Key Insights

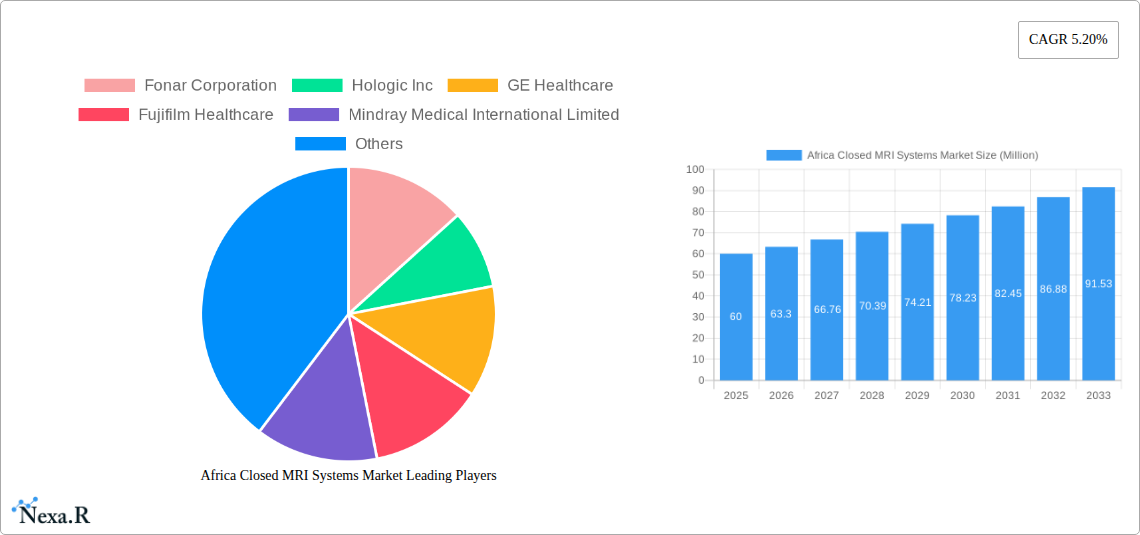

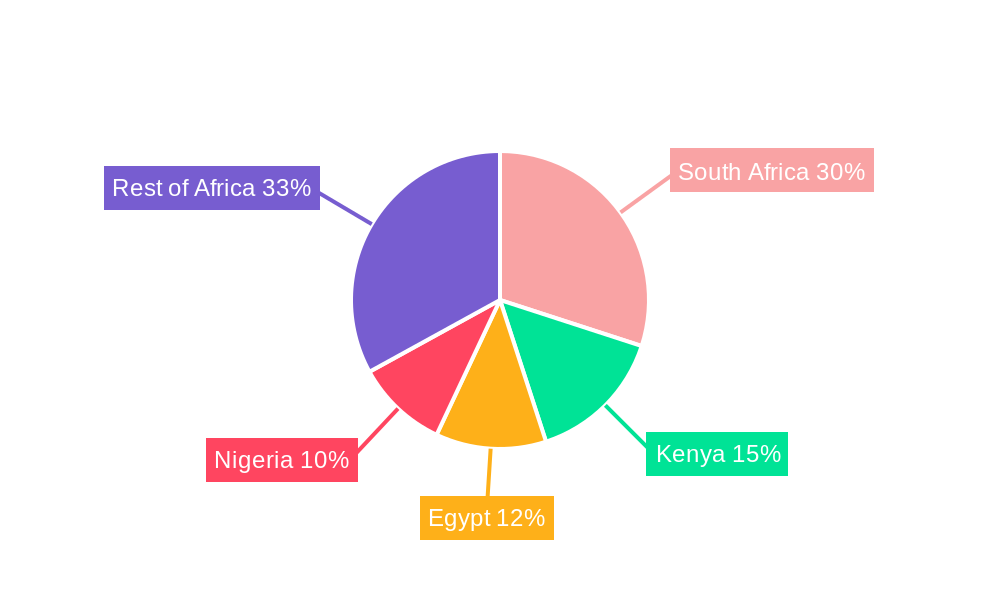

The Africa Closed MRI Systems Market is poised for significant growth, driven by increasing prevalence of chronic diseases requiring advanced diagnostic imaging, rising healthcare infrastructure investments, and growing government initiatives promoting healthcare access across the continent. While the overall market size for MRI systems in Africa isn't explicitly stated, considering a global CAGR of 5.20% and the substantial unmet medical needs in many African nations, a conservative estimate for the 2025 market size of Closed MRI Systems in Africa would be in the range of $50-75 million USD. This segment, characterized by its superior image quality and diagnostic capabilities compared to open MRI systems, is experiencing robust demand, particularly in major urban centers and countries with relatively developed healthcare sectors such as South Africa, Kenya, and Egypt. The high initial investment cost associated with Closed MRI systems remains a significant restraint, particularly for smaller clinics and hospitals in less developed regions. However, the long-term return on investment, coupled with the increasing availability of financing options and public-private partnerships, is gradually mitigating this barrier. Technological advancements, such as the development of more compact and cost-effective Closed MRI systems, are further expected to drive market expansion. The application segments within Closed MRI systems in Africa are likely to be dominated by oncology, neurology, and cardiology, mirroring global trends in diagnostic imaging. Competitive dynamics within the market are expected to remain intense, with established international players such as GE Healthcare, Philips, and Siemens competing with emerging regional distributors and providers.

The forecast period (2025-2033) is expected to witness accelerated growth, fuelled by expanding healthcare insurance coverage, improved medical infrastructure, and increased physician specialization across several African countries. The market segmentation by field strength (low, high, very high/ultra-high field) reflects varying diagnostic capabilities and associated price points. While high-field systems might be concentrated in major metropolitan areas initially, lower-field systems are expected to gain broader penetration over time. Strategic partnerships between multinational companies and local healthcare providers will be crucial in facilitating the adoption of Closed MRI systems across a wider geographical spread within Africa. The focus on improving healthcare outcomes and addressing the significant disease burden across the continent will continue to be a strong catalyst for market expansion in the coming years.

Africa Closed MRI Systems Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Closed MRI Systems market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The analysis encompasses market dynamics, growth trends, regional segmentation, product landscape, key drivers and challenges, emerging opportunities, and profiles of leading market players. This report is designed for immediate use and requires no further modification.

Africa Closed MRI Systems Market Market Dynamics & Structure

The African Closed MRI Systems market is characterized by moderate concentration, with key players such as GE Healthcare, Siemens AG, and Philips vying for market share. Technological innovation, particularly in high-field strength systems and advanced imaging techniques, is a significant driver. Regulatory frameworks vary across African nations, impacting market access and adoption. The market faces competition from open MRI systems, but closed systems maintain dominance due to superior image quality. The end-user demographic is primarily focused on larger hospitals and specialized clinics in urban centers. M&A activity has been relatively limited, with xx deals recorded in the historical period (2019-2024), representing a xx% market share shift among the top 5 players.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: High-field MRI systems and AI-driven image analysis are key innovation drivers.

- Regulatory Landscape: Varies significantly across countries, creating both opportunities and challenges.

- Competitive Substitutes: Open MRI systems offer competition but with compromised image quality.

- End-User Demographics: Primarily large hospitals and specialized clinics in urban areas.

- M&A Activity: xx deals in 2019-2024, resulting in a xx% shift in market share among top players. Innovation barriers include high initial investment costs and limited skilled technicians.

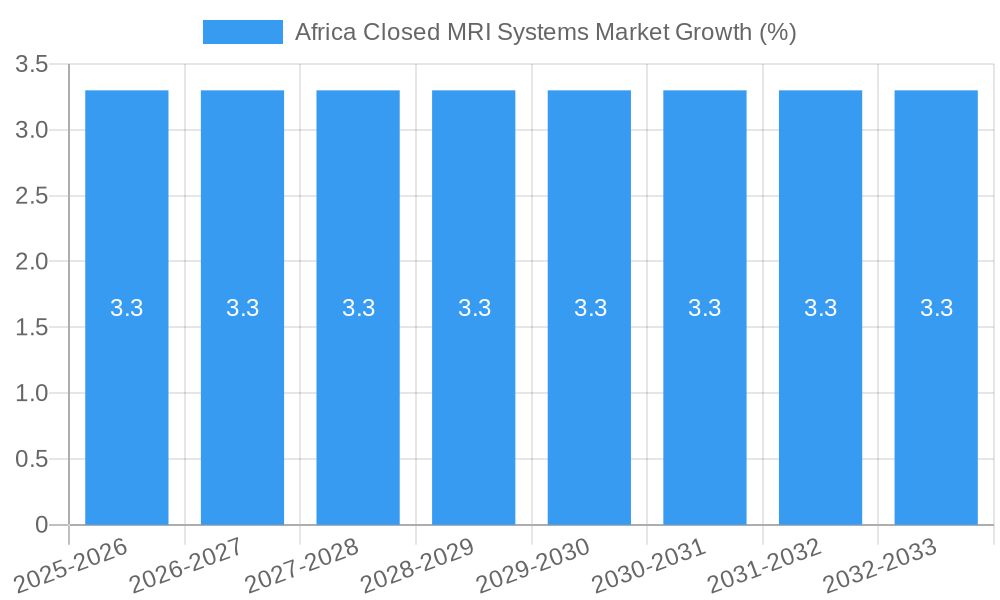

Africa Closed MRI Systems Market Growth Trends & Insights

The African Closed MRI Systems market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing healthcare infrastructure development, rising prevalence of chronic diseases, and growing government initiatives to improve healthcare access. Market penetration remains relatively low, creating substantial growth potential. Technological advancements, such as the adoption of AI and cloud-based solutions, are further accelerating market expansion. The shift in consumer behavior towards advanced diagnostic solutions is also fueling the market growth. Increased awareness regarding early disease detection and diagnosis, coupled with rising disposable incomes, is further driving demand.

Dominant Regions, Countries, or Segments in Africa Closed MRI Systems Market

South Africa and Egypt dominate the African Closed MRI Systems market, owing to better healthcare infrastructure and higher per capita healthcare expenditure. Within the segments, high-field MRI systems hold the largest market share due to their superior imaging capabilities, followed by applications in oncology and neurology. Growth is primarily driven by expanding healthcare infrastructure, government investments in healthcare, and increasing prevalence of chronic diseases.

- Leading Regions: South Africa, Egypt, Nigeria, Kenya, Morocco.

- Key Segments: High-field MRI systems (market share: xx%), Oncology applications (market share: xx%), Neurology applications (market share: xx%).

- Growth Drivers: Expanding healthcare infrastructure, government investments, rising prevalence of chronic diseases, and increasing insurance coverage.

Africa Closed MRI Systems Market Product Landscape

The market offers a diverse range of closed MRI systems, varying in field strength, application, and technological capabilities. High-field MRI systems dominate the market, offering superior image quality and diagnostic capabilities. Product innovation focuses on improving image resolution, reducing scan times, and enhancing patient comfort. Advanced features like AI-powered image analysis and cloud-based connectivity are becoming increasingly integrated. Unique selling propositions include enhanced image quality, faster scan times, reduced noise levels, and increased patient comfort.

Key Drivers, Barriers & Challenges in Africa Closed MRI Systems Market

Key Drivers: Increasing prevalence of chronic diseases, government initiatives to improve healthcare access, expanding healthcare infrastructure, and rising investments in medical technology.

Challenges: High initial investment costs, limited skilled technicians, regulatory hurdles, and infrastructural limitations in several African countries, resulting in a xx% reduction in market growth in xx.

Emerging Opportunities in Africa Closed MRI Systems Market

Untapped markets in sub-Saharan Africa, particularly in rural areas, represent a significant growth opportunity. The increasing adoption of telemedicine and cloud-based solutions, coupled with the potential for public-private partnerships, could accelerate market expansion. Innovative applications, such as AI-driven diagnostic tools and remote monitoring systems, will shape the future of the market.

Growth Accelerators in the Africa Closed MRI Systems Market Industry

Technological advancements, particularly in AI-driven image analysis and high-field MRI systems, are pivotal in driving long-term growth. Strategic partnerships between international medical technology companies and local healthcare providers are accelerating market penetration. The expansion of healthcare infrastructure and government initiatives aimed at improving access to quality healthcare will also fuel market growth.

Key Players Shaping the Africa Closed MRI Systems Market Market

- Fonar Corporation

- Hologic Inc

- GE Healthcare

- Fujifilm Healthcare

- Mindray Medical International Limited

- Analogic Corporation

- Siemens AG

- Koninklijke Philips NV

- Neusoft Corporation

- Canon Medical Systems Corporation

- Stryker Corporation

- Shimadzu Corporations

Notable Milestones in Africa Closed MRI Systems Market Sector

- July 2022: The International Atomic Energy Agency (IAEA) partnered with GE Healthcare to launch the "Rays of Hope" training program for African medical imaging professionals, focusing on PET-CT and PET-MRI technologies.

- July 2022: The Kenyan government allocated USD 12.2 million to Kilifi County for the construction of cancer screening and treatment facilities, including MRI facilities.

In-Depth Africa Closed MRI Systems Market Market Outlook

The African Closed MRI Systems market is poised for significant growth over the next decade. Continued investments in healthcare infrastructure, technological advancements, and increasing government support will drive market expansion. Strategic partnerships and the penetration of untapped markets offer substantial opportunities for growth. The focus on improved image quality, reduced scan times, and enhanced patient comfort will remain key drivers of innovation. The market is expected to reach xx million units by 2033, representing substantial growth potential for market participants.

Africa Closed MRI Systems Market Segmentation

-

1. Architecture

- 1.1. Closed MRI Systems

- 1.2. Open MRI Systems

-

2. Field Strength

- 2.1. Low Field MRI Systems

- 2.2. High Field MRI Systems

- 2.3. Very High and Ultra High MRI Systems

-

3. Application

- 3.1. Oncology

- 3.2. Neurology

- 3.3. Cardiology

- 3.4. Gastroenterology

- 3.5. Other Applications

-

4. Geography

- 4.1. South Africa

- 4.2. Egypt

- 4.3. Nigeria

- 4.4. Kenya

- 4.5. Rest of the Africa

Africa Closed MRI Systems Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Nigeria

- 4. Kenya

- 5. Rest of the Africa

Africa Closed MRI Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Chronic Diseases and Rising Geriatric Population; Technological Advancements in MRI Systems; Increasing Adoption of MRI Systems

- 3.3. Market Restrains

- 3.3.1. High Cost of MRI Systems

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Witness a Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. Closed MRI Systems

- 5.1.2. Open MRI Systems

- 5.2. Market Analysis, Insights and Forecast - by Field Strength

- 5.2.1. Low Field MRI Systems

- 5.2.2. High Field MRI Systems

- 5.2.3. Very High and Ultra High MRI Systems

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oncology

- 5.3.2. Neurology

- 5.3.3. Cardiology

- 5.3.4. Gastroenterology

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Nigeria

- 5.4.4. Kenya

- 5.4.5. Rest of the Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Egypt

- 5.5.3. Nigeria

- 5.5.4. Kenya

- 5.5.5. Rest of the Africa

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. South Africa Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Architecture

- 6.1.1. Closed MRI Systems

- 6.1.2. Open MRI Systems

- 6.2. Market Analysis, Insights and Forecast - by Field Strength

- 6.2.1. Low Field MRI Systems

- 6.2.2. High Field MRI Systems

- 6.2.3. Very High and Ultra High MRI Systems

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Oncology

- 6.3.2. Neurology

- 6.3.3. Cardiology

- 6.3.4. Gastroenterology

- 6.3.5. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Egypt

- 6.4.3. Nigeria

- 6.4.4. Kenya

- 6.4.5. Rest of the Africa

- 6.1. Market Analysis, Insights and Forecast - by Architecture

- 7. Egypt Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Architecture

- 7.1.1. Closed MRI Systems

- 7.1.2. Open MRI Systems

- 7.2. Market Analysis, Insights and Forecast - by Field Strength

- 7.2.1. Low Field MRI Systems

- 7.2.2. High Field MRI Systems

- 7.2.3. Very High and Ultra High MRI Systems

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Oncology

- 7.3.2. Neurology

- 7.3.3. Cardiology

- 7.3.4. Gastroenterology

- 7.3.5. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Egypt

- 7.4.3. Nigeria

- 7.4.4. Kenya

- 7.4.5. Rest of the Africa

- 7.1. Market Analysis, Insights and Forecast - by Architecture

- 8. Nigeria Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Architecture

- 8.1.1. Closed MRI Systems

- 8.1.2. Open MRI Systems

- 8.2. Market Analysis, Insights and Forecast - by Field Strength

- 8.2.1. Low Field MRI Systems

- 8.2.2. High Field MRI Systems

- 8.2.3. Very High and Ultra High MRI Systems

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Oncology

- 8.3.2. Neurology

- 8.3.3. Cardiology

- 8.3.4. Gastroenterology

- 8.3.5. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Egypt

- 8.4.3. Nigeria

- 8.4.4. Kenya

- 8.4.5. Rest of the Africa

- 8.1. Market Analysis, Insights and Forecast - by Architecture

- 9. Kenya Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Architecture

- 9.1.1. Closed MRI Systems

- 9.1.2. Open MRI Systems

- 9.2. Market Analysis, Insights and Forecast - by Field Strength

- 9.2.1. Low Field MRI Systems

- 9.2.2. High Field MRI Systems

- 9.2.3. Very High and Ultra High MRI Systems

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Oncology

- 9.3.2. Neurology

- 9.3.3. Cardiology

- 9.3.4. Gastroenterology

- 9.3.5. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. South Africa

- 9.4.2. Egypt

- 9.4.3. Nigeria

- 9.4.4. Kenya

- 9.4.5. Rest of the Africa

- 9.1. Market Analysis, Insights and Forecast - by Architecture

- 10. Rest of the Africa Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Architecture

- 10.1.1. Closed MRI Systems

- 10.1.2. Open MRI Systems

- 10.2. Market Analysis, Insights and Forecast - by Field Strength

- 10.2.1. Low Field MRI Systems

- 10.2.2. High Field MRI Systems

- 10.2.3. Very High and Ultra High MRI Systems

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Oncology

- 10.3.2. Neurology

- 10.3.3. Cardiology

- 10.3.4. Gastroenterology

- 10.3.5. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. South Africa

- 10.4.2. Egypt

- 10.4.3. Nigeria

- 10.4.4. Kenya

- 10.4.5. Rest of the Africa

- 10.1. Market Analysis, Insights and Forecast - by Architecture

- 11. South Africa Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Africa Closed MRI Systems Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Fonar Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Hologic Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 GE Healthcare

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Fujifilm Healthcare

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Mindray Medical International Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Analogic Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Siemens AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Koninklijke Philips NV

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Neusoft Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Canon Medical Systems Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Stryker Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Shimadzu Corporations

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Fonar Corporation

List of Figures

- Figure 1: Africa Closed MRI Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Closed MRI Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Closed MRI Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 4: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Closed MRI Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Africa Closed MRI Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 15: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 16: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 20: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 21: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 25: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 26: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 30: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 31: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Africa Closed MRI Systems Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 35: Africa Closed MRI Systems Market Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 36: Africa Closed MRI Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Africa Closed MRI Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Africa Closed MRI Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Closed MRI Systems Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Africa Closed MRI Systems Market?

Key companies in the market include Fonar Corporation, Hologic Inc, GE Healthcare, Fujifilm Healthcare, Mindray Medical International Limited, Analogic Corporation, Siemens AG, Koninklijke Philips NV, Neusoft Corporation, Canon Medical Systems Corporation, Stryker Corporation, Shimadzu Corporations.

3. What are the main segments of the Africa Closed MRI Systems Market?

The market segments include Architecture, Field Strength, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Chronic Diseases and Rising Geriatric Population; Technological Advancements in MRI Systems; Increasing Adoption of MRI Systems.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Witness a Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

High Cost of MRI Systems.

8. Can you provide examples of recent developments in the market?

July 2022: the International Atomic Energy Agency (IAEA) partnered with GE Healthcare to train professionals from Africa in medical imaging that will focus on PET-CT and PET-MRI, imaging techniques that provide a more accurate diagnosis of diseases such as cancer under the training program named- Rays of Hope.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Closed MRI Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Closed MRI Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Closed MRI Systems Market?

To stay informed about further developments, trends, and reports in the Africa Closed MRI Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence