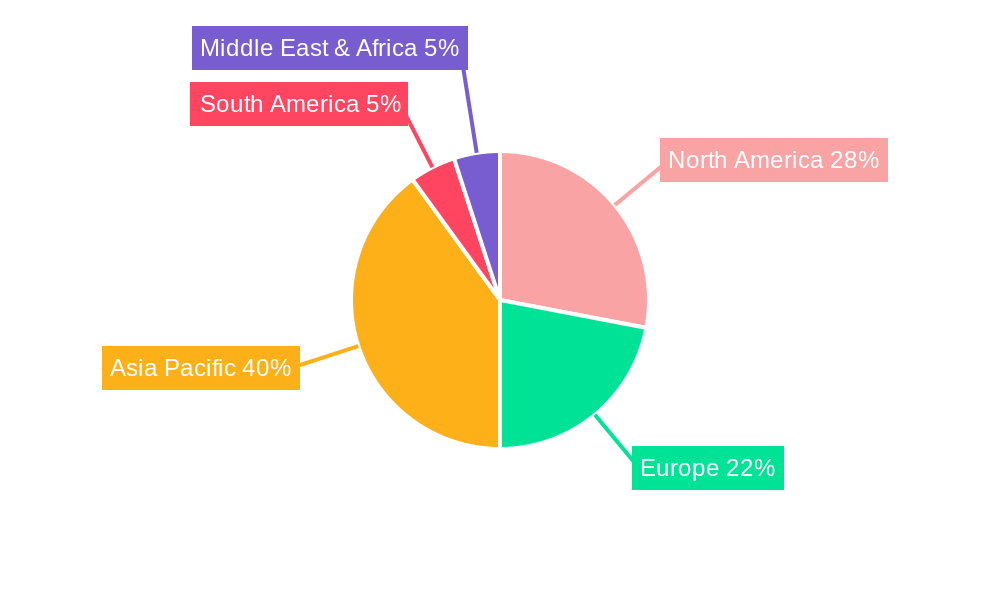

However, the market is not without its challenges. Intense price competition among key players, coupled with potential supply chain disruptions and the evolving regulatory landscape surrounding wireless spectrum allocation, could act as restraints. Despite these hurdles, the market is characterized by continuous innovation, with companies like Qualcomm, Broadcom, and Intel leading the charge in developing next-generation chips that offer enhanced speed, lower power consumption, and greater security. The Asia Pacific region, particularly China and India, is emerging as a dominant force in both production and consumption, owing to its massive manufacturing capabilities and a burgeoning consumer base for connected technologies. North America and Europe also represent significant markets, driven by advanced technological adoption and strong R&D investments. The market is segmented by application, with Smart Home Devices and Automotive applications showcasing exceptional growth potential, and by type, with Wi-Fi and Bluetooth chips leading the pack.

Here is the SEO-optimized report description for the Wireless Transmission Chip market, structured as requested:

This in-depth report provides a definitive analysis of the global Wireless Transmission Chip market, a critical component powering the interconnected world. With extensive coverage from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this study delves into market dynamics, growth trends, regional dominance, product innovation, key players, and future outlook. Essential for industry professionals, strategists, investors, and technology providers, this report offers actionable insights into a rapidly evolving landscape. We dissect the market at both global and granular levels, analyzing the parent market and child markets to provide a holistic view of opportunities and challenges.

Wireless Transmission Chip Market Dynamics & Structure

The global Wireless Transmission Chip market is characterized by a moderately concentrated structure, with key players like Qualcomm, Broadcom, Intel, MediaTek, Cisco, Marvell Technology Group, NXP Semiconductors, Realtek Semiconductor, Skyworks Solutions, Silimicro, and others vying for market share. Technological innovation is the primary driver, fueled by advancements in IoT, 5G, AI, and edge computing, necessitating faster, more efficient, and lower-power wireless solutions. Regulatory frameworks, particularly concerning spectrum allocation and device certification, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as wired connectivity alternatives in specific applications, present a challenge, though the inherent flexibility of wireless solutions often provides a distinct advantage. End-user demographics are increasingly sophisticated, demanding seamless connectivity across diverse applications. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and expansion, with an estimated XX significant M&A deals in the historical period (2019–2024) aimed at acquiring new technologies or market access.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: IoT, 5G, AI, Edge Computing, miniaturization, power efficiency.

- Regulatory Frameworks: Spectrum allocation, device certification, international standards.

- Competitive Product Substitutes: High-speed wired Ethernet, fiber optics (in niche applications).

- End-User Demographics: Growing demand for ubiquitous, secure, and high-performance wireless connectivity.

- M&A Trends: Strategic acquisitions for technology enhancement and market penetration.

Wireless Transmission Chip Growth Trends & Insights

The global Wireless Transmission Chip market is poised for substantial growth, driven by an insatiable demand for seamless connectivity across an ever-expanding array of devices and applications. The market size is projected to grow from an estimated $XX million units in 2024 to $XX million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Adoption rates for wireless technologies are accelerating across consumer electronics, automotive, industrial automation, and healthcare sectors. Technological disruptions, including the rollout of Wi-Fi 7, advancements in Bluetooth Low Energy (BLE), and the increasing sophistication of RFID for supply chain management, are fundamentally reshaping the market. Consumer behavior shifts towards connected lifestyles, remote work, and smart living environments are further amplifying the need for robust wireless transmission capabilities. The integration of AI and machine learning into chip design is leading to smarter, more adaptive wireless solutions. The market penetration of these chips is expected to reach XX% by 2033, indicating widespread integration.

Dominant Regions, Countries, or Segments in Wireless Transmission Chip

The Smart Home Device segment, within the Application category, is a significant growth engine for the Wireless Transmission Chip market, driven by the burgeoning adoption of smart speakers, security systems, thermostats, and other connected appliances. Regionally, Asia Pacific is emerging as a dominant force, propelled by its massive manufacturing base, increasing disposable incomes, and rapid technological adoption in countries like China, South Korea, and India. The Wi-Fi Chip type, within the Types category, continues to hold a leading position due to its ubiquitous presence in routers, laptops, smartphones, and increasingly, smart home devices. In the country-level analysis, China stands out due to its extensive electronics manufacturing ecosystem and the government's strong push for digital infrastructure development.

- Dominant Application Segment: Smart Home Device, driven by convenience and automation trends.

- Market Share in Smart Home Devices: Estimated at XX% of the total wireless transmission chip market.

- Growth Potential: High, fueled by increasing consumer acceptance and product diversification.

- Dominant Region: Asia Pacific, due to its manufacturing prowess and high adoption rates.

- Economic Policies: Favorable government policies supporting electronics manufacturing and R&D.

- Infrastructure: Extensive deployment of 5G and high-speed internet.

- Dominant Chip Type: Wi-Fi Chip, foundational for nearly all connected devices.

- Market Share: Estimated at XX% within the wireless transmission chip market.

- Technological Advancements: Continuous evolution with standards like Wi-Fi 6E and upcoming Wi-Fi 7.

- Leading Country: China, a global hub for electronics production and consumption.

- Market Size: Estimated to contribute XX% to the global market in 2025.

- Key Drivers: Strong domestic demand and export-oriented manufacturing.

Wireless Transmission Chip Product Landscape

The product landscape of Wireless Transmission Chips is characterized by continuous innovation aimed at enhancing performance, reducing power consumption, and increasing integration. Manufacturers are developing advanced Wi-Fi chips supporting the latest IEEE 802.11 standards (e.g., Wi-Fi 6/6E, upcoming Wi-Fi 7) for faster speeds and lower latency, crucial for demanding applications like augmented reality and high-definition streaming. Bluetooth chips are evolving with enhanced BLE capabilities for improved battery life and expanded range in wearables and IoT sensors. Furthermore, RFID chips are becoming more sophisticated, enabling advanced tracking and identification solutions in logistics and retail. The trend towards System-on-Chip (SoC) designs, integrating multiple wireless functionalities onto a single die, is a key selling proposition, reducing device complexity and cost.

Key Drivers, Barriers & Challenges in Wireless Transmission Chip

Key Drivers:

- Explosive Growth of IoT Devices: The proliferation of smart homes, wearables, and industrial IoT necessitates ubiquitous wireless connectivity.

- 5G Network Expansion: The rollout of 5G infrastructure demands advanced wireless chips for backhaul and device connectivity, enabling higher speeds and lower latency.

- Increasing Demand for High-Speed Data: Streaming, gaming, and immersive technologies require chips capable of handling massive data throughput.

- Advancements in AI and Edge Computing: These technologies rely on efficient wireless communication for data transfer and local processing.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical factors and component shortages can disrupt production and impact pricing.

- Intensifying Competition: A highly competitive market with price pressures and rapid innovation cycles.

- Regulatory Hurdles: Navigating complex and evolving regulations across different regions for spectrum usage and device certification.

- Power Consumption Constraints: Balancing performance with energy efficiency remains a critical design challenge, especially for battery-powered devices.

- Security Concerns: Ensuring robust security protocols for wireless transmissions against cyber threats.

Emerging Opportunities in Wireless Transmission Chip

Emerging opportunities in the Wireless Transmission Chip market lie in specialized applications and niche markets. The automotive sector's transition towards connected vehicles and autonomous driving presents a significant growth avenue, requiring robust and reliable wireless communication for V2X (Vehicle-to-Everything) interactions. The healthcare industry is increasingly leveraging wireless sensors for remote patient monitoring and diagnostics, creating demand for low-power, high-precision chips. Furthermore, the burgeoning metaverse and extended reality (XR) applications will demand ultra-low latency and high-bandwidth wireless solutions. The continued evolution of smart city initiatives, with interconnected infrastructure and services, also offers substantial untapped potential.

Growth Accelerators in the Wireless Transmission Chip Industry

The Wireless Transmission Chip industry's long-term growth is being significantly accelerated by ongoing technological breakthroughs. The development of Wi-Fi 7 promises revolutionary speed and capacity, unlocking new use cases. Strategic partnerships between chip manufacturers, device makers, and cloud providers are crucial for co-innovation and faster market penetration of new technologies. Market expansion strategies, particularly in emerging economies where connectivity adoption is rapidly increasing, will further fuel growth. The increasing integration of these chips into everyday appliances and industrial equipment, coupled with the growing consumer demand for seamless connectivity, acts as a powerful growth catalyst.

Key Players Shaping the Wireless Transmission Chip Market

- Qualcomm

- Broadcom

- Intel

- MediaTek

- Cisco

- Marvell Technology Group

- NXP Semiconductors

- Realtek Semiconductor

- Skyworks Solutions

- Silimicro

Notable Milestones in Wireless Transmission Chip Sector

- 2019: Introduction of Wi-Fi 6 (802.11ax) standard, enhancing speed and efficiency for connected devices.

- 2020: Increased adoption of BLE 5.x for enhanced range and lower power consumption in IoT devices.

- 2021: Growing prominence of 5G chips enabling higher bandwidth and lower latency in mobile devices and fixed wireless access.

- 2022: Advancements in UWB (Ultra-Wideband) technology for precise location tracking and secure communication.

- 2023: Significant investments in R&D for Wi-Fi 7, promising multi-gigabit speeds.

- 2024: Continued integration of AI capabilities within wireless chips for intelligent network management and optimization.

In-Depth Wireless Transmission Chip Market Outlook

- 2019: Introduction of Wi-Fi 6 (802.11ax) standard, enhancing speed and efficiency for connected devices.

- 2020: Increased adoption of BLE 5.x for enhanced range and lower power consumption in IoT devices.

- 2021: Growing prominence of 5G chips enabling higher bandwidth and lower latency in mobile devices and fixed wireless access.

- 2022: Advancements in UWB (Ultra-Wideband) technology for precise location tracking and secure communication.

- 2023: Significant investments in R&D for Wi-Fi 7, promising multi-gigabit speeds.

- 2024: Continued integration of AI capabilities within wireless chips for intelligent network management and optimization.

In-Depth Wireless Transmission Chip Market Outlook

The future outlook for the Wireless Transmission Chip market is exceptionally strong, driven by pervasive connectivity trends. Growth accelerators include the ongoing evolution of wireless standards, the expansion of 5G and future 6G networks, and the relentless demand for sophisticated IoT solutions across all sectors. Strategic collaborations and an increasing focus on energy-efficient designs will further bolster market expansion. The potential for innovative applications in areas like immersive entertainment, advanced healthcare, and autonomous systems paints a robust picture of sustained growth and significant market opportunities for leading players and emerging innovators alike.

Wireless Transmission Chip Segmentation

-

1. Application

- 1.1. Smart Home Device

- 1.2. Car

- 1.3. Others

-

2. Types

- 2.1. Wi-Fi Chip

- 2.2. Bluetooth Chip

- 2.3. RFID Chip

- 2.4. Others

Wireless Transmission Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wireless Transmission Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Smart Home Device

- 5.1.2. Car

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wi-Fi Chip

- 5.2.2. Bluetooth Chip

- 5.2.3. RFID Chip

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Smart Home Device

- 6.1.2. Car

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wi-Fi Chip

- 6.2.2. Bluetooth Chip

- 6.2.3. RFID Chip

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Smart Home Device

- 7.1.2. Car

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wi-Fi Chip

- 7.2.2. Bluetooth Chip

- 7.2.3. RFID Chip

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Smart Home Device

- 8.1.2. Car

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wi-Fi Chip

- 8.2.2. Bluetooth Chip

- 8.2.3. RFID Chip

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Smart Home Device

- 9.1.2. Car

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wi-Fi Chip

- 9.2.2. Bluetooth Chip

- 9.2.3. RFID Chip

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wireless Transmission Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Smart Home Device

- 10.1.2. Car

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wi-Fi Chip

- 10.2.2. Bluetooth Chip

- 10.2.3. RFID Chip

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Qualcomm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Broadcom

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MediaTek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marvell Technology Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Realtek Semiconductor

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Skyworks Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silimicro

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Qualcomm

List of Figures

- Figure 1: Global Wireless Transmission Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Wireless Transmission Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Wireless Transmission Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Wireless Transmission Chip Revenue (million), by Types 2024 & 2032

- Figure 5: North America Wireless Transmission Chip Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Wireless Transmission Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Wireless Transmission Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wireless Transmission Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Wireless Transmission Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Wireless Transmission Chip Revenue (million), by Types 2024 & 2032

- Figure 11: South America Wireless Transmission Chip Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Wireless Transmission Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Wireless Transmission Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Wireless Transmission Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Wireless Transmission Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Wireless Transmission Chip Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Wireless Transmission Chip Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Wireless Transmission Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Wireless Transmission Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Wireless Transmission Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Wireless Transmission Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Wireless Transmission Chip Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Wireless Transmission Chip Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Wireless Transmission Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Wireless Transmission Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Wireless Transmission Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Wireless Transmission Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Wireless Transmission Chip Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Wireless Transmission Chip Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Wireless Transmission Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Wireless Transmission Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wireless Transmission Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Wireless Transmission Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Wireless Transmission Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Wireless Transmission Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Wireless Transmission Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Wireless Transmission Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Wireless Transmission Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Wireless Transmission Chip Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Wireless Transmission Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Wireless Transmission Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Transmission Chip?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Wireless Transmission Chip?

Key companies in the market include Qualcomm, Broadcom, Intel, MediaTek, Cisco, Marvell Technology Group, NXP Semiconductors, Realtek Semiconductor, Skyworks Solutions, Silimicro.

3. What are the main segments of the Wireless Transmission Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Transmission Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Transmission Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Transmission Chip?

To stay informed about further developments, trends, and reports in the Wireless Transmission Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence